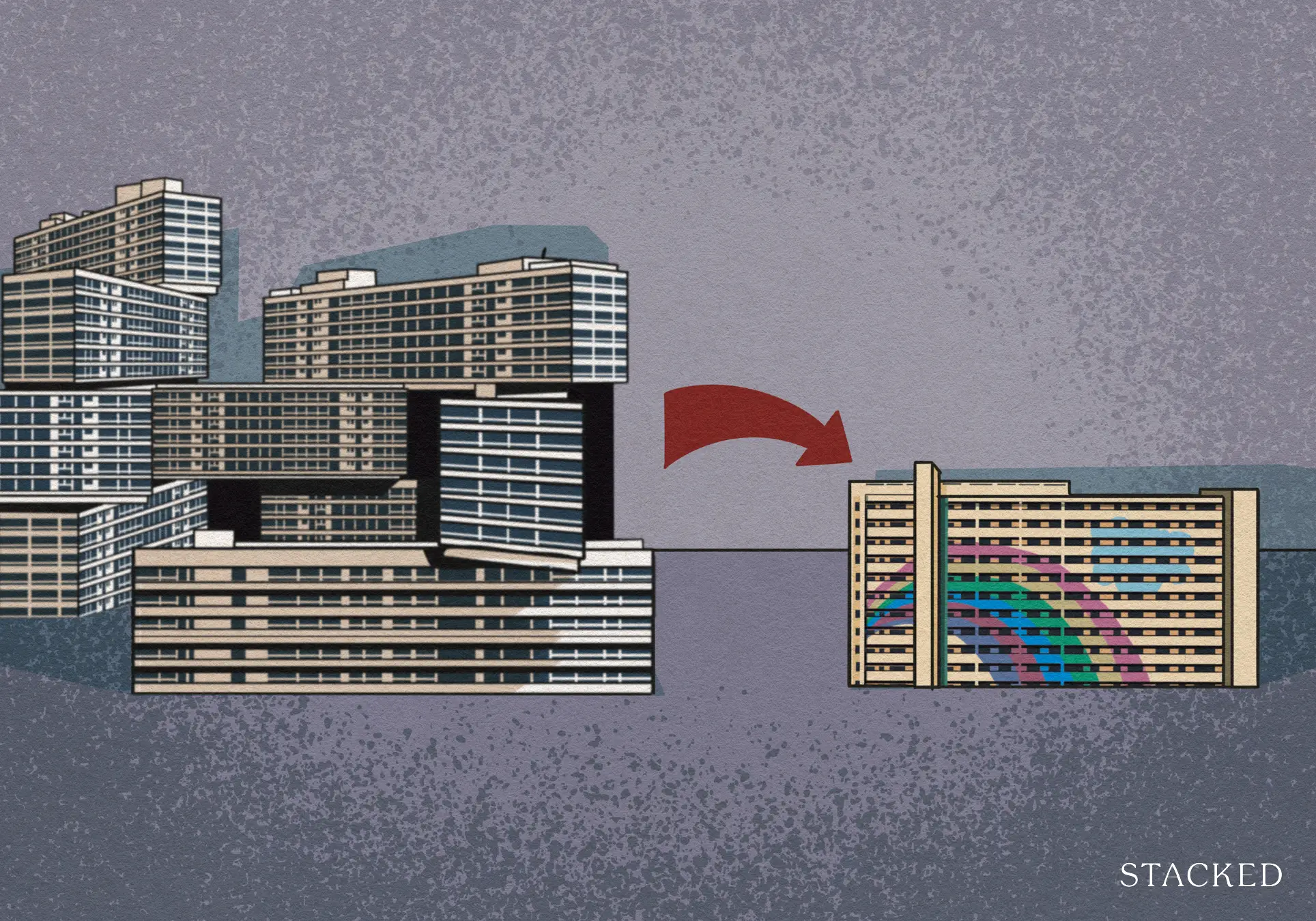

From Large Condo To Small Flat: Homeowners Share Their Downgrading Regrets In Singapore

July 29, 2024

The post-Covid era is generally regarded as a good time for sellers. Home prices were at a high, so those looking at property gains for retirement (or other investments) would theoretically have done well. But as we’ve found out, not all downgraders who rushed to capitalise on their gains have been totally happy. This is where real estate differs from other financial investments, in that it tends to go far beyond money:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Some belongings are not worth giving up, even for the money

YK is in his mid-forties, and he just right-sized from a large, 2,000+ sq. ft. condo unit, which was handed down from his late mother. YK and his wife moved into a smaller two-bedder unit. This meant lower maintenance fees, as well as savings on transport and necessities: the couple’s previous home was quite far from malls or MRT stations, causing the couple to spend excessively on food and grocery deliveries.

Within the first year, however, YK says he already began to have regrets:

“The shock of moving from 2000+ sq. ft. to 650 sq. ft. is huge, and there’s definitely a negative impact. We had to give up a lot of hobbies, and we underestimated how little the space really is.”

It was especially painful for YK who collects vintage electronics, and he had to auction off his collection of game consoles, which included a prized complete set of ZX Spectrum games. In addition, belongings like sporting equipment, bicycles, and large parts of the couple’s wardrobe also had to be given away. In hindsight, the couple find themselves missing these more than they enjoy the monetary savings.

Even having food nearby started to lose its charm:

“When we lived far away, having a 24-hour coffee shop and prata at all hours was like a fantasy. After the first two months, I was already sick of the food, and I started ordering on Grab Food again anyway.”

The biggest loss though, according to the couple, is the ability to easily host his father, siblings, or nephew when they want to stay overnight:

“In our old place, we had a guest bedroom, so it was easy for them to stay. And when they visited they would stay longer, because if it was too late they would just spend the night. Now we don’t have the room, so we’ve lost our late-night conversations and all-night movie marathons, which were the highlight of the weekend for me.”

YK describes the financial gains as “substantial” and agrees that, on paper, the move was a good one which made sense. However, both he and his wife still feel it was the wrong move, given the impact on their lifestyle.

The main regret?

“Big houses are rare today. I don’t think at the prices today, I will ever have the chance to own a unit that’s so big again; so my biggest regret is that I can’t undo this move.”

2. Negative impact on children

Joan is a recently widowed parent of two, who downgraded from a condo to a resale flat in 2021. Part of the reason was financial: Joan was previously a homemaker; she has just re-entered the workforce, and is earning less than her late husband. In addition, only one of her children is of working age, and able to contribute.

Nonetheless, Joan says that in hindsight her decision to downgrade was too much of a knee-jerk reaction:

“We could have kept the condo because it* was insured, and we could have coped with the maintenance. My in-laws and my own parents also promised to help if I needed it. But I was in a lot of fear at the time, and I suffered from anxiety attacks every few days; downgrading to have more savings was my way of feeling secure.”

Joan realised she had made a mistake when, a year after the move, her children seemed less outgoing, more moody, and often refused to leave the house:

“Previously they had friends and they socialised a lot. Now they mostly stay at home and watch Netflix. For my eldest, I thought at first she was just tired, because she had started working. But after a while I realised it’s because they’ve lost touch with their circle of friends.”

More from Stacked

6 Final Upcoming GLS Sites In 2025: Which Sites Hold The Most Promise For Buyers?

With the government furiously churning out GLS sites, there may be some hope for at least moderating property prices, and…

Joan says that, even though keeping in touch is easier with social media, there’s less time and inclination to meet up due to the realities of distance. Her children don’t want to travel for 30 to 40 minutes each way to meet up, and to just hang out for a much shorter time than they had before.

There is another major issue that worsens this: Joan says that she shouldn’t have implemented the move so soon after the loss of the children’s father, as this likely imposes even more stress.

Her advice to downgraders, especially those facing big changes in their financial situation, is to: “Calm down, give yourself time to think, don’t rush to downgrade because of a panic. And consider the impact on other family members as well.”

One of the few upsides though, is that the downgrade has helped to ensure Joan’s eldest can quit her part-time job to focus on schooling, if he so chooses.

*This refers to the mortgage. Mortgage insurance pays off the outstanding home loan in the event of death.

3. The loss of privacy isn’t worth the money

BK moved from a landed home in the Jalan Eunos area, to a three-bedder in the Middle Road area. This was due to the needs of his mother, who suffers from dementia. The former landed house not only had stairs, it was also easy for her to wander out the front gate and directly onto the road.

(Incidentally, BK raises some points that might be useful to know: Smaller homes are less confusing than large, multi-level homes for people with dementia. And even if you install a lift, which BK did consider, it doesn’t change the fact that it’s harder to monitor dementia patients when they might be on a different floor).

By shifting to a single-floor condo, BK had multiple intentions: the first was that it was safer for his mother. The second was to prepare for retirement. BK expects this to happen within the next decade, and he says that: “I know how I am, if I didn’t do it within five years, I would have ended up staying there forever.”

Everything makes sense, so why was BK unhappy after the first year?

“I should have picked a smaller place, because the noise is quite bad. The moment I try to walk out, there are people shouting, there’s a roar from the waterfall pool, there are dogs barking and kids on scooters. It’s not an environment that my mum would feel comfortable walking in.”

BK also misses the opportunity to sit in his own garden and backyard, and just relax as the sun goes down. While he’s tried to do this in the quieter areas of the condo, he’s inevitably interrupted by cleaners, kids starting ball games (even though it’s against the rules), and food delivery workers, contractors, etc. going by.

BK says his mistake was simply underestimating the impact of living with many more people; and it may be the contrast that worsens it:

“I think if you are going from a condo to HDB or HDB to condo, it’s a bit less jarring. But when you go from landed to either of these two, especially if you were in a quiet place like Jalan Eunos, it feels like you step into a pasar malam every time you head in and out of your house.”

Do you know anyone who isn’t too happy after downsizing their home? Comment and let us know their story.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Homeowner Stories

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

Homeowner Stories What I Only Learned After My First Year Of Homeownership In Singapore

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

0 Comments