A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

July 2, 2025

Veteran property investors, as well as industry professionals, tend to know what to expect from a developer’s name. This is especially important for new launch projects, where you may not be able to visibly check on the issues yet – you may be going largely on trust that you’ll get what’s promised. And with a wide range of developers to research, it can be hard to figure out who’s who in the property market. So, for the sake of newcomers to the property market, here’s a list of key factors to check:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Table of contents

- 1. Start with BCA Developer Quality Banding

- 2. Next, check for the developer’s history of after-sales services

- 3. Check if the developer is established in that particular segment of the market

- 4. Be prepared for greater risks in small or boutique projects

- Don’t let this overshadow the more fundamental aspects of the property, though

1. Start with BCA Developer Quality Banding

In May 2023, the Building and Construction Authority (BCA) introduced a banding system, to provide greater transparency into the quality of residential developers and builders. This system evaluates the workmanship quality of residential projects over a rolling six-year period (i.e., the reviews are based on the most recent six years of project data) and assigns developers to one of six bands:

- Band 1: Very low incidence of major defects

- Band 2: Low incidence of major defects

- Band 3-4: Moderate levels of defects

- Band 5-6: High incidence of major or recurring defects

The assessment for banding mainly emphasises structural works, architectural finishes, and mechanical and electrical works.

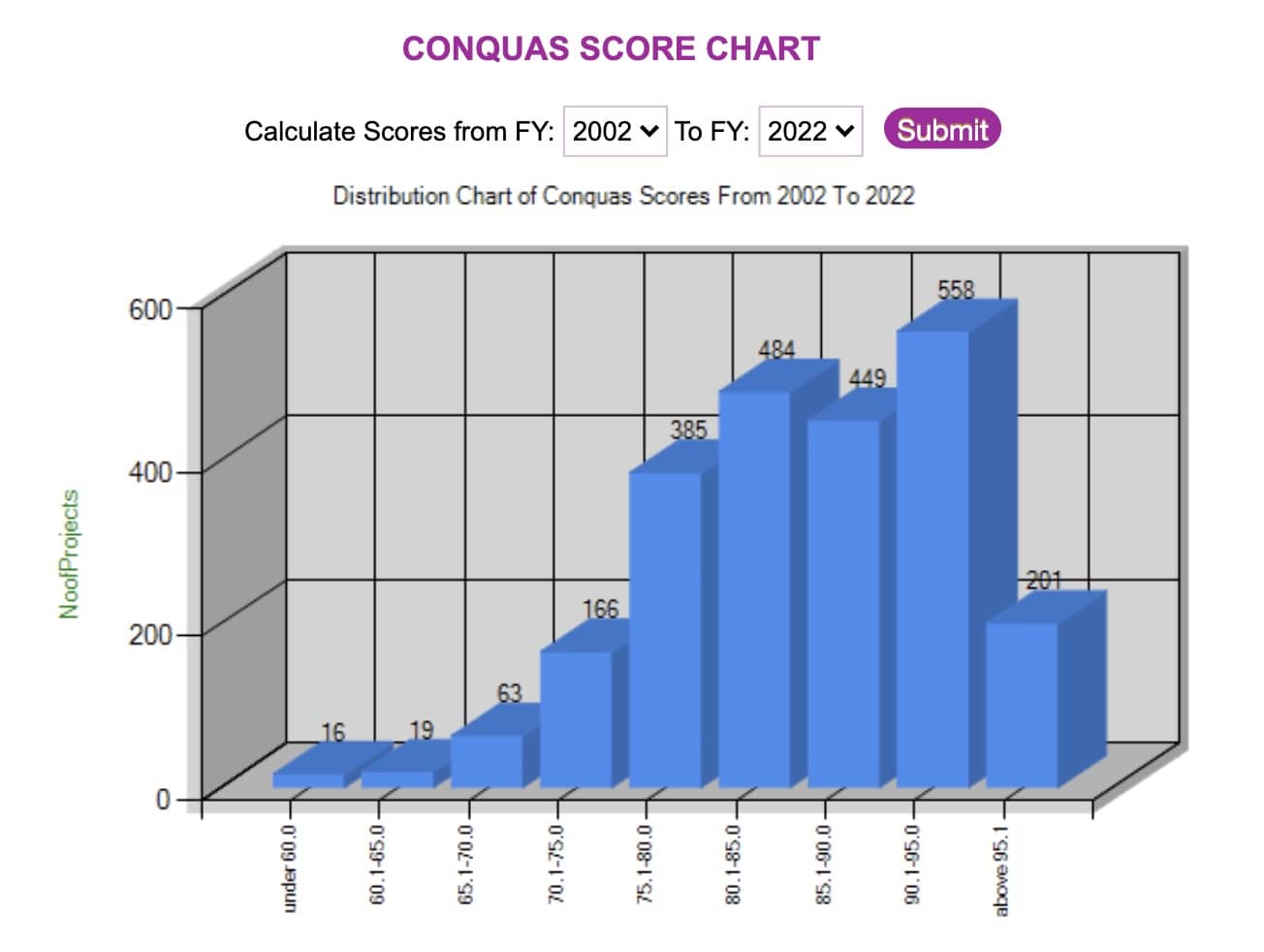

If you really want to go into further detail, bands are derived from BCA’s CONQUAS (Construction Quality Assessment System) scores, as well as customer feedback and quality audits; but as a general approach, you should just look for developers in the first two bands.

You can look up the developers/builders bands on the Quality Housing Portal here.

A note on Developers vs Builders:

The builder is not the same as the developer. The developer is the company that plans, finances, markets, and sells the property. The builder (or main contractor) is responsible for the actual construction. While both are assessed in the BCA banding system, a high-quality developer typically works with reliable builders. It would be quite odd for a band 1 developer to work with a band 4 builder, for example.

Still, even a reputable developer can have problems if they outsource to a weak builder; so it’s worth checking both names on the BCA Quality Housing Portal when doing your due diligence.

To give you a sense of how this plays out in real life, here are some examples of projects that have scored well and earned praise:

- Amber Park by CDL – This luxury development in East Coast scored Band 1, and has been noted for its elegant finishes and efficient layouts.

- Clavon by UOL – A well-executed mass-market project in Clementi, also scoring Band 1, with many buyers praising the spacious layouts and attention to detail.

- North Park Residences by Frasers Property – An Integrated development atop Northpoint City, known for its family-friendly convenience and reliable build quality.

- Martin Modern by GuocoLand – Located in Robertson Quay, this luxury condo has received acclaim for its lush landscaping and architectural design, also with Band 1 quality.

- Bellewoods EC by Qingjian Realty – This executive condominium achieved a CONQUAS Star, reflecting one of the highest standards in construction quality.

And on the other end of the scale:

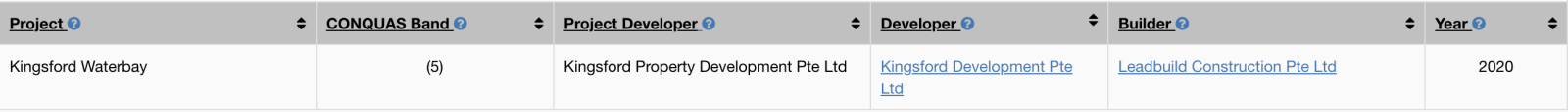

- Kingsford Waterbay by Kingsford Development – This earlier project was flagged for major defects and scored Band 5. The developer was even issued a no-sale licence at one point. However, their recent mega-project, Normanton Park, scored Band 1, suggesting significant improvement.

- Sea Pavillion Residences by Oxley Holdings – This boutique condo also scored Band 5, raising concerns about finishing. But Oxley has since delivered better-performing projects like The Addition and Riverfront Residences, both of which scored Band 1 and 2.

2. Next, check for the developer’s history of after-sales services

More from Stacked

I Like People’s Park Complex For The Space And Location. Is It A Good Choice? (And More On Parc Clematis)

Question 1

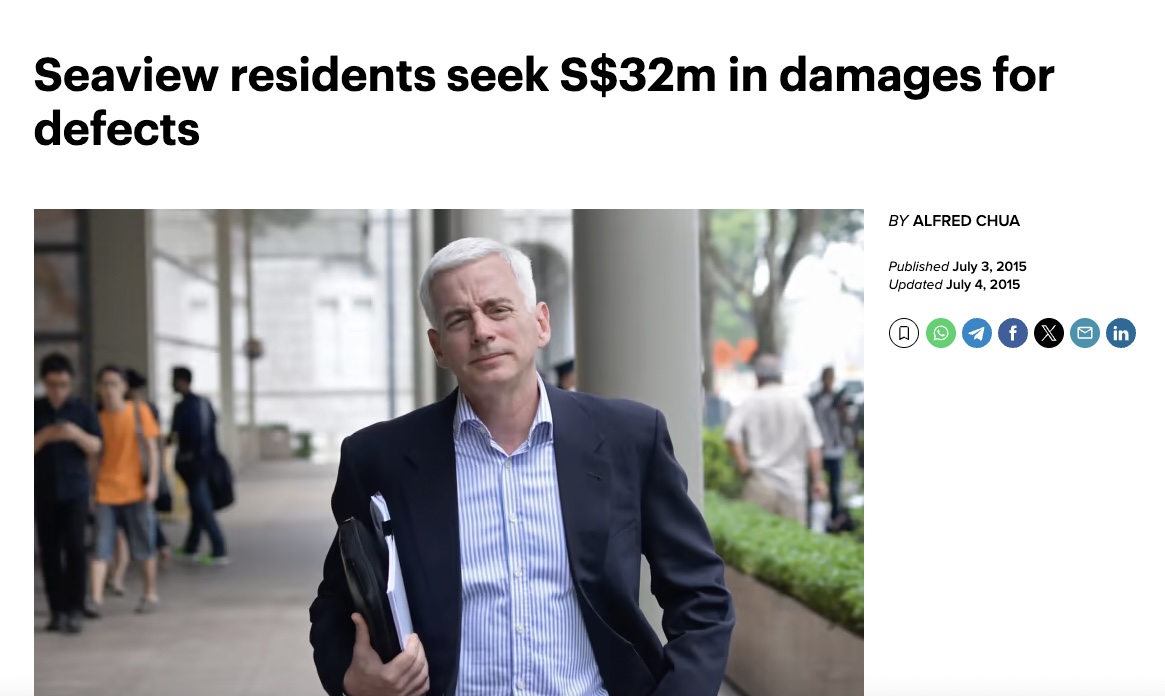

This is mainly to see how the developer behaves during the Defects Liability Period (DLP). You want to hear that they’re fast, responsive, and not argumentative. The most obvious red flag here is lawsuits over defects, such as we once saw in The Seaview in 2008.

Some developers, like CDL and Frasers, are known for reliable after-sales service. From word on the ground, homeowners at Amber Park and Clavon have reported efficient rectification of defects during the DLP period. In contrast, some smaller developers or those with lower banding may be less responsive post-handover, leading to prolonged defect resolution timelines.

While you could wait till construction is complete before buying (to check for yourself), that’s seldom ideal as developer prices would be at their peak by then. So a lot of trust is involved here.

3. Check if the developer is established in that particular segment of the market

Some developers are known for entry-level pricing and efficiency; others specialise in luxury or integrated developments. Knowing this helps you calibrate expectations.

For instance, Sim Lian typically targets the value-conscious family market, as seen in projects like Treasure at Tampines. On the other end, GuocoLand focuses on premium urban living, exemplified by Martin Modern and Wallich Residence. Understanding a developer’s target audience can help you gauge what kind of finishing, layout, and facilities you can expect.

But do note that some major developers, who have been in the market for a very long time, are so versatile they’re too hard to pin down or associate with any one segment.

Far East Organization, for example, has projects from mass-market family condos like Mi Casa (Choa Chu Kang), to One Holland Village and The Reserve Residences in Bukit Timah. With over 700 projects over the decades, it’s hard to pigeonhole them.

4. Be prepared for greater risks in small or boutique projects

Smaller boutique developers can be more unpredictable. While some may deliver excellent niche projects, others may face resource constraints or inconsistent quality due to limited experience. Buyers should conduct extra due diligence when the developer is relatively unknown and the offerings are boutique condos (e.g., projects with 50 units or fewer).

That said, boutique developers can sometimes shine in niche markets. Projects like The Hyde (by Aurum Land, but note that their parent company is very well established and has worked on projects like Gardens by the Bay) and Jervois Mansion (by Kimen Group) show how small-scale developments can deliver high-end design and exclusivity when backed by experienced teams with strong financials. Other names you might encounter in the boutique category include Macly Group (The Iveria and Neu at Novena), or Roxy-Pacific Holdings (RV Altitude). We’d suggest you look up reviews of these projects to get a sense of who you’re dealing with.

Don’t let this overshadow the more fundamental aspects of the property, though

In the end, factors like location, layout, pricing, etc., should still weigh more; and tight regulations in Singapore make true developer failures a rarity. This is more of an added consideration when shortlisting projects, as we have a very high-quality built environment. If you’re viewing two fairly similar projects, for example, you might want to lean toward the stronger and more established developer. For specifics of each project, however, do follow us on Stacked or reach out to us, for in-depth reviews and on-the-ground insights.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What should I look for in a property developer's quality rating in Singapore?

Why is a developer’s after-sales service important when buying a condo in Singapore?

How does a developer’s experience in a specific market segment affect my condo purchase?

Are small or boutique developers riskier than large developers in Singapore?

Can the reputation of a developer influence the quality of a condo project?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

0 Comments