Would You Sell Your Home To Retire On A Cruise Ship For $300k In Singapore?

April 21, 2024

Do you like cruises? Do you really really like them, to the point you can stay on that ship for months or years?

Then you’ll be glad to know you can, in fact, buy a cruise ship cabin and live in it. Now I don’t know when exactly this started, but in the past, it was a thing for the uber-rich. I know of at least one person (indirectly) who’s done this: the mother of an American friend, who intends to spend her retirement cruising around the world, only coming off the ship a few days at a time.

These days though, prices are dropping – and of late, the MV Narrative has been in the news. Prices are reportedly between US$1 million to US$8 million, with prices varying based on the cabin and tenure. So a million or so might buy you a 24-year lease, while $8 million might get you a cabin for the lifetime of the ship.

I have no idea how long a cruise ship lasts, but for a cool $8 million, I would expect it to be sometime around the heat death of the universe.

I did, however, spy a news article where someone bought a 12-year lease for US$300,000, and I’m also told that part-share purchases are possible. But MV Narrative expects some 1,000 residents, which is quite different from older models of this business, which might see as little as 150 to 200 residents (at a correspondingly higher price). So I guess MS Narrative is the equivalent of a more mass-market condo, to put it in real estate terms.

As to making money, I’m a bit skeptical. Monthly fees are upward of US$2,000 from most reports, although that does include food, drinks, and all the other cruise ship facilities; and I doubt you’ll be able to sell your cabin for a profit (if resale is even allowed) given the very short lease.

Some of the ships also let you rent out the cabin when you’re not on it. But this sort of defeats the purpose, since if you want to be a landlord you may as well get a longer lease unit on solid earth; and with monthly maintenance fees so high, I wouldn’t be too optimistic about your net yield.

But while this may seem silly and exotic right now, there may be a real niche market for it in the future

Take Singapore as an example: we’re having fewer children, and we’re an ageing population. Some of us will be single late in life, without any beneficiaries to worry about – at that point, the end-of-life goal may be to die with zero. (You can read this excellent piece by TJ on alternative retirement homes here). That is, to have exactly enough to live a comfortable life and use up all the money you’ve rightfully earned before that.

Case in point: a friend who stays in serviced apartments and hotels only, and doesn’t want any assets left over as they have no one to inherit anything (I may be able to cover this if they agree to an interview).

In the context of this particular group, the idea of buying a cruise ship cabin, living only in serviced apartments, etc. may not be that outrageous. The facilities on a cruise ship are more upscale than any nursing home (if you have no family to look after you), there’s a maintenance crew if anything breaks, and there are social activities, variety shows, and constant travelling to different ports. It may also just make more sense from a planning perspective – you now know exactly how much your monthly expenditure would be, as compared to the variances from living on land.

More from Stacked

What You Need To Know About En-bloc Sales In 2021

For those who remember the en-bloc fever of 2016/17, the current Singapore property market may look a little depressing. Back…

No disrespect to retirement homes, but that does sound more appealing than arguing which channel should be on in a shared TV room.

The sticky issue here though, is how well-planned one’s finances are.

What happens if someone spends all their money on a cruise ship cabin, and the ship comes to an end, or they outlive their lease by a significant margin? Or what if they’ve purchased a cabin, but later health conditions make it impossible for them to go cruising around the world?

I can see insurance companies losing their minds over this, since any medical emergency on a cruise ship might involve a very pricey helicopter ride – and to facilities in a foreign country to boot.

Plus, remember what I said about resale? There’s no real “downgrade” option from here, as you might end up selling for less than the price of your resale flat would cost. So a lot of the usual safety nets are gone, once you trade off a conventional home for something exotic like a cruise ship cabin.

Now I’ll admit I’m biased because I’m not a cruise person, since (1) I have a massive accumulation of junk that won’t fit in a cabin, and (2) after one week on a cruise ship I’m so bored I’m having arguments with deck chairs, let alone a few months.

But I really do think the market for this sort of thing – along with other “die with zero” style retirement ideas – is set to grow.

Meanwhile in other property news:

- Boutique condos are quirky, individualistic, and marketed by really quiet whispering and like, one advertisement a year. Here are some cool ones that may have slipped your notice.

- 5-room flats close to the MRT, for under $600,000! They’re hard to find, but they do exist.

- Old leasehold condos: their values must drop like a brick thrown out an aeroplane right? Wrong, they’ve kept appreciating.

- Do you like duplex or loft-style units? Take a break from Singapore’s tiny-looking homes with these big monsters.

- Ever wondered what it’s like to live in a high-end, central condo like Sky Everton? Check it out here

Weekly Sales Roundup (08 April – 14 April)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WATTEN HOUSE | $11,828,000 | 3412 | $3,457 | FH |

| 19 NASSIM | $5,368,000 | 1475 | $3,640 | 99 yrs (2019) |

| THE RESERVE RESIDENCES | $4,854,563 | 1765 | $2,750 | 99 yrs (2021) |

| KLIMT CAIRNHILL | $3,118,000 | 893 | $3,490 | FH |

| THE BOTANY AT DAIRY FARM | $3,053,000 | 1539 | $1,983 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| GEMS VILLE | $1,018,000 | 517 | $1,970 | FH |

| THE ARDEN | $1,250,000 | 657 | $1,904 | 99 yrs (2023) |

| HILLHAVEN | $1,393,544 | 678 | $2,055 | 99 yrs (2023) |

| HILLOCK GREEN | $1,486,000 | 624 | $2,380 | 99 yrs (2022) |

| LENTORIA | $1,491,000 | 732 | $2,037 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE MARQ ON PATERSON HILL | $13,000,000 | 3057 | $4,253 | FH |

| YONG AN PARK | $8,480,000 | 3434 | $2,470 | FH |

| PANDAN VALLEY | $5,400,000 | 5974 | $904 | FH |

| WINDY HEIGHTS | $5,360,000 | 4973 | $1,078 | FH |

| BELLE VUE RESIDENCES | $5,150,000 | 2530 | $2,036 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CASA AERATA | $600,000 | 388 | $1,548 | FH |

| THE INFLORA | $670,000 | 463 | $1,448 | 99 yrs (2012) |

| EASTWOOD REGENCY | $680,000 | 398 | $1,707 | FH |

| TREASURE AT TAMPINES | $768,000 | 463 | $1,659 | 99 yrs (2018) |

| TRE RESIDENCES | $783,000 | 420 | $1,865 | 99 yrs (2014) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| PANDAN VALLEY | $5,400,000 | 5974 | $904 | $3,670,000 | 24 Years |

| MARTIN PLACE RESIDENCES | $4,780,000 | 1722 | $2,775 | $2,329,000 | 15 Years |

| WATTEN HILL | $4,950,000 | 2669 | $1,854 | $1,720,000 | 13 Years |

| MONTEREY PARK CONDOMINIUM | $2,448,888 | 1421 | $1,724 | $1,571,888 | 20 Years |

| MANDARIN GARDENS | $2,150,000 | 1572 | $1,368 | $1,500,000 | 21 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE MARQ ON PATERSON HILL | $13,000,000 | 3057 | $4,253 | -$900,000 | 13 Years |

| ONE SHENTON | $1,430,000 | 850 | $1,682 | -$320,000 | 11 Years |

| BELLE VUE RESIDENCES | $5,150,000 | 2530 | $2,036 | -$163,000 | 12 Years |

| JARDIN | $3,280,000 | 1776 | $1,847 | $22,700 | 12 Years |

| WATERBANK AT DAKOTA | $850,000 | 484 | $1,755 | $35,000 | 10 Years |

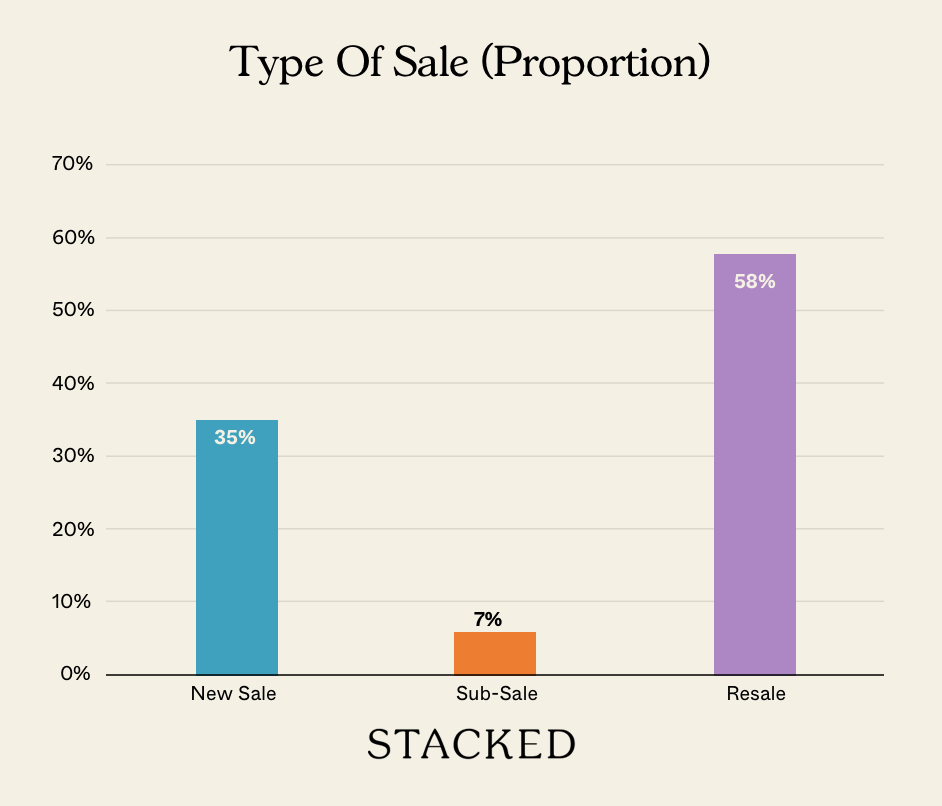

Transaction Breakdown

Follow us on Stacked for more news and discoveries in the Singapore property market!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Can you live on a cruise ship permanently in Singapore?

Is it affordable to buy a cruise ship cabin in Singapore for retirement?

What are the benefits of living on a cruise ship instead of traditional retirement homes?

Are there risks or downsides to buying a cruise ship cabin for retirement?

Could this idea become popular in the future for retirees in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments