For Singapore’s property market, the writing’s on the wall for analysts and realtors alike.

In an opinion that managed to surprise exactly zero people, Morgan Stanley has shifted its position on two key developers from overweight and equal weight to underweight. What most people would be more interested in, however, is their prediction that housing prices would likely decline 3 per cent in 2024 due to indicators such as housing vacancies and sales. Consider this:

- Normanton Park with 1,862 units is completed this year, as is Treasure at Tampines (2,203 units) and Parc Clematis (1,468 units). These are some of the biggest developments to date, and they’re all being finished the same year.

- New launch prices are averaging $2,100 to $2,300 psf, and realtors are already complaining HDB upgraders are backing down. Even if you could sell your 5-room flat for $700,000, what can you afford to upgrade to? The typical new launch three-bedder is now over $2.1 million.

- We’re seeing more and more Deferred Payment Schemes (DPS) reappear on the market. These are usually a sign of developers struggling to move their last few units; and there’s a need to make the payment more attractive.

- 60 per cent ABSD for foreign buyers, coupled with slashed taxes in our rival Hong Kong, is likely to drain away foreign investment; particularly for higher-end central region condos, and luxury homes.

- In the HDB market, the government has gone into overdrive, completing 23,782 in 2022, which was the highest in five years; and more will be finished this year.

- Even developers sense the change, growing more cautious in their bids despite the last tranche of en-bloc properties (back in 2017) being long-since redeveloped. A recent sign has been the closing of Pine Grove (Parcel B), where the highest bid of $1,223 psf ppr is lower than the $1,318 UOL paid for Parcel A (and let’s not forget the lower number of

The supply crunch is, broadly speaking, over; and the new hurdle is the combination of rising interest rates, plus the mind-boggling heights that prices have risen to. I also think that the April 2023 cooling measures are too recent for us to really gauge the impact yet, and next year is when we’ll truly start to see its teeth.

With luck, HDB upgraders will again be able to afford new condos (or at least sizeable resale ones). I know most property agents are on their side, as many realtors are now fighting for a supply of properties to sell.

(That’s also a warning: you’ll soon get a lot more flyers and calls, insisting your flat can now provide a retirement with 50 per cent more bird’s nest per week, so call me now to sell, etc.)

In any case, let’s also not forget that the Government still has a lot of levers to adjust (all those cooling measures) – if there are signs that property prices may drop more than expected.

Besides, buying at a low doesn’t mean much if you aren’t selling at the right time either (just take a look at some of these examples).

And while I used to think the government could help by dropping land prices, my naivety was checked by clearer heads

More from Stacked

We Spoke To BCA To Clear Common Property Misconceptions In Singapore: Here Are 9 You Need To Know

Singapore has a high-quality built environment, so most of us don’t’ ponder questions like “what if my condo runs out…

Why doesn’t the government just lower Land Betterment Charges, or drop the Government Land Sales reserve prices to rock bottom? That would make new properties cheaper right?

But a conversation with a realtor, plus a former executive in a development firm, cleared that innocent thought from my head.

Consider what would happen if the government dropped land prices, and two or three lucky developers get the land for cheap.

The current market rate for new launches is around $2,100 psf. Now will the developers drop prices below this amount, because they got the land for cheaper? Or will they continue to sell at $2,100 psf anyway because that’s the market rate?

Given that developers aren’t charities, and many have shareholders to answer to, the latter is more likely. Even if the government did sell land for cheaper, the developers will just sell at the current rates and reap better profits.

Besides showing why I’d be a terrible policymaker, all of this suggests that – if new launch prices fall – it will have come from somewhere besides cheaper land and development charges.

Meanwhile in other property news…

- The buzz right now is Pearl’s Hill, where we’ll soon see the first BTO flats in 40 years. But can this location, better known for being near the CBD, reinvent itself as a family area?

- Need a double-storey maisonette, and don’t mind the age so much? Here’s where the most affordable ones have been found.

- Sell one, buy two has been a sales pitch for a long time. But with prices and interest rates so high, many realtors are reconsidering this advice.

- Two-bedders may seem tempting given the cost of bigger units today; but beware of the potential drawbacks.

- Buying a property is expensive, but did you know that selling one can be expensive too? The cost of a replacement property is starting to wreak havoc in 2023.

Weekly Sales Roundup (30 October – 05 November)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| AMO RESIDENCE | $5,600,000 | 2293 | $2,443 | 99 yrs (2021) |

| MIDTOWN MODERN | $4,481,000 | 1464 | $3,061 | 99 yrs (2019) |

| PULLMAN RESIDENCES NEWTON | $3,740,000 | 1163 | $3,217 | FH |

| GRAND DUNMAN | $3,462,000 | 1432 | $2,418 | 99 yrs (2022) |

| THE RESERVE RESIDENCES | $3,458,499 | 1475 | $2,345 | 99 yrs (2021) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| GRAND DUNMAN | $1,409,000 | 549 | $2,567 | 99 yrs (2022) |

| THE LANDMARK | $1,420,000 | 495 | $2,868 | 99 yrs (2020) |

| PARKSUITES | $1,443,321 | 635 | $2,273 | 110 yrs (2017) |

| THE LAKEGARDEN RESIDENCES | $1,508,000 | 732 | $2,060 | 99 yrs (2023) |

| PULLMAN RESIDENCES NEWTON | $1,615,000 | 463 | $3,489 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| 8 NAPIER | $6,780,000 | 2013 | $3,368 | FH |

| WALLICH RESIDENCE | $5,210,000 | 1668 | $3,123 | 99 yrs (2011) |

| TURQUOISE | $4,610,000 | 2680 | $1,720 | 99 yrs (2007) |

| D’LEEDON | $4,128,000 | 2153 | $1,918 | 99 yrs (2010) |

| VALLEY PARK | $4,060,000 | 1808 | $2,245 | 999 yrs (1877) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| VIBES @ EAST COAST | $693,000 | 398 | $1,740 | FH |

| RIVERBANK @ FERNVALE | $700,000 | 549 | $1,275 | 99 yrs (2013) |

| MILLAGE | $733,000 | 463 | $1,584 | FH |

| KINGSFORD WATERBAY | $733,000 | 484 | $1,513 | 99 yrs (2014) |

| D’NEST | $740,000 | 484 | $1,528 | 99 yrs (2010) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| VALLEY PARK | $4,060,000 | 1808 | $2,245 | $2,170,000 | 28 Years |

| THE IMPERIAL | $3,400,000 | 1410 | $2,411 | $2,089,000 | 18 Years |

| TIARA | $3,088,000 | 1346 | $2,295 | $1,888,000 | 22 Years |

| ASPEN HEIGHTS | $3,300,000 | 1572 | $2,100 | $1,350,000 | 27 Years |

| D’LEEDON | $4,128,000 | 2153 | $1,918 | $1,267,000 | 7 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| TURQUOISE | $4,610,000 | 2680 | $1,720 | -$2,336,030 | 16 Years |

| ST REGIS RESIDENCES SINGAPORE | $3,900,000 | 1507 | $2,588 | -$1,606,578 | 16 Years |

| 8 NAPIER | $6,780,000 | 2013 | $3,368 | -$320,000 | 13 Years |

| MANHATTAN MANSIONS | $3,990,000 | 2196 | $1,817 | -$290,000 | 16 Years |

| ONZE @ TANJONG PAGAR | $1,270,000 | 570 | $2,226 | -$193,000 | 10 Years |

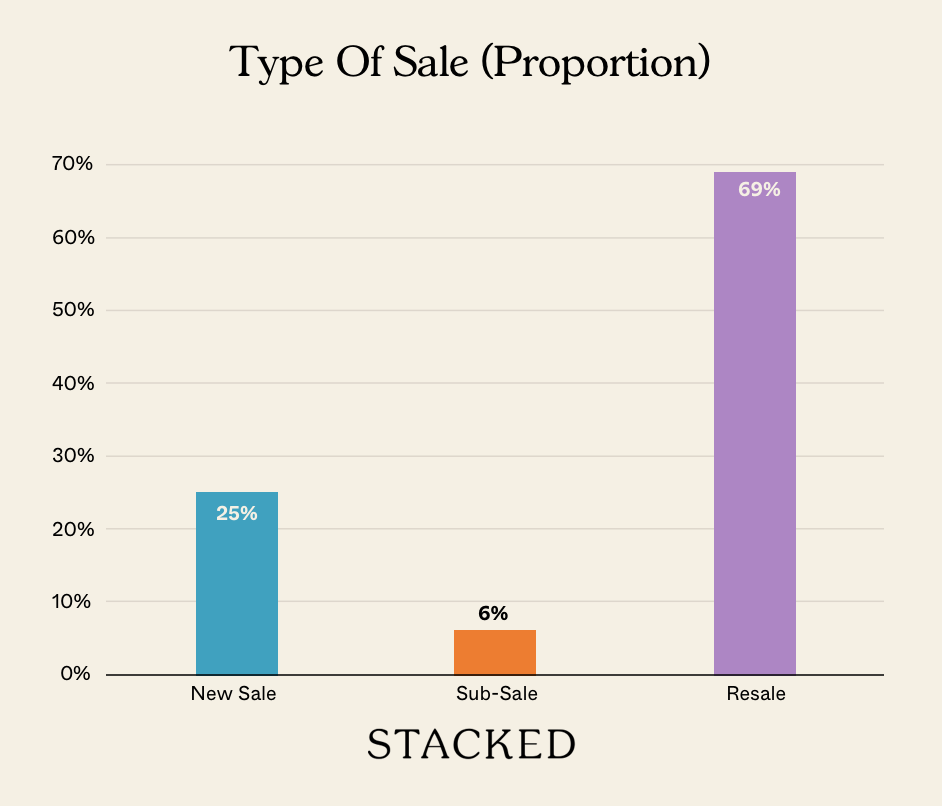

Transaction Breakdown

For more updates on the property market, as we enter a scary-looking 2024, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Will Singapore property prices go down in 2024?

What factors might cause property prices to fall in Singapore next year?

Are new property launches in Singapore becoming more affordable in 2024?

How is the government influencing the property market in Singapore?

Is it a good time to buy or sell property in Singapore in 2024?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Singapore Property News Why Housing Took A Back Seat In Budget 2026

Latest Posts

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

2 Comments

Would you please explain what cooling measures the government has at it’s disposal if property prices were to fall too much?

Removing ABSD for Singaporeans and PRs on second investment property will have no effect as people will likely not speculate with second investment property in a high interest rate environment where they can barely pay the first mortgage.

Lowering loan to value makes no sense when residents are already stressed to the max with the loans that they already have.

And finally taking off ABSD on the elusive foreign buyer..your blog ran an article saying that the foreign buyer effect is always overstated and very concentrated on the higher end of the market. So if this factor was never really that relevant, how would this move the market?

So which of these cooling measures can the government really use to fight lowering property prices? I never really understood this argument as cooling measures really didn’t work on prices on its way up and there is this expectation that they would incredibly well on price on its way down.

Amid anticipations, predicting exact market changes is intricate. Economic measures, community strength, and prudent policies can potentially safeguard against substantial drops, fostering stability in Singapore’s property landscape. I own business which is Kelvin Property.