Will Landed Homes Continue Their Momentum In The Singapore Market For 2021?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

The landed property market saw a strong pick up in Q4 2020. Back then, we heard plenty of market watchers speculate that landed prices had to come down soon; it just took time for Covid-19’s effects to bite.

Well, it hasn’t happened yet; and so far demand has been unrelentingly high. Case in point: the sale of a $128.8 million Good Class Bungalow (GCB) along Nassim Road, in Q1 of this year, at a jaw dropping $4,005 psf.

And it has barely been 2 months since – and there have been reports of that record being broken. A GCB on Cluny Hill is in the early stages of a sale at $63.7 million, or a potentially new record of $4,291 psf.

That’s staggering.

So great news, if you’re selling a landed home. But if you’re just trying to upgrade to a landed home now, you’d better take a deep breath. Sellers aren’t budging from asking prices. and the spectre of new cooling measures looms overhead:

What’s happening to the landed property scene in Singapore?

Edmund Tie mentioned in the Straits Times that, for Q1 2021, landed properties beat out non-landed counterparts for the quarter. This was on a comparison of profitable versus non-profitable transactions between the two (do see their overall conclusions in the linked article above).

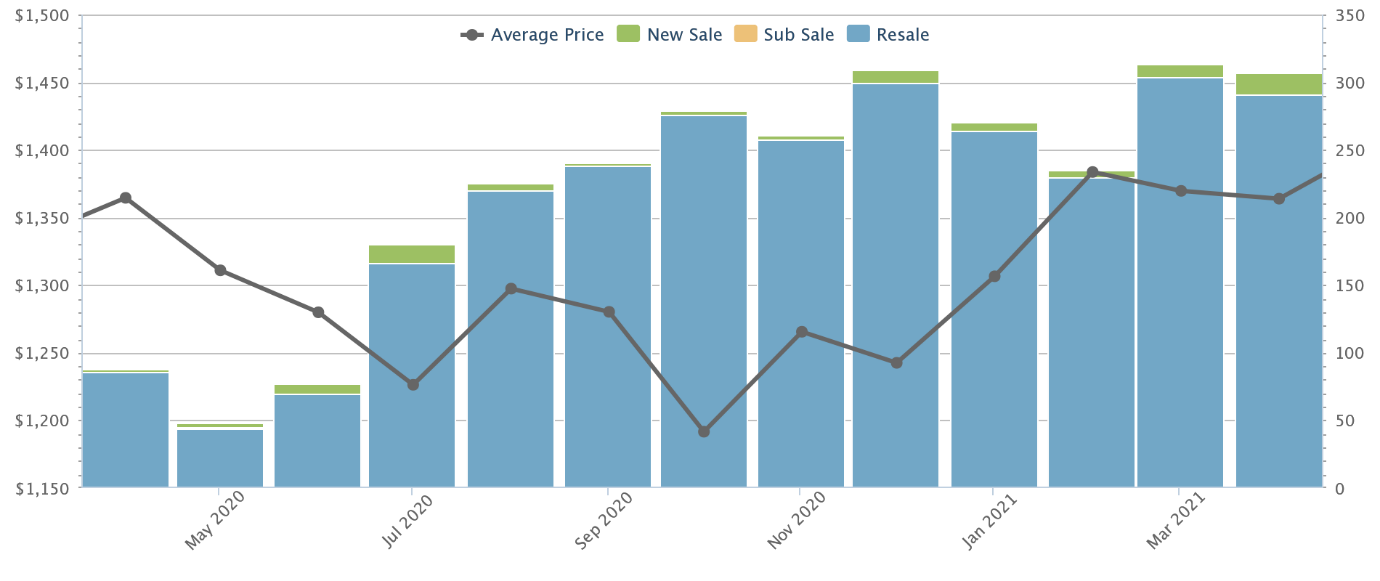

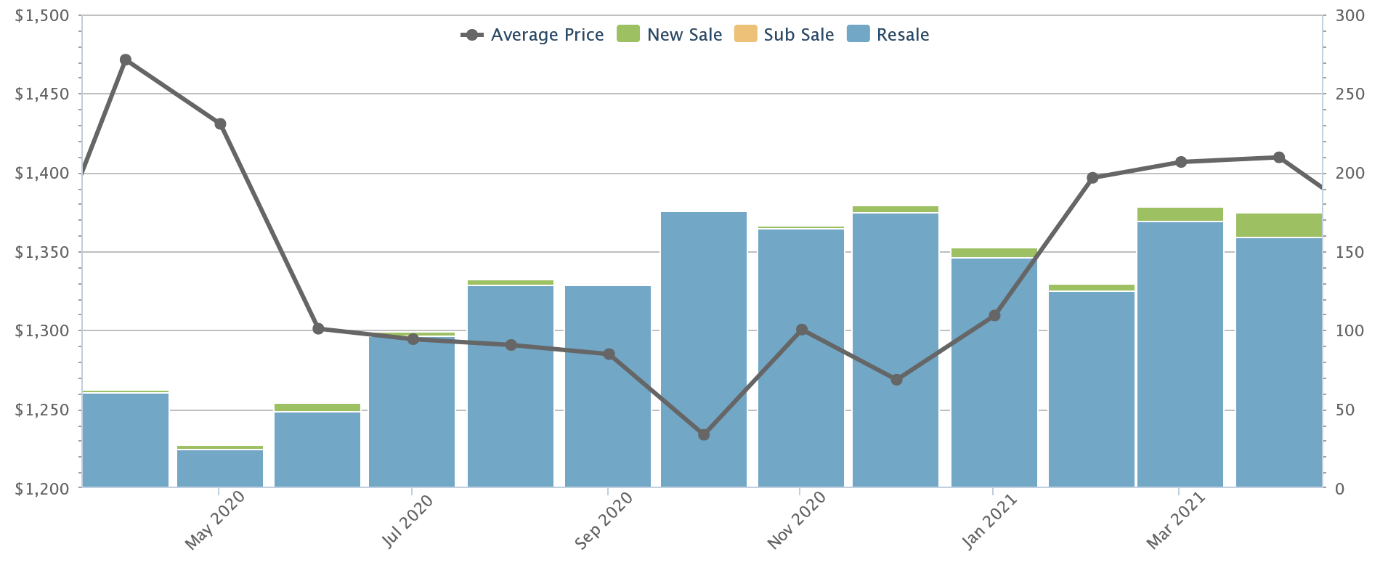

To get a sense of actual prices and volume, we took a look at landed transactions island-wide, over the past 12 months:

Based on data from Square Foot Research, overall price psf has remained flat at $1,364 psf (down from $1,365 a year ago). What has increased is the number of transactions.

There were 306 landed property transactions in end-April 2021, which is the highest we’ve seen in a while.

The low volume from April to July 2020 is due to the Circuit Breaker; this began on 7th April 2020, and ended on 1st June 2020. However, note that from August 2020 onward, landed home transactions haven’t fallen below 200 units for nine straight months.

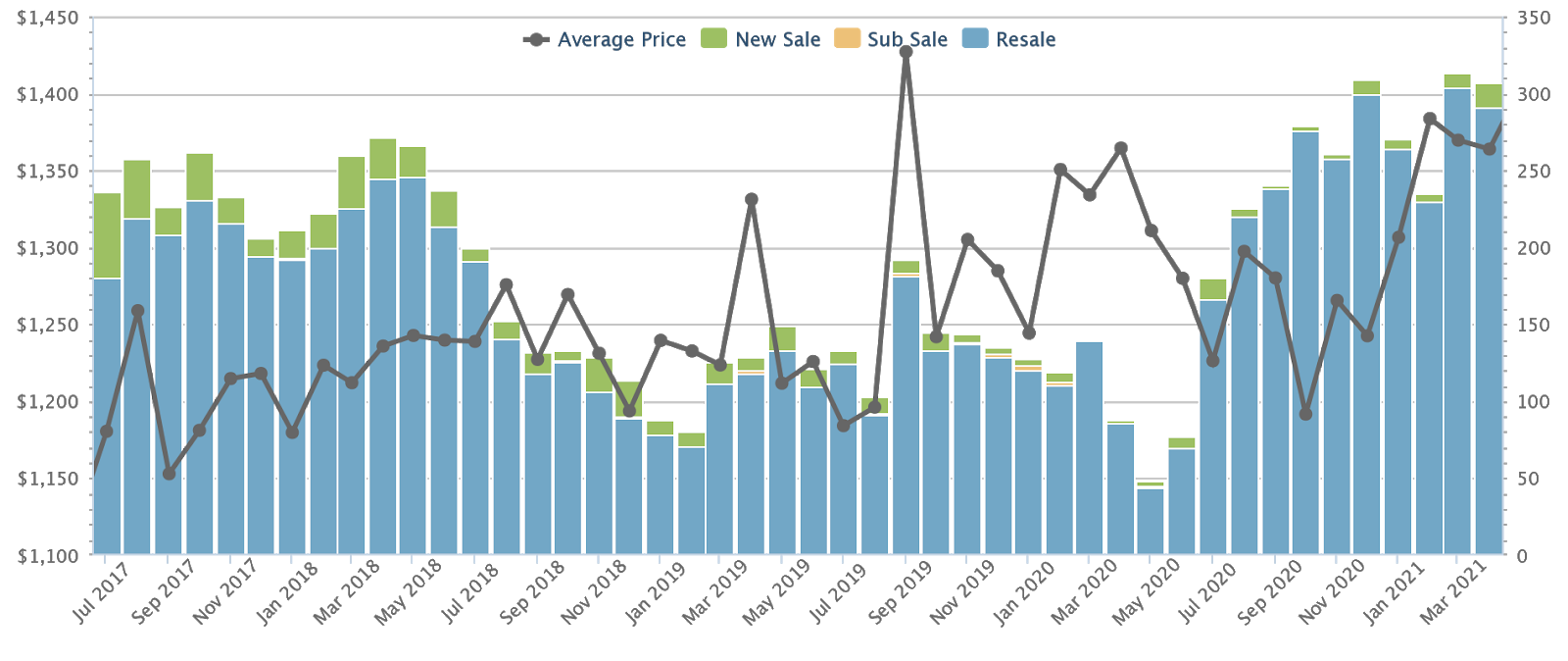

We haven’t seen transaction figures like this since July 2017 to June 2018, just before new cooling measures kicked in:

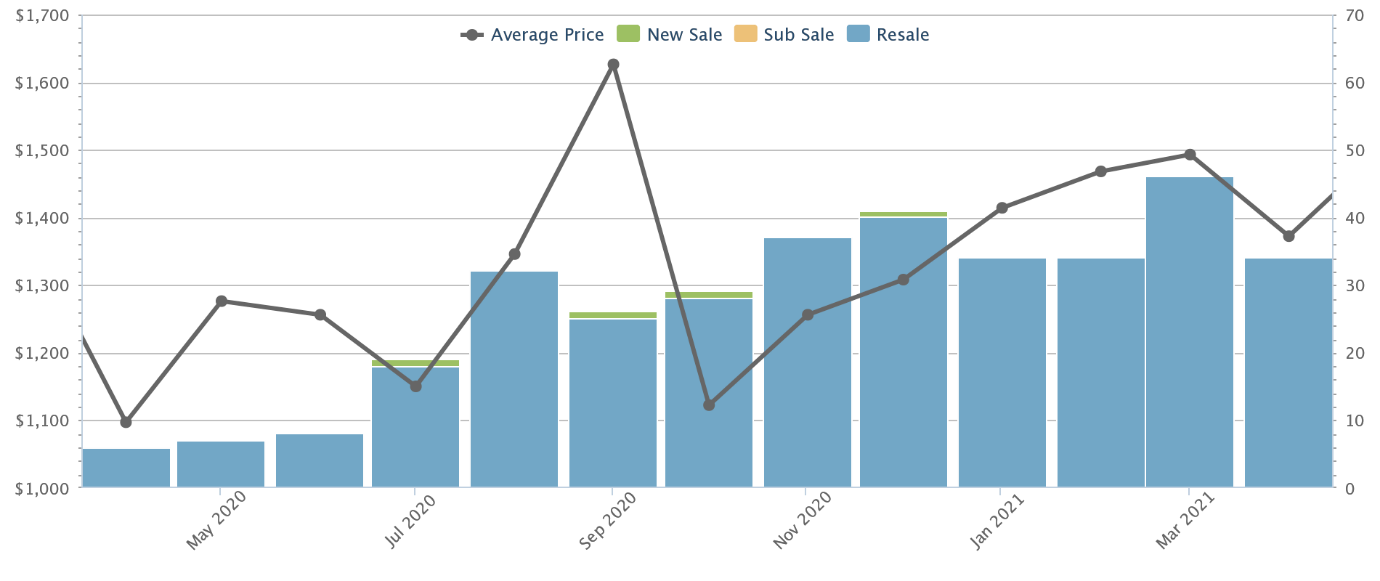

Detached houses have seen the biggest overall pick-up since the end of the Circuit Breaker

Detached houses have seen strong sale volumes since the end of the Circuit Breaker.

March 2021, in particular, saw 46 transactions. This is the highest transaction volume for detached houses in around 10 years, although the number fell back to 34 the next month.

Prices for detached homes now average $1,372 psf, up from $1,097 at the same time last year. This is up around 25 per cent.

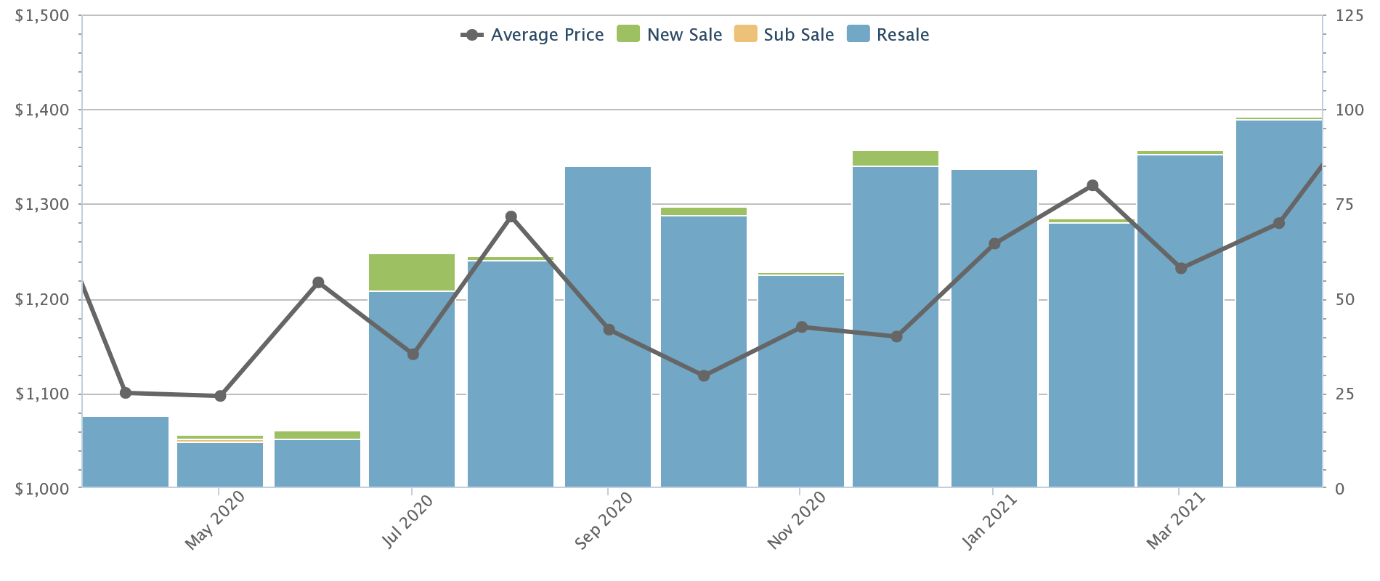

Semi-detached houses also saw their highest transaction volume in around 10 years, reaching 98 transactions in end-April 2021:

Prices for semi-detached houses now average $1,280 psf, up from $1,100 psf the same time last year. This is up around 16 per cent.

Terrace houses didn’t see as dramatic a pick-up, compared to their other landed counterparts. They reached 174 transactions as of end-April 2021, while average price declined from $1,471 to $1,410 psf.

Overall, we can see that larger landed homes (semi-D and detached) have been the highlight of the year.

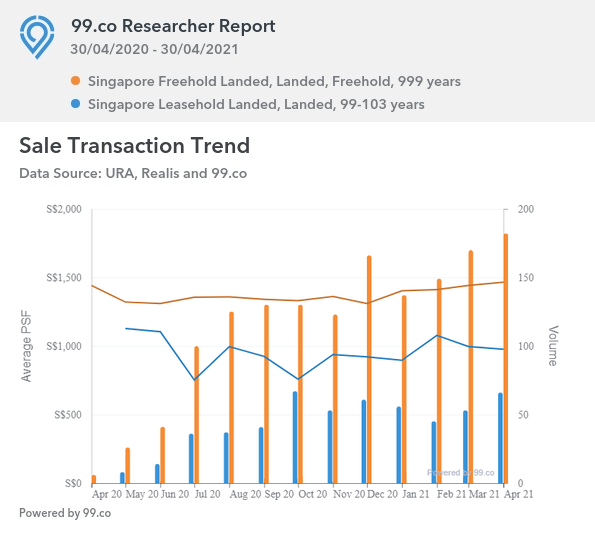

However, there’s a wide discrepancy between freehold and leasehold landed

Realtors on the ground warned that the pick-up in landed homes has been one-sided. Some of them said that demand has been almost entirely for freehold landed homes only, with leasehold landed showing more lacklustre sales.

We checked on 99.co to see the price movement between freehold and leasehold (we used a different data source because this leasehold / freehold distinction wasn’t on Square Foot Research):

As you can see, freehold houses made up the majority of transactions every month (also could be because of the bigger supply). Price movement has been mostly flat for freehold, from $1,441 to $1,465 psf over the year. However, leasehold houses have seen prices slide over 13.4 per cent; from $1,128 in May (no transactions in April) to $977 in April 2021.

One of the realtors we spoke to pointed out that Sentosa Cove is contributing to this:

“The problem is the ABSD is currently 20 per cent for foreigners, or about $840,000 tax on an average price of $4.2 million. So foreigners find Sentosa Cove prices are too high, and we Singaporeans all want freehold landed.”

More from Stacked

We Bought Our First Home On Carousell: Here’s What We Learnt

The digital aspects of Singapore’s private property market have grown to new proportions – from a time when people didn’t…

Property Market CommentaryAre Sentosa Cove Bungalows Really Seeing A Turnaround?

by Ryan JOther realtors pointed out that landed property buyers are looking for generational assets. A landed home is the last stop on an asset progression journey, and buyers often want it to provide for their descendants for multiple generations. Leasehold properties, however well located, are unable to fulfil this purpose. As such, leasehold landed prices are not likely to see the same pick-up anytime soon.

This might be a silver lining for some readers. If you’re looking for a landed home, and you don’t mind leasehold, you may not have to compete with too many others. Do give us a shout, and we can help you find the best options.

Is the trend for landed homes likely to continue?

As always, there’s no perfect crystal ball. However, the general consensus from analysts and realtors is that – barring new cooling measures – the demand for landed homes is unlikely to diminish. This is down to three main causes:

- Fear of new cooling measures

- Lower interest rates

- A safe haven investment

1. Fear of new cooling measures

At the moment, we’re running the risk of new cooling measures. Some buyers (e.g., those who want to move into a landed home, while retaining and renting out their existing condo) will feel driven to act now; before new loan curbs or higher ABSD rates kick in.

Also, a spike in transaction volumes – especially for high-value properties like landed homes – is often seen as a red flag. For example, the last round of cooling measures (July 2018) happened after landed home transactions stayed above 200 units, for several consecutive months.

Although some may also say at this point with the current new measures that will naturally tamper the number of viewings, this might actually be a form of cooling measure that may slow things down.

2. Lower interest rates

At present, home loan rates are at 1.2 to 1.3 per cent per annum. This is due to the US lowering rates at home, to stimulate their economy in a downturn. Covid-19 will have after-effects for years down the road, due to the number of businesses shut and jobs lost.

As such, it’s likely that we’ll see low interest rates for a long time to come. As a point of reference, interest rates were last dropped to help with the Global Financial Crisis in 2007/8. The rates still hadn’t normalised by 2020, when the pandemic hit and sent them down again.

Among some investors, an interest rate lower than the risk-free CPF rate of 2.5 per cent is seen as “borrowing for free”.

3. A safe haven investment

Much like we saw in 2007/8, investors who have liquidated other assets – such as their stock portfolios – are not always eager to leave it with the bank. With interest rates being rock bottom, they need to find something else to invest in.

While there are a range of alternatives (gold, bond funds, etc.), Singapore real estate is one of the most notable assets on that list. This is especially the case for Singaporean investors, who have – historically and culturally – learned to see real estate as a part of retirement planning.

Landed homes are perceived as an ideal asset, since new condos and flats are being built all the time; but actual houses are so rare (about five per cent of current housing stock), that there’s never a supply issue.

But if all you want is a landed home for the space, there are alternatives

Don’t forget there are condo developments with landed homes as well, like the villas in Normanton Park. Yes, they’re not “true landed” properties, they have maintenance fees, and they’re mostly leasehold – but if you’re not focused on investment returns, is that really a big drawback?

These units still provide the space you need, with the added bonus of pools, gyms, 24/7 security, and all the usual condo benefits.

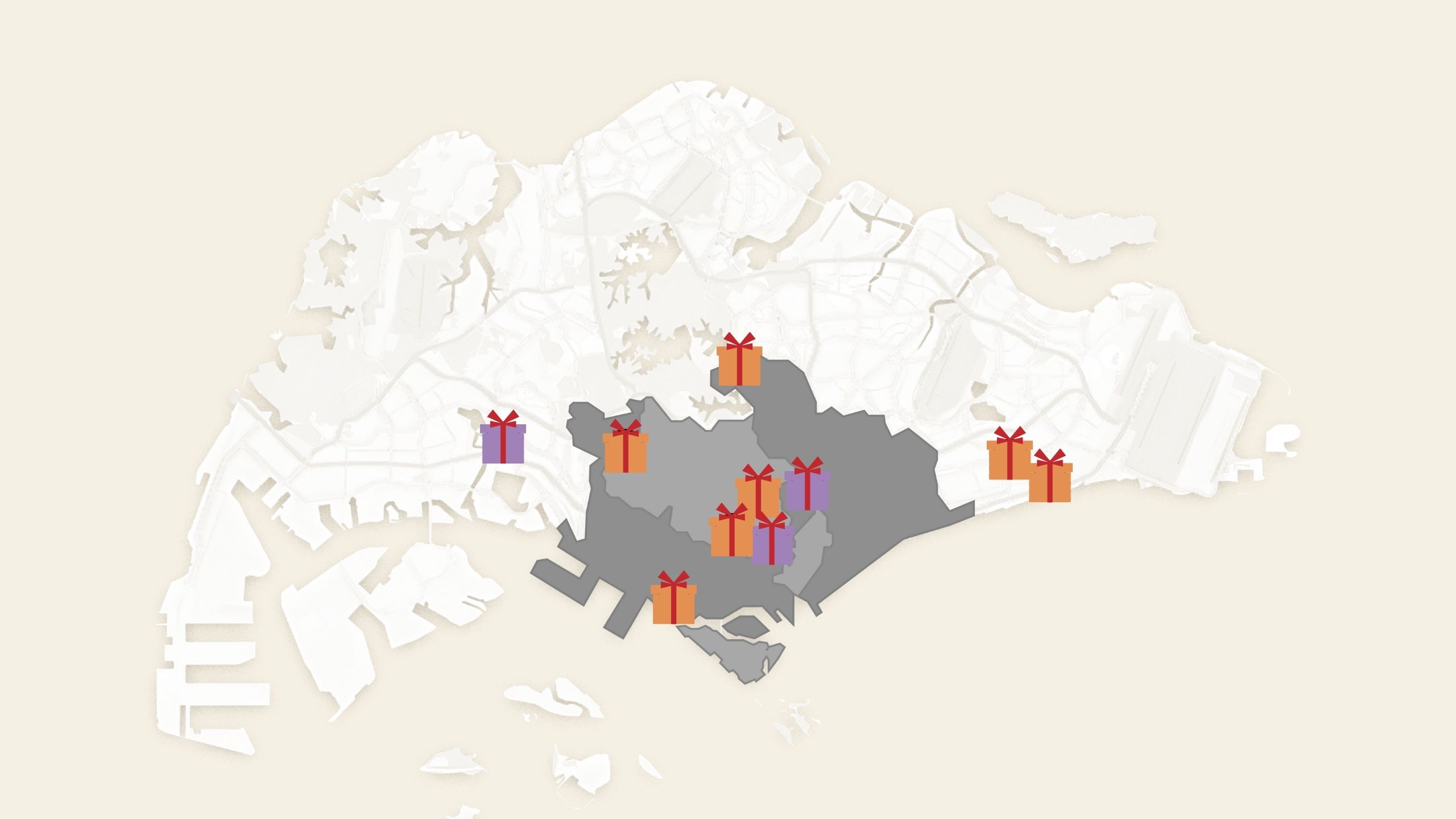

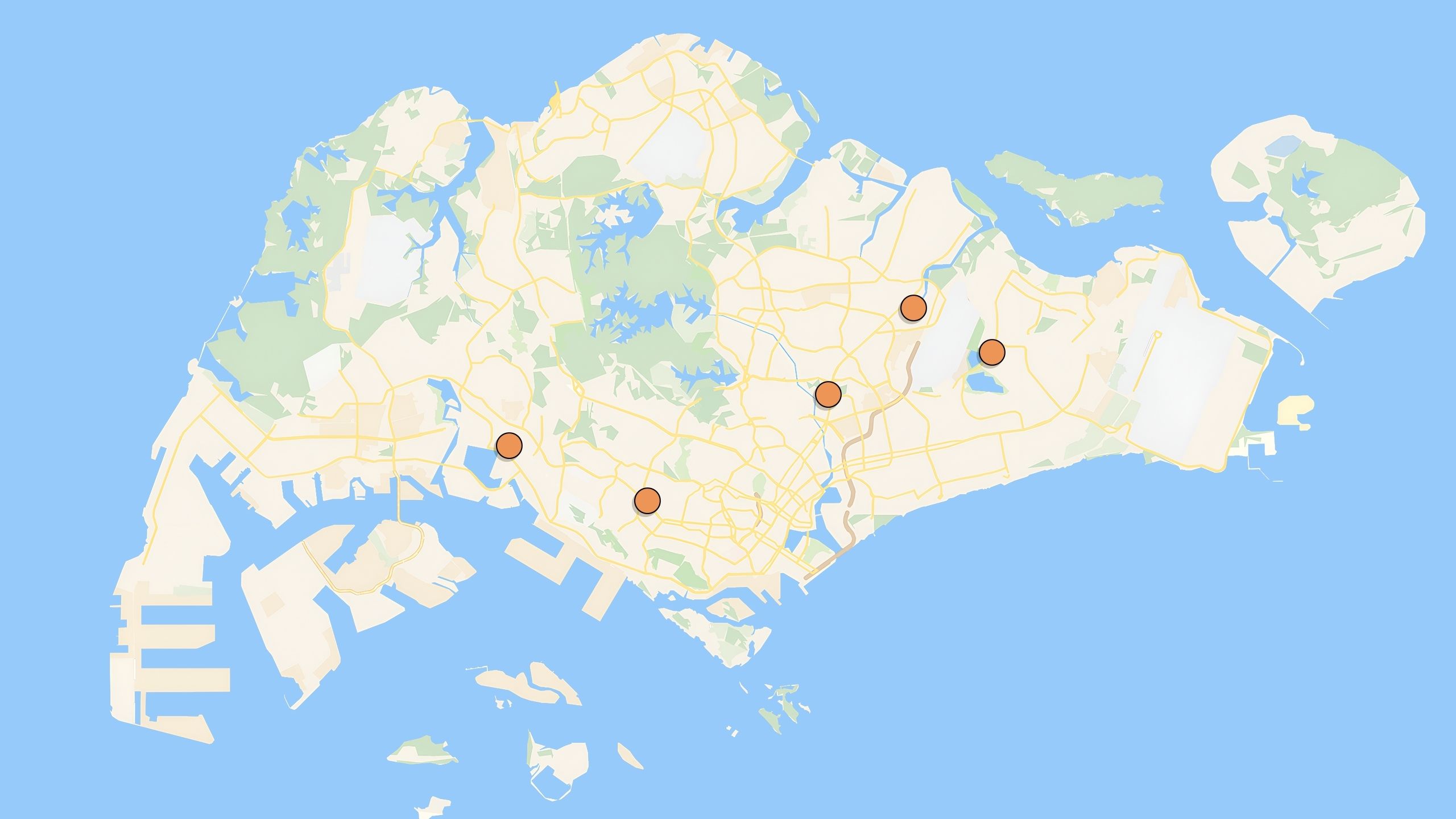

Some of the condos with landed properties right now are:

- The Verandah Residences

- Normanton Park

- Parc Clematis

- Kent Ridge Hill Residences

- Parksuites

- Leedon Green

For more on the Singapore private property market, and reviews of new and resale developments alike, follow us on Stacked. We’ll update you with more details as we get them.

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Market Commentary

Property Market Commentary The Rare Condos With Almost Zero Sales for 10 Years In Singapore: What Does It Mean for Buyers?

Property Market Commentary 5 Upcoming Executive Condo Sites in 2026: Which Holds the Most Promise for Buyers?

Property Market Commentary We Analysed Dual-Key Condo Units Across 2, 3 and 4 Bedders — And One Clear Pattern Emerged

Property Market Commentary Are New Launch Condos Really Getting Cheaper in 2025? The Truth Isn’t What You Think

Latest Posts

Landed Home Tours We Toured a Freehold Landed Area Buyers Overlook — It’s Cheaper (and Surprisingly Convenient) From $3.2M

Singapore Property News The Hidden Costs of Smaller Homes in Singapore

Property Advice We Own A 2-Bedder Condo In Clementi: Should We Decouple To Buy A Resale 3 Bedder Or Sell?

On The Market We Found the Cheapest Yet Biggest 4-Room HDBs You Can Buy From $480K

Pro Why This Freehold Mixed-Use Condo in the East Is Underperforming the Market

Singapore Property News 10 New Upcoming Housing Sites Set for 2026 That Homebuyers Should Keep an Eye On

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Singapore Property News Will Relaxing En-Bloc Rules Really Improve the Prospects of Older Condos in Singapore?

Pro Why This Large-Unit Condo in the Jervois Enclave Isn’t Keeping Up With the Market

Singapore Property News A Housing Issue That Slips Under the Radar in a Super-Aged Singapore: Here’s What Needs Attention

Landed Home Tours Inside One of Orchard’s Rarest Freehold Enclaves: Conserved Homes You Can Still Buy From $6.8M

Property Investment Insights These 5 Condos In Singapore Sold Out Fast in 2018 — But Which Ones Really Rewarded Buyers?

On The Market We Found The Cheapest 4-Bedroom Condos You Can Still Buy from $2.28M

Pro Why This New Condo in a Freehold-Dominated Enclave Is Lagging Behind

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K