Why The Orie At Toa Payoh Sold 86% Of Its 777 Units In One Weekend

January 20, 2025

The Orie at Toa Payoh has set the tone for 2025 due to its rapid sales: it moved 86 per cent of its 777 units during the launch weekend. This has prompted some eye-rolling among market watchers, as it achieved a particularly high average price per square foot of $2,705 psf. However, the market has spoken: buyers are interested, and the Toa Payoh location is proving to be a massive draw. Here’s what happened during the launch weekend, and how The Orie managed to exceed expectations:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A rundown on The Orie

The Orie is a leasehold, 777-unit project at the junction of Lorong 1/Lorong 4 Toa Payoh. It’s jointly developed by CDL, Frasers Property and Sekisui House. The Orie is within walking distance to Braddell MRT station (NEL), which puts it in striking distance of the Toa Payoh HDB hub (one stop away). If you want two other train lines, Caldecott MRT station (CCL, TEL) is also within range, if you don’t mind needing a bus connection.

The average selling price during the launch weekend was $2,705 psf, which is quite striking; this pricing level is typically associated with prime region luxury properties rather than an area like Toa Payoh. In terms of overall quantum, most of the smaller one-bedroom units started at $1.28 million, while three-bedroom units (850 sq. ft.) reached around $2.09 million. The larger four- and five-bedroom units (approximately 1,216 sq. ft. and 1,453 sq. ft., respectively) were priced at around $2.92 million and $3.48 million.

The nearby HDB enclave is well-developed, with a direct bus connection to the Toa Payoh West Market & Food Centre. One of the other major attractions is the proximity to the HDB Hub, which offers a variety of restaurants, retail outlets, banking services, and more. The HDB enclave immediately surrounding The Orie also has the usual heartland amenities, and Toa Payoh Block 95 nearby has an NTUC FairPrice.

The upcoming Toa Payoh Integrated Development may also be a lure, but this is much further down the road in 2030.

The Orie sold 668 of its 777 units over the launch weekend, or about 86 per cent of units. You can see a full review of The Orie here.

How did it sell so well if it’s expensive?

Here’s a comment we saw online, regarding The Orie’s price:

This more or less captures the essence of the complaints, and it must be said that they are not unfounded. At over $2,700 psf, buyers could indeed afford a property in the Core Central Region (CCR). There’s also a psychological factor at play here, as seeing a non-city-centre property hit such price levels is bound to concern some buyers. That said, the real issue in 2025 is that comparing properties based on psf alone no longer provides a meaningful picture, given the evolving priorities of buyers and GFA harmonisation changes. Nonetheless, there are reasons why The Orie can command its price tag:

It’s the first new condo in Toa Payoh in around eight years

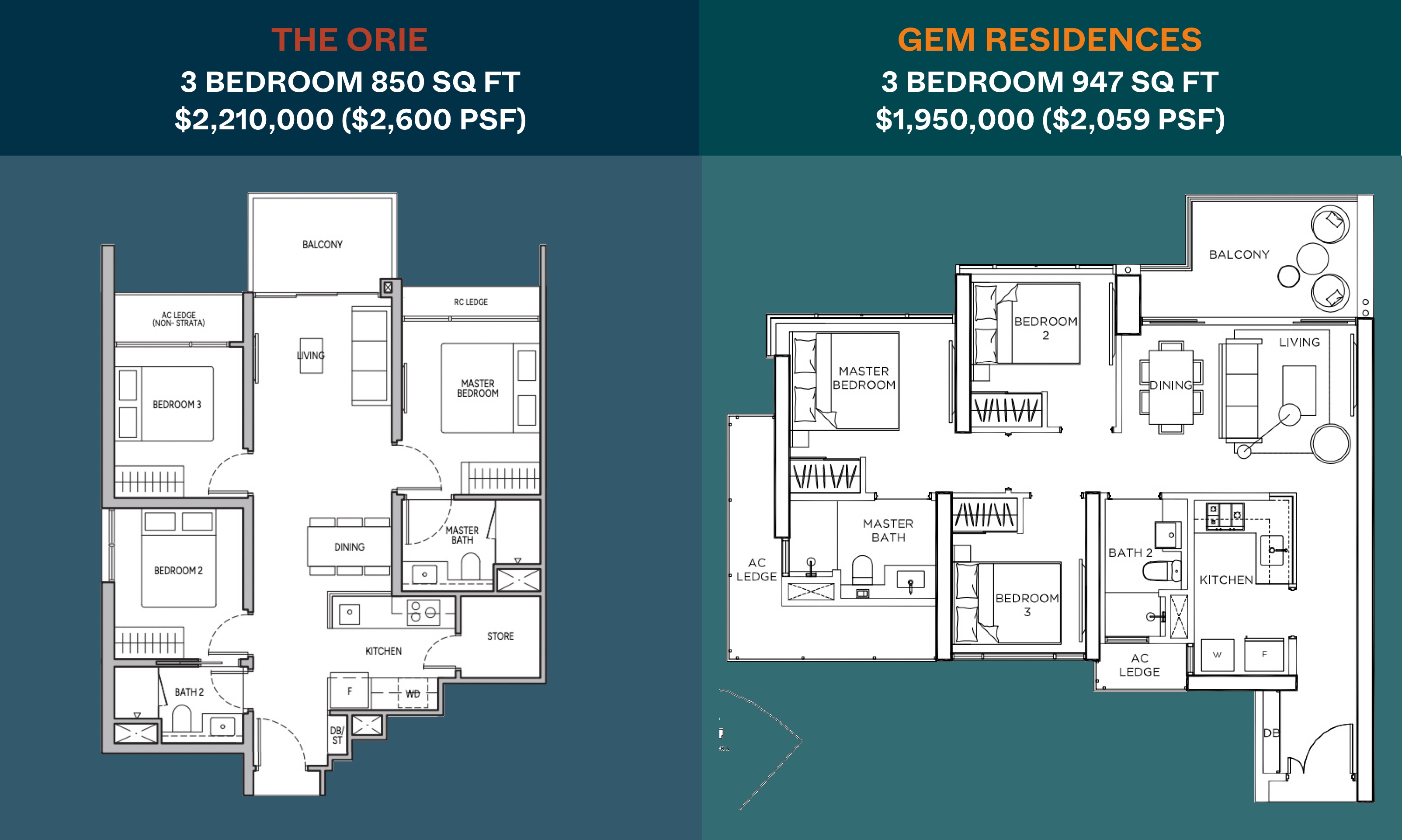

The Orie has seen a lot of pent-up demand. The last notable project in the area was Gem Residences, which was back in 2016 (and Gem Residences can’t compare in quality of layout, being older and much less efficient.)

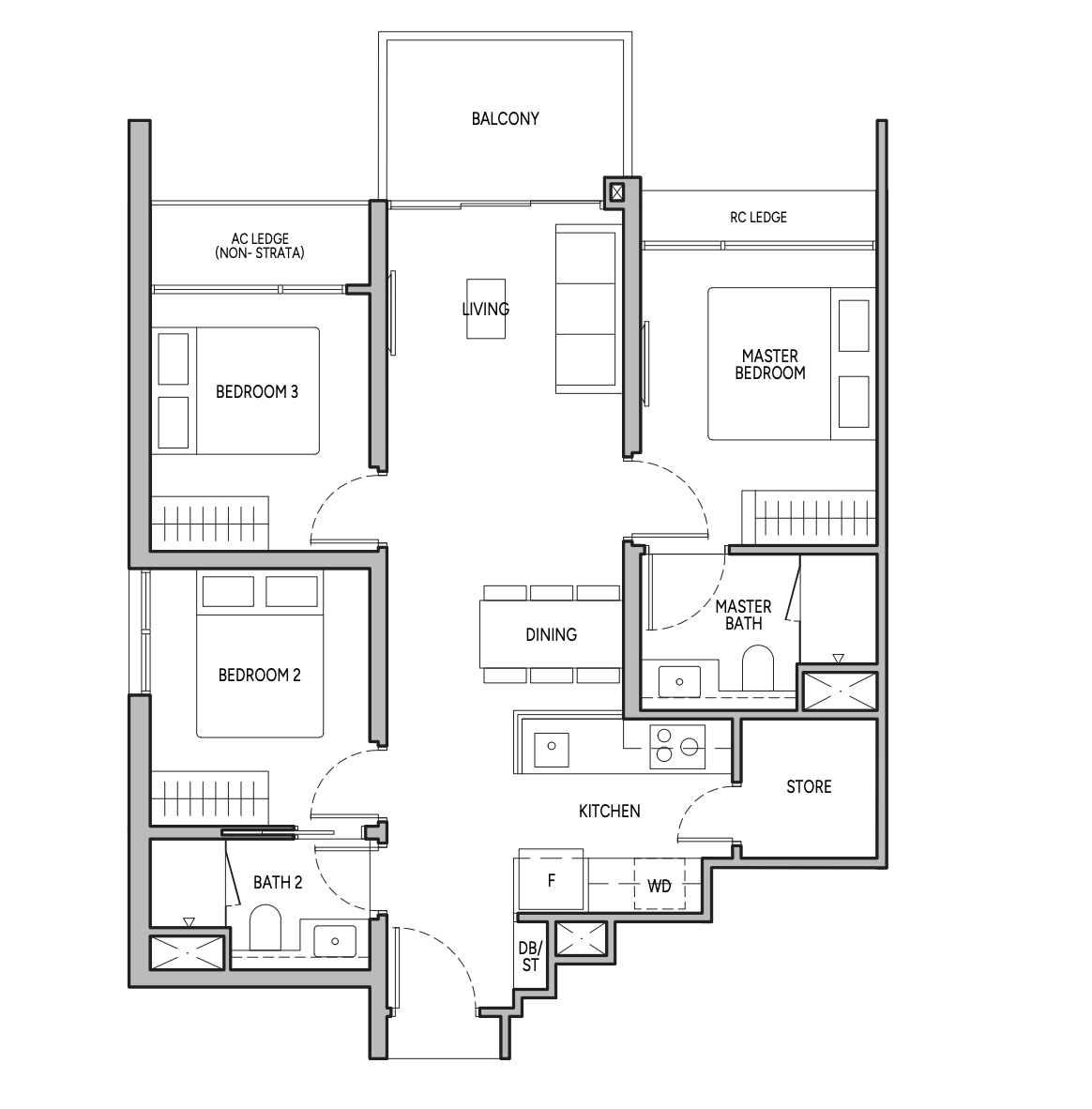

Some other projects nearby include Trevista, Trellis Towers, and Oleander Tower; but The Orie is notably newer than them. This also means that Orie has layouts which are more space-efficient, such as two and three-bedders with a dumbbell layout. This makes for a positive contrast against its 2010-era counterparts, which are more likely to have wasteful features like big air-con ledges, planter boxes, bay windows, and so forth.

However, we should point out that the dumbbell layout is prominent in the smaller units. The larger units (four and five-bedders) have some long corridors, which are less efficient.

That said, we’ve made a price comparison between The Orie and the surrounding options here. None of the older counterparts besides Trevista seem to even reach the $2,000 psf mark on account of the age gap.

The high price per square foot may be due to the smaller units

By the end of the launch weekend, if you looked at the sales board, you’d see that most of the units sold were two and three-bedders. Sales of the larger units, as well as the dual-key units, saw smaller numbers. As with most properties, a smaller unit tends to have a higher price per square foot, but a lower quantum (and the reverse is true for bigger units.) There are, for instance, one-bedders at The Orie that reached $3,000 psf or more.

More from Stacked

Is Singapore’s Property Market Slowing Down? What Top Developers Are Hinting

When buyers spy developer caution, they know their time is coming.

So it’s in part the small sizes of units sold, which are contributing to the high average of $2,700 psf.

On that note, realtors also pointed out a surprising turn here: the 850 sq. ft. three-bedders were highly contested. This is undoubtedly compact for a three-bedder, and it was uncertain if the buyers would accept it; many family buyers tend to look for at least 1,000 sq. ft. But in reality, these compact three-bedders sold faster than the two-bedders. In fact, when one of the buyers for the three-bedders dropped out, we heard that a further 77 people balloted for it.

This may be due to buyers’ better understanding of post-GFA harmonisation rules. Under the new rules, unliveable spaces such as air-con ledges, strata void spaces, etc. no longer count toward the total square footage. For this reason, The Orie’s three-bedders may have just as much living space as an older, pre-GFA harmonisation condo. This could make a count of 850 sq. ft. more palatable.

Potentially high numbers of HDB upgraders in future

Agents have noted that the surrounding HDB projects could experience a surge of upgraders in the future. This is because HDB upgraders often prefer to remain in the same neighbourhood, either due to familiarity or practical considerations such as proximity to schools and workplaces.

The HDB projects in Toa Payoh and Caldecott are typically of the high-value variety. As mentioned earlier, nearby HDB developments like The Peak @ Toa Payoh have achieved record-breaking prices. There’s also an expectation that 3-room flats in Caldecott could even reach $1 million, while 5-room flats here could reach $1.5 million and above, mirroring what has happened over at the Dawson area.

This creates an ideal scenario for future gains, as The Orie could attract a substantial pool of future buyers. The HDB upgraders in this area will likely have the purchasing power to buy a condo; and The Orie will stand out from the rest by being much newer (and timely, as well).

The Orie’s fast sales are driven by strong fundamentals

This represents the trinity of pent-up demand, a strong location, and a ready pool of future buyers. It demonstrates that, even at a higher price point, condominiums meeting these three criteria can continue to attract buyers. In this context, comparing The Orie to, say, a District 9 property may not be entirely fair.

Generally speaking, a condominium in Toa Payoh should not command the same price psf as one in Orchard, but in 2025 the psf comparison is one that shouldn’t even be made in the first place. However, property comparisons are far more nuanced than that, and buyers are likely to focus on practical considerations. Toa Payoh Hub is a proven area with growth potential, and already well-supported prices.

One agent pointed out that Trevista’s four-bedders (1,701 sq. ft.) are selling at around $3.158 million currently. The Orie’s four-bedders (1,216 sq. ft.) are smaller, but are around $3.1 million; this is still somewhat within expectations for the area, if you stick to comparing total quantum.

It may also be that, in terms of a new launch investment property, the next up-and-comer is the Zion Road plot (that is again bought by CDL). This may launch at a price close to Orie anyway given the lower land price, and there’s much more supply along Zion Road, so we may expect to have a competitive launch here.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did The Orie at Toa Payoh sell so many units during its launch weekend?

What makes The Orie at Toa Payoh different from older nearby condos?

How does the price per square foot at The Orie compare to other properties in the area?

Why are smaller units at The Orie selling at a higher price per square foot?

Are there future prospects for buyers of The Orie in terms of property value?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

6 Comments

i live in the area and i think you got some of the details about proximity to the MRT stations wrong

the location of the development is actually across from gem residences and about a 10-minute walk from braddell mrt station. it’s a really far walk to caldecott or toa payoh mrt stations – the error is probably because the orie’s showroom location is near these 2 MRT stations

which makes the demand for the orie rather even more unexpected because that particular location is really not that great for toa payoh (it’s a pretty busy intersection too), but to each their own!

Hi H T, I too live in that area, and I walked past The Orie development site (not the show flat), just to verify for myself the proximity of Braddell MRT station. Actually I think the developer’s claims (about the closeness of Braddell MRT station) were quite accurate. The Orie will have a side gate that exits to Lorong 1 Toa Payoh. From that side gate, Braddell MRT station entrance (also situated along Lor 1 TP) is around 4~5 minutes away by walking. Don’t even need to cross any road.

the nearest market is also the toa payoh palm spring market on lorong 4, not toa payoh west

(not that it matters since it’s almost sold out, but in case anyone is considering!)

in my humble opinion, Toa Payoh is one of the oldest HDB estates in Singapore – it is 100% not at all atas or worth paying $2,600-$2,700 PSF for a “luxury” condo in a neighbourhood filled with serfs

who really enjoys living in a dumbbell layout?