Why I Bought A 2-Bedder Investment Property At Leedon Green In District 10: A Buyer’s Case Study

March 20, 2024

Leedon Green is a freehold condo that was completed just this year. It’s one of the newer headline developments in the Holland V/Farrer area, and we’ve covered it extensively in our review. With three-storey maisonettes and villas, this is one of the more spacious new options in District 10; and in this week’s case study, we showcase how we helped a buyer narrow down to choose a unit at Leedon Green:

Project Case Study: Leedon Green

Client Details

- Client in her 40s

- Professional

Buyer’s Brief

- Looking for first investment property

- Have viewed quite a few projects

- Not sure which to go for

- Wasn’t convinced by the numbers

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How it all started

The client came to me having already viewed quite a few projects. She was looking at her first investment property but wasn’t quite convinced by the numbers. Based on her preferences/requirements and what she has already seen on the market, I helped to narrow down the choices to freehold options such as Leedon Green and Continuum, as well as resale comparisons around such as completed developments at the Bartley area and D’Leedon.

Here are some of the questions she had:

1. Which development is near Leedon Green that is higher priced despite being leasehold?

2. From a capital appreciation standpoint, what are the factors for and against Leedon Green/Continuum vs other developments in Bartley?

3. What does the data show in terms of price increases between CCR/RCR/OCR over the last 5 to 10 years?

4. For 2b2b units, how important is the 1 km school proximity? Is there a demand for units of that size given that it seems small for families, and also given the ample supply at D’Leedon how does that affect Leedon Green?

As such, here’s how I approached the questions:

1) One Holland Village Residences (99-year leasehold)

The first one to start with is One Holland Village Residences. This one is interesting because it has some similar attributes to Leedon Green: Large land size, a good mix of unit types, and the age difference is small.

One Holland Village also has good access to Holland V MRT (very close walking distance), and the surrounding eateries and entertainment are landmarks. However, there is one glaring issue: despite being leasehold – it is transacting at a similar price to Leedon Green, which is a freehold condo; and prices are in the range of $3,4XX psf.

To help put things in context, I put together a comparison of surrounding projects. However, I didn’t include resale as the comparisons weren’t suitable – most of them were much older or much smaller in terms of scale. Perhaps the only close resale comparison would be Leedon Residence as it has similar attributes to Leedon Green (large land size, good unit mix, and still relatively young).

To show you what I mean, here’s how some of the nearest new projects match up.

15 Holland Hill

15 Holland Hill highest transacted $3,496 psf for a 3,907 sq ft unit.

Leedon Green’s highest transacted was $3,467 psf for a 1,496 sq ft unit.

Let’s now look at the projects around the area:

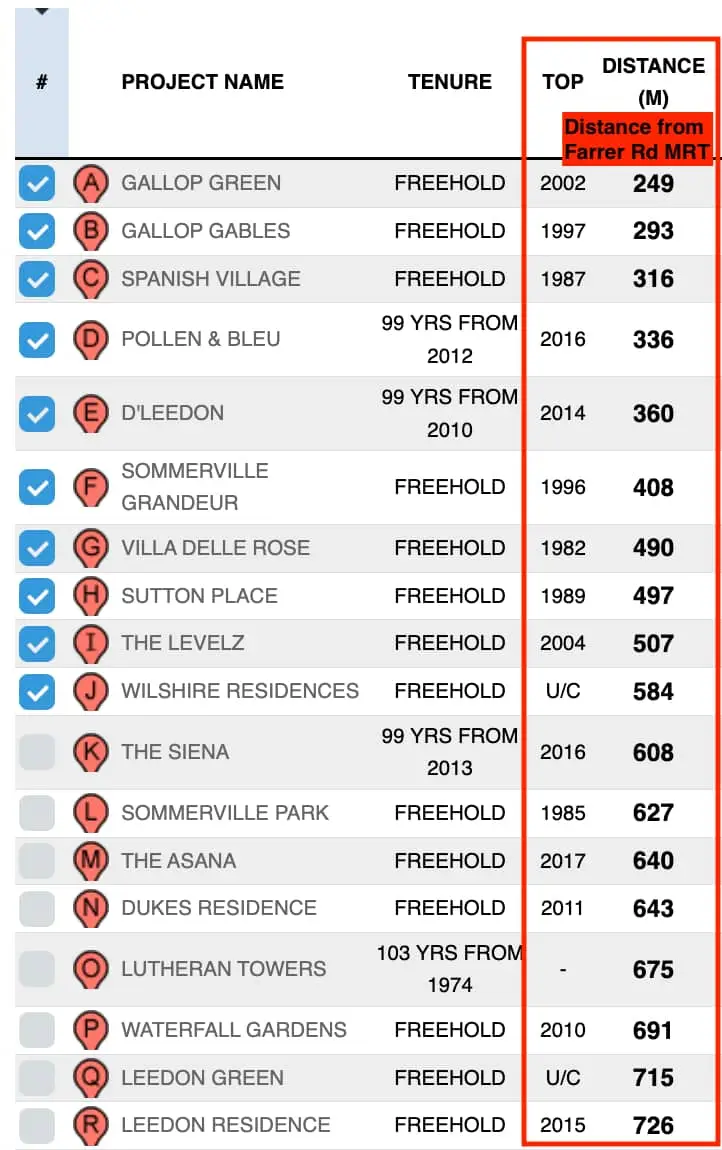

Developments surrounding Farrer Road MRT

In the process of identifying these, some of these projects are very old (by Singapore standards!), and many of the newer ones are leasehold or boutique developments, which don’t compare well to Leedon Green as a mid-sized freehold project.

Some notable developments within 1 km of Nanyang Primary School with 2-bedroom units are:

| Project | Tenure | TOP Year |

| Sommerville Park | Freehold | 1985 |

| Gallop Gables | Freehold | 1997 |

| Casabella | Freehold | 2005 |

| The Shelford | Freehold | 2005 |

| Leedon Residence | Freehold | 2015 |

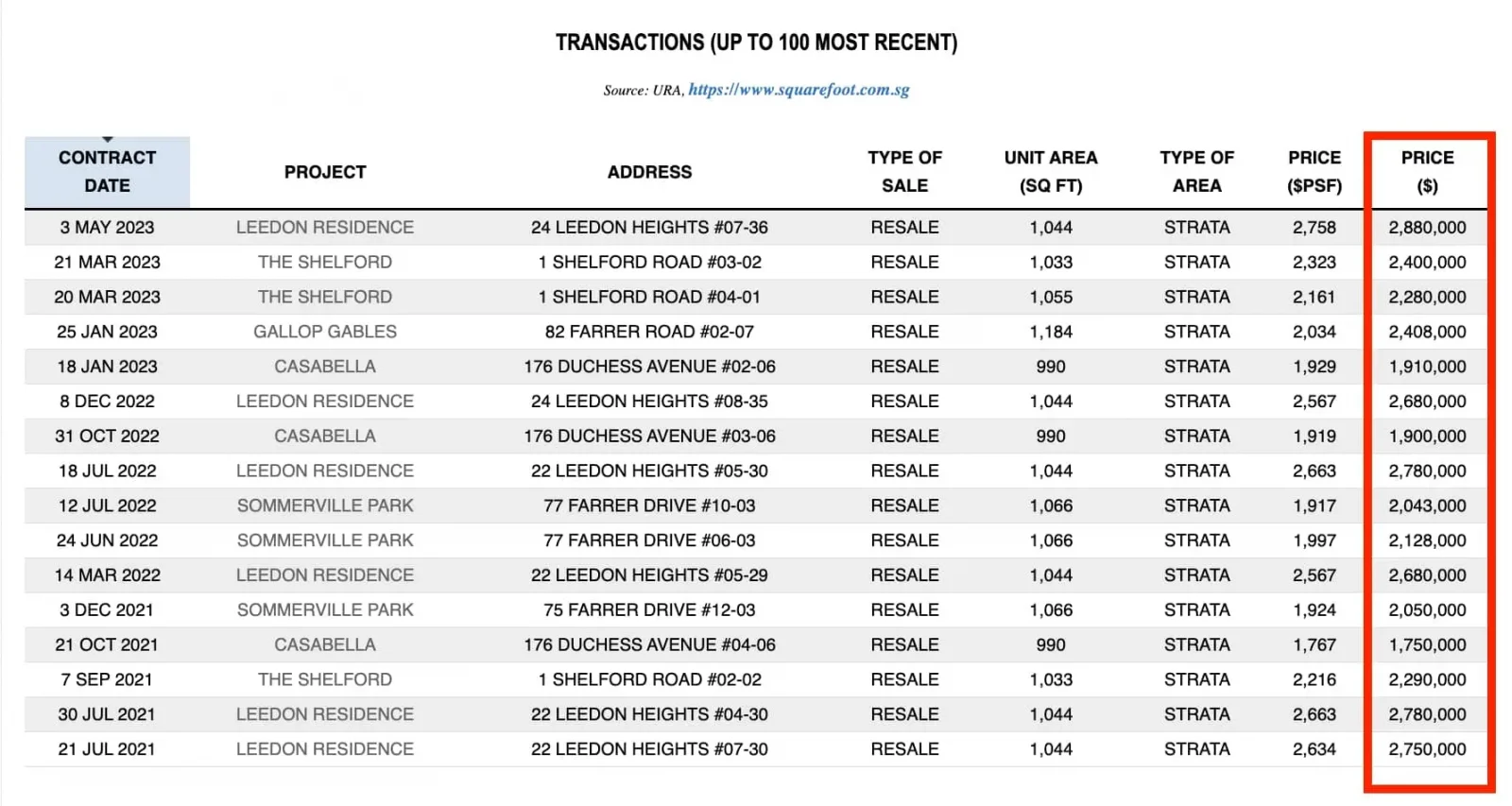

These were some of the transactions in the past 24 months (as of the end of 2023):

| Projects | Highest Price |

| Casabella | $191,000 |

| Sommerville Park | $2,050,000 |

| The Shelford | $2,400,000 |

| Gallop Gables | $2,408,000 |

| Leedon Residence | $2,880,000 |

From the numbers, the typical 2-bedroom buyer here can definitely afford one that is well over $2 million. Noticeably, the ones along Farrer Road do better than those located in areas like Shelford or Duchess. You could say that Farrer Road is more prime than the others, hence there is a higher price ceiling even though projects like Gallop Gables and Sommerville Park are relatively older compared to Casabella and The Shelford.

As such, Leedon Green can fill in the gap between the developments along Farrer Road. This ranges from old 99-year leasehold ones from $1.8m to $1.9m +/- to new freehold (Leedon Green) at $1.9m to $2.15m +/- and old freehold ones at $2.4m to $2.8m +/-.

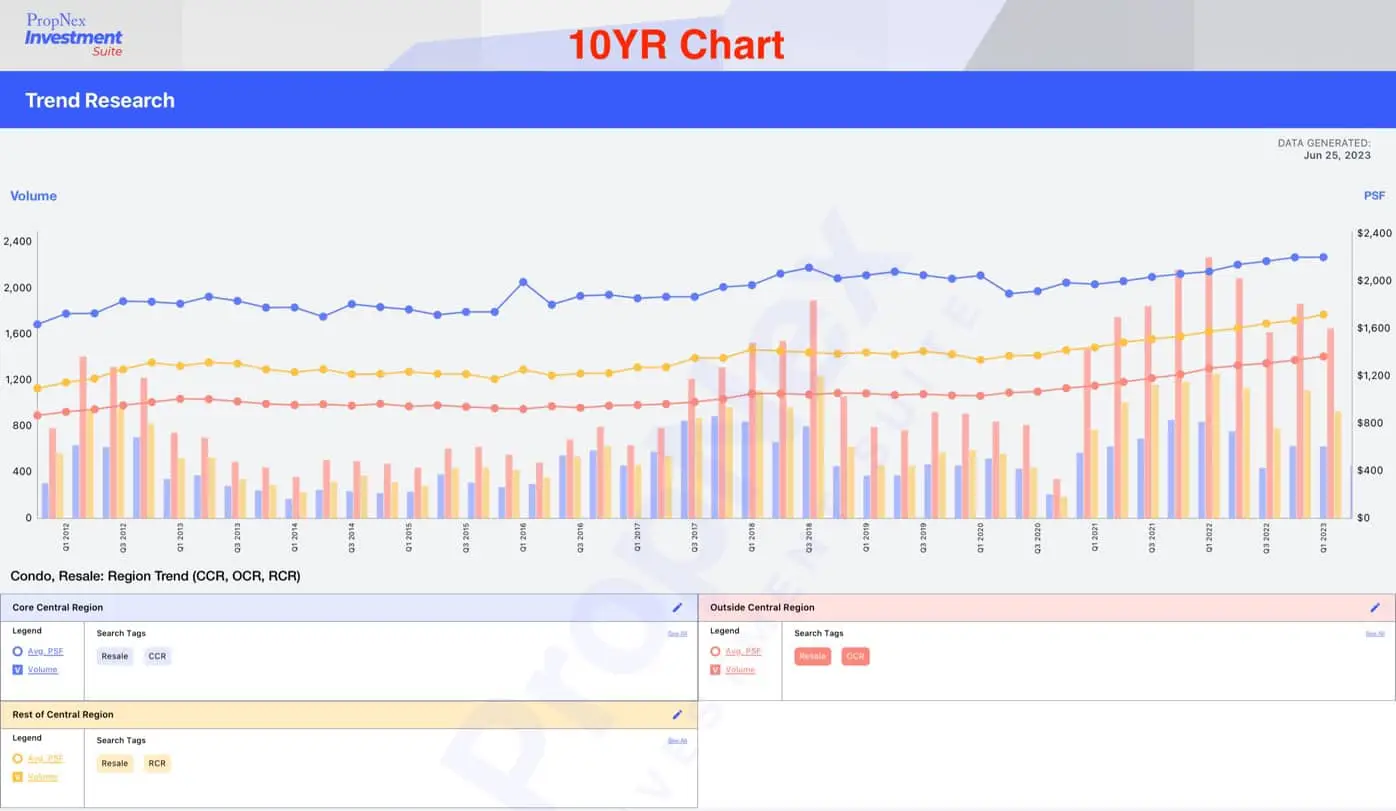

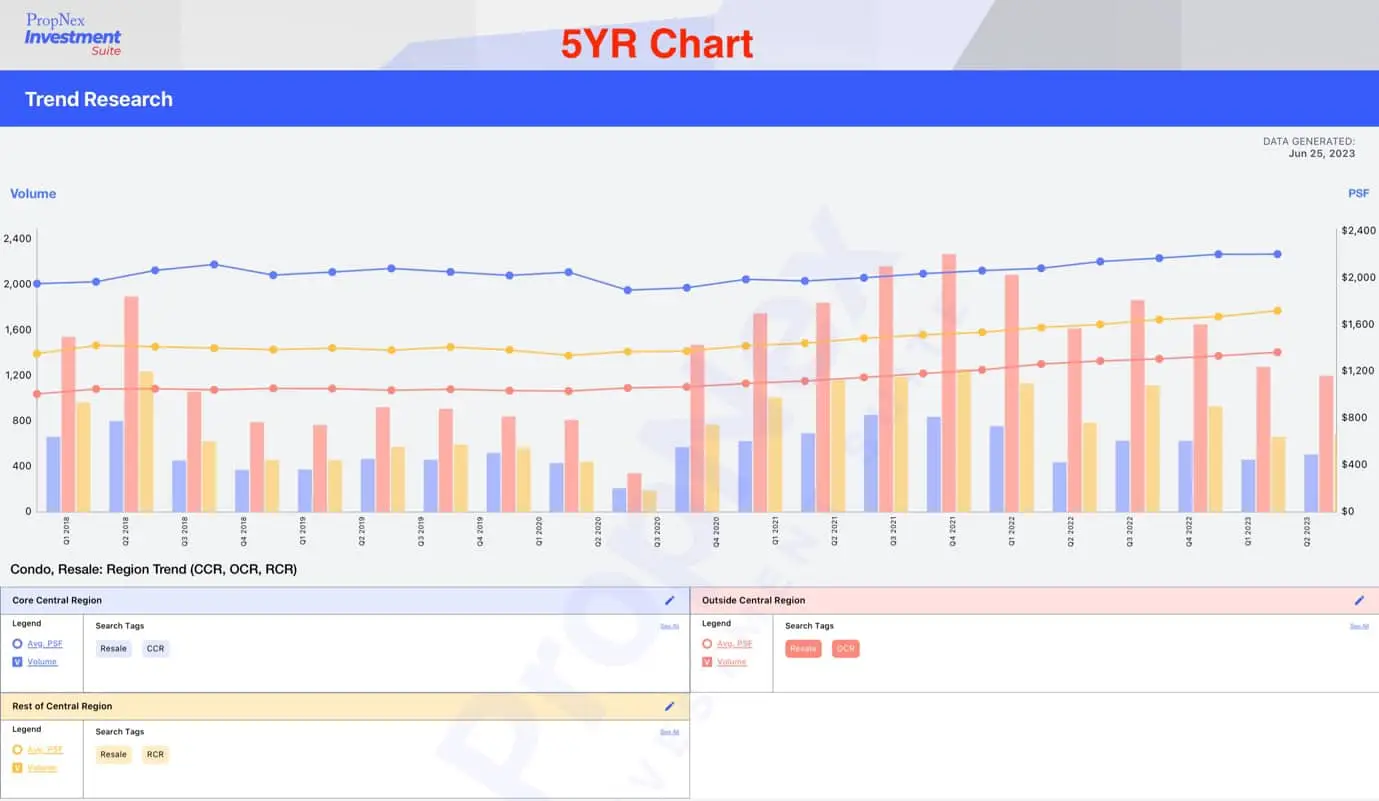

A general question on buying in the CCR, RCR, and OCR

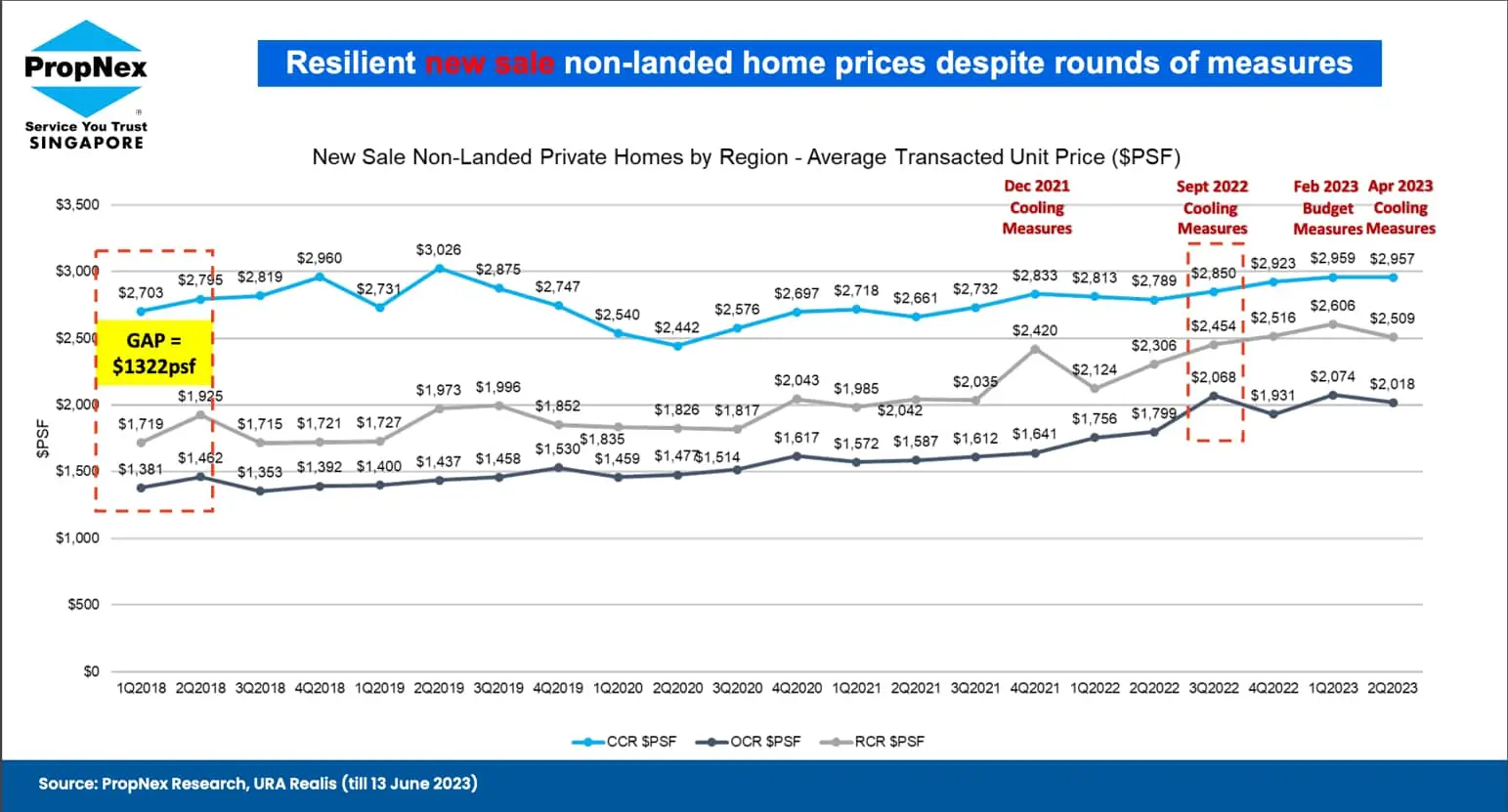

As for the data on price movements between the different regions, here’s how it currently looks:

From an investment perspective, it is worth noting the narrowing price gap between the RCR and CCR. You can see the CCR has been relatively flat for the past few quarters, with the RCR and OCR catching up.

I also looked at the narrowing price gap of new launch condos in the CCR:

Notice that back in 2018, the price gap for new launches between the RCR and OCR was $1,322 psf. But as of now, the gap is only around $939 psf.

For a breakdown of why this is happening, check out our article on how recent cooling measures bite deeper in the CCR than in other regions.

Next, here’s a comparison of Leedon Green vs Continuum vs resale condos in the Bartley area.

Leedon Green vs Continuum

To explain further, there is a closing gap in terms of pricing because these 2 developments are built in a “different” era. Leedon Green from the previous batch of land sale, and Continuum from the more current batch of land sales. (In short, the newer the land, the more expensive it gets).

Hence, Leedon Green makes sense here because of the narrowing gap between RCR and CCR. Especially when both projects have similar attributes: freehold, large land, near mrt, 1 km to good school.

One point to support Leedon Green is that the prices it is transacted at has already been attained in the area, whether it is for a 99-year or freehold new development. This is important as it means you are not entering above market prices.

So while the RCR and OCR grew relatively well over the past few years, on the other hand, it would mean that freehold in the CCR still has room to grow.

Therefore, between the two at the moment, I believe that Leedon Green is preferable based on your needs.

The Continuum

In any case, let’s look further at The Continuum.

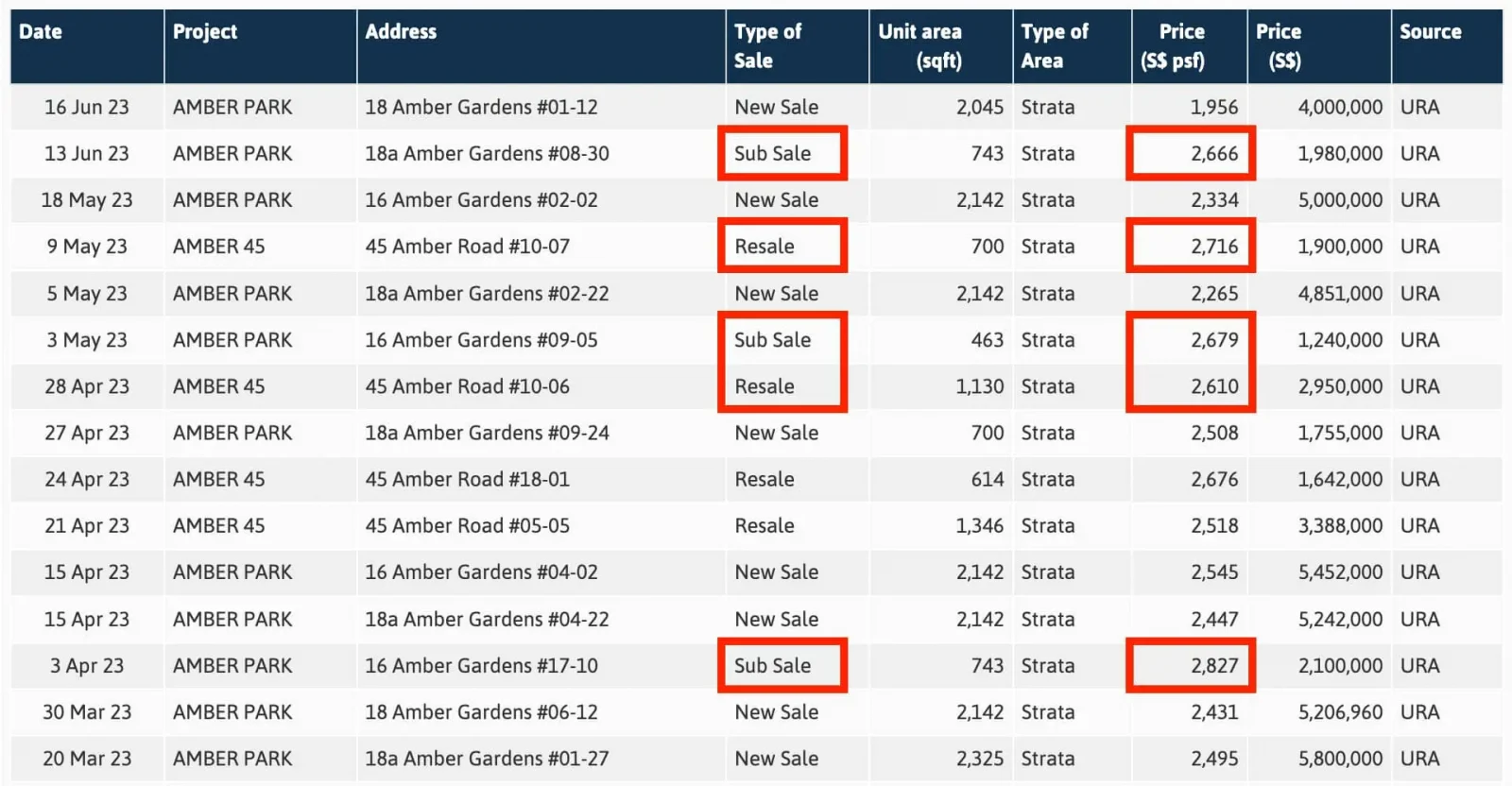

This is a freehold condo that will be completed in 2027, in District 15. This is a larger development than Leedon Green, with 816 units. Prices here are supported by nearby projects Amber 45, and Amber Park.

More from Stacked

The Hidden Risks Of Investing In Freehold Luxury Properties In Singapore

If you’re new to Singapore’s property market it may shock you to learn this, but freehold luxury properties may not…

The area near Thiam Siew Avenue and the location of Amber Road/Amber Gardens are frankly a world apart. Do note that some new sales in Amber Park have a low psf because they are ground floor with big balconies or big units on the lower floors facing the Amber Road and Amber Gardens (both are main roads of the Amber area).

Nonetheless, from how the prices have moved, you can see buyers have accepted the price points in District 15.

| CONTRACT DATE | ADDRESS | TYPE OF SALE | UNIT AREA (SQFT) | TYPE OF AREA | PRICE (S$ PSF) | PRICE (S$) | PURCHASER ADDRESS |

| 29 Dec 2023 | 45 AMBER ROAD #XX-07 | RESALE | 700 | STRATA | $2,791 | $1,953,000 | PRIVATE |

| 25 Oct 2023 | 45 AMBER ROAD #XX-05 | RESALE | 1,346 | STRATA | $2,787 | $3,750,000 | PRIVATE |

| 23 February 2024 | 16 AMBER GARDENS #XX-04 | SUB SALE | 947 | STRATA | $2,829 | $2,680,000 | PRIVATE |

| 12 Jan 2024 | 18 AMBER GARDENS #XX-11 | SUB SALE | 1,109 | STRATA | $2,886 | $3,200,000 | PRIVATE |

| 8 Nov 2023 | 18 AMBER GARDENS #XX-11 | SUB SALE | 1,109 | STRATA | $2,951 | $3,271,550 | HDB |

| 24 Oct 2023 | 18A AMBER GARDENS #XX-28 | SUB SALE | 463 | STRATA | $3,085 | $1,428,000 | PRIVATE |

| 6 Oct 2023 | 18 AMBER GARDENS #XX-20 | SUB SALE | 743 | STRATA | $2,834 | $2,105,000 | PRIVATE |

| 18 Aug 2023 | 18 AMBER GARDENS #XX-20 | SUB SALE | 743 | STRATA | $2,926 | $2,173,000 | PRIVATE |

However, I would say that The Continuum will do fairly well because of the lack of similar freehold supply in the area. Freehold owners tend to hold for the long term, thus pushing buyers toward new ones that appear (as sellers aren’t parting with their existing units).

Invariably, discussion about District 15 will bring up the big three: Continuum, Dunman Grand, and Tembusu Grand, which all launched at about the same time.

The overall quantum of The Continuum is very close to its leasehold counterparts, Tembusu Grand and Grand Dunman. Tembusu Grand has sold up to $2,730 psf, with the cheapest available 2 + study unit being $1.93m (2B2B fully sold). Grand Dunman averages about $2,500 psf.

| Project Name | Bedrooms | Lowest | Average | Highest |

| GRAND DUNMAN | 1 | $1,093,000 | $1,267,352 | $1,578,000 |

| 2 | $1,541,330 | $2,009,389 | $2,430,000 | |

| 3 | $2,124,000 | $2,826,547 | $3,236,000 | |

| 4 | $3,462,000 | $3,580,938 | $3,723,000 | |

| 5 | $4,016,000 | $4,570,800 | $5,200,000 | |

| TEMBUSU GRAND | 1 | $1,248,000 | $1,323,593 | $1,472,000 |

| 2 | $1,556,000 | $1,774,312 | $1,978,000 | |

| 3 | $2,288,000 | $2,509,463 | $2,958,000 | |

| 4 | $3,341,000 | $3,457,200 | $3,677,000 | |

| 5 | $4,220,000 | $4,220,000 | $4,220,000 | |

| THE CONTINUUM | 1 | $1,463,000 | $1,510,200 | $1,561,000 |

| 2 | $1,670,000 | $1,886,674 | $2,129,000 | |

| 3 | $2,306,000 | $2,825,341 | $3,711,000 | |

| 4 | $3,312,000 | $3,640,444 | $4,861,000 | |

| 5 | $5,746,000 | $6,076,000 | $6,406,000 |

Because of this reason, the price point between 99-years and freehold is close, as the cheapest 2 + study is at $2,610 psf (as of end 2023).

Considering the minimal price difference and the 10 to 12-minute disparity in walking distance to the MRT, we prefer Continuum as a freehold option over its counterparts. Over 10 years, I may expect a better performance.

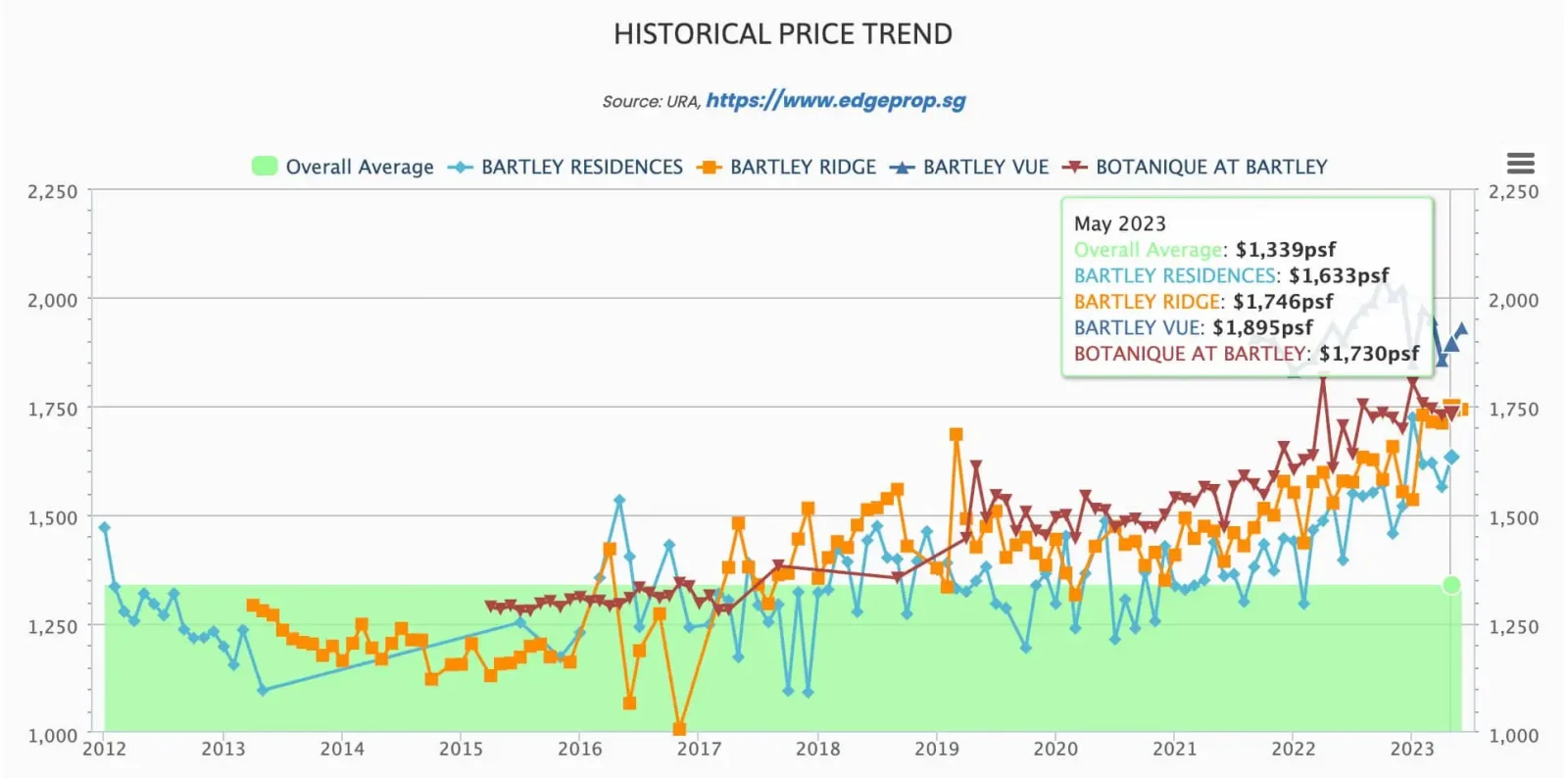

Now, for the condos at Bartley.

Bartley resale condos are predominantly 99-years.

There are four main developments of note here: three older release projects and one new launch (Bartley Vue).

The resale projects are very close in price despite their age disparity. Bartley Ridge (2015) had the lowest price point initially but is now in the same range as the newer Botanique (2019).

(This might be because Bartley Ridge, despite the proximity, is in District 13 and not District 19, which makes it technically an RCR property).

Bartley Vue’s average price being $1.9k psf has pushed existing freehold new condos like Gazania and Lilium in the area which had a small gap in prices of less than 10% ($2 – $2.2k psf).

I’m not so much in favour of Gazania and Lilium because of the higher entry prices, combined with the smaller land plots; smaller condos tend to have more bare-bones facilities, which are less conducive to own-stay use. That could be one of the reasons why the units only started to move closer to TOP or after TOP (when there was low supply of units in the market but high demand, so people just bought whatever the market was left with).

As an aside, I do think that freehold status in the OCR is not as important for buyers. This would cut out many future buyers (which is important for exit in the future).

Most buyers in the OCR and HDB upgraders find the freehold premium less palatable. In general, this buyer demographic will have a combined income of about $14,000 to $16,000 per month, which makes freehold developments a luxury and a stretch.

As such, leasehold projects tend to be better off in the OCR, being about 15 to 20 per cent cheaper than a comparable freehold condo. Nevertheless, we moved on from Bartley because most of the projects are reaching the 10-year mark. This may not be a good entry point for a long-term investment, as leasehold properties can possibly see weaker appreciation after the 10 to 15-year mark.

Ultimately, these comparisons brought us down to picking between Leedon Green and The Continuum.

Picking Leedon Green lets us capitalise on the narrowing gap between RCR and CCR prices. Based on the available stacks, #XX-47 stands out the most, although there’s a slight premium:

#XX-28 – $2.06x million

#XX-28 – $2.07x million

#XX-28 – $2.08x million

#XX-47 – $2.13x million

This works out to a price difference of about $50,000 for a higher floor and a quieter facing.

As an alternative, we also looked at #08-28, facing the filter lane of Holland Road to Farrer Road; but this is a difference of $70,000.

One of the factors here is the distance to Nanyang Primary.

With Leedon Green, some stacks are within one kilometre of Nanyang Primary; others are not (the distances can be checked on One Map). The instinct here is to pay the premium for the stacks within the enrolment range.

Yellow = Farrer Road Facing (7 Stacks)

Purple = Pool Facing (5 Stacks)

Red = Leedon Heights/Holland Road facing (6 Stacks)

In total, there are 18 stacks of 2b2b units.

Whatever that is remaining is mainly in the non-1 km blocks (black box). So buyers do care whether it is 1 km or not (to a certain extent). The choice units here would be circled in purple and red because there isn’t road noise.

Do note that the red units do have a bit of West sun, which can be avoided by curtains or UV film over the windows.

I understand that desire for rental potential, but it is worth considering that the unit in question is a two-bedder.

Prospective tenants and buyers are typically couples, singles, or smaller families. There may be some buyers who are a couple with one child, but that’s generally a small target audience. In addition, most tenants in this area may be expatriates, typically working in areas like the One-North tech and media hub, or embassies in the Holland Road/Orchard belt. Access to a primary school doesn’t mean much to them.

As such, my feel was that this shouldn’t be the main factor in deciding to buy; it’s more of a “nice to have”. Ultimately, my recommendation of #XX-47 is based on the road facing (it’s harder to sell units facing a main road, just from my experience).

To conclude, the final choice was Leedon Green, which I felt was a good balance between investment prospects (rental and resale), as well as own-stay use should it be necessary.

If you need similar help in picking your property, you can reach out to me here.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Kenny Sia

With over 12 years of expertise, Kenny has guided clients in navigating the purchase and sale of condos, apartments, and HDB real estate. To date, he has successfully transacted with over 400 clients. His expertise lies in selecting ideal developments for acquisitions, ensuring seamless future transactions. Consistently ranking in the top 3% of PropNex agents and recognized as a top transactor, Kenny's dedication and commitment to excellence sets him apart in the industry. As a self-proclaimed 'shoe aficionado,' he appreciates the finer details, applying his eye for detail to every aspect of his real estate practice, ensuring the perfect fit for his clients in both property and service.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

3 Comments

Hi Kenny i read your article in leedin Green which is enlightening. I also have a unit there 2B1B,which is main pool facing and nice view. 614sf. And rented out recently after TOP. As this is a 2bed 1 bath, do u think reselling( or future renting) will be a challenge in the future? Even though the facing is very good. It is stack 51. Perhaps one of the few premium stacks. Appreciate your advice.

I also purchased a 2b1b unit in stack 51 🙂