Whistler Grand Vs Twin VEW: Which Has Been A Better Purchase?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Twin VEW and Whistler Grand are just across the road from each other; so even back when they were launched in 2018, comparisons between the two were common. Now that it’s 2024, it’s time we took a look at how the two have performed, and see if previous assumptions have held. Here’s how it’s looking for both West Vale condos right now:

A rundown on Twin Vew and Whistler Grand

Both Twin VEW and Whistler Grand were launched in 2018, and are roughly the same age (Twin Vew was finished in 2021, while Whistler Grand was completed in 2022). Twin VEW’s first sale was on 4th May 2018, whilst Whistler Grand’s first sale was on 2nd November 2018; a mostly negligible age difference. Both are 99-year leasehold condos.

Twin VEW is the smaller of the two, at 520 units, while Whistler Grand is larger at 716 units. As they’re so close, there’s little differentiation in terms of location; Twin VEW is a bit closer to the Pandan River (and was marketed more heavily on the waterfront view), while Whistler Grand does benefit from a more established developer in Singapore, at least. That said, for their first maiden project Twin VEW certainly received a very favourable response.

A look at Twin Vew’s price movements

| New Sale | Sub Sale | Resale | ||||||||

| Bedroom | 2018 | 2019 | 2020 | 2021 | 2021 | 2022 | 2022 | 2023 | 2024 | 2018 – 2023 profit |

| 1BR | $1,514 | $1,692 | $1,667 | $1,748 | 15.44% | |||||

| 2BR | $1,426 | $1,509 | $1,554 | $1,569 | $1,642 | $1,759 | $1,694 | 23.34% | ||

| 3BR | $1,345 | $1,440 | $1,491 | $1,528 | $1,554 | $1,564 | $1,662 | $1,757 | $1,706 | 30.61% |

| 4BR | $1,332 | $1,482 | $1,479 | $1,480 | $1,593 | $1,558 | $1,616 | $1,774 | $1,799 | 33.16% |

| Average | $1,400 | $1,476 | $1,485 | $1,490 | $1,573 | $1,566 | $1,646 | $1,758 | $1,733 | |

Twin VEW’s land price was $292 million, or about $591.50 psf. The estimated breakeven price for the developer was around $1,065 psf (based on Squarefoot Research). The initial developer prices ranged between $1,332.50 psf to $1,513.80 psf, with an average of $1,400 psf.

2018 was a down period for the wider market, but prices did pick up quite well through to the first sub sale units. Between 2018 to 2023:

- One-bedders rose 15 per cent in price psf, while

- Two-bedders rose 23 per cent

- Three-bedders rose 31 per cent, and

- Four-bedders rose 33 per cent

If we were to look only at profit margins, we’d see an average gain of around 18.91 per cent:

| Bedrooms | Average of Profit (%) | Average of Holding Period (Years) | Volume |

| 1BR | 16.5% | 4.4 | 10 |

| 2BR | 17.0% | 4.2 | 26 |

| 3BR | 19.6% | 3.8 | 28 |

| 4BR | 22.1% | 3.7 | 17 |

| Grand Total | 18.91% | 4.0 | 81 |

Four-bedders were the main winners here, perhaps partly due to HDB upgraders being such a strong buyer demographic since 2018, and the preference for bigger units since the pandemic.

In any case, a return of close to 19 per cent is solid for a holding period of just four years, especially in light of cooling measures maintaining downward pressure on the market.

Performances of different stacks at Twin VEW

| Stack | Facing | Bedroom | Volume | Average of Profit (%) |

| 1 | Pool/Football Field | 3 | 4 | 14.09% |

| 2 | Pool/Football Field | 4 | 8 | 25.24% |

| 3 | Parc Riviera/AYE | 4 | 1 | 3.71% |

| 4 | Parc Riviera/AYE | 2 | 4 | 19.68% |

| 5 | Parc Riviera/AYE | 3 | 6 | 21.62% |

| 6 | Pool/Football Field | 4 | 7 | 22.37% |

| 7 | Pool/Football Field | 2 | 8 | 13.26% |

| 8 | Pool/Football Field | 2 | 4 | 20.87% |

| 9 | Pool/Football Field | 3 | 4 | 16.78% |

| 10 | Parc Riviera/AYE | 3 | 11 | 20.51% |

| 11 | Parc Riviera/AYE | 2 | 5 | 17.36% |

| 12 | Parc Riviera/AYE | 1 | 4 | 19.72% |

| 13 | Parc Riviera/AYE | 2 | 5 | 17.24% |

| 14 | Tennis Court/Botannia | 1 | 6 | 14.36% |

| 15 | Pool/Football Field | 3 | 4 | 21.10% |

| Grand Total | 81 | 18.91% | 81 | 18.91% |

More from Stacked

Should You Buy ELTA? A Pricing Review Against Clavon, Clement Canopy And Other New Launches

Welcome to our pricing review of ELTA, the newest (and final) Government Land Sales (GLS) site along Clementi Avenue 1.…

Note that Stack 14 has no good point of comparison, as it’s the only stack in Twin Vew with the tennis court/Botannia facing.

Overall, there’s no particular facing that stands out for having the best gains:

| Facing | Average of Profit (%) |

| Parc Riviera/AYE | 19.16% |

| Pool/Football Field | 19.38% |

| Tennis Court/Botannia | 14.36% |

| Grand Total | 18.91% |

The “best facing” stacks have a profit margin that is comparable to the wider average for Twin VEW (which may also mean the closer proximity to the Pandan River hasn’t made a huge difference).

Which floors in Twin VEW were the most profitable?

| Floor | Volume | Average of Profit (%) |

| 2 | 1 | 11.1% |

| 3 | 2 | 27.5% |

| 4 | 6 | 16.9% |

| 5 | 2 | 17.4% |

| 6 | 4 | 18.8% |

| 7 | 4 | 20.4% |

| 8 | 2 | 21.2% |

| 9 | 1 | 16.1% |

| 10 | 2 | 28.7% |

| 11 | 4 | 20.6% |

| 12 | 2 | 19.4% |

| 13 | 6 | 22.8% |

| 14 | 3 | 20.7% |

| 15 | 1 | 21.4% |

| 16 | 3 | 16.0% |

| 17 | 4 | 18.2% |

| 18 | 2 | 16.5% |

| 19 | 3 | 14.8% |

| 20 | 2 | 20.8% |

| 21 | 3 | 21.7% |

| 22 | 2 | 18.1% |

| 23 | 1 | 23.0% |

| 24 | 5 | 15.7% |

| 25 | 2 | 14.8% |

| 28 | 2 | 18.3% |

| 29 | 1 | 18.0% |

| 30 | 3 | 18.5% |

| 31 | 2 | 13.9% |

| 33 | 1 | 7.9% |

| 35 | 3 | 17.4% |

| 36 | 2 | 22.8% |

| Grand Total | 81 | 18.9% |

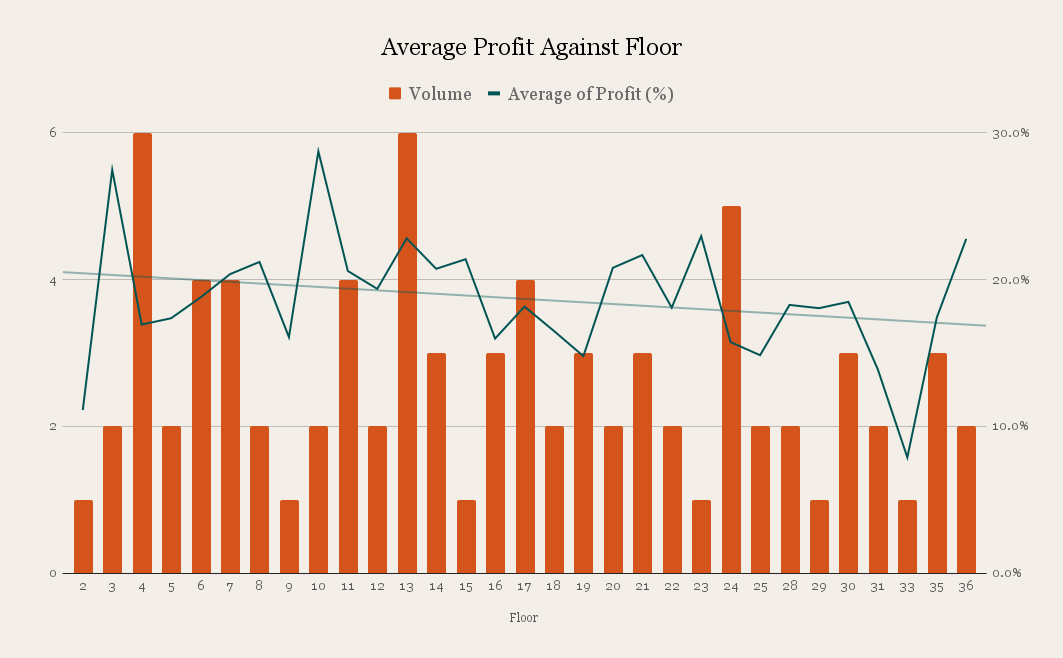

To put it in a more visual form, here’s what happens when we compare floor to profit:

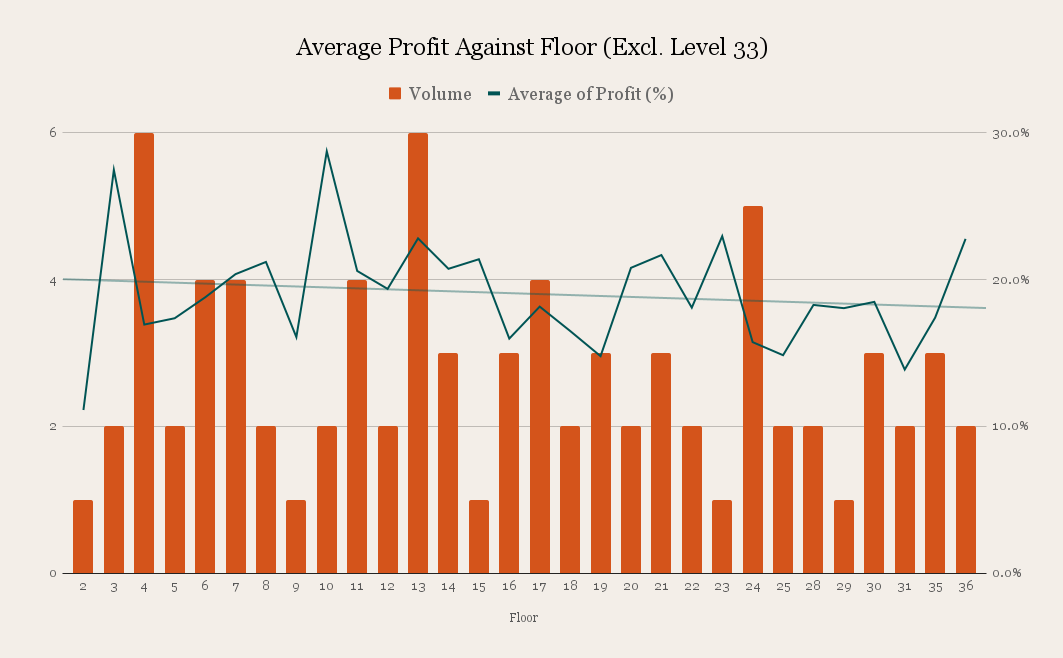

The slight downtrend suggests the lower floors might have better profits (possibly due to lower initial costs). But note that there are some outliers, such as the abnormally low 7.9 per cent profit margin for a single unit on the 33rd floor – this may slightly skew the results. However, even removing it doesn’t make a huge change, and the trend seems similar:

Now let’s look at Whistler Grand

Whistler Grand had a land price of $472.4 million, which comes to a price of about $800 psf. This is more than a third (35 per cent) higher than what was paid for Twin VEW, and the estimated breakeven price was accordingly higher at $1,314 psf.

But here’s an interesting twist:

| Bedrooms | 2018 | 2019 | 2020 | 2021 | 2021 | 2022 | 2023 | 2023 | 2024 |

| 1BR | $1,440 | $1,499 | $1,619 | $1,734 | $1,699 | $1,741 | $1,851 | $1,850 | $1,904 |

| 2BR | $1,364 | $1,439 | $1,530 | $1,625 | $1,662 | $1,694 | $1,881 | $1,892 | $1,858 |

| 3BR | $1,318 | $1,363 | $1,479 | $1,664 | $1,786 | $1,917 | $1,924 | ||

| 4BR | $1,295 | $1,315 | $1,386 | $1,416 | $1,696 | $1,796 | $1,829 | $1,732 | |

| 5BR | $1,295 | $1,378 | $1,377 | ||||||

| Grand Total | $1,357 | $1,399 | $1,515 | $1,563 | $1,681 | $1,697 | $1,833 | $1,878 | $1,869 |

Despite the higher breakeven price, the average developer price for Whistler Grand was just $1,357 psf, lower than Twin VEW’s $1,400 psf. But this could be due to Whistler Grand launching about half a year later than Twin VEW, and catching up by slightly undercutting its neighbour. It was quite a bold move, as CDL was selling for cheaper, despite paying more for the land price.

Price movements at Whistler Grand

| Bedroom | 2018 | 2019 | 2020 | 2021 |

| 1BR | $662,400 | $729,011 | $765,656 | $846,500 |

| 2BR | $915,411 | $976,999 | $1,039,240 | $1,039,287 |

| 3BR | $1,348,657 | $1,368,206 | $1,487,593 | |

| 4BR | $1,666,699 | $1,679,393 | $1,768,064 | $1,836,667 |

| 5BR | $1,868,400 | $1,987,924 | $1,985,964 | |

| Grand Total | $1,083,564 | $1,202,647 | $1,201,580 | $1,357,231 |

Let’s contrast this with Twin VEW. For ease of comparison, we’ve tabled the price differences between Twin VEW and Whistler Grand:

| Bedroom | 2018 | 2019 | 2020 | 2021 |

| 1BR | $136,388 | |||

| 2BR | $152,383 | $122,335 | ||

| 3BR | $70,161 | $315,794 | $191,782 | |

| 4BR | $182,711 | $170,608 | $272,811 | $174,697 |

| Grand Total | $171,924 | $254,496 | $658,545 | $606,055 |

Notice that between the two, Twin VEW – at the time of launch – had a price premium of $171,924 over Whistler Grand.

How profitable is Whistler Grand compared to Twin VEW?

Profits are quite strong, averaging around 26.9 per cent after a holding period of just under three years.

| Bedroom | Average of Profit (%) | Average of Holding Period | Volume |

| 1BR | 20.4% | 3.6 | 25 |

| 2BR | 25.7% | 3.7 | 40 |

| 3BR | 32.7% | 3.8 | 22 |

| 4BR | 34.8% | 4.1 | 10 |

| Grand Total | 26.9% | 3.8 | 97 |

For convenience, we took the profits from Twin VEW (see above), and just tabled the differences in profits:

| Bedrooms | Average of Profit (%) |

| 1BR | 3.9% |

| 2BR | 8.7% |

| 3BR | 13.1% |

| 4BR | 12.7% |

| Grand Total | 8.0% |

This clearly puts Whistler Grand in the lead, with its buyers making around 42 per cent more than Twin VEW. Whistler Grand saw better returns across units of all sizes – and given that most had a slightly shorter holding period, this would further raise the respective ROI for some buyers.

Whistler Grand’s performance by stack:

| Stack | Facing | Bedroom | Volume | Average of Profit (%) |

| 1 | Pool Facing | 2 | 4 | 26.6% |

| 2 | Pool Facing | 4 | 5 | 33.8% |

| 3 | Tennis Courts/AYE | 4 | 1 | 35.4% |

| 4 | Tennis Courts/AYE | 1 | 9 | 22.7% |

| 5 | Tennis Courts/AYE | 2 | 2 | 23.1% |

| 6 | Tennis Courts/AYE | 2 | 1 | 17.2% |

| 7 | Tennis Courts/AYE | 1 | 5 | 20.5% |

| 9 | Pool Facing | 3 | 2 | 26.8% |

| 10 | Pool Facing | 2 | 11 | 24.1% |

| 11 | Pool Facing | 2 | 6 | 30.8% |

| 12 | Pool/The Infiniti | 3 | 4 | 32.0% |

| 13 | Pool/The Infiniti | 1 | 4 | 16.8% |

| 14 | Pool/The Infiniti | 2 | 4 | 31.2% |

| 15 | Pool/The Infiniti | 2 | 6 | 22.8% |

| 16 | Pool/The Infiniti | 1 | 7 | 19.4% |

| 17 | Pool/The Infiniti | 3 | 4 | 35.7% |

| 18 | Botannia | 4 | 4 | 35.9% |

| 19 | Botannia | 2 | 6 | 24.6% |

| 20 | Botannia | 3 | 6 | 30.8% |

| 21 | Botannia | 3 | 6 | 35.1% |

| Grand Total | 97 | 26.9% |

The stacks facing Botannia, as well as the ones with a pool facing, were generally more profitable:

| Facing | Volume | Average Profit (%) |

| Botannia | 22 | 31.6% |

| Pool Facing | 28 | 28.4% |

| Pool/The Infiniti | 29 | 26.3% |

| Tennis Courts/AYE | 18 | 23.8% |

| Grand Total | 97 | 27.3% |

But it may not be entirely to do with the stack’s facing

We noticed that, for the stacks facing Botannia, the four-bedders were the most profitable unit types; and for the pool-facing units, the transactions were larger four-bedders. So as we mentioned above, it may be due to HDB upgraders looking for larger condo units; this suggests unit sizes and layouts, rather than stack facings, are responsible for better gains.

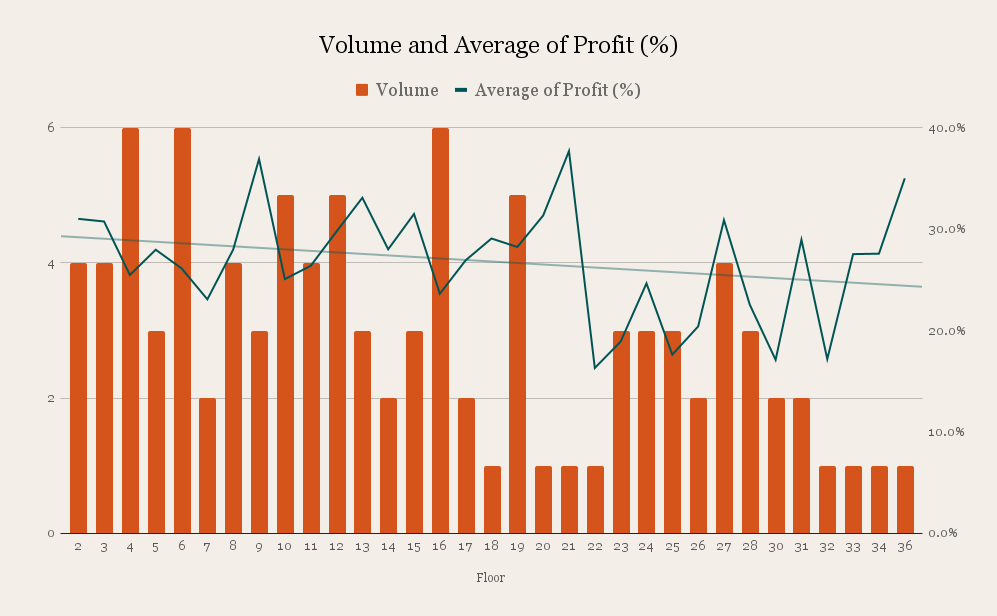

Looking at profitability by floor

Whistler Grand showed a similar trend to Twin VEW, in this particular comparison:

| Floor | Volume | Average of Profit (%) |

| 2 | 4 | 31.0% |

| 3 | 4 | 30.8% |

| 4 | 6 | 25.5% |

| 5 | 3 | 28.0% |

| 6 | 6 | 26.1% |

| 7 | 2 | 23.1% |

| 8 | 4 | 28.0% |

| 9 | 3 | 36.9% |

| 10 | 5 | 25.1% |

| 11 | 4 | 26.4% |

| 12 | 5 | 29.8% |

| 13 | 3 | 33.1% |

| 14 | 2 | 28.0% |

| 15 | 3 | 31.5% |

| 16 | 6 | 23.6% |

| 17 | 2 | 26.9% |

| 18 | 1 | 29.1% |

| 19 | 5 | 28.2% |

| 20 | 1 | 31.3% |

| 21 | 1 | 37.7% |

| 22 | 1 | 16.3% |

| 23 | 3 | 18.9% |

| 24 | 3 | 24.7% |

| 25 | 3 | 17.6% |

| 26 | 2 | 20.4% |

| 27 | 4 | 30.9% |

| 28 | 3 | 22.6% |

| 30 | 2 | 17.1% |

| 31 | 2 | 29.0% |

| 32 | 1 | 17.2% |

| 33 | 1 | 27.5% |

| 34 | 1 | 27.6% |

| 36 | 1 | 35.0% |

| Grand Total | 97 | 26.9% |

There is the same downward trendline we saw in Twin VEW:

Again, we see that lower floor units seem to have better chances for higher profit. As with Twin Vew, this may be due to lower prices – and more room for appreciation – compared to high-floor units.

Overall, Whistler Grand seems to have come out ahead

While both projects launched at the same time, Whistler Grand just seems to have been better priced from the start. In terms of developer comparisons, CDL may also have an edge in this neighbourhood: consider that nearby Botannia (built in 2006) was also a CDL project, as is Hundred Trees just around a kilometre down the road (built in 2013).

For more condo comparisons in the Singapore property market, follow us on Stacked. We also provide in-depth reviews of new and resale properties. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Investment Insights

Property Investment Insights We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Property Investment Insights We Compared New Launch And Resale Condo Prices Across Districts—Here’s Where The Price Gaps Are The Biggest

Property Investment Insights Similar Layout, Same District—But Over $500K Cheaper? We Compare New Launch Vs Resale Condos In District 5

Property Investment Insights Analysing Forest Woods Condo at Serangoon: Did This 2016 Project Hold Up Over Time?

Latest Posts

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

On The Market 5 Spacious Old But Freehold Condos Above 2,650 Sqft

New Launch Condo Analysis The First New Condo In Science Park After 40 Years: Is LyndenWoods Worth A Look? (Priced From $2,173 Psf)

Editor's Pick Why The Johor-Singapore Economic Zone Isn’t Just “Iskandar 2.0”

Editor's Pick URA’s 2025 Draft Master Plan: 80,000 New Homes Across 10 Estates — Here’s What To Look Out For

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Market Commentary This Upcoming 710-Unit Executive Condo In Pasir Ris Will Be One To Watch For Families

Editor's Pick Where To Find Freehold Terrace & Semi-D Landed Homes From $4.85 million In The East

Hi Ryan, i believe the average sqft per unit (or per n-bedder) in Whistler Grand is smaller than that in Twin Vew. Could this be a factor why Whistler Grand seems to come out ahead in your analysis?

Hi what does the grand total refers to, in the first two tables after the sub header Price movements at Whistler Grand?