8 Key Things To Note When Right-Sizing From A Condo To An HDB In 2025

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Whether you planned the move from the beginning, or your finances have changed, it’s time for you to switch back down to an HDB flat. This doesn’t just involve lifestyle changes: it may also mean regulatory hurdles like the waiting period, or dealing with reno issues (for resale flats). Here’s what to watch out for in 2025:

1. Unless you’re exempted, start planning for your 15-month wait ahead of time

After you sell your condo, you must wait 15 months before buying a resale flat*. It’s even worse if you want a BTO flat, as that takes 30 months. You can appeal to HDB if you’re facing special circumstances, but to date, the only successful cases we know of are the ones involving death or divorce.

Note that flats sold under the Sale of Balance Flats (SBF) exercise also require a 30-month wait, even if the flat in question is already completed.

As such, it’s best to plan ahead and work out where you’re going to stay, for those 15 months. If rental is on the cards, we suggest you start looking for a place as close to your intended HDB estate as possible. This doesn’t just make moving easier; it gives you time to scout out the better blocks in the neighbourhood and monitor prices for your replacement home.

Also don’t forget to plan for storage of bulkier items, if you don’t want to move them twice.

*Unless you’re 55 or older and are moving into a 4-room or smaller flat.

2. Check for early loan repayment penalties, and inform your bank early

This applies if you have an outstanding loan on your condo:

First, note that several banks (not all) impose fines or processing fees, if you try to pay off the loan without early notice. In most cases, the stipulated “early notice” period will be around three months. But check with your bank to be sure, and don’t wait till the last minute to tell them.

Second, some loan packages (again not all) have lock-in periods. Attempting to pay off the remaining loan within the lock-in period incurs a penalty, usually around 1.5 per cent of the redeemed amount. E.g., if you pay back $200,000 during the lock-in, you may have to pay $3,000 as a penalty.

Some loan packages allow for repayment of up to a certain amount without penalty, whilst some other loans don’t impose a penalty if the loan is being paid early due to a sale. If you foresee having to right-size in a few years, you might want to consider a loan package with these features, the next time you refinance.

3. The CPF refund still matters when right-sizing

You need to refund the CPF monies used for your condo, when you sell it. CPF could have been used for the down payment, stamp duties, legal fees, and monthly loan repayments. You’ll need to log in to your CPF account, to determine how much you need to refund.

While the CPF refund is usually a bigger worry for upgraders, it does matter when right-sizing. One reason is that, as of 2025, more resale flats are sold with Cash Over Valuation (COV). The COV is any amount above HDB’s valuation of the flat. This amount has to be paid in cash.

For example, if you agree to buy a resale flat for $600,000, and HDB’s valuation turns out to be $550,000, there’s a COV of $50,000, which needs to be paid in cash.

A quick note for those who last bought a flat before 2013: HDB no longer publishes COV data. As of today, you need to agree on the price first, and you’ll only know the official valuation later. Some property agencies track COV data on their own though, so a realtor may be able to help here.

It might matter if the cash you need ends up being refunded and locked into CPF, so plan your budget accordingly.

Also, keep in mind that renovations tend to be much pricier for resale flats

Resale flats tend to be older, and most homeowners will want to replace the former occupants’ renovations. This could be a problem if most of your sale proceeds end up going back into CPF, and you have limited cash left over for renovations.

4. Prepare for the possibility of rehoming your pets

HDB has an approved list of pets, including a list of approved dog breeds. Pets that were okay with your condo management may not be alright with HDB, so you’ll need to make appropriate plans.

At this point, many of you will point out that there are people with unapproved dog breeds living in HDB flats. That’s likely true. After all, cats were also illegal in HDB flats until September 2024, but we know HDB owners have had cats since way before that – probably since the dawn of the first HDB blocks.

From an on-the-ground perspective, it seems that action is taken when action must be taken (i.e., someone makes a complaint). But since this is a real possibility, you should be aware of the risks regarding your pets, and have appropriate back-up plans.

It’s also important for us to say, at this point, that we don’t encourage anyone to break any HDB rules.

5. There’s no more 24/7 security or locked lifts, so make safety changes for your family

Take note of this if you have young children, or elderly family members who shouldn’t be wandering out on their own. In most condos, there’s 24/7 security that can help you search for them, or who can be help to alert you when certain family members wander out.

Most newer condos also have locked lifts (you need a keycard), which could prevent young toddlers, dementia patients, etc. from wandering out of the condo.

For HDB flats, all you have is the front door and front gate. A compensating factor is more neighbours to help you keep an eye out – but still, you may need to take extra precautions. It’s a good reason to get to know the people next door or in your block, in case anything happens.

Another consideration is picking a dementia-friendly town. Some of these include Kebun Baru, Yishun, and Woodlands. Toa Payoh West, and Bedok. These towns have initiatives such as local volunteers to help with dementia patients, or colour and picture-coded directions, to help guide the way to the market, home, etc. (These sorts of direction markings are also good for young children.) We have some further details on whether Singapore neighbourhoods are dementia-ready, in this article.

While loan shark problems are a lot rarer these days, they’re still more common in HDB flats than in condos.

The lack of private security makes it easier for loan shark runners to get to any floor in the block. Keep this in mind when choosing your flat, and be extra vigilant for signs of loan shark activities (e.g., graffiti at stairwells, CCTVs mounted outside the door, or parts of the common corridor that are emptier than others, with no plants, shoe racks, and so forth.)

6. Decide whether you’re giving up the car before you pick the flat

Older HDB blocks may not be near multi-storey car parks. The first ones appeared in a handful of estates in the late 1970s but for the most part, they only became commonplace by around the mid-80s. This can mean a lack of sheltered parking among the older flats. You could be walking quite far in the rain to get to your car.

It might also be time to evaluate if the car is really necessary, given that HDB estates tend to be better connected via public transport; and most of them will have minimarts, coffee shops, and other day-to-day amenities within walking distance. In light of that, it may be worth giving up the car to, say, cover the cost of renovations.

In any case, the decision to give up or retain the car helps to inform your choice of flat location. It may be worth paying a bit more to be near the mall, MRT station, or market centre if you know you’ll be without private transport.

7. Remember that time is on your side

The difference between upgraders and right-sizers is that between the two, time is on the side of the right-sizer.

In general, private home prices tend to rise faster than HDB resale prices; so it’s less of a risk to wait. If you can’t find a replacement flat you like, or you aren’t comfortable with the budget, there’s less harm in waiting another year or two.

Even if prices rise, a right-sizer’s replacement home is at a much lower quantum. An upgrader has to worry about a five per cent increase, for example, because that makes their $2 million condo cost $100,000 more. But the same price increase in a $600,000 flat is just $30,000 more.

Being able to wait and stay patient is a huge advantage, and one that right-sizers should take full advantage of. Don’t feel pressured to move too fast, and give yourself time to find a replacement flat you’ll really enjoy.

It’s much tougher to find a nice replacement flat in 2025.

Fewer people are selling, compared to previous years. Blame it on the high property prices we’re seeing: given the high cost of a replacement property, many upgraders have put their plans on hold.

If you need help finding the right replacement unit, or you’re not sure about the timeline for your right-sizing, reach out to us at Stacked and we can help. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Advice

Property Advice The Ultimate Work From Home Homebuyer Checklist (That Most People Still Overlook)

Property Advice When ‘Bad’ Property Traits Can Be A Bargain For Homebuyers In Singapore

Property Advice The Hidden Risks Of Buying A Landed Home In Singapore: 6 Renovations That Could Be Illegal

Property Advice Why Being The First Seller In A Condo Can Be Risky (And How To Make It Work)

Latest Posts

Pro How Different Condo Views Affect Returns In Singapore: A 25-Year Study Of Pebble Bay

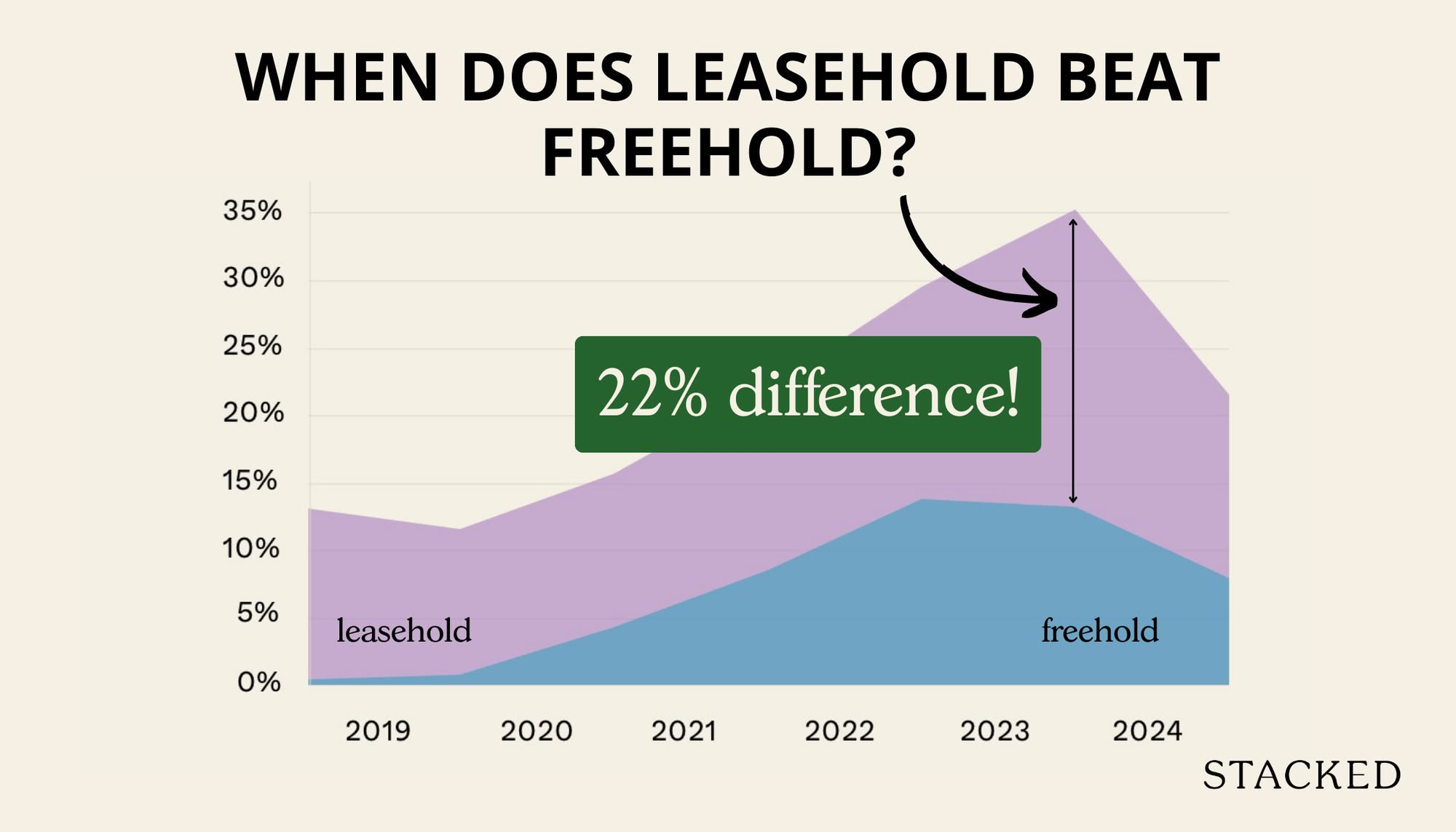

Pro Can Leasehold Condos Deliver Better Returns Than Freehold? A 10-Year Data Study Says Yes

Home Tours Inside A Minimalist’s Tiny Loft With A Stunning City View

On The Market 5 Most Affordable Newly MOP 4-Room HDB Flats From $585k

Property Market Commentary Distressed Property Sales Are Up In Singapore In 2025: But Don’t Expect Bargain Prices

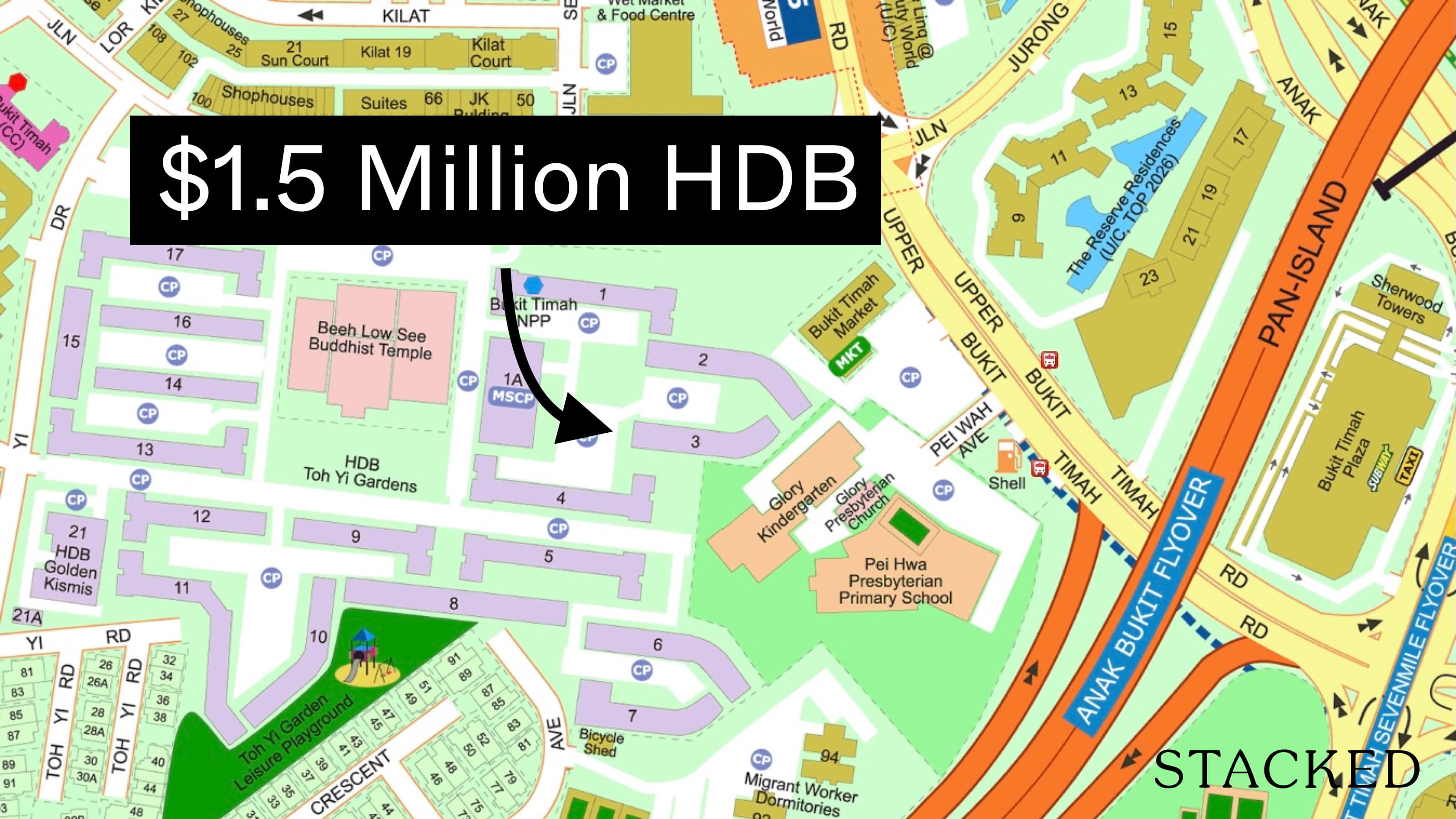

Singapore Property News This $1.5M Bukit Timah Executive HDB Flat With 62-Years Lease Left Just Set A Record: Here’s Why

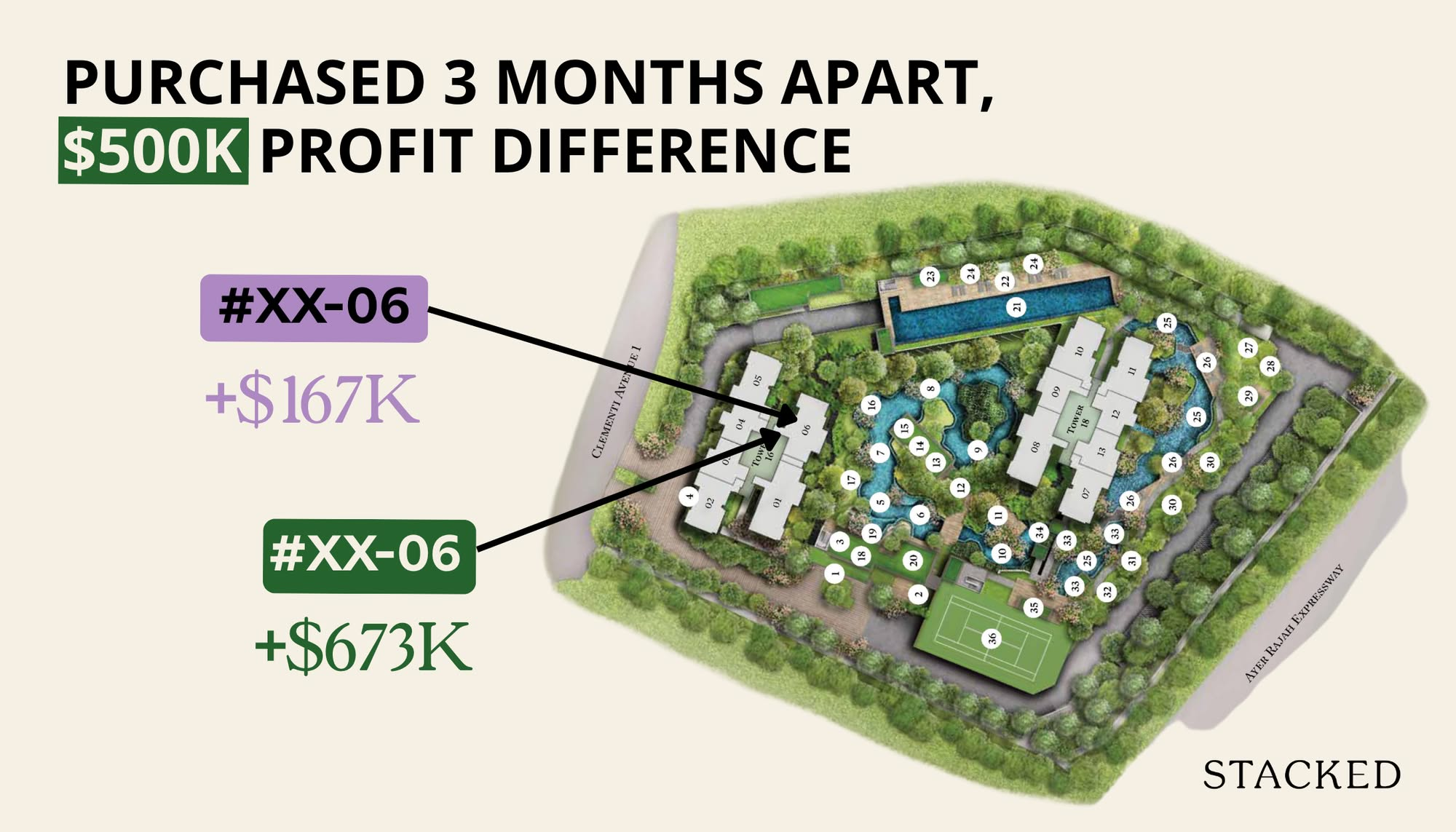

Editor's Pick How A Clement Canopy Condo Buyer Made $700K More Than Their Neighbours: A Data Breakdown On Timing

Editor's Pick Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Editor's Pick These $4m Freehold Landed Homes In Joo Chiat Have A 1.4 Plot Ratio: What Buyers Should Know

Editor's Pick Now That GE2025 Is Over, Let’s Talk About The Housing Proposals That Didn’t Get Enough Scrutiny

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Property Market Commentary Why Do Property Agents Always Recommend New Launch Condos? Is It Really About The Money?

On The Market 5 Affordable Condos With Unblocked Views Priced Under $1 Million

Pro Watertown Condo’s 10-Year Case Study: When Holding Period And Exit Timing Mattered More Than Buying Early

I managed to appeal successfully to waive of 15mths wait without death or divorce case. But Hdb only allow me buy 3 or 4rm flat & use bank loan if needed.