We Own An HDB Executive Apartment And Are In Our 60s: Should We Right-Size To A BTO Or Resale HDB?

September 29, 2023

Dear Ryan,

As usual, you and your Team continue to amaze me with the wide range of posts weekly – be it review of landed housing estates, HDB largest and cheapest flat and the issues faced by landlord! :):):)

I come across this yesterday and thought you might find it useful to post it in that you have always been advising on private properties decision but now this is related to HDB which has also been in the focus recently amidst an ageing population.

Background of case:

- Couple is from Merdeka generation. Husband will be retiring soon while wife has been a housewife for 3 decades.

- Couple owns a HDB EA in Pasir Ris Drive 1 St 13, mid floor

- Only child, a daughter will be getting married next year end and marital home will be near Serangoon Gardens and consequently, couple has to embark on rightsizing decision.

Housing decision to be made soon:

- Options available: a) 3-room BTO; b) 3-room Resale; or c) 2-room Flexi

- what are the pros and cons of each

- if resale, should they be choosing MOP of 5-10 years type of flat or similar age of their Pasir Ris flat since 1993 or more aged flat for cost consideration

- speed of the purchase ie if apply for BTO, what is the estimated time frame from application to key collection for BTO 3-room BTO or 2-room Flexi

- Potential locations given that the couple would need to stay relatively nearer to their daughter’s new home. Convenient for both parties to meet in the future.

- Government grants available for such a rightsizing exercise for both BTO and resale decision

- Any other considerations that the couple has to take note?

- Website for obtaining past HDB sale transactions as my attempts to retrieve from URA website has not been successful. I only manage to get from Property Guru if there is an advertisement for sale of a nearby block to have some semblance.

Ryan, I hereby give you permission to put up the above mentioned case and related advice including your findings and analysis as your weekly posting. I am sure that many others who are in the same boat could learn from it.

Thanks a million Ryan & looking forward to your usual detailed analysis.

Hi there,

We’re happy to hear that you’re enjoying our content and thank you for the kind words.

Indeed, there have been discussions lately about the role of HDBs as a means of financial support for seniors during their retirement (we wrote about the lease buyback scheme recently).

So while the introduction of 2-room flexi units serves the purpose of enabling seniors to convert their existing homes into financial resources, it does seem that a number of seniors are opting to retain their properties (possibly due to sentimental reasons) rather than accessing the funds tied to them.

Before we explore the available options, let’s begin by assessing the current performance of this particular HDB property.

Performance of current HDB

These are the Executive Apartments (EA) along Pasir Ris Dr 1 that were sold this year:

| Date | Block | Level | Size (sqm) | Lease commencement date | Price |

| Jun 2023 | 534 | 10 to 12 | 147 | 1992 | $930,000 |

| Jun 2023 | 536 | 01 to 03 | 145 | 1992 | $850,000 |

| May 2023 | 535 | 04 to 06 | 150 | 1992 | $848,000 |

| Feb 2023 | 533 | 04 to 06 | 145 | 1992 | $835,000 |

There were 2 mid floor units that were transacted at an average price of $841,500. If you like, you can obtain the HDB transactions here. With this tool, you can also see prices of HDBs 200 metres from your selected block.

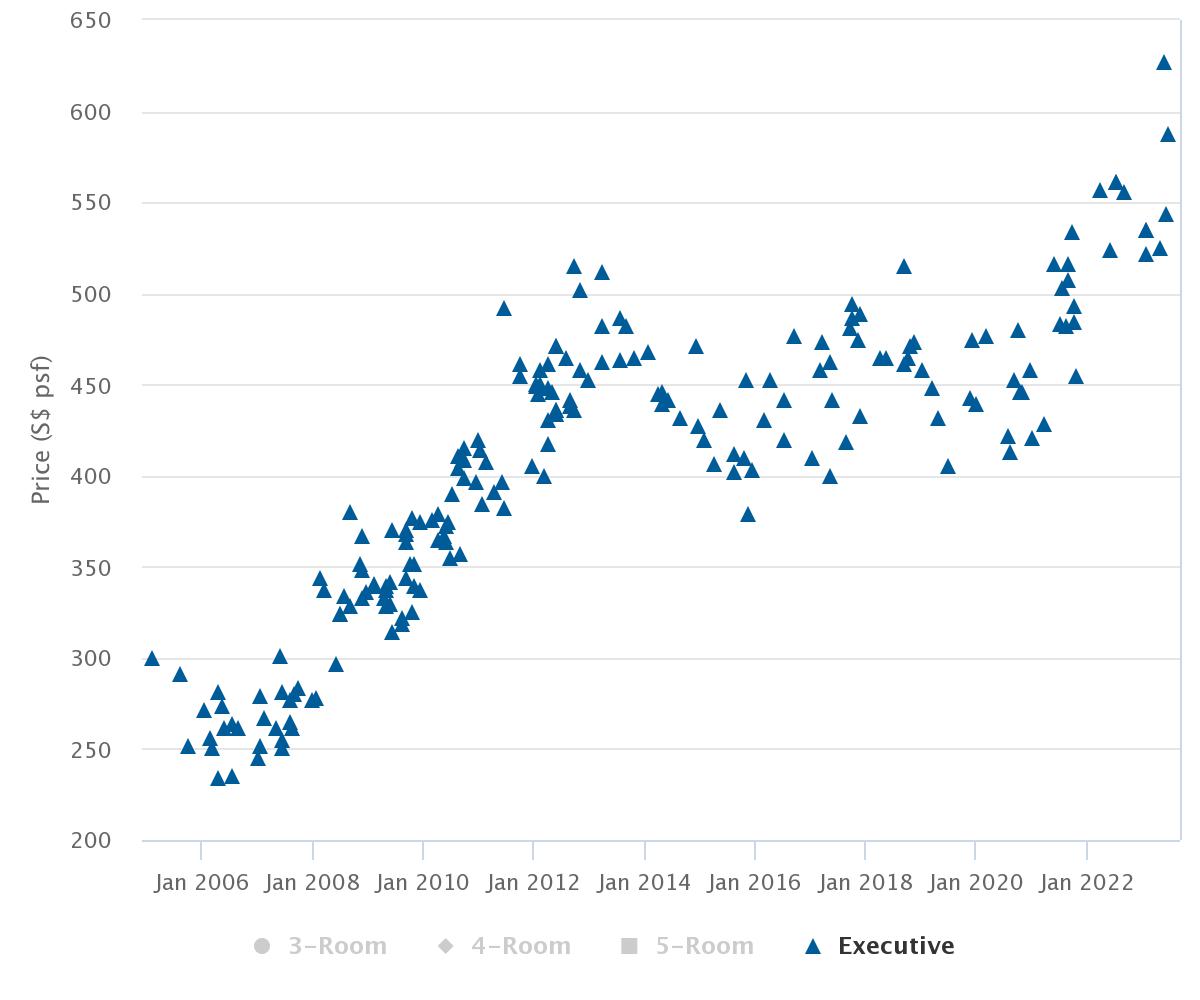

The chart presented above illustrates the price movements of HDB executive units situated within the 53x series cluster along Pasir Ris Dr 1.

This trend aligns with the broader HDB market, where prices stabilised following the implementation of several rounds of cooling measures in 2013 and then began to rise with the onset of the pandemic.

This location enjoys a prime position, nestled among essential amenities like the Pasir Ris MRT station, White Sands, Pasir Ris Town Park, and the soon-to-arrive Pasir Ris Mall. The close proximity to these facilities may positively influence property values in the vicinity. Furthermore, executive units, as the most spacious HDB type and no longer in production, consistently attract significant demand.

That being said, it’s still essential to consider lease decay factors as the unit is currently 31 years old. Given the current peak in prices, opting to cash out from the property at this juncture may be a wise decision. This is because as the flat continues to age, the buyer pool would diminish since the use of CPF and the LTV is pro-rated so that the flat could last the youngest buyer up to 95 years of age.

Considering that the couple belongs to the Merdeka Generation (which encompasses Singaporeans born between 1st January 1950 and 31st December 1959) they would currently fall within the age range of 64 to 73 years old. Therefore, it is highly likely that they have fully settled the mortgage on their HDB, as the maximum loan tenure typically extends up to the age of 65.

However, as they are over the age of 55, if they were to sell the property, any CPF funds utilised will be refunded into their Retirement Accounts (RA). Subsequently, they will need to set aside at least the Basic Retirement Sum (BRS) before they can utilise any excess amount for the next property purchase.

Given their age group, they would have turned 55 between 2005 to 2014. The following are the respective CPF FRS and BRS amounts.

| 55th birthday on or after | Full Retirement Sum (FRS) | Basic Retirement Sum (BRS) |

| 1 July 2005 | $90,000 | $45,000 |

| 1 July 2006 | $94,600 | $47,300 |

| 1 July 2007 | $99,600 | $49,800 |

| 1 July 2008 | $106,000 | $53,000 |

| 1 July 2009 | $117,000 | $58,500 |

| 1 July 2010 | $123,000 | $61,500 |

| 1 July 2011 | $131,000 | $65,500 |

| 1 July 2012 | $139,000 | $69,500 |

| 1 July 2013 | $148,000 | $74,000 |

| 1 July 2014 | $155,000 | $77,500 |

Since we do not know how much CPF they have used for the current property or how much CPF they have in their RAs, for the purpose of the article, we will assume they have the funds necessary to purchase the 3 options listed (a 2-room flexi or 3-room BTO, or a resale 3-room flat).

Given the couple’s age, it’s likely they won’t qualify for a mortgage loan, necessitating a full upfront payment for the property, be it a BTO or resale flat. It’s important to highlight that typically, buyers of a 2-room flexi unit cannot secure a loan and must pay the full price. However, after setting aside the BRS, CPF funds can be used.

Options

Let’s start by looking at the differences between buying a BTO and a resale flat.

| BTO | Resale | |

| Location | Restricted to where the BTO launches are at | No restrictions, can choose your preferred location – in this case, near their daughter’s home in Serangoon |

| Unit availability/selection | Requires a stroke of luck as the availability of your preferred unit(s) depends on your queue number | Unable to predict when a suitable unit will come on the market |

| Environment | Will only have a rough idea of what the surrounding environment might be like. Will not know who your neighbours are until you move in. | Able to physically see the surrounding environment before purchasing the property |

| Price | Flats are subsidised, so they are naturally more affordable than a resale flat in the same location | Influenced by demand and market movements, and is also dependent on factors such as location, age, reno |

| Waiting time | Takes 3 to 4+ years to complete | A regular transaction may take 3 – 4 months to complete but can vary depending on the seller and buyer’s agreement (eg. extension of stay, delayed submission, etc.) |

| CPF housing grants | As the flats are already subsidised, only the Enhanced Housing Grant (EHG) is available subject to buyers meeting the eligibility conditions | More grants are available such as the First Timer Grant and the Proximity Housing Grant (PHG), subject to buyers meeting the eligibility conditions |

| Resale levy | If the buyers are purchasing their second subsidised flat, a resale levy is payable (in cash) | No resale levy |

| Certainty of getting a unit | Runs on a balloting system and also depends on the queue number to select a choice unit. May require a stroke of luck. | Higher chance of getting a unit subjected to matching the seller’s expected closing price. |

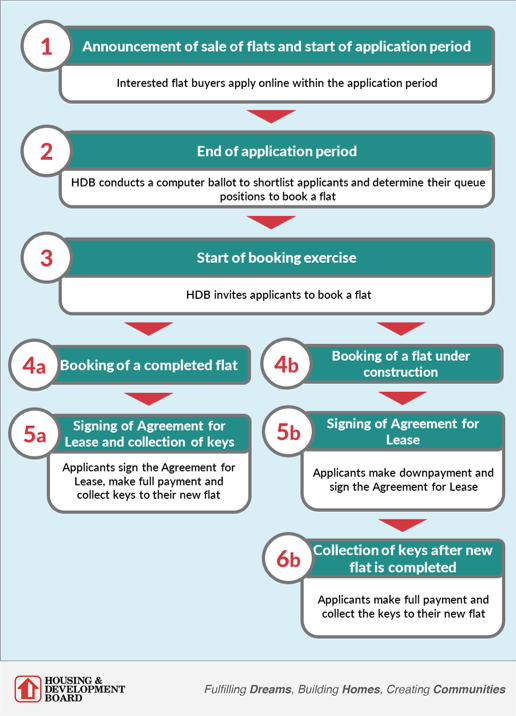

In addition to a BTO, you can also look at Sale of Balance Flats (SBF) and open booking of flats. SBF is basically surplus flats from previous BTO launches which are usually already under construction, nearing completion or already completed. They tend to be in high demand due to the shorter waiting time and interested buyers will have to go through a ballot system similar to buying a BTO.

This is an overview of the SBF process:

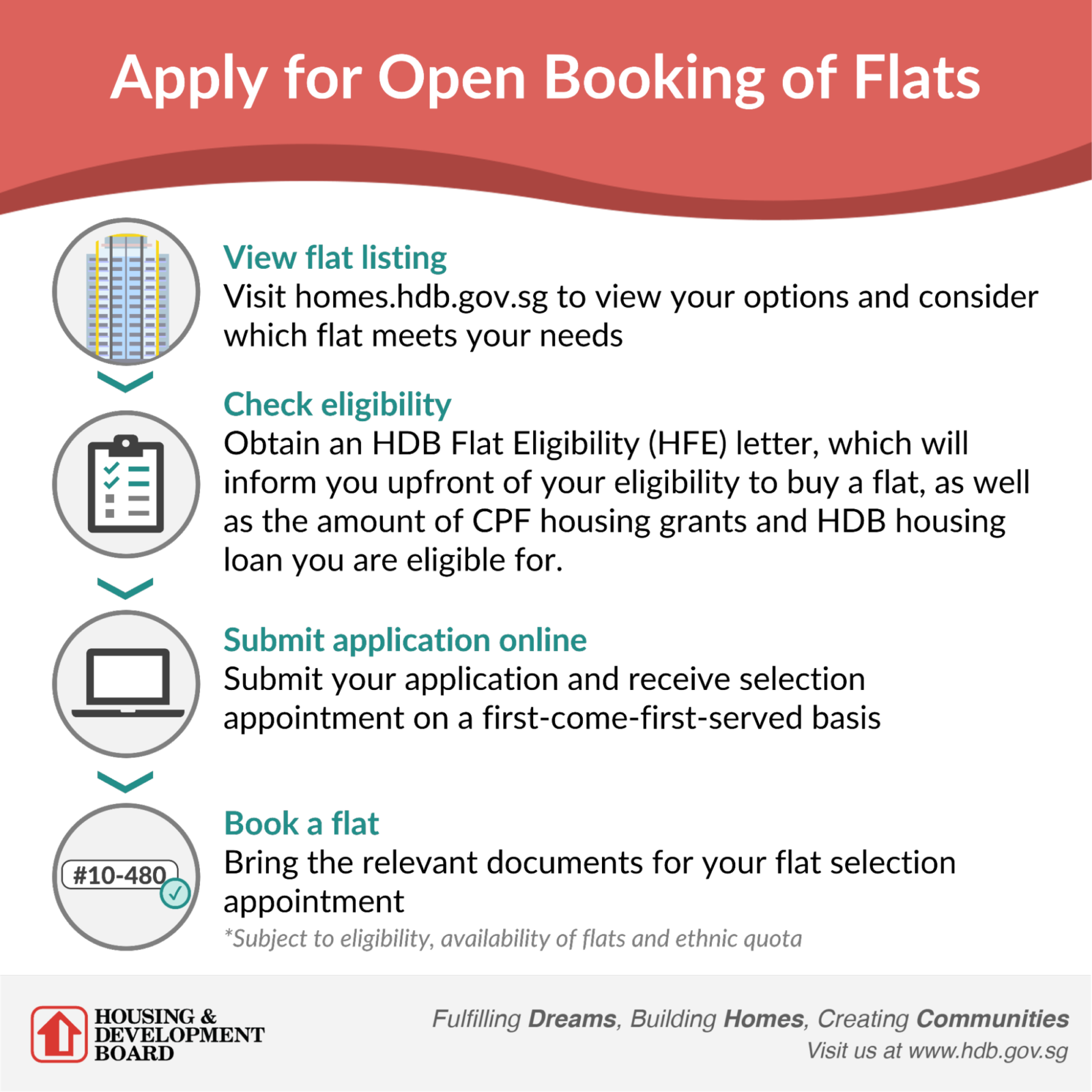

As for the open booking of flats, these are unselected flats from previous SBF exercises and interested buyers can apply for them at any time.

Here is an overview of the process:

Option 1. Buy a 2-room flexi BTO

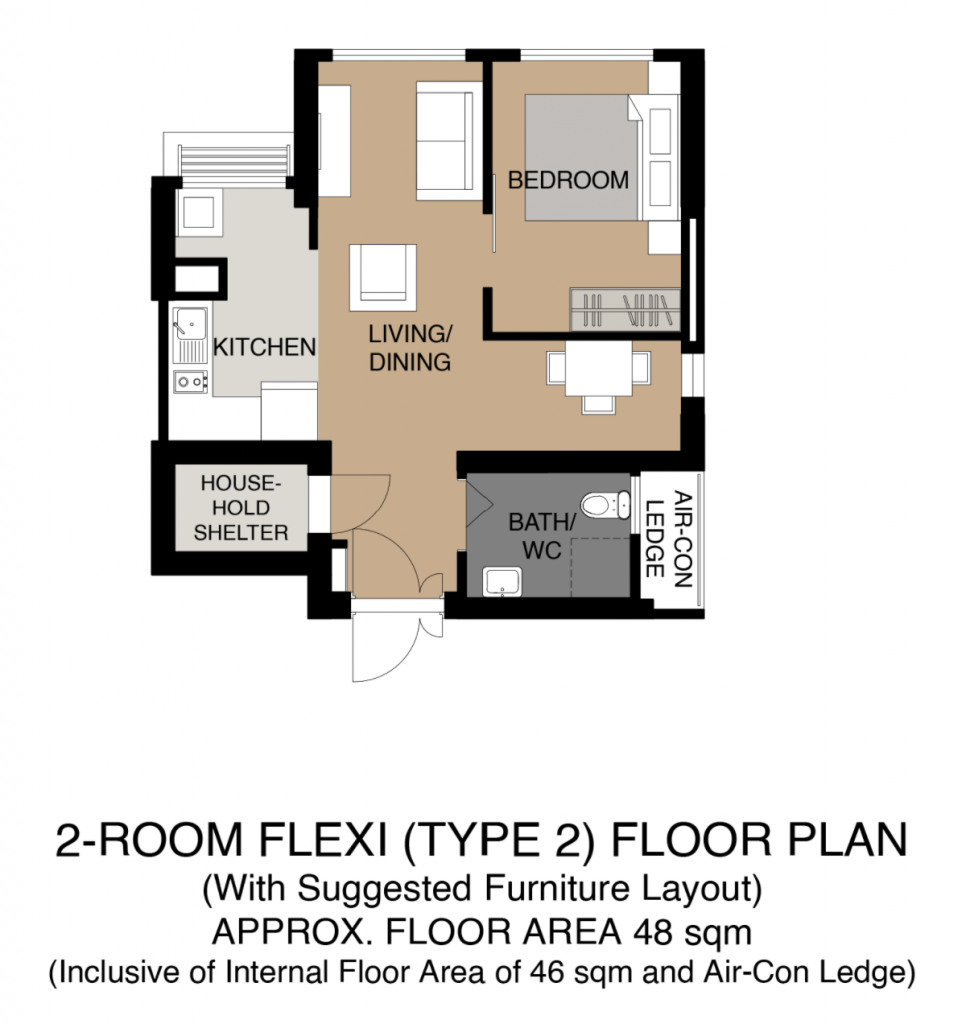

There are two different 2-room unit types. Type 1 is typically around 37 – 39 sqm and Type 2 around 47 – 49 sqm. This can vary slightly depending on the individual projects.

Here are some sample floor plans.

Let’s start by looking at some of the pros and cons of this option.

| Pros | Cons |

| The most affordable option, especially with short-term leases. | Smaller living space may take some getting used to especially since they’re moving from an EA |

| Smaller living space will be easy to maintain especially when they’re ageing | Unable to sell the unit on the open market. In the event that the owners pass on or wish to move out before the lease expires, the flat will have to be returned to HDB, and HDB will pay out a pro-rated sum based on the remaining lease of the flat to the owners or their next-of-kin. |

| Even if the buyers have utilised both their chances of buying a subsidised flat, they can still purchase a 2-room flexi unit but a resale levy will be payable (this will be pro-rated depending on the lease term) |

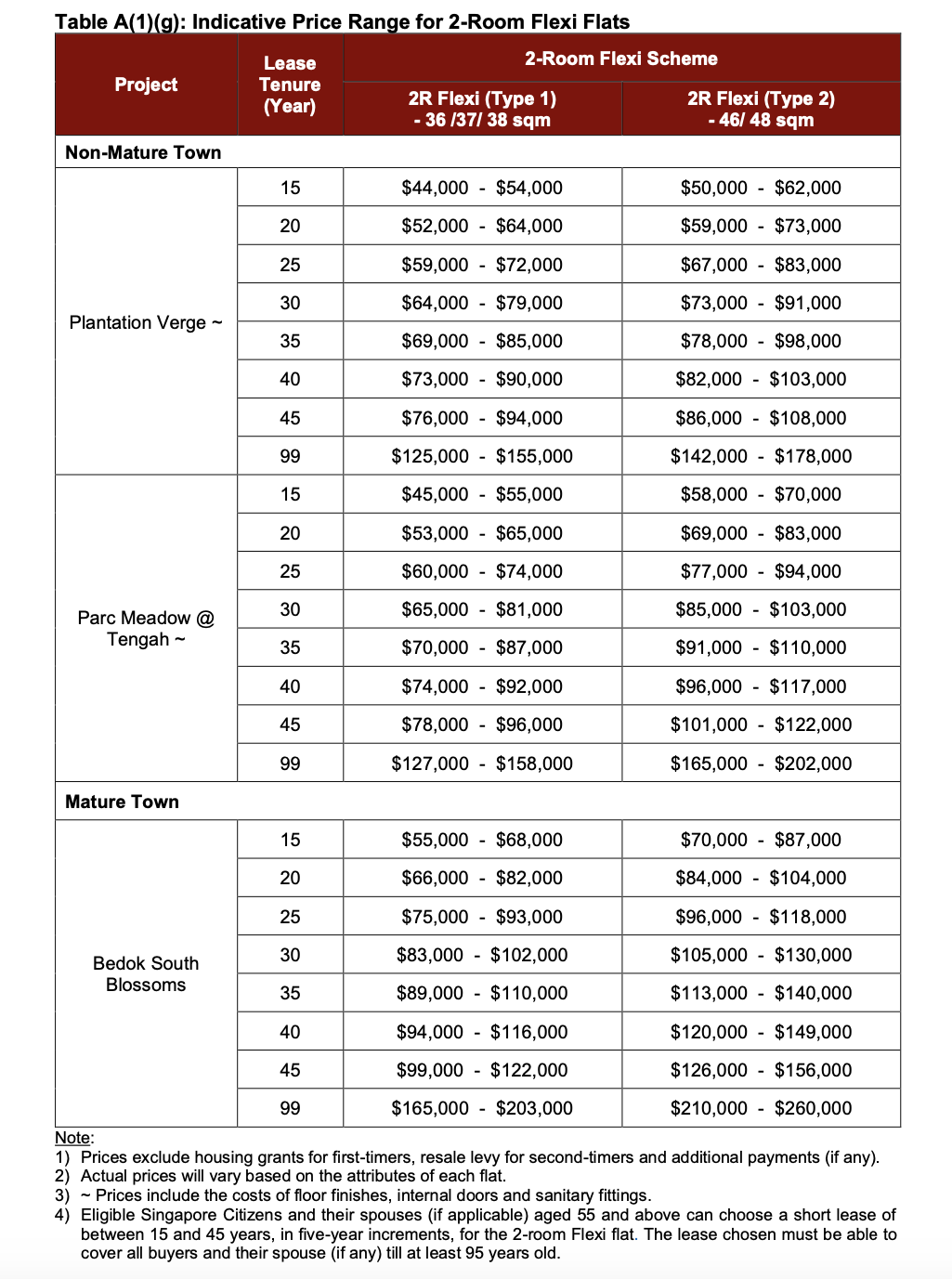

The following table shows the prices for a 2-room flexi unit depending on their lease term for the latest launch in May this year.

If the youngest buyer is 64 years old, they would need to select a unit with a lease term of at least 31 years to ensure it covers them until the age of 95. So let’s say they were to opt for a unit with a 35-year lease, the cost would range roughly between $69,000 and $140,000, depending on factors like location and unit size.

By choosing this option, the couple would have more liquid funds at their disposal, which they could allocate to other investments, thereby enhancing the longevity of their retirement funds.

Furthermore, there is a Senior Priority Scheme (SPS) designed for seniors seeking to purchase a 2-room flexi unit within a 4-kilometer radius of their current residence or the residence of their married child. This initiative aims to facilitate aging in a familiar environment or staying close to their children, increasing their chances of successfully balloting for a flat.

Option 2. Buying a 3-room BTO

Here’s the layout of a typical 3-room flat.

| Pros | Cons |

| Fresh 99 year lease | Will cost more compared to a 2-room flexi unit |

| Extra bedrooms can be rented out to generate passive income to fund their retirement | |

| In the event that the owners wish to move elsewhere or when they pass on, the unit can be sold on the open market or willed to their children (but in their case, since they only have one daughter who already owns a property, it is unlikely she will be able to inherit the flat) | |

| Will make a profit if the owners decide to sell |

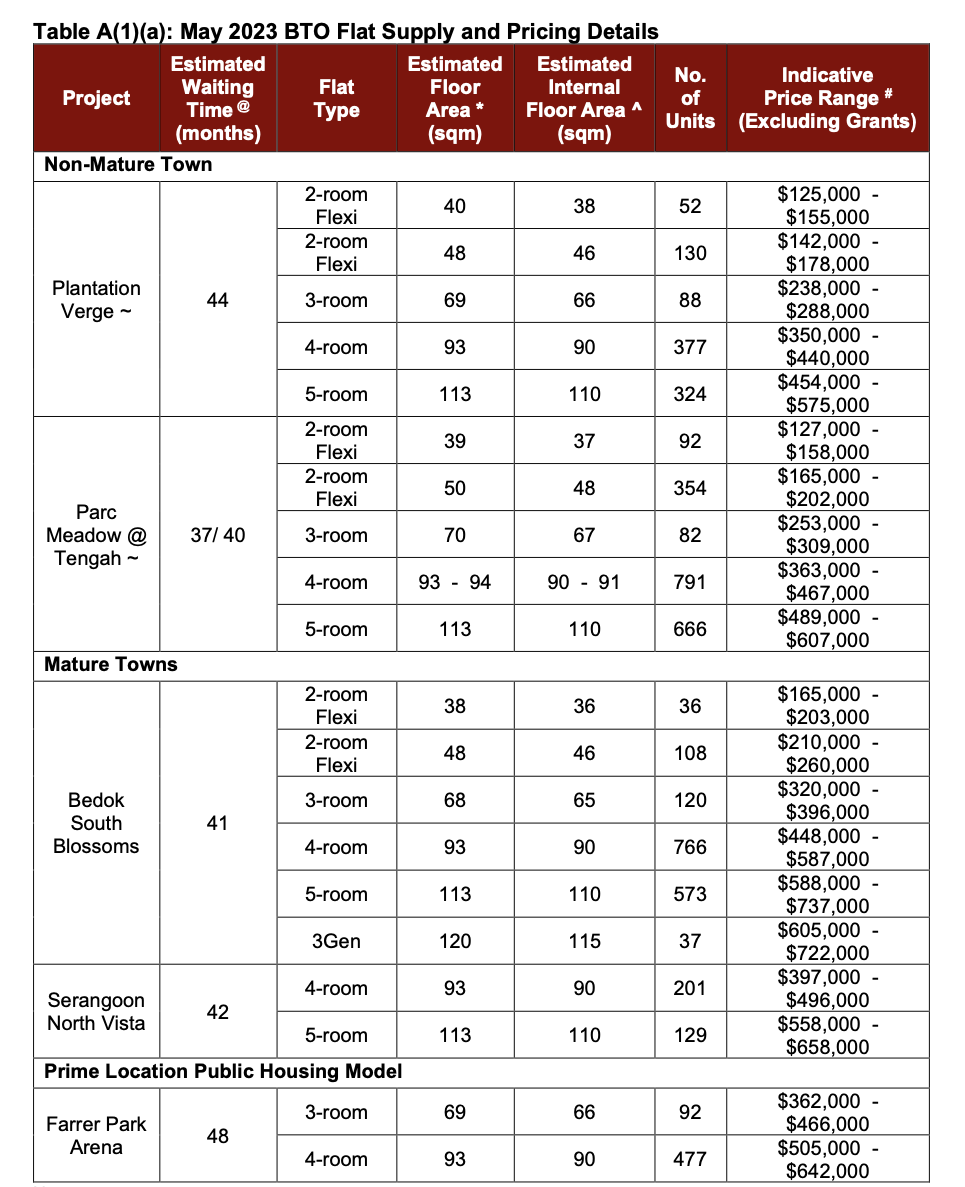

Here are the prices from the recent BTO launch in May.

The cost of the unit can vary quite significantly depending on its location. Opting for a more centrally located unit would result in having considerably less readily available funds. While it’s possible to supplement their retirement income by renting out an extra bedroom, this would come at the expense of reduced privacy. Therefore, if privacy is a crucial consideration for them, they may need to accept a lower amount in their retirement savings.

It’s important to note that they will only qualify to purchase a 3-room BTO unit if they haven’t exhausted their two opportunities to buy a subsidised flat. If they have already acquired a subsidised flat in the past, they will be required to pay a resale levy.

Option 3. Buy a 3-room resale flat

If being near their daughter is a top priority, this option might become essential, as the availability of BTO flat locations will be constrained to wherever the launches occur, which may or may not align with their desire to be close to their daughter.

| Pros | Cons |

| Able to select a unit in their preferred location | Prices are likely to be higher than a BTO unless an old flat is chosen |

| Extra bedroom can be rented out to generate passive income to fund their retirement | Mostly older flats in Serangoon (for 3-room units) |

| Shorter timeline compared to a BTO | |

| If the flat is within 4km of their daughter’s home, they will be eligible for the Proximity Housing Grant (PHG) of $20,000 |

Let’s take a look at some of the recent 3-room transactions in Serangoon.

We can see that despite these flats being at least 38 years old or older, their prices remain relatively elevated. One possible explanation for this is the advantageous proximity of these blocks to amenities such as the Serangoon MRT station, NEX shopping mall, and the Serangoon Avenue 3 Market & Food Centre.

However, if we were to shift our focus slightly further to the Serangoon North area, we observe that prices are noticeably more affordable. While it remains in close proximity to Serangoon Gardens (where their daughter resides) the amenities in the vicinity are not as abundant.

Purchasing an older flat should not pose a problem given the couple’s likely age. The remaining lease on these older flats would cover them up to the age of 95, and consequently, it would not impact their CPF Withdrawal Limit (WL).

Also, if this is intended to be their final property, they need not be overly concerned about a potentially reduced pool of future buyers due to the age of the flat.

Nonetheless, looking at the recent transactions, it’s evident that even with the $20,000 PHG, the couple would still need to allocate a substantial sum from their cash and CPF reserves to cover the property’s cost, thereby diminishing their retirement savings.

Alternative option. Remain status quo or rent out the current unit

If living near their daughter isn’t paramount and they’re amenable to sharing their home, they could consider leasing the spare bedrooms. With a potential monthly rent of $900 per room, two rooms could yield $1,800 monthly. This supplemental income could greatly enhance their retirement finances.

But if staying near their daughter holds greater importance, they could explore the option of renting out their current property and securing a residence in close proximity to their daughter. Given their spacious unit and their own need for a smaller living space, it’s likely that they could still make a modest profit from this arrangement, thereby generating some passive income.

This is the average HDB rental for Q2 2023 in the respective estates.

| Town | 3-room | Executive |

| Pasir Ris | * | $3,500 |

| Serangoon | $2,600 | * |

Assuming the above rental prices, they would be able to enjoy an extra $900/month.

They could even consider the possibility of renting a one-bedroom condominium instead. In Serangoon, smaller projects like Casa Cambio and Cardiff Residences have one-bedroom units that were rented out for prices ranging from $2,500 to $3,000 over the last 3 months.

Having said that, one downside to this option is that they won’t be able to access the substantial amount of funds tied up in their current property, which is a significant financial consideration. If unlocking funds for retirement is a must, then this option is a no-go.

So what should they do?

Among the few options, Option 1, which involves purchasing a 2-room flexi flat, appears to be the more financially sound choice. It offers affordability and provides the highest amount of liquid funds which can be reinvested in various avenues to bolster their retirement funds.

However, there are two crucial factors the couple should carefully consider to facilitate their decision-making process – location and timeline.

In such a scenario, their primary choice would be to purchase a resale flat. You mentioned the housing choices to be decided “soon” which implies some urgency and a resale flat can be moved into quickly.

If being near their daughter is their utmost priority, then a resale flat also makes sense since you would have to play the waiting game for a BTO to be offered in Serangoon. This doesn’t even include the extended construction timeline, typically lasting 3 to 4 years.

While searching for a flat now, the couple can also consider looking at Sale Of Balance Flats and Open Booking of Flats. These tend to have shorter waits as they were leftover units from previous launches. The next Sale Of Balance Flats exercise would be around the end of the year – usually in November. You can sign up with HDB to receive notifications so you don’t miss it out. You can then set a timeline so that you do not wait indefinitely – perhaps after the November and May SBF/OBF exercise, you can pull the trigger for a resale flat with greater certainty and no regrets.

Finally, we presented the option of renting out the EA while renting a flat or condo nearby. This option only makes sense if there’s no need to unlock the EA for their retirement.

However, the biggest problem with this is renting. As the couple ages, the prospect of having to move house becomes more and more painful. Being a tenant creates a lot of uncertainty as landlords have the ability to find reasons to discourage you from extending your lease.

As such, our advice to the couple would be to house hunt for older flats near their daughter while keeping an open mind to the upcoming BTO/SBF/OBF exercises up to a specific time when they know they’ve tried their best before purchasing a resale flat.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Property Advice We’re In Our 50s And Own An Ageing Leasehold Condo And HDB Flat: Is Keeping Both A Mistake?

Latest Posts

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments