We Own A 4-Room HDB And An Investment Condo. Should We Sell Both To Upgrade Or Keep For Rental?

October 28, 2022

Hello Ryan

Thank you for all the insightful articles.

We are in a dilemma with some property decisions and hope you can share with us your thoughts.

Both my spouse and I are in mid 40s. We have three children (aged 16, 14 and 12).

We are living in 4-bedroom HDB (purchased in 2003 and fully paid) in District 23. Total CPF fund used including accrued interest was about 333k. The HDB unit is under both names.

In 2014, we paid for a new one bedder condo in District 28 as part of retirement planning (passive income). Outstanding mortgage is about 338k. The condo unit is currently being rented out for 1.7k per month. Total CPF fund used including accrued interest was 192k. The condo unit is under both names (wife 99% and me 1%).

My annual income is about 180k. My wife is currently a housewife.

We are debating on following options:

Should we sell both HDB and condo units and upgrade to a new or resale 4 bedder private property in the West area?

Should we sell the condo unit, wait for 30 months before applying for an EC?

Should we keep the condo unit for rental income and continue to stay at the HDB unit?

Or do we have other options?

We look forward to hearing from you.

Thank you.

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hi there! Thanks for writing in!

Owning two properties is definitely on the bucket list for most Singaporeans and getting there is hard enough in itself but now that you’re there, what’s next? Let’s run through your options!

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

4-room HDB in District 23

As we do not have the details of your flat we will look at the overall prices in District 23. Seeing that you purchased the unit in 2003, the HDB must have been completed in 1998 or earlier to have fulfilled the MOP, which means it’s at least 24 years old.

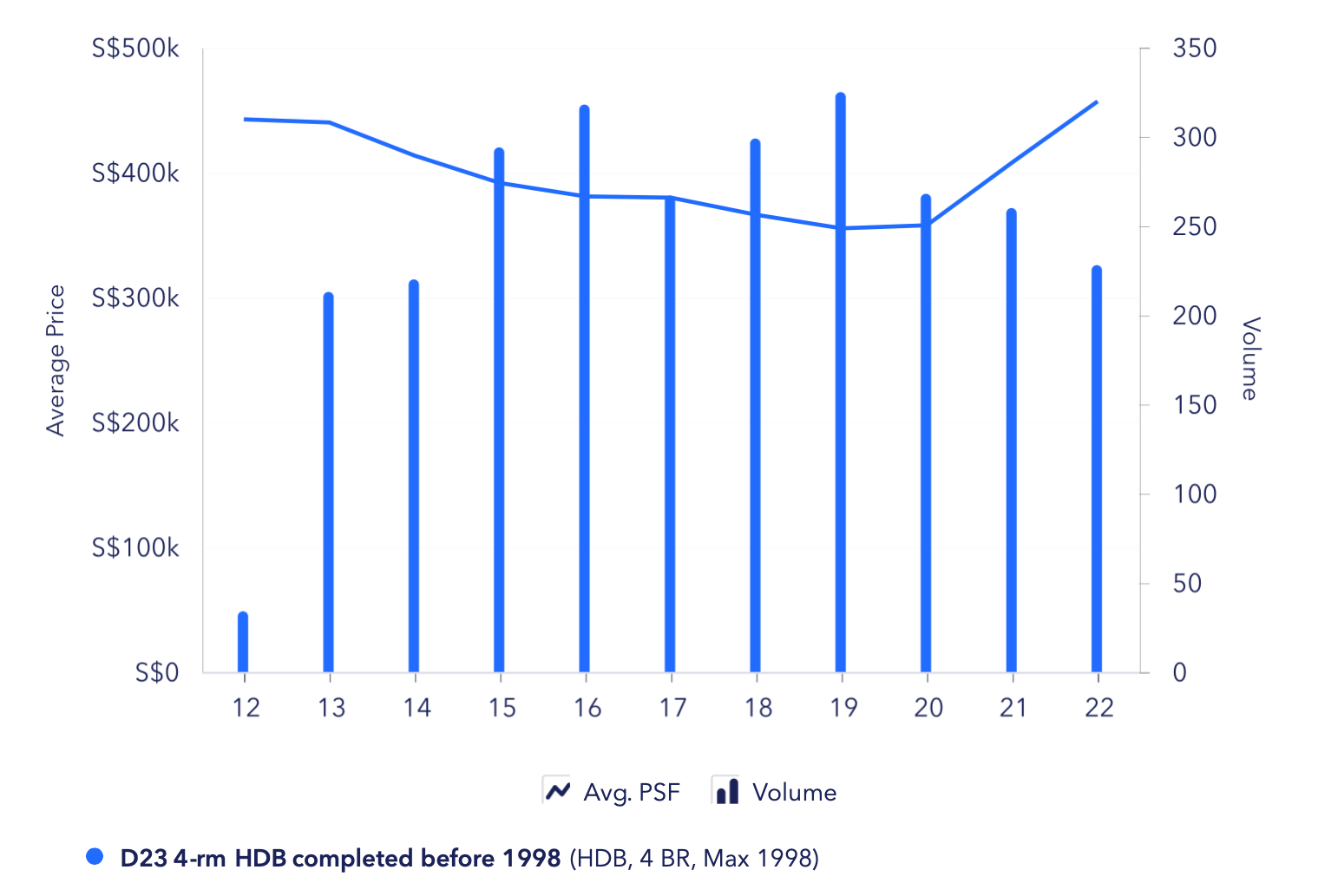

For the last 10 months, there were 228 4-room HDB (completed in or before 1998) transactions in District 23 that changed hands at an average price of $456,860.

We can see from the graph above that the average prices of these flats have been gradually declining up until 2020 when the overall market picked up and demand for older flats went up due to a lack of supply.

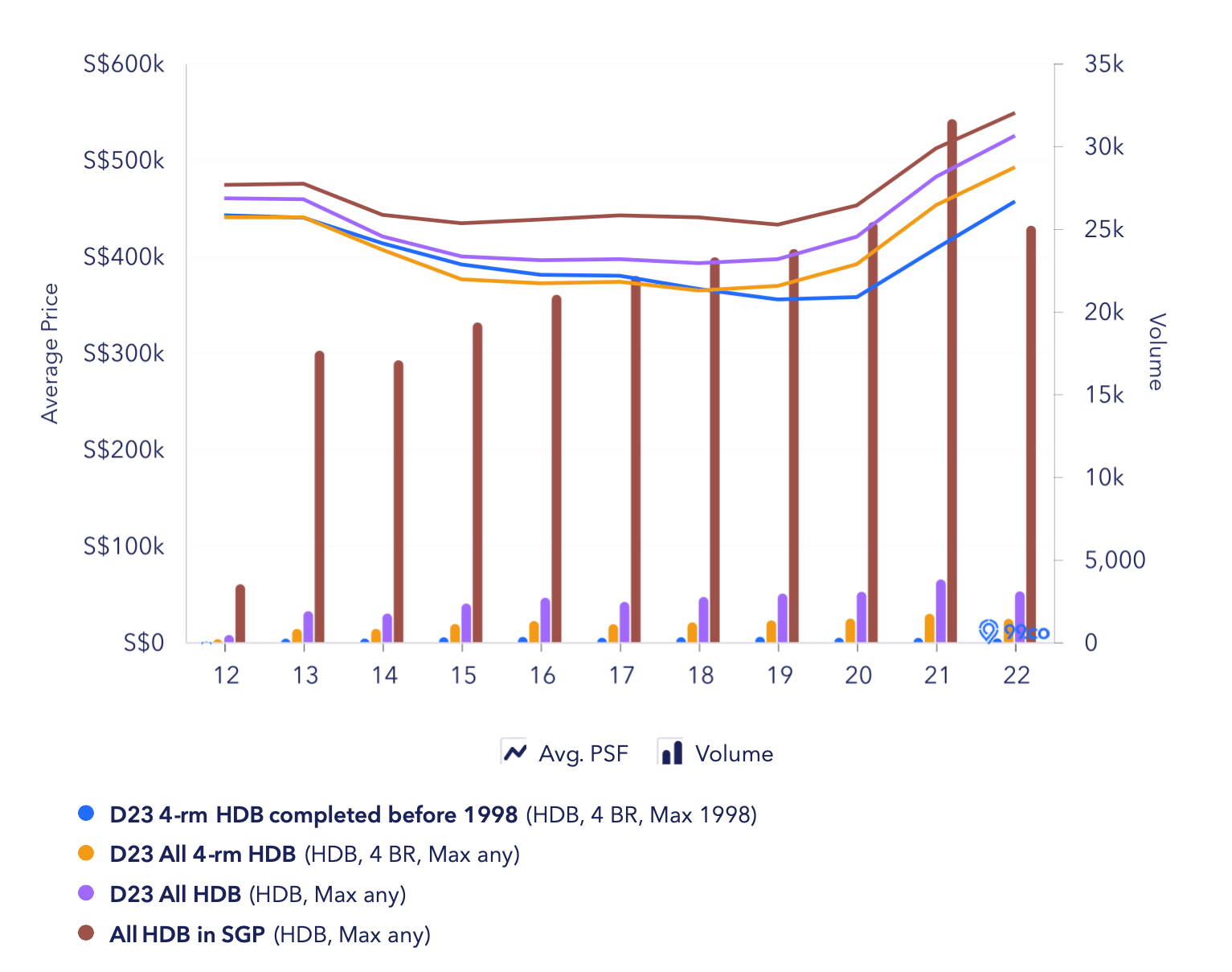

Prices of HDBs in District 23 on a whole are moving in line with overall HDB prices in Singapore. However, you’ll notice from the graph above, that prices of 4-room HDBs in District 23 that were completed before 1998 are lower than the overall HDB and 4-room prices in District 23. This is likely due to the blocks being older in age.

Let’s say you were to sell your unit at the average price of $456,860. We’ll use $456,000 for easy calculation.

| Description | Amount |

| Sale price | $456,000 |

| CPF used + accrued interest | $333,000 |

| Cash proceeds | $123,000 |

Editor’s Note (03 Nov 2022): We’ve adopted the use of the Resale Price Index (10-year horizon) in our calculations to project prices into the future. This figure is a moving target over the quarters and will be reflected in our advice article at the point of writing. As of 2022Q3, the RPI stands at 168.1. Compared to 2012Q4 (146.7), this is a 14.58% jump in 10 years.

Let’s do a 10-year projection in the event you decide not to sell the HDB:

| Description | Amount |

| Assuming | $522,485 |

| Current valuation | $456,000 |

| Interest costs | $0 (house is fully paid) |

| Property tax (assuming 19,200 annual value – $2300 average monthly rental minus $700 for furniture and maintenance fees) | $4480 |

| Town council service & conservancy fees (assuming $63.50/month) | $7620 |

| Estimated gains | $54,385 |

| Town | Avg 4-Room Rent (Q2 2022) |

| Bukit Batok | $2,400 |

| Bukit Panjang | $2,300 |

| Choa Chu Kang | $2,200 |

| Average rent | $2,300 |

One bedder condo in District 28

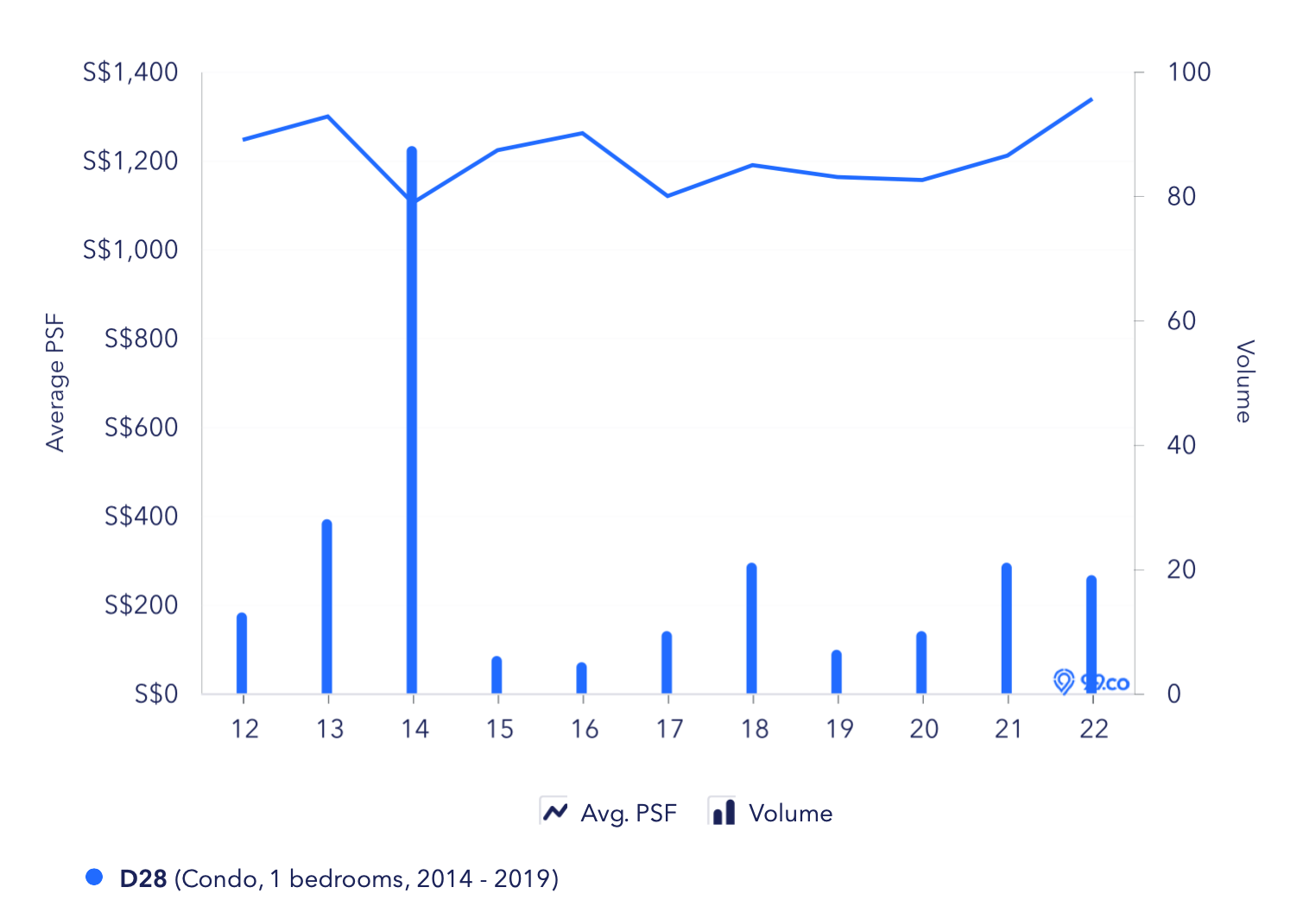

Similarly, as we do not have the details for your investment property, we will be looking at the overall prices for District 28. You’ve mentioned that you guys purchased a brand new unit in 2014, so we took the data for projects with 1 bedder that obtained their TOP from 2015-2018 which includes, Rivertrees Residences, Riverbank @ Fernvale, Seletar Park Residence, Floraville and H20 Residences.

In the last 10 months, 19 of these 1-bedders transacted at an average of $1338psf.

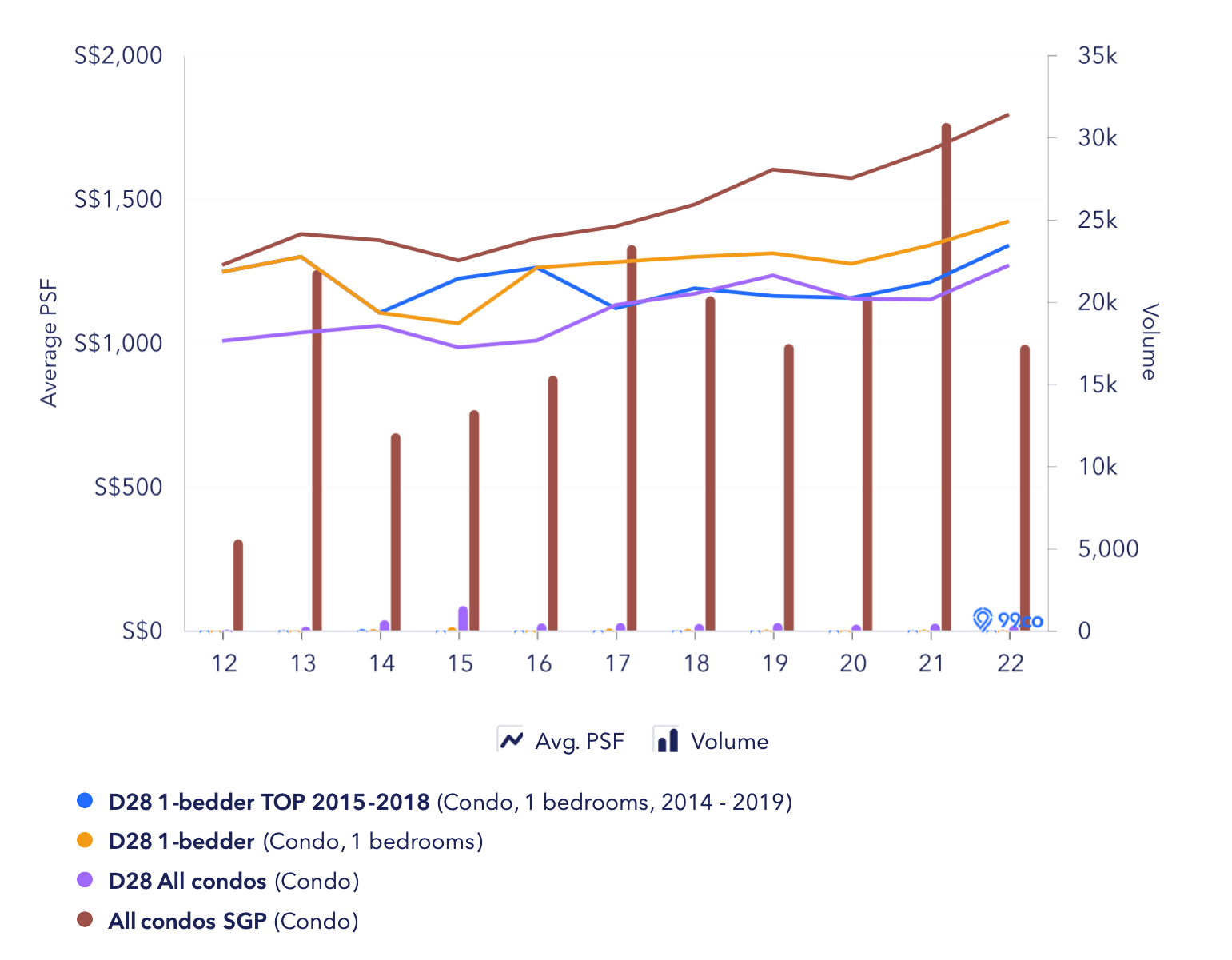

We can see from the graph above that prices of condominiums in District 28 are moving in tandem with the overall prices of condominiums in Singapore. The average PSF for the 1-bedder is higher than that of all condominiums in District 28, which is normal as smaller units usually tend to have a higher PSF.

Assuming a unit size of 495sqft, the selling price you’ll be looking at is $662,310. For easier calculation, we’ll use $662,000.

| Description | Amount |

| Sale price | $662,000 |

| Outstanding loan | $338,000 |

| CPF used + accrued interest | $192,000 |

| Cash proceeds | $132,000 |

Editor’s Note (03 Nov 2022): We’ve adopted the use of the Property Price Index (10-year horizon) in our calculations to project prices into the future. This figure is a moving target over the quarters and will be reflected in our advice article at the point of writing. As of 2022Q3, the PPI stands at 187.1. Compared to 2012Q4 (151.5), this is a 23.5% jump in 10 years.

Let’s do a 10-year projection in the event you decide not to sell the investment property:

| Description | Amount |

| Assuming | $817,570 |

| Current valuation | $662,000 |

| Interest costs (based on a $338,000 outstanding loan with 20 years tenure* and at 4% interest) | $110,088 |

| Property tax (assuming 14,400 annual value – $1700 monthly rental minus $500 for furniture and maintenance fees) | $14,400 |

| MCST fees (assuming $250/month) | $30,000 |

| Rental income at $1700/month for 11 months each year | $187,000 |

| Estimated gains | $188,082 |

Now let’s take a look at your affordability in a few scenarios.

Affordability (if you sell the HDB)

| Description | Amount |

| Maximum loan (based on a fixed monthly income of $15K and assumed ages of 45) | $1,361,430 (20 year tenure) |

| Monthly repayment at 4% interest | $8250 |

| CPF funds (refund after selling the flat) | $333,000 |

| Cash (proceeds from the sale of the flat) | $123,000 |

| Total loan + CPF + cash | $1,817,430 |

| BSD based on $1,817,430 | $57,297 |

| Estimated affordability | $1,760,133 |

Affordability (if you sell the condo)

| Description | Amount |

| Maximum loan (based on a fixed monthly income of $15K and assumed ages of 45) | $1,361,430 (20 year tenure) |

| Monthly repayment at 4% interest | $8250 |

| CPF funds (refund after selling the condo) | $192,000 |

| Cash (proceeds from the sale of the flat) | $132,000 |

| Total loan + CPF + cash | $1,685,430 |

| BSD based on $1,685,430 | $52,017 |

| Estimated affordability | $1,633,413 |

While your maximum loan is $1,361,430, in this situation, because your cash and CPF funds add up to a total of $324,000, which makes up the 25% downpayment, the remaining 75% loan you are eligible for will be $972,000.

| Description | Amount |

| Maximum loan (based on $324K downpayment) | $972,000 (20-year tenure) |

| Monthly repayment at 4% interest | $5890 |

| CPF funds (refund after selling the condo) | $192,000 |

| Cash (proceeds from the sale of the flat) | $132,000 |

| Total loan + CPF + cash | $1,296,000 |

| BSD based on $1,296,000 | $36,440 |

| Estimated affordability | $1,259,560 |

Affordability (if you sell both HDB & condo)

| Description | Amount |

| Maximum loan (based on a fixed monthly income of $15K and assumed ages of 45) | $1,361,430 (20 year tenure) |

| Monthly repayment at 4% interest | $8250 |

| CPF funds (refund after selling the flat and condo) | $525,000 |

| Cash (proceeds from the sale of the flat and condo) | $255,000 |

| Total loan + CPF + cash | $2,141,430 |

| BSD based on $2,141,430 | $70,257 |

| Estimated affordability | $2,071,173 |

Now that we have a better understanding of your affordability, let’s run through the options you’re considering!

Option 1: Sell both HDB & condo and upgrade to a new or resale 4 bedder private property in the West

We presume you have your reasons to stay in the West such as being close to your parents or workplace, or perhaps you’re just comfortable with this location. With a budget of $2.07M, these are some newer 4-bedroom units in the West that are available on the market:

| Project | District | Tenure | Completion Year | Size (sqft) | PSF | Asking Price |

| Parc Riviera | 5 | 99 years | 2020 | 1160 | $1466 | $1,700,000 |

| Westwood Residences | 22 | 99 years | 2018 | 1238 | $1212 | $1,500,000 |

| Waterfront @ Faber | 5 | 99 years | 2018 | 1292 | $1548 | $2,000,000 |

| Lake Life | 22 | 99 years | 2017 | 1453 | $1193 | $1,733,800 |

| J Gateway | 22 | 99 years | 2017 | 1206 | $1658 | $2,000,008 |

At the moment there are no 4-bedroom new launches in the West under $2.07M, unless you want to consider an EC, in which you would have to wait 30 months before you are eligible. Also, the loan amount will be different.

If you were to purchase an EC:

| Description | Amount |

| Maximum loan (based on a fixed monthly income of $15K and assumed ages of 45) | $742,598 (20-year tenure) |

| Monthly repayment at 4% interest | $4500 |

| CPF funds (refund after selling the flat and condo) | $525,000 |

| Cash (proceeds from the sale of the flat and condo) | $255,000 |

| Total loan + CPF + cash | $1,522,598 |

| BSD based on $1,522,598 | $46,704 |

| Estimated affordability | $1,475,894 |

Currently, there is only Copen Grand EC in the West but the most affordable 4-bedroom unit is $1,657,000 which is unfortunately over your budget.

Seeing that you plan to purchase a 4 bedder, we’re guessing you’re looking to stay for some time at least until your kids move out, so let’s do a 10-year projection. Let’s say you were to purchase the Parc Riviera unit at $1.7M.

| Description | Amount |

| Assuming | $2,099,500 |

| Current valuation | $1,700,000 |

| Interest costs (based on $920,000 loan with 20 year tenure at 4% interest) | $299,648 |

| Property tax (assuming $44,100 annual value – $5175 avg monthly rental minus $1500 for furniture and maintenance fees) | $14,440 |

| MCST fees (assuming $400/month) | $48,000 |

| Estimated gains | $37,412 |

If you were to stay put in the HDB and continue renting out the condo for the next 10 years, your estimated gains will be $374,201 (From the 10-year projection $87,761 + $286,440) $242,467 ($54,385 + $188,082). You will make $84,209 $205,055 less if you were to sell both properties and buy a 4 bedroom. We need to caveat that these projections are on paper estimates and purely meant as a guide. Market conditions play a huge role in affecting these numbers.

Selling both properties to buy a 4 bedder would mean you’d lose your stream of passive income, at least for the duration of your stay in this property. Should you still wish to own 2 properties in your retirement years, you will have to restructure down the road. 10 years later, you guys will be in your mid-50s and your loan tenure will be shorter. This may affect the options you have and also the amount of cash/CPF you’ll need to pay upfront.

Option 2: Sell the condo unit, and wait for 30 months before applying for an EC

If you’re holding on to the HDB unit, you will not be able to apply for an EC. You will have to sell both the HDB and condo, and wait 30 months before you will be eligible for a brand-new EC. However all the brand-new ECs at this point in time are asking above $1.47M, so this may not be a viable option.

Also, renting for 30 months can be rather costly. Given there are 5 of you, you would minimally need 3 bedrooms. A quick search on PropertyGuru and you’ll find that the most affordable 4-room HDB is currently asking $2800/month. Say you were to rent this for 30 months, that would be $84,000 which is almost a third of your cash proceeds from selling both the HDB and condo.

Option 3: Keep the condo unit for rental income and continue to stay at the HDB unit

We have done the projections for these earlier, if you were to stick with your current property portfolio for the next 10 years, the estimated return is $374,201.

One concern we do have with this option is the lease decay of the HDB. The unit is now at least 24 years or older, 10 years down the road it will be 34 or older. We have seen from the graph above that prices of these flats in District 23 that were built before 1998 were declining and only picked up likely due to the lack of supply when the pandemic hit. When the market returns to normal, prices may start declining again. Also, given the shorter remaining lease, the potential buyer pool may be reduced as younger buyers will not be able to fully utilise their CPF funds and their loan and housing grants will also be pro-rated.

Alternative option

Sell HDB, decouple investment property, purchase a condo for own stay

It is a bit of a pickle because currently, you are the only breadwinner, and 99% share of the investment property is in your wife’s name. Given that she is not working at the moment, unless she has sufficient CPF funds or cash to buy over your 1% share, it will be hard to decouple. But let’s do the calculations to see how much she will need in order to buy over your share.

Assuming a valuation of $662,000 with an outstanding loan of $338,000. We will also assume that the $192,000 of CPF funds used is split equally.

| Description | Seller (Husband) | Buyer (Wife) |

| Shares | 1% | 99% |

| CPF usage | $96,000 | $96,000 |

| BSD | – | $66 |

| Legal fees | $3000 | $3000 |

| Valuation | $6620 | $655,380 |

| Outstanding loan | $3380 | $334,620 |

| Option & exercise fees (5%) | $331 (received) | $331 (paid) |

| 20% downpayment | – | $1324 |

| CPF refund | $96,000 | – |

| New loan | – | $339,585 |

| Cash proceeds | -$92,760 | – |

| Total cash and CPF needed if not taking a loan | $344,240 |

Your wife will have to pay $344,240 in cash or CPF in order to buy over your share without taking a loan and notice you’ll be making a negative sale in this situation. This is in the event your CPF funds are split equally.

After selling the HDB, you’ll get a CPF refund of $333,000 and cash proceeds of $123,000. If we were to split these equally amongst the two of you, you will each get $228,000. Your wife will have to top up $116,240 in order to buy over your share. However, making a negative sale through decoupling may not be the smartest move.

The rationale behind this option was to free up your name so you guys can purchase another property without having to pay ABSD. Due to the lease decay of the HDB, it will be wise to switch to a property with better value retention.

Unfortunately, it is also not feasible to sell both properties and purchase 2 units, one under each name, as your wife is not drawing an income and there is insufficient cash and CPF funds to buy 2 properties while taking only one loan.

Conclusion

Let’s do a quick recap of what we have gone through!

Option 1 is workable but you will be losing your stream of passive income and your supposed retirement plan. If you plan to restructure further down the road your loan amount will be lower which might limit your options.

Option 2 is not possible unless you sell both your HDB and condo. However, it might be costly to rent during the 30 month wait-out period. Also, there is no brand-new 4-bedroom EC that is within your budget at this point in time so you may have to look for resale options or a smaller unit type if you want a brand-new development.

The alternative option of decoupling is not the best either given the large amount of cash/CPF that is required to do so and you’ll be making a negative sale.

After looking through the few options, option 3 which is to stay put in the HDB and continue renting out the condo seems like the most ideal of the lot. Given you have a place for your own stay and another that is generating passive income.

As you are currently the sole breadwinner and there are limited cash and CPF funds, it’s pretty restrictive what you can do so staying put for now might be the best option.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

1 Comments

180k only? And 3 kids? Better practise frugality and exercise caution mate.