We Own A 3-Bedder At Treasure At Tampines: Should We Sell To Buy 2 Properties Or A Bigger Unit?

September 6, 2024

Hi,

We are a married couple earning 100k each.

We own a business earning 100k annually.

Husband and wife around mid-thirties.

We just bought a 3B3B condo at Treasure at Tampines with 99-1 in in 2024. Wife 99.

Investment about SGD 500k and looking to cash out and buy property.

No CPF

Questions:

- Should we decouple and buy 1 bedder from Treasure at Tampines this year?

- Should we buy a 2B2B from other project or Treasure at Tampines?

- Should we wait 3 years later then buy 2 properties?

- Should we save a bit more till next year to buy bigger property (3Bedder)?

- How’s Costa Del Sol and Mandarin Garden as investment or own stay?

Looking forward to hearing from you.

Regards,

Hi there!

Thanks for writing in with your query.

As usual, let’s start by looking at your affordability before delving into the various options.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

As you’re looking to either decouple and purchase a second property or sell the current property and purchase 2 properties, we will look at your individual affordability in both scenarios.

We will have to make the following assumptions for the calculations as we don’t have the full picture:

- 75% loan with a 30-year tenure at 4% interest was taken up for the purchase of Treasure at Tampines

- 25% down payment for Treasure at Tampines was paid equally by both of you

- No CPF used

Decoupling Treasure at Tampines

Looking at the transactions done in February this year, the average price for a 3-bedder above 1,000 sqft is $1,743,333. We will assume this to be the purchase price and that the current valuation remains unchanged. Do note that the SSD will be payable since it has not been 3 years since the purchase.

| Description | Seller (Husband) | Buyer (Wife) |

| Shares | 1% | 99% |

| Valuation | $17,433 | $1,725,900 |

| Outstanding loan | $13,075 | $1,294,376 |

| Legal fees | $3,000 | $3,000 |

| BSD | – | $174 |

| SSD | $2,091 | |

| 5% option fee | $872 (Received) | $872 (Paid) |

| 20% completion fee | $3,487 (Received) | $3,487 (Paid) |

| Sales proceeds | -$733 | – |

| New loan | – | $1,307,450* |

*Wife’s maximum loan eligibility based on annual income of $100K at age 32, with a 4.8% interest: $873,643

Based on this calculation, decoupling will only be feasible if you put in the $500k you’re planning to cash out from investments.

But just for calculation purposes, let’s presume that your wife’s maximum loan amount will be able to cover the loan required for decoupling, without having to utilise the $500K.

Husband’s affordability after decoupling

| Maximum loan based on a fixed annual income of $100K at age 35, with a 4.8% interest | $873,643 (30-year tenure) |

| Cash | $500,000 |

| Total loan + cash | $1,373,643 |

| BSD based on $1,373,643 | $39,545 |

| Estimated affordability | $1,334,098 |

Selling Treasure at Tampines and purchasing 2 properties

We will do a simple forecast presuming that Treasure at Tampines grows at the average growth rate of private properties over the last 10 years of 2.9%, so in 3 years, it will be $1,899,444.

| Selling price | $1,899,444 |

| Outstanding loan | $1,235,524 |

| Sales proceeds | $663,920 |

Husband’s affordability in 3 years

| Maximum loan based on a fixed annual income of $100K at age 38, with a 4.8% interest | $831,461 (27-year tenure) |

| Cash (Assuming an even split on the sales proceeds and $500K cash) | $581,960 |

| Total loan + cash | $1,413,421 |

| BSD based on $1,413,421 | $41,136 |

| Estimated affordability | $1,372,285 |

Wife’s affordability in 3 years

| Maximum loan based on a fixed annual income of $100K at age 35, with a 4.8% interest | $873,538 (30-year tenure) |

| Cash (Assuming an even split on the sales proceeds and $500K cash) | $581,960 |

| Total loan + cash | $1,455,498 |

| BSD based on $1,455,498 | $42,819 |

| Estimated affordability | $1,412,679 |

As you have a considerable amount of cash, you can easily adjust your individual affordability by moving the cash around.

Given that you mentioned potentially buying another unit at Treasure at Tampines in two of your five options, let’s assess how the project has performed so far. Since the development just obtained its TOP this year, there isn’t extensive resale data available. Therefore, we’ll review its performance from the launch date to the present.

Performance of Treasure at Tampines

| Year | Avg PSF | YoY |

| 2019 | $1,339 | – |

| 2020 | $1,369 | 2.24% |

| 2021 | $1,411 | 3.07% |

| 2022 | $1,540 | 9.14% |

| 2023 | $1,646 | 6.88% |

| 2024 | $1,694 | 2.92% |

| Average | – | 4.85% |

Since its launch, the average price PSF at Treasure at Tampines has increased by 26.5%, averaging a yearly growth rate of 4.85%, which is impressive. Typically, new launches benefit from a developer’s pricing strategy, where the PSF gradually rises as the project nears its TOP. Given that this is a mega project with over 2,000 units, and that the developer needed to complete and sell all units within five years from the acquisition date to qualify for the ABSD remission, we can see that the growth rate in the first two years wasn’t as high. However, as the project neared TOP and the majority of units were sold, the developer was more confident and increased prices more substantially while still meeting the ABSD deadline. It also helped that the overall property market picked up.

| Year | D18 99y non-landed | YoY | All 99y non-landed | YoY |

| 2019 | $935 | – | $1,178 | – |

| 2020 | $933 | -0.21% | $1,173 | -0.42% |

| 2021 | $994 | 6.54% | $1,207 | 2.90% |

| 2022 | $1,141 | 14.79% | $1,337 | 10.77% |

| 2023 | $1,250 | 9.55% | $1,463 | 9.42% |

| 2024 | $1,387 | 10.96% | $1,564 | 6.90% |

| Average | – | 8.33% | – | 5.91% |

When comparing the growth rate of Treasure at Tampines to that of resale 99-year leasehold developments in District 18 and across the island during the same period, it appears to be lagging behind. However, the data suggests that much of the growth in those resale developments was likely driven by the supply shortages during the pandemic.

So since these were all resale transactions, this isn’t an entirely fair comparison. Prior to Treasure at Tampines obtaining its TOP earlier this year, its prices were more influenced by the developer’s pricing strategy than by market conditions.

Now let’s take a look at the options you’re considering.

Potential pathways

Decouple and buy a 1-bedder in Treasure at Tampines

These are some of the recent 1-bedroom transactions:

| Date | Size (sq ft) | PSF | Transacted price | Address |

| Jul 2024 | 463 | $1,750 | $810,000 | 49 Tampines Lane #10 |

| Jul 2024 | 484 | $1,631 | $790,000 | 53 Tampines Lane #07 |

| Jul 2024 | 484 | $1,641 | $795,000 | 49 Tampines Lane #07 |

| Jul 2024 | 463 | $1,685 | $780,000 | 27 Tampines Lane #05 |

| Jul 2024 | 463 | $1,804 | $835,000 | 41 Tampines Lane #12 |

If we take the average price of a 1-bedroom unit at Treasure at Tampines over the past three months and compare it to the average rent during the same period, the rental yield stands at a decent 3.95% which puts it slightly above average yields today.

1-bedroom units typically attract investors more than homeowners due to their compact size and lower entry price. Tampines is a mature estate with a handful of reputable primary schools, making it appealing to families seeking larger spaces It also has the advantage of being close to the Industrial Park and Changi General Hospital – both potential sources of tenants.

While Treasure at Tampines is about a 15-minute walk to Simei MRT station—slightly further compared to projects directly adjacent to the station—this could work in its favour. The slightly lower rent might attract more tenants, especially since it’s the newest project in the area. Moreover, among the projects near the MRT, only My Manhattan and Double Bay Residences offer 1-bedroom units, so competition in this area is not as intense.

Additionally, most condominiums in Tampines are located along Tampines Avenue 10, which is not within walking distance of an MRT station.

Now let’s take a look at the potential costs and gains. We will assume a 10-year holding period for calculation purposes.

Costs of holding your existing unit

| Decoupling cost (Legal fee + BSD + SDD) | $5,268 |

| Interest expense assuming loan of $873,643 with a 30-year tenure at 4% interest | $315,156 |

| Property tax | $27,870 |

| Maintenance fee (Assuming $250/month) | $30,000 |

| Total cost | $378,294 |

Purchasing and renting out the 1-bedder

We will use the average price and rent for a 1-bedroom unit in Treasure at Tampines over the last 3 months for this calculation.

| Purchase price | $803,000 |

| BSD | $18,690 |

| Funds available | $500,000 |

| Loan required | $321,690 |

| BSD | $18,690 |

| Interest expense (Assuming 30-year tenure at 4% interest) | $116,046 |

| Property tax | $39,360 |

| Maintenance fee (Assuming $170/month) | $20,400 |

| Renovation | $20,000 |

| Rental income (Assuming $2,640/month) | $316,800 |

| Agency fee (Payable once every 2 years) | $14,390 |

| Total gains | $87,914 |

Total cost if you were to take this pathway: $378,294 – $87,914 = $290,380

Decouple and buy a 2-bedroom unit

It’s challenging to provide specific advice on this pathway without knowing the other developments you’re considering, as each project performs differently. With a budget of $1.3M, you have a range of options to explore.

| Year | D18 99y non-landed | All 99y non-landed |

| 2013 | $878 | $1,057 |

| 2014 | $873 | $1,029 |

| 2015 | $837 | $1,033 |

| 2016 | $829 | $1,129 |

| 2017 | $845 | $1,115 |

| 2018 | $914 | $1,153 |

| 2019 | $935 | $1,178 |

| 2020 | $933 | $1,173 |

| 2021 | $994 | $1,207 |

| 2022 | $1,141 | $1,337 |

| 2023 | $1,250 | $1,463 |

| 2024 | $1,387 | $1,564 |

| ROI (13-24) | 4.2% | 3.6% |

Looking again at the overall performance of 99-year leasehold projects in District 18, they have outpaced other 99-year leasehold developments across the island over the past 10 years. We’ve already reviewed the growth rate of Treasure at Tampines, so now let’s compare its pricing with resale projects and new launches in the area.

For the resale projects, we’ll focus on developments that are within walking distance of Simei MRT station and offer 2-bedroom units.

| Project | Tenure | Completion year | Avg psf of a 2-bedder (last 3 months) | Avg price of a 2-bedder (last 3 months) | Avg rent of a 2-bedder(last 3 months) | Avg rental yield |

| Eastpoint Green | 99-years | 1999 | $1,153 | $1,104,629 | $3,541 | 3.85% |

| Modena | 99-years | 2001 | $1,306 | $1,265,000* | $3,467 | 3.29% |

| Tropical Spring | 99-years | 2002 | $1,041 | $1,120,000** | $3,950*** | 4.23% |

| Double Bay Residences | 99-years | 2012 | $1,380 | $1,332,200 | $4,042 | 3.64% |

| My Manhattan | 99-years | 2014 | $1,514 | $1,319,888 | $3,995 | 3.63% |

| Treasure at Tampines | 99-years | 2023 | $1,681 | $1,094,251 | $3,264 | 3.58% |

*There was only one 2-bedder sold this year in March.

**There were no 2-bedders sold this year. This was the last 2-bedder sold in July 2023.

***There was only one 2-bedder rented out in the last 3 months.

The table shows that the average rental yields across the various developments are quite similar, except for Tropical Spring, though its figures might be skewed due to only having one sale and one rental transaction. Notably, while Treasure at Tampines has the highest price psf, it has the lowest overall quantum, indicating that units in other developments are likely larger. Being the newest and having the lowest overall quantum, Treasure at Tampines may be attractive for buyers, especially those with budget constraints.

Comparing this with the latest new launch in Tampines, Tenet (an EC), which has an average price psf of $1,473, it is only 15% lower than the $1,694 average price psf of Treasure at Tampines. This is not a wide gap if you consider that these are prices of a new EC compared to a private condo.

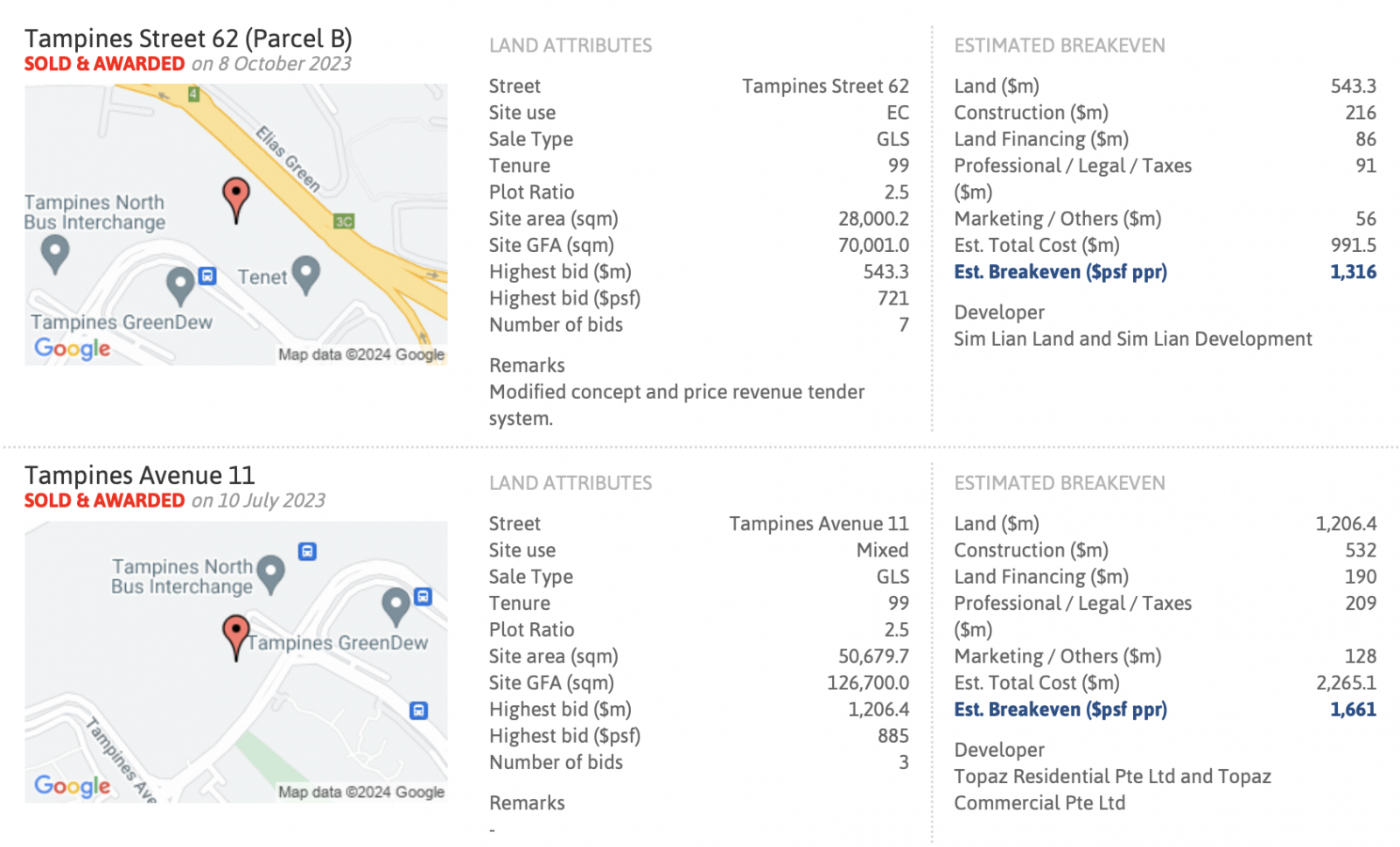

Additionally, the most recent land sales in Tampines show that the breakeven price for the plot on Tampines Avenue 11 is nearly equivalent to the average price psf of Treasure at Tampines. Assuming a 15% profit margin for developers, this would imply a launch price of approximately $1,910 psf. For the EC plot, with the same profit margin, the projected launch price would be around $1,513 psf.

With these factors in mind, it is reasonable to anticipate some potential for growth in Treasure at Tampines in the future.

Since we do not know what other developments you’re considering, let’s presume that you purchase a unit at Treasure at Tampines for $1,094,251 and rent it out at $3,264.

Purchasing and renting out the 2-bedder

| Purchase price | $1,094,251 |

| BSD | $28,370 |

| Funds available | $500,000 |

| Loan required | $622,621 |

| BSD | $28,370 |

| Interest expense (Assuming 30-year tenure at 4% interest) | $224,603 |

| Property tax | $54,340 |

| Maintenance fee (Assuming $200/month) | $24,000 |

| Renovation | $20,000 |

| Rental income (Assuming $3,264/month) | $391,680 |

| Agency fee (Payable once every 2 years) | $17,790 |

| Total gains | $22,577 |

Total cost if you were to take this pathway: $378,294 – $22,577 = $355,717

Wait 3 years to sell and purchase 2 properties

Given the performance and growth potential of Treasure at Tampines, holding onto it for another three years shouldn’t raise any concerns and the impact on your affordability is relatively minor.

According to the URA’s Q2 2024 report, “Price and rental momentum in the private residential market moderated further in the second quarter of 2024. Overall private housing prices increased at a slower pace of 0.9% in Q2 2024, compared to 1.4% in the previous quarter. The quarterly average price increase of 1.2% in the first half of 2024 was lower than the 1.7% average in 2023 and 2.1% in 2022. Private housing rentals fell for the third consecutive quarter by 0.8% in Q2 2024, following a 1.9% decline in the previous quarter.” The report also noted that mortgage rates are expected to remain high.

There are both advantages and disadvantages to waiting. On one hand, you could save on interest expenses, which could be substantial given the current rates. On the other hand, property prices might continue to rise, potentially leading to higher costs for the same property in the future. To illustrate, let’s look at a hypothetical scenario:

For a $1M property with a 75% loan at 4% interest and a 30-year tenure, the interest expense over three years would be $87,643. Assuming the average annual growth rate of 2.9% for private properties over the last 10 years, the property would cost $1,089,547 in three years. If you take a 75% loan at 3.5% interest and a 27-year tenure, the interest expense over three years would be $82,917, resulting in a savings of just $4,726.

Given that interest rates are unlikely to drop significantly unless there’s an economic downturn, the potential savings may be minimal, especially if a larger loan is needed. However, if you anticipate a rise in income that could offer more options in the future, waiting might be worthwhile.

For calculation purposes, let’s presume that both you and your husband each purchase a unit at $1.3M and rent one of it out at a 3% rental yield.

| Purchase price | $1,300,000 |

| BSD | $36,600 |

| Funds available | $581,960 |

| Loan required | $754,640 |

Husband’s unit – own stay

| BSD | $36,600 |

| Interest expense (Assuming 27-year tenure at 3.5% interest) | $231,258 |

| Property tax | $22,800 |

| Maintenance fee (Assuming $280/month) | $33,600 |

| Renovation | $20,000 |

| Total cost | $344,258 |

Wife’s unit – investment

| BSD | $36,600 |

| Interest expense (Assuming 30-year tenure at 3.5% interest) | $239,489 |

| Property tax | $74,400 |

| Maintenance fee (Assuming $280/month) | $33,600 |

| Renovation | $20,000 |

| Rental income | $480,000 |

| Agency fee (Payable once every 2 years) | $21,800 |

| Total gains | $54,111 |

Total cost if you were to take this pathway: $344,258 – $54,111 = $290,147

Decouple and save more to purchase a bigger property next year

There isn’t a single “best” unit size; however, larger properties like a 3-bedroom unit might attract a broader range of buyers compared to smaller properties like a 1-bedroom unit.

| Year | <650 sqft | 680 – 850 sqft | 900 – 1,150 sqft |

| 2013 | $1,742 | $1,466 | $1,181 |

| 2014 | $1,660 | $1,418 | $1,151 |

| 2015 | $1,603 | $1,320 | $1,147 |

| 2016 | $1,739 | $1,316 | $1,180 |

| 2017 | $1,688 | $1,410 | $1,213 |

| 2018 | $1,571 | $1,397 | $1,236 |

| 2019 | $1,618 | $1,408 | $1,239 |

| 2020 | $1,461 | $1,452 | $1,203 |

| 2021 | $1,525 | $1,413 | $1,244 |

| 2022 | $1,617 | $1,495 | $1,351 |

| 2023 | $1,731 | $1,653 | $1,457 |

| ROI | -0.06% | 1.21% | 2.12% |

Over the past decade, larger unit types have generally performed better than those smaller than 650 sq ft. Additionally, during the market downturn after 2013, larger units tended to retain their value better.

Assuming that you save 30% of your combined income as well as the revenue from your business, that will amount to an additional $90,000 which can be put towards the purchase. This will bring your husband’s affordability up to $1.4M.

Since you haven’t specified the development you’re considering, let’s use a 3-bedroom unit at Treasure at Tampines as an example. Recent transactions show that smaller 3-bedroom units (under 1,000 sq ft) average around $1.53M. Given your husband’s affordability of $1.4M after decoupling, you would need an additional $130K to purchase a unit in this range. However, with a budget of $1.4M, there are still many other projects you could consider.

For our calculation, we’ll assume you have the additional funds needed and will use the maximum loan amount available. We’ll also assume that you rent out the unit at the average monthly rent for a 3-bedroom unit under 1,000 sq ft, which is at $4,196 over the last 3 months.

| Purchase price | $1,530,000 |

| BSD | $46,100 |

| Maximum loan based on age 36 with an annual income of $100K, at a 4.8% interest | $860,178 |

| Funds required | $715,922 |

| BSD | $46,100 |

| Interest expense (Assuming 30-year tenure at 4% interest) | $308,293 |

| Property tax | $80,990 |

| Maintenance fee (Assuming $300/month) | $36,000 |

| Renovation | $20,000 |

| Rental income | $503,520 |

| Agency fee (Payable once every 2 years) | $22,870 |

| Total cost | $10,733 |

Total cost if you were to take this pathway: $378,294 + $10,733 = $389,027

Performance of Costa Del Sol and Mandarin Gardens

Both projects are 99-year leasehold developments, with Costa Del Sol completed in 2004 and Mandarin Gardens in 1986. Costa Del Sol features 906 units, while Mandarin Gardens is larger with 1,006 units. Mandarin Gardens is situated on a much larger land plot of approximately 100,235 sqm, compared to Costa Del Sol’s 39,535 sqm.

Although the two developments are only a 4-minute drive apart, they are located in different districts. Let’s compare their performance within their respective districts.

| Year | Costa Del Sol | D16 99y non-landed | All 99y non-landed |

| 2013 | $1,285 | $1,040 | $1,057 |

| 2014 | $1,329 | $1,009 | $1,029 |

| 2015 | $1,215 | $991 | $1,033 |

| 2016 | $1,187 | $949 | $1,129 |

| 2017 | $1,188 | $958 | $1,115 |

| 2018 | $1,285 | $1,090 | $1,153 |

| 2019 | $1,280 | $1,089 | $1,178 |

| 2020 | $1,267 | $1,076 | $1,173 |

| 2021 | $1,402 | $1,163 | $1,207 |

| 2022 | $1,598 | $1,305 | $1,337 |

| 2023 | $1,681 | $1,404 | $1,463 |

| ROI | 2.72% | 3.05% | 3.30% |

Costa Del Sol has a notable advantage as it is one of the few projects in District 16, alongside Bayshore Park, that offers proximity to East Coast Park and unobstructed sea views. It is also considerably newer than Bayshore Park, which was completed in 1986. However, over the past 10 years, Costa Del Sol has slightly underperformed compared to other projects in District 16 and across the island.

The development primarily consists of 3 and 4-bedroom units, with only 31 2-bedroom units. The predominance of larger units suggests a higher proportion of homeowners relative to investors. This is beneficial as homeowners tend to be more attached to their properties and are less likely to sell at a loss compared to investors, who may be more willing to sell at a loss if a better opportunity arises. Investors, having earned rental income, might be more inclined to let go of a property at a lower price, potentially impacting the prices of other units within the development.

| Unit type | Average price (last 3 months) | Average rent (last 3 months) | Average rental yield |

| 2-bedroom | $1,580,000* | $4,300 | 3.27% |

| 3-bedroom | $2,342,000 | $5,776 | 2.96% |

*There was only one 2-bedroom transacted in the last 3 months

| Year | Mandarin Gardens | D15 99y non-landed | All 99y non-landed |

| 2013 | $1,056 | $1,107 | $1,057 |

| 2014 | $1,020 | $1,100 | $1,029 |

| 2015 | $949 | $1,110 | $1,033 |

| 2016 | $880 | $1,045 | $1,129 |

| 2017 | $899 | $1,056 | $1,115 |

| 2018 | $1,107 | $1,182 | $1,153 |

| 2019 | $1,027 | $1,164 | $1,178 |

| 2020 | $1,003 | $1,208 | $1,173 |

| 2021 | $1,129 | $1,285 | $1,207 |

| 2022 | $1,227 | $1,430 | $1,337 |

| 2023 | $1,311 | $1,517 | $1,463 |

| ROI | 2.19% | 3.20% | 3.30% |

District 15, located on the city fringe, is known for its affluence and generally commands higher property prices compared to District 16.

From the table, it is evident that Mandarin Gardens has shown a slower growth rate compared to other projects in District 15 and across the island. However, it does experience significant growth during market upswings. Despite several en bloc attempts, the large land plot and high reserve price have deterred buyers. Additionally, some owners are reluctant to support a collective sale due to the challenge of finding another similarly-sized unit in the same area at a comparable price.

| Unit type | Average price (last 3 months) | Average rent (last 3 months) | Average rental yield |

| 2-bedroom | $1,320,000* | $3,750 | 3.41% |

| 3-bedroom | $2,217,000 | $5,963 | 3.23% |

*There was only one 2-bedroom transacted in the last 3 months

Both developments offer excellent options as personal residences due to their spacious units and proximity to amenities. However, when considering their average growth rate over the past decade and rental yield, there may be more promising investment opportunities available.

What should you do?

Let’s do a quick summary of the 4 options you’re considering:

| Potential pathway | Costs incurred |

| Decouple and buy a 1-bedder in Treasure at Tampines | $290,380 |

| Decouple and buy a 2-bedder | $355,717 |

| Wait 3 years, then purchase 2 properties | $290,147 |

| Decouple and save more to purchase a bigger property next year | $389,027 + cash top up (depending on purchase price) |

Since you have a 99/1 ownership arrangement for your current property, the cost of decoupling is relatively low, making it an ideal option. However, this also means you should be content staying in your current place unless you plan to rent it out and move into the new property you’re purchasing.

When considering what type of unit to purchase for your second property, your choice will depend on your comfort level and preferences. There’s no clear winner based on the options proposed as it’s a matter of personal choice and how you wish to allocate your resources.

Here are some factors to consider:

- Larger units generally offer more price stability and a broader buyer pool compared to smaller ones. Between 1, 2, and 3-bedroom units, a 2-bedroom unit is often a good compromise as it appeals to both investors and homeowners. It also avoids the need for additional cash top-ups (for properties under $1.3M), resulting in a lower initial outlay. As such, you may prefer to decouple and buy a 2-bedder as compared to buying a 1-bedder due to the better price stability/growth of 2-bedders and flexibility when it comes to renting (either rooms or whole unit).

- How many properties do you wish to own? This is a matter of resource allocation. A bigger condo means more resources allocated for own stay reasons. If you want to purchase a larger home that’s more affordable and invest the remaining amount, you’ll likely be looking at an older leasehold development. These could show a lower growth rate due to their age as in the case of Mandarin Gardens.

There are many 2-bedroom projects within your budget, so further advice would depend on more specific details about your goals and preferences.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Latest Posts

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

0 Comments