We Make $400k Per Year And Own A Bidadari HDB: Should We Look At 2 Properties Instead Of 1 Freehold Landed?

November 22, 2024

Hi Stacked Homes!

Thank you for writing these interesting articles! It has been very helpful.

I’m writing to seek some advice on our next home purchase. My family of three (with another one on the horizon) is currently living in a 4 bedroom hdb in bidadari. Its been great, and we are aware that our area is generating alot of interest in the news. We have enjoyed our stay so far, great facilities for children, proximity to MRT stations and other great amenities. For legacy planning for our kids, my wife and I have been contemplating buying a freehold property for our next home, or buying two properties (one for investment potentially), where one could be freehold.

We are around 35 years old. Our family’s yearly household income is currently about $400k, and we do still have an outstanding loan of around $400k on the current hdb left, with the MOP ending in ~3 years. We do not have any major loans on hand.

We do have around $700k in cash and stocks, and have also around $500k in CPF. We have been looking out for new launch condos with 4 or more bedrooms (just for experience), but we considered the feasibility of landed properties as well, just that we are concerned with the high prices, as well as the uncertain maintenance costs.

Can we seek your quick thoughts and advice on this? And whether it makes sense to get two properties instead of 1 freehold?

Of course, any decision we make is on our own volition and Stackedhomes will not be liable for our choices.

We thought that there might be a large number of readers interested in the Bidadari estate because its been in the news recently, and many readers who share a similar earning portfolio as us, who might be exploring options in the future.

Alternatively, if there is another article that you have written that is similar, we would appreciate it if you could share that with us, as i wasn’t able to find a similar write up.

Thank you very much!

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hi there,

We’re glad our content has been helpful for you and thank you for taking the time to write in.

Bidadari is certainly an estate to watch, with its proximity to the city centre, walkable access to two MRT stations and malls, and its status as a new HDB town.

As property costs rise, it’s understandable that younger parents are factoring legacy planning into their purchases. Since you’re around 35, your next property may not be your last. As such, you might want to consider options beyond a freehold property.

To begin, let’s look at your affordability.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

Currently, only one cluster in Bidadari has reached its Minimum Occupation Period (MOP): Alkaff Vista. We’ll use recent 4-room flat transactions from this cluster as a reference.

| Resale Registration Date | Block | Storey | Floor Area (sqm) /Flat Model | Resale Price |

| Oct 2024 | 105A | 10 to 12 | 94.00 Model A | $1,080,000 |

| Oct 2024 | 106B | 07 to 09 | 94.00 Model A | $1,055,000 |

| Sep 2024 | 105A | 01 to 03 | 94.00 Model A | $937,500 |

| Sep 2024 | 106A | 13 to 15 | 94.00 Model A | $1,133,388 |

| Sep 2024 | 106B | 16 to 18 | 94.00 Model A | $1,170,000 |

| Aug 2024 | 106B | 10 to 12 | 94.00 Model A | $1,080,000 |

Let’s assume that you sell your flat at the average price of $1,075,981.

| Selling price | $1,075,981 |

| Outstanding loan* | $400,000 |

| Sales proceeds (CPF + cash) | $675,981 |

*Considering that your outstanding loan will be lower in 3 years, the sales proceeds should be higher

Combined affordability

| Maximum loan based on ages of 38 with a monthly combined income of $33,300 at a 4.8% interest | $3,322,651 (27-year tenure) |

| CPF + cash* | $1,525,981 |

| Total loan + CPF + cash | $4,848,632 |

| BSD based on $4,848,632 | $230,517 |

| Estimated affordability | $4,618,115 |

*Of the $700K cash and stocks that you have on hand, we are assuming that half of it is cash and have only included that in this calculation

Individual affordability

For calculation purposes, we are presuming that you are both the same age, your monthly incomes are the same and that the CPF and cash are split evenly.

| Maximum loan based on the age of 38 with a monthly income of $16,650 at a 4.8% interest | $1,661,325 (27-year tenure) |

| CPF + cash | $762,991 |

| Total loan + CPF + cash | $2,424,316 |

| BSD based on $2,424,316 | $90,815 |

| Estimated affordability | $2,333,501 |

Since you have a substantial amount of cash available, you have the flexibility to adjust your individual affordability by reallocating funds as needed.

Now, let’s examine how freehold properties have been performing compared to leasehold.

Freehold vs Leasehold

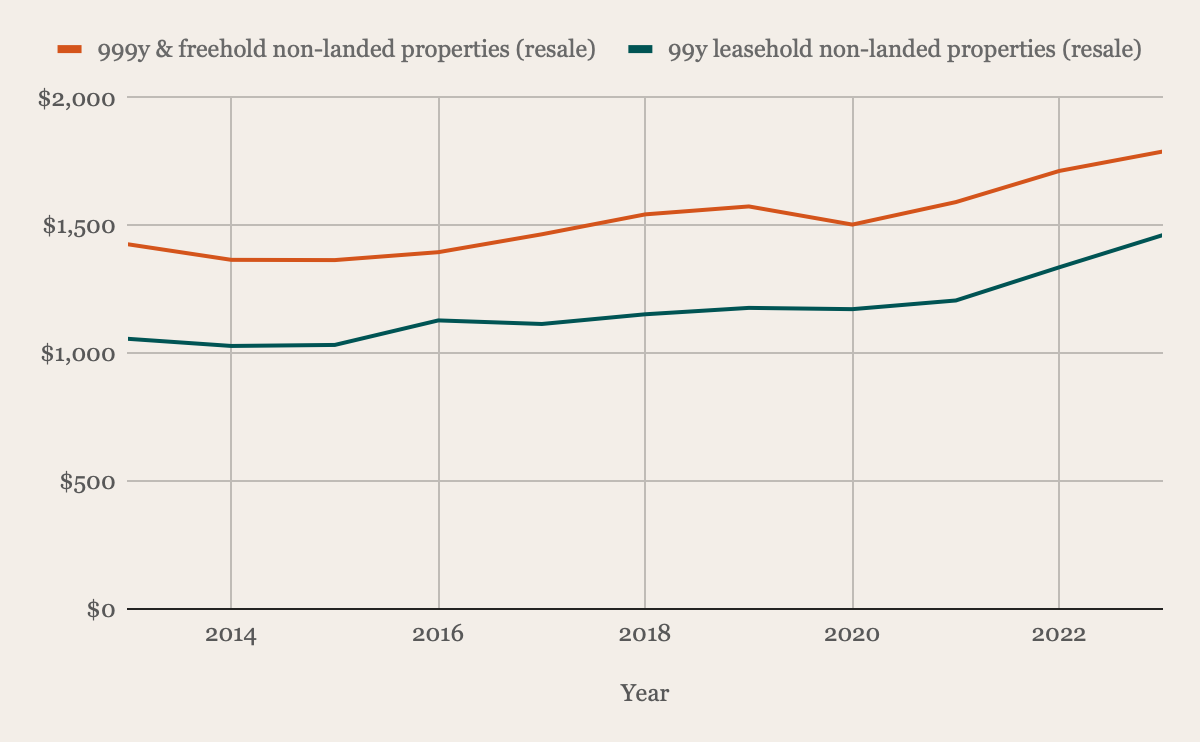

Non-landed properties

| Year | 999y & freehold non-landed properties (resale) | 99y leasehold non-landed properties (resale) |

| 2013 | $1,427 | $1,057 |

| 2014 | $1,366 | $1,029 |

| 2015 | $1,365 | $1,033 |

| 2016 | $1,396 | $1,129 |

| 2017 | $1,466 | $1,115 |

| 2018 | $1,544 | $1,153 |

| 2019 | $1,575 | $1,178 |

| 2020 | $1,504 | $1,173 |

| 2021 | $1,592 | $1,207 |

| 2022 | $1,714 | $1,337 |

| 2023 | $1,790 | $1,463 |

| Average | 2.37% | 3.40% |

Over the past decade, leasehold condominiums have outpaced freehold condominiums. With lower purchase prices, leasehold condos are accessible to a wider range of buyers, including HDB upgraders looking to transition into private property ownership. This affordability fuels higher demand for leasehold condos, which in turn supports its consistent price appreciation.

For investors, leasehold condos tend to deliver higher rental yields since they usually cost less than freehold condos, the rental income they generate translates to a better yield in comparison to their purchase value. This makes leasehold properties more attractive to those prioritising rental income as part of their investment strategy.

Furthermore, with the government no longer releasing freehold land for new residential projects, the majority of new launches are leasehold projects. These new developments are generally priced higher due to increasing land and construction costs, and when they enter the resale market, they tend to drive up the overall average price of leasehold properties.

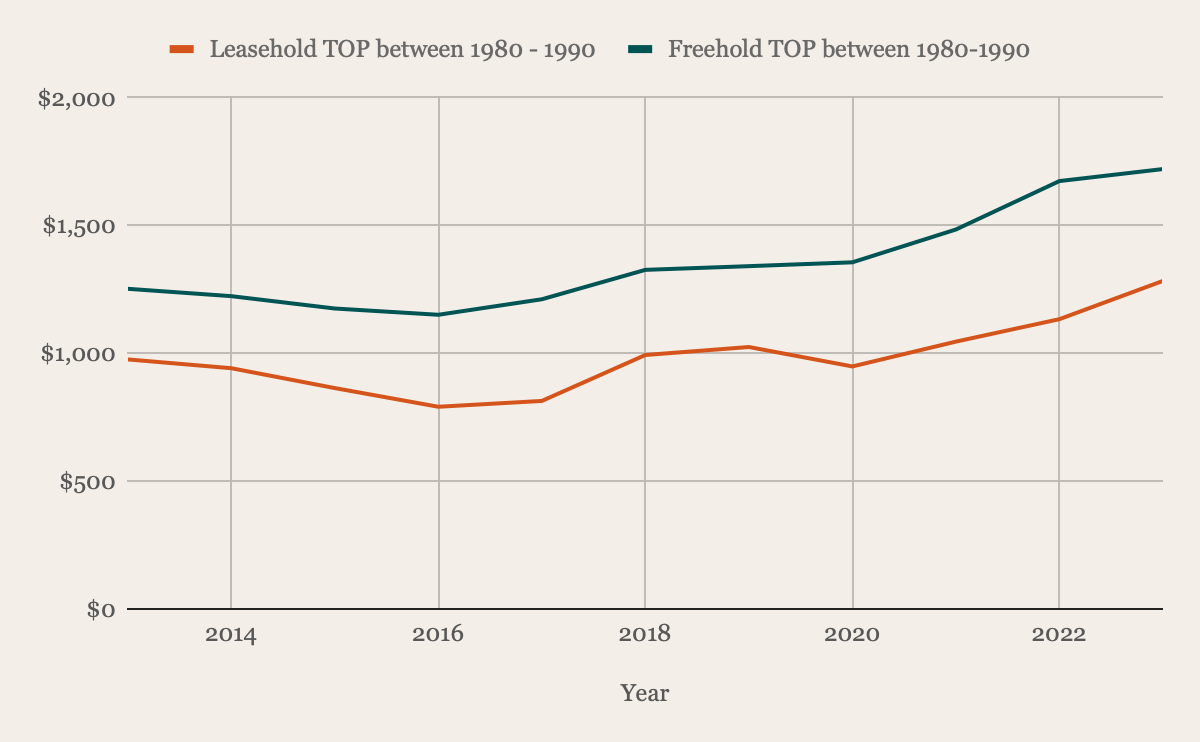

To go a little deeper, let’s take a look at how older freehold and leasehold condos have been performing.

| Year | Leasehold TOP between 1980 – 1990 | Freehold TOP between 1980-1990 |

| 2013 | $976 | $1,253 |

| 2014 | $942 | $1,224 |

| 2015 | $864 | $1,176 |

| 2016 | $791 | $1,151 |

| 2017 | $814 | $1,212 |

| 2018 | $994 | $1,327 |

| 2019 | $1,025 | $1,341 |

| 2020 | $949 | $1,356 |

| 2021 | $1,046 | $1,485 |

| 2022 | $1,134 | $1,674 |

| 2023 | $1,284 | $1,721 |

| Average | 3.23% | 3.37% |

While the average growth rates over the past decade for older freehold and leasehold condos are not drastically different, a closer look at the data reveals that older leasehold condos experienced a sharper decline during the market downturn, whereas older freehold condos saw a milder dip and a steadier recovery. Since freehold condos don’t face the issue of lease decay, they generally show stronger performance than leasehold condos in the long run.

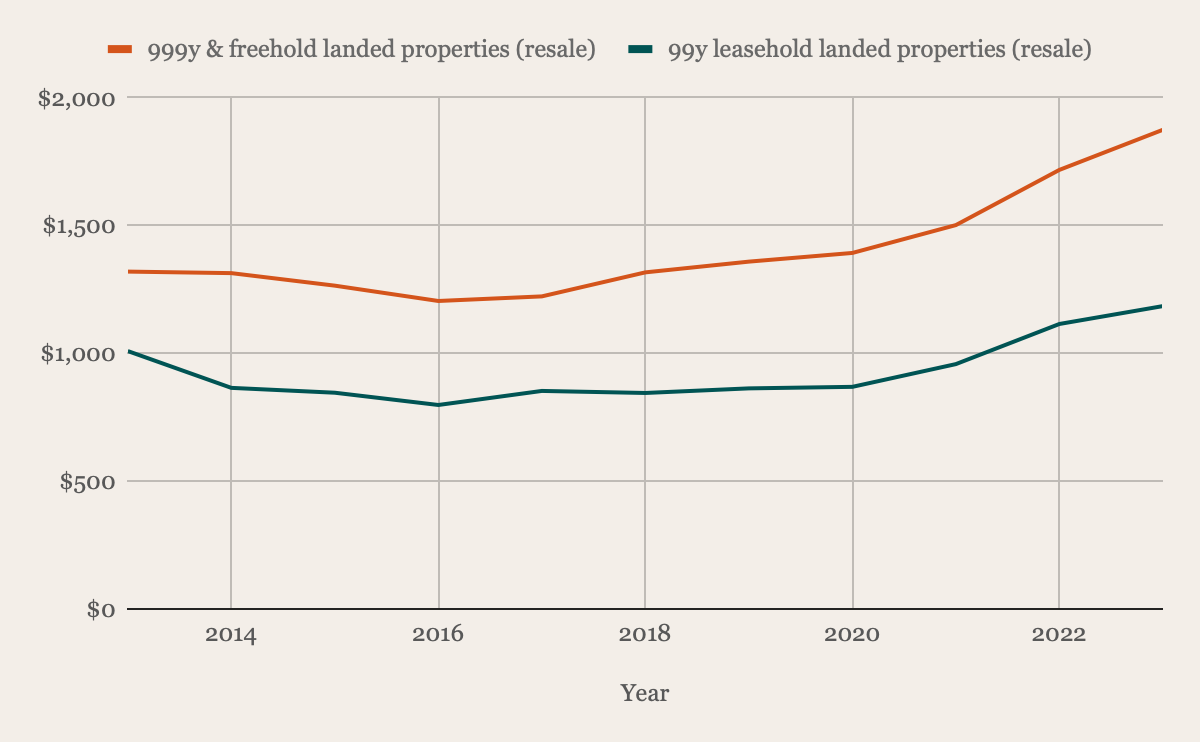

Landed properties

| Year | 999y & freehold landed properties (resale) | 99y leasehold landed properties (resale) |

| 2013 | $1,320 | $1,009 |

| 2014 | $1,314 | $865 |

| 2015 | $1,265 | $846 |

| 2016 | $1,205 | $798 |

| 2017 | $1,223 | $853 |

| 2018 | $1,317 | $845 |

| 2019 | $1,359 | $863 |

| 2020 | $1,393 | $869 |

| 2021 | $1,502 | $958 |

| 2022 | $1,718 | $1,115 |

| 2023 | $1,875 | $1,185 |

| Average | 3.73% | 1.95% |

The opposite is true for landed properties – freehold landed properties have been doing better than their leasehold counterparts. This trend largely reflects the perceived rarity and enduring value of freehold land. In a land-scarce environment, freehold landed homes are highly sought after as they offer permanent ownership, giving both homeowners and investors confidence that their property value will not diminish over time as with leasehold options.

Freehold landed properties are also seen as both a status symbol and a legacy asset that can be passed down through generations, making them a popular choice for wealth preservation. From an investment standpoint, freehold landed properties are typically considered more stable assets with better potential for long-term capital appreciation. Although leasehold condominiums may attract investors with their rental yields, the sustained demand and lasting appeal of freehold landed properties have led to their better performance.

With that in mind, let’s explore your options.

Potential pathways

Buy a freehold condo (resale)

If you’re considering purchasing a 4-bedroom unit, with a combined affordability of $4.6M, you have a wide range of options available. Depending on the location and specific project, you may not need to fully utilise your budget. For the sake of our calculations, let’s assume you buy one at $4M. We will evaluate this over a 10-year time frame.

| Purchase price | $4,000,000 |

| BSD | $179,600 |

| CPF + cash | $1,525,981 |

| Loan required | $2,653,619 |

Costs incurred

| BSD | $179,600 |

| Interest expense (Assuming a 27-year tenure at 4% interest) | $937,164 |

| Property tax | $183,800 |

| Maintenance fee (Assuming $450/month) | $54,000 |

| Renovation* | $80,000 |

| Total costs | $1,434,564 |

*Depends on the extent of work done

Buy a freehold condo (new launch)

Unless your available funds can cover the 25% down payment and BSD for a new launch, you will likely need to sell your current flat before making a purchase. If you don’t have alternative accommodation to move into temporarily, the rental costs could become quite substantial.

However, if you do have enough funds to buy the new launch (after your MOP) before selling your flat, be aware that Additional Buyer’s Stamp Duty (ABSD) will apply. Since the property is under both your names and considered a matrimonial asset (after selling your HDB), you can apply for a reimbursement. This approach can help you avoid rental costs, although the initial outlay will be significant.

For calculation purposes, let’s presume that you sell your flat, purchase a 4-bedroom new launch at $3.5M, and rent for 3.5 years while waiting for the project to be completed. We will use the average rent of a 4-room flat in Toa Payoh of $3,500 as the monthly rental cost. Similarly, we will look at a 10-year time frame.

| Purchase price | $3,500,000 |

| BSD | $149,600 |

| CPF + cash | $1,525,981 |

| Loan required | $2,123,619 |

Progressive payment plan

| Stage | % of purchase price | Disbursement amount | Monthly estimated interest | Monthly estimated principal | Monthly estimated repayment | Duration* | Total interest cost |

| Completion of foundation | 5% | $0 | $0 | $0 | $0 | 6-9 months (from launch) | $0 |

| Completion of reinforced concrete | 10% | $23,619 | $79 | $41 | $0 | 6-9 months | $369 |

| Completion of brick wall | 5% | $198,619 | $662 | $341 | $1,003 | 3-6 months | $3,972 |

| Completion of ceiling/roofing | 5% | $373,619 | $1,245 | $642 | $1,887 | 3-6 months | $7,470 |

| Completion of electrical wiring/plumbing | 5% | $548,619 | $1,829 | $943 | $2,772 | 3-6 months | $10,974 |

| Completion of roads/car parks/drainage | 5% | $723,619 | $2,412 | $1,244 | $3,656 | 3-6 months | $14,472 |

| Issuance of TOP | 25% | $1,598,619 | $5,329 | $2,748 | $8,077 | Usually a year before CSC | $31,974 |

| Certificate of Statutory Completion (CSC) | 15% | $2,123,619 | $7,079 | $3,650 | $10,729 | Monthly repayment until the property is sold | $467,214 |

*We are assuming the longest duration at each stage

Cost incurred

| BSD | $149,600 |

| Interest expense (Assuming a 27-year tenure at 4% interest) | $536,445 |

| Property tax | $88,270 |

| Maintenance fee (Assuming $450/month) | $35,100 |

| Renovation* | $50,000 |

| Rental expenses | $147,000 |

| Total costs | $1,006,415 |

*Depends on the extent of work done

Buy 2 condos

Since we don’t have the exact details of your CPF and cash amounts, we’ll be making some assumptions. Let’s say we were to allocate $1M in CPF and cash for the purchase of your own stay property, your affordability will go up to:

| Maximum loan based on the age of 38 with a monthly income of $16,650 at a 4.8% interest | $1,661,325 |

| CPF + cash | $1,000,000 |

| Total loan + CPF + cash | $2,661,325 |

| BSD based on $2,661,325 | $102,666 |

| Estimated affordability | $2,558,659 |

As for the investment property, given that the remaining CPF and cash of $525,981 have to cover the 25% down payment and BSD, the estimated affordability will be around $1.85M.

At $2.55M, the number of freehold 4-bedroom options may be limited.

Own stay property

| Purchase price | $2,550,000 |

| BSD | $97,100 |

| CPF + cash | $1,000,000 |

| Loan required | $1,647,100 |

Cost incurred

| BSD | $97,100 |

| Interest expense (Assuming a 27-year tenure at 4% interest) | $581,697 |

| Property tax | $63,800 |

| Maintenance fee (Assuming $450/month) | $54,000 |

| Renovation* | $80,000 |

| Total costs | $876,597 |

*Depends on the extent of work done

Investment property

Rather than stretching your budget to the maximum, let’s assume you buy a unit priced at $1.5M, which yields a rental return of 3%.

| Purchase price | $1,500,000 |

| BSD | $44,600 |

| CPF + cash | $525,981 |

| Loan required | $1,018,619 |

Cost incurred

| BSD | $44,600 |

| Interest expense (Assuming a 27-year tenure at 4% interest) | $359,740 |

| Property tax | $66,000 |

| Maintenance fee (Assuming $280/month) | $33,600 |

| Renovation* | $30,000 |

| Rental income | $450,000 |

| Agency fees (Assuming it’s paid once every 2 years) | $20,440 |

| Total costs | $104,380 |

*Depends on the extent of work done

Total cost if you were to take this pathway: $876,597 + $104,380 = $980,977

Buy a landed property

Based on recent transactions, with a budget of $4.6M, there are freehold landed properties available, primarily in the form of terraces. However, significant additions and alterations may not be feasible unless you’re willing to secure a loan for those improvements.

We will assume that you max out your budget in this scenario.

| BSD | $215,600 |

| Interest expense (Assuming a 27-year tenure at 4% interest) | $1,161,776 |

| Property tax | $241,400 |

| Maintenance fee (Assuming $5,000/year on average) | $50,000 |

| Renovation* | $250,000 |

| Total costs | $1,918,776 |

*Depends on the extent of work done

What should you do?

Let’s do a quick summary of the 4 options.

| Potential pathway | Number of property | Total property value | Cost incurred |

| Buy a freehold condo (resale) | 1 | $4,000,000 | $1,434,564 |

| Buy a freehold condo (new launch) | 1 | $3,500,000 | $1,006,415 |

| Buy 2 condos | 2 | $4,050,000 | $980,977 |

| Buy a landed property | 1 | $4,600,000 | $1,918,776 |

Among the four options, purchasing a landed property is perhaps the least favourable choice at this time. While you do have options available, they may still be a stretch unless you are willing to compromise on the location. Landed properties often come with the expectation of personalising the space to fit your family’s needs and lifestyle. However, if you utilise all your cash for the purchase, you may find it challenging to undertake significant renovations without securing a loan.

In contrast, considering the other three options, buying two condos can result in lower overall costs compared to purchasing a single property. Although the values of the condos may vary, the rental income from the investment property helps offset some of the expenses, making this pathway more cost-effective than the alternatives. In essence, you’ll be putting some of your capital to work which is why the overall cost is lower. However, this approach might limit your options for your own residence, particularly if you’re looking for a 4-bedroom freehold property.

That said, depending on your intended holding period, purchasing two leasehold condos could be a strategic choice. You could hold these properties for the short to medium term and eventually upgrade to a freehold property and leave that for your children. Given your age and financial situation, this pathway appears viable. Overall, this option would be less financially burdensome while allowing for diversification in your investments.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

1 Comments

Flex post. Not value adding to the majority singaporean