We Make $27k Per Month And Own An HDB And Condo: Should We Sell The HDB To Buy Another Resale?

Dear Stacked homes,

Thanks for all the valuable information you have provided. I would like to ask for your advice on our situation.

We are a mid-40 couple with 3 young children. We have a combined income of approx 27k per month, and we have been staying in a resale 5-room HDB near Lakeside MRT for the last 13 years. We also owned a 2BR unit in Botanique at Bartley which we bought in 2016.

We have been debating over the last few years, if we should sell our HDB and buy a new/resale 3-4BR condo near Lakeside MRT. However, there are not many new condos, until recently, yet the prices are sky high (Factoring future prices.) especially for a 4BR condo.

- Option 1: stay put in HDB, keep Botanique and continue to rent.

- Option 2: sell both, get a new condo

- Option 3 : Get a resale condo of lower cost, and keep Botanique.

We are keen on option 3, but we are also worried about the capital appreciation if we are thinking of exit plans in 6-10 years.

Which of the condos would hold best for capital appreciation – Caspian, Lakefront, Lakeshore, Lake Grande if we were to enter now?

Thanks,

Hi there,

Thanks for reaching out to us.

As the saying goes, “The best time to buy a property was yesterday.” Though often said in jest, it does hold some truth. With land and construction costs continually rising, it’s only natural to expect prices of new properties to follow suit. Additionally, the price gap between HDB flats and private properties continues to widen, making it increasingly challenging for homeowners to upgrade from public to private housing, so your dilemma is understandable here.

Before going into the pathways you’re considering, let’s start by looking at the performance of your existing properties.

Performance of existing properties

5-room HDB

As we do not know the specific block you’re currently staying in, here are some of the recent transactions for 5-room flats that are within walking distance of Lakeside MRT station.

| Date | Block | Level | Size (sqm) & unit type | Completion year | Price |

| Sep 2024 | 529 | 13 to 15 | 118.00 Improved | 1982 | $620,000 |

| Aug 2024 | 468 | 01 to 03 | 130.00 Improved | 1985 | $585,000 |

| Jun 2024 | 461 | 04 to 06 | 121.00 Improved | 1985 | $570,000 |

| May 2024 | 529 | 01 to 03 | 118.00 Improved | 1982 | $560,000 |

| May 2024 | 532 | 01 to 03 | 118.00 Improved | 1982 | $588,000 |

| May 2024 | 533 | 16 to 18 | 118.00 Improved | 1982 | $610,000 |

| May 2024 | 345 | 04 to 06 | 121.00 Improved | 1997 | $660,000 |

| May 2024 | 354 | 07 to 09 | 120.00 Improved | 1997 | $647,777 |

| Year | 5-room HDBs in Jurong West | All 5-room HDBs |

| 2013 | $409 | $445 |

| 2014 | $383 | $422 |

| 2015 | $367 | $405 |

| 2016 | $376 | $411 |

| 2017 | $367 | $419 |

| 2018 | $350 | $417 |

| 2019 | $354 | $415 |

| 2020 | $373 | $429 |

| 2021 | $410 | $480 |

| 2022 | $451 | $520 |

| 2023 | $475 | $543 |

| Average growth rate | 1.66% | 2.13% |

While the average growth rate for 5-room flats in Jurong West is lower compared to the overall growth rate of all HDB flats, this can vary depending on the specific cluster.

In a recent article, we noted that larger unit types, such as 4 and 5-room flats, have outperformed 3-room flats when it comes to older properties. Despite the lease decay issue that affects ageing leasehold properties, these larger units still experience growth during market upswings. In particular, older 5-room flats have shown the strongest performance over the past decade.

| Flat Type | 5 ROOM | |

| Year | 1980 – 1990 | 2010 – 2020 |

| 2013 | $571,371 | $712,654 |

| 2014 | $547,093 | $827,600 |

| 2015 | $539,496 | $909,485 |

| 2016 | $548,537 | $833,561 |

| 2017 | $552,698 | $765,952 |

| 2018 | $532,676 | $745,114 |

| 2019 | $528,019 | $645,633 |

| 2020 | $530,707 | $631,037 |

| 2021 | $592,566 | $689,930 |

| 2022 | $643,078 | $740,113 |

| 2023 | $676,126 | $773,757 |

| 2024 | $699,885 | $805,123 |

| ROI (13 – 24) | 1.9% | 1.1% |

| ROI (13 – 19) | -1.3% | -1.6% |

| ROI (19 – 24) | 5.8% | 4.5% |

In addition to the ongoing transformation of the Jurong Lake District, your flat’s proximity (likely within 1km) to Rulang Primary School, one of the most prestigious schools in the western part of the island will help in supporting its demand.

Botanique @ Bartley

These are some of the recent 2-bedroom transactions in Botanique @ Bartley:

| Date | Size (sqft) | PSF | Price | Address |

| Jul 2024 | 753 | $1,964 | $1,480,000 | 221 Upper Paya Lebar Road #09 |

| Jun 2024 | 732 | $2,029 | $1,485,000 | 237 Upper Paya Lebar Road #10 |

| Jun 2024 | 657 | $1,934 | $1,270,000 | 233 Upper Paya Lebar Road #14 |

| Jun 2024 | 732 | $1,981 | $1,450,000 | 229 Upper Paya Lebar Road #08 |

| Jun 2024 | 753 | $1,940 | $1,462,000 | 221 Upper Paya Lebar Road #11 |

| Jun 2024 | 732 | $2,029 | $1,485,000 | 227 Upper Paya Lebar Road #08 |

| May 2024 | 861 | $1,951 | $1,680,000 | 221 Upper Paya Lebar Road #17 |

| May 2024 | 743 | $2,006 | $1,490,000 | 221 Upper Paya Lebar Road #12 |

| May 2024 | 732 | $1,947 | $1,425,000 | 231 Upper Paya Lebar Road #10 |

As the first resale transaction for the project was only done in 2020, we only have the last 4 years of resale data to look back on.

| Year | Botanique @ Bartley | D19 99y non-landed | All 99y non-landed |

| 2020 | $1,484 | $1,027 | $1,173 |

| 2021 | $1,564 | $1,107 | $1,207 |

| 2022 | $1,667 | $1,258 | $1,337 |

| 2023 | $1,807 | $1,373 | $1,463 |

| Average growth rate | 6.79% | 10.19% | 7.70% |

Over the past four years, while the project has appreciated well, it has been trailing behind other developments in D19 and across the island. Since you purchased it as a new launch in 2016, let’s also examine the growth rate from then until now.

| Year | Botanique @ Bartley |

| 2016 | $1,301 |

| 2017 | $1,297 |

| 2018 | $1,355 |

| 2019 | $1,493 |

| 2020 | $1,489 |

| 2021 | $1,564 |

| 2022 | $1,667 |

| 2023 | $1,807 |

| Average growth rate | 4.87% |

Transactions done in 2018, 2019, and partially in 2020 were primarily sub-sale transactions. The majority of the growth occurred during the sub-sale and resale periods, rather than at the initial launch, where developers often use a pricing strategy that gradually increases the price per square foot (PSF). This indicates a healthy level of demand for the project in the secondary market.

Let’s also take a look at how the project is faring in comparison to the neighbouring developments.

| Project | Number of units | Completion year | Tenure |

| Botanique @ Bartley | 797 | 2019 | 99 years |

| Bartley Ridge | 868 | 2016 | 99 years |

| Bartley Residences | 702 | 2015 | 99 years |

| Year | Botanique @ Bartley | Bartley Ridge | Bartley Residences |

| 2020 | $1,484 | $1,411 | $1,337 |

| 2021 | $1,564 | $1,470 | $1,369 |

| 2022 | $1,667 | $1,583 | $1,502 |

| 2023 | $1,807 | $1,742 | $1,661 |

| Average growth rate | 6.79% | 7.30% | 7.56% |

Although Botanique @ Bartley’s performance over the past 4 years has slightly lagged behind the other two developments, the difference isn’t too significant. Given that it is the newest development in the area with the highest average price psf, the other projects had more room to catch up.

In the vicinity, there is a new launch project, Bartley Vue, which is expected to obtain its TOP in 2026. Like the other 3 projects, it’s a 99-year leasehold condo, with 115 units. The average transacted price psf for Bartley Vue is $1,966.

The Bartley area is a relatively small estate, and the URA Master Plan indicates that there are no other available land plots near the MRT station. This means that buyers interested in this area are limited to the existing developments, which could help sustain demand and support prices.

Now, let’s review the costs associated with the various options you’re considering.

Potential pathways

Remain status quo

Since we do not have all your financial details, the following assumptions will be used for our calculations:

- The average purchase price for a 2-bedroom unit at Botanique @ Bartley in 2016 was $862,698. We will assume this as your purchase price, with an 80% loan at a 3.5% interest rate.

- Assuming you are both 45 years old now, you would have purchased Botanique @ Bartley at age 37, giving you a maximum loan tenure of 28 years.

- Your current outstanding loan balance is estimated to be $556,092, with 20 years remaining on the tenure.

- Over the past decade, HDB prices increased at an average annual rate of 2.3%. Based on this growth rate and the average value of 5-room flats near Lakeside MRT station over the last 6 months, estimated at $609,333, your flat would have been purchased for around $453,390, 13 years ago. We’ll assume you took an 80% loan at a 3.5% interest rate with a 25-year tenure.

- Your current outstanding loan for the flat is estimated to be $213,261, with 12 years remaining on the tenure.

- The average rent for a 2-bedroom unit at Botanique @ Bartley over the past 3 months is $3,718, which we will use as the rental estimate.

For calculation purposes, we will use a 10-year timeframe.

Cost of holding the HDB

| Interest expense (Assuming a 4% interest and 12-year tenure) | $53,796 |

| Town council service & conservancy fees (Assuming $90/month) | $10,800 |

| Property tax | $4,060 |

| Total cost | $68,656 |

Gains from holding Botanique @ Bartley

| Interest expense (Assuming a 4% interest and 20-year tenure) | $181,121 |

| Maintenance fees (Assuming $250/month) | $30,000 |

| Property tax | $65,230 |

| Rental income | $446,160 |

| Agency fees (Assuming its paid once every 2 years) | $20,265 |

| Total gains | $149,544 |

Total gains if you were to take this pathway: $149,544 – $68,656 = $80,888

Sell both and get a new condo

Once again, since we don’t have your exact figures, we’ll use the same outstanding loan amounts mentioned earlier to estimate your potential sales proceeds and assess your affordability.

Selling the HDB

For the selling price, we are using the average price of 5-room flats in the vicinity of Lakeside MRT station transacted over the last 6 months.

| Selling price | $609,333 |

| Outstanding loan | $213,261 |

| Sales proceeds (CPF + cash) | $396,072 |

Selling Botanique @ Bartley

Here, we are using the average price of 2-bedroom units sold over the last 6 months as the selling price.

| Selling price | $1,432,654 |

| Outstanding loan | $556,092 |

| Sales proceeds (CPF + cash) | $876,562 |

Combined affordability

| Maximum loan based on ages of 45 with a combined monthly income of $27K, at a 4.8% interest | $2,288,286 |

| CPF + cash | $1,272,634 |

| Total loan + CPF + cash | $3,560,920 |

| BSD based on $3,560,920 | $153,255 |

| Estimated affordability | $3,407,665 |

Looking at the latest launch in the Lakeside area, Sora, the most affordable 3-bedroom unit (936 s qft) at the moment is priced at $2.05M, which is within your budget. For the 4-bedroom units, pricing is available only upon request from the developer. However, based on recent transactions, they are estimated to be around $3.3M. This falls within your budget but would require you to fully maximise your loan capacity and utilise all available funds.

Since you plan to sell both properties to fund the new purchase, you will need to arrange for temporary accommodation, as the project is only expected to obtain its TOP in 2028, which is 4 years away. This means you would incur significant rental expenses during this period.

An alternative approach would be to sell Botanique @ Bartley first and use the proceeds to fund the purchase. You could then stay in your HDB flat while awaiting the completion of the new project and sell the HDB within 6 months of the new project’s TOP.

However, this option would affect two things: First, your LTV ratio would drop to 45% since you would be buying a second property. Second, ABSD will be payable for the new launch, although you could qualify for a remission if you sell the HDB within 6 months of the project obtaining its TOP considering it is a matrimonial property (property will have to be purchased under both your names).

Having said that, this second option might require a CPF or cash top-up due to the reduced LTV and ABSD. Let’s take a look at the funds required assuming you purchase a 3-bedder:

| Purchase price | $2,050,000 |

| BSD | $72,100 |

| ABSD | $410,000 |

| Maximum loan (45% LTV) | $922,500 |

| Funds required | $1,609,600 |

With the sales proceeds from Botanique @ Bartley amounting to $876,562, you would need to contribute an additional $733,038 to complete the purchase, which is a substantial sum.

Let’s instead assume that you sell both properties and rent for 4 years.

| Purchase price | $2,050,000 |

| BSD | $72,100 |

| CPF + cash | $1,272,634 |

| Loan required | $849,466 |

Based on the Q2 HDB rental statistics, the median rent for a 5-room flat in Jurong West is $3,500. We will use this as the rental price.

| BSD | $72,100 |

| Interest expense (Assuming a 4% interest and 20-year tenure) | $276,675 |

| Maintenance fees (Assuming $350/month) | $25,200 |

| Property tax | $23,340 |

| Rental expense | $168,000 |

| Total cost | $565,315 |

*Given that it is a new launch, maintenance fees and property tax will only be payable upon TOP

Buy a more affordable resale condo and keep Botanique @ Bartley

Among the 4 condos you’ve shortlisted, The Lakeshore has the lowest average transacted price for a 3-bedroom unit over the past 6 months, at $1,654,265. Let’s use this as the purchase price. Assuming that Botanique @ Bartley is under both your names, you will be subjected to ABSD and your LTV ratio will be reduced.

| Purchase price | $1,654,265 |

| BSD | $52,313 |

| ABSD | $330,853 |

| Maximum loan (45% LTV) | $744,419 |

| Funds required | $1,293,012 |

If Botanique @ Bartley is jointly owned by both of you, this option might not be feasible due to the significant amount of funds required. Even after accounting for the sales proceeds from the HDB, you would still need to top up nearly $900,000.

However, if Botanique @ Bartley is owned under only one name, this pathway might be feasible, depending on your individual loan amounts.

| Purchase price | $1,654,265 |

| BSD | $52,313 |

| CPF + cash | $396,072 |

| Loan required | $1,310,506 |

At age 45 and with an interest rate of 4.8%, the individual purchasing this property would need a minimum monthly income of $16,000 to qualify for the loan amount mentioned. For calculation purposes, let’s assume this is the case.

Cost of purchasing and holding a unit at The Lakeshore

| BSD | $52,313 |

| Interest expense (Assuming a 4% interest and 20-year tenure) | $426,837 |

| Maintenance fees (Assuming $350/month) | $42,000 |

| Property tax | $24,430 |

| Total cost | $545,580 |

Total cost if you were to take this pathway: $545,580 – $149,544 = $396,036

Let’s now take a look at how the 4 projects you’ve picked out are performing.

Performance of shortlisted condos

| Project | Number of units | Completion year | Average 3-bedroom price (last 6 months) |

| Lake Grande | 710 | 2019 | $1,750,000 (Just one transaction) |

| The Lakefront Residences | 629 | 2014 | $1,717,700 |

| Caspian | 712 | 2012 | $1,724,000 |

| The Lakeshore | 848 | 2008 | $1,654,265 |

| Year | Lake Grande | The Lakefront Residences | Caspian | The Lakeshore | D22 99y non-landed | All 99y non-landed |

| 2013 | $1,145 | $1,158 | $955 | $1,057 | ||

| 2014 | $1,131 | $1,067 | $921 | $1,029 | ||

| 2015 | $1,291 | $1,045 | $1,085 | $898 | $1,033 | |

| 2016 | $1,279 | $1,053 | $1,045 | $893 | $1,129 | |

| 2017 | $1,234 | $1,059 | $1,028 | $892 | $1,115 | |

| 2018 | $1,304 | $1,116 | $1,074 | $1,052 | $1,153 | |

| 2019 | $1,314 | $1,076 | $1,061 | $1,014 | $1,178 | |

| 2020 | $1,505 | $1,323 | $1,123 | $1,008 | $992 | $1,173 |

| 2021 | $1,559 | $1,315 | $1,168 | $1,073 | $1,136 | $1,207 |

| 2022 | $1,627 | $1,385 | $1,259 | $1,191 | $1,243 | $1,337 |

| 2023 | $1,729 | $1,548 | $1,410 | $1,350 | $1,316 | $1,463 |

| Average (2020-2023) | 4.74% | 5.50% | 7.93% | 10.27% | 9.94% | 7.70% |

| Average (2015-2023) | – | 2.40% | 3.91% | 2.97% | 5.16% | 4.54% |

| Average (2013-2023) | – | – | 2.25% | 1.76% | 3.52% | 3.40% |

From the tables above, it is evident that the overall price difference for a 3-bedroom unit among the four projects is not significantly large. Even with The Lakeshore being over a decade older than Lake Grande, the price gap is about $100,000. However, when considering the average price psf, there is a notable difference, suggesting that older projects like The Lakeshore have larger sizes, which could offer a more comfortable living space.

The pandemic created a unique market situation over the past couple of years, leading to substantial price growth especially in larger unit types, including for older properties. Between 2020 and 2023, older projects experienced a higher rate of appreciation compared to newer ones likely due to the larger living spaces that they offer and at a more affordable price range.

While property prices generally declined following the multiple rounds of cooling measures introduced in 2013, the numbers show that The Lakefront Residences (which is newer than Caspian and The Lakeshore) enjoyed a much faster recovery.

The URA Master Plan reveals that there are limited land plots available near the MRT station. Of these, only one plot is designated for residential development, while two others are reserve sites, meaning their future uses have yet to be determined.

What should you do?

We will do a quick summary of the 3 pathways you’re considering.

| Potential pathways | Number of properties owned | Costs incurred over 10 years |

| Remain status quo | 1 HDB, 1 condo | $80,888 |

| Sell both and get a new condo | 1 condo | $565,315 |

| Buy a more affordable resale condo and keep Botanique @ Bartley | 2 condos | $396,036 |

For option 3, do note that it may not be feasible if Botanique @ Bartley is jointly owned unless decoupling is an option. The substantial ABSD and reduced LTV for purchasing a second property would require a significant amount of CPF or cash top-up if Botanique @ Bartley is held jointly.

Alternatively, you might consider selling both properties and purchasing two separate properties. Without knowing your individual incomes, it’s challenging to determine if this is a viable option.

Among the three pathways, options 1 and 3 would enable you to own two properties, allowing you to separate your primary residence from your investment properties. This approach offers diversification, greater flexibility, and a stream of passive income that can help offset some of your expenses. Additionally, an HDB or an older resale condo could provide a more comfortable living space compared to a newer property which is likely to be smaller. As such, options 1 and 3 may be more suitable

Between the two pathways, while maintaining the current status quo incurs lower costs, it means you could miss out on the potential gains from optimising the profits from both properties. Given that you are in your mid-40s, you are still in a favourable position to leverage on the mortgage.

By keeping your residence and investment properties separate, the appreciation rate of your primary residence may become less critical. Instead, you can prioritise a living space that better suits your family’s needs and offers a higher level of comfort.

We hope that our analysis will help you in your decision-making. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Read next from Editor's Pick

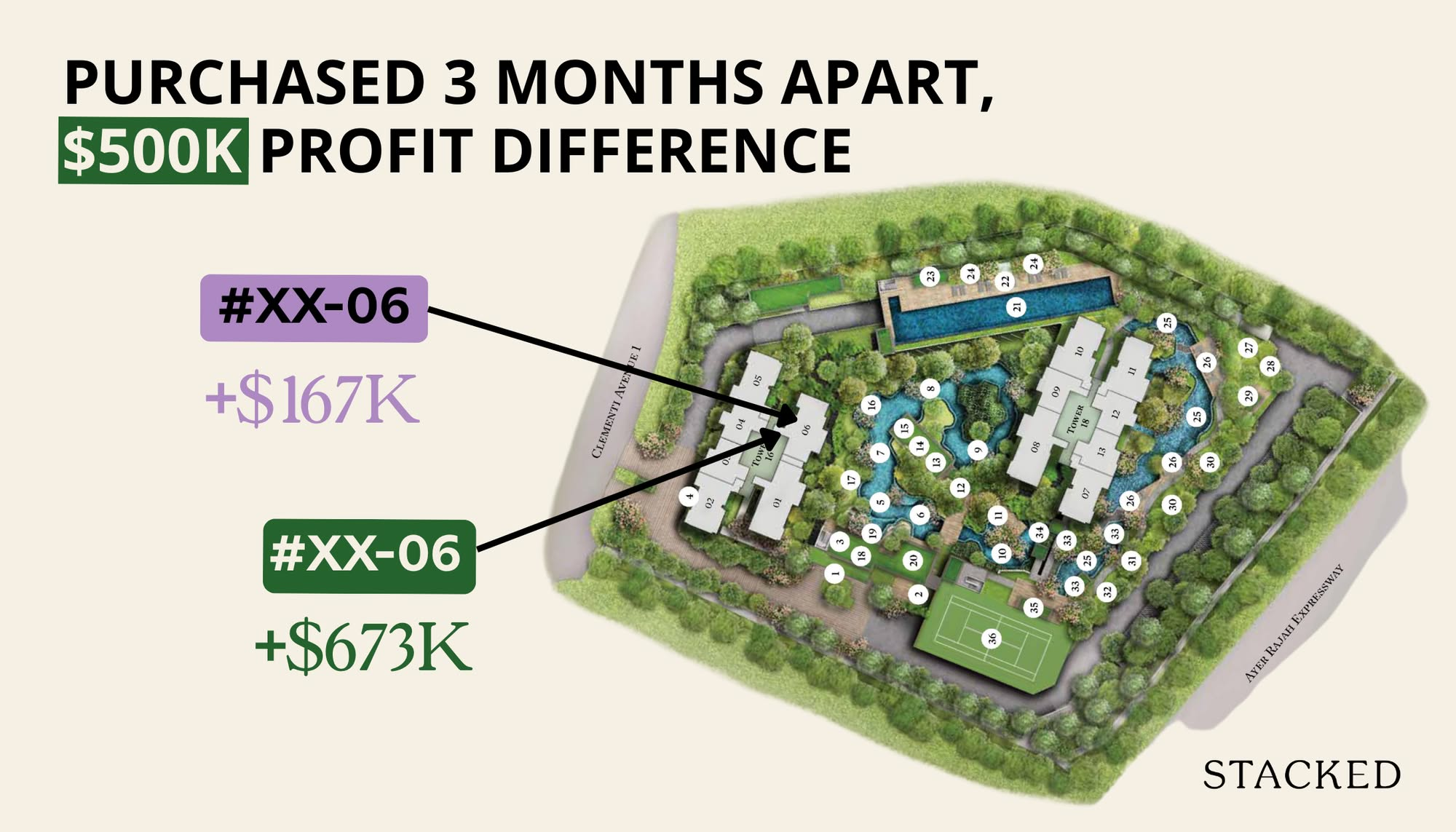

Property Investment Insights How A Clement Canopy Condo Buyer Made $700K More Than Their Neighbours: A Data Breakdown On Timing

Property Picks Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Advice The Ultimate Work From Home Homebuyer Checklist (That Most People Still Overlook)

Landed Home Tours These $4m Freehold Landed Homes In Joo Chiat Have A 1.4 Plot Ratio: What Buyers Should Know

Latest Posts

Pro How Different Condo Views Affect Returns In Singapore: A 25-Year Study Of Pebble Bay

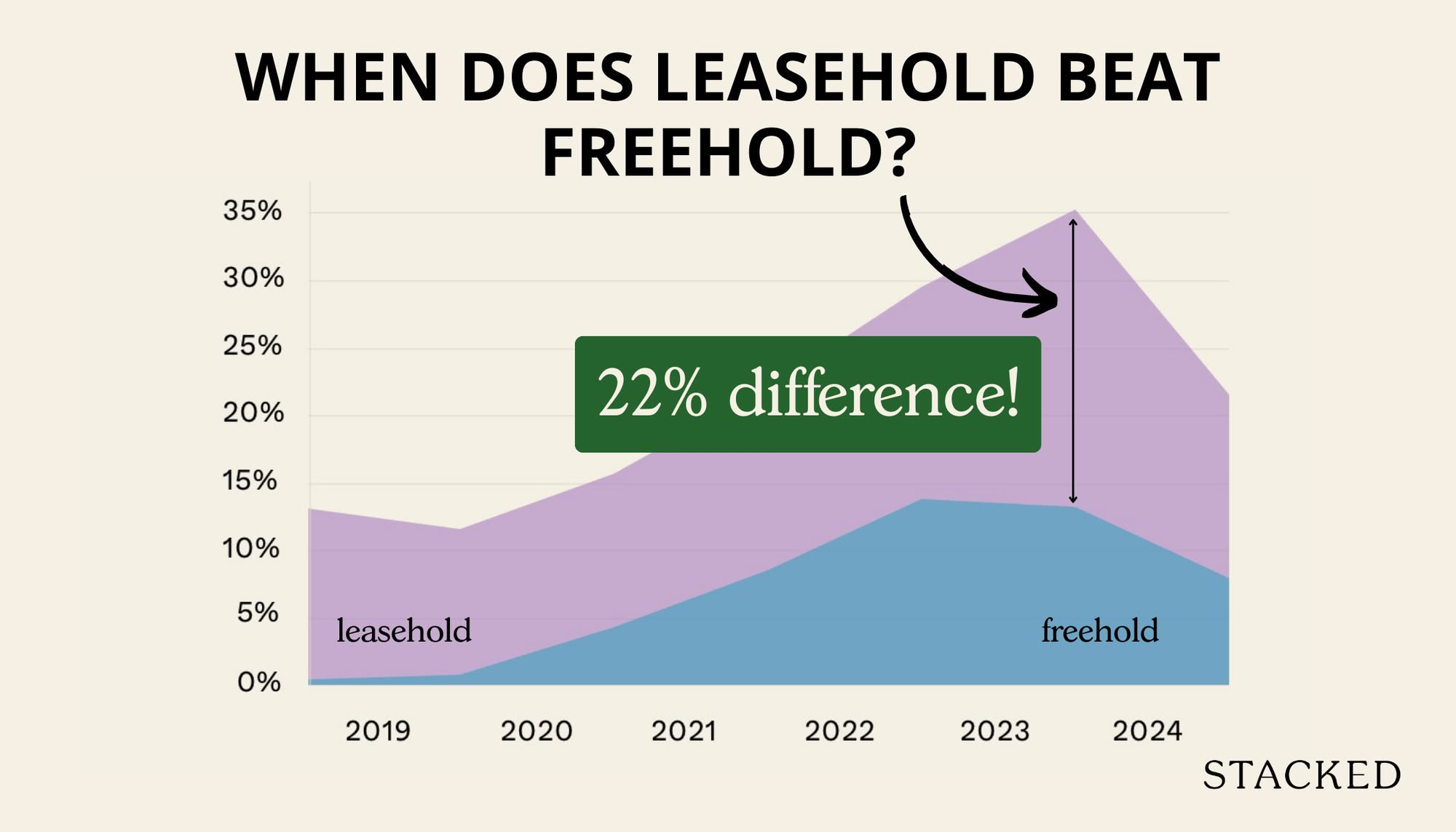

Pro Can Leasehold Condos Deliver Better Returns Than Freehold? A 10-Year Data Study Says Yes

Home Tours Inside A Minimalist’s Tiny Loft With A Stunning City View

On The Market 5 Most Affordable Newly MOP 4-Room HDB Flats From $585k

Property Market Commentary Distressed Property Sales Are Up In Singapore In 2025: But Don’t Expect Bargain Prices

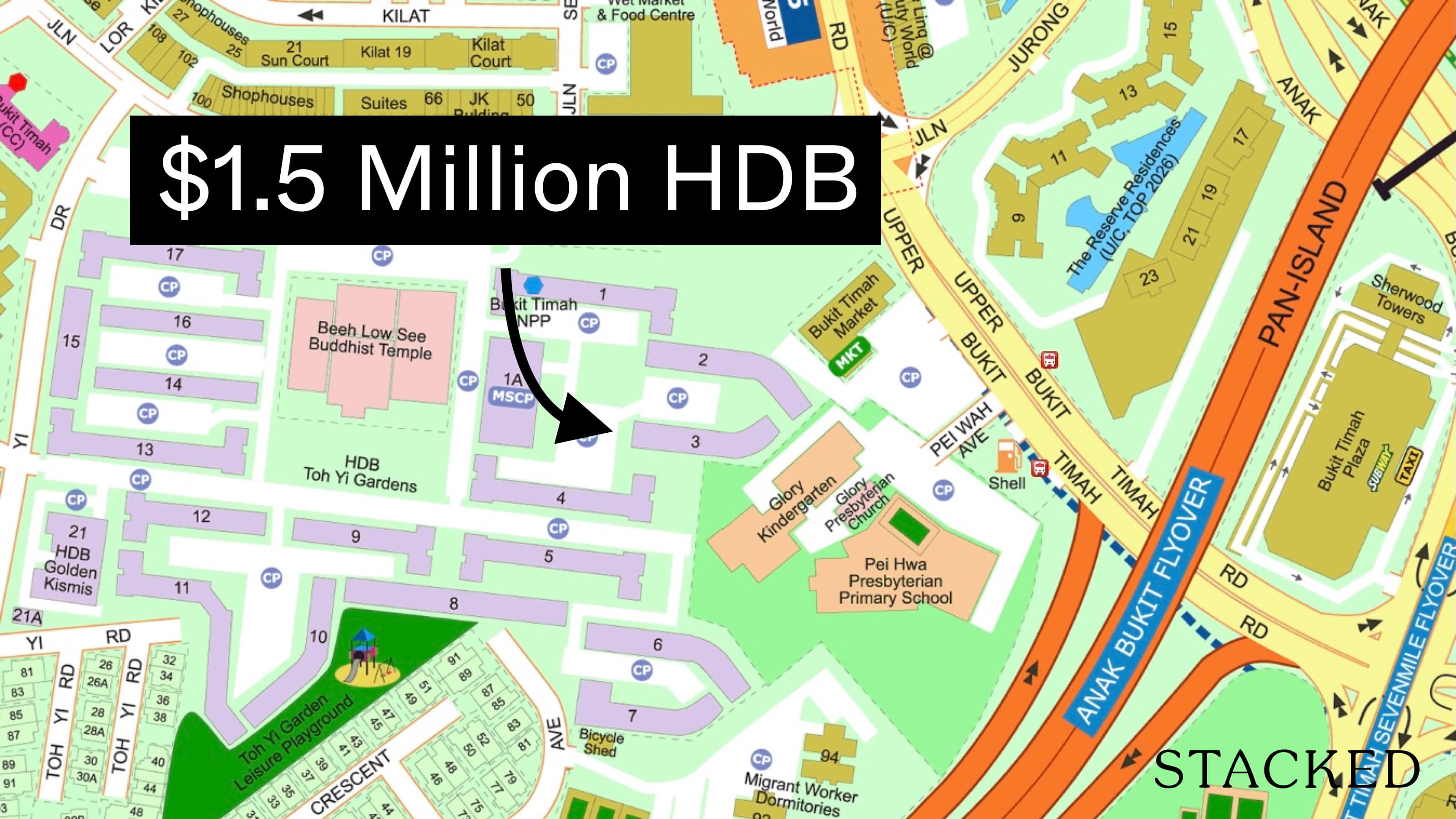

Singapore Property News This $1.5M Bukit Timah Executive HDB Flat With 62-Years Lease Left Just Set A Record: Here’s Why

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Property Market Commentary Why Do Property Agents Always Recommend New Launch Condos? Is It Really About The Money?

On The Market 5 Affordable Condos With Unblocked Views Priced Under $1 Million

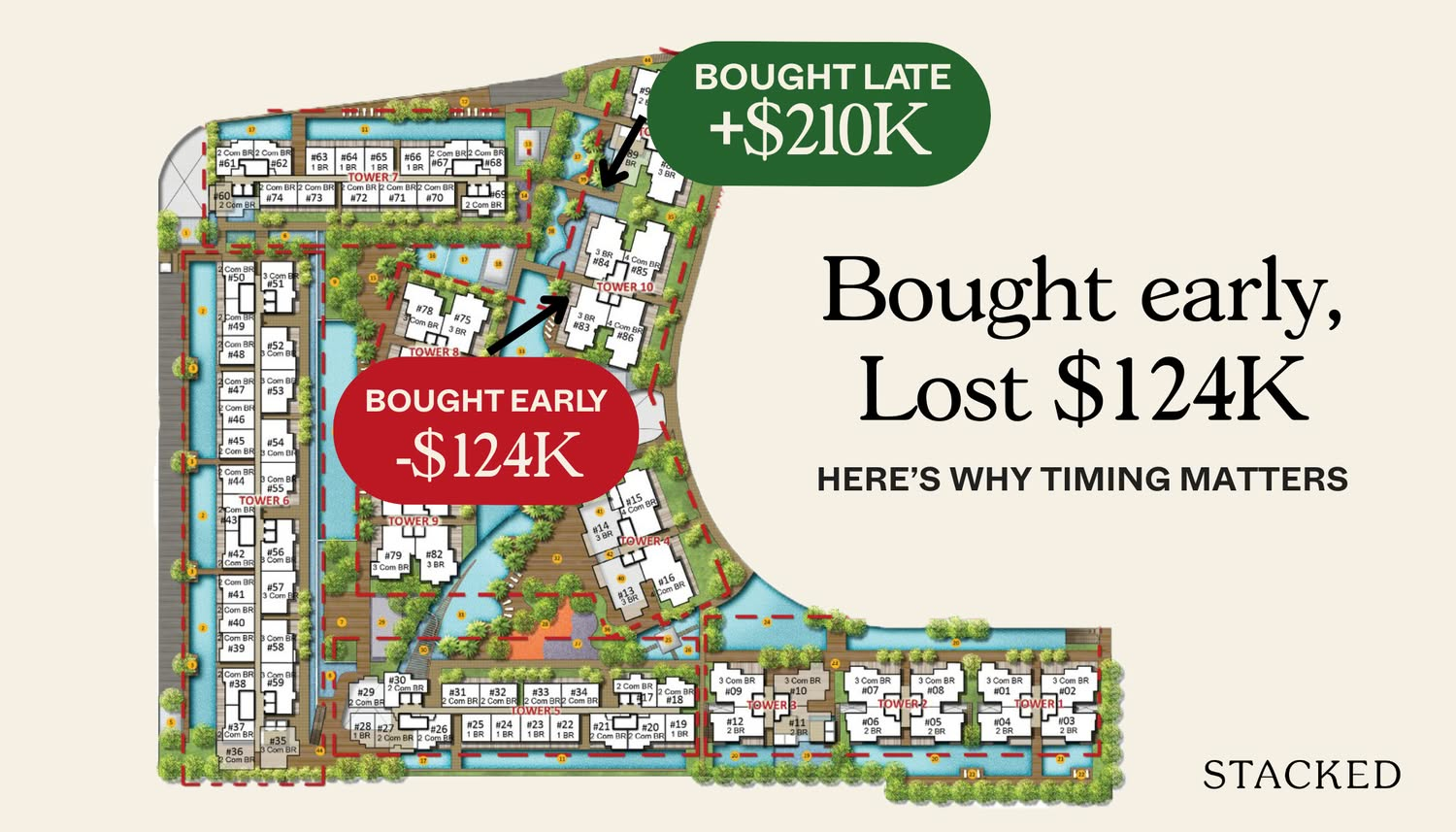

Pro Watertown Condo’s 10-Year Case Study: When Holding Period And Exit Timing Mattered More Than Buying Early

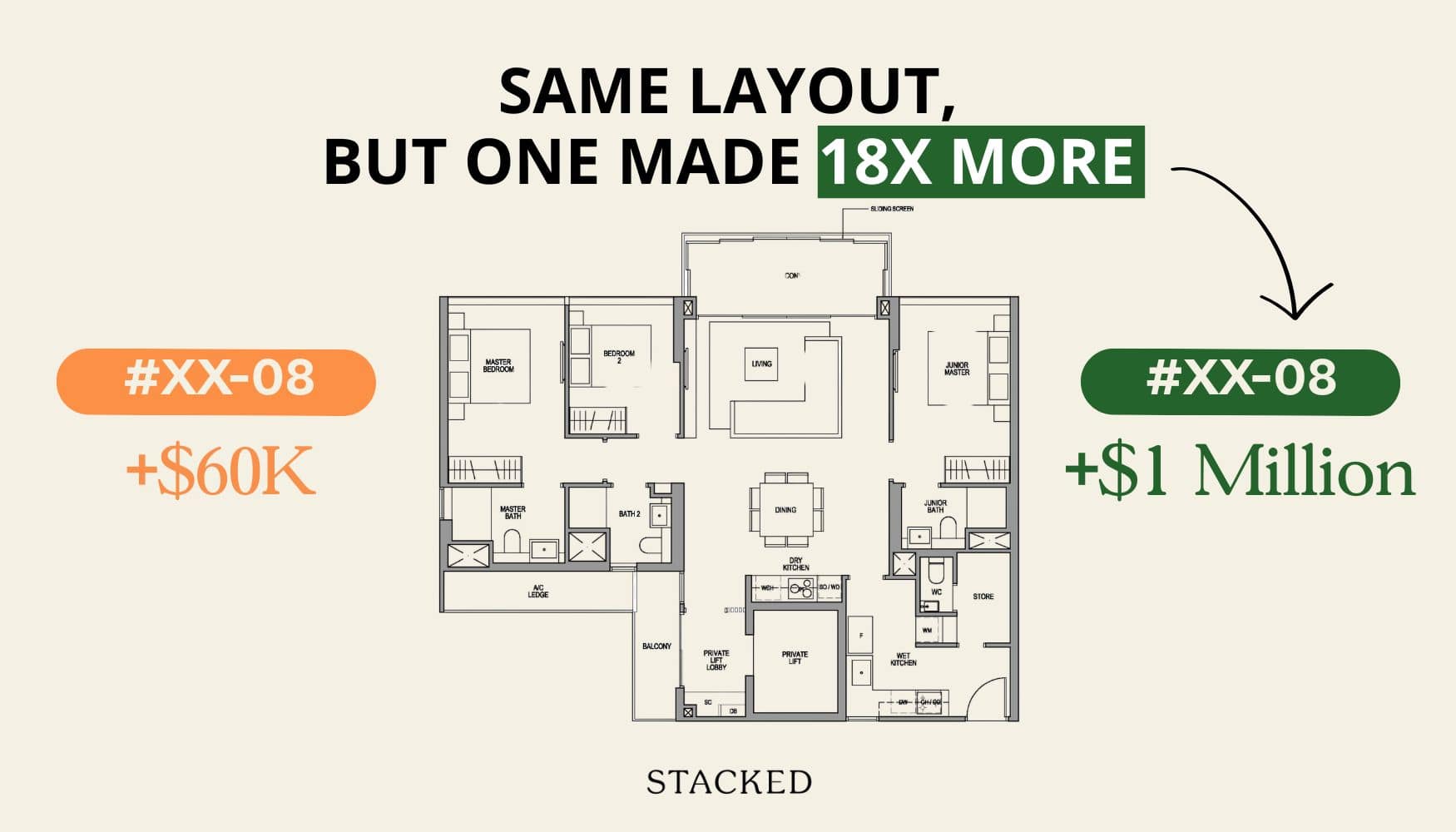

Pro Same Condo, Same Layout — But A $1M Profit Gap: A Data-Driven Study On Martin Modern

Singapore Property News GE2025: Who’s Got the Better Housing Plan? We Break Down PAP, WP, RDU, PSP And SDP Proposals

Homeowner Stories Buying A Walk-Up Apartment In Singapore? Don’t Overlook The Shops Below – Here’s Why

Pro How Purchase Timing Affects Returns In Mega Developments: A Case Study Of Treasure At Tampines