We Make $190k Per Year. Should We Sell Our Punggol EC For $650k Profit Or Hold On & Rent It Out?

September 2, 2022

Hi Stacked Homes

I have been following your articles for some time now because they are always provided good insights.

Recently, your article, ”We make $180k per annum. Should we sell our EC for $650k profit to buy 2 condos or just a bigger HDB?” dated 12th Aug triggered me to write in with my situation.

We are a couple 48/49 years old with 2 Kids. Currently, we are staying in a 4 bedroom EC Condo, Ecopolitan, in Punggol. Combined Income of $190k/year.

Earlier this year, my Mum passed away suddenly and we got my Dad to shift in with us for now.

My Dad stays in a terrace house in Teachers Estate and the plan is to do some renovation and all of us will then shift back there to stay with him.

Should we sell our condo and realise a $650-$700k gain? Or should we keep the condo and rent it out?

If we sell the condo, what other property moves can we make now for investment, bearing in mind the property market and the interest rates?

Another option we considered was also to buy over the terrace house from my Dad but that might be a bit of a stretch.

Our long term plan is to eventually shift into a HDB in our retirement years.

Hi there!

First off, we’re really sorry to hear about the passing of your mum, and would like to offer our sincere condolences.

We are happy to hear though, that our articles have been providing good insights for you and we appreciate the support thus far.

You are in quite a unique position where you are faced with quite a few choices, and it can be hard to decide which would be a better route. We understand that you guys are at the stage where you are thinking to perhaps capitalise on one more investment property before your retirement years so let’s go through the options you’re considering.

Should you keep the condo and rent it out?

Recent rental transactions for Ecopolitan:

| Date | Size (sqft) | Price | No. of bedrooms |

| Jul 2022 | 1000 – 1100 | $4,000 | 3 |

| Jul 2022 | 1000 – 1100 | $4,400 | 3 |

| Jul 2022 | 800 – 900 | $3,600 | 3 |

| Jun 2022 | 1200 – 1300 | $4,800 | 3 |

| Jun 2022 | 1200 – 1300 | $4,000 | 3 |

| May 2022 | 1200 – 1300 | $4,100 | 3 |

| May 2022 | 1000 – 1100 | $4,000 | 3 |

| May 2022 | 1200 – 1300 | $2,800 | 4 |

| Apr 2022 | 800 – 900 | $3,500 | 3 |

| Jan 2022 | 1200 – 1300 | $3,300 | 3 |

Looking at Ecopolitan’s unit mix of 3, 4 and 5 bedrooms, it’s targeted mostly for own stay buyers (as with ECs anyway) so there are not many rental transactions. There was supposedly only one 4 bedroom rental transaction at $2,800 but this seems absurdly low so we’d just take an average of the bigger 3 and 4 bedroom units so far. Over the past 8 months, there were only 8 units being rented out at an average rate of $3,925/month.

In the last 8 months the 4 bedders in Ecopolitan have transacted at an average of $1,430,231 (we’ll show these transactions in the later part of this article). Based on the average rent of $3,925, the rental yield will be 3.3% which is decent but certainly not the best considering the current rental market. That said, this average rent is based largely on 3 bedders so the rental yield for a 4 bedroom unit could possibly be higher.

The rent will likely cover the monthly mortgage payment if we assume you purchased the unit at around $1m and took the full 75% loan. Some outgoings to take note of when you’re renting out the place; MCST charges are still paid by you, agent fees should you engage one to assist with the rental, up-keeping cost if anything in the house requires fixing/replacing during the tenancy period.

Since you guys do have a place to stay and are not in a rush to sell or buy another property, renting it out could be an option to consider until the time you find another suitable place to purchase or move to. But as you said, it could be better to sell it off to realise the gains, and depending on your outlook, purchase an investment property with an eye for capital gains or rental income.

Should you buy over your dad’s terrace house?

Affordability

Assuming that both of you have a fixed income of $7,900 a month with no other outstanding loans:

Maximum loan for a private property purchase: $1,276,164 (16 year tenure)

Monthly repayment at 3.5% interest: $8,690

As we do not know how much CPF you’ve utilised or have in your OA at the moment, we’ll presume it to be $300,000 each (According to CPF’s 2021 Annual Report, about 50% of people aged 45-50 have at least $300,000 in their CPF accounts).

Before we proceed, we would like to just caution you on the likelihood of a possible $650-700k gain on your property as judging from the past recent sales. Of course, we aren’t sure about your actual unit and aren’t able to accurately advise, but the average gains currently seems to be between $4-500,000.

To achieve such a profit, you’d have to purchase the largest 4 bedroom 1,367 sq ft unit at the lowest possible psf ($730), and sold it at the current highest achieved psf ($1,225) to get a gain of $676,665. Not that this isn’t achievable in today’s market, it’s just to caution against over expectation.

Nevertheless, let’s work out the numbers from what you’ve provided:

Estimated cash proceeds from sale: $650,000

Maximum purchase price using only half of cash proceeds, full CPF and taking the full loan: $2,201,000

Note that we have not taken into consideration the BSD and legal fees.

Recent transactions at Teacher’s Housing Estate:

| Date | Address | Land size (sqft) | PSF | Price |

| Jul 2022 | 140 Tagore Avenue | 1,799 | $1790 | $3,220,000 |

| Jun 2022 | 154 Tagore Avenue | 1,794 | $1816 | $3,258,000 |

| May 2022 | 74 Kalidasa Avenue | 1,811 | $1779 | $3,220,000 |

| May 2022 | 57 Iqbal Avenue | 2,884 | $1325 | $3,820,000 |

| Apr 2022 | 21 Omar Khayyam Avenue | 1,806 | $1938 | $3,499,998 |

There were 5 houses that transacted over the last 8 months at an average price of $3,403,600 and an average PSF of $1,730.

Given your affordability at $2.2M, it’s unlikely that you’ll be able to buy over your dad’s house. Also, buying a $2.2M property would mean your monthly mortgage is going to cost 55% of your combined monthly income. If your kids are still going to school and you have to support them financially, this may not be the most prudent move.

Should you sell the property to realise the $650K – $700K profits?

Recent transactions for 4 bedders at Ecopolitan:

| Date | Size (sqft) | PSF | Price | Level |

| Jul 2022 | 1,141 | $1,157 | $1,320,000 | #07 |

| Jun 2022 | 1,195 | $1,155 | $1,380,000 | #03 |

| Jun 2022 | 1,367 | $1,141 | $1,560,000 | #02 |

| May 2022 | 1,367 | $1,110 | $1,5180,000 | #04 |

| May 2022 | 1,367 | $1,112 | $1,520,000 | #05 |

| Apr 2022 | 1,367 | $1,141 | $1,560,000 | #11 |

| Apr 2022 | 1,195 | $1,130 | $1,350,000 | #01 |

| Mar 2022 | 1,141 | $1,170 | $1,335,000 | #14 |

| Mar 2022 | 1,249 | $1,161 | $1,450,000 | #02 |

| Mar 2022 | 1,367 | $1,119 | $1,530,000 | #10 |

| Feb 2022 | 1,195 | $1,105 | $1,320,000 | #05 |

| Jan 2022 | 1,141 | $1,096 | $1,250,000 | #03 |

| Jan 2022 | 1,367 | $1,097 | $1,500,000 | #13 |

In the past 8 months, there were 13 4-bedroom units that changed hands at an average price of $1,430,231 and at an average PSF of $1,130.

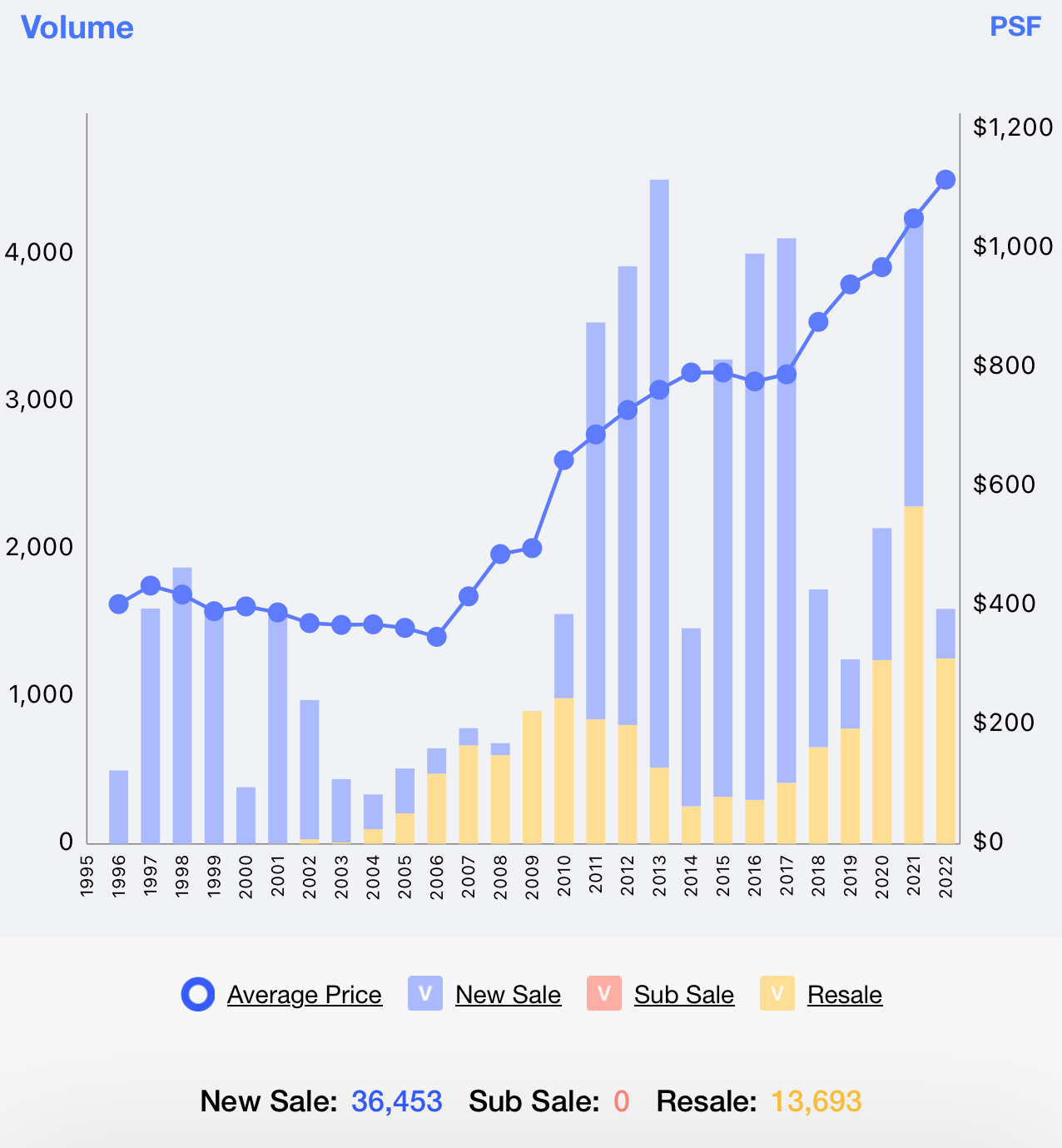

Let’s take a look at the performances of some ECs in District 19.

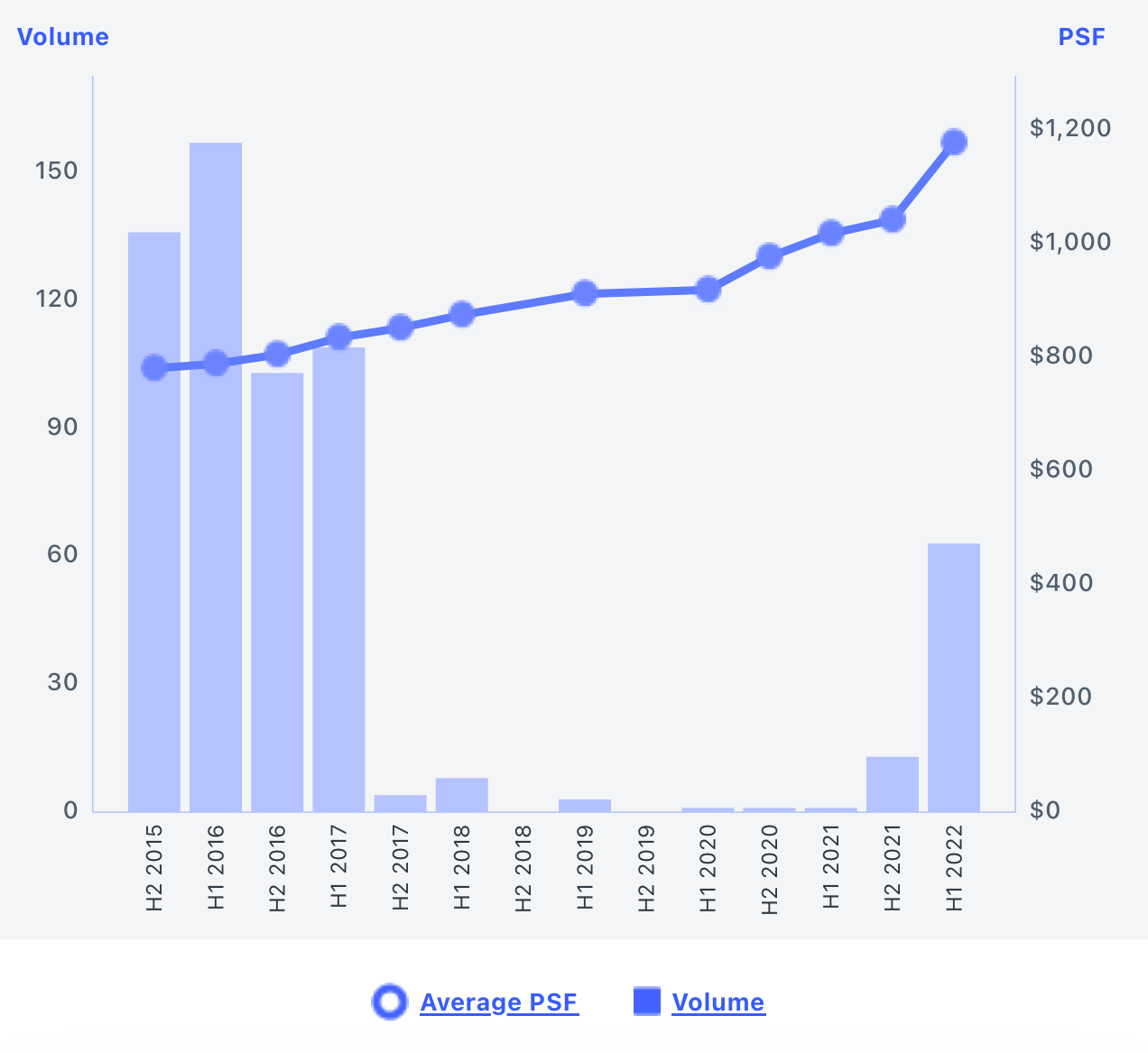

The Vales – TOP May 2017

Ecopolitan – TOP August 2016

Prive – TOP July 2013

Park Green – TOP September 2004

The Rivervale – TOP June 2000

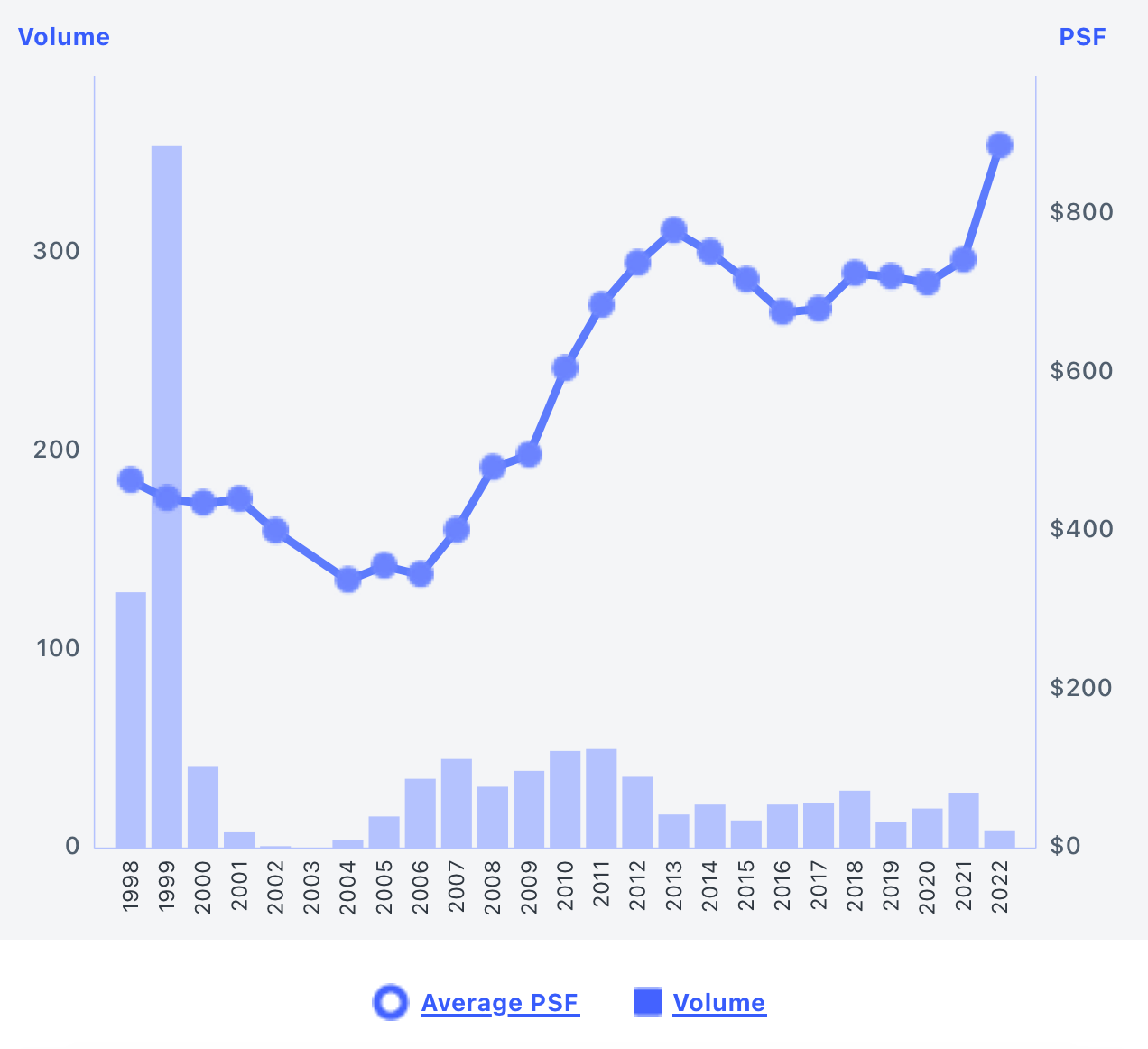

Overall EC transaction volume and average price:

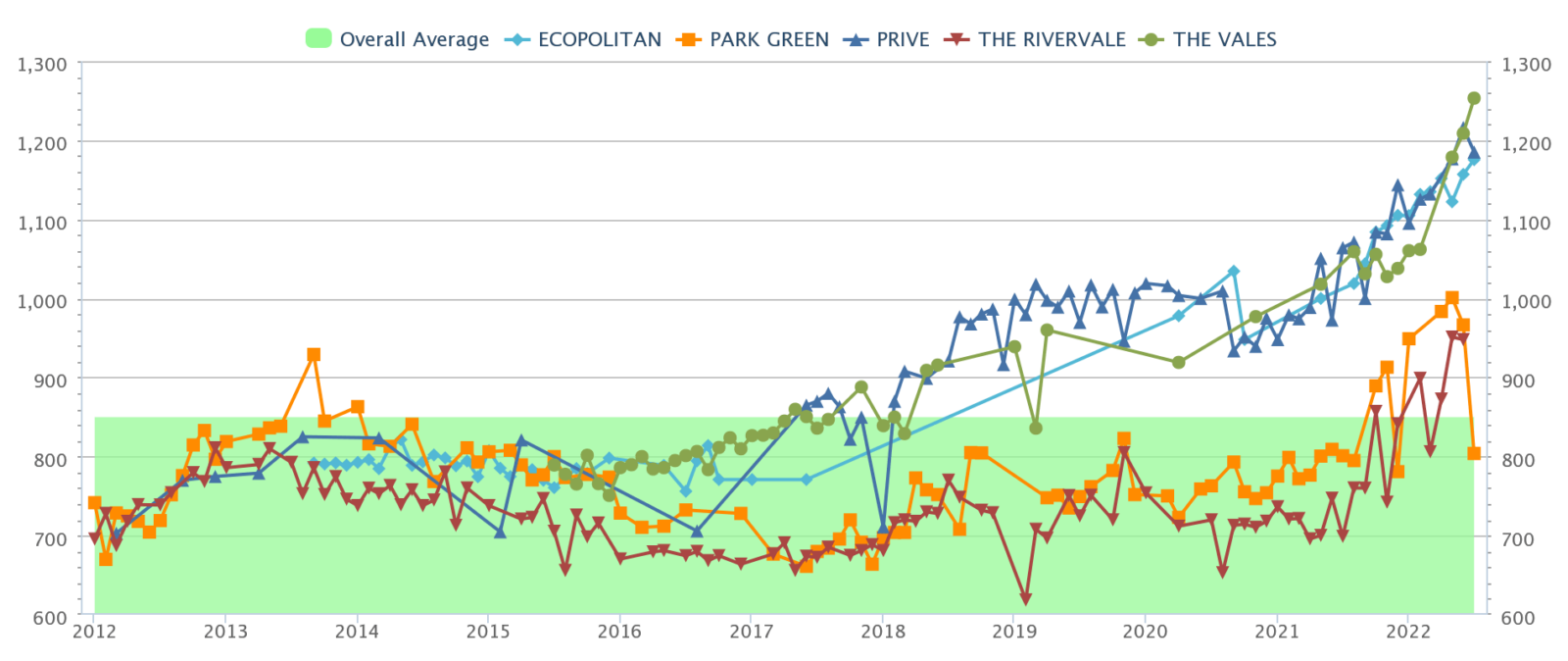

From the above charts, you’ll realise that generally once the projects reach their MOP, that’s when prices start to go up. Looking at older developments like Park Green and The Rivervale which are 18 and 22 years old respectively, we can see that their price movements are inline with the overall EC market movement and prices are still on an uptrend despite their ages.

A previous NUS study found that property prices start to stagnant or drop when the property reaches 21 years. However, given the current market situation, the demand for these older projects could be due to the lack of supply and also possibly due to their price point being lower than that of the newer ones in the vicinity which is what’s driving the prices up.

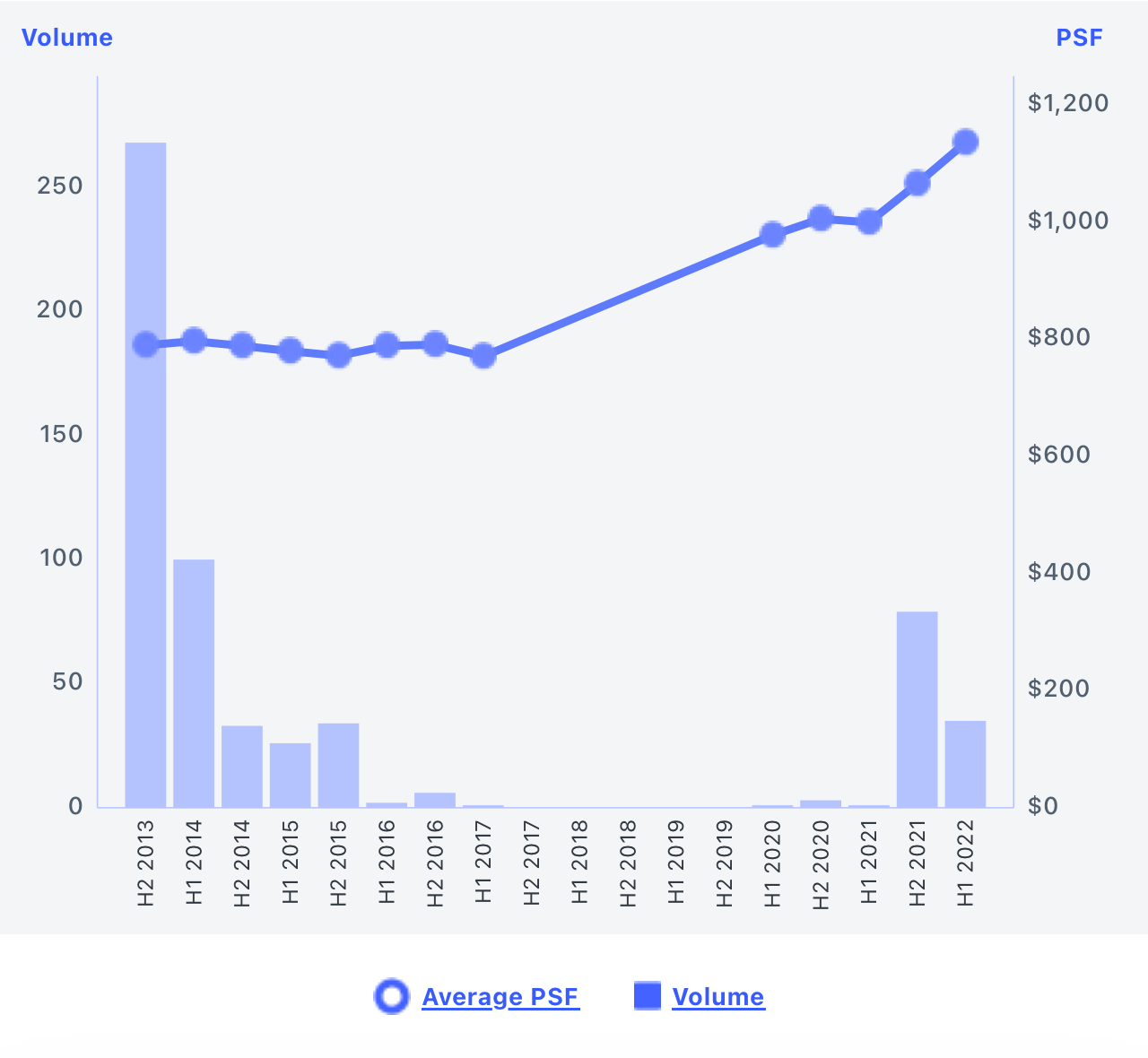

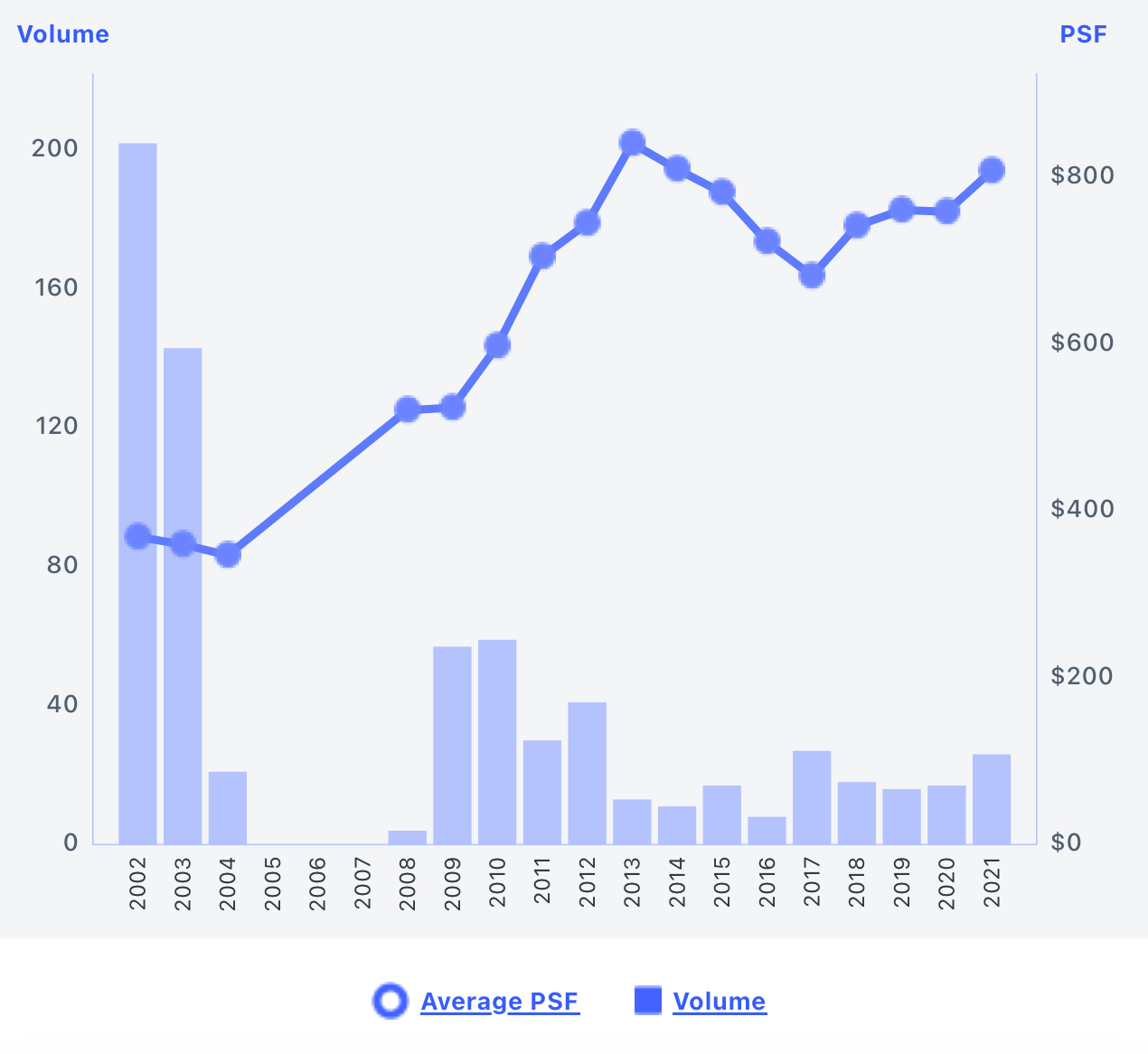

Price trend of District 19 ECs:

From this chart we can see that at one point in time, prices of the 5 developments were very comparable but as the years go by, the price disparity between the older projects and the newer ones start to become a lot clearer.

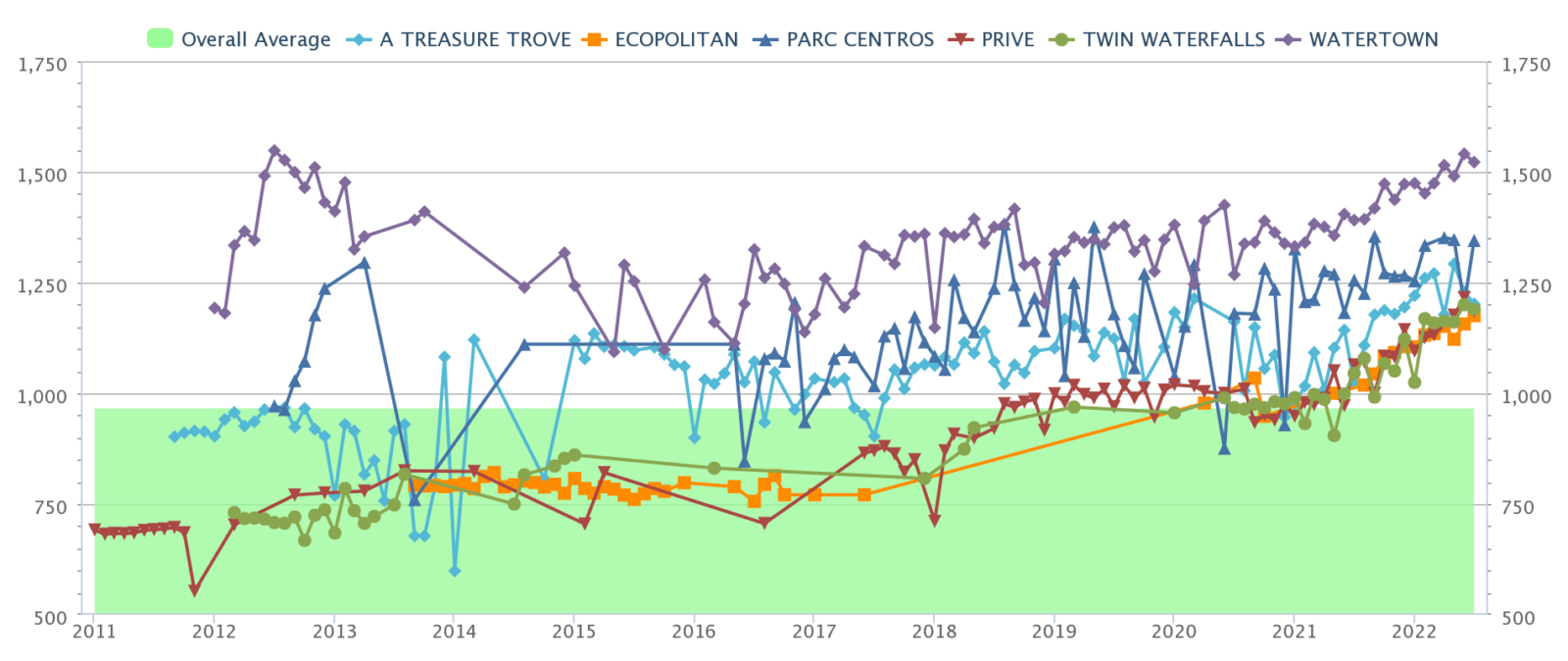

Price trend of projects in close proximity to Ecopolitan:

We can see from this chart that in recent years, the price gap between the 3 ECs (Ecopolitan, Prive and Twin Waterfalls) and the private condominiums is getting smaller. When new projects come unto the market, they do help with pushing up the prices of other projects in the vicinity.

Question is, should you sell now or hold on longer?

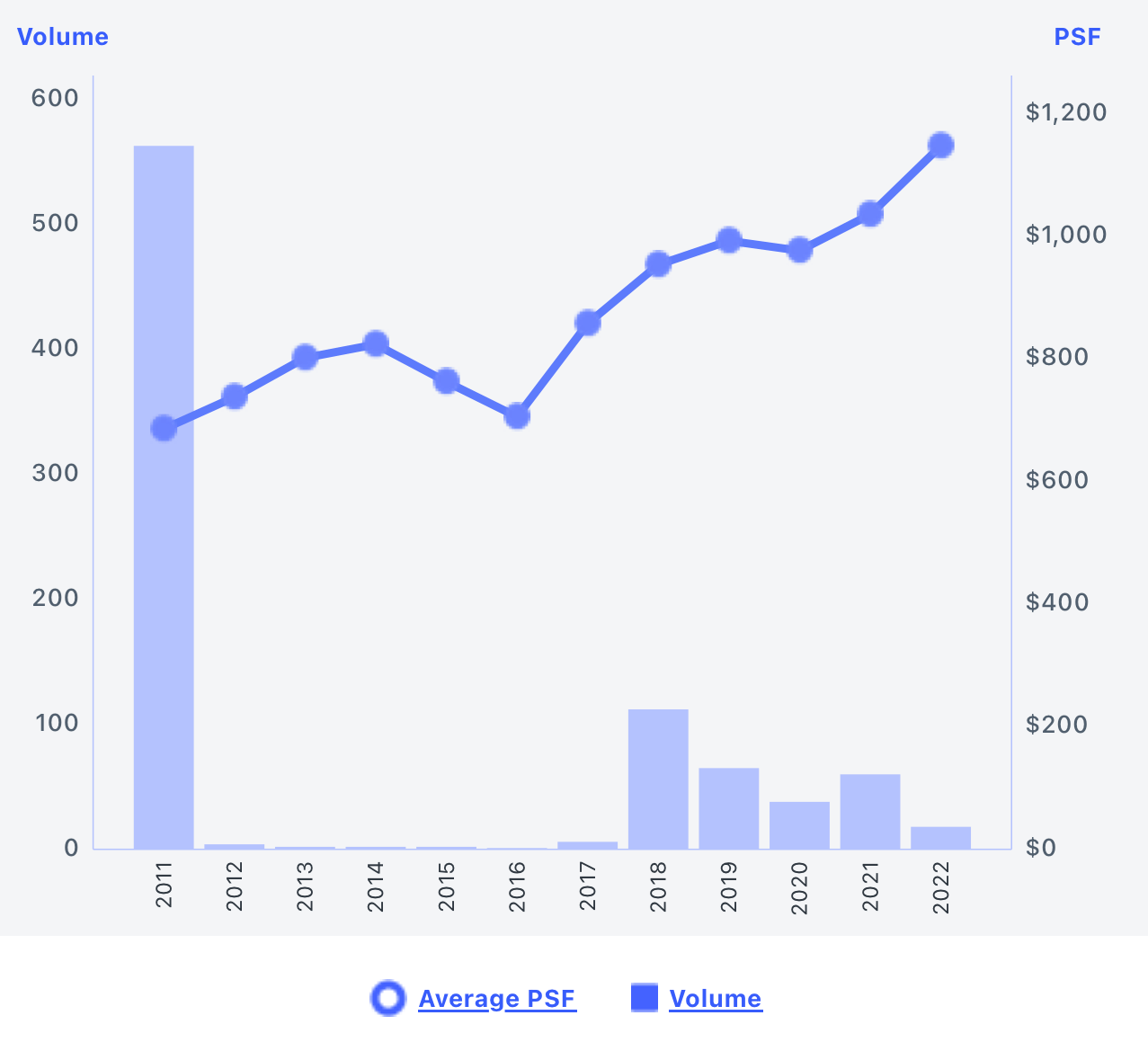

EC profits at 5 and 10 year mark:

ECs are a unique group of property sandwiched between HDBs and private condominiums. It has a 5 year MOP but once it hits the 10 year mark, it will become fully privatised which means it has the same status as a private condominium and can be sold to foreigners.

Looking at the chart above, you’ll notice that some of the projects actually made a loss when selling at the 5 year mark. Whereas, all of the ECs made a profit when they sold on the 10 year mark.

However, we should note that the projects that made a loss at the 5 year mark were some of the first few batches of ECs launched in 1996/1997 and reached their MOP in 2004/2005. This timeline coincided with the Asian financial crisis and aftermath of the dotcom bubble burst, Iraq war and SARS outbreak. These worldwide events could be contributing factors.

Of course this does not necessarily mean that if you hold onto the property for 10 years you’ll definitely make more than selling it upon MOP. It still really depends on market movements and also demand and supply of the area.

At the moment, Ecopolitan is the youngest amongst the three ECs that is within walking distance to Punggol MRT. As for private condominiums, Parc Centros obtained its TOP in the same year as Ecopolitan (2016), while Watertown is the newest of all, obtaining its TOP in 2017.

You should note that there are still several empty plots near Punggol MRT station. 4 of which are reserve sites which means their land use has not been determined, and 1 plot slated for a mixed development similar to Watertown. You do have an upper hand currently, being one of the youngest development in the area. However, in the event that these reserve sites do become earmarked for residential properties, there could potentially be an issue of oversupply which will have an adverse effect on prices. That said, it is more likely though that this would uplift the area given that there are still further upsides to look forward to in Punggol such as the Punggol Digital District.

But let’s say you were to sell, what property moves could you make?

Frankly, as we do not know your exact figures and family situation, it’s difficult to really advise properly on what property moves you can make. But let’s assume you take the maximum loan of $1.276M and utilise all your (also assumed) CPF of $600K, saving the cash proceeds for emergencies or other investments, you’ll have a budget of $1.876M.

The following are some available new launches that fall within your budget but we would suggest that you consult an agent who can better advise after doing up your actual affordability, have a clearer understanding of your family situation and what’s the best move to make. Of course, you could also consider upcoming launches like Lentor Modern, Sceneca Residence, and Jalan Anak Bukit.

| Project | Tenure | District | Bedrooms | Size (sqft) | Level | Price | PSF |

| Bartley Vue | 99 years | 19 | 2 | 657 | #11 | $1,421,000 | $2,163 |

| Pasir Ris 8 | 99 years | 18 | 2 | 710 | #04 | $1,438,000 | $2,025 |

| Forett at Bukit Timah | Freehold | 21 | 2+S | 721 | #04 | $1,761,000 | $2,442.44 |

| The Landmark | 99 years | 3 | 2 | 764 | #17 | $1,798,888 | $2,354.57 |

| Watergardens at Canberra | 99 years | 27 | 3+S | 1324 | #05 | $1,752,000 | $1,323 |

| Mori | Freehold | 14 | 3 | 990 | #03 | #1,763,000 | $1,781 |

If you wish to purchase an investment property that you can immediately rent out to generate cash flow, these are some available resale projects on the market with decent rental yields. But do note that a good rental yield does not necessarily translate to good capital appreciation.

| Project | Tenure | District | Bedrooms | Size (sqft) | Asking price | Average rent | Rental Yield (After shaving 10%) |

| Pavilion Square | Freehold | 14 | 1 | 398 | $710,000 | $2,180 | 3.32% |

| #1 Suites | Freehold | 14 | 1 | 560 | $750,000 | $2,389 | 3.44% |

| Parc Botannia | 99 years | 28 | 2 | 667 | $1,088,888 | $3,500 | 3.47% |

| Bellewoods | 99 years | 25 | 2 | 786 | $943,200 | $3,050 | 3.49% |

| Whistler Grand | 99 years | 5 | 3 | 958 | $1,690,000 | $6,085 | 3.89% |

Conclusion

Buying over your dad’s house is unlikely going to work out unless you’ve a lot of cash on hand and wish to put it all into buying the property, but overall it’s still not a bad position to be in. Remember, even doing nothing is a decision in itself, and that could still work out well for you.

Given that you guys have an alternative place to stay, you can always rent out your place while waiting for a suitable investment property to come up. That allows you to get some cash flow in immediately, and you can take some time to study the market. A budget of $1.5-$1.8M is pretty decent and you do have quite a number of new launches coming up and even more resale options to choose from.

So the question really is if you can find a good investment property that would make sense for you to cash out now to plough the money back in. Because if there’s nothing out there that can get you better returns, holding on and renting it out wouldn’t be the worst decision in the world right now given the strength of the rental market.

Moving from a private property to a HDB in your retirement years is definitely good thinking. You would have fully paid up your property by the time you are 65 years old. Let’s say the property is worth $1.8M and you were to buy a HDB at $800K, that’s a million dollars worth of proceeds that can help to fund your retirement. It goes without saying that there will be other costs involved in the course of the transaction but you get the drift.

Lastly, just some food for thought – selling the terrace house could also be a viable option given the cost of construction right now. At some point, a landed home isn’t the most ideal for elderly (unless you’ve fitted in a lift and such), and it could be ideal to cash out on that and your current home to look for a more suitable place. This, of course, may not be the most financially rewarding option in the long run, but could be something that may be better suited lifestyle wise for the family.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Property Advice We’re In Our 50s And Own An Ageing Leasehold Condo And HDB Flat: Is Keeping Both A Mistake?

Latest Posts

On The Market A 40-Year-Old Prime District 10 Condo Is Back On The Market — As Ultra-Luxury Prices In Singapore Hit New Highs

Pro This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

Editor's Pick Happy Chinese New Year from Stacked

0 Comments