We Make $14k Per Month And Own A 57-Year-Old HDB: Should We Get A BTO, An EC, Or A Jumbo HDB?

Hi Stacked Homes,

We have a unique situation on hand and would love to hear your thoughts on this. My husband and I own a 3 room HDB flat in a very mature estate in Commonwealth that is 57 years old. We had gotten it as our first flat as we loved the area and it suited our budget and lifestyle (and we still do!).

With the age of our flat and the uncertainty of VERS, and considering plans to eventually start a family, we are now quite unsure of our next steps. We have a combined income of $14k now and about $100k in cash.

We are considering

a) applying for upcoming BTO in the area,

b) applying for EC in further areas, or

c) our neighbour had unfortunately passed away recently and there could be an opportunity to take over her flat and combine the two units into a jumbo flat.

For c) we could potentially rent out some rooms for an income before our family expands in the future.

Appreciate your thoughts on this!

Hi there,

Thanks for reaching out.

Given that your current combined income is just at the ceiling for a BTO and slightly below that for a new EC, it makes sense that you’re considering purchasing one while you’re eligible. The other option of buying your neighbour’s adjoining unit and converting it into a jumbo flat is indeed interesting, but there are several regulations you must meet before this can be done, which we’ll go through later.

As usual, let’s begin by assessing your affordability.

Affordability

Based on what you’ve provided, we assume you’re referring to the blocks along Commonwealth Close and Drive, which were completed in 1967.

These are some of the recent 3-room transactions:

| Date | Block | Level | Size (sqm) and unit model | Price |

| May 2024 | 83 | 13 to 15 | 60.00 Standard | $376,000 |

| May 2024 | 83 | 10 to 12 | 60.00 Standard | $400,000 |

| May 2024 | 89 | 07 to 09 | 69.00 Standard | $405,000 |

| May 2024 | 94 | 07 to 09 | 69.00 Standard | $330,000 |

| May 2024 | 94 | 07 to 09 | 60.00 Standard | $360,000 |

| Apr 2024 | 81 | 04 to 06 | 60.00 Standard | $350,000 |

| Apr 2024 | 84 | 07 to 09 | 58.00 Standard | $348,000 |

| Apr 2024 | 85 | 01 to 03 | 60.00 Standard | $320,000 |

| Apr 2024 | 86 | 01 to 03 | 58.00 Standard | $365,000 |

Since we don’t have your complete details, we will only estimate your loan and assume you have sufficient funds for the downpayment of an HDB or EC.

These estimated loan amounts apply as long as both of you are under 35 years old. For this calculation, we are using a fixed monthly combined income of $14K and an interest rate of 4.8%.

- Maximum loan for an HDB: $732,988 (25-year tenure)

- Maximum loan for an brand new EC: $800,510 (30-year tenure)

- Maximum loan for a resale EC/condo: $1,467,602 (30-year tenure)

Now, let’s examine the performance of the different property types you’re considering.

Performance of the different property types

BTO

Profits in terms of quantum:

| BTO Launch Year | 3-Room BTO Profit | 4-Room BTO Profit | 5-Room BTO Profit |

| 2004 | – | $528,167 | $593,270 |

| 2006 | – | $366,322 | – |

| 2007 | $363,937 | $435,099 | – |

| 2009 | $327,767 | $380,964 | $435,676 |

| 2011 | $237,129 | $312,859 | $255,104 |

| 2012 | $292,559 | $356,636 | $462,497 |

Profits in terms of quantum:

| BTO Launch Year | 3-Room BTO Profit | 4-Room BTO Profit | 5-Room BTO Profit |

| 2001 | – | $251,545 | $208,907 |

| 2002 | – | $330,729 | – |

| 2003 | – | $296,615 | – |

| 2004 | $289,318 | $390,603 | – |

| 2005 | $261,652 | $327,522 | – |

| 2006 | $246,087 | $264,044 | – |

| 2007 | $220,114 | $230,054 | $399,500 |

| 2008 | $178,243 | $190,973 | $209,709 |

| 2009 | $183,958 | $191,906 | $233,264 |

| 2010 | $205,243 | $212,946 | $281,209 |

| 2011 | $199,008 | $255,454 | $320,921 |

| 2012 | $221,369 | $267,129 | $333,526 |

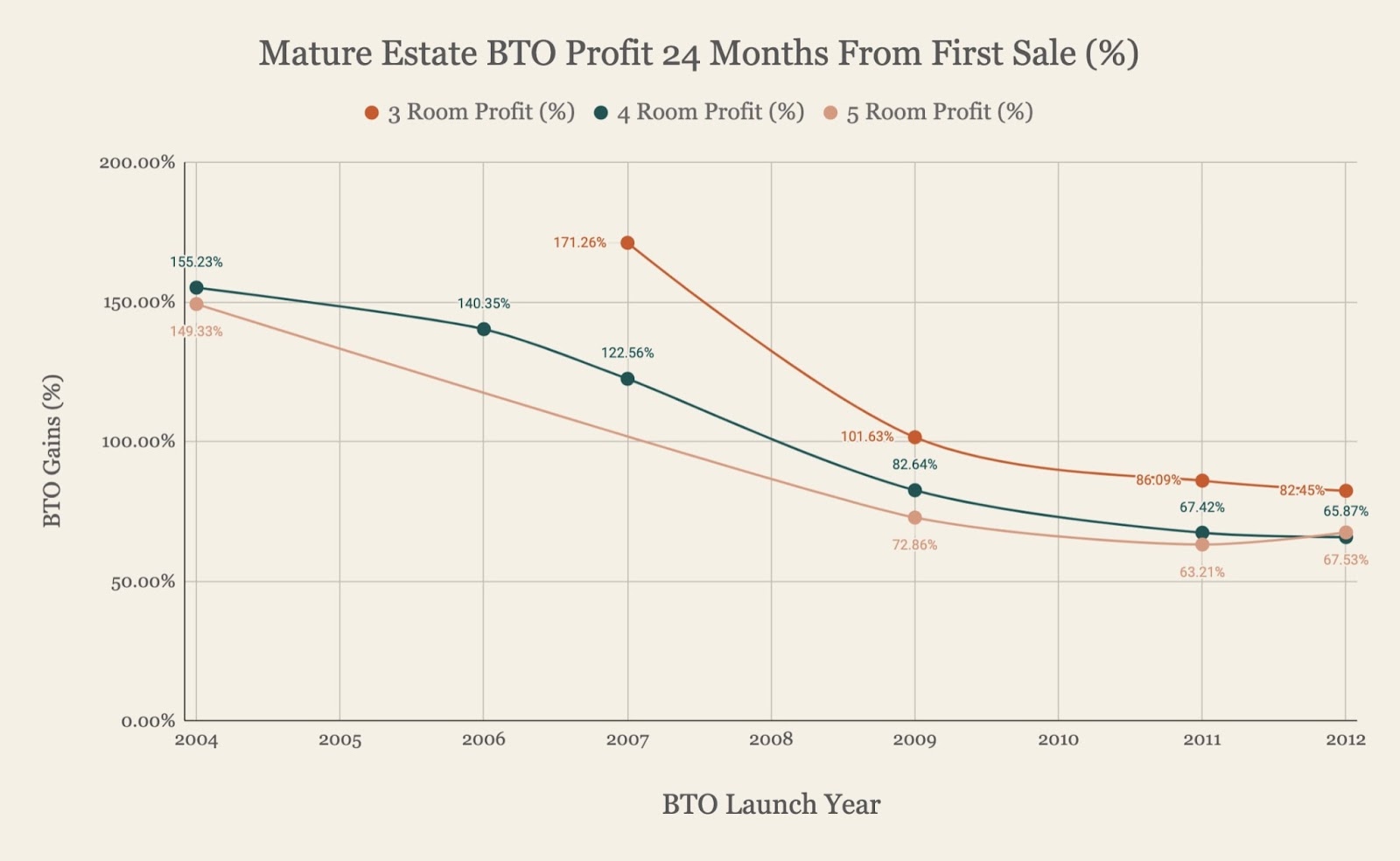

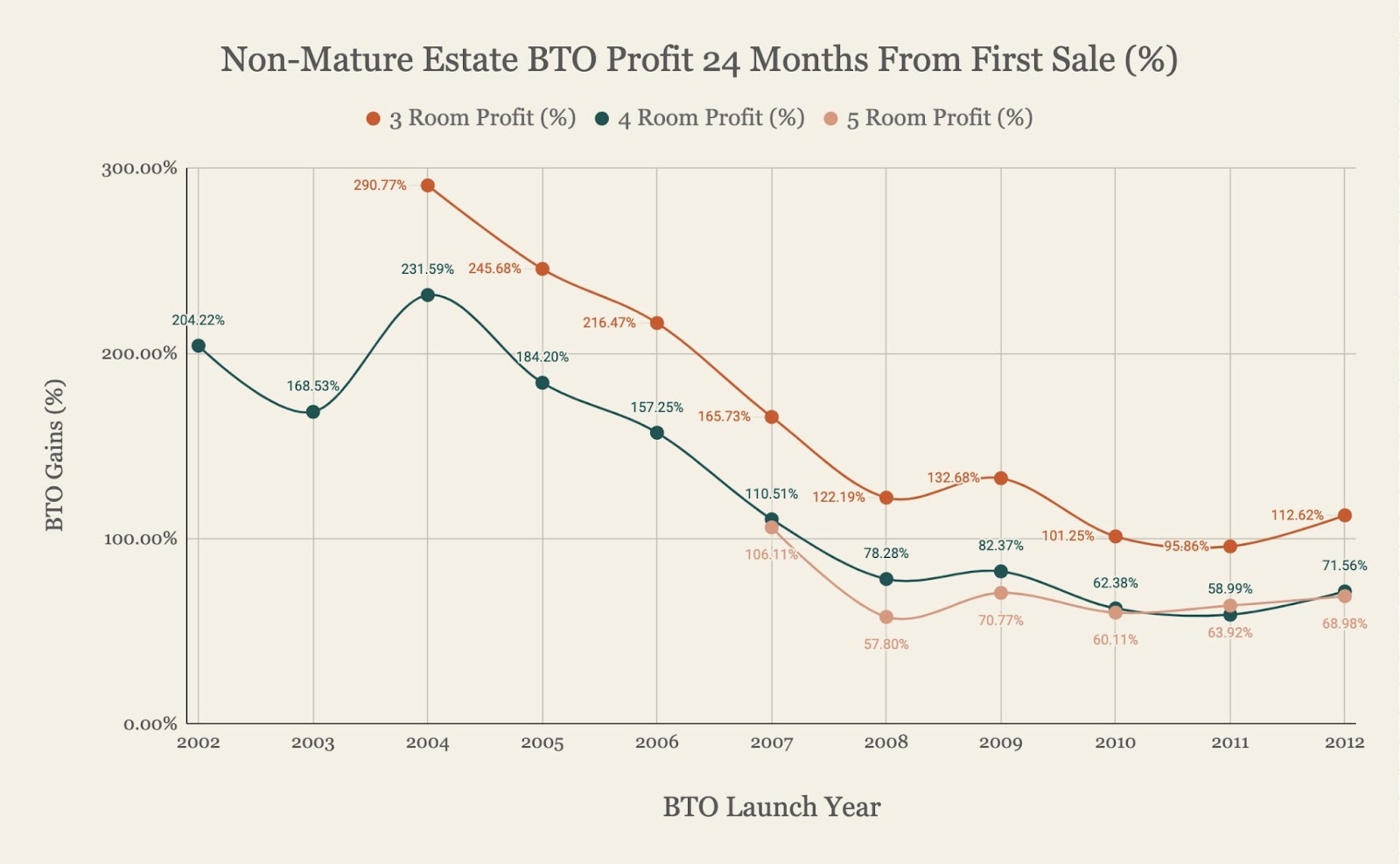

We have previously written an article discussing the profitability of BTO flats. Although the profit margins have decreased over the years, most units typically yield at least a 60% profit.

Jumbo HDBs

| Year | Jumbo HDB (resale)* | YoY | All HDB (resale) | YoY |

| 2013 | $423 | – | $469 | – |

| 2014 | $409 | -3.31% | $441 | -5.97% |

| 2015 | $399 | -2.44% | $423 | -4.08% |

| 2016 | $404 | 1.25% | $424 | 0.24% |

| 2017 | $407 | 0.74% | $425 | 0.24% |

| 2018 | $406 | -0.25% | $419 | -1.41% |

| 2019 | $397 | -2.22% | $416 | -0.72% |

| 2020 | $403 | 1.51% | $431 | 3.61% |

| 2021 | $452 | 12.16% | $488 | 13.23% |

| 2022 | $497 | 9.96% | $532 | 9.02% |

| 2023 | $526 | 5.84% | $564 | 6.02% |

| Average | – | 2.32% | – | 2.02% |

*Here we defined Jumbo flats as units sized above 1,400 sq ft so they may possibly also include some larger-sized Executive units

Compared to HDB flats in general, Jumbo flats have shown a slightly better growth rate over the last 10 years. These flats, predominantly found in areas like Woodlands and Yishun, were introduced by HDB in 1989 to address an oversupply of unsold units before the BTO system was implemented.

As Jumbo flats in the Central Region tend to be older, let’s also look at their performance specifically. To be more specific, we will focus on Bukit Merah and Queenstown since you’re contemplating buying over your neighbour’s unit.

| Year | Jumbo HDB (Bukit Merah, Queenstown)* | YoY |

| 2013 | $555 | – |

| 2014 | $553 | -0.36% |

| 2015 | $563 | 1.81% |

| 2016 | $567 | 0.71% |

| 2017 | $551 | -2.82% |

| 2018 | $552 | 0.18% |

| 2019 | $546 | -1.09% |

| 2020 | $568 | 4.03% |

| 2021 | $581 | 2.29% |

| 2022 | $673 | 15.83% |

| 2023 | $677 | 0.59% |

| Average | – | 2.12% |

*Here we defined Jumbo flats as units sized above 1,400 sq ft so they may possibly also include some larger-sized Executive units

We can see that the performance of Jumbo units in Bukit Merah and Queenstown is still comparable to the overall performance of the flat type. While having a Jumbo flat in Queenstown is rare, it doesn’t eliminate concerns about lease decay, especially given that a 57-year-old flat is considerably old.

Next, let’s look at an EC.

Executive Condominiums (EC)

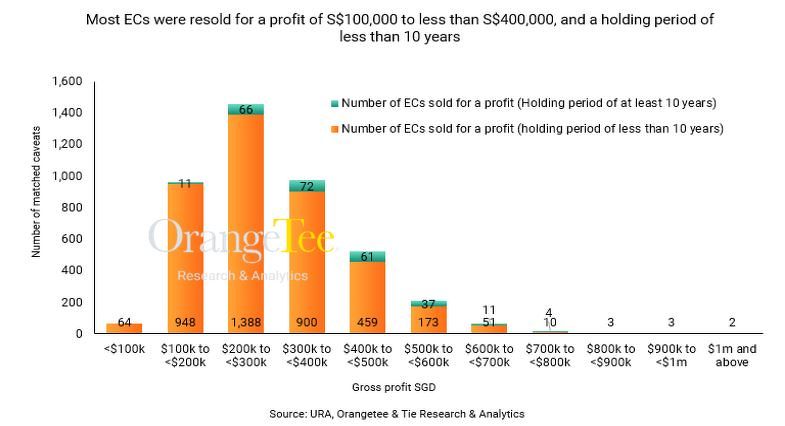

In a report done by Orangetee & Tie, they analysed new sale caveats from 2007 to August 21, 2022, and matched them with the resale caveats (if any) of the same units during that period. They found that 99.9% of a sampled 4,266 ECs were resold for a gross profit, averaging around S$300,000 each. Among these, 294 units generated a gross profit of at least S$500,000 each.

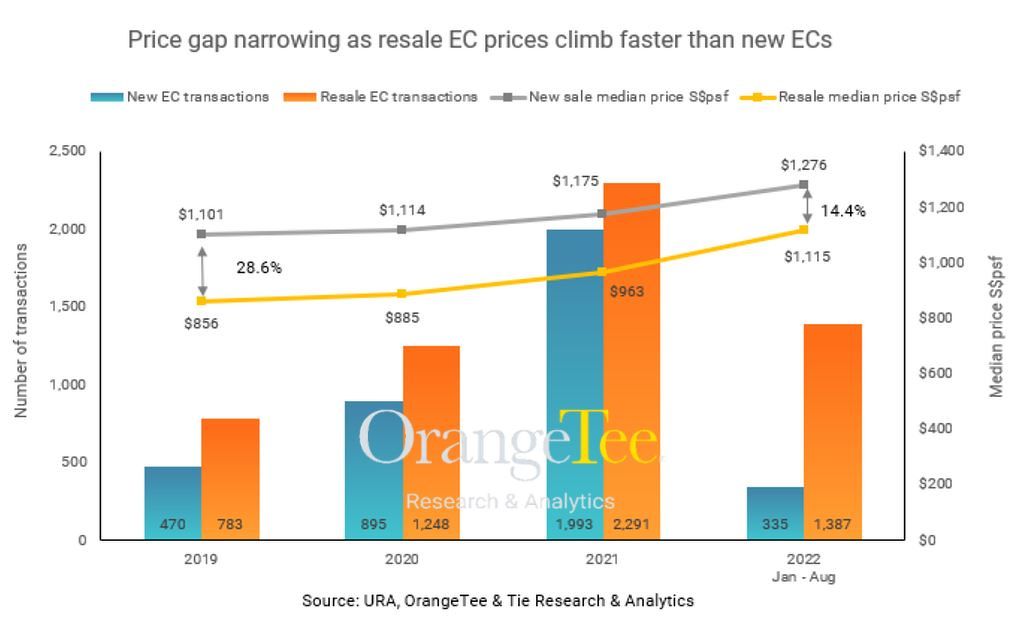

The report also talked about how prices of resale ECs are moving faster than new launch ECs suggesting that there is a strong demand for this category of property.

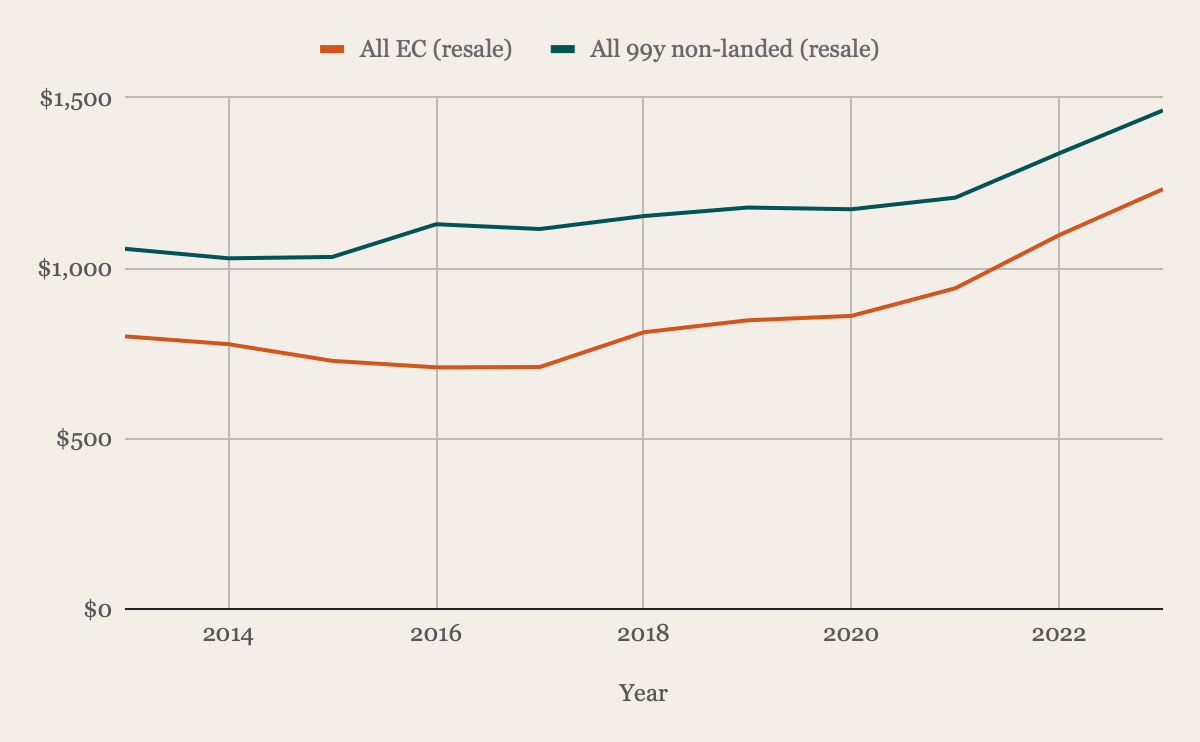

| Year | All EC (resale) | YoY | All 99y non-landed (resale) | |

| 2013 | $800 | – | $1,057 | – |

| 2014 | $777 | -2.88% | $1,029 | -2.65% |

| 2015 | $728 | -6.31% | $1,033 | 0.39% |

| 2016 | $709 | -2.61% | $1,129 | 9.29% |

| 2017 | $710 | 0.14% | $1,115 | -1.24% |

| 2018 | $812 | 14.37% | $1,153 | 3.41% |

| 2019 | $847 | 4.31% | $1,178 | 2.17% |

| 2020 | $860 | 1.53% | $1,173 | -0.42% |

| 2021 | $941 | 9.42% | $1,207 | 2.90% |

| 2022 | $1,097 | 16.58% | $1,337 | 10.77% |

| 2023 | $1,232 | 12.31% | $1,463 | 9.42% |

| Average | – | 4.69% | – | 3.40% |

When examining the price movements of resale ECs compared to all 99-year leasehold non-landed private properties, it’s evident that the former has outpaced the latter in terms of its average growth rate over the past decade.

Next, let’s take a look at some factors you need to consider:

Factors to consider

Objective of purchase

First, you will need to be clear about your primary objective. We assume that purchasing a BTO or a new EC is primarily for capital gains while you are still eligible. However, the prospect of acquiring your neighbour’s house and transforming it into a Jumbo unit, despite your block being 57 years old, suggests that your priority may lean more towards expanding your living space rather than solely focusing on capital appreciation.

It’s crucial to determine which aspect holds greater importance for you as clarifying this will help you narrow down your options effectively.

Holding period

Another crucial consideration is the duration for which you plan to hold the property. If your intention is a short-term stay, notable fluctuations in property prices are unlikely unless there’s a unique event like the pandemic. In such cases, purchasing an older property may not pose a significant concern.

However, if your plan involves a more extended stay, especially given your mention of starting a family, opting for a newer property might be more sensible.

Resale levy

If you utilised CPF housing grants when buying your current property, acquiring a second subsidised property like a BTO or new EC would entail paying a resale levy. For a 3-room HDB purchased after 2006, this levy amounts to $30,000, payable in cash.

Availability of alternative accommodation

Purchasing a BTO shouldn’t pose an issue since you have $100K in cash, sufficient to cover the initial 10% down payment (for an HDB loan; it’s 20% for a bank loan) and Buyer’s Stamp Duty (BSD). The remaining down payment is only due upon key collection. Thus, you may not need funds from your existing property for the purchase and can continue residing there until key collection.

In the recent BTO launch in February, 4-room flats at Tanglin Halt Courtyard were priced between $565,000 to $720,000, with an average price of $642,500. Consequently, the BSD amounts to $13,335, while the 10% down payment totals $64,250, summing up to $77,585. If you plan to take a bank loan, additional funds from your CPF accounts might be necessary.

When considering a new EC purchase, you’ll likely require funds from your current property for the down payment and BSD. If so, and if you lack alternative accommodation, renting during the construction period could lead to significant expenses.

Unable to select locations and element of luck

If you’re considering purchasing a BTO or a brand new EC, you lack control over the launch locations, which may or may not align with your preferences. Furthermore, both are based on a ballot system, so there’s no assurance of securing your preferred unit or any unit at all.

Now, let’s analyse the potential costs and gains for the three options.

Potential costs

Option 1. Buy a BTO

Suppose the purchase price is $642,500, which is the average price for a 4-room flat at Tanglin Halt Courtyard, launched during the BTO exercise in February this year.

Here, we’ll assume that you opt for an HDB loan and retain the property for a duration of 10 years.

| Purchase price | $642,500 |

| BSD | $13,875 |

| 20% down payment | $128,500 |

| 80% loan | $514,000 |

Costs incurred

| Description | Amount |

| BSD | $13,875 |

| Interest expense (Assuming 2.6% interest and 25-year tenure) | $113,081 |

| Property tax | $4,510 |

| Town council service & conservancy fees (Assuming $77/month) | $9,240 |

| Total costs | $140,706 |

Option 2. Buy a brand new EC

Looking at the latest EC launch, Lumina Grand, at the moment, their 936 sq ft 3-bedders are asking around $1.36M – $1.46M. For calculation purposes, let’s use the average price of $1.41M as the purchase price and similarly assume a 10-year holding period.

| Purchase price | $1,410,000 |

| BSD | $41,000 |

| 25% down payment (minimally 5% in cash) | $352,500 |

| 75% loan | $1,057,500 |

| Stage | % of purchase price | Disbursement amount | Monthly estimated payment | Monthly estimated interest | Monthly estimated principal | Duration | Total interest cost |

| Completion of foundation | 5.00% | $70,500 | $102 | $235 | $337 | 6-9 months (from launch) | $2,115 |

| Completion of reinforced concrete | 10.00% | $141,000 | $305 | $705 | $1,010 | 6-9 months | $6,345 |

| Completion of brick wall | 5.00% | $70,500 | $406 | $940 | $1,346 | 3-6 months | $5,640 |

| Completion of ceiling/roofing | 5.00% | $70,500 | $508 | $1,175 | $1,683 | 3-6 months | $7,050 |

| Completion of electrical wiring/plumbing | 5.00% | $70,500 | $609 | $1,410 | $2,019 | 3-6 months | $8,460 |

| Completion of roads/car parks/drainage | 5.00% | $70,500 | $711 | $1,645 | $2,356 | 3-6 months | $9,870 |

| Issuance of TOP | 14.36% | $352,500 | $1,219 | $2,820 | $4,039 | Usually one year until CSC | $33,840 |

| Certificate of Statutory Completion (CSC) | 15.00% | $211,500 | $1,524 | $3,525 | $5,049 | Until property is sold (66 months) | $232,650 |

| Total interest paid in 10 years* | $305,970 |

*This is assuming a 4% interest and 30-year tenure

Costs incurred

| Description | Amount |

| BSD | $41,000 |

| Interest expense (Assuming 2.6% interest and 25-year tenure) | $305,970 |

| Property tax | $10,260 |

| Maintenance fees (Assuming $350/month) | $25,200 |

| Total costs | $382,430 |

*Property tax and maintenance fees are only payable after the project obtains its TOP

Option 3. Buy over neighbour’s flat and convert into a Jumbo unit

There are several things to take note of when purchasing an adjoining flat and converting it into a Jumbo.

You can read more on that here.

As we do not know your current outstanding loan amount, we will not be able to provide an accurate calculation.

We will assume the following:

- The outstanding loan for the current property is $150,000

- The adjoining unit is purchased at $361,556 which is the average price for a 3-room flat along Commonwealth Close and Drive (for April and May 2024)

- You’re taking an HDB loan

- The valuation of the converted flat is $723,112 (As there are no such transactions in the Commonwealth/Queenstown area, we are just making a simple assumption of $361,556 X 2)

- You rent out 2 of the bedrooms at $1,000 each for the first 5 years

| Purchase price | $361,556 |

| BSD | $5,446 |

| 20% down payment | $72,311 |

| 80% loan | $289,245 |

| New loan (Including outstanding loan) | $439,245 |

Costs incurred

| Description | Amount |

| BSD | $5,446 |

| Interest expense (Assuming 2.6% interest and 25 year tenure) | $96,635 |

| Property tax | $5,480 |

| Town council service & conservancy fees (Assuming $77/month) | $9,240 |

| Rental income | $120,000 |

| Agency fees (Payable once every 2 years) | $6,540 |

| Total costs | $3,341 |

What should you do?

As previously mentioned, your choice among the options hinges on your purchasing objective and the duration you plan to hold the property.

If prioritising capital appreciation, Options 1 and 2 present your best options. This is because BTOs historically result in a larger gain compared to resale HDBs (no one loses money on BTOs). Particularly if you anticipate a longer stay due to starting a family, opting for a younger property would be logical.

For Option 1, securing a BTO in your current locale might entail adherence to Prime Location Public Housing (PLH) guidelines, subjecting you to regulations like a 10-year MOP and potential subsidy recovery upon sale. These rules are aimed at mitigating the lottery effect for BTOs in the central region. Nonetheless, this option allows you to reside in your current residence until BTO completion, given your financial readiness for the initial payments, assuming an HDB loan is taken.

In contrast, Option 2 necessitates liquidating your current property to finance the purchase, potentially incurring substantial rental expenses without an alternate residence.

Regarding Option 3, limited historical data on Jumbo units in Queenstown impedes definitive performance forecasts despite the property’s uniqueness. However, this alternative offers increased living space and familiarity with the neighbourhood, with potential rental income offsetting expenses.

We hope that our analysis will help you in your decision-making. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Read next from Editor's Pick

New Launch Condo Reviews Arina East Residences Review: First Condo Launch in Tanjong Rhu in 13 Years, Near MRT Station

Property Market Commentary 4 Potential Residential En Bloc Sites That Could Be Worth Watching In 2025

Landed Home Tours We Tour Freehold Landed Homes Within 1km Of Tao Nan & CHIJ Katong (From $3.88M In 2021)

Property Investment Insights Why I Bought A $1.45 Million 2-Bedder At ELTA: A Buyer’s Case Study

Latest Posts

Landed Home Tours Touring Onan Road, A Freehold Landed Estate With A “Hidden” Enclave Of Shophouses

Singapore Property News In a Weak Economy, This Policy Hurts Singaporean Homeowners Most

Overseas Property Investing I’m A Singaporean House-Hunting In Mexico City: Here’s What 2 Weeks On The Ground Taught Me

Homeowner Stories I’ve Lived In Braddell View For 14 Years: What It’s Like To Live In Singapore’s Largest Residential Site

Singapore Property News Rare Mixed-Use Site At Hougang MRT And New Sembawang EC Plot Just Launched: What You Need To Know

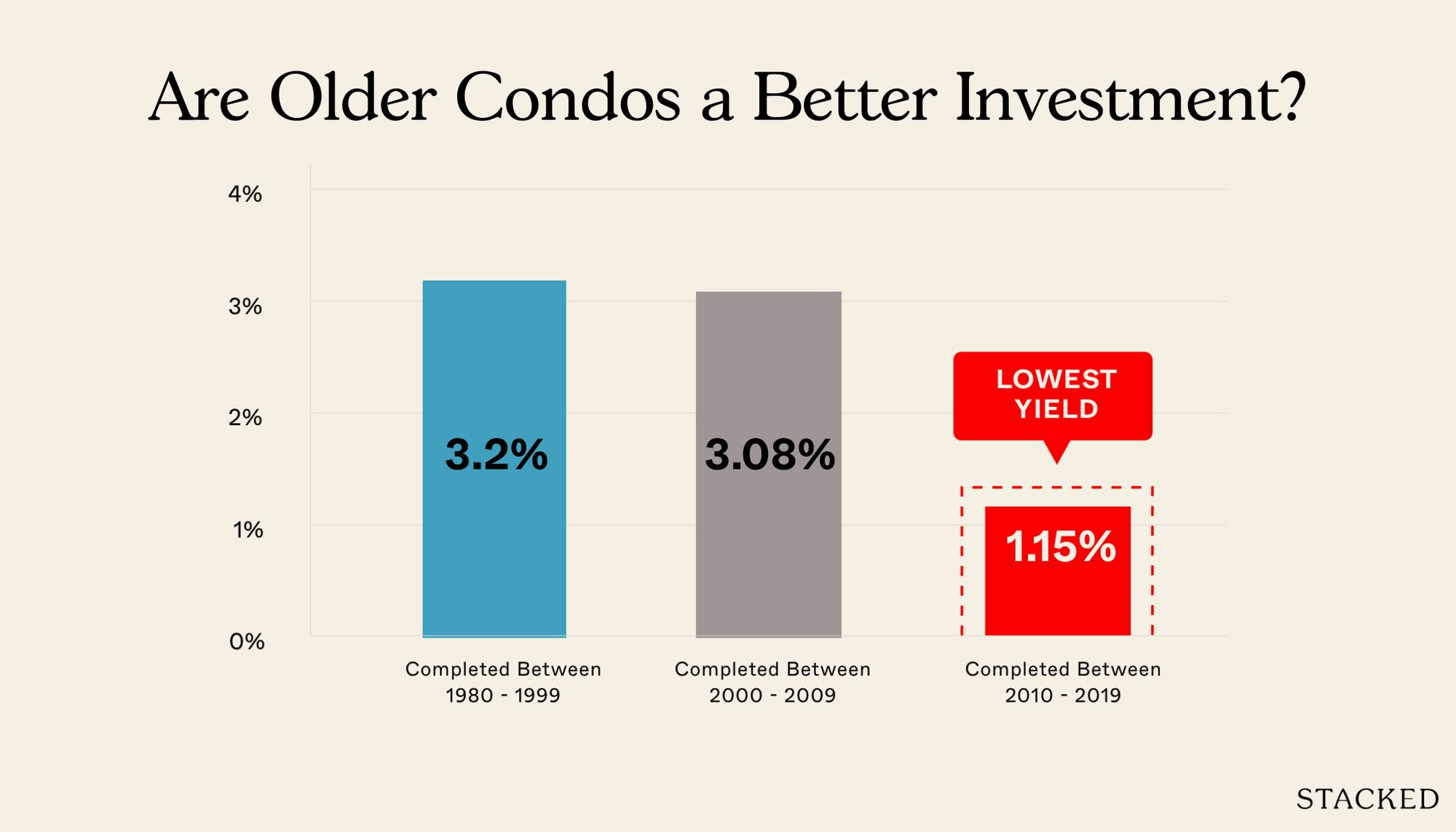

Property Investment Insights Why Some 30-Year-Old Leasehold Condos Are Still Outperforming New Ones

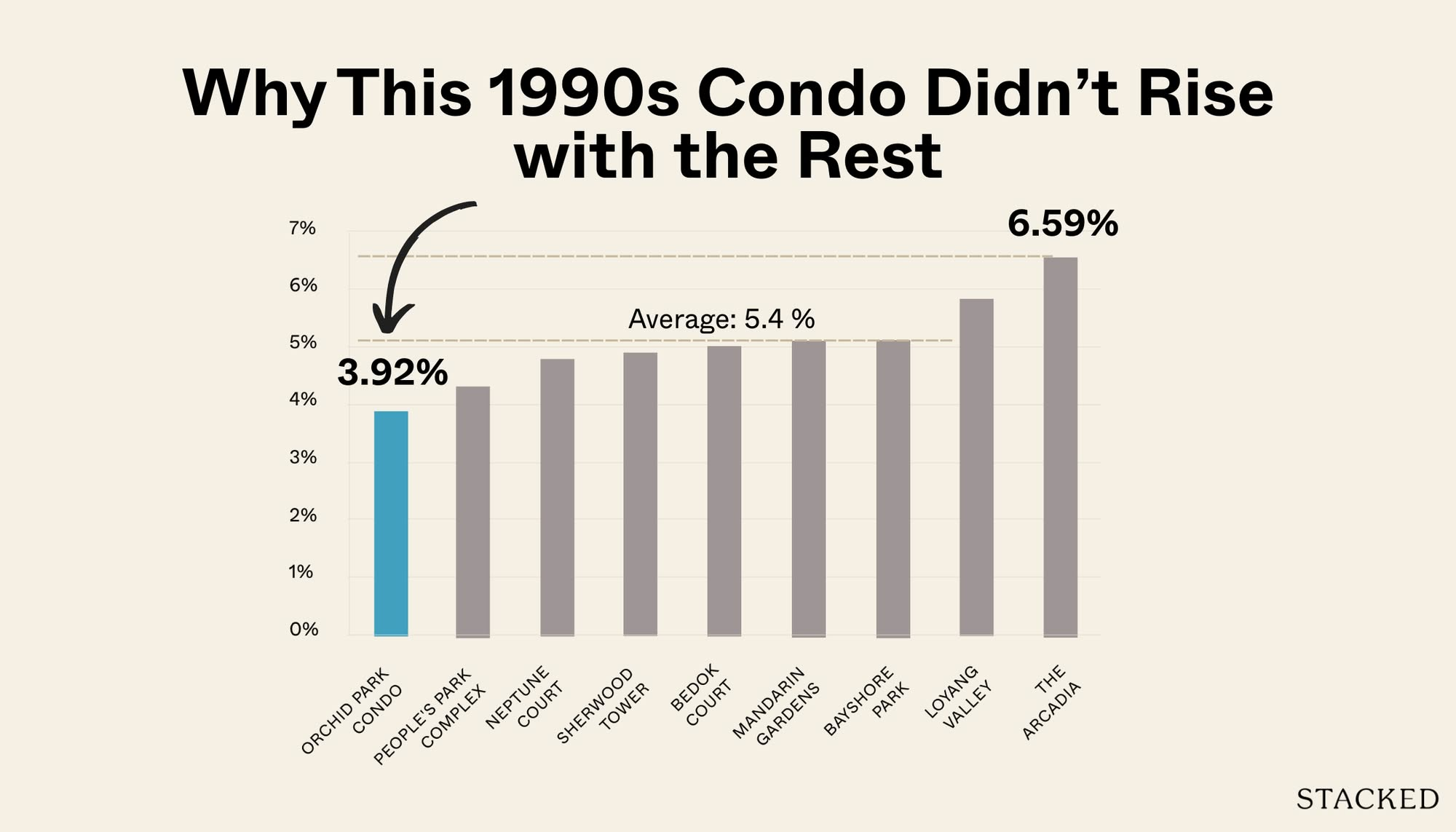

Pro How Do Old Leasehold Condos Hold Up Against Newer Projects? A Case Study Of Orchid Park

On The Market 5 Cheapest 4 Room HDB Flats In Central Singapore (From $495K)

Homeowner Stories Why These Buyers Chose Older Leasehold Condos—And Have No Regrets

Singapore Property News $1.16M For A 4-Room HDB In Clementi? Why This Integrated Development Commands Premium Prices

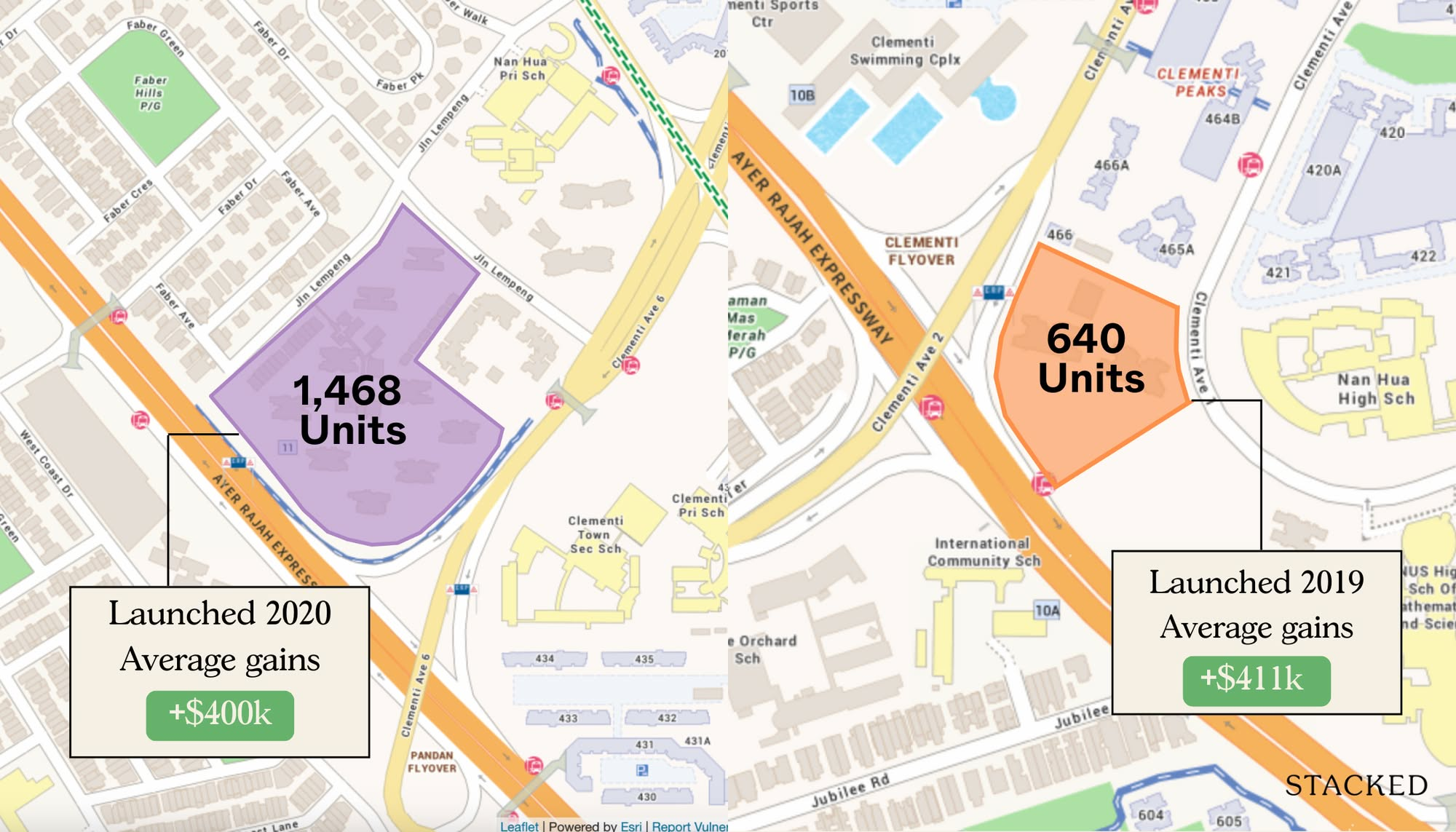

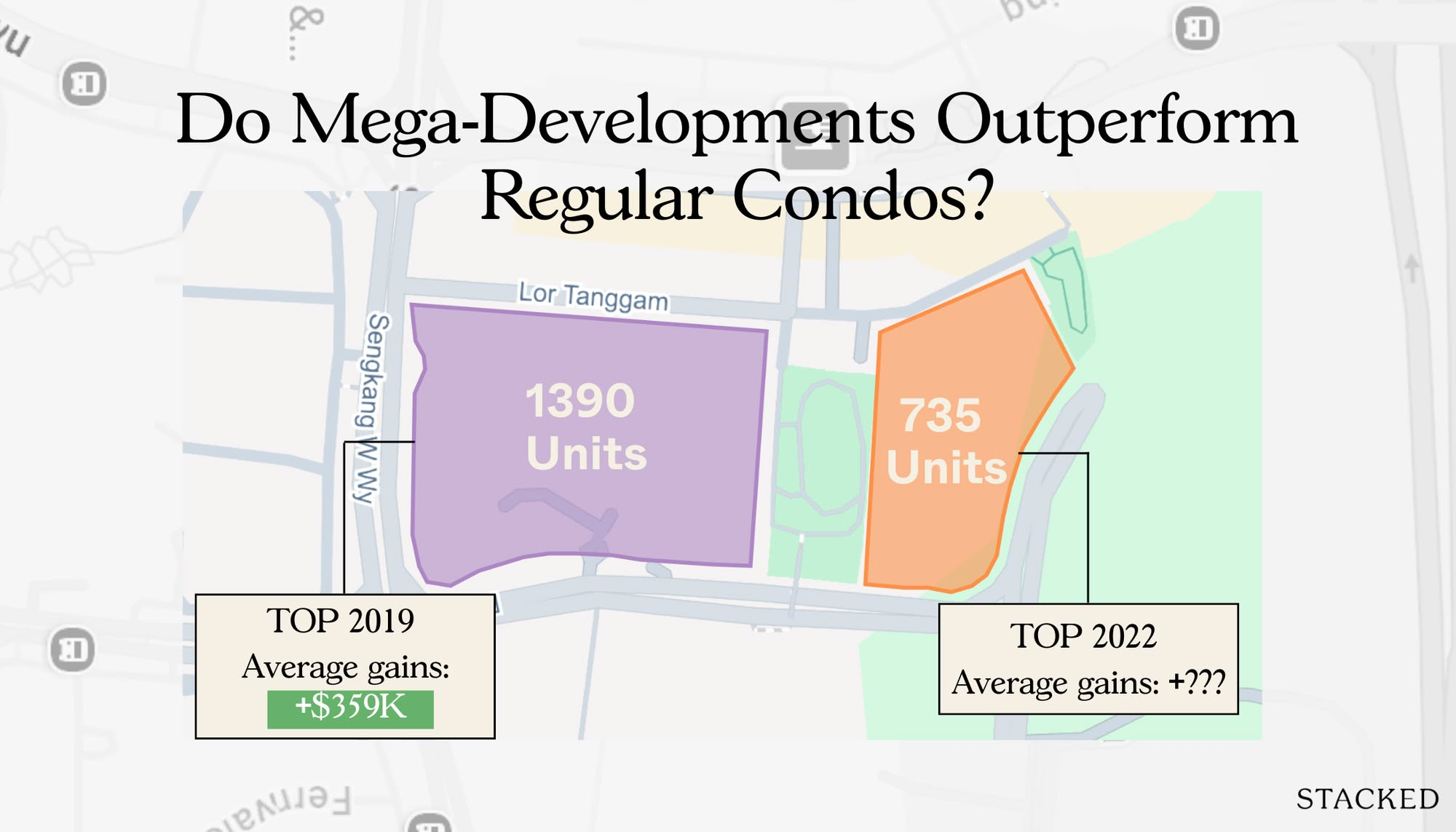

Pro Do Mega-Developments Really Outperform Regular Condos? A Parc Clematis Vs Clavon Case Study

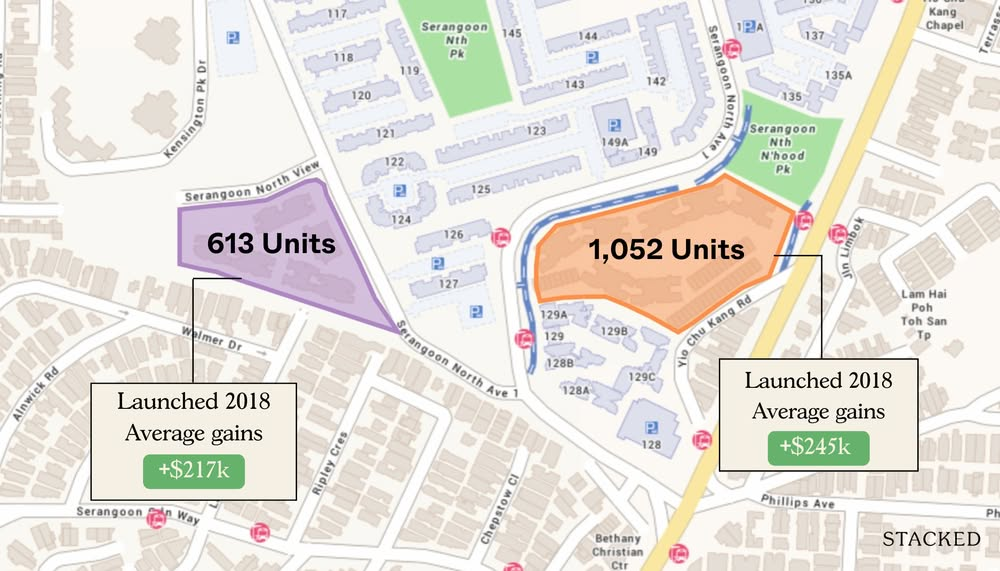

Pro Affinity at Serangoon vs The Garden Residences: Same Launch Year, Same Location — But Which Gave Better Capital Gains?

Property Market Commentary Can Singapore’s Housing Market Handle A Rapidly Ageing Population?

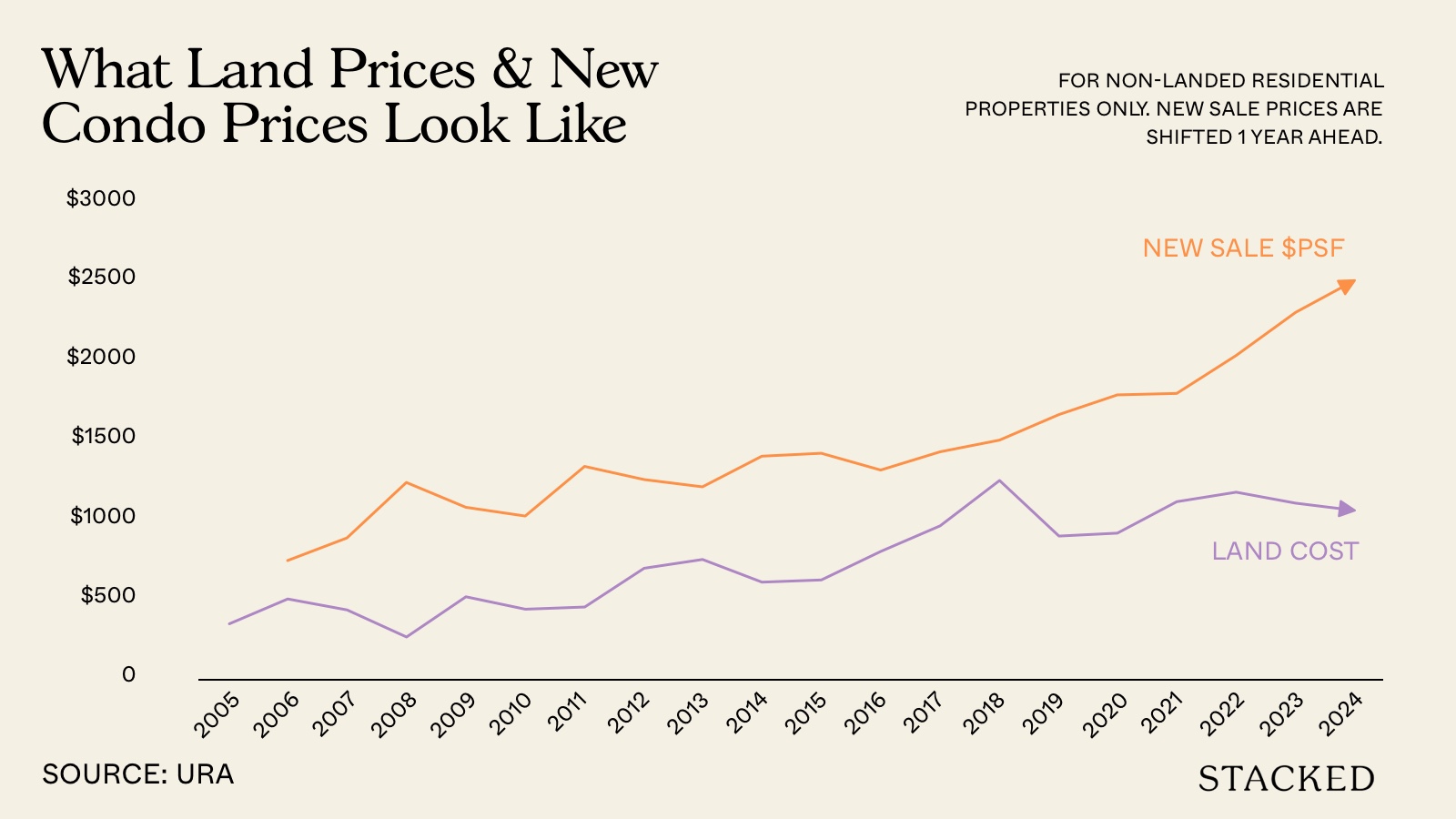

Singapore Property News Why Lower Land Prices In Singapore Don’t Mean Cheaper New Condos

Property Investment Insights Can You Upgrade From An HDB To A $1.8M Condo In 2025? Here’s What It Takes

No, you should be able to buy a good-class bungalow instead.