We Have A $1.1 Million Budget And Want To Retire In A 3-Room HDB In Marine Parade: Should We Buy A New Launch Before Downgrading?

October 27, 2023

Hey Ryan,

I have been following your YT channel very closely and have to say that it is extremely insightful unlike other property YT channel

Me and my partner ( we are in our late forties) have been looking around recently.

My partner is keen to look for a place in MP likely a 3 room. However, we have been discouraged from some agents citing:

- too young to be buying a home in MP

- given the age possible to ” flip” once before settling down in MP

- MP houses are pretty inflated this year

Given the above recommendation, we decided to start on our house hunt.

Options incl:

- small 1 bedder new launch and ” flip” once it TOP and then downgrade to MP HDB

- buy a rentable unit and make some money from rent before selling it off and eventually settling down in MP

For some reason, we are keen to explore old development like people’s park complex. It is currently selling at ard $600,000 for a 500 SQFT unit. The rental accordingly to property guru is $1700-1900 per room ( 200 sqft)

It kinda make sense to us looking at the numbers as a form of investment

To just clarify, I do have my own private house now and sorry when I said we, I meant I was on this housing hunt journey with him but I am unable to buy any house now since I already own one.

I am 49 and my partner is 48 this year.

Our eventual plan in the next 5-10 years will be for me ( and him) to downgrade to resale HDB together and retire

He is able to loan up to 768K presently and we are ready to invest around 150K ish cash. It really depends again because I am happy to co invest in this investment so may be able to chip in more but just for the sake of shortlisting properties I would say anyway within 1.1 M ish should be comfortable.

Unfortunately he moved his OA to SA few years back and currently only has around 70K in OA.

Given his age, we need to plan very carefully since things will change once he reaches age 55 and we need correct accurate information in order to make informed decisions.

“New launch versus Resale” is one pressing question now.

In addition, we are also keen on old development with strategic location like the Chinatown Complex. Was thinking rental yield may be decent, however, exit might be challenging. Wouldn’t want to be stuck with this for years.

I hope the above info is sufficient and let me know if you require more info.

Many thanks!

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hi there,

First off, thank you for the kind words about our YouTube channel. We are happy to hear that you’ve found it useful!

While some agents might have discouraged you from purchasing in Marine Parade due to your age, the most important aspect is understanding your long-term goals. If you’ve always wanted to settle down/retire in Marine Parade anyway, being able to “flip” a property one more time before doesn’t change the age of the houses you are looking at – the only question is if you would outlive the lease of the home.

Also, opting for another property investment with the aim of turning a profit in the short term carries a certain degree of risk, as profitability isn’t guaranteed. If the property doesn’t yield the expected profit within your intended holding period, it could potentially impact your partner’s plan to acquire the next property before turning 55.

To begin, we’ll assess your partner’s affordability before delving into a more detailed discussion of the options you’re contemplating.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

| Estimated loan | $768,000 |

| CPF funds | $70,000 |

| Cash | $150,000 |

With his combined CPF funds and cash totaling $220,000, which he plans to use for the 25% downpayment, he can potentially purchase a property worth up to $880,000. This is despite his eligibility to borrow up to $768,000.

Since you’ve mentioned that you are open to chipping in on the purchase and a price of $1.1M is comfortable, we will assume you have the funds required. In order to purchase a $1.1M property, the 25% downpayment will be $275,000, which will require a top up of $55,000 and there will be a loan shortfall of $57,000 since his maximum loan quantum is less than 75% of the purchase price. In addition, the BSD payable is $28,600. This totals up to an additional $140,600 needed.

As you brought up the point that things will change when he is 55 years old, we presume that the plan is to sell this property and purchase the next one before that happens. So we will use a holding period of 5 years for the next property.

Let’s look at how his loan quantum will change 5 years down the road. Working backwards on his current loan, assuming an interest rate of 4.6%, we take that his income is likely around $9,800.

| Maximum loan based on monthly income of $9,800 at age of 53, with a 4.6% interest | $595,611 |

| CPF funds (refunded from the sale of the next property, includes accrued interest) | $79,199 |

We can see here that in 5 years time, his eligible loan quantum will reduce by around 22%. This would mean more cash and/or CPF will be required for the purchase. However, seeing as the plan is to eventually buy a 3-room HDB in Marine Parade, this may not be an issue. Based on the Q2 HDB resale statistics, an average 3-room HDB in Marine Parade costs $425,000.

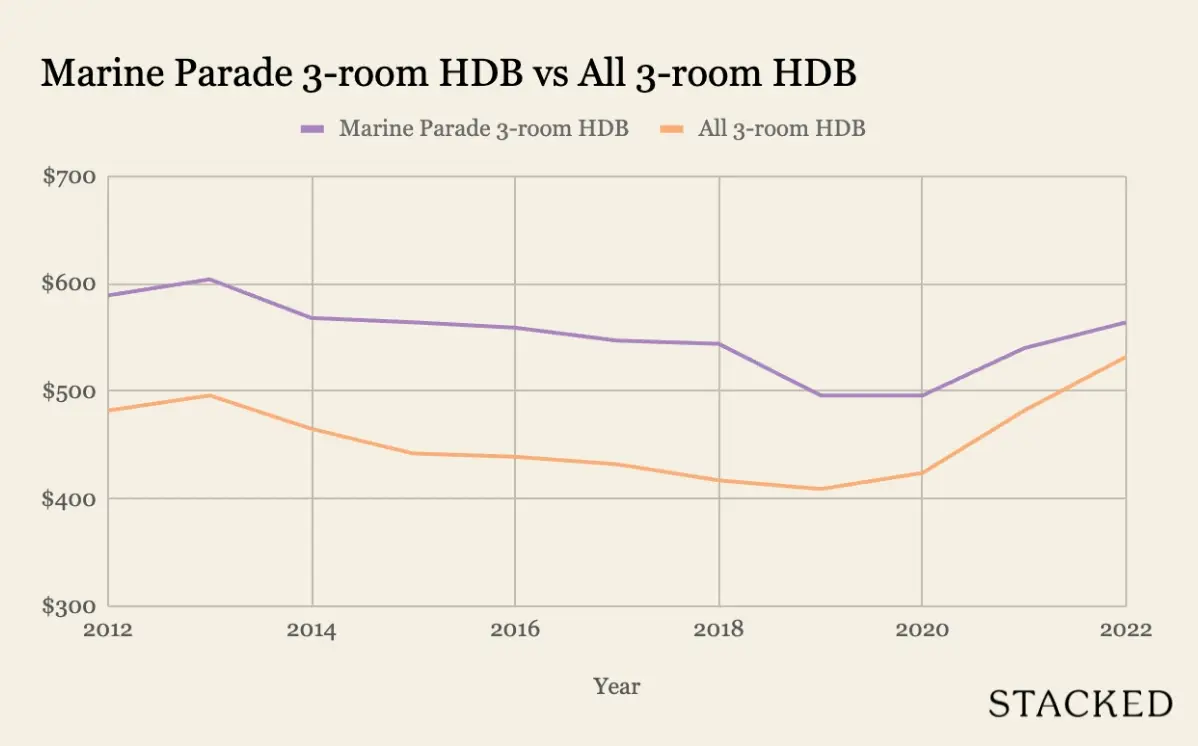

Marine Parade Price Trend

| Year | Marine Parade 3-room HDB Avg PSF | YoY | All 3-room HDB Avg PSF | YoY |

| 2012 | $589 | – | $482 | – |

| 2013 | $604 | 2.55% | $496 | 2.90% |

| 2014 | $568 | -5.96% | $465 | -6.25% |

| 2015 | $564 | -0.70% | $442 | -4.95% |

| 2016 | $559 | -0.89% | $439 | -0.68% |

| 2017 | $547 | -2.15% | $432 | -1.59% |

| 2018 | $544 | -0.55% | $417 | -3.47% |

| 2019 | $496 | -8.82% | $409 | -1.92% |

| 2020 | $496 | 0.00% | $424 | 3.67% |

| 2021 | $540 | 8.87% | $482 | 13.68% |

| 2022 | $564 | 4.44% | $532 | 10.37% |

| Annualised | – | -0.43% | – | 0.99% |

Looking at the above graph and table, it becomes apparent that while the prices of 3-room HDBs in Marine Parade follow a similar trend to those across the island, their annualised growth rate over the past decade is negative.

Given that most 3-room HDBs in Marine Parade were built in 1975 and 1976, they are now 47 to 48 years old. Many people would consider this quite old for HDB flats. While prices did rise over the past two years following the pandemic and as the market began its recovery, demand for these older flats might decrease.

You’ll also see that in 2022, the average $PSF of Marine Parade 3-room flats failed to exceed the highs in 2013 whereas the overall market managed to do so. This is a telltale sign that the flats here would continue to struggle in capital appreciation relative to the overall market.

Marine Parade certainly possesses its unique charm, but this may not be adequate to sustain demand in the long term. The fact that there is a shorter remaining lease on these flats translates to reduced loans and CPF Housing Grants for younger buyers, increasing the necessity for a larger upfront cash and/or CPF payment. Consequently, this is likely to significantly shrink the potential buyer pool.

However, if your intention is to purchase this property as your retirement home, the lease decay might not be a major concern for you. It may even make sense not to purchase it now given the relative lacklustre appreciation and perhaps channel your funds elsewhere with better growth potential and circle back to the 3-room flats again.

With that, let’s run through the options you’re considering.

Options

Option 1. Buy a new launch and sell upon TOP

With the abundance of content extolling the benefits of purchasing a new property, there is a common misconception among buyers that investing in a new launch is a guaranteed success. While there are certainly advantages to buying new launches, their profitability is certainly not a sure thing. We have previously addressed this topic in an article, which you can explore here.

One of the advantages of property investment is the potential to leverage a loan, particularly with a new launch, where the interest expenses incurred during the construction phase are lower due to the progressive payment plan. However, given the current elevated interest rates, it may not be the most opportune time to take on a substantial mortgage loan, especially for an investment property. Given your short holding period, it’s less likely the interest rates will see a significant drop.

Another important consideration is what to do if the property isn’t profitable upon TOP, or rather, the wrong time to be selling. Do you rent it out, temporarily move in, or sell it at a loss? Opting for the first two options would extend your holding period indefinitely and could impact your partner’s plan to make a subsequent purchase before turning 55.

Nevertheless, let’s take a look at what’s available on the market.

At the moment, there are only 2 new launches with 1-bedroom units under $1.1M:

| Project | District | Tenure | Estimated TOP | Unit type | Size (sqft) | Price |

| Gems Ville | 14 | Freehold | 2025 | 1b | 517 | $1,048,000 |

| The Lake Garden Residences | 22 | 99-years | 2027 | 1 + study | 527 | $1,069,800 |

Let’s presume your partner buys the unit at The Lake Garden Residences and sells it after the 3-year SSD period.

| Purchase price | $1,069,800 |

| BSD | $27,392 |

| Maximum loan | $768,000 |

| CPF funds | $70,000 |

| Cash required | $259,192 |

Progressive payment plan

| Stage | % of purchase price | Disbursement amount | Monthly estimated payment | Monthly estimated interest | Monthly estimated principal | Duration |

| Completion of foundation | 1.80% | $19,150 | $62 | $73 | $135 | 6-9 months (from launch) |

| Completion of reinforced concrete | 10% | $106,980 | $409 | $484 | $892 | 6-9 months |

| Completion of brick wall | 5% | $53,490 | $582 | $689 | $1,271 | 3-6 months |

| Completion of ceiling/roofing | 5% | $53,490 | $756 | $894 | $1,649 | 3-6 months |

| Completion of electrical wiring/plumbing | 5% | $53,490 | $929 | $1,099 | $2,028 | 3-6 months |

| Completion of roads/car parks/drainage | 5% | $53,490 | $1,102 | $1,304 | $2,406 | 3-6 months |

| Issuance of TOP | 25% | $267,450 | $1,969 | $2,329 | $4,298 | Usually a year before CSC |

| Certificate of Statutory Completion (CSC) | 15% | $160,470 | $2,490 | $2,944 | $5,434 | Monthly repayment until property is sold |

Costs incurred

| Description | Amount |

| BSD | $27,392 |

| Interest expense (Assuming 17 year tenure and 4.6% interest) | $21,105 |

| Total costs | $48,497 |

This is assuming you were to sell at the 3-year mark before the project obtains its TOP. Therefore, no property tax and maintenance fees are payable. Also, given that you are selling before the bulk of the loan is disbursed, in spite of the high interest rate, the interest incurred is still relatively low.

We will use the annualised growth rate of private properties over the past decade of 2.21% to do a simple projection of the potential gains.

| Time period | Price | Potential gains |

| Starting point | $1,069,800 | $0 |

| Year 1 | $1,093,443 | $23,643 |

| Year 2 | $1,117,608 | $47,808 |

| Year 3 | $1,142,307 | $72,507 |

Potential gains if your partner were to buy a new launch and sell it after 3 years: $72,507 – $48,497 = $24,010

Option 2. Buy a unit to rent out

Since you’ve specifically mentioned People’s Park Complex, let’s take a look at its performance.

The last 1-bedder transaction was done in June last year at $635,000 for a 463 sqft unit. In Q2 this year, there were 17 1-bedders rented out at an average price of $2,412/month. This translates to a rental yield of 4.6% which is above market average.

However, given its current age of 55 years, the primary concern revolves around the prospect of selling it in the future. Even though a significant price drop in the short term is unlikely, the remaining lease of 44 years means that younger buyers may not qualify for the maximum loan amount or be able to fully utilise their CPF funds, as the lease duration may not cover them until the age of 95.

This would mean a larger upfront payment in cash or CPF. When combined with the issue of lease decay, this factor may discourage potential buyers from considering the unit, thereby reducing the pool of prospective buyers.

Moreover, 1-bedroom units inherently cater to a smaller buyer demographic since their size is more suitable for singles or couples.

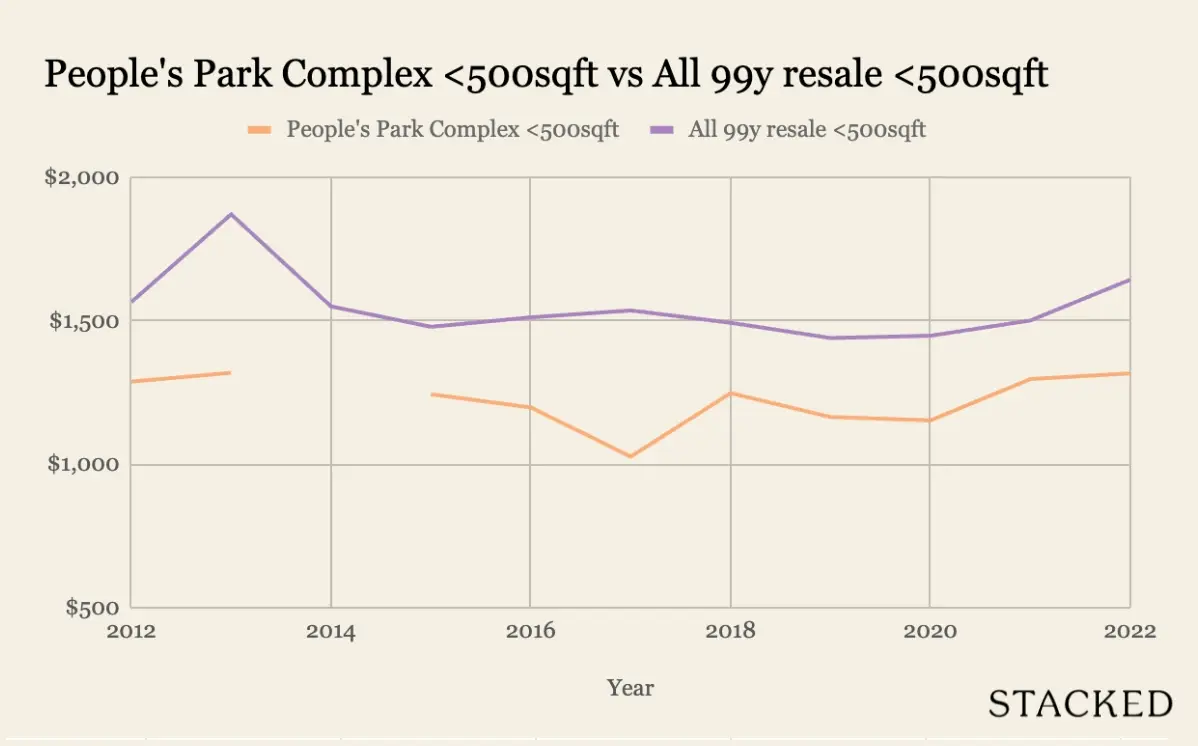

| Year | People’s Park Complex <500sqft | YoY | All 99y resale <500sqft | YoY |

| 2012 | $1,287 | – | $1,564 | – |

| 2013 | $1,318 | 2.41% | $1,870 | 19.57% |

| 2014 | – | – | $1,549 | -17.17% |

| 2015 | $1,243 | – | $1,478 | -4.58% |

| 2016 | $1,197 | -3.70% | $1,511 | 2.23% |

| 2017 | $1,026 | -14.29% | $1,535 | 1.59% |

| 2018 | $1,247 | 21.54% | $1,492 | -2.80% |

| 2019 | $1,164 | -6.66% | $1,439 | -3.55% |

| 2020 | $1,152 | -1.03% | $1,447 | 0.56% |

| 2021 | $1,296 | 12.50% | $1,500 | 3.66% |

| 2022 | $1,316 | 1.54% | $1,642 | 9.47% |

| Annualised | 0.22% | 0.49% |

We can see from the above that the price movement of 1-bedders in People’s Park Complex is rather erratic, but this is likely due to the low transaction volume. Over the last 10 years, the average 1-bedder transaction done annually is just 3.

We understand the draw of such older developments given its centralised location, affordable entry price and great rental yield. But unless you are looking at this as a potential en bloc in the future, when it comes to reselling, this may post a challenge. Perhaps you can also consider buying a younger property with decent rental yields, that will be easier to offload when the time comes.

These are some younger developments on the market with decent rental yields under $1.1M:

| Project | District | Tenure | Completion year | Unit type | Size (sqft) | Asking price | Avg 2b rent (Q2 2023) | Avg rental yield |

| Sol Acres | 23 | 99-years | 2019 | 2b2b | 732 | $1,080,000 | $3,940 | 4.4% |

| High Park Residences | 28 | 99-years | 2019 | 2b2b | 667 | $1,028,000 | $3,337 | 3.9% |

| Kingsford Waterbay | 19 | 99-years | 2018 | 2b2b | 689 | $950,000 | $3,500 | 4.4% |

We selected 2-bedroom units because they appeal to a broader spectrum of buyers, and as a result, may be easier for you to exit when the time comes. The data presented in the table underscores that, despite these projects not being situated in the city centre, they still yield favourable rental returns.

Let’s assume your partner buys a unit at Kingsford Waterbay and rents it out for the next 3 years.

From January till date, there have been six 689 sq ft units transacted at an average price of $943,500. We will assume this to be the purchase price.

| Purchase price | $943,500 |

| BSD | $22,905 |

| 75% loan | $707,625 |

| CPF funds | $70,000 |

| Cash required | $188,780 |

Costs incurred

| Description | Amount |

| BSD | $22,905 |

| Interest expense (Assuming 17 year tenure and 4.6% interest) | $91,864 |

| Property tax | $18,000 |

| Maintenance fees (Assuming $290/month) | $10,440 |

| Rental income (Assuming $3,500/month with no vacancy period) | $126,000 |

| Agency fees (Payable once every 2 years) | $7,560 |

| Total costs | $24,769 |

Similarly, we will use the annualised growth rate of private properties over the past decade of 2.21% to do a simple projection of the potential gains.

| Time period | Price | Potential gains |

| Starting point | $943,500 | $0 |

| Year 1 | $964,351 | $20,851 |

| Year 2 | $985,664 | $42,164 |

| Year 3 | $1,007,447 | $63,947 |

Potential gains if your partner were to buy a unit and rent it out for 3 years: $63,947 – $24,769 = $39,178

In this scenario, even though there are more outgoings as compared to Option 1, the rental income earned helps to offset these payments.

Alternative option

As previously discussed, one of the advantages of property investment is the potential to leverage. However, in a high-interest rate environment, this approach may not be the most appropriate choice.

Additionally, given that your partner has shifted a significant portion of his CPF funds into his SA, the remaining funds in his OA are not substantial. This would require a larger cash contribution for the purchase.

So considering that you already have a place to reside and do not have a real need to purchase a property, another option worth considering is investing your cash savings in alternative avenues, such as stocks and shares.

Let’s assume a conservative ROI of 4% annually and investing the $150,000 of cash that your partner was planning to put towards the purchase.

| Time period | Price | Potential gains |

| Starting point | $150,000 | $0 |

| Year 1 | $156,000 | $6,000 |

| Year 2 | $162,240 | $12,240 |

| Year 3 | $168,730 | $18,730 |

Potential gains based on various ROI:

| ROI | Potential gains |

| 5% | $23,644 |

| 6% | $28,652 |

| 7% | $33,756 |

| 8% | $38,957 |

Do note that we have not included any fees payable to financial consultants (if any).

While the returns in this scenario may or may not match those of Options 1 and 2, the expenses are significantly lower, and the process is much more straightforward.

In contrast, Options 1 and 2 would involve the entire process of identifying an appropriate property, navigating the purchase procedures, finding and managing tenants, which demands a substantial amount of time and effort. However, the decision ultimately rests with you, determining whether the returns justify the time and effort involved.

What should you do?

Given that your partner has a few more years before turning 55, it’s understandable that you’d want to make the most of this time to possibly increase your savings while waiting for potential price reductions in your retirement home.

So it’s important to first really plan out your timeline. Do you plan to hold it for 5 or 10 years? Since you have plans for retirement, your exit strategy here would be crucial to get it right.

Opting for a resale property offers more affordable options, immediate rental potential to offset monthly payments, and the possibility of securing a 2-bedroom unit within a similar budget.

Whether choosing an older centrally located development or a newer suburban project, both can generate favourable rental yields, buying a newer property is a safer choice for a short-term hold. This is because buyers face no restrictions on their loans and CPF utilisation. Also, you get to benefit from rental income, rather than solely relying on appreciation.

You could also lock your rates in over the next 3 years to have a more predictable profit down the road and our interest rate of 4.6% used is on the conservative side, so you could potentially profit even more.

Finally you could just look at investing your spare cash.

Considering the interest rate environment we’re in, investing for a near-guaranteed 3+% return isn’t too difficult and you could see gains that are even higher. The downside is volatility if you go for higher-return instruments like stocks, so if you’re very dependent on this cash to make the downpayment for the Marine Parade HDB, then investing in a diversified and safer debt instrument could be better.

So while you don’t get to take advantage of leverage or rental income, the process is more straightforward and demands less time and effort. Additionally, this calculation is based on an investment of $150,000 in cash. If you were to invest a larger amount, as you would when purchasing a property, the returns would likely be higher.

Opting for a new launch at this point might entail a certain degree of risk. Given your limited budget, you don’t have many options, and if the property doesn’t yield a profit at the 3-year mark or upon its TOP, you might find yourself in a bit of a pickle as this may necessitate an extended holding period in the hope of price appreciation, which could disrupt your partner’s plan to purchase the next property before turning 55.

Assuming the Basic Retirement Sum (BRS) increases by 3.5% annually, when he reaches 55 in 2030, the required BRS will be $127,000. Consequently, if he wishes to utilise his CPF funds for a property purchase after turning 55, he must first meet this BRS before he can allocate any excess funds toward the purchase. This consideration is important if the use of his CPF funds is vital.

Furthermore, purchasing a new launch would demand a substantial amount of cash. According to our calculations, for a property valued at $1,069,800, nearly $260,000 in cash is required, which exceeds your partner’s intended cash contribution by $110,000.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

1 Comments

In terms of location and amenities, jalan batu is even better than marine parade and price is also cheaper