We Have $2.5m In Cash+CPF. Is It Better To Buy A Landed Home Near Our Children’s School Or Rent And Buy A Freehold Landed Elsewhere?

December 9, 2022

Hi! I have been reading your articles and wonder if it’s possible to seek your advice.

We currently stay in a 99-year leasehold 3-bed condo (heritage view) under husband’s name. As we have 2 children growing up, we would like to get a larger home >4 bedrooms. The children are studying in a popular primary school in D10.

Which makes more financial sense:

(i) to buy a condo/landed near school or

(ii) rent a property near school while buying a more spacious freehold landed in other areas next year?

Some concerns are rentability, future profitability and space. To avoid ABSD, we will make purchase under wife. Wife is 37 years old, annual income 250k, cash + CPF on hand about 2.5m.

Your advice and help will be much appreciated.

Hi there,

Thanks for writing to us with your enquiry.

Given that you have 2 children already in primary school, we are assuming this move is to cater to them when they move on to secondary school. Needless to say, unless they both also go to the same secondary school (or ones that are nearby), choosing the right location may be tough.

In any case besides the financial objectives, you do also have to consider liveability in the longer term. For example, if you do buy a landed property, would it be feasible to stay when you are older and climbing the stairs would be difficult (or you would need to future-proof it with a lift)? Landed homes will typically require more maintenance as they get older too, which you have to undertake yourself.

If you are looking for a home near school, this could also pose an issue when your children graduate and the school no longer is a priority. Traffic may be an issue during drop-off or pick-up peak hours, both of which you may not want to deal with in the future.

This also means that your options are a lot narrower which can be a good or a bad thing, depending on how you see it. The good is that you’ll be able to hone down on specific developments more easily, but of course, this limits the options that you have – sometimes this also means having to make sacrifices.

In an attempt to answer your question and derive the best option (in our opinion), we’ll run through:

- Your affordability

- The 2 pathways you’re considering

- Which makes more financial sense?

- What else can you do?

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

You’ve mentioned that the purchase would be made solely under your wife’s name to avoid having to pay the ABSD. Here’s what the numbers look like:

| Description | Amount |

| Maximum loan based on a fixed monthly income of $20,800 and age 37 | $2,310,120 (28 years tenure) |

| Monthly mortgage repayment based on 4% interest (assuming max. loan and tenure) | $11,440 |

| Cash + CPF funds | $2,500,000 |

| Total loan + cash + CPF | $4,810,120 |

| BSD based on $4,810,120 | $177,005 |

| Estimated affordability | $4,633,115 |

Note that we’re assuming that this $2.5m is set aside to purchase your next property, and that you’ve other rainy-day funds set aside.

Now that we have a better idea of your wife’s affordability, we’ll run through the two pathways you’re considering.

Pathways

Option 1: Buy a condo/landed near school

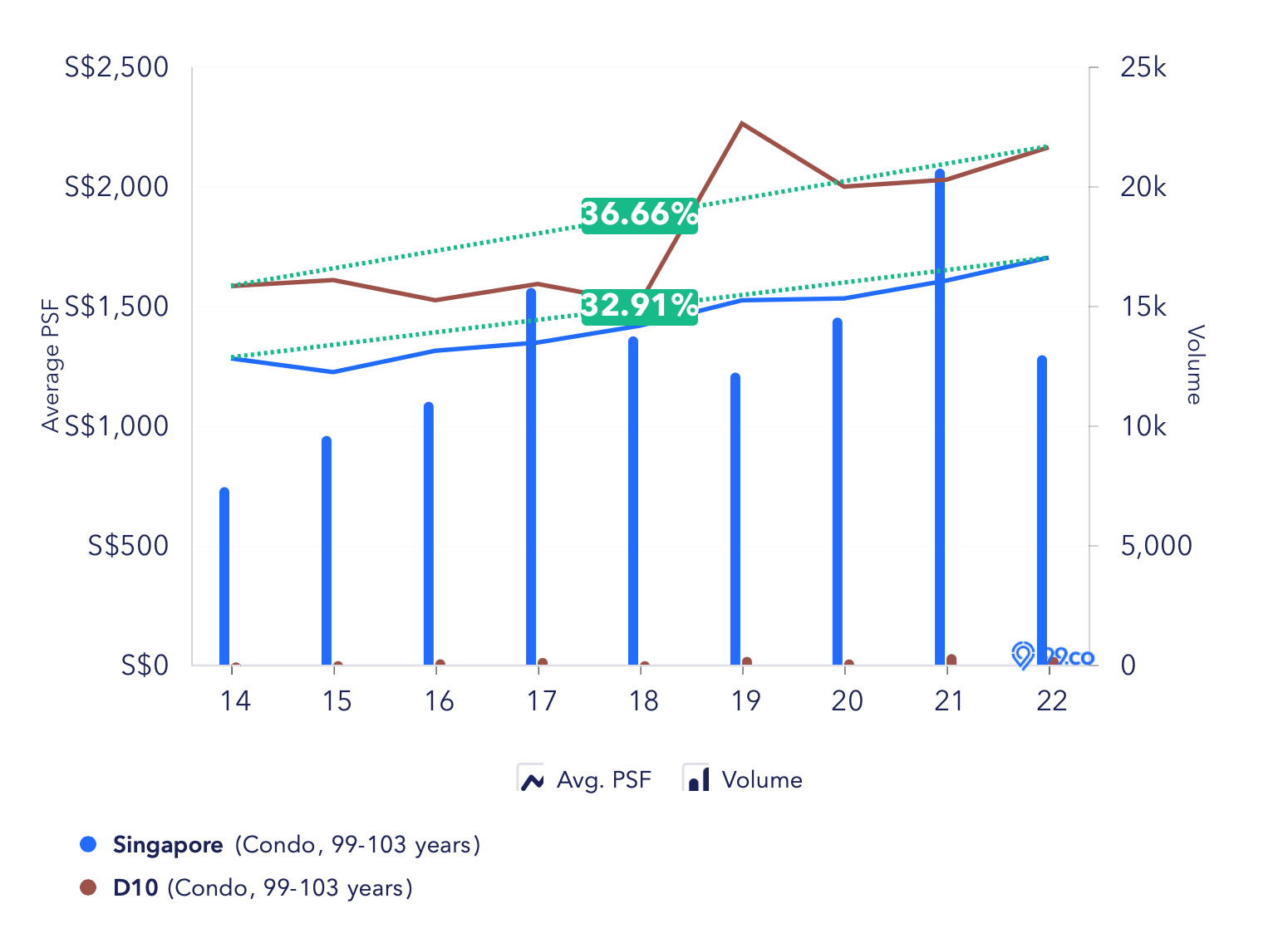

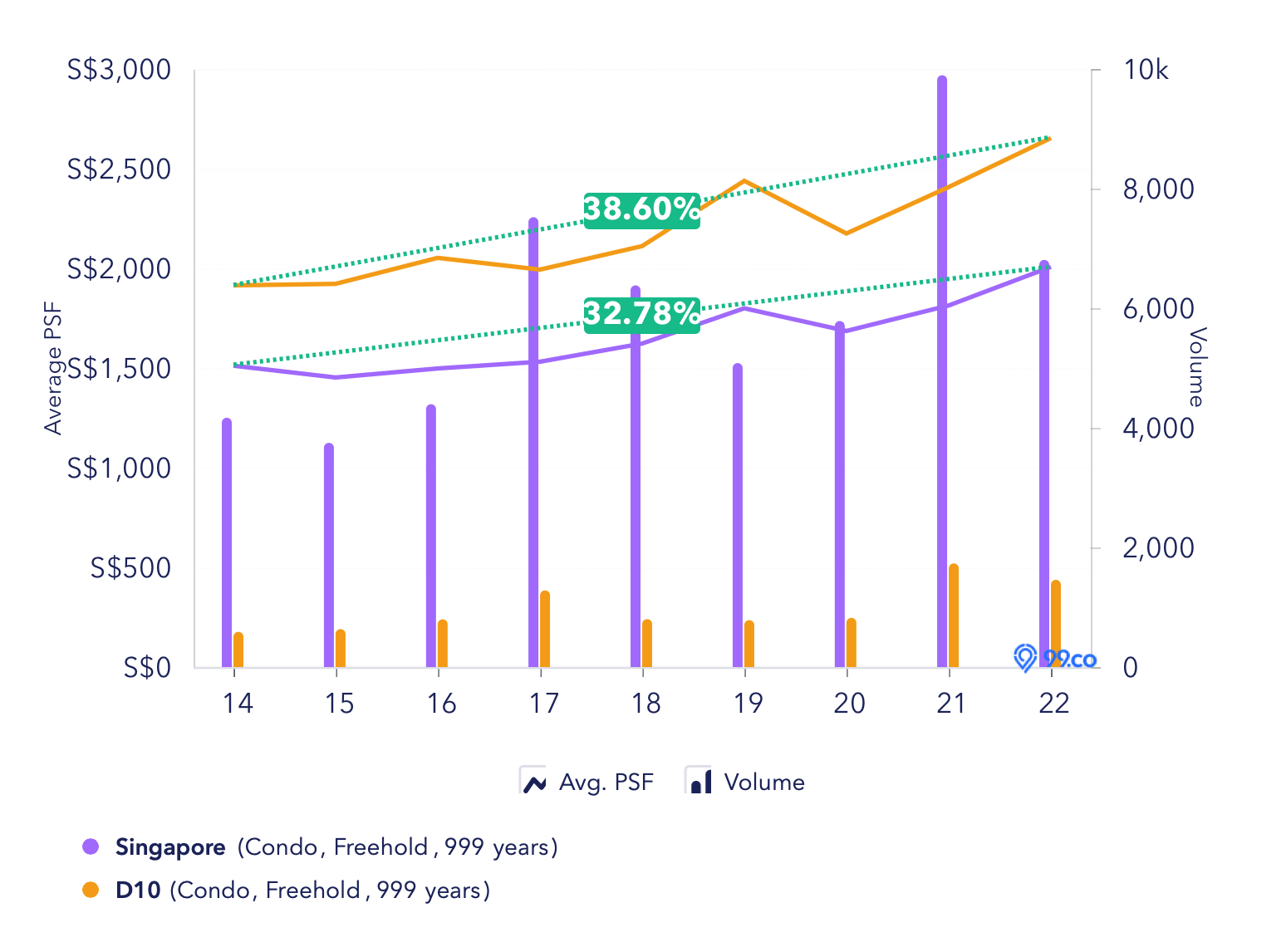

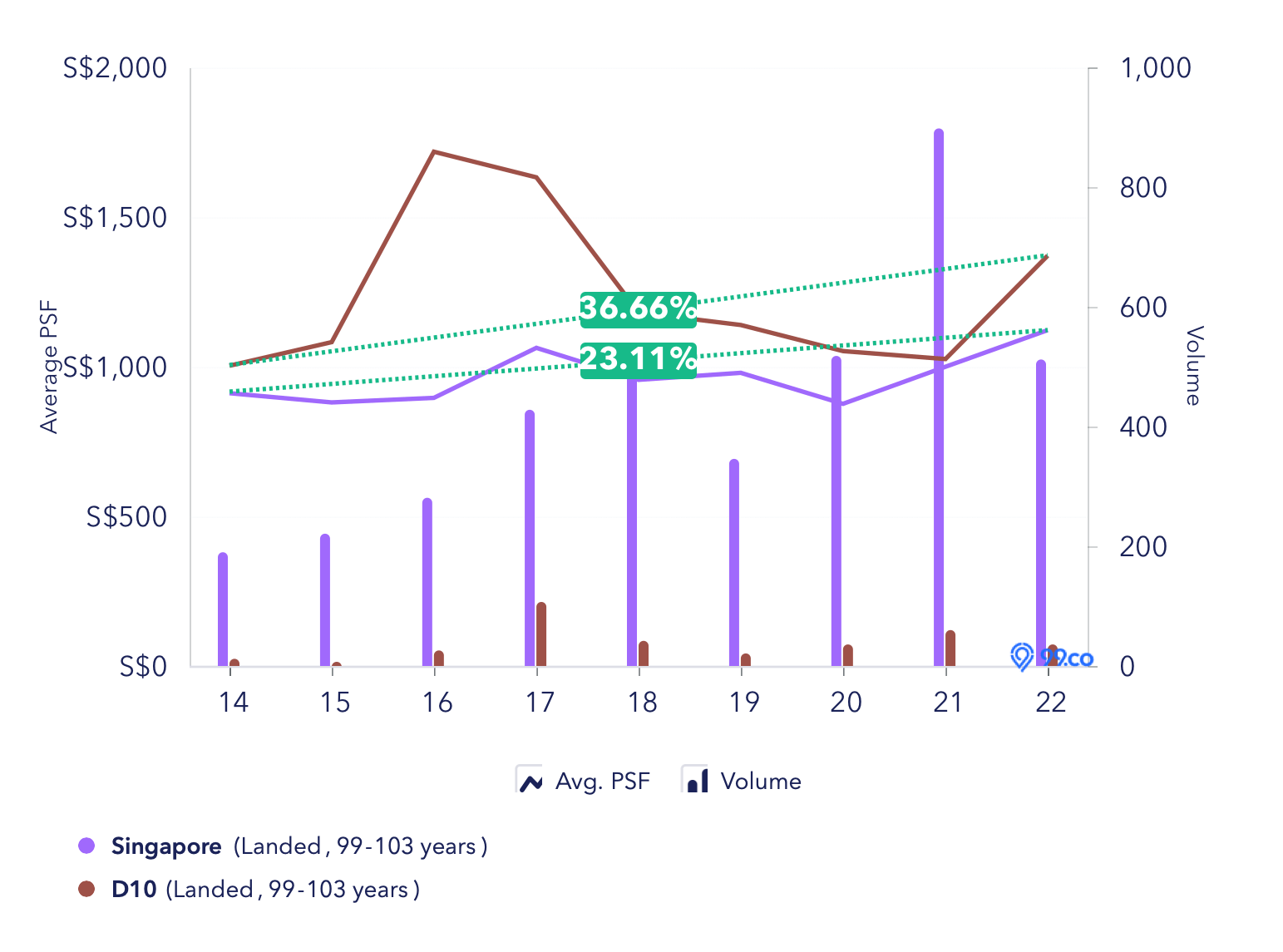

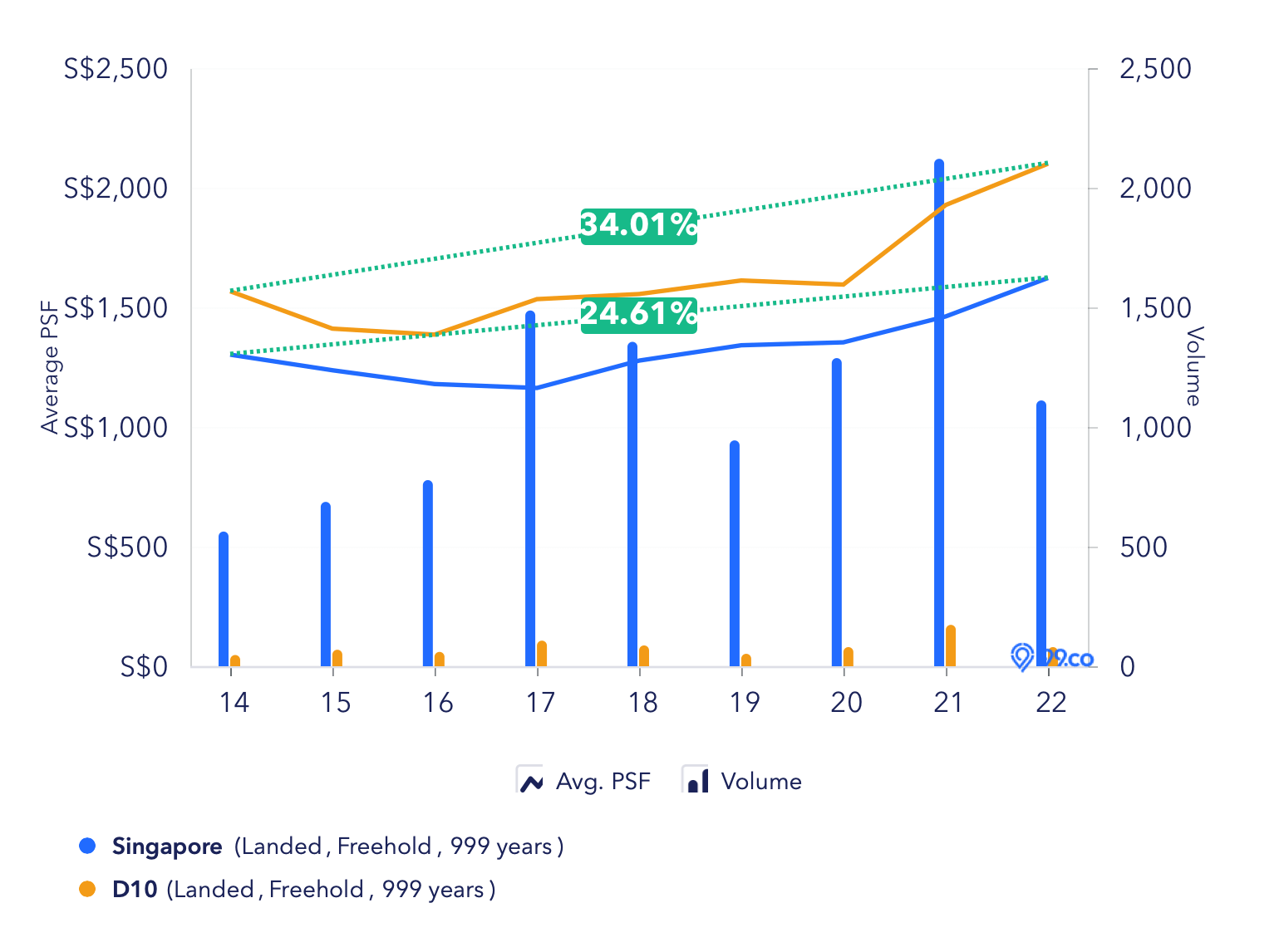

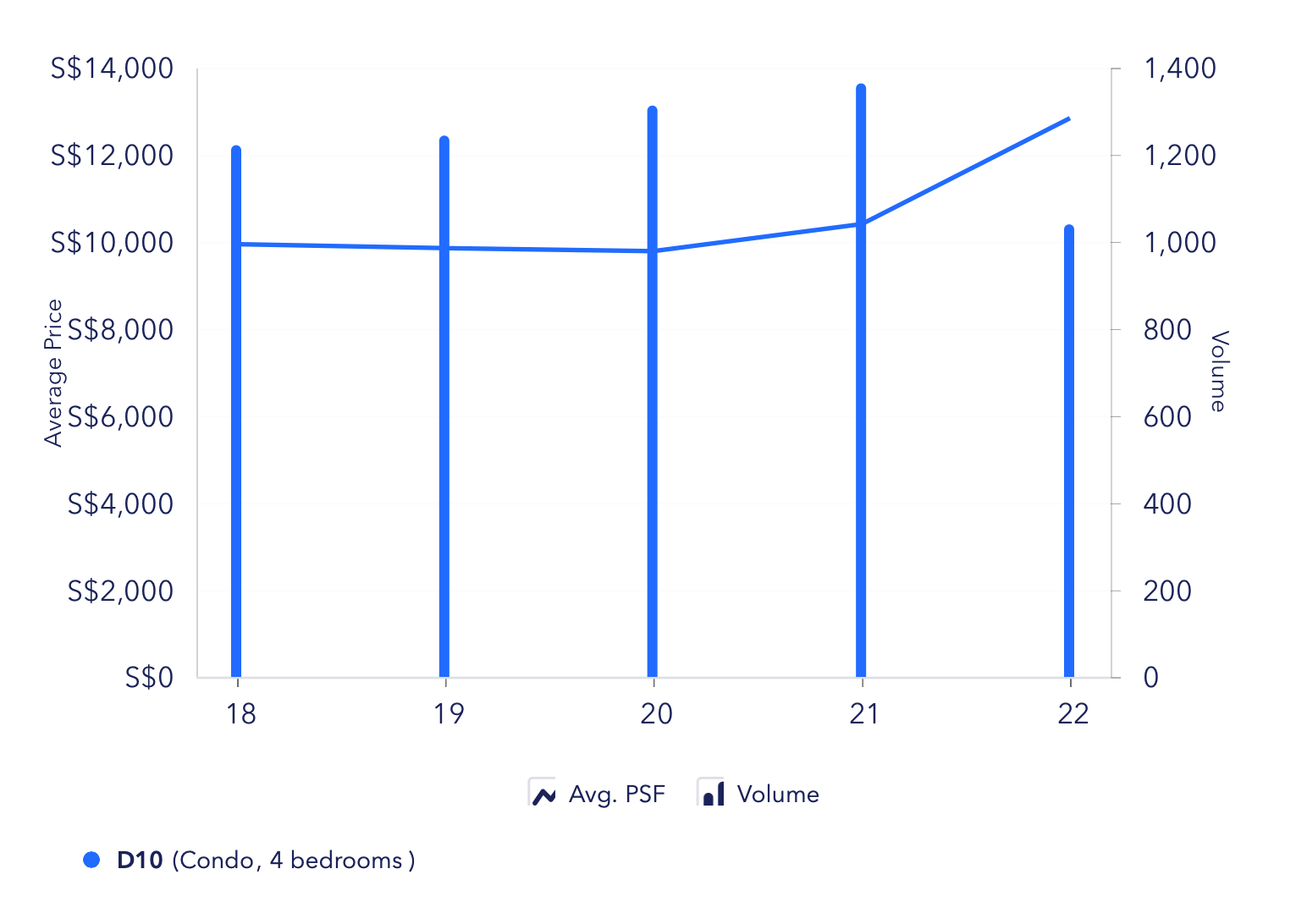

One of your main concerns here is profitability, so let’s start by taking a look at how private properties in District 10 have been performing over the past 8 years. We’re looking at the price trends from 2014 onwards after the three rounds of cooling measures were implemented in 2013 as it’s more relatable to current times.

We can see from the graphs above that prices of condominiums in D10 (be it 99 years or freehold) have appreciated slightly more than the rest of the market in the past 8 years.

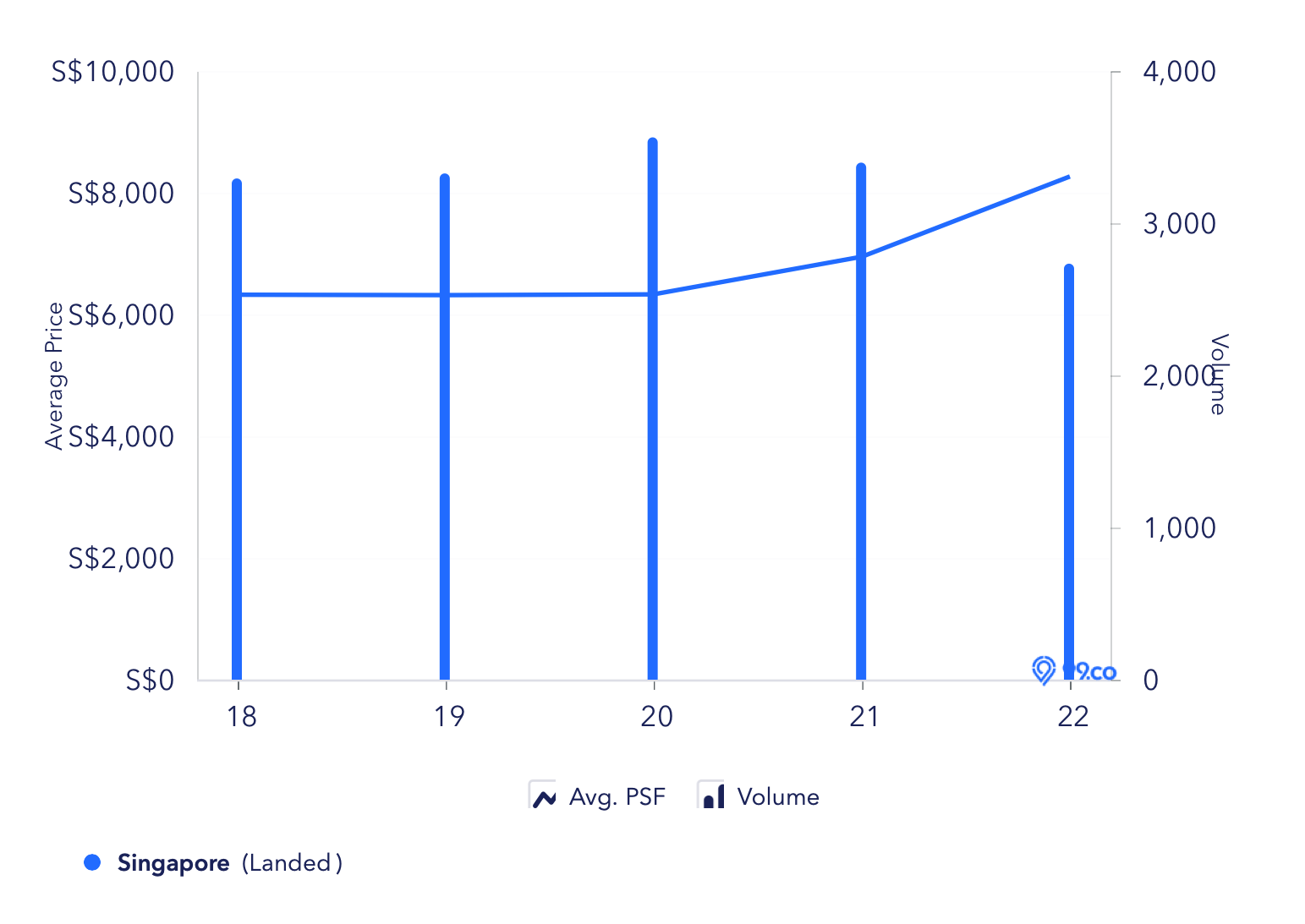

This is compared to landed properties in D10 (whether 99 years or freehold) have appreciated at least 10% more than the rest of the market.

That said, with a budget of $4.6M, it won’t be easy to find a suitable property in this area. While it is not impossible to get a 4 bedder landed property in D10, the pickings are slim and you’ll most likely be looking at older 99-year leasehold properties. Also with landed homes, depending on their condition, extensive renovations may be required which could set you back in terms of your affordability.

As for 4 bedder condominiums in D10, you definitely will have more options to choose from. But whether to purchase a 99-year leasehold or a freehold property would depend on your holding period. Given that they are in primary school and were to attend a secondary school that is in the vicinity, we could possibly be looking at a 10-year timeframe.

Since profitability is one factor you’ve in mind, perhaps getting a young 99-year leasehold project (preferably under 10 years old) might be a better option given that prices of these developments tend to move faster than freehold developments in the shorter term (as long as you pick the right one).

Also, the facilities and condition of the unit will likely not deteriorate as much during this time, and with a longer remaining lease, selling it in the future won’t be an issue.

Let’s take a look at the costs incurred if you were to stay in this property for 5 years while renting out Heritage View:

| Description | Amount |

| Interest costs (based on max. loan of $2,310,120 at 4% interest) | $438,468 |

| MCST for 4 bedder in D10 (assuming $800/month) | $48,000 |

| MCST for Heritage View (assuming $350/month) | $21,000 |

| Agency fees for renting out Heritage View (assuming $2,750/year) | $13,750 |

| Rental income (assuming $5,500 for 11 months each year) | $302,500 |

| Estimated costs incurred | $218,718 |

Option 2: Rent a property near the school while buying a more spacious freehold landed in other areas next year

For the last 11 months of 2022, the monthly rent of a 4-bedder in D10 ranged from $3,400 to a whopping $80,000 with the average rent being $12,840.

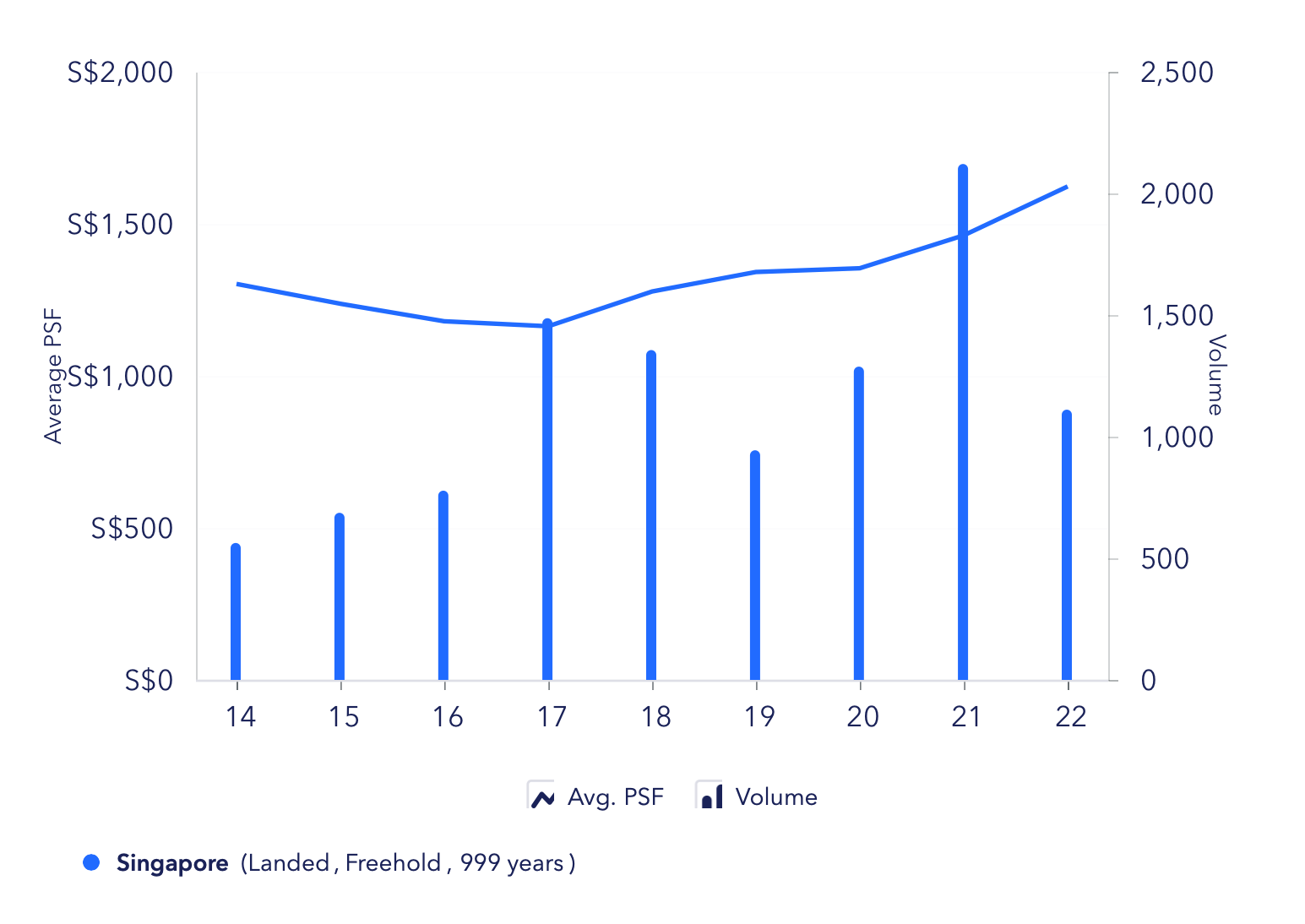

Next, since you mentioned purchasing a landed home elsewhere, we’ll look at the $PSF of landed homes in the past 11 months.

For a freehold/999-year leasehold landed property, the average PSF for the last 11 months is $1,623. Since the location you’re looking at wasn’t specified, we can’t provide the exact average PSF or price.

However, the low supply of landed properties helps ensure price stickiness and continued demand in the long term. Having said that, as we’ve mentioned earlier, do bear in mind the renovation costs for a landed property could be pretty substantial.

Since you will not be staying in the landed property, we assume you will be renting that out for the time being. The average monthly rent for a landed property for the last 11 months is at $8,268. Do note that this is for landed houses of all sizes and tenure types all over Singapore so it will vary depending on where you decide to purchase. Regardless, renting out a landed home does result in typically lower yields compared to renting out a condo – so from a cash flow perspective, you would be worse off than if you spent the same amount on a condo and generated a better yield.

Let’s now take a look at the costs incurred if you were to rent a 4-bedder near the school for the next 5 years while renting out both the landed and Heritage View:

| Description | Amount |

| Interest costs (based on max. loan of $2,310,120 at 4% interest) | $438,468 |

| MCST for Heritage View (assuming $350/month) | $21,000 |

| Agency fees for renting out Heritage View (assuming $2,750/year) | $13,750 |

| Rental income from Heritage View (assuming $5,500 for 11 months each year) | $302,500 |

| Agency fees for renting out landed property (assuming $4,150/year) | $20,750 |

| Rental income from landed property (assuming $8,300 for 11 months each year) | $456,500 |

| Cost of renting (assuming $12,800/month) | $768,000 |

| Costs incurred | $502,968 |

Based on this calculation, the costs incurred in this option are considerably higher than in Option 1. This is mostly due to the high cost of renting. There are some variables here that affect the costs incurred such as the cost of rental and the location of the landed property you’ll be buying which will determine your rental income. If the rental income from either Heritage View or the landed property can help to offset your rental cost, the overall costs incurred will be reduced.

For instance, if you manage to find a 4 bedder in D10 for rent at $8,300/month:

| Description | Amount |

| Interest costs (based on max. loan of $2,310,120 at 4% interest) | $438,468 |

| MCST for Heritage View (assuming $350/month) | $21,000 |

| Agency fees for renting out Heritage View (assuming $2,750/year) | $13,750 |

| Rental income from Heritage View (assuming $5,500 for 11 months each year) | $302,500 |

| Agency fees for renting out landed property (assuming $4,150/year) | $20,750 |

| Rental income from landed property (assuming $8,300 for 11 months each year) | $456,500 |

| Cost of renting (assuming $8,300/month) | $498,000 |

| Estimated costs incurred | $232,968 |

You can see that renting at a lower cost of $8,300/month results in a loss of $232,968. While this is just an illustration, what’s clear is that if you can cover your rental from your investment property, then you’ll be able to enjoy staying in your location of choice while having a wider option of investment choices. This is also close to how much you would lose if you simply bought a property in D10 instead of buying an investment property and renting it out.

Renting a landed property out for $8,300 per month is also achievable as this results in about a 2.15% yield based on your affordability of $4,633,115.

That being said, with increasing rental costs and huge uncertainty on a stable rental amount for the years you intend to stay, we’re more inclined to say that the option to rent a home in D10 and buying a landed home elsewhere to rent out would result in a greater loss unless the capital appreciation more than makes up for the high rental cost in D10.

Which option makes more financial sense?

Estimated costs incurred for Option 1 – $218,718

Estimated costs incurred for Option 2 – $232,968 – $502,968

The difference in costs incurred for both options may or may not be drastic depending on the cost of rent and rental income earned in Option 2.

One drawback of Option 1 is that the choices you have will be limited to properties in close proximity to the school. Whereas for Option 2, there is no restriction in terms of location so you can decide based on which property has better potential profitability instead.

What are your other choices?

Now that we’ve illustrated what the financials could look like based on your options, it’s time to look at one more option that you may want to consider: Sell your current home at Heritage View and purchase two properties

Let’s start by looking at your current property!

Should you hold on to Heritage View?

The main advantage of holding on to Heritage View is not having to deal with the selling process and continuing to earn rental income. But is it worth it?

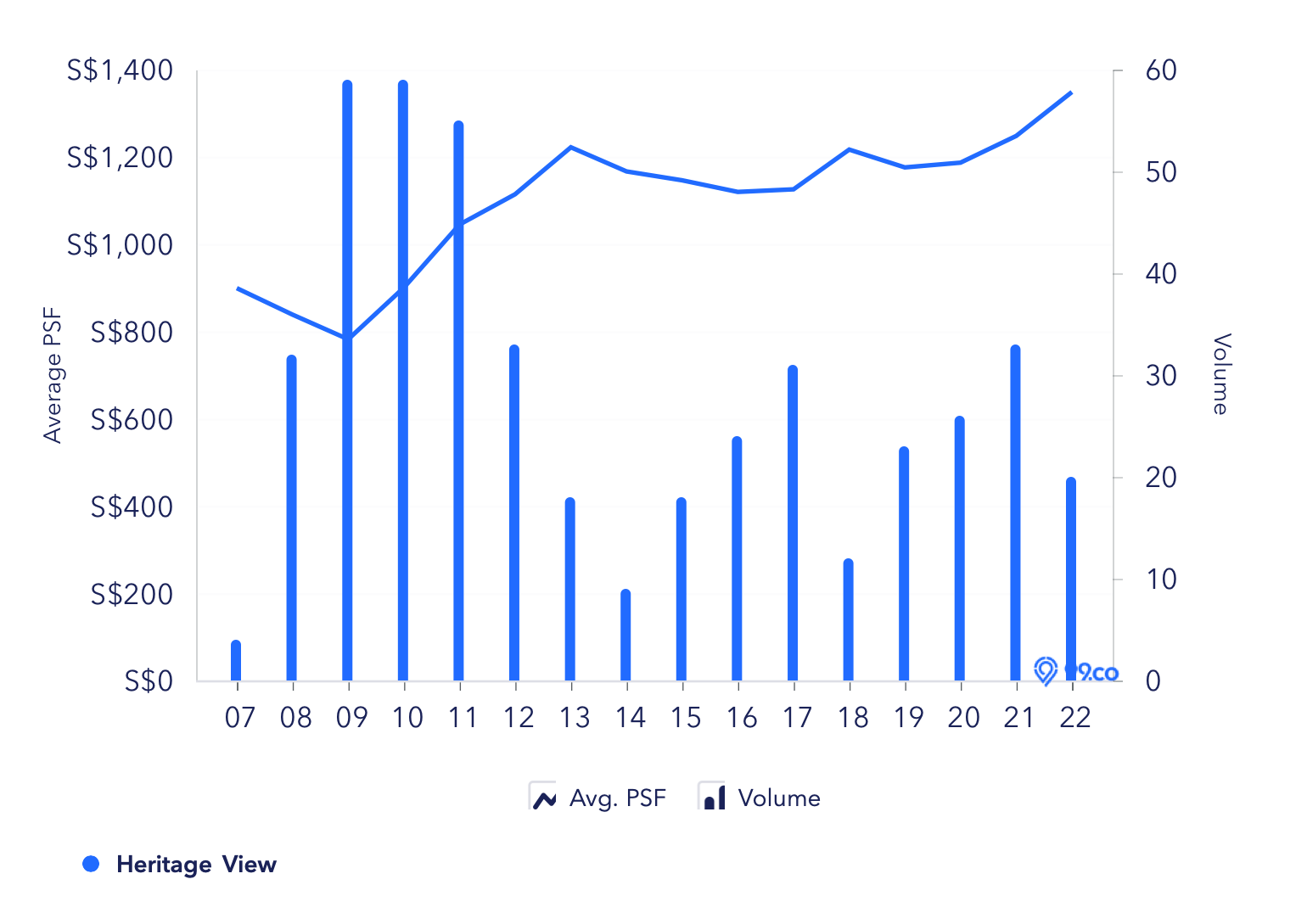

Here’s a look at the Heritage View rental price trend:

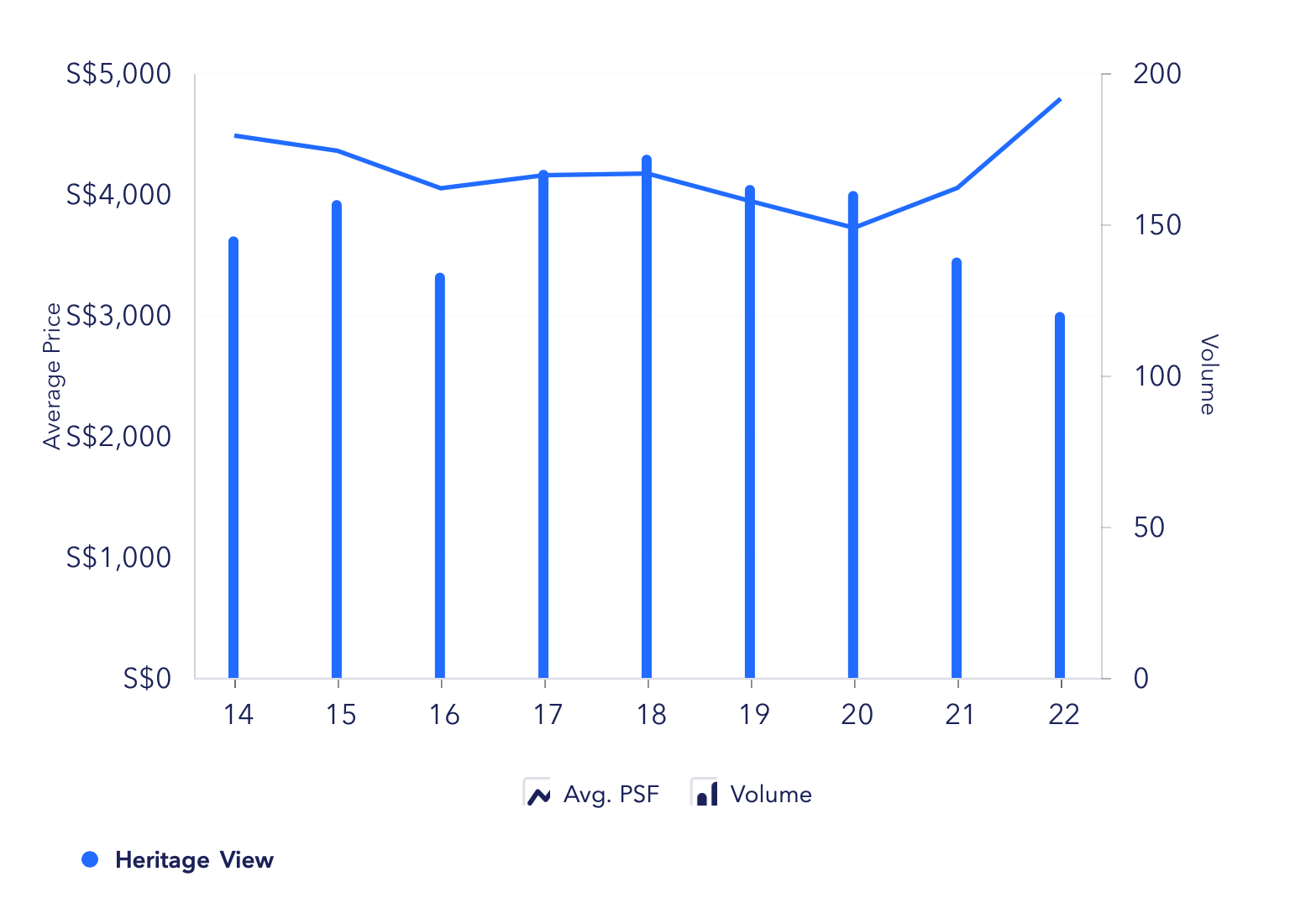

With the rental for Heritage View being at an all-time high now, it does look like capitalising on this makes sense. However, we will not suggest holding on to it for a long period of time due to lease decay. As we have seen from the graph above, prices were stagnating before the pandemic hit.

How has Heritage View performed in terms of prices so far?

Heritage View is a 99-year leasehold project that was completed in 2000. Its tenure starts from 1996, making it 26 years old this year. It’s a mid-sized development with 618 units comprising of 2, 3, and 4 bedders.

Prices at Heritage View were rather stagnant in the years preceding the pandemic except for the period between 2017 and 2018 when overall prices in Singapore went up and the government introduced a round of cooling measures that effectively brought prices back down.

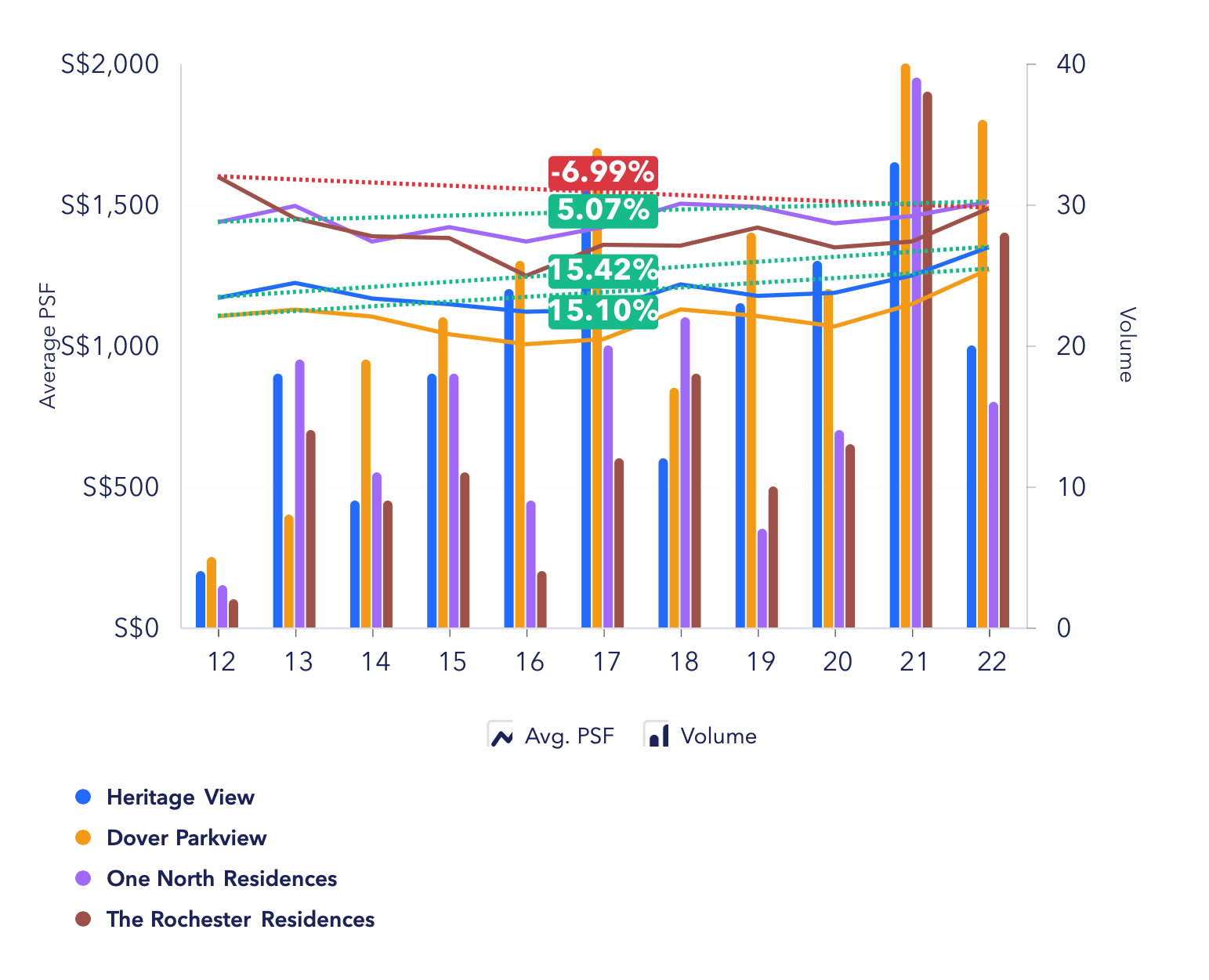

There are only 4 developments in the Dover and One-North area (excluding One North Eden which is still under construction), namely Dover Parkview (TOP 1997), Heritage View (TOP 2000), One North Residences (TOP 2009), and The Rochester Residences (TOP 2011).

Despite Dover Parkview and Heritage View being older, their prices have appreciated much more than the other two developments. This could be due to One North Residences and Rochester Residences having a higher number of 1 and 2-bedders than 3 and 4-bedders, which cater more to investors than homeowners. Prices are usually more protected when there is a high percentage of homeowners as they tend to be more emotional than investors and will not simply sell just because there is a better opportunity elsewhere.

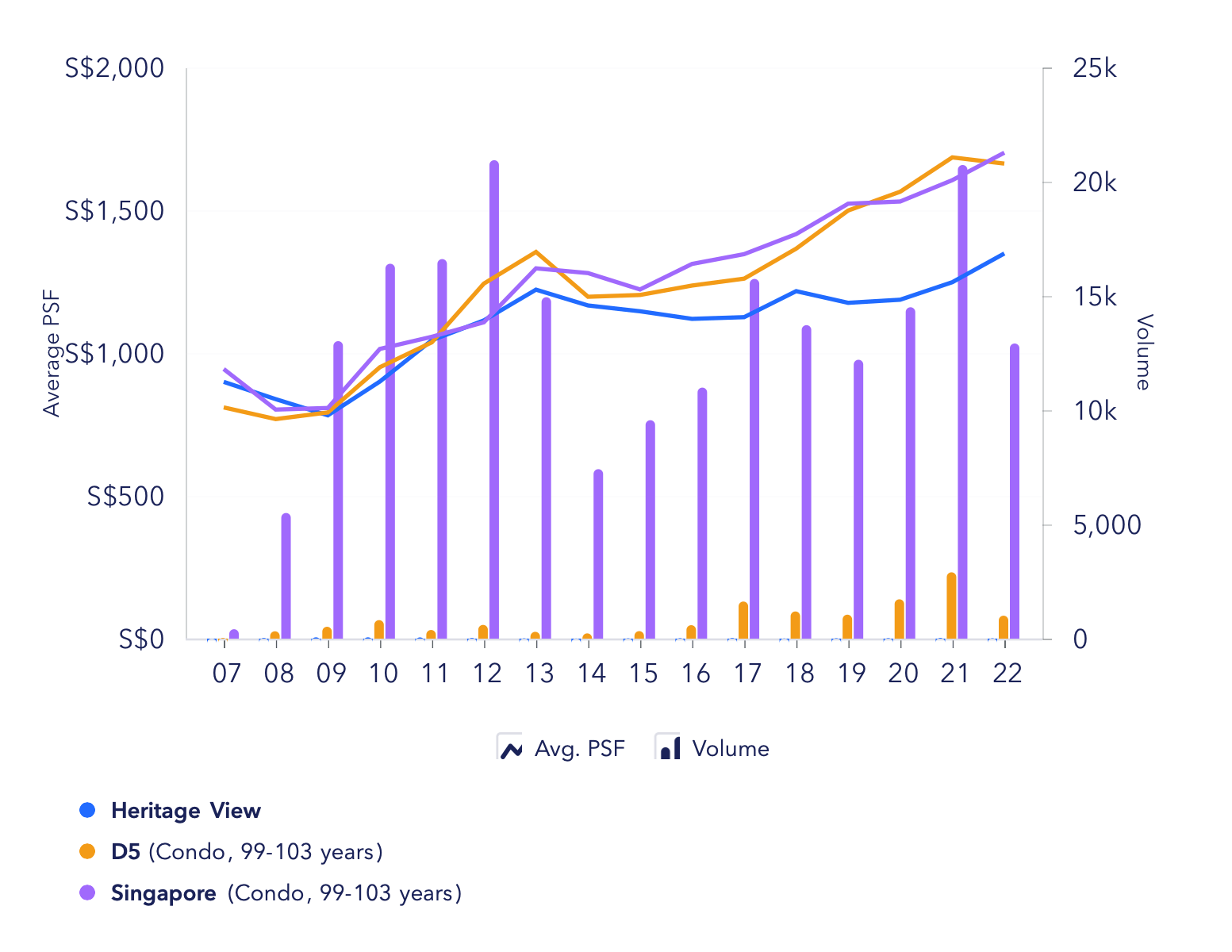

From the graph above, we can see that while prices of 99-year leasehold developments in District 5 are moving in line with the overall market, Heritage View has been lagging behind.

Heritage View recent transactions:

| Date | Size (sqft) | PSF | Price | Level |

| OCT 2022 | 1,195 | $1,599 | $1,910,000 | #07 |

| SEP 2022 | 1,163 | $1,435 | $1,668,000 | #17 |

| AUG 2022 | 1,195 | $1,532 | $1,830,000 | #06 |

| JUL 2022 | 1,195 | $1,423 | $1,700,000 | #06 |

| MAY 2022 | 1,195 | $1,406 | $1,680,000 | #06 |

| APR 2022 | 1,195 | $1,431 | $1,710,000 | #09 |

| MAR 2022 | 1,195 | $1,364 | $1,630,000 | #07 |

| MAR 2022 | 1,195 | $1,404 | $1,678,000 | #07 |

| FEB 2022 | 1,206 | $1,350 | $1,628,000 | #03 |

| FEB 2022 | 1,163 | $1,415 | $1,645,000 | #17 |

| JAN 2022 | 1,163 | $1,247 | $1,450,000 | #15 |

In the last 11 months of 2022, 11 3-bedders changed hands at an average PSF of $1,419 and at an average price of $1,684,455. And in the past 6 months, there were 50 3-bedder rental transactions at an average price of $5,527. Using these average prices, if you were to hold on to the unit and rent it out, the rental yield is estimated to be 3.94%.

Rental yields for 3-bedders in the vicinity:

| Project | Average price (Jan 22 till date) | Average rent (last 6 months) | Rental yield |

| Dover Parkview | 1,566,636 | 4,395 | 3.37% |

| One North Residences | 2,170,000 | 6,444 | 3.56% |

| The Rochester Residences | 2,751,917 | 8,573 | 3.74% |

Compared to the other 3 developments in the area, Heritage View has the best rental yield. However, again one concern with older leasehold developments is lease decay.

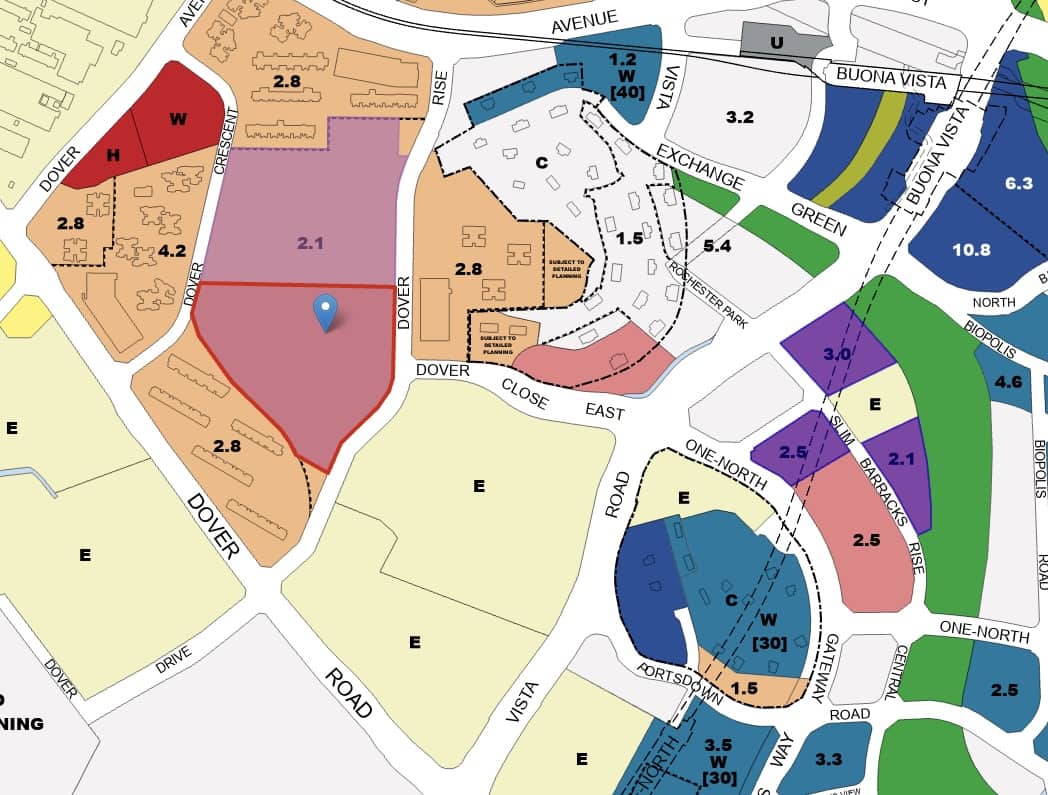

The only advantage to holding Heritage View from a capital appreciation perspective is through a collective sale. As of now, it’s clear that the One-North area doesn’t leave developers with many options since the 3 GLS sites have been successfully tendered for, and the surrounding plots are mainly business and education:

So if a collective sale is not an option, and considering Heritage View is already 26 years into its lease (from 1996), we’re wary of how prices here would move. As such, you may want to sell the property and use the proceeds to buy another property that would have a lesser chance of eroding in value over time. But as we do not have much more information on your income, it would be impossible to make further suggestions on what you should purchase.

Conclusion

Given the high rental rates now, it’s easy to see that option 2 will be one that is harder to swallow in the short term. But if you do find the right freehold landed property elsewhere, it could be offset by the potential capital appreciation in the future. There’s no question that freehold landed homes are a rarity in Singapore, and land will not be allocated to such homes anymore. It’s the holy grail for many Singaporeans, and as a stable asset to hold in the long run you won’t be able to do much better.

So the question is, is it worth paying the high rental rates now to be able to acquire a landed property today? Or would waiting a few more years (which would mean paying a higher price for it) be more expensive overall given how much landed properties would probably appreciate in the future?

Perhaps you should think about the liveability aspects in the long run too. Is this location that you are eyeing for a freehold landed property ultimately one that you want to stay in as you age? Or is this going to be sold for you to right-size in the future?

That being said, if both options have the same costs incurred, Option 2 definitely provides more flexibility as you won’t be restricted to investment properties within the vicinity of the school.

And since you will be renting, you won’t have to purchase the landed property right away too.

You can first buy a smaller condominium with good rental yields and growth potential and upgrade to a landed further down the road when you plan to move in.

However for Option 2 to be feasible, you’d have to purchase the second property for sure as it’ll help to offset (even just partially) the rental cost incurred. Without this second property, the costs incurred will be a lot higher.

Lastly, perhaps it’s worth considering selling off your current property at Heritage View, even though it may seem silly not to take advantage of the hot rental market now. But given the age of the property, it may be better to sell it off as the market is still at a high.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

0 Comments