We Bought A New $2.2m Condo In River Valley: Is It Better To Sell Now Or Rent It Out?

December 27, 2024

Hi Team,

Thank you for the years of amazing content at Stacked Homes. Always such informative articles and detailed analysis.

We are currently faced with a decision which we’d love to have your opinion on if you also find it interesting to analyse.

We have a 2-bedroom condo in the CCR area and are currently faced with the question of: Is it more worth it to rent out or sell our current place?

If we rent out, here’s what we incur and earn in the first year:

Income earned:

We earn a rental income of $84K (assuming a $7K monthly rent from the information available publicly, we might be wrong here)

Costs incurred:

We pay a higher tax of ~$33K (income + property tax)

We continue paying the mortgage of $90K ($44K in interest, $46K in principal)

We pay ~$5K in conservancy fees

If we sell, we want to figure out what’s a break-even price taking into account all our other fees:

Buying price: $2.2xxM

Fees + expenses: $275K (interest paid + BSD + lawyer fee + reno + agent selling commission)

So we are assuming that our breakeven selling price is $2.53M?

If we sell at the general asking price of $2.4M (rough gauge from the listings on PropertyGuru), would that mean we make a loss of $130K?

– From your expertise, do you see the CCR psf rising 5-7% in the next few years?

– Would it make sense for us to hold it for a couple more years 2-3 years and rent it out, since the sunk costs are high (interest payment and stamp duty, and that can be amortised over the holding period)?

– Or should we liquidate earlier and put the cash received into stocks (assuming a conservative return of 5%)?

Thank you so much!

Hi there,

Thank you for the kind words!

The dilemma you’re facing is a common one for new launch condo investors: should you sell or rent it out first?

Let’s start by looking at some of the recent sale and rental transactions in the development.

Given that the project is still rather new, only two 2-bedroom units were being transacted, both of which are sub-sale units.

| Date | Size (sqft) | PSF | Price | Level |

| Jul 2024 | 818 | $2,836 | $2,320,000 | #13 |

| Mar 2024 | 840 | $2,882 | $2,420,000 | #05 |

Here are the 2-bedroom rental transactions from Q3 2024.

| Date | Size (sqft) | Rent |

| Sep 2024 | 800-900 | $7,500 |

| Sep 2024 | 800-900 | $7,500 |

| Sep 2024 | 800-900 | $7,500 |

| Sep 2024 | 800-900 | $6,700 |

| Sep 2024 | 800-900 | $7,000 |

| Aug 2024 | 800-900 | $7,000 |

| Aug 2024 | 800-900 | $7,000 |

| Jul 2024 | 800-900 | $6,800 |

| Jul 2024 | 800-900 | $6,900 |

| Jul 2024 | 800-900 | $6,400 |

The average monthly rent aligns closely with your initial estimate, amounting to $7,030. Given your purchase price of $2.2xxM, this translates to a decent rental yield of approximately 3.7%.

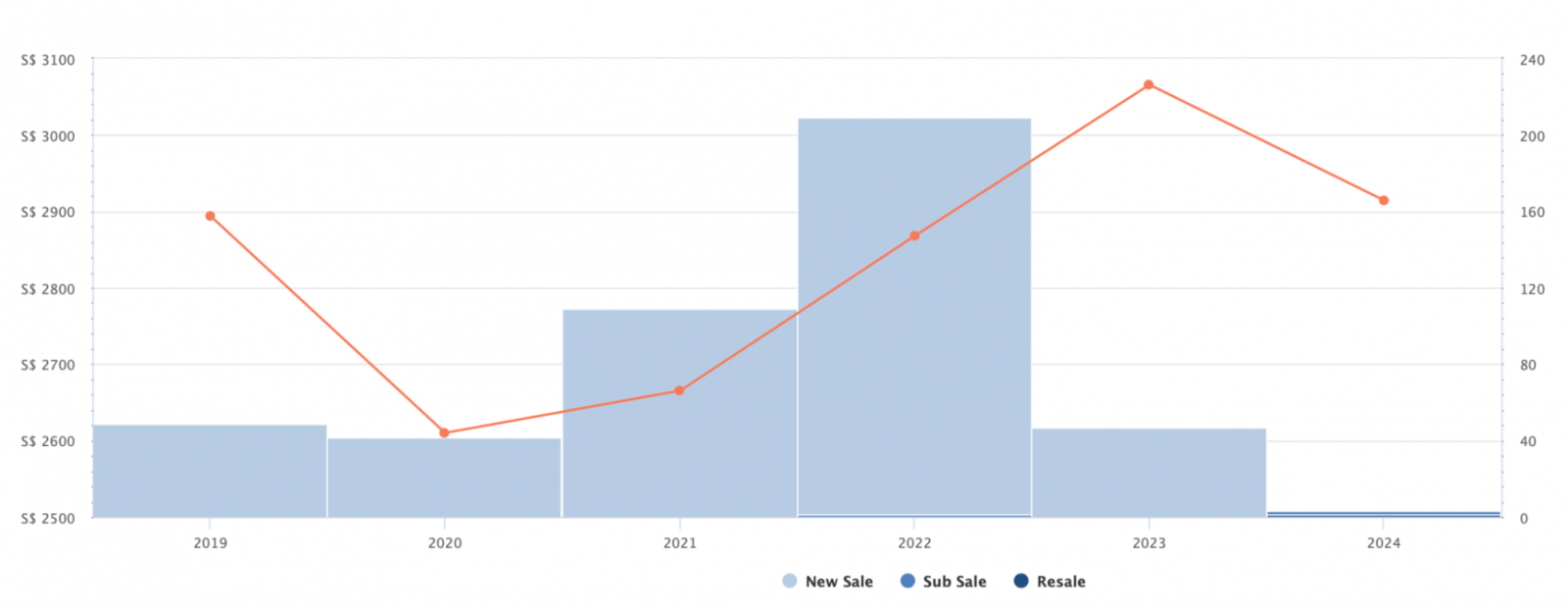

Now let’s take a look at how the project has been performing since its launch.

Performance of Riviere

| Year | Avg PSF |

| 2019 | $2,894 |

| 2020 | $2,610 |

| 2021 | $2,665 |

| 2022 | $2,868 |

| 2023 | $3,066 |

| 2024 | $2,914 |

| Average | 0.37% |

The observed decline in prices between 2019 and 2020 can be explained by the higher proportion of 1-bedroom units sold, which typically command a higher price per square foot (psf). This was also a period when the development was launched at a higher price but slow sales, which resulted in a lower price during 2020 to move units.

As such, the transactions only picked up from 2021 to 2022, which is why you see so few transactions still – as a bulk of the owners here have yet to fulfill the SSD period. So given the limited transaction data for the current year (only three transactions), it may be a little premature to make any definitive assessments regarding the project’s performance.

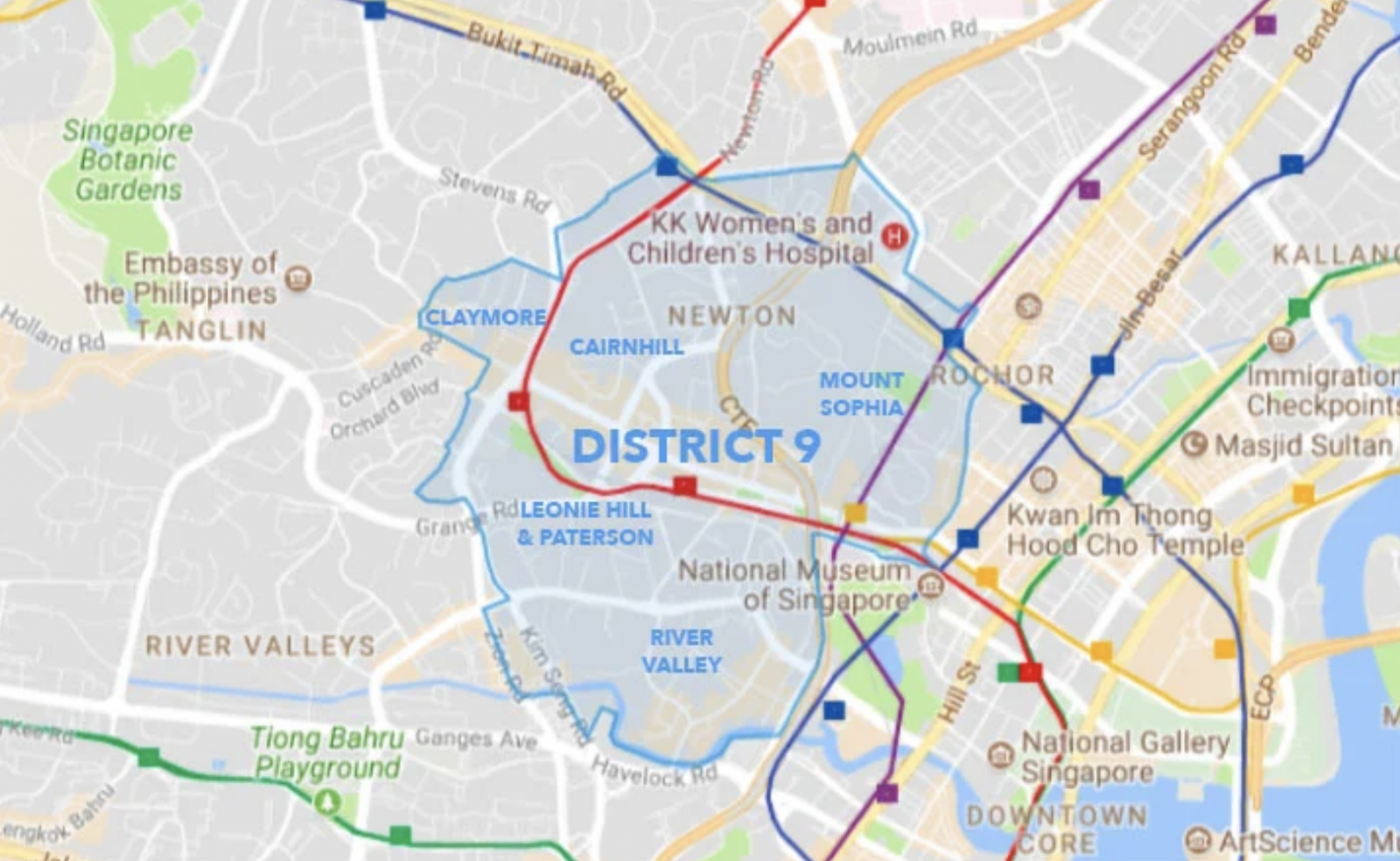

One intriguing aspect of Riviere is its classification under District 3, despite its neighbouring projects being listed in District 9. While District 9 is part of the Core Central Region (CCR), District 3 falls within the Rest of Central Region (RCR). This distinction harks back to Singapore’s historical 2-digit postal district system, which divided the country into 28 districts for postal purposes between 1950 and 1979. Although the system was eventually replaced by the more precise 6-digit postal code, these 2-digit district codes remain widely used for their simplicity and familiarity.

Source: 99.co

While the project is technically classified under District 3, a closer examination of the District 9 boundaries reveals that the development can be compared with developments in District 9 and the Core Central Region (CCR). With this in mind, let’s delve into the historical price trends in the CCR.

| Year | CCR | RCR | OCR |

| 2004 | 76.9 | 92.9 | 83.4 |

| 2005 | 81.5 | 94.1 | 84.3 |

| 2006 | 95.4 | 96.9 | 87.9 |

| 2007 | 126.5 | 126.4 | 111 |

| 2008 | 119.4 | 120.4 | 107.9 |

| 2009 | 117.2 | 124.1 | 120.5 |

| 2010 | 133.9 | 145.9 | 138.6 |

| 2011 | 139.2 | 152.5 | 149.2 |

| 2012 | 140.3 | 155 | 158.9 |

| 2013 | 137.6 | 154.8 | 169.3 |

| 2014 | 131.9 | 146.6 | 165.6 |

| 2015 | 128.6 | 140.3 | 159.4 |

| 2016 | 127 | 136.4 | 154 |

| 2017 | 127.8 | 138.9 | 156.1 |

| 2018 | 136.4 | 149.2 | 170.7 |

| 2019 | 134.1 | 153.4 | 177.9 |

| 2020 | 133.6 | 160.6 | 183.6 |

| 2021 | 138.7 | 186.7 | 199.7 |

| 2022 | 145.4 | 204.9 | 218.2 |

| 2023 | 148.1 | 211.3 | 248.1 |

| Average | 3.85% | 4.74% | 6.15% |

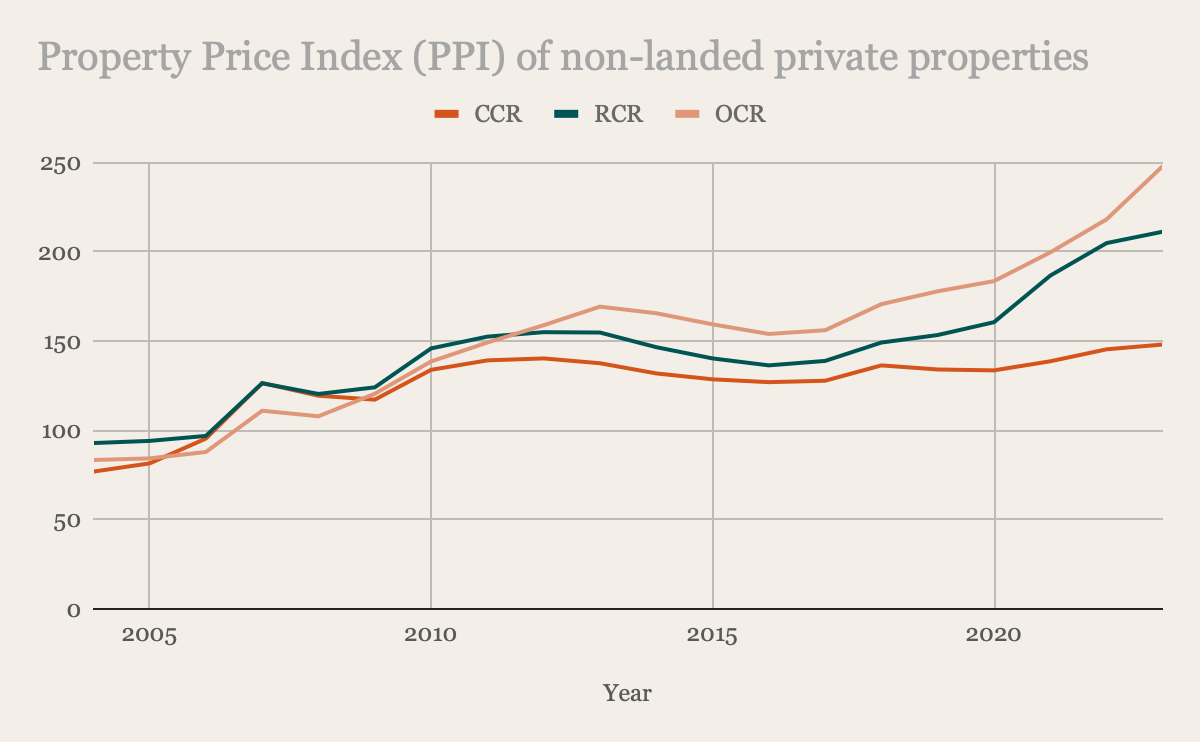

To gain a more comprehensive understanding of the trends, let’s look back to 2004. Over the last 19 years, the CCR has shown the lowest average growth rate compared to the RCR and OCR. However, the disparity is less pronounced when viewed over this extended period. Between 2004 and 2023, the CCR’s growth rate averaged 0.79%, while the RCR and OCR achieved significantly higher rates of 3.35% and 4.06%, respectively.

Key Turning Points

2004–2007: Pre-Global Financial Crisis Boom

From 2004 to 2007, all regions experienced a notable upswing in property prices, driven by strong market sentiment and economic growth. However, the global financial crisis in 2008 disrupted this momentum, causing property prices to fall across the board.

2008–2012: Recovery and Divergence

Following the financial crisis, the RCR and OCR demonstrated a faster recovery compared to the CCR. By 2010–2012, while prices in the CCR began to recover, the pace was noticeably slower. This divergence can be attributed to two possible key factors:

- Occupancy Trends: Properties in the RCR and OCR are predominantly owner-occupied, offering more stability during economic uncertainty. In contrast, the CCR, with its higher concentration of investor-owned properties, proved more sensitive to market volatility.

- Decentralisation Policies: Government efforts to decentralise commercial hubs and shift businesses outside the central business district (CBD) enhanced the appeal of the RCR and OCR. These regions also benefited from a higher proportion of HDB upgraders, further driving demand.

2019–2023: Pandemic Impact and the WFH Shift

The COVID-19 pandemic marked another pivotal moment. From 2019 onward, property prices in the RCR and OCR rose as demand surged for larger living spaces to accommodate work-from-home needs. Conversely, prices in the CCR initially declined due to border closures and investor caution, as uncertainty about the market’s trajectory caused many to adopt a “wait-and-see” approach.

Although CCR prices eventually recovered, their growth lagged behind the RCR and OCR, which continued to benefit from robust demand among homeowners.

2023: ABSD Policy Changes

The recent hike in Additional Buyer’s Stamp Duty (ABSD) for foreign buyers to 60% in April 2023 could further temper growth in the CCR. As the CCR has historically attracted foreign investors/buyers, this policy change may lead to subdued demand, particularly from this buyer segment.

| Year | CCR | RCR | % difference |

| 2013 | $2,054 | $1,509 | 36.12% |

| 2014 | $1,975 | $1,449 | 36.30% |

| 2015 | $1,972 | $1,383 | 42.59% |

| 2016 | $2,063 | $1,368 | 50.80% |

| 2017 | $2,059 | $1,437 | 43.28% |

| 2018 | $2,208 | $1,505 | 46.71% |

| 2019 | $2,278 | $1,520 | 49.87% |

| 2020 | $2,119 | $1,495 | 41.74% |

| 2021 | $2,111 | $1,568 | 34.63% |

| 2022 | $2,187 | $1,690 | 29.41% |

| 2023 | $2,204 | $1,823 | 20.90% |

| Year | CCR | OCR | % difference |

| 2013 | $2,054 | $1,054 | 94.88% |

| 2014 | $1,975 | $1,072 | 84.24% |

| 2015 | $1,972 | $1,075 | 83.44% |

| 2016 | $2,063 | $1,051 | 96.29% |

| 2017 | $2,059 | $1,070 | 92.43% |

| 2018 | $2,208 | $1,110 | 98.92% |

| 2019 | $2,278 | $1,098 | 107.47% |

| 2020 | $2,119 | $1,087 | 94.94% |

| 2021 | $2,111 | $1,167 | 80.89% |

| 2022 | $2,187 | $1,292 | 69.27% |

| 2023 | $2,204 | $1,410 | 56.31% |

The slower growth rate in the CCR has led to a gradual narrowing of the price gap between the CCR and the RCR and OCR. However, this trend doesn’t necessarily indicate that buyers from the RCR or OCR will shift their focus to the CCR. The higher price point of CCR properties often presents a significant barrier, particularly for homeowners.

For the same budget, buyers can frequently secure larger units in the RCR and OCR. This is especially appealing to homebuyers prioritising space and practicality over the prestige of a prime location. As a result, while the CCR may still attract investors and high-net-worth individuals, the RCR and OCR remain more desirable options for many owner-occupiers.

| Year | PPI | % change |

| 2013 | 153.2 | – |

| 2014 | 147 | -4.05% |

| 2015 | 141.6 | -3.67% |

| 2016 | 137.2 | -3.11% |

| 2017 | 138.7 | 1.09% |

| 2018 | 149.6 | 7.86% |

| 2019 | 153.6 | 2.67% |

| 2020 | 157 | 2.21% |

| 2021 | 173.6 | 10.57% |

| 2022 | 188.6 | 8.64% |

| 2023 | 201.5 | 6.84% |

| 2024Q3 | 204.7 | 1.59% |

The PPI indicates that prices are still climbing, albeit at a slower pace. This trend could suggest the market is gradually correcting itself, moving toward a more stable and sustainable trajectory.

In a recent Business Times article, a BI analyst commented: “Prices in Singapore should rise as interest rates fall. Housing demand will continue to be supported by inflation-hedging power, healthy household balance sheets, cheaper interest rates, and the demand from public homeowners upgrading to private apartments. However, selective buyers, macroeconomic uncertainty, more property launches, and unsold inventory may limit further growth.”

While falling interest rates are generally expected to stimulate the property market, their impact may be more significant for homeowners than for investors. Homeowners, who often rely on loans to finance property purchases, benefit directly from reduced borrowing costs. In contrast, investors (particularly those in the CCR) tend to have higher liquidity or access to alternative financing, making interest rate fluctuations less critical to their decision-making.

Also, taking into account the factors we’ve discussed earlier such as ABSD rates, the government’s decentralisation efforts and price stabilisation, it is difficult to see CCR property prices experiencing a significant increase of 5–7% in the short term, unless there is some relaxation of cooling measures.

Ultimately, the question shouldn’t really be if the CCR properties would see an appreciation as a whole. While a rising tide would lift all boats, there is still a distinction when it comes to the individual properties.

As such for Riviere, it is a little tough to see it as a good investment product to begin with. The smaller target audience as a result of its location, bigger than average unit size (which means a higher price) makes it great for those who want to stay in the area, but price growth could be difficult to achieve especially when we compare them to surrounding developments.

Let’s do a simple comparison between Riviere and its neighbouring resale developments. We will compare against those that have at least one 2-bedroom unit transacted in the past year.

| Project | Tenure | Completion year | No. of units | Avg price psf for a 2-bedder (in 2024) | Avg price for a 2-bedder (in 2024) | Avg rent for a 2-bedder (Q3 2024) | Rental yield |

| Riviere | 99-years | 2023 | 455 | $2,859 | $2,370,000 | $7,030 | 3.56% |

| Martin Modern | 99-years | 2021 | 450 | $2,608 | $2,067,500 | $6,936 | 4.03% |

| Tribeca | Freehold | 2010 | 175 | $2,535 | $2,620,000 | $5,750 | 2.63% |

| The Trillium | Freehold | 2010 | 231 | $2,468 | $3,454,000 | $8,056 | 2.80% |

| Rivergate | Freehold | 2009 | 545 | $2,858 | $2,953,000 | $7,300 | 2.97% |

Let’s also take a look at how it compares against new launches in the area.

| Project | Tenure | Estimated completion year | No. of units | Avg price psf for a 2-bedder (sub sale tnx in 2024) | Avg price for a 2-bedder (sub sale tnx in 2024) |

| Irwell Hill Residences | 99-years | 2026 | 540 | $2,860 | $1,870,000 |

| The Avenir | Freehold | 2024 | 376 | $3,439 | $2,850,000 |

Among the neighbouring resale projects, Riviere stands out for its competitive rental yields, trailing only behind Martin Modern. While its average price psf is comparable to or higher than nearby freehold developments, these freehold units typically feature significantly larger floor plates, resulting in substantially higher overall quantum prices.

Comparing it to the 99-year new launch in the area, Irwell Hill Residences, the average price psf for sub-sale units is comparable. However, due to Irwell Hill’s more compact unit sizes, the overall quantum remains notably lower.

Given that Riviere commands one of the highest price psf and also a higher overall quantum than the upcoming Irwell Hill Residences, it’s difficult to predict with certainty how much prices could appreciate in the short term.

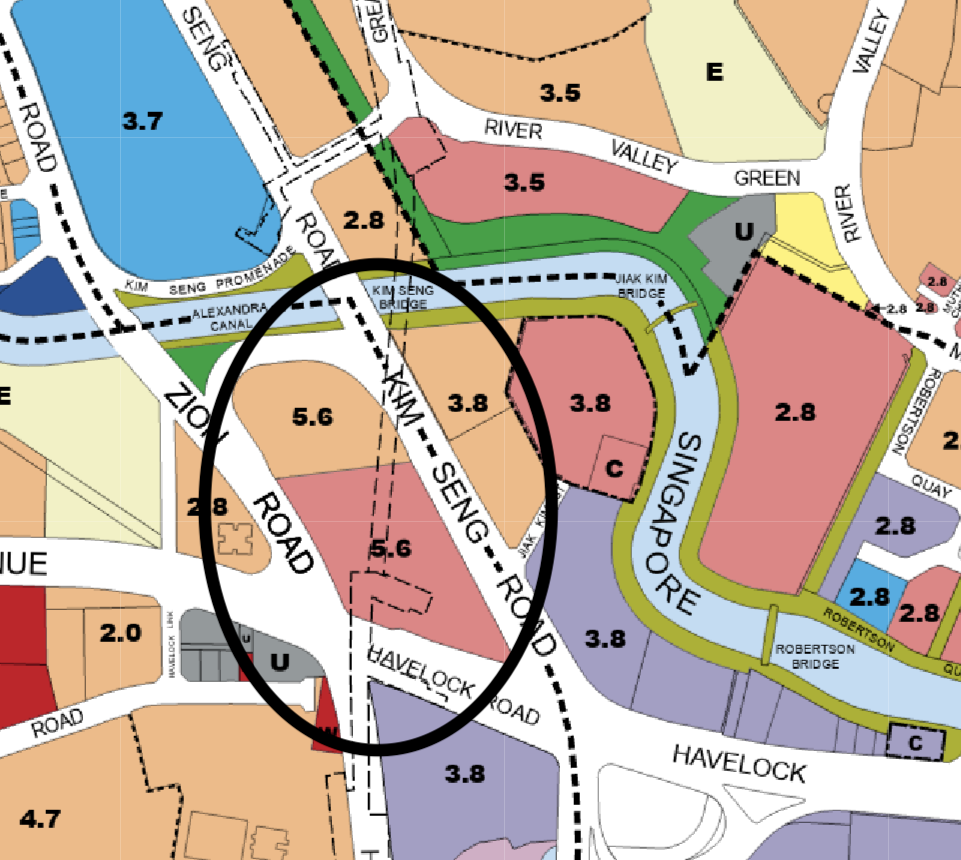

The other issue of prediction of prices here is due to the upcoming supply in the area.

Opposite Riviere sits an empty land parcel divided into two plots: one earmarked for purely residential developments and the other for mixed-use developments, featuring residential units with commercial spaces on the ground floor – quite similar to Riviere.

The development of the land plots opposite Riviere could influence its market positioning, depending on the launch timing and pricing. Typically, new launches are priced higher due to rising land and construction costs, which might make Riviere more attractive as a value option for buyers if the price gap is significant.

The introduction of additional residential units could also increase competition for tenants, especially if the new developments offer competitive rental rates.

That said, given Riviere’s positioning as a luxury development with larger-than-average new launch unit sizes – it doesn’t seem as if the Zion Road plot opposite would be following the same trend. It’ll more likely be similar to the unit sizes at Irwell Hill Residences, just like what we’ve seen from the recent Union Square Residences (as it would be by the same developer CDL).

On the positive side, the new developments could enhance the overall appeal of the area by adding infrastructure and retail options, indirectly benefiting Riviere. If the new projects are priced significantly higher, they could create a price floor, supporting Riviere’s resale value as a more affordable alternative in the same sought-after location. Ultimately, the extent of the impact will depend on the execution and market conditions at the time.

Now let’s take a look at the two pathways you’re considering.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Potential pathways

Renting the unit

Renting out the unit for a couple of years before selling offers several strategic advantages.

First, it provides you with the opportunity to monitor the market and assess how the development performs over time. Given that the property is relatively new and there have been few transactions, it can be challenging to accurately gauge its potential. Renting gives you the flexibility to hold off on a sale until you have a clearer understanding of market trends. Additionally, if you decide to sell while the unit is being leased out, you can opt to sell it with tenancy, which may appeal to investors seeking immediate rental income.

Second, renting out the property allows you to generate rental income, which as you have mentioned, allows you to amortise the sunken costs, thereby easing your financial burden. For new launch properties, buyers often depend on price appreciation during the construction phase, driven by the developer’s pricing strategy, to secure a profit upon the project’s completion. However, if prices do not rise significantly during this period, the opportunity to capitalise on the building phase is lost. In such situations, renting out the unit after completion becomes a potential pathway since it provides a stream of income, helping to offset holding costs like mortgage payments and maintenance fees while giving the market time to recover or appreciate further.

For calculation purposes, let’s assume you rent out the unit for 3 years. As we don’t have the full details of your outstanding loan, we will estimate by reducing the annual mortgage interest by $1,000 each year.

Costs incurred

| BSD | $82,350 |

| Interest expense | $129,000 |

| Property and income tax | $99,000 |

| Maintenance fees | $15,000 |

| Agency fees (Assuming it’s paid once every 2 years) | $15,326 |

| Rental income (Assuming rent of $7,030/month) | $253,080 |

| Total cost | $87,596 |

To calculate the selling price required to break even, we can use the following table.

We will be making some assumptions based on the numbers you’ve provided. Since we don’t have the full details of your financial situation, you may need to adjust the figures where necessary.

For this calculation, we will assume the following:

- You took out a loan of $1.6M, which is approximately 75% of the purchase price, with a 25-year tenure at an interest rate of 2.75%.

- We will also assume that you utilised your CPF to pay for 20% of the down payment. Since we do not know if you have used any CPF for the monthly mortgage payments, this calculation only factors in the initial 20% down payment paid.

| Outstanding loan + CPF used | $1,946,458 |

| BSD + cost incurred over 3 years | $87,596 |

| Reno cost | $90,000 |

| Legal fees | $3,500 |

| Agency fees for selling (Assuming 2% + GST and a selling price of $2,370,000) | $51,666 |

| Breakeven price | $2,179,220 |

However, to calculate the sale proceeds, you will use the selling price minus the outstanding loan, CPF used (principal plus accrued interest), legal fees and agency fees. Let’s assume the eventual selling price to be the average of $2,370,000.

| Selling price | $2,370,000 |

| Outstanding loan + CPF used | $1,946,458 |

| Legal fees | $3,500 |

| Agency fees for selling (Assuming 2% + GST) | $51,666 |

| Sales proceeds | $368,376 |

If you do utilise your CPF funds to pay for the monthly mortgage, the sales proceeds are likely to be lower.

Selling the unit

The cost incurred here will depend on how fast you manage to sell your unit. For calculation purposes, let’s assume that it takes a year.

Costs incurred

| BSD | $82,350 |

| Interest expense | $44,000 |

| Property tax | $4,751 |

| Maintenance fees | $5,000 |

| Total cost | $136,101 |

We can see here that the cost of holding the property for a year without renting it is more than the cost of holding it and renting it out for three years.

Similarly, to calculate the selling price required to break even, you can use the following table.

We will use the same assumptions as we have in the earlier calculation.

| Outstanding loan + CPF used | $2,017,137 |

| BSD + cost incurred over a year | $136,101 |

| Reno cost | $90,000 |

| Legal fees | $3,500 |

| Agency fees for selling (Assuming 2% + GST and a selling price of $2,370,000) | $51,666 |

| Breakeven price | $2,298,404 |

Sales proceeds

| Selling price | $2,370,000 |

| Outstanding loan + CPF used | $2,017,137 |

| Legal fees | $3,500 |

| Agency fees for selling (Assuming 2% + GST) | $51,666 |

| Sales proceeds | $297,697 |

If you do utilise your CPF funds to pay for the monthly mortgage, the sales proceeds are likely to be lower.

Let’s say you were to invest this for 2 years (to compare against renting for 3 years).

| ROI | Gains | Total |

| 3% | $18,130 | $315,827 |

| 4% | $24,292 | $321,989 |

| 5% | $30,514 | $328,211 |

| 6% | $36,795 | $334,492 |

| 7% | $43,136 | $340,833 |

What should you do?

Based on the calculations, it’s clear that holding onto the unit for a year comes with a higher cost compared to holding it for 3 years and renting it out since the rental income helps offset a significant portion of the ongoing expenses.

Additionally, if you were to sell the unit in three years, the sales proceeds would be comparable to selling the unit in one year and investing the proceeds for two years, assuming a 7% return on investment (ROI). This suggests that the financial outcome over the next few years could be quite similar, whether you choose to sell now or wait. It is also likely that the property will be sold at a higher price in three years.

Given that the development is still very new, renting out the property and observing its performance over the next few years can make sense. This approach allows you to monitor the market for any potential shifts, such as price increases or changes in demand. If property values do rise, you would have the option to sell the unit with tenancy in place, which could appeal to investors seeking immediate rental income.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Latest Posts

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

1 Comments

A loan was secured for 75% of the $2.2 million purchase price, totaling $1.65 million. It is assumed that 20% of the purchase price was paid using CPF for the down payment. Shouldn’t the remaining 5%, likely paid in cash, also be included in the total cost calculation?