The Curious Case Of Seahill: Good Rental Yield But Poor Resale Performance

December 3, 2021

If you are looking for a property for investment, which would you pick:

Would you buy a property with a good rental yield but depreciating prices?

Or…

A property with decent potential for appreciation but a poor rental yield?

I suppose ultimately, it depends on your investment objectives, but recently a reader reached out asking about a 1 bedroom rental investment unit at the Seahill.

And after digging deeper, this development offers investors exactly that dilemma today: rental yield or capital appreciation.

So today, let’s look at this case study on the Seahill and see what we can learn from it.

Let me start with some background on the Seahill for those who are less familiar with it:

The Seahill is a condo that was recently built in 2016. It has a total of 338 units and is quite unique in that it offers 4 different types of unit options. There’s the regular unit, SOHO, triplex townhouse, and serviced apartments as well.

But one interesting aspect here is that the townhouses here are eligible to be purchased by foreigners.

This is because Far East purchased the land before the new legislation, so unlike similar cluster home projects by Far East such as the Alana, in which foreigners are required to apply for LDAU approval – there’s no such requirement here.

So background aside, one thing that Seahill has going good for it is the facilities:

Good facilities

As you can see, the Seahill is very generous when it comes to swimming pools. Each section basically comes with its own pool and so you are never really more than a few footsteps away from one.

While it’s nice that you do have various pools to choose from should one get overly crowded, they are all more or less rectangular in nature – so variety wise it isn’t super different.

Also because there is a tower block, you do have facilities at the top (24th floor) that allow residents to enjoy the sea views too even if they are living on a lower level or a ground floor type like the Townhouse. And playing tennis at that level must be quite something!

Next, it has a location that is well-suited rentability wise:

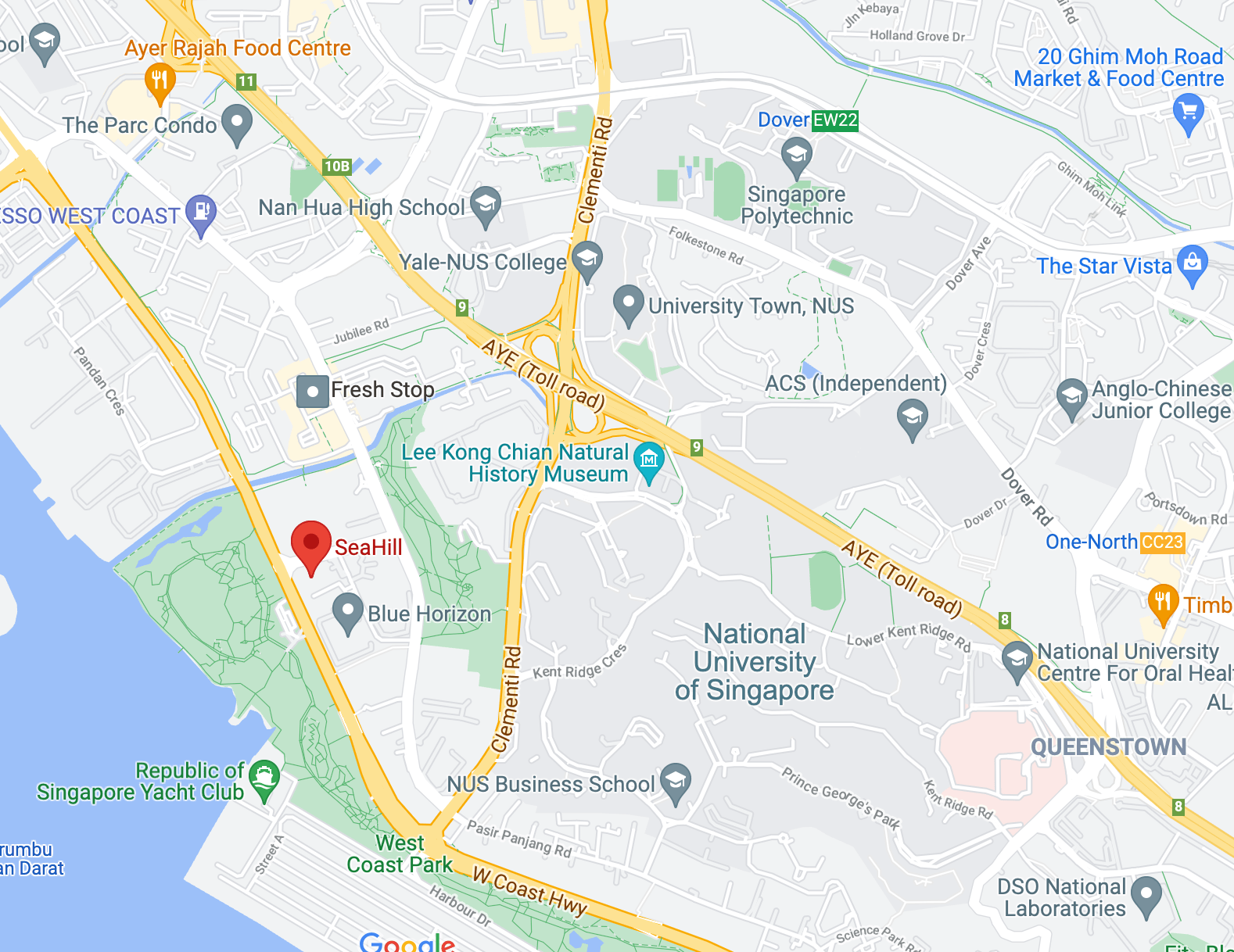

Semi-attractive location

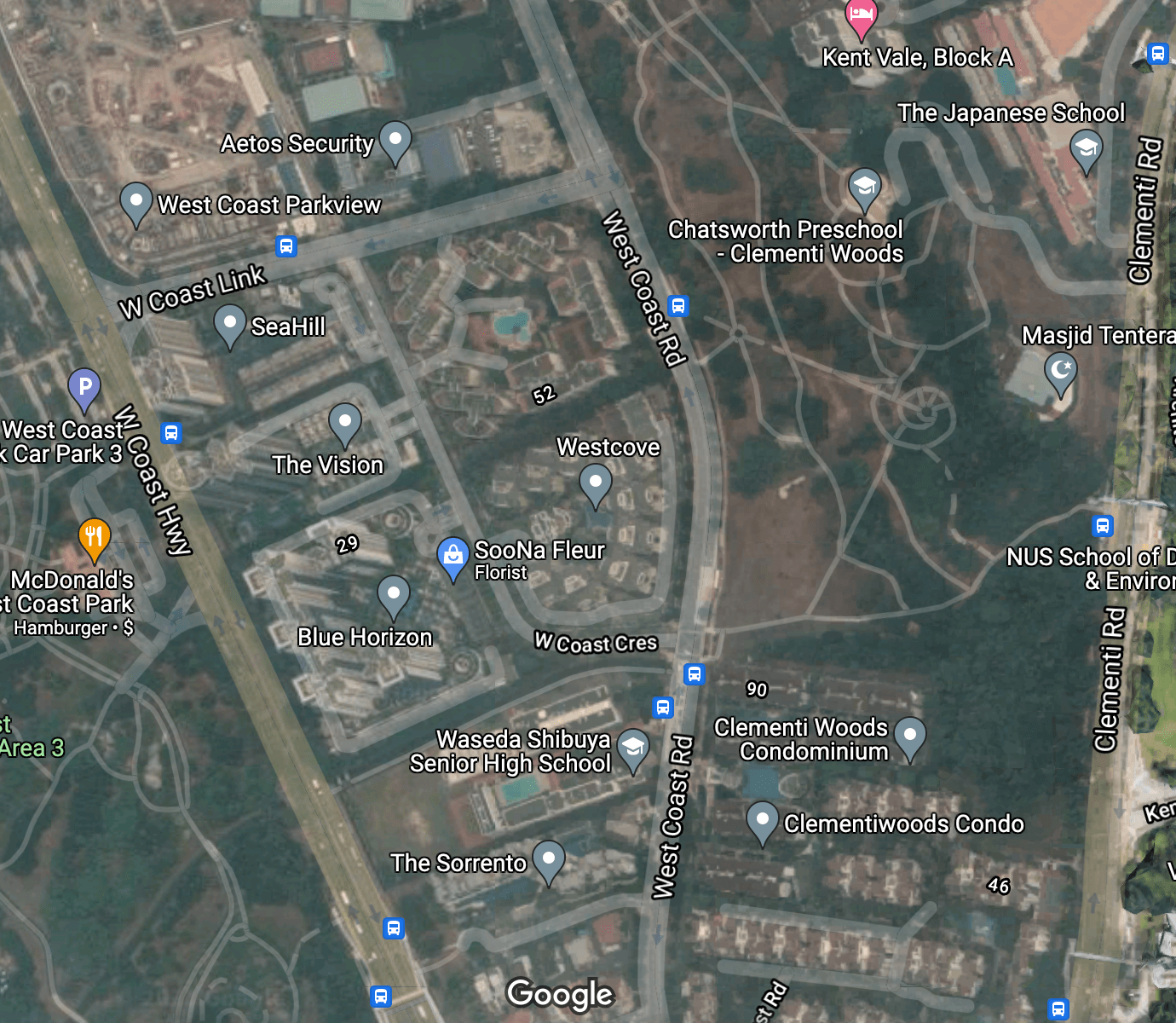

Of course, being so far out in the West, the Seahill isn’t what you’d call a centrally located development. Still, it does offer various perks in its immediate location.

For one, it is located pretty close by to West Coast Plaza and the food centre/market too.

In terms of nature, this is probably as good as it gets as the estate is practically straddled between 2 sizable parks – West Coast Park and Clementi Woods Park. Of the 2, West Coast Park is a little more famous because of the huge selection of playgrounds for kids and the usually busy Mcdonalds along with the drive-thru.

So even with the good selection of pools, having this much open area at your doorstep is naturally very attractive to families with young children.

Property Picks10 Most Affordable New Launch 4-bedroom Units Under $1,540 PSF For Families

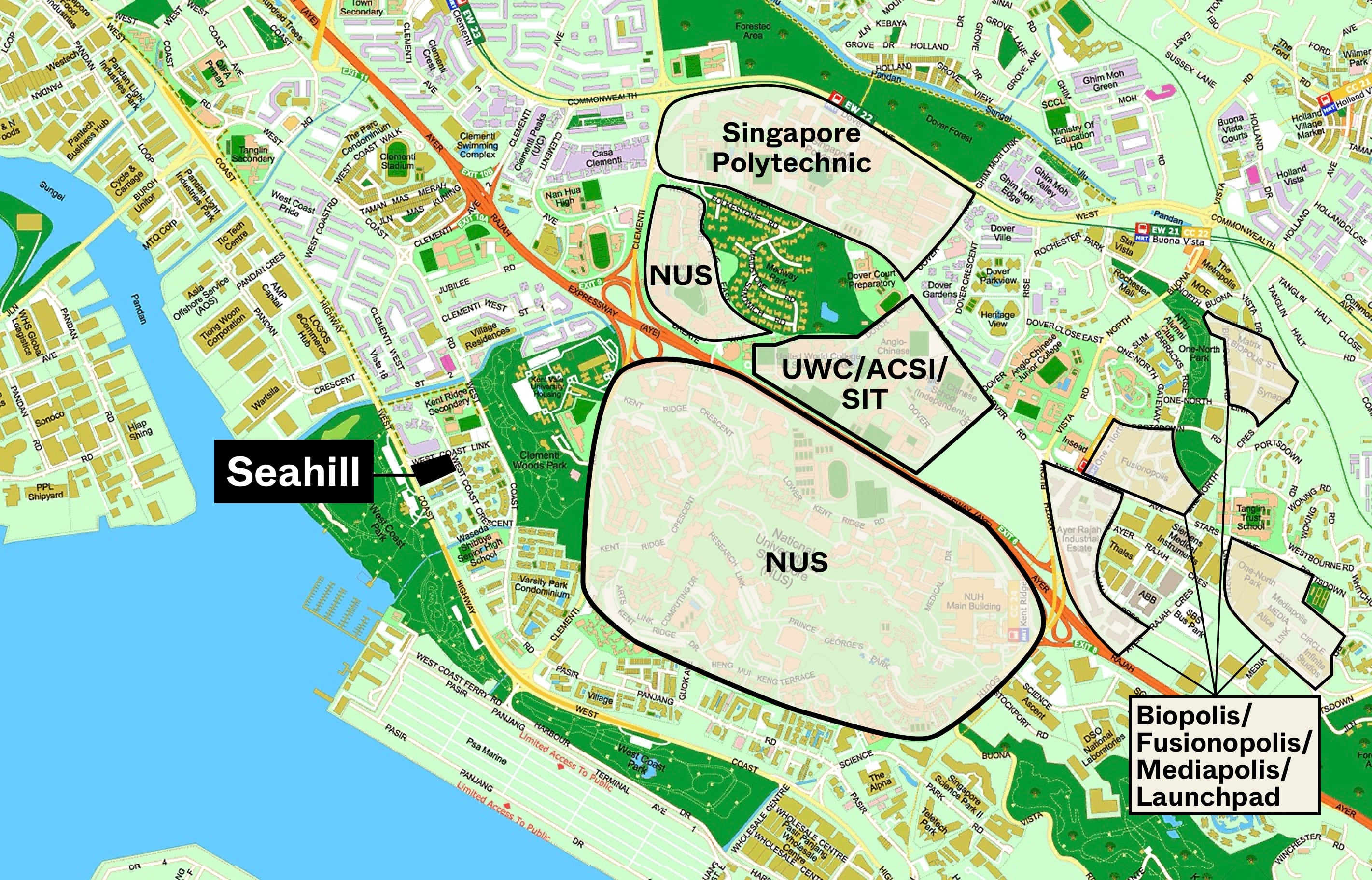

by Ryan J. OngNext, you are closely located to major educational institutes (NUS), and areas such as the Pandan Loop industrial area along with the Mapletree Business City further down the road.

The biggest downside? It isn’t near an MRT station so you are highly dependent on bus services to get to the MRT.

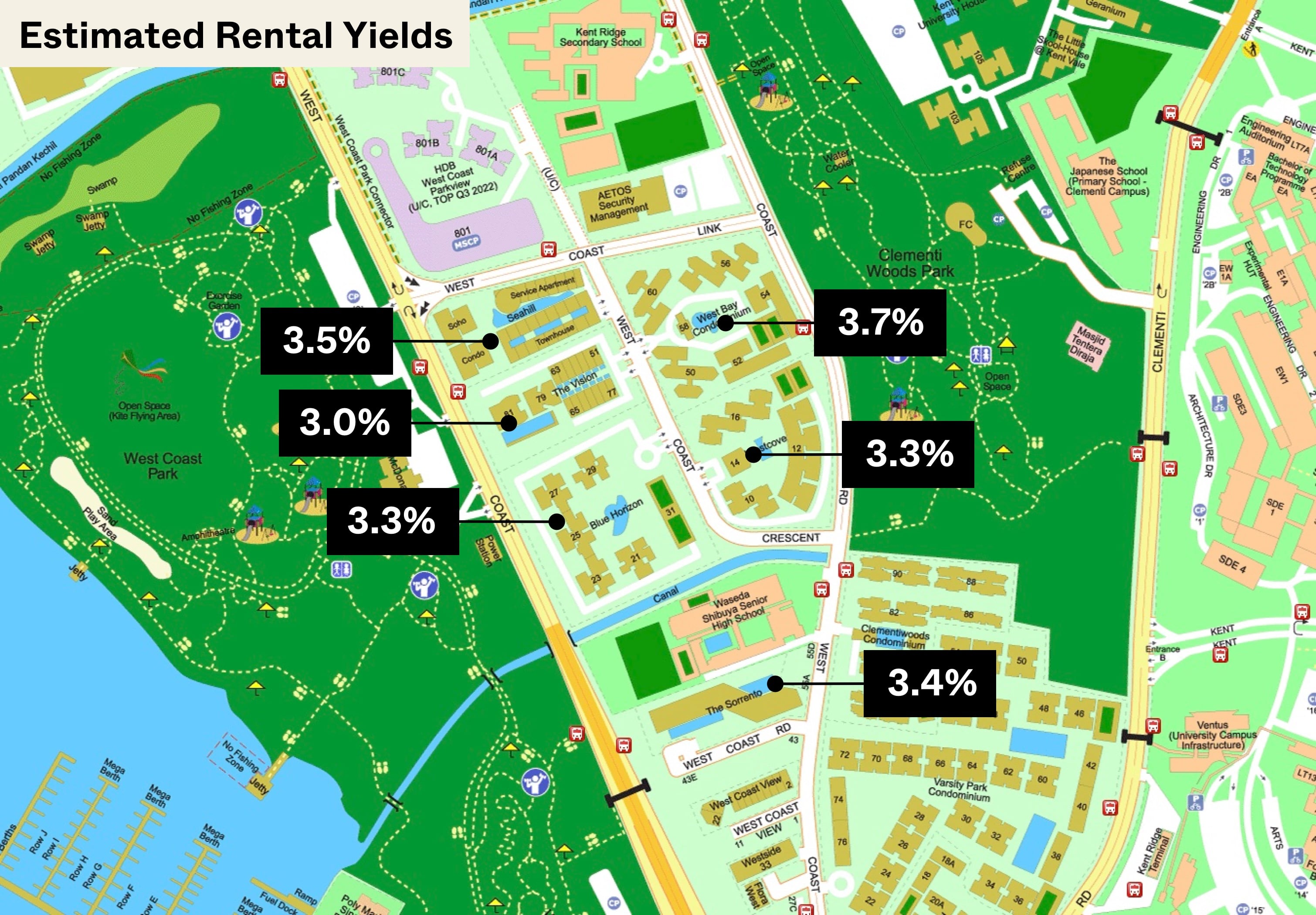

So primarily because of the location and strong facility offering, rentability is high and the rental yield is higher than the market average as well, with current rental yields of around 4%

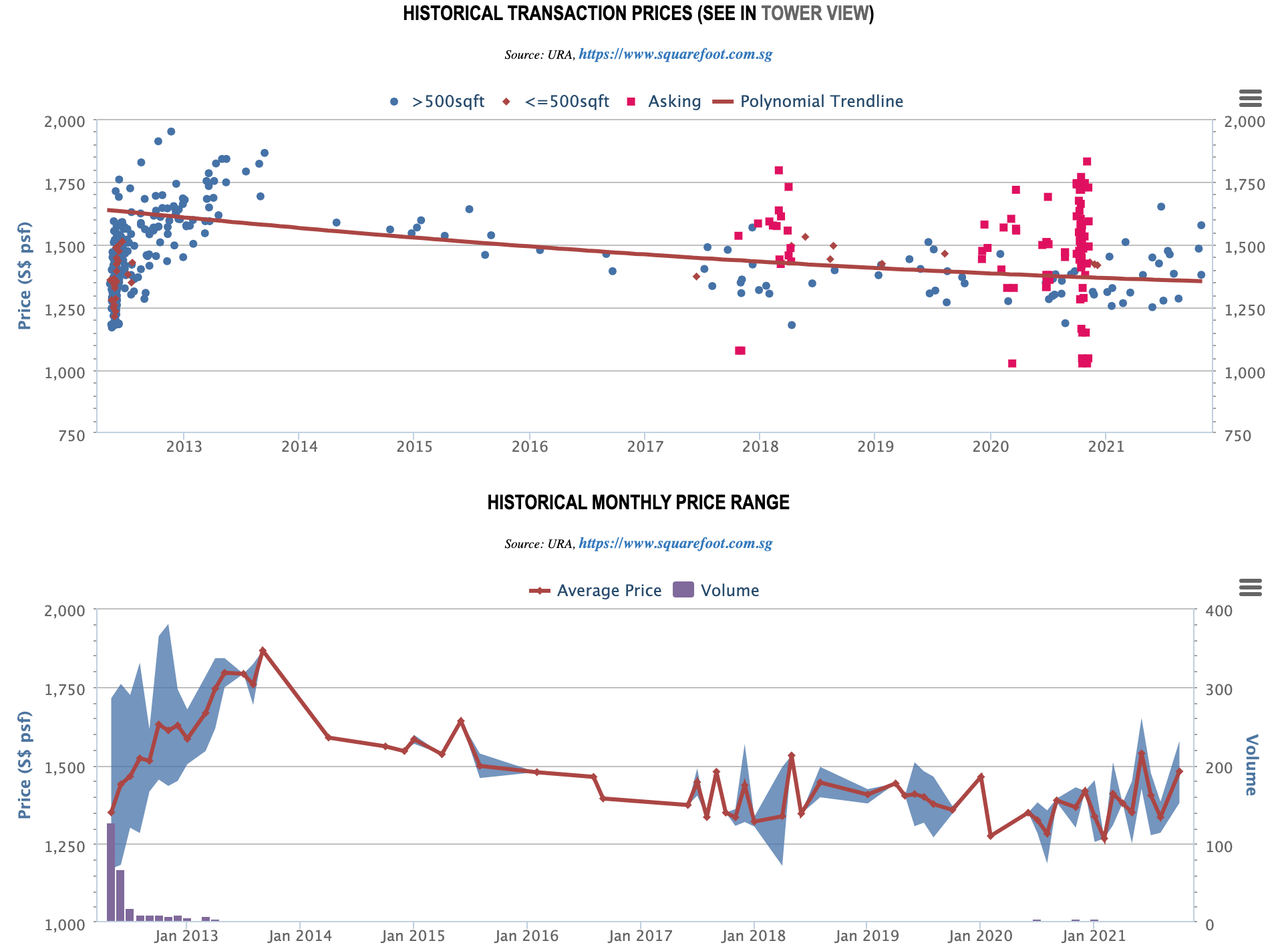

However, there is a catch. As yield is a function of rental rates and prices, something has to give – and the low quantum here is what makes it attractive in terms of yields. Prices have rather stagnated and some even depreciated since its launch back in 2012:

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Is The Upcoming 900-Unit Chuan Park Residences Worth Looking At? 4 Crucial Things You Need To Know

It was a bumpy road for the $890 million en-bloc sale of Chuan Park - but now we’re at the…

What are some reasons behind this?

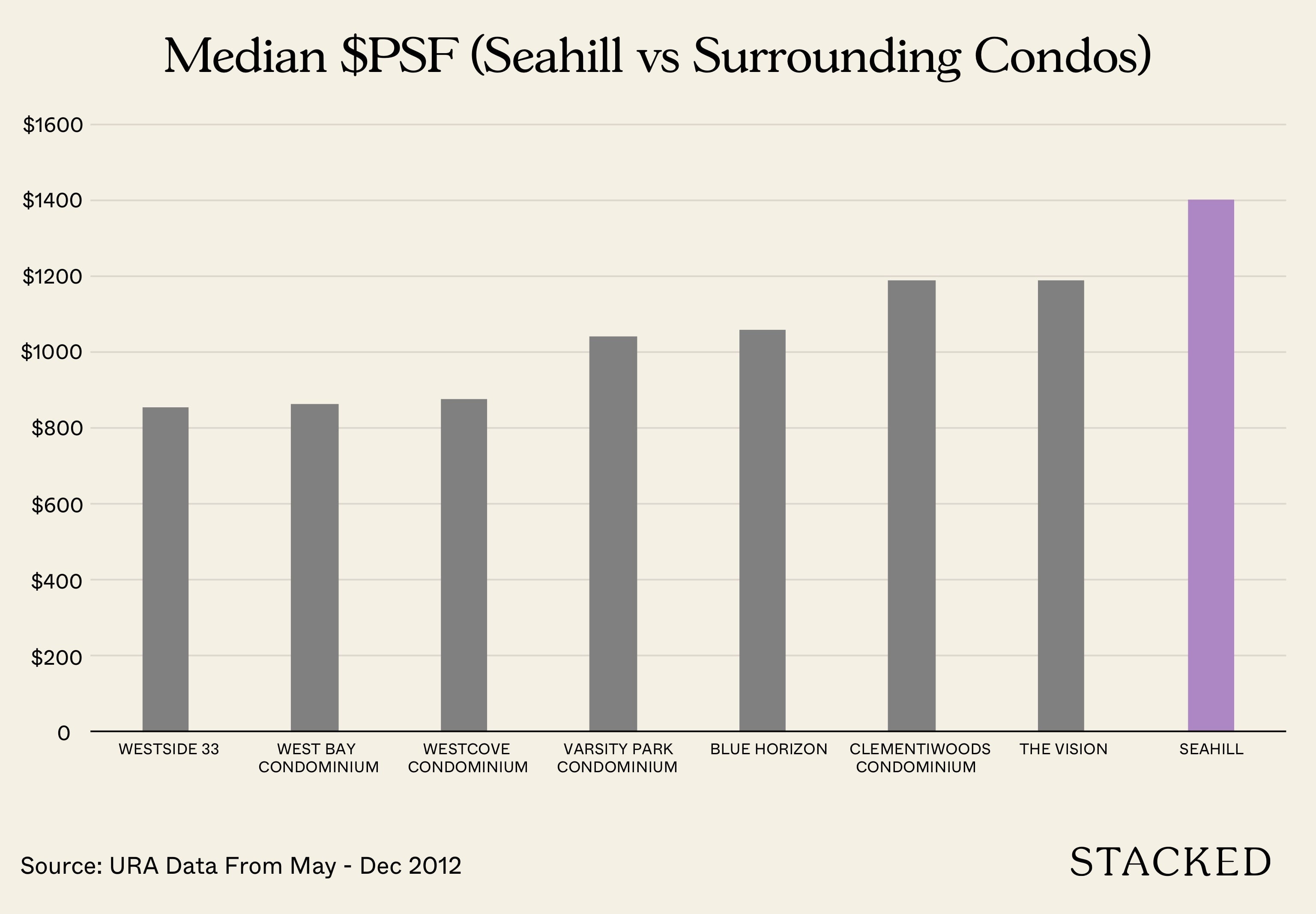

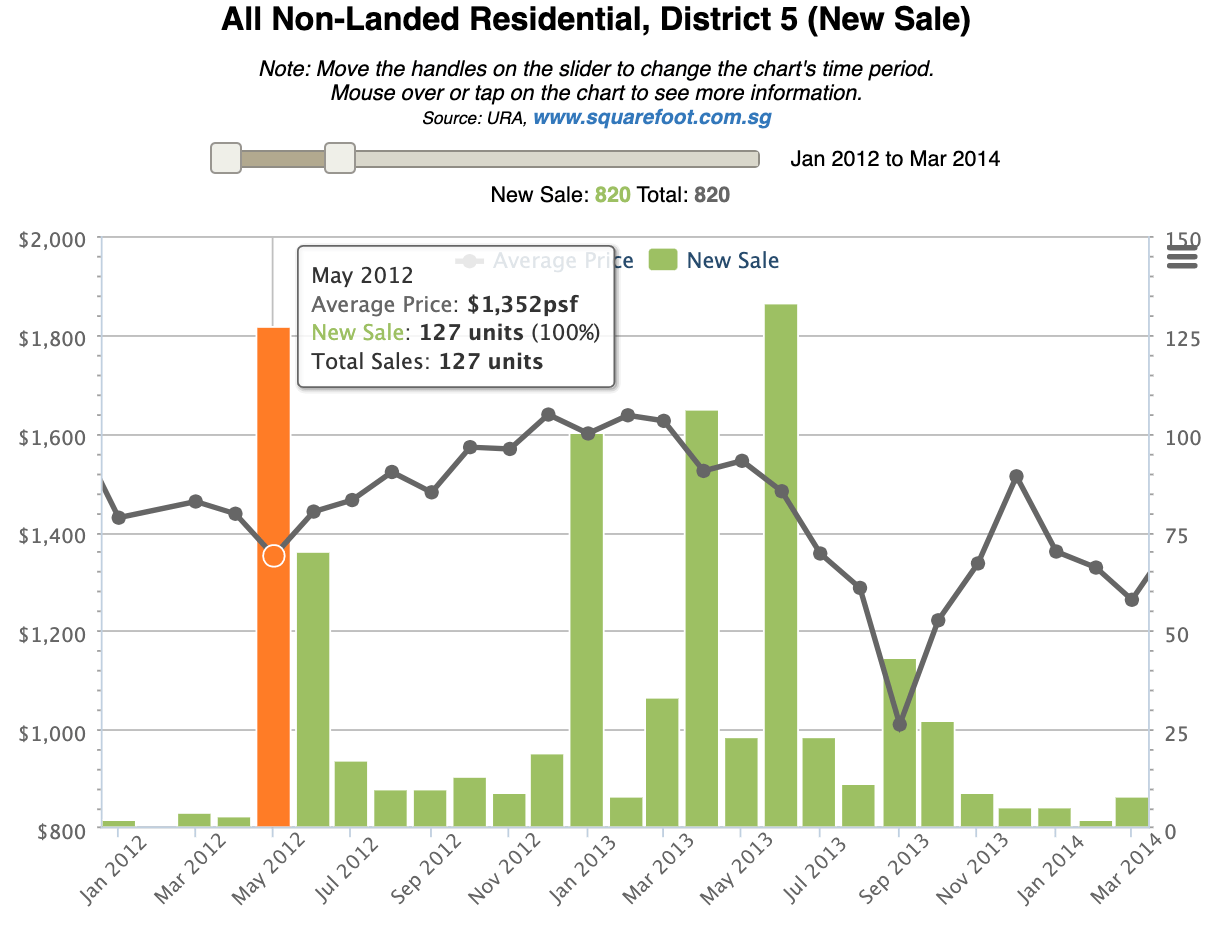

For one, it was launched in May 2012 at a $1,3xx psf average which rose to $1,6xx average by the end of 2012 – these were prices that were significantly higher than its resale comparables. Hence, it’s likely that when it was finally built and the end product could not justify such pricing, the resale market could not support this either.

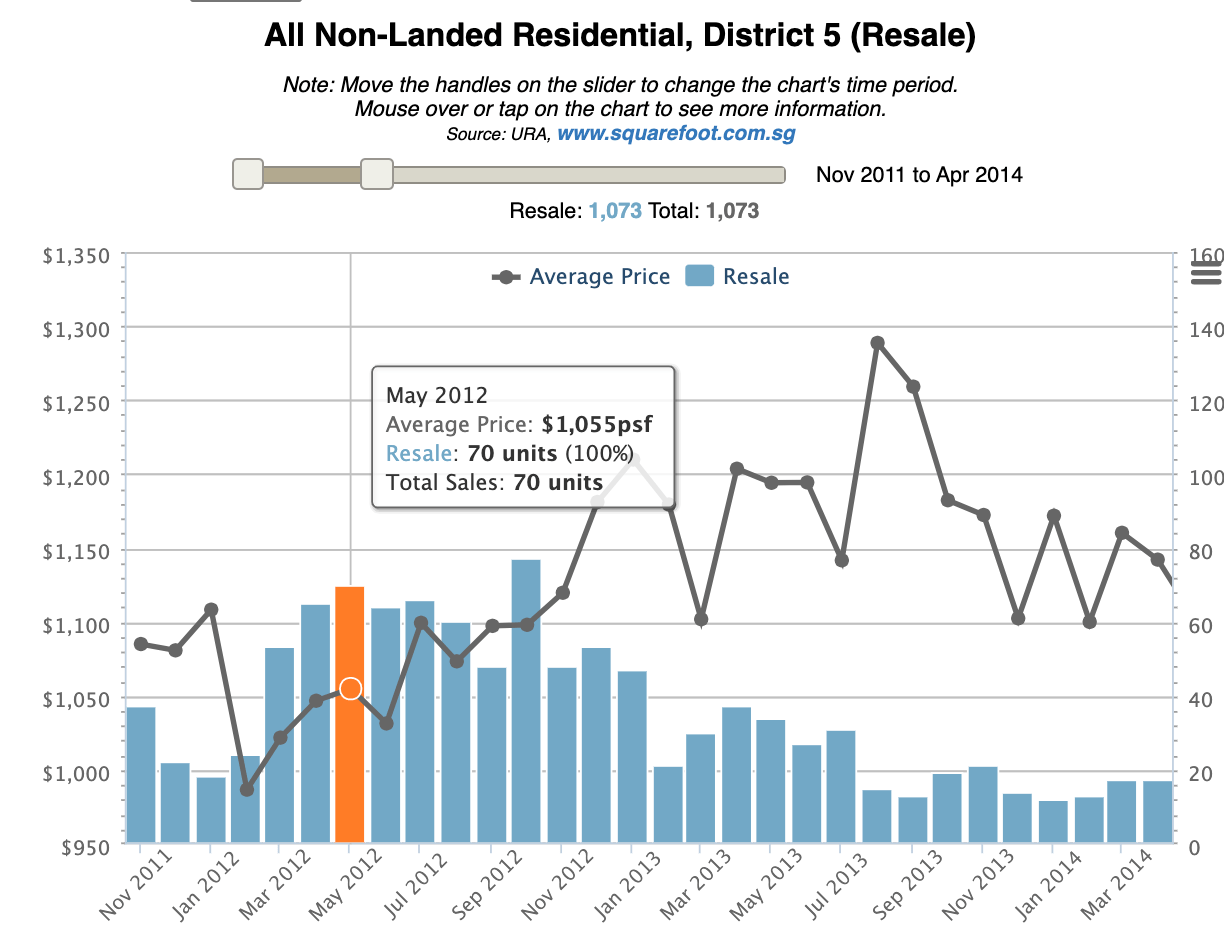

The surrounding resale prices were transacting at $1,0xx psf for the district, which signalled a close to 22% gap between its resale counterparts.

Here’s what prices of resale and new sales looked like in district 5:

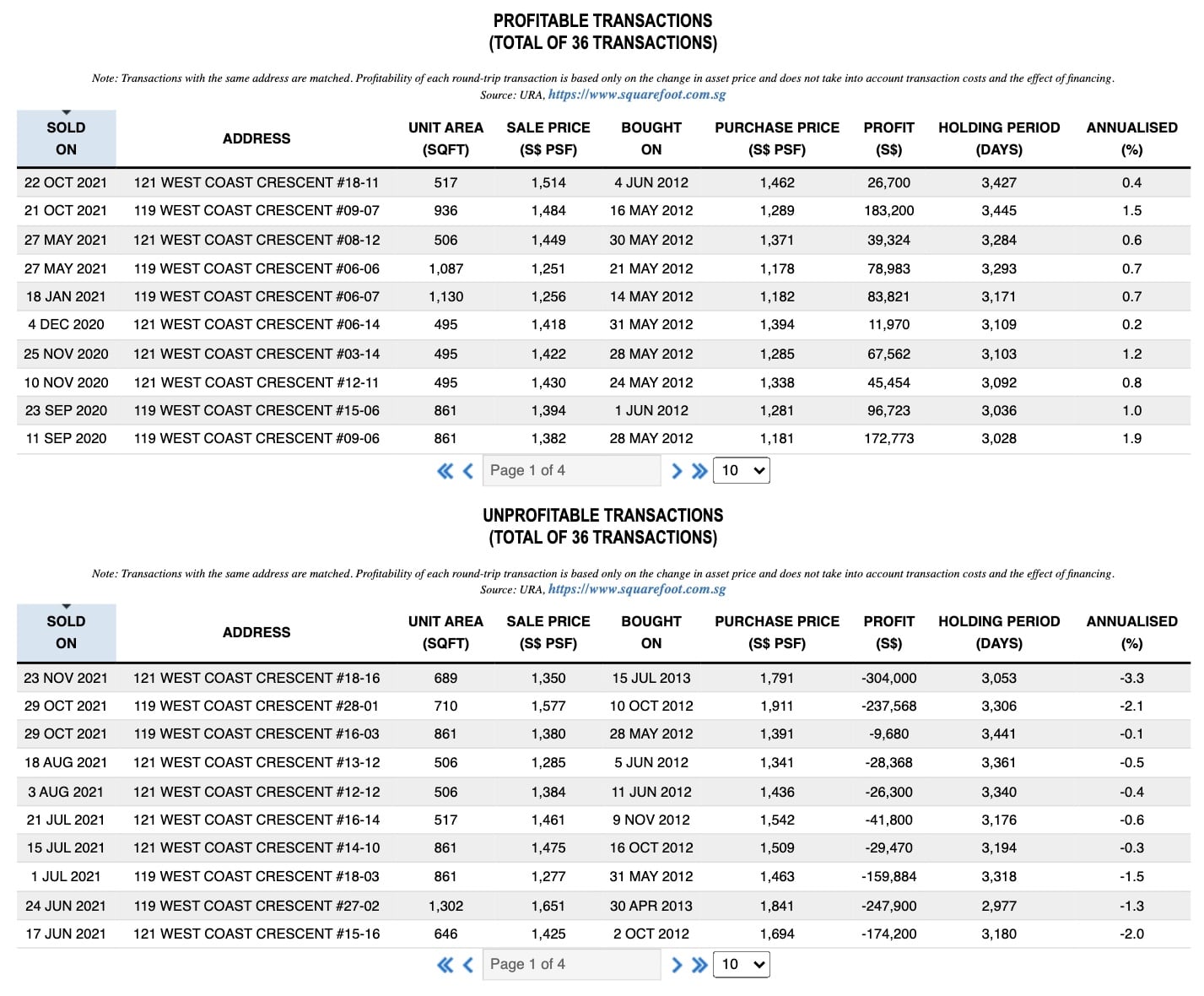

As of today, the development has seen 36 profitable transactions and 36 unprofitable transactions. This is a red flag that prices have remained rather stagnant.

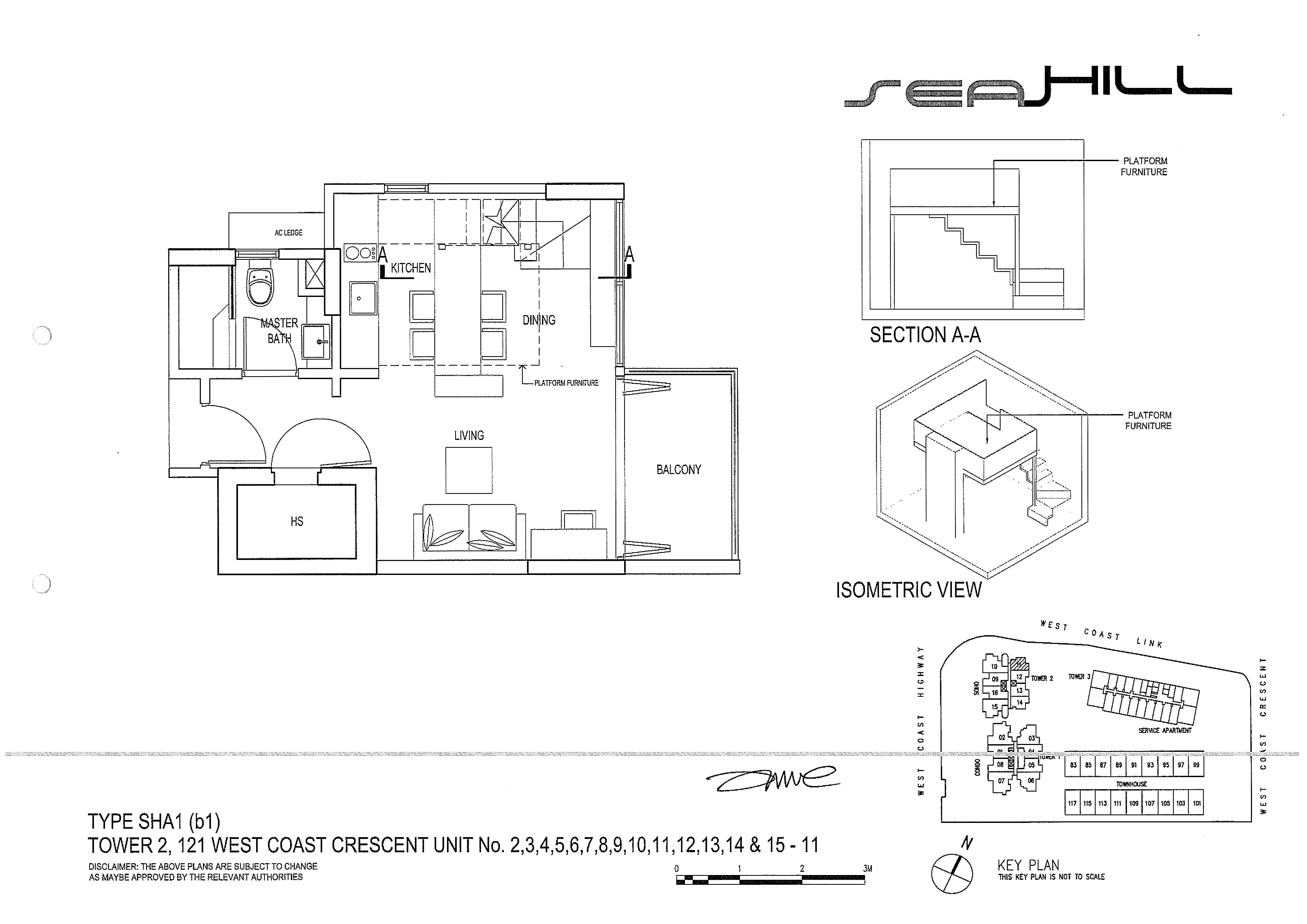

Next, this is likely due to the unfavourable unit layout, a loft unit type that is where it caters to a niche group of buyers.

We think that a proper one-bedroom separating the bedroom and living area and not having to climb to bed would be more preferable – this is based on our experience talking to clients and is evident in pricing behaviours of such unit types (see The Tennery as another example).

Admittedly, the high ceilings are attractive, but it’s just not as practical to live with on a day to day basis, especially with the low headroom in the sleeping area.

Yet, rental rates here have been quite decent. Why so?

If you look at the supply of 1-bedders in the area, you’ll find that Seahill is the only condo with this unit type. Other developments around have minimally 2-bedders onwards with rental rates of at least $3k+.

This combination of its location and facility attributes but a niche unit type that isn’t very favourable led to a situation of good rental rates but stagnant pricing.

As such, it’s great for rental, but perhaps not so much if you are looking for good capital appreciation.

Final Words

To sum it up, there is generally an inverse relationship between yield and capital appreciation. The higher the yield, the lower the capital growth is likely to be, and the higher the capital growth the lower the yield is likely to be.

It goes without saying that properties with good capital appreciation are found in areas where you have more demand than the supply, and prices are driven up as buyers compete for the limited properties available.

This will happen in areas that are close to working areas, with good amenities, public transport and infrastructure (or future growth).

In other words, in good locations that people want to live in.

However, over time because these properties cost more to purchase, rental yields may not necessarily rise along with the demand.

So which would you pick? Let us know in the comments below.

For more on issues affecting property investment, or in-depth reviews of new and resale properties, follow us on Stacked. If you’re pondering the future gains of your property purchase, do reach out to us for a proper consultation.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the main advantages of investing in Seahill?

Why has Seahill experienced stagnant property prices despite good rental returns?

Is Seahill suitable for investors seeking capital growth?

What are the challenges of living in Seahill's unit types?

How does Seahill's location impact its rental potential?

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Property Investment Insights This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

Property Investment Insights We Compared Lease Decay Across HDB Towns — The Differences Are Significant

Property Investment Insights This Singapore Condo Skipped 1-Bedders And Focused On Space — Here’s What Happened 8 Years Later

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments