The Curious Case Of Multi-Million Dollar Coffeeshops In Singapore

December 17, 2023

If anything will make me believe in Feng Shui, it’s coffee shops

Take, for instance, this coffee shop which I frequent, which was sold for $40.5 million. To begin with, I personally disagree with most of the comments on why exactly that coffee shop is so valuable.

Because it has a KFC and draws students? X to doubt (*gamers of LA Noire would know this). There’s a KFC in NEX, which – as the same article will tell you – is about five minutes away. That’s where I see students, because like me, if they want to eat at KFC, they’ll go to the air-conditioned one in NEX (which is also next to Jollibee and Yoshinoya, so you can even mix-and-match your meal).

A lack of competition nearby? Also dubious. There are at least three other coffee shops nearby, at least one of which is far more packed.

As for being near NEX? To me, that’s even less reason for it to be valuable, because have you seen the number of food options at NEX? There are TWO giant food courts in it. One day of food supplies to NEX could probably feed a small village for a week. The last place I would set up a coffee shop is within walking distance of NEX.

But I’m wrong, and the market says so.

None of my reasoning, which I assert is solid “on-the-ground, I-live-here” reasoning, matters. Not compared to the fact that someone bought it for $40.5 million, because as the old saying goes, everything is worth what someone will pay for it.

There are other coffee shops here that are just as popular. There are coffee shops minutes away with (some) better stalls. Are those worth over $40 million? I doubt so. But why, when they’re practically in the same location?

This also brings up tangentially related mysteries, such as:

- Why do some Singaporeans always walk to a further coffee shop, even if the food at a closer coffee shop is of similar quality?

- What makes one cai png stall work, while another – which may be less than 100 metres away with the same dishes – fail?

- Why do the “old uncles who stay past 11 pm” do so only at one coffee shop, and not the one right next to it?

- Why is the coffee shop that’s closer to the JC/office/factory etc. not always more valuable than the one further from it*?

*Personal anecdote from a commercial investor back in 2011 – their group’s coffee shop, which was closest to both a JC and some offices, sold for about two-thirds of the price of another coffee shop, that was 15-minutes further on foot.

What makes one coffee shop more valuable than another is a total mystery. Check out the list of coffee shops mentioned in the article, which sold for $40 million or more. Are any of them particularly famous? I bet most readers haven’t ever heard of them.

More from Stacked

4 Key Trends Reshaping Singapore’s New Launch Condo Market In 2026

As 2025 draws to a close, the new launch market can look forward to a bit of a breather -…

So when someone brings up Feng Shui for coffee shops, I think maybe that’s a better analytical approach than anything I have. This is also why I stick to residential properties, by the way – while residential isn’t always a saner market, there’s more consistency in its brand of craziness.

I am very curious about these coffee shops though, anyone in this market that is willing to share, reach out to me please! It’s no wonder at these prices the prices of food at these coffee shops have begun to rival those that you see at food courts.

Meanwhile, in other property news:

- Property taxes are going up. Here’s hoping your AV wasn’t moved up too much, especially if you’re already contending with higher interest and falling rent.

- Home loan application not approved? Some other people are going through the same thing, and have taken on some…let’s say grey area tactics.

- Some condos have been surprisingly profitable in the past 10 years, and the names are not what you’d expect.

- You’re supposed to go to condo AGMs to have your say; but sometimes this involves sitting through inane arguments, that will make your brain leak out your ear.

- Before you pick a unit, here are some less obvious things that may not show up on the floor plan.

Weekly Sales Roundup (04 December – 10 December)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WATTEN HOUSE | $7,595,000 | 2368 | $3,207 | FH |

| MIDTOWN MODERN | $4,319,000 | 1464 | $2,950 | 99 yrs (2019) |

| 19 NASSIM | $3,453,280 | 969 | $3,565 | 99 yrs (2019) |

| LENTOR MODERN | $3,316,500 | 1528 | $2,170 | 99 yrs (2021) |

| BLOSSOMS BY THE PARK | $3,188,000 | 1302 | $2,448 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE LANDMARK | $1,414,195 | 495 | $2,856 | 99 yrs (2020) |

| THE MYST | $1,480,000 | 678 | $2,182 | 99 yrs (2023) |

| PINETREE HILL | $1,690,000 | 700 | $2,415 | 99 yrs (2022) |

| THE LANDMARK | $2,009,000 | 764 | $2,629 | 99 yrs (2020) |

| THE BOTANY AT DAIRY FARM | $2,131,000 | 1076 | $1,980 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WATERFALL GARDENS | $7,100,000 | 3380 | $2,101 | FH |

| LEONIE TOWERS | $5,900,000 | 2960 | $1,993 | FH |

| BEAVERTON COURT | $5,555,000 | 3122 | $1,780 | FH |

| SUTTON PLACE | $5,168,000 | 3305 | $1,564 | FH |

| THE SAIL @ MARINA BAY | $5,000,000 | 2056 | $2,432 | 99 yrs (2002) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SUITES @ KOVAN | $595,000 | 366 | $1,626 | FH |

| KINGSFORD WATERBAY | $698,000 | 474 | $1,474 | 99 yrs (2014) |

| H2O RESIDENCES | $720,000 | 527 | $1,365 | 99 yrs (2010) |

| LAUREL TREE | $726,888 | 463 | $1,570 | FH |

| ALEXIS | $750,000 | 398 | $1,883 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE SAIL @ MARINA BAY | $5,000,000 | 2056 | $2,432 | $2,700,824 | 19 Years |

| NATHAN PLACE | $3,650,000 | 2024 | $1,804 | $2,076,890 | 20 Years |

| SUTTON PLACE | $5,168,000 | 3305 | $1,564 | $2,018,000 | 17 Years |

| THE SAIL @ MARINA BAY | $4,500,000 | 2045 | $2,200 | $1,429,920 | 18 Years |

| ENG HOON MANSIONS | $2,180,000 | 1421 | $1,534 | $1,390,000 | 17 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| LUMIERE | $1,090,000 | 635 | $1,716 | -$240,000 | 13 Years |

| GILSTEAD TWO | $1,675,000 | 775 | $2,161 | -$49,200 | 13 Years |

| KINGSFORD WATERBAY | $1,145,000 | 850 | $1,346 | -$17,000 | 5 Years |

| SANDY EIGHT | $870,000 | 506 | $1,720 | -$10,000 | 6 Years |

| AFFINITY AT SERANGOON | $910,000 | 538 | $1,691 | $44,000 | 3 Years |

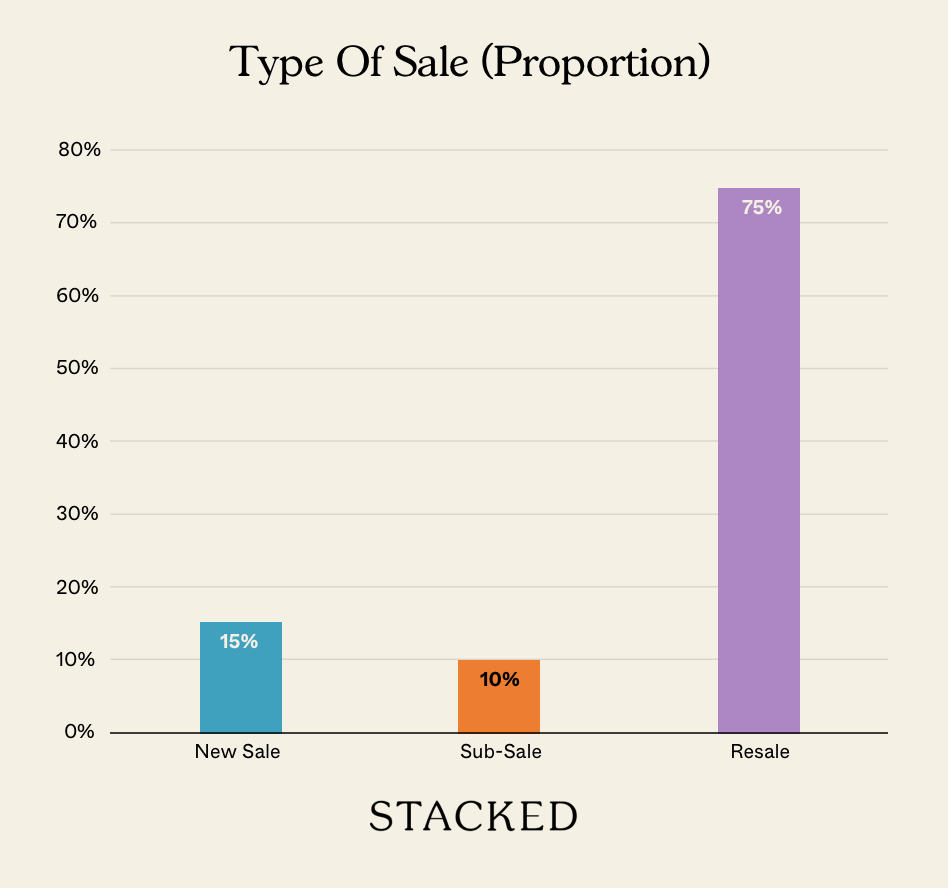

Transaction Breakdown

For more news and stories about the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are some coffee shops in Singapore worth over $40 million?

Does proximity to shopping malls like NEX determine the value of a coffee shop?

Why do some Singaporeans prefer walking to a farther coffee shop instead of a closer one?

What makes one coffee shop more successful or valuable than another nearby?

Are the most expensive coffee shops in Singapore well-known or famous?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Latest Posts

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

1 Comments

I dont really patronise the stalls in tis $40.5mio stalls bcos the food is not tat great. Also the stalls have changed over the 26 years i have lived nearby. There is no stall here tat has really good food.The cai png is more expensive. There r 3 other cai png stalls in small coffeeshops just round the corner which r tastier and cheaper…like u can get something reasonable for $2.50. There r also better ba chor mee, laksa, wanton noodle, vegetarian stalls, roti prata, lor mee in these other small cofeeshops.

– but tis $40.5mio coffeeshop stands out for 1 thing…..it is the biggest coffeeshop in the area, facing a road with net tat stops birds flying in. Quite pleasant to sit there to enjoy food and a beer

– the waiting time at the small kfc in tis $40.5mio coffeeshop is short…good for family eating out who wants mostly cheaper local food in coffeeshop with some kfc esp for kids

– just sharing