An RHB Analyst View Of The Singapore Property Market (Post Covid-19): A Recap

June 19, 2020

As we head into the second phase of the circuit breaker in Singapore, things are looking to be slightly more positive in the near future.

Retail shops are gradually reopening, bubble tea shops are back, and to the delight of real estate agents all over Singapore – showflats and viewings are now allowed again.

But even as we rejoice in the small wins, it is hard to ignore the impact that Covid-19 has had to the economy. And as everyone starts to adjust to the new “normal”, the truth is that many are still uncertain about the real estate market moving forward.

Recently, I had the chance to attend a webinar that featured Vijay Natarajan, an assistant vice-president of real estate at RHB. For those of you who don’t know him, his views have been featured in the Business Times as well as on MoneyFM 89.3 (if you need some insight into his credibility).

More importantly, it was on a current trendy topic that many of you would no doubt be interested in:

What will happen to the Singapore property market in light of the Covid-19 situation?

Let’s first begin with the market overview.

Similarly to what we recapped in our what the experts said about the Coronavirus article, most in the industry believe that long-term fundamentals are solid and you should definitely see a recovery after the recession (I think everyone expects this, to be fair).

Of course, prices are expected to fall (he estimates 5 – 15%), but they don’t expect a steep decline like the past major crisis events in Singapore.

Why?

It’s mainly down to 3 factors.

- The ultra low interest rates from the Fed cuts.

- Stronger household balance sheet

- Proactive Government policy measures to support the market

So immediately we will see an impact on the number of transactions not only because of the weak economy but also because of the circuit breaker measures (closed showflats, and no resale viewings allowed at all).

And we can see that happening already in the past two months. The volume of sales of new private homes dropped 58 per cent in April – from 277 units as compared to 660 units in March. Even though sales volume actually increased in May by 74.7 percent, overall transaction volume was definitely down when you compare it to the same period the year before in 2019. But overall, expectations are that private property transaction volumes could possibly drop 30 – 40 per cent in 2020.

Now that you know the general picture, let’s dive deeper into the key factors. To make things easier on the eye, I’ve split it into two sections – key supporting indicators, and factors that might prove otherwise.

Let’s start with the more pessimistic news.

Key Indicators That Point To A Depressed Market

Unemployment levels and lowered housing income

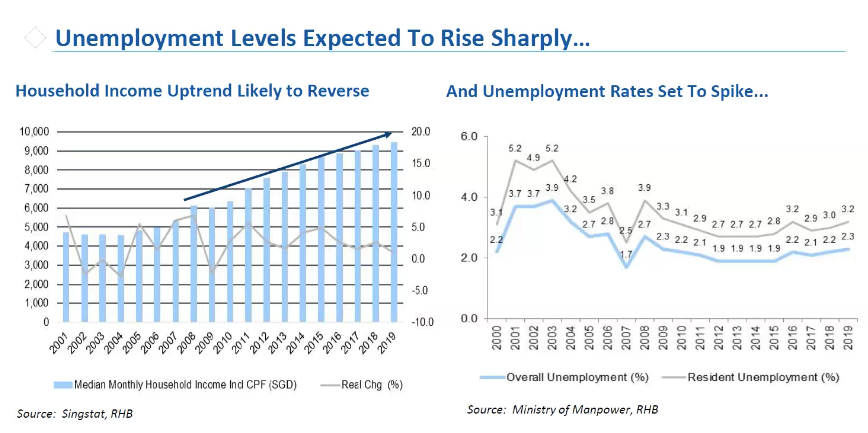

First things first, because of the current condition it is expected that unemployment rates will spike. As of the last update it now sits at 2.4 per cent overall and 3.5 per cent if you take into account just Singapore residents – which is the highest in a decade.

Total employment has shrunk by 25,600 in the first quarter of 2020, the worst numbers on record so far. In comparison, the SARS outbreak recorded 24,000, while the global financial crisis recorded 24,000.

In the same manner, annual household income will definitely be affected too. While annual household income has been growing at 4.6 per cent per annum over the last decade (which has supported the rise in housing price), that is now expected to drop given the GDP outlook forecast at -5.8%.

Slower population growth

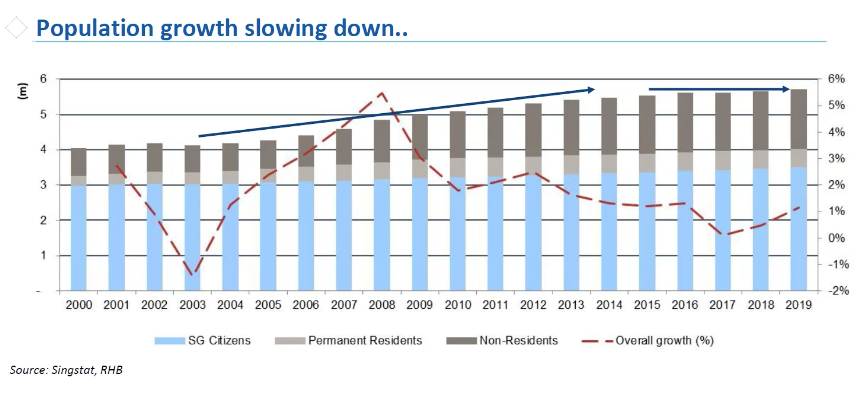

Population growth in Singapore has definitely plateaued since 2015 with the result of stricter immigration policies and a low birth rate (which has always been an issue).

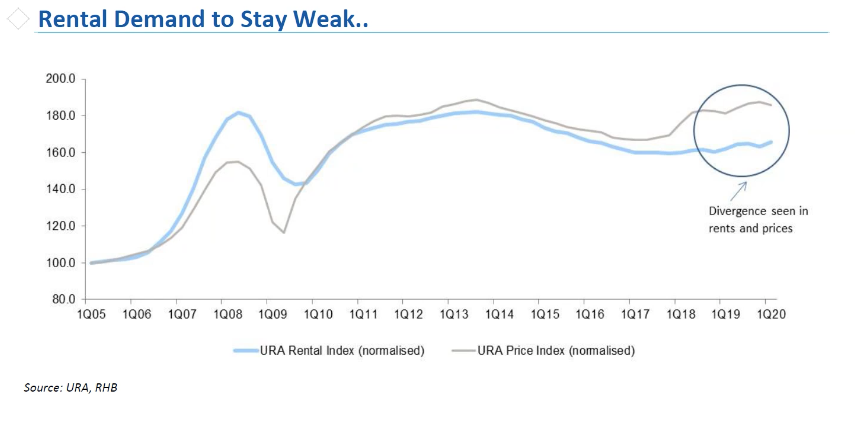

Weak rental demand

Following the trend of slower population growth and less expats (lowered expat packages – less attractive to come to Singapore given the higher cost of living.), rental demand will definitely remain weak. With the shuttered borders and expected drop in business travel given the Covid-19 situation, don’t expect any improvement here.

Increased land and construction costs

Cost of acquiring land for developers in Singapore is at an all time high thanks to increased competition especially from Chinese developers. A key example would be the record $1 billion winning bid for the Queenstown GLS site from Chinese developer Logan Property Holdings.

Higher construction costs are also expected to rise with the introduction of a new Covid-19 testing regime on workers in the construction industry.

All this adds to the already thinning profit margins of developers at 5 – 15%, limiting the flexibility of further discounts for new launches.

Now let’s look at the key supporting contributors.

Key supporting indicators

Interest rates at the lowest of lows

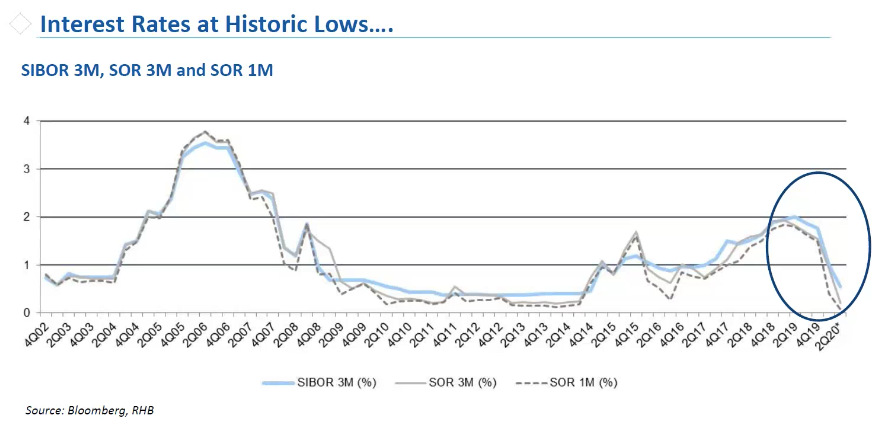

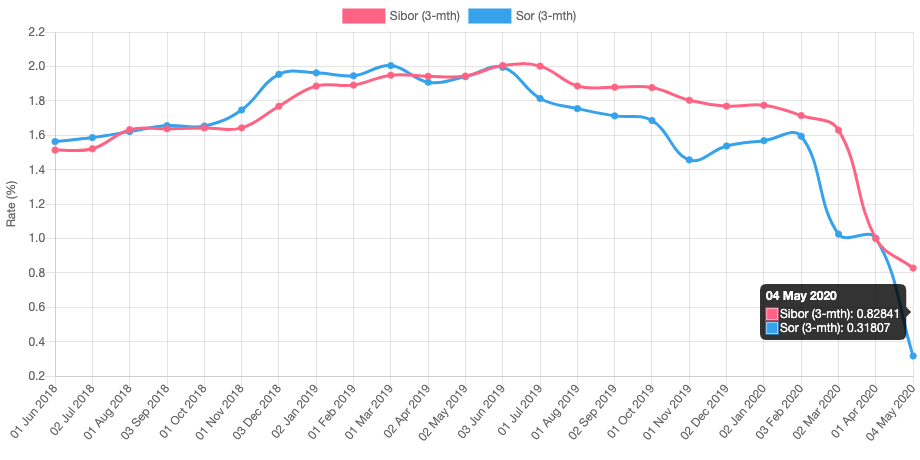

As a stimulus to help facilitate the economy, the US Federal Reserve has cut its interest rates to near zero. As the Sibor and the US Fed rates have always been closely correlated, this means that the interest rates for floating home loans are currently at historic lows.

More importantly, the interest rates are expected to stay low to continue to encourage activity in the market.

Government policy measures

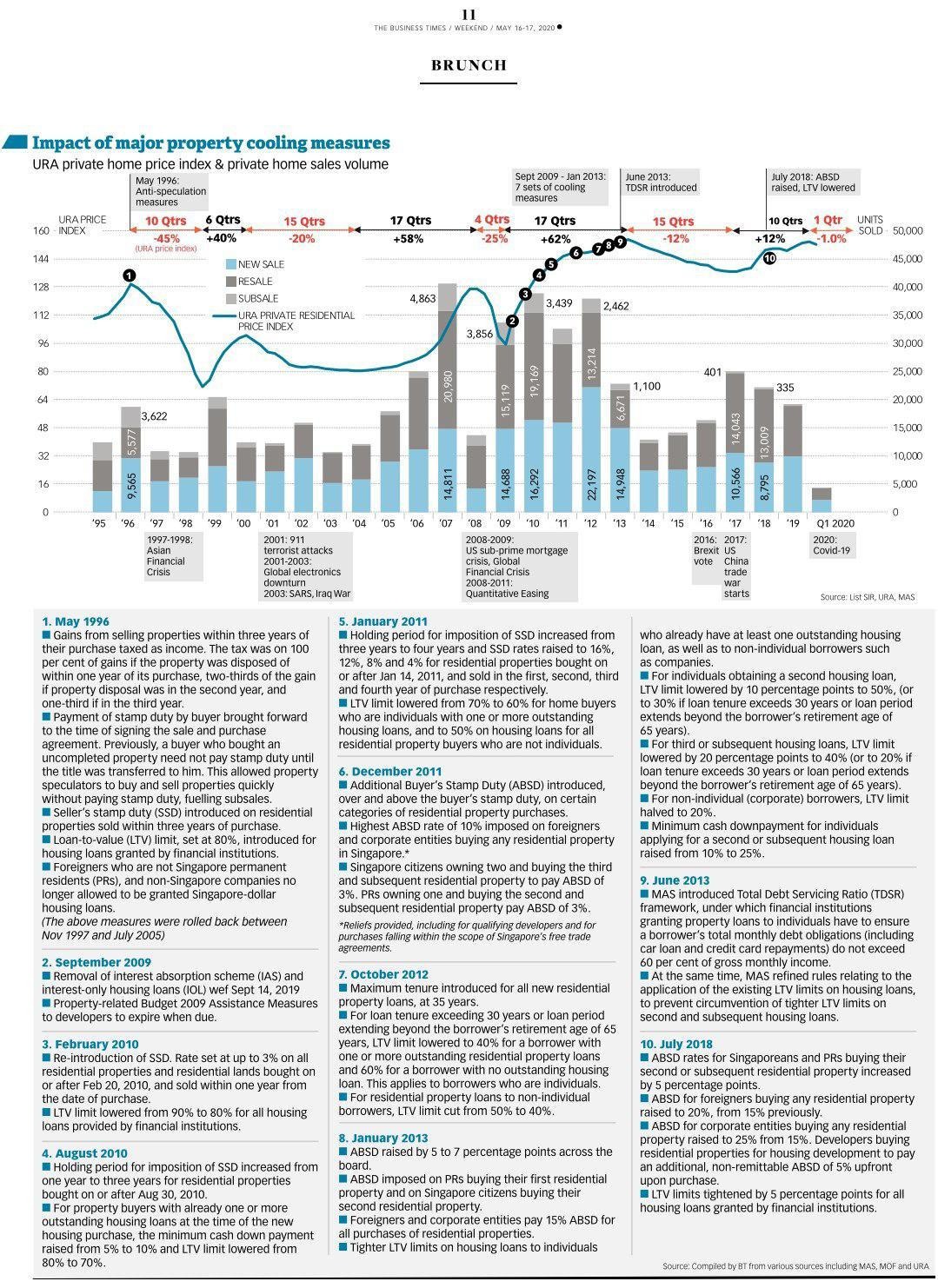

As shown on the graph, you can see the impact of the major property cooling measures in Singapore on the volume of transactions and URA price index. There’s no doubt that these measures can have a huge bearing on the market, as can be seen from the 2013 TDSR introduction where the price index slid for 15 quarters.

In this case, the Government has moved quickly to introduce measures to support the property market (extension of six-month for ABSD deadline for developers, extension of ABSD remission period for couples, and mortgage loan deferment schemes). This move will allow better price resilience for both developers and owners for the time being.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Here’s Where The Future MRT Stations May Be

These are some interesting - and well-researched - speculations on MRT lines that we may see in future. Some of…

One more important point to note – because of the previous cooling measures in place, the property market is in a much better position than it was during the last major crisis. Don’t forget, these measures can also be rolled back accordingly to inline with the market conditions. A big one up their sleeve is to tweak the ABSD ruling, both for second/third properties as well as for foreigners.

Singapore Property NewsCovid-19 and the Singapore Property Market Outlook: What The Experts Say

by Reuben DhanarajStrong household balance sheets

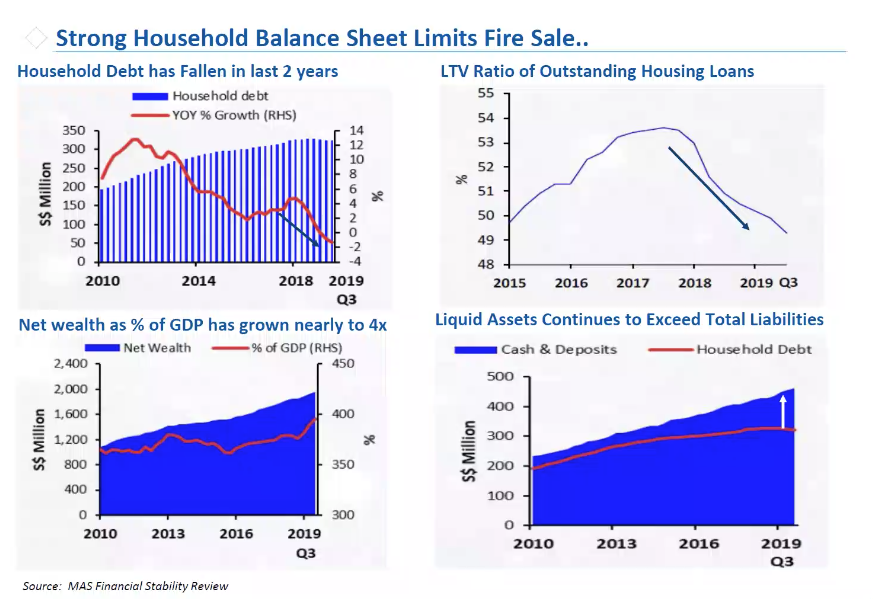

According to the MAS Financial Stability Review, household debt in Singapore has decreased quite significantly in the last 2 years. Outstanding housing loans and average Loan to Value (LTV) ratios have also improved no thanks to the July 2018 cooling measures that have tempered housing loan growth.

The bottom two graphs further show that household net wealth has grown to almost 4 times of GDP in Q3 2019 – while household cash and deposits continue to exceed household debt at an increasing pace. All these points to quite healthy fundamentals as households have adequate financial buffers (contrary to the recent OCBC survey).

Good affordability compared to major cities

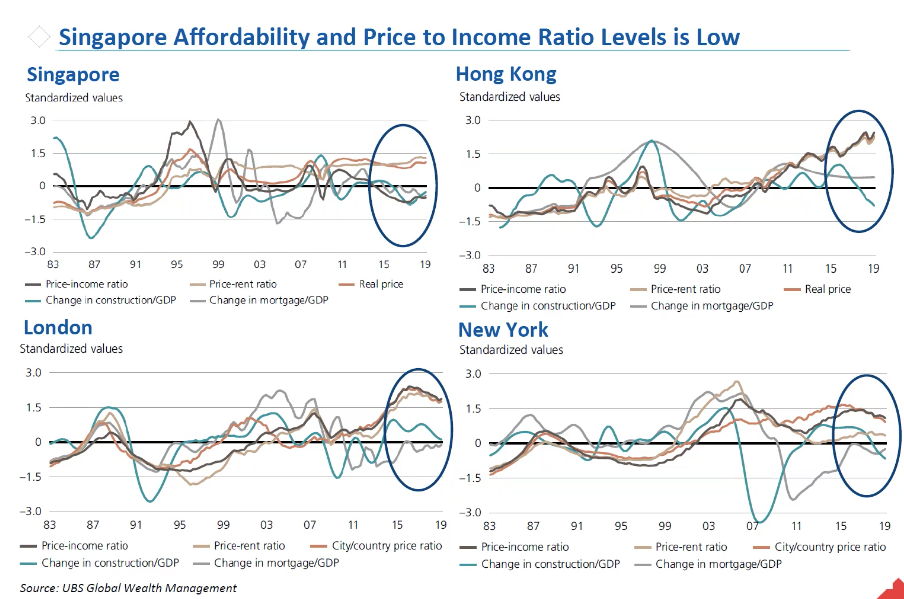

Another strong point in the favour of the property market in Singapore is that affordability and price to income ratio levels is low. In an analysis by UBS comparing residential property prices in 24 major global cities, Singapore is ranked at a fair value. Look at the difference as compared to Hong Kong, London, and New York (anything above 1.5 signifies a bubble).

Decline in inventory and vacancy rates

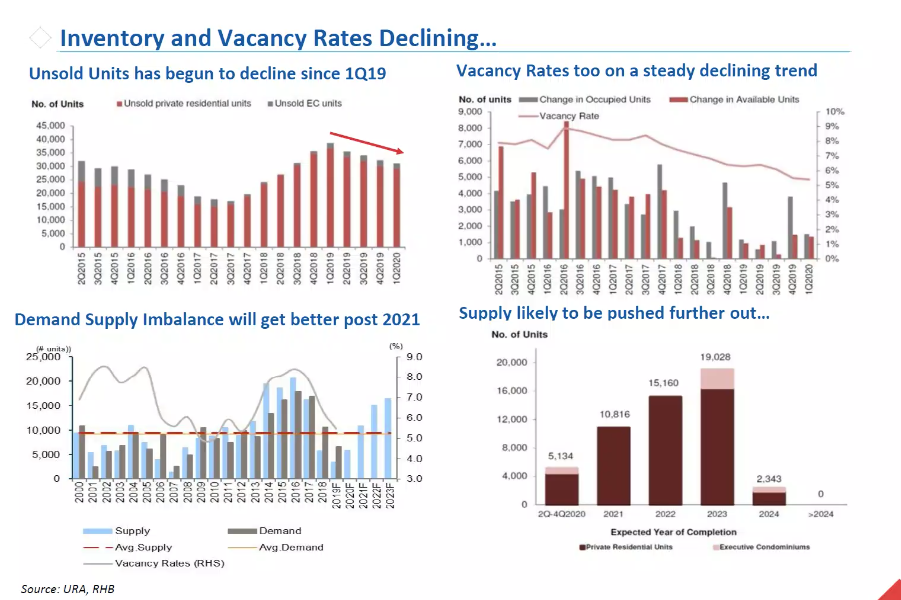

Property oversupply was a big topic in 2019, but we can see that inventory rates have been improving. Unsold units have started to decline since the first quarter of 2019, while vacancy rates have been on a steady declining trend as well.

The bulk of the residential units are expected to be completed from 2021 to 2023, with supply in 2024 looking to be much lower. Of course with the current situation, we can expect construction delays to push back on timelines a little.

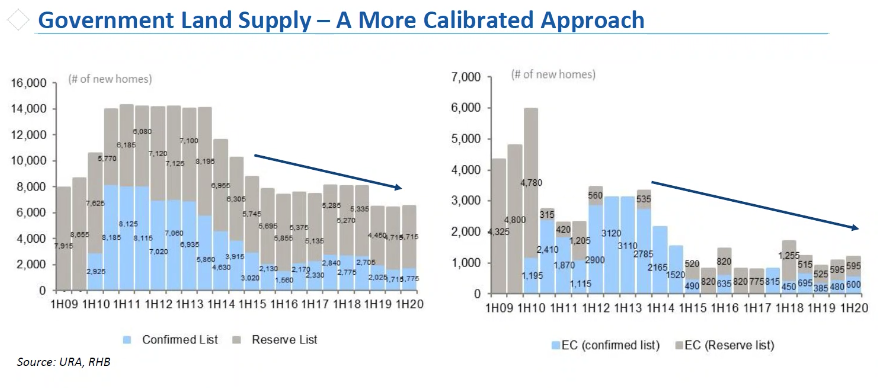

Control over Government Land Supply

Another way the property market is kept in check by the Government is through the control of the land supply through the GLS programme.

The way it works is that land on the reserved list has to be triggered by developers submitting bids first. Once it has hit a reserved mark it can then be put on the confirmed list. So you can see from here that that has limited the supply of land going out. While this means that prices are kept to a certain level, conserving the supply of land prevents the possibility of an oversupply and price collapse.

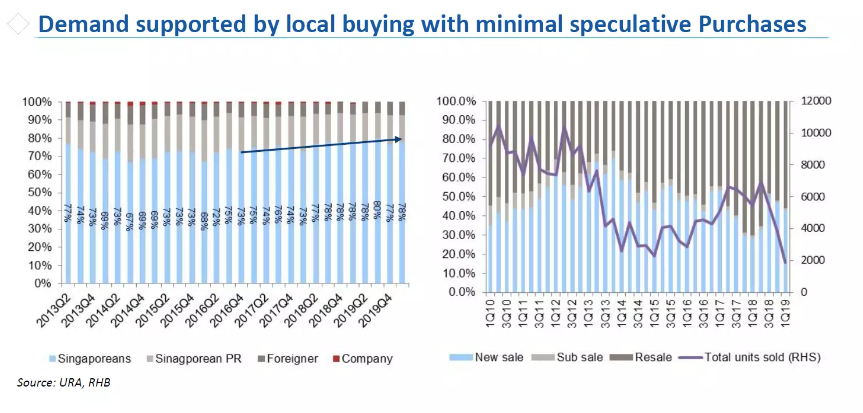

Demand more local less reliant on foreigners

A key trend of the current purchasing behaviour is the falling reliance on foreigners buying into Singapore property – this remains at 6% of the total transactions overall. Another measure of speculative behaviour is through sub-sale transactions. Seeing as this is at less than 2% of total sales it is safe to say that house flipping is a thing of the past (all credit to the implementation of the SSD) – especially when this figure was at 10% during the previous crisis.

During times of crisis, foreigners tend to let go of their properties quite quickly. So because there is a lower proportion of foreigners purchasing it means there would be less fire sales overall as well.

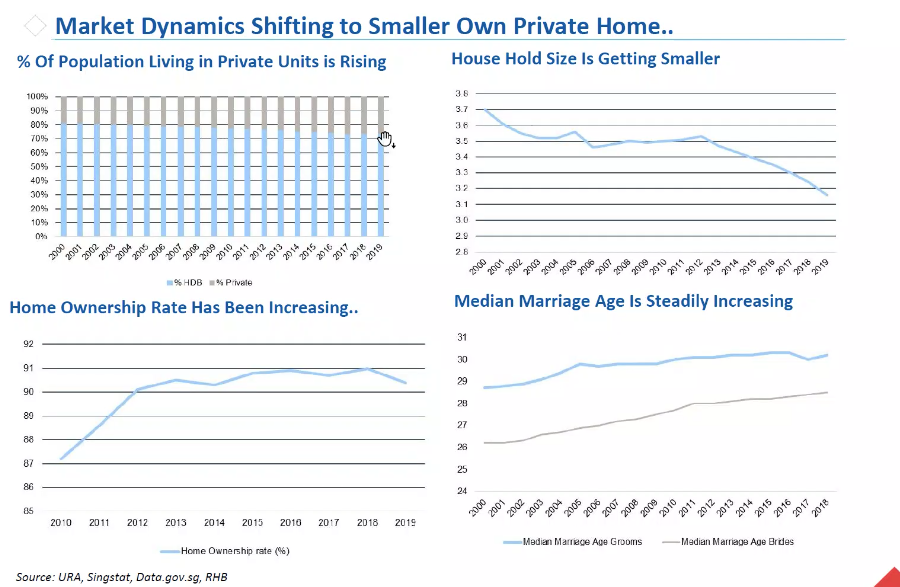

Shift in market dynamics

Here are some current trends that could play a telling role in the property market moving forward. The percentage of the population living in private residential units has been increasing, while household size is getting smaller. One reason could be because of the rising household income = more people upgrading to private condos. Smaller household size can be attributed to the reduction in size of units. So rather than multi-generation living in one household, this can be split into 2 or 3 different units in the future – so more housing needed.

Median marriage age has been increasing (which surprises no one), this could signal that as people get married later, they tend to be more financially stable which could also lead to greater affordability when it comes to housing.

So what’s next for the property market?

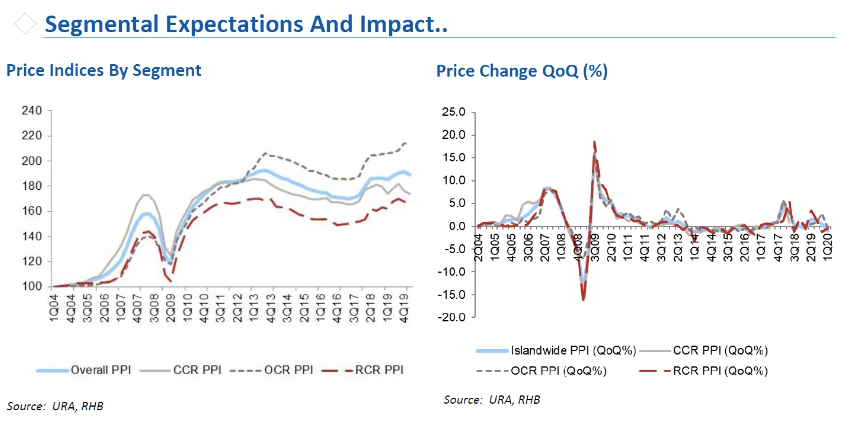

Finally, looking at the higher-end segment, it will definitely be impacted more purely because of the higher quantum and higher proportion of investors in those areas, but the mass market should stay relatively resilient.

To wrap things up, here are his thoughts on developer discounts moving forward.

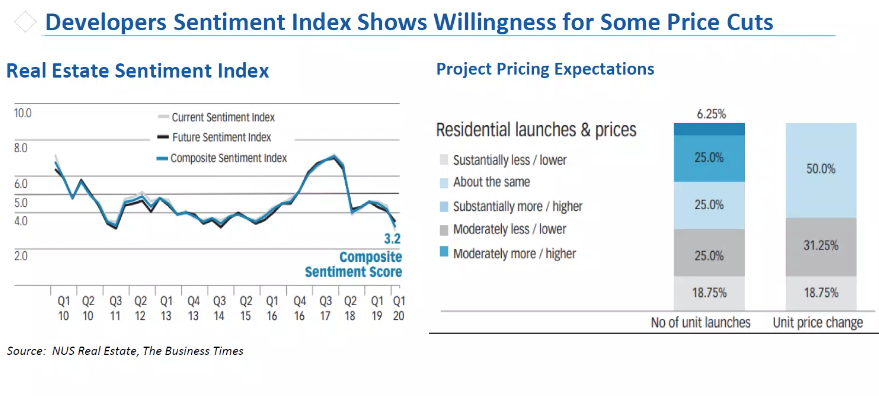

Just as we mentioned in our developer discounts article, the developer sentiment index has hit a record low of 3.2 in the first quarter of 2020.

From the recent 38 Jervois discounts and 8 St Thomas price cuts, we can already see some developers making drastic moves to clear their inventory. But if you are expecting further large scale discounts, you might have to think twice.

In his words:

“This time around, the margins have fallen. There has been quite a bit of competition to acquire land. Because of the recent en bloc cycle, developers are sitting on expensive land banks. Going forward, construction costs are going to rise. This is going to put pressure on the developer margins which are already low at around 5 to 15 percent, so considering these factors, developers have much less room to cut property prices going forward,”

If you have any thoughts or comments feel free to comment below or you can always reach out to us at stories@stackedhomes.com!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the expected impact of Covid-19 on Singapore property prices?

How has the Covid-19 pandemic affected property transaction volumes in Singapore?

What are the main challenges facing the Singapore property market during Covid-19?

What factors are supporting the Singapore property market despite the pandemic?

How might developer discounts change in the near future in Singapore?

Druce Teo

Druce is one of the co-founders at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

1 Comments

Excellent in-depth coverage on the property market!