The amount that you will have to pay for rental stamp duty is dependant on the average annual rent (AAR). So on any lease period of 4 years or less, it is just 0.4% of total rent for the period of the lease. If it is a lease period of more than 4 years(which is very uncommon) it will be 0.4% of 4 times the AAR for the period of the lease.

If you are reading this right now, congrats! Finding a suitable home is probably the toughest process of the whole rental exercise, so everything else from then on will seem like a walk in the park. So now that you have signed your tenancy agreement you will have to pay the rental stamp duty on the TA to IRAS (Inland Revenue Authority of Singapore). The good news is that Singapore is mightily efficient and paying the rental stamp duty is an easy enough process.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How to calculate rental stamp duty?

You will have to pay rental stamp duty on any AAR exceeding $1,000 (which is basically everyone). AAR includes consideration for other payments such as:

1. Advertising and promotion

2. Furniture and fittings

3. Maintenance

4. Service

5. Any other charges, excluding GST charges

So who pays for the stamp duty?

It is common practice in Singapore for the tenants to pay the rental stamp duty for tenancy agreements.

When should it be paid?

The rental stamp duty should be paid within 14 days if the tenancy agreement is signed in Singapore. If it is signed overseas, you will be given 30 days. Do not forget to pay as there are late payment penalties involved!

Is it compulsory to pay for the rental stamp duty?

In order for the agreement to be binding, the stamp duty has to be paid. If you are a landlord you can take action against tenants who fail to pay on time or decide that they would not pay for it after signing the tenancy agreement.

More from Stacked

From The 70s To The Present: The Evolution Of Singapore’s Condo Layouts

Our tastes as homeowners have changed over the years, and so have regulations. From the experimental era of the ‘70s,…

For late payments not exceeding 3 months, a penalty of $10 or an amount equal to the duty payable, whichever is greater, will be imposed.

For late payments exceeding 3 months, a penalty of $25 or 4 times of the duty payable, whichever is greater, will be imposed.

What if the rent is increased?

If in the situation that the rental amount is increased or tenancy lease is extended, stamp duty will be payable based on the increase in rental or the rental for the extended lease. The good news is that if there is a decrease in rental or the lease is shortened you do not have to do anything!

There are also other variations where the rental stamp duty will not have to be paid:

1. Changing the use of the property with no additional payment

2. Lifting the restrictions in the lease with no additional payment

3. Amending the terms of the lease that do not affect the rental and lease term such as addition of an option to renew

As always, feel free to leave a comment below or you can reach us at stories@stackedhomes.com!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How is rental stamp duty calculated in Singapore for leases of different lengths?

Who is typically responsible for paying the rental stamp duty in Singapore?

When do I need to pay the rental stamp duty after signing a lease in Singapore?

Is paying rental stamp duty mandatory for the lease to be valid?

What happens if I pay the rental stamp duty late?

Will I have to pay stamp duty if the rent increases or the lease is extended?

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Rental Market

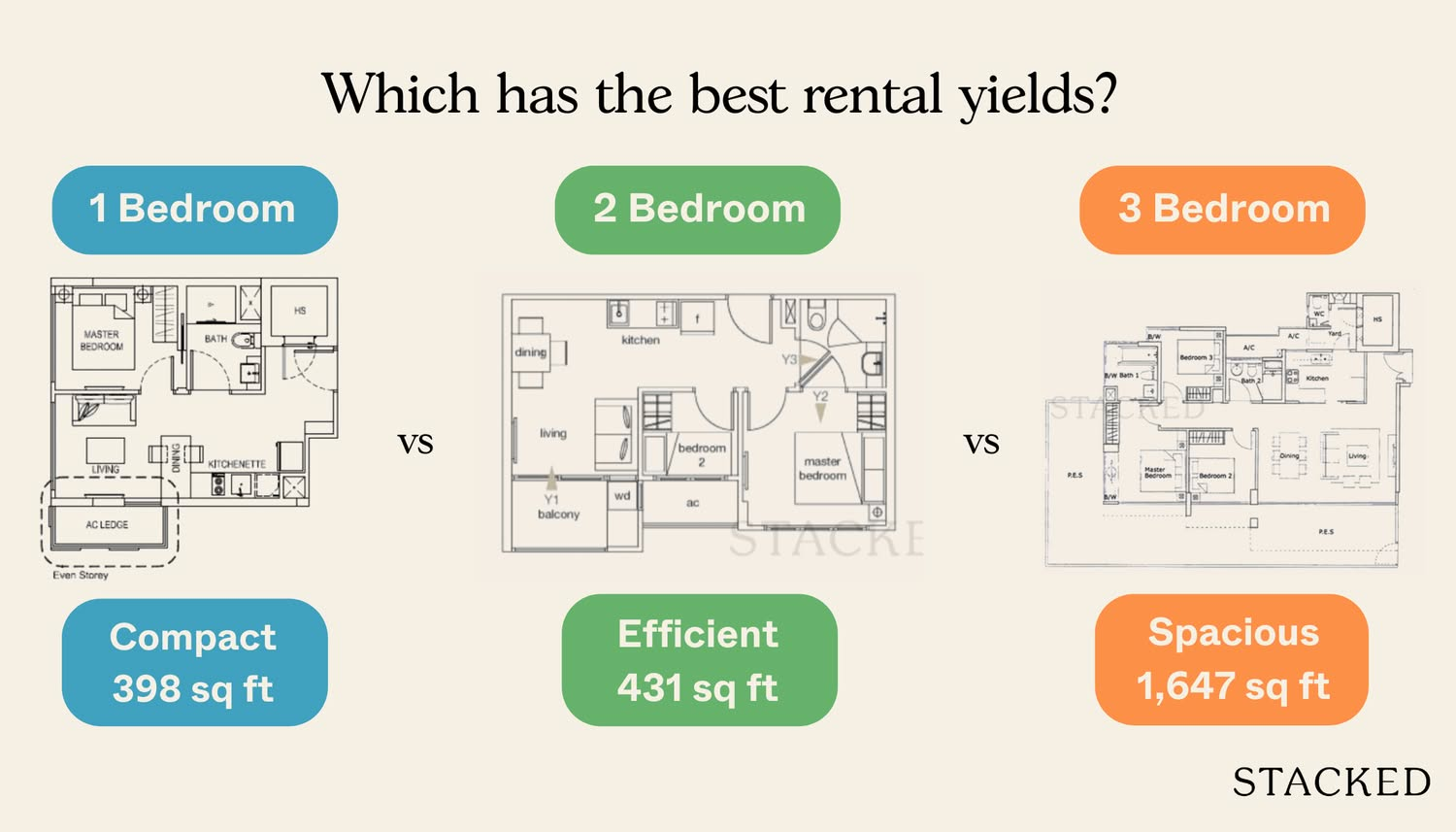

Rental Market Is Singapore’s Rental Market Really Softening? We Break Down The 2024 Numbers By Unit Size

Editor's Pick The Cheapest Condos For Rent In 2024: Where To Find 1/2 Bedders For Rent From $1,700 Per Month

Rental Market Where To Find The Cheapest Landed Homes To Rent In 2024 (From $3,000 Per Month)

Rental Market Where To Find High Rental Yield Condos From 5.3% (In Actual Condos And Not Apartments)

Latest Posts

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

0 Comments