How Do We Keep Prime HDB Flats Fair? We Review Your Responses

December 14, 2020

Last week we asked you how we could keep prime area HDB flats fair, and we got a good number of answers. It’s also timely, as a little more information regarding new flat policies have come up: as of 12th December, the Business Times has also reported that the government may have to give out more subsidies, to support the higher prices of prime area HDB flats.

Before we get into that, let’s look at some of your proposed solutions:

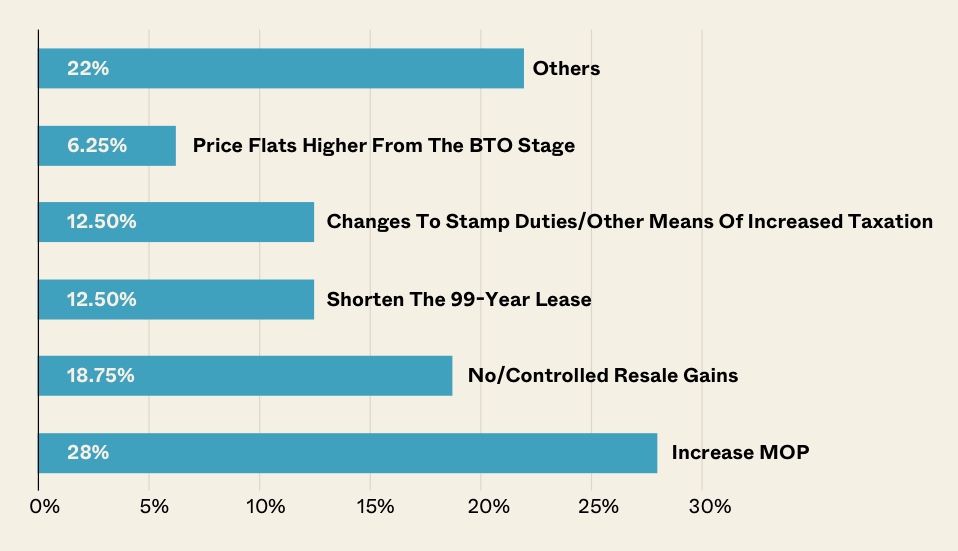

What did most of you think would work?

Note: Many responses involved a mix of the solutions below, so this doesn’t add up to 100 per cent

Some of the more interesting suggestions we noted were:

Increasing the MOP to 99 years

This would mean that the flat can never be sold on the open market, or fully rented out; the only possible buyer would be HDB itself.

This would make flats in prime areas almost entirely an indulgence: you get to enjoy a mature central location – but in the end, your flat would have been a pure expense. There’s no way to sell it to fund your retirement, use it a stepping stone to owning a private home, etc. At the most, you could rent out rooms (assuming your flat is at least a three-room unit).

We think this method, however, would require that authorities regulate home loan prepayments further. This is to avoid situations where the home owners rush to pay off their flat early (e.g., in the first 10 years), then end up in a financial jam when a crisis occurs; remember they can’t sell their flat and downgrade (not unless special rules are created to remedy this).

Clawbacks and further taxation

One of the solutions was to impose a clawback of subsidies with any prime area BTO flat. Selling the flat within a given time period would trigger the clawback (i.e. you pay back any subsidies given by HDB). See below for more on this,

There were some other variations of the concept, such as tiered taxation on Cash Over Valuation (COV), and a flat-out capital gains tax. One solution even suggested a cap or reduction on real estate agent commissions.

We feel that government solutions will likely also fall somewhere into this category. That’s because there’s precedent for it: the government has already seen the efficacy of the Additional Buyers Stamp Duty (ABSD) and Sellers Stamp Duty (SSD), which cooled the market while bringing in tax dollars. See below for one of these solutions.

We’d have to be careful though – if the losses from various taxes, clawback clauses, etc. are too high, that could leave the financially distressed in an impossible position: they may need to sell and downgrade to deal with their financial difficulties, but incur even further costs by selling within a certain period.

For example, say someone is medically unable to work within the MOP of the flat, and needs to sell it. Would they still be liable for any clawback or high stamp duties?

HDB will likely be jammed up with appeals, and having to review everything on a case-by-case basis.

Impose requirements for balloting for prime HDB flats

Some suggestions were to require certain justifications, to be part of the balloting process. Buyers could have to meet certain requirements, such as working nearby or having children in a school nearby. This could be part of other methods discussed here, to separate the profiteers from the genuine home owners.

While this does seem equitable in theory, we suspect it will actually cause even more debates on fairness. There’s bound to be people, for instance, who insist it’s unfair that you can ballot for a Toa Payoh area flat just because your office happens to be nearby!

Also, given how Singaporeans can be good at gaming real estate systems, this could result in many unintended effects (e.g. people refusing to work from home, or insisting on being sent to a specific company branch, just because of flat balloting).

More from Stacked

Here’s How To Read Your Credit Report For Your Home Loan / Mortgage

This is Part 4 of our 18-part first-time home buyer series. You may refer to the full table below:

The current system needs no fixing

This is mostly on the premise that any system we devise will simply introduce a new form of unfairness. As such, a ballot really is the simplest and most just means of determining who gets a prime area flat.

Perhaps that’s true; but with reports of million-dollar flats rising every year, it may not be socially conducive – or politically smart – to allow things to run on unchecked!

Singaporeans seem okay to accept their 4D losses, but when it comes to housing the issue is much more sensitive.

HDB ReviewsPinnacle@Duxton Review: More Liveable Than You Might Think

by Reuben DhanarajWhat were some of the best overall answers?

“Consider categorising HDB estates according to mid-tiered and high-tiered district housing – based on past six months of transacted price, rather than just “prime” or not.

Mid-tiered district flats were transacted between $600,000 to $800,000 and high-tiered district flats transacted above $800,000. Impose SSD plus tiered MOP accordingly for each district.

Newly launched BTOs at these respective districts can be sold at a shorter lease of 80 years (with the lease can be topped up later based on market rates) so that the BTO flats launched in these districts are priced correctly and won’t set another upward spiralling price trend. This will dampen the high demand calls, due to the anticipated windfall down the road.”

Also:

“I supposed ‘matured’ estates will be ring fenced into the category of Prime. To achieve equitable distribution of resources, I believe the following may be possible for new BTOs since they are so sought after:

1. A clawback subsidy upon sale of a new BTO

2. No clawback for sale after 10 years for the new BTO

3. Shorter lease on “prime” land, hence corresponding to a lower quantum for the new BTO.

4. SSD of 15% on MOP, plus the clawback.

5. Longer MOP (e.g. 10 years) for the new BTO.

I think clawback is the essence for equitable resource allocation, if indeed there are grants given.”

Congratulations to the reader who came up with the above response!

We’d also like to take this opportunity to thank everyone who wrote in, and took the time to think of various solutions. When we share our responses in this way, we can all get a better sense of what the wider public feels regarding housing.

That said, the things we’ve heard from the government so far are pointing toward a particular direction:

That’s the inclusion of lower-income families in prime areas; hence the recent suggestion of higher subsidies. This would serve two purposes: first, it prevents the HDB towns taking on an overly-gentrified or “elite” air.

Second, and we think this is more important – it could be a way of giving lower-income Singaporeans a leg-up. Families making under $3,000 a month may struggle to build enough sufficient CPF for retirement; but if they could sell their (heavily subsidised) flat for good gains, it could mean a bigger safety net in their twilight years.

In effect, wealthier buyers for their resale HDB flats would help fund their retirement, without falling back on, say, social welfare schemes.

It’s early days yet though, and we suspect we won’t hear any hard rules / policy guidelines for these prime area HDB flats until well into 2021. Given that HDB flat owners are almost all in the “pure home owner” category though, we wouldn’t count on any “rush to sell” once the new rules are announced.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How can the government make prime HDB flats more affordable?

What are some suggested ways to prevent speculation on prime HDB flats?

Could changing the lease length help control the prices of prime HDB flats?

How does the government plan to support lower-income families in prime areas?

Are there any current policies that regulate the pricing of prime HDB flats?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

0 Comments