The Underrated Advantage Of Paying Your Home Loan In Cash

September 29, 2020

Paying in cash when you can use CPF? There must be a method to this madness. And indeed, there’s a small demographic of home buyers who service that monthly loan out of their own pocket – even if they could tap the forced savings in their CPF Ordinary Account (OA).

While this rationale is often handwaved as “oh, they want bigger payouts when they retire”, that’s a gross simplification. In this article, we’ll explain why some home buyers chose the tougher – and some might even say crazy – approach of not tapping their CPF for home loans:

A quick note on how you can use your CPF monies to buy a house

You can use your CPF OA funds to pay the following:

- Down payment on the property (up to 10 per cent for HDB properties, and 20 per cent for private properties or Executive Condominiums).

- Stamp duties

- Legal fees

- Some types of insurance premiums, like HDB’s Home Protection Scheme (HPS), though you need to check what types of policies are approved

- Servicing the monthly home loan (regardless of whether you use a bank loan or HDB loan)

The advantages of not using your CPF OA to pay the monthly home loan

- You avoid the risk of negative cash sales

- There’s a fallback in case you ever lose your income

- Transferring the unused OA funds to your SA for added interest

- Better awareness of your loan

1. You avoid the risk of negative cash sales

This is one of the main reasons some buyers – especially HDB upgraders – don’t want to use their CPF. This is to avoid the possibility of a negative cash sale, when they offload their first HDB property.

When you sell your property (be it public or private), you’re required to refund any monies used from your CPF.

This is to prevent you from withdrawing your CPF money in a roundabout way (i.e. if this rule didn’t exist, you could buy a property with your CPF, then sell the property and pocket the cash).

You need to refund all the CPF money used, such as for the down payment, home loan, stamp duties, etc., plus the interest that would have accrued. At present, this is a rate of 2.5 per cent for your CPF OA.

At the end of the day, you may not have enough cash left after selling your HDB, and in some cases, you’d even have to come up with more cash than you have!

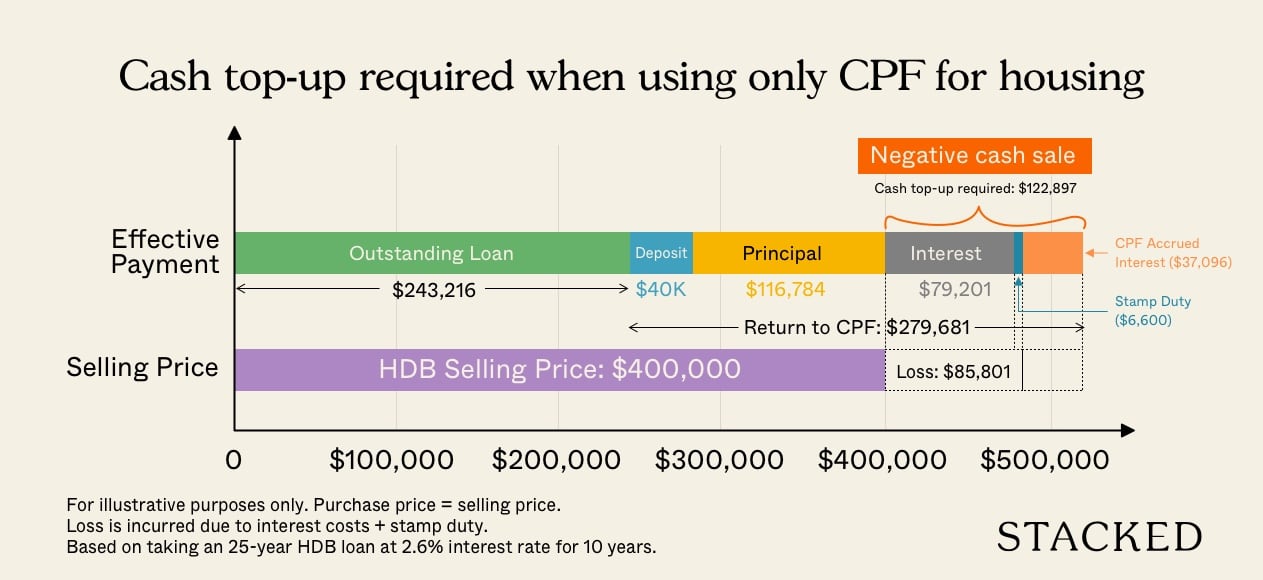

Let’s break it down from the perspective of someone buying a $400,000 resale HDB flat using an HDB loan and paying everything with just their CPF OA monies.

| Description | Amount |

| Purchase Price (A) | $400,000 |

| Down Payment (10% via CPF) (B) | $40,000 |

| Buyer Stamp Duty (C) | $6,600 |

| Principal Paid Over 10 Years (D) | $116,784.30 |

| Interest Paid Over 10 Years (E) | $79,200.90 |

| Accrued CPF Interest Over 10 years (F) | $37,095.69 |

| Total CPF Owed To Your OA Account After Selling (B+C+D+E+F) | $279,680.89 |

| Outstanding Loan Payable After Selling (H) | $243,216 |

| Cash Top-Up Required (C + E + F) | $122,896.59 |

The flat costs $400,000 (A). You then use $40,000 (B) from CPF for the down payment (10%). You also pay $6,600 (C) for the Buyers Stamp Duty (BSD) using your CPF OA monies.

Over the next 10 years, you’d have to make about $19,598.52 in home loan repayments every year using your CPF too. This adds up to $195,985.20 (D + E) over 10 years.

In total, you would have paid $242,585.20 with your CPF monies (B + C + D + E).

But let’s not forget the elephant in the room – the accrued interest. At 2.5 per cent interest rate over 10 years, you would need to put back $37,096 (F) (highlighted orange in the chart) into your CPF OA account.

In total, you’d owe your CPF OA $279,680.89 (B+C+D+E+F).

Here’s what the breakdown looks like visually:

Now, let’s assume that at the end of the 10 years, you’re selling it for the same price you bought it for at $400,000 (a reality for many who purchased in 2010 and sold in 2020!).

The outstanding loan balance on your flat after 10 years will now be $243,216 (H).

After selling your flat for $400,000, you will have to pay the $243,216 outstanding loan to the bank.

This leaves you with $156,784 (your deposit + principal paid). But immediately this amount would go back into your CPF OA.

On top of that, you’ll need to top-up the remaining $122,897 in cash.

Now I know what you are thinking, why is this sum so big?

Well, the bulk of it comes in the form of the interest you’ve paid on the loan. The cost of interest adds up to $79,200.90 over 10 years.

Top it off with the amount you could’ve made if you had left your CPF untouched at 2.5% and you owe yourself another $37,096.

Add the $6,600 you used for the stamp duty and that totals $122,897.

So your property would have to appreciate by at least $122,897 here for you to start from $0 cash proceeds and further upwards to see any cash returns.

And we’re not even counting miscellaneous fees like conveyancing costs and seller agent fees!

You’ve essentially borrowed from your future self to pay for not just the portion that builds your home equity, but outright costs like interest expense and stamp duty too, making it difficult to cough up the cash later on when you sell your home.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Single And 35 Years Old? Here Are Your HDB Options (BTO + Resale Affordability Calculations)

The Singapore public housing market, while often regarded as one of the most successful in the world, comes with one…

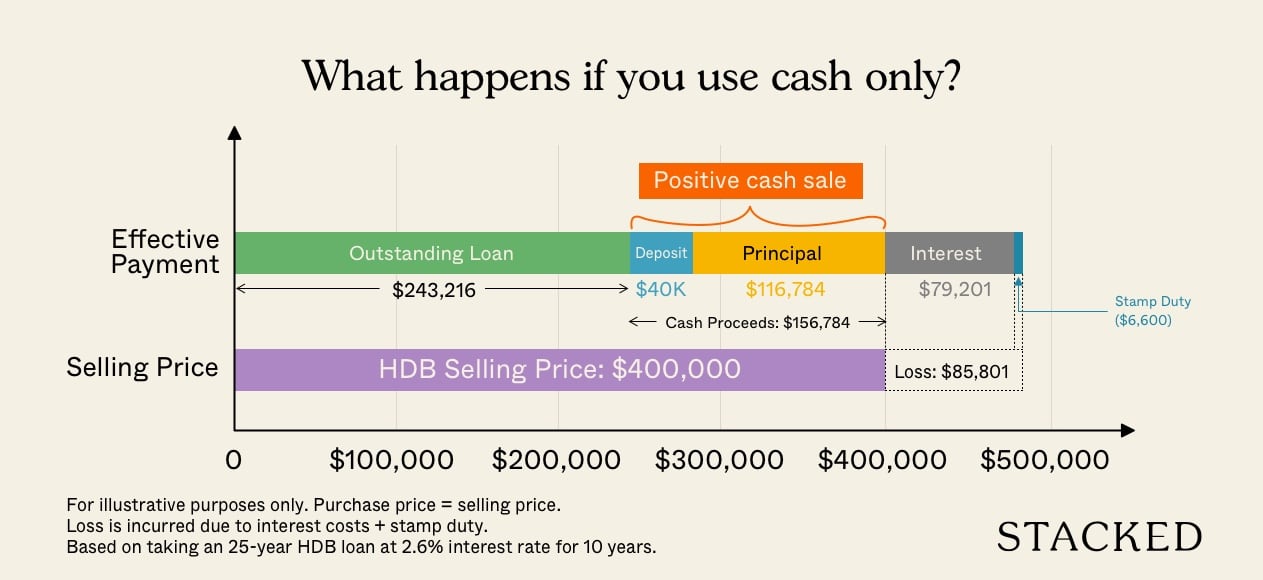

Now on the flip side, here’s what happens if you use cash instead:

You can see that at the same selling price, even though you have suffered a loss of $85,801, you do not owe your CPF OA anything.

Hence, you would still see around $156,784 in cash remaining even though you’ve made a loss.

This is the initial down payment as well as the principal you’ve paid over 10 years, all of which can be used to finance the 5% of the next property purchase and other fees.

Moral of the story: If you don’t have the financial discipline to save and invest your cash elsewhere if you use CPF to pay for your housing, then perhaps you should use cash to pay for your housing.

If you find yourself in a negative cash scenario, contact us at Stacked, and we’ll help you work out the right approach.

Property Advice3 tips you absolutely need to know before using your CPF to buy your HDB

by Sean Goh2. There’s a fallback in case you ever lose your income

If you’re paying your home loan in cash, your CPF contributions are untouched and compounding every month. In the event you’re retrenched, have to shut down your business, etc., the amount you’ve stashed in your CPF OA can likely keep your home loan paid for several months, if not years.

In fact, this is the main reason you’re now allowed to keep up to $20,000 in your CPF OA when taking an HDB loan (previously you had to use it all).

That said, all this could be a tad excessive for most home buyers. On average, just $9,600 will pay the home loan on most four-room flats for half a year.

As for situations where you pass away or become permanently disabled (touch wood), the mandatory Home Protection Scheme will pay your outstanding HDB loan. For private properties, Mortgage Reducing Term Assurance (MRTA) will serve the same function.

So as far as financial prudence goes it can be a valid reason; but speak to a qualified financial planner, to see if this degree of caution is necessary.

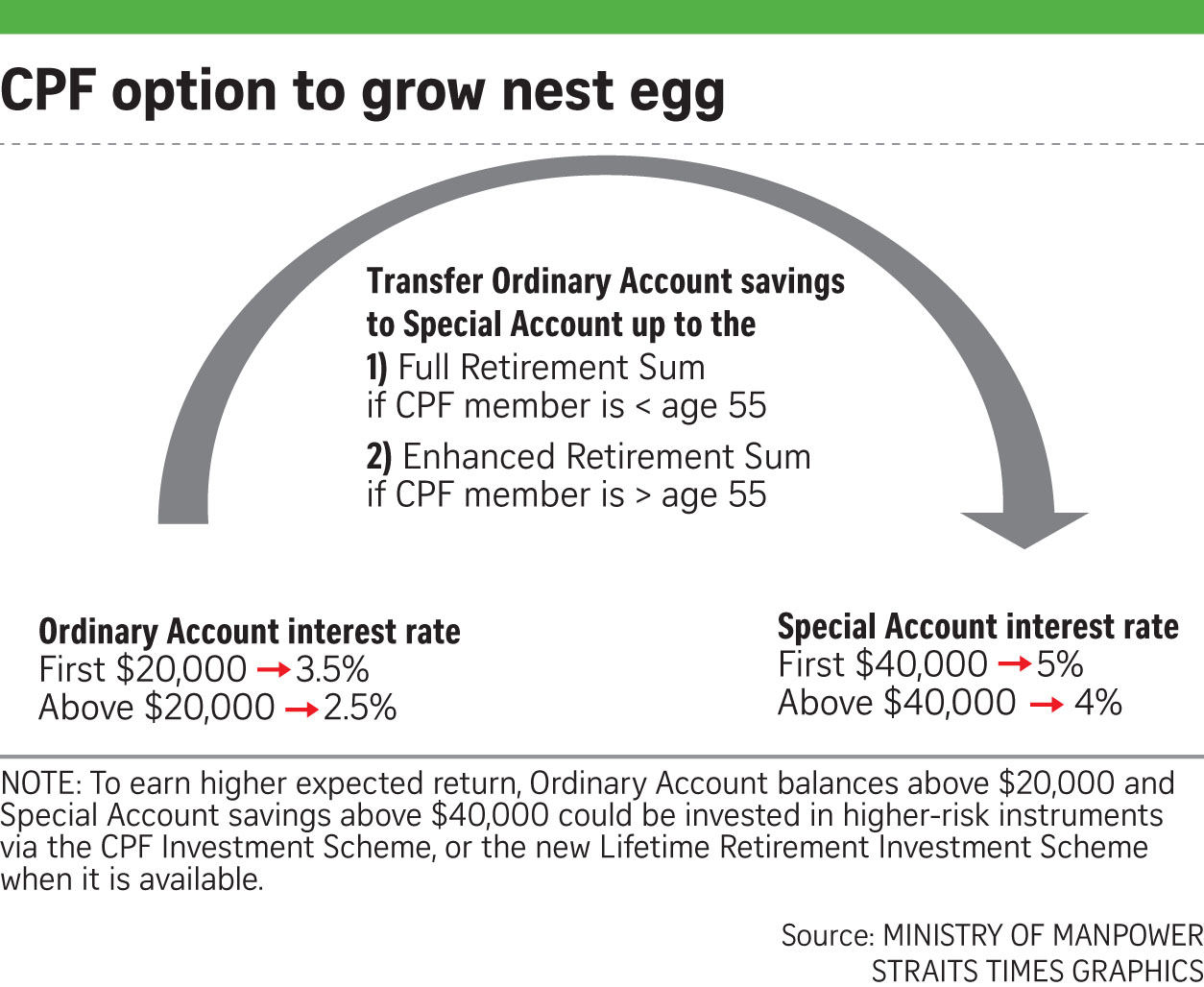

3. Transferring the unused OA funds to your SA for added interest

This method is often used by the 1M65 movement, who are a group of Singaporeans trying to have $1 million in their CPF by age 65.

The CPF OA accrues at a guaranteed 2.5 per cent, whereas the CPF Special Account (SA) guarantees four per cent. As such, some home buyers pay their home loan in cash, while transferring the unused OA monies into their SA for higher interest.

But do note that you must be under the age of 55 to do this, and you must not have already met the Full Retirement Sum.

(To find out how to do this, visit the CPF website).

This requires financial discipline and is not easy to do. It’s probably best to keep your monthly loan repayment to 30 per cent or less than your monthly income, if you want to service it in cash for 25 to 30 years.

4. Better awareness of your loan

Most people couldn’t tell you their home loan interest rate, or exactly how much they’re paying each month. That’s because most people leave it to their CPF and ignore it.

Home buyers who pay in cash, however, are forced to be aware of what they’re paying. This is especially helpful for landlords, as they can better see the ratio of their rental income to expenses.

It also encourages good habits, like remembering to check for lower interest rates. Most home loans charge lower rates for the first three years, before rising sharply on the fourth; this makes it a good idea to check for repricing or refinancing options often.

At the time of writing, you should be paying a rate of about 1.3 per cent per annum for bank loans. Otherwise, we can find you something cheaper. HDB loan rates seldom change, and are still at 2.6 per cent.

Be flexible about using cash or CPF, and vary it to your situation

Remember it’s not an either / or situation. You can use CPF to pay for some elements of housing, and cash to pay for others. This can be varied to your needs.

For example, some first-time flat buyers only use cash until they sell the property five years later. Once they’ve upgraded, they’ll pay for their home loan with CPF. Some other buyers pay via a combination of cash and CPF, such as if they’re regularly transferring a planned amount from their OA to their SA.

If you’re counting on CPF as a big part of your retirement, or dread the thought of negative cash sales, do consider what using a bit more in cash could do for you. You can also follow us on Stacked for the latest in property strategies, and deep insights into various property developments in Singapore.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why do some home buyers choose to pay their mortgage in cash instead of using CPF funds?

What are the risks of using CPF funds to pay for a home loan?

How does paying in cash provide a fallback if I lose my income?

Can transferring unused CPF OA funds to the Special Account improve my savings?

Why is it important to be aware of your home loan interest rate if paying in cash?

Is it better to use a combination of cash and CPF for my home purchase?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

0 Comments