Older HDB Flats Don’t Depreciate As Quickly As You Think. Here’s What The Numbers Show

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Common wisdom holds that, because of their 99-year lease, older HDB flats should see a steeper depreciation than newer ones. For many homeowners, it’s a good reason to sell and upgrade early. It was even a big point of online debate in 2018 when Minister Khaw Boon Wan said even 50-year-old flats could appreciate. But how true is all this? We did some digging:

Methodology:

We examined all transaction data from January 2021 to November 2021 (incomplete data for November 2021). Next, we looked at the actual transacted prices of flats across the different ages and plotted them out. Finally, we looked at the price per lease remaining and study how it differs from the theoretical price behaviour.

Do note, however, that this study only compares age and price. It does not factor in location. As a result, there may be “old” properties that are just located in better places, hence the location factor helps sustain prices more than the newer flats. To better address this, all transactions are used instead in hopes that the aggregate data should paint a sufficiently accurate picture.

The commonly accepted theory of leasehold depreciation rates

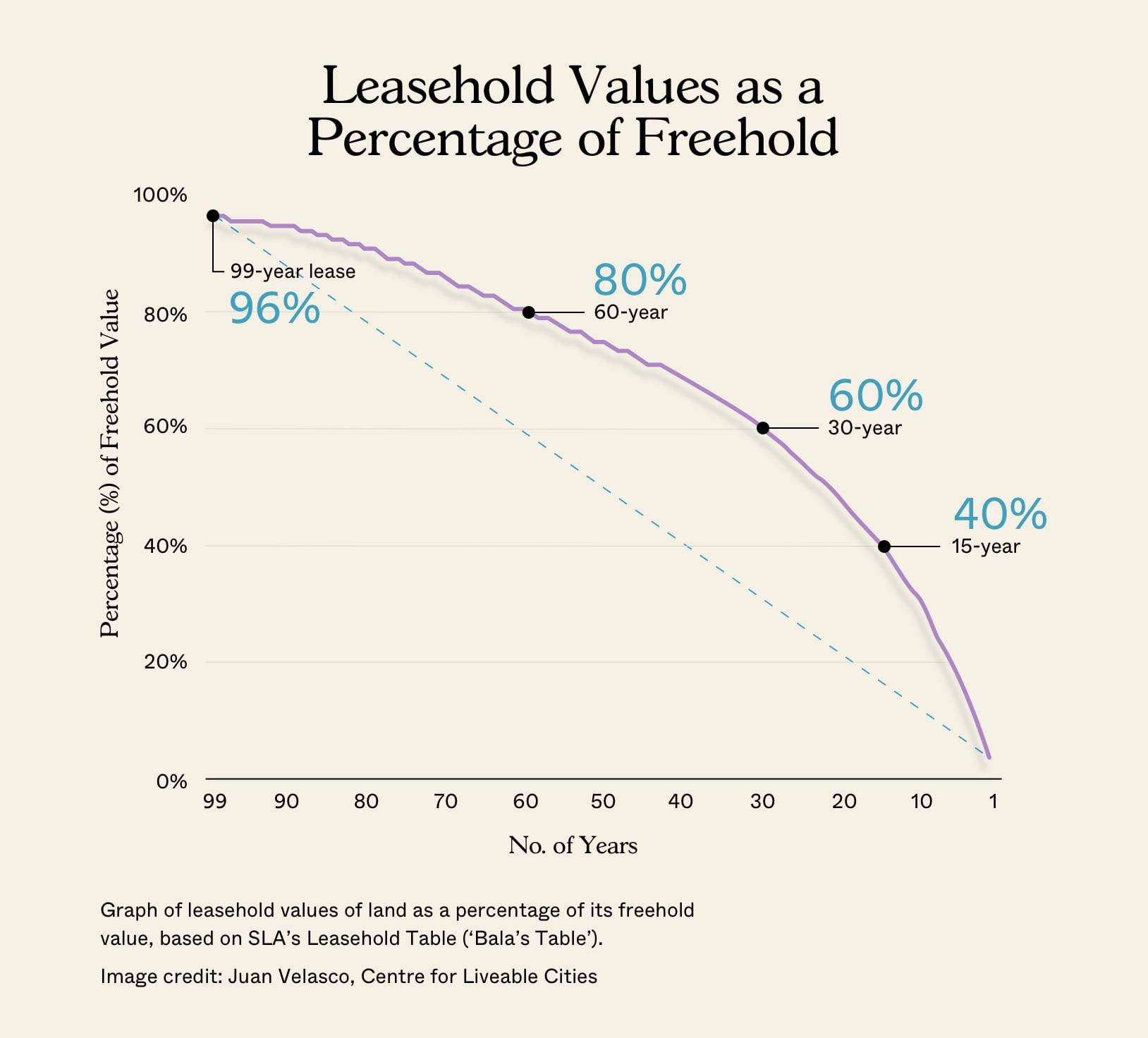

Bala’s Curve is the most commonly used method of gauging leasehold value. This approach pegs leasehold value to a percentage of its freehold counterpart, with depreciation accelerating toward the end of the lease.

For example, based on the curve, a new leasehold property (99-years) is valued at 96 per cent of equivalent freehold land.

By the time there are 49-years of lease remaining, the value should be around 74.1 per cent of equivalent freehold land. With 30 years remaining, values fall to 60 per cent, and so forth. The discount rate applied in Bala’s Curve is about 3.5 per cent which was chosen as this is the Monetary Authority of Singapore (MAS) medium-term interest rate used in the calculation of the Total Debt Servicing Ratio (TDSR) for property loans.

Note that the depreciation is not linear, forming an inverted U shape on a graph. This is due to the time value of money; the first five years of the lease are thus worth more than the last five years.

While Bala’s Curve can’t be applied literally in every instance, it is the widely accepted model of how a leasehold property depreciates over time.

At this stage, we must point out that the depreciation rate is not so much the focus here – regardless of the rate (unless it’s 0), prices would fall at a steeper rate as the years go by. This is primarily what we’re interested in.

Do we see the same kind of depreciation in HDB flats as they age?

Surprisingly, the answer we derived was no. You would expect that as a property grows older, prices should fall faster over time. As such, if we were to plot out prices of HDBs across the different age categories, we should expect to see a curve similar to Bala’s Curve.

However, older flats do not seem – based on our findings – to be losing more money than newer ones.

To derive this, we compared transaction data from January 2021 to November 2021. We then plotted the transaction prices for flats of different ages to compare the behaviour of prices.

We then checked if it corresponded to Bala’s Curve. This is what we found:

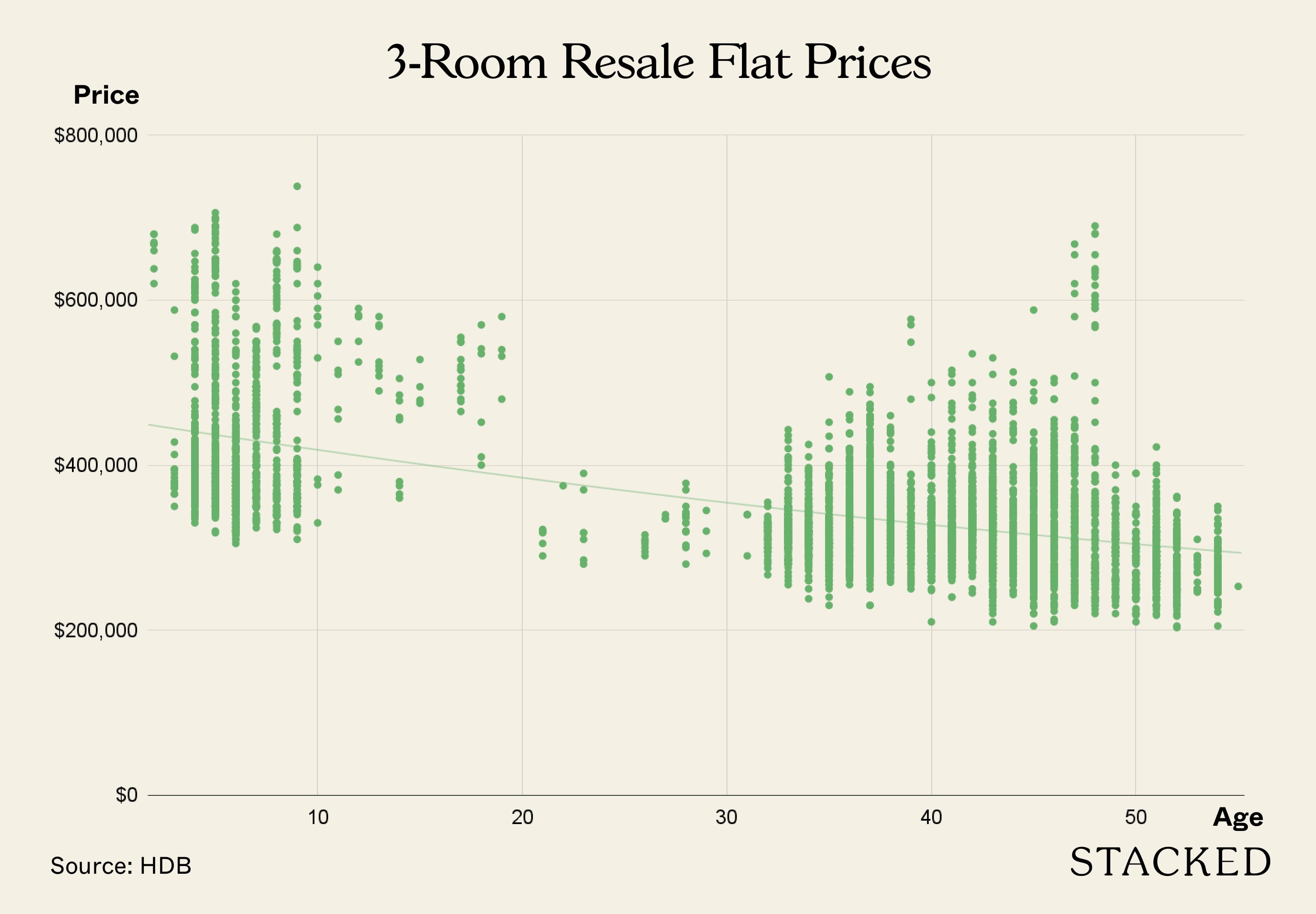

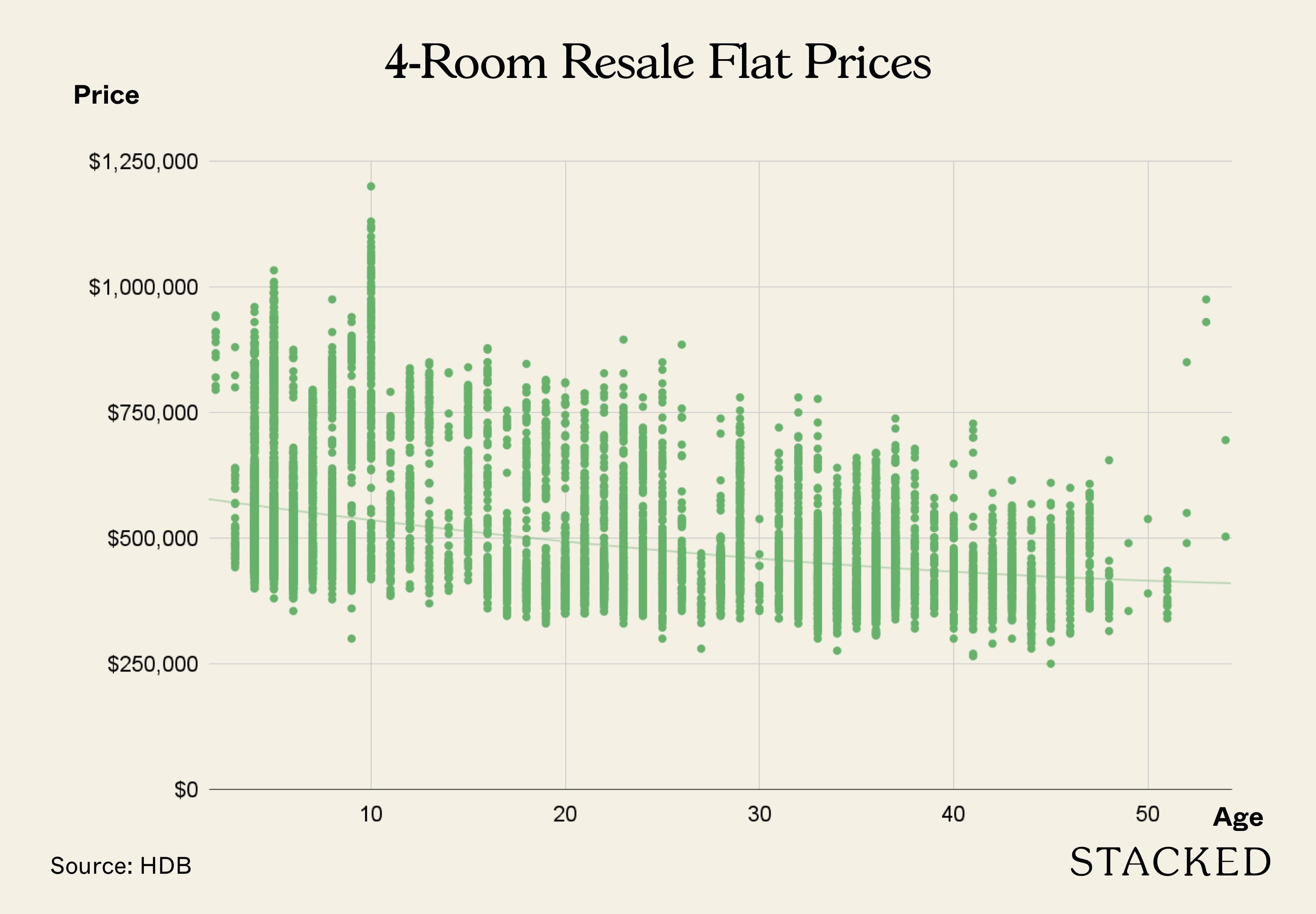

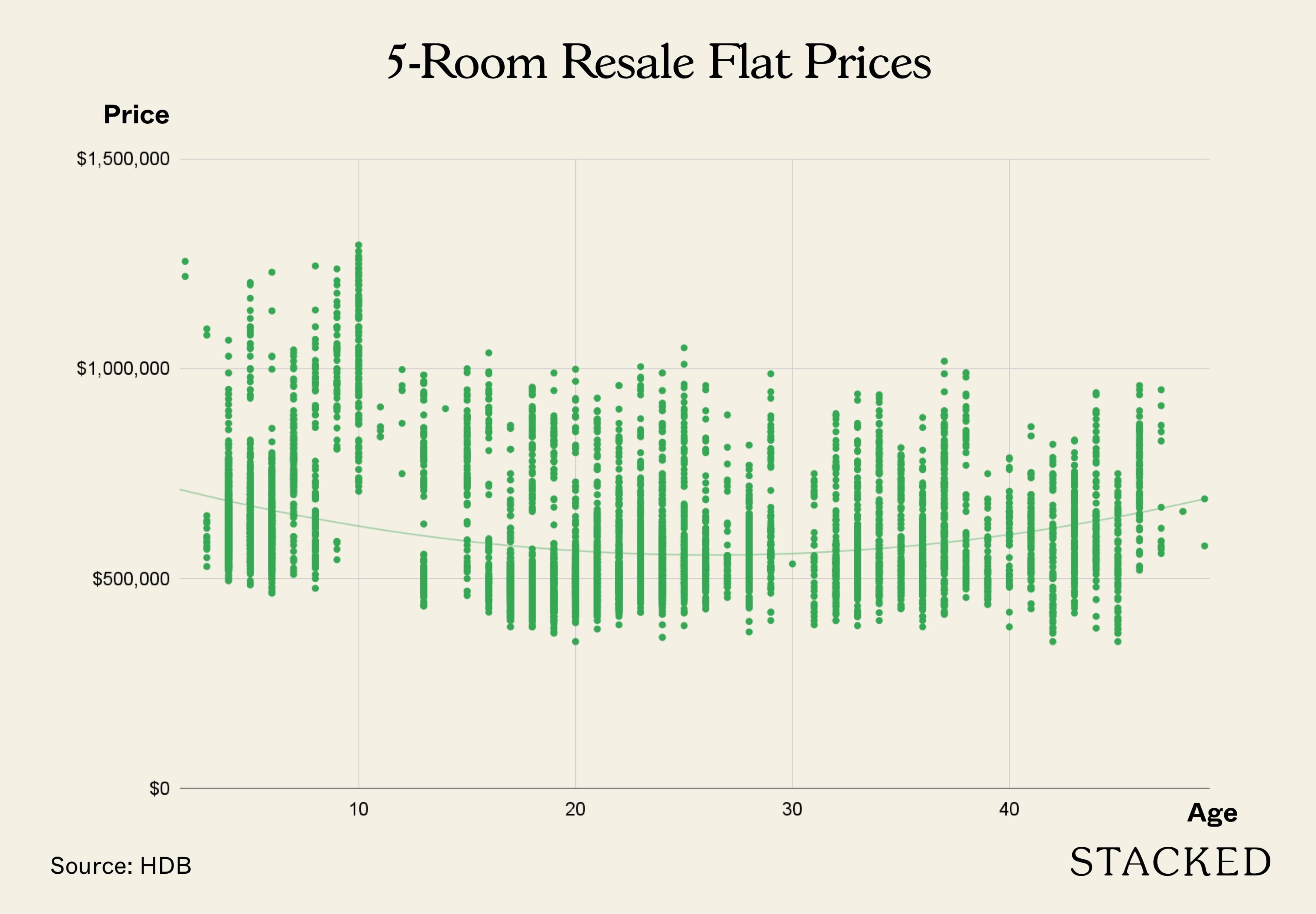

The charts above show a scatterplot of the transactions of different flat types across different ages. You would see that the polynomial trendline follows more or a linear to inverted U curve, meaning the price reduction is the same or slows down as it gets older. This is opposed to the accelerating inverted U of Bala’s Curve.

While prices go down with lease decay, the depreciation is nowhere near as fast as Bala’s Curve suggests. For 5-room flats, in particular, average prices for older flats even seem to defy depreciation and can cost more than newer counterparts. This is especially evident in certain “prestige” neighbourhoods, such as Marine Parade. There are certainly other factors here at play.

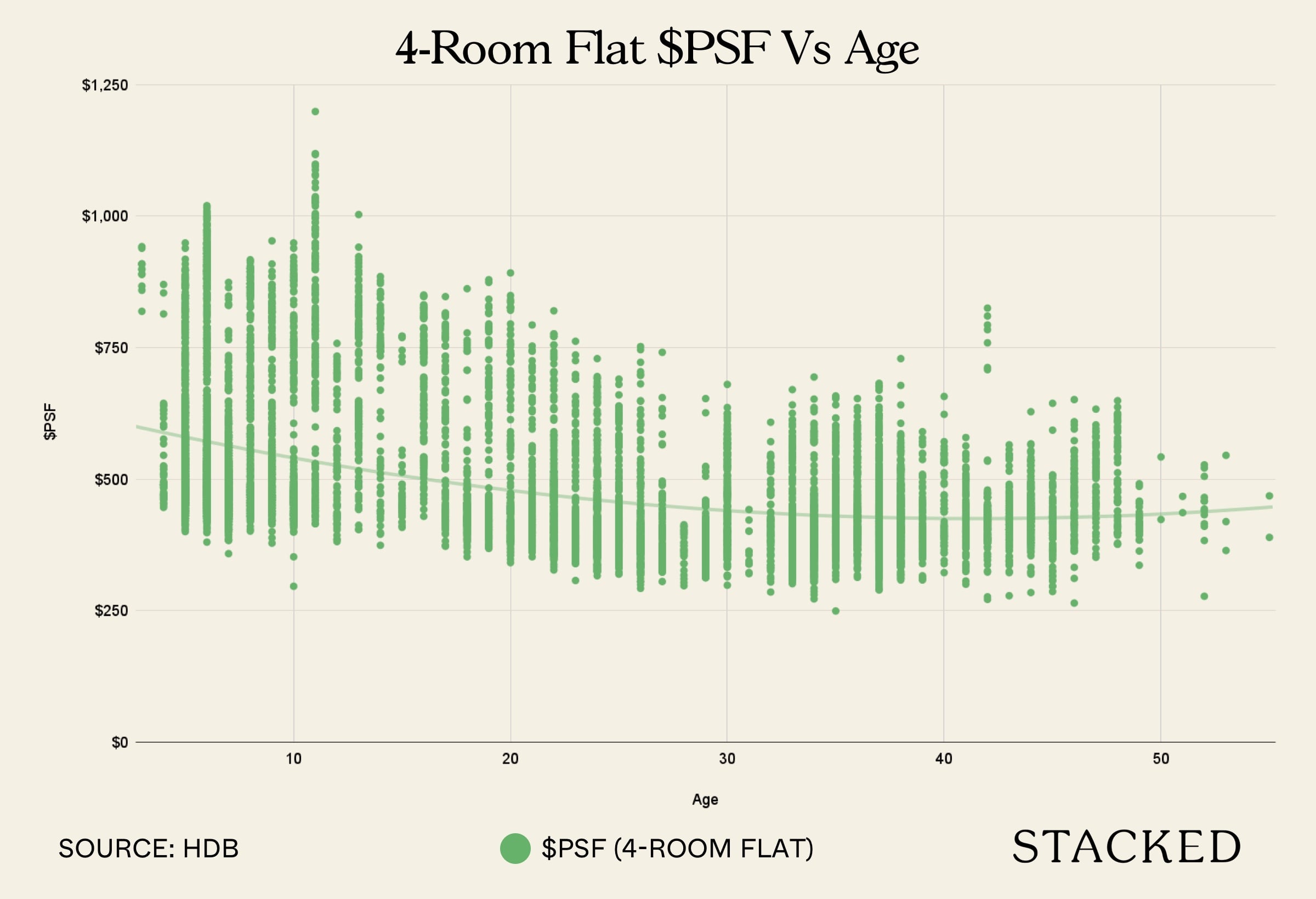

Update 21 March 2022: We were asked to consider using $PSF instead of the overall price (as shown above) given that older flats tend to have bigger unit sizes. As such, we plotted the $PSF alongside the age into a scatterplot below:

The outcome still shows the same pattern: a U-shaped curve. In fact, the $PSF vs age scatterplot has a more pronounced effect on older HDBs.

Price per lease remaining

Another way to look at HDB prices is to see what is its price per lease remaining. This is done by taking the price of the flat and dividing it by the remaining years of its lease.

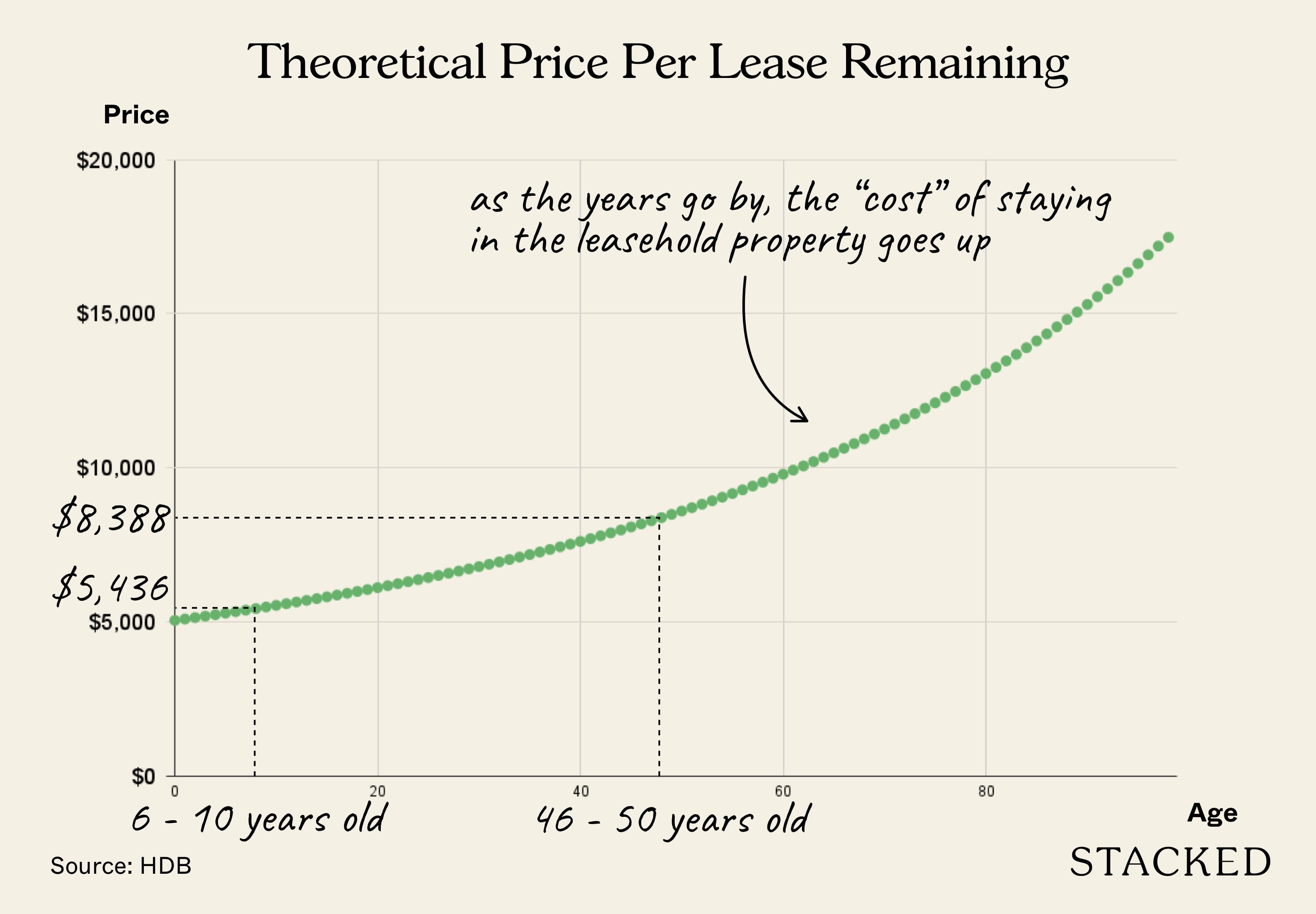

Due to the way prices depreciate (slower at the start, faster later on), the price per lease remaining increases slower in the earlier part of its life than later on. Here’s what it looks like in theory based on a 3.5% depreciation rate:

Over time, the price per lease remaining increases. Consider a flat with a theoretical value of $500,000:

Applying Bala’s Curve, the average price per lease, at six to 10 years old, is about $5,436. At 46 to 50 years old, the average should increase to $8,388, or up around 54 per cent.

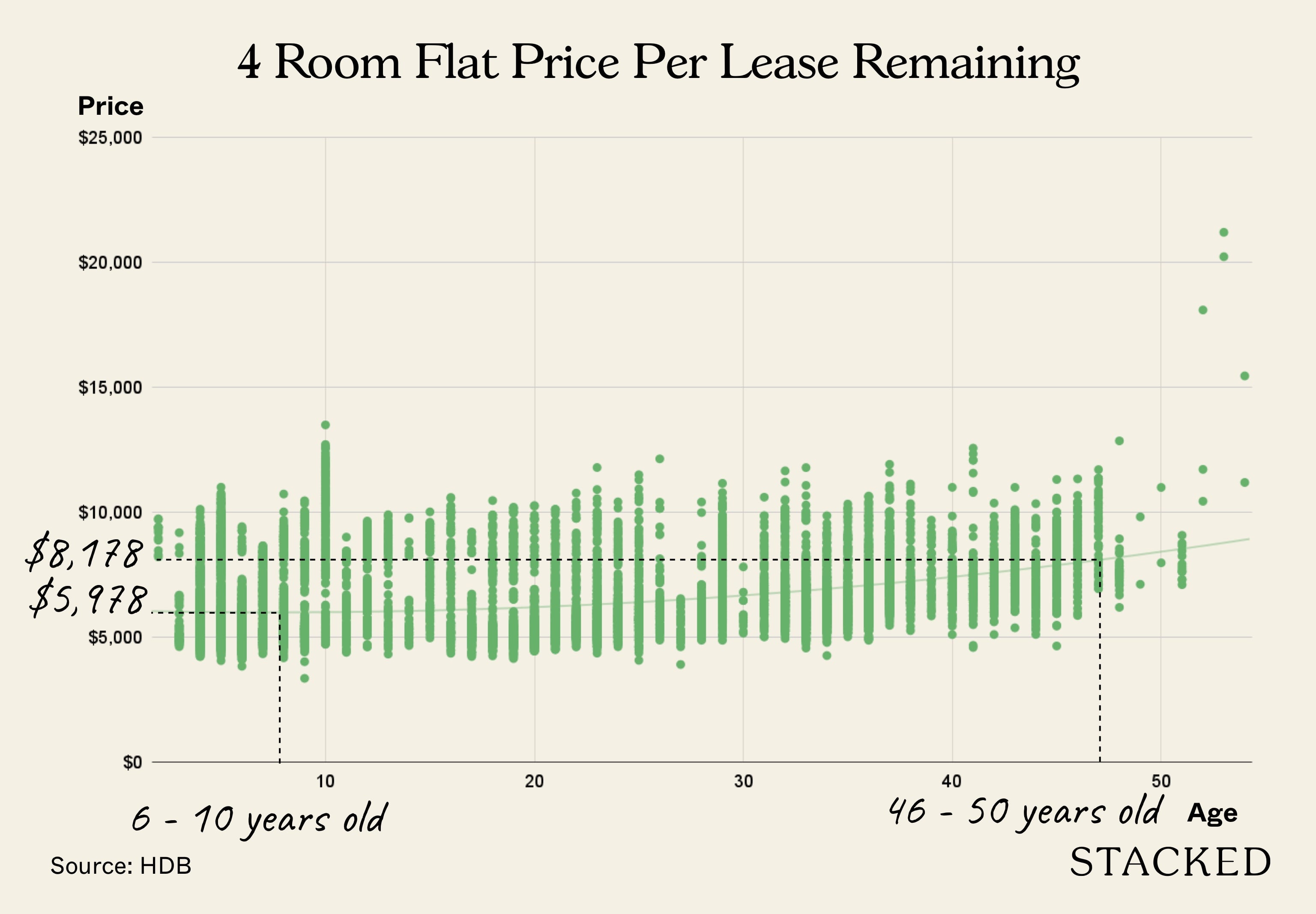

However, we noted that the increase (using data from 4-room flats transacted in January – November 2021) went from $5,978 per lease remaining to $8,178 per lease remaining over the same age average. This is an increase of about 37 per cent – less than the 54 per cent as the theoretical model implies.

This suggests that the value retention of HDB flats, as they age, is far greater than the commonly used model. This implies the price per remaining lease may be much higher than the common consensus holds.

So while older HDB flats certainly do depreciate, the rate is much slower than we may have expected.

Property Investment InsightsAre Higher Floor Units Better In Terms Of Profitability? We Look At 3,569 Transactions.

by IanWhy could this be happening?

- Our observations are not location-specific

- Housing grants don’t change for older flats

- It could be related to the buyer demographic

1. Our observations are not location-specific

Due to practical limitations, we were not able to derive observations based on specific estates. This gap may explain the reason why some older flats – such as those in Marine Parade – are able to defy depreciation.

A mature estate holds greater appeal, as there are more shops, eateries, and sometimes transportation nodes. Bishan or Queenstown, for example, have more in the way of amenities compared to Sengkang or Punggol.

In addition, some estates are more central than others. Central Area flats, flats in Toa Payoh, etc., see greater demand than most fringe region flats.

For these reasons, a centrally located – or mature – flat could hold significant appeal despite its apparent age.

2. Housing grants don’t change for older flats

Whether a flat is 10 years old or 40 years old, a buyer gets the same $20,000 CPF Housing Grant, and other Enhanced Housing Grant (EHG) amounts that they qualify for.

Because these subsidies are fixed, but older flats tend to be cheaper, the subsidies soak up a greater percentage of the price in older flats. i.e., a $20,000 grant for a new $500,000 flat soaks up four per cent of the price. For an older flat in the same area, depreciated to $400,000, the same $20,000 grant soaks up five per cent of the price.

This can help to maintain demand for older flats, and could contribute to slowing their depreciation.

3. It could be related to the buyer demographic

We can’t ignore that most buyers of these older flats are not younger Singaporeans. They are often seniors and retirees, who are at the last stop of their property journey. This has two implications:

First, the flat they’re buying is meant to last to the end of their life. There is little concern over resale value, as they don’t see these flats being sold within their lifetime.

This means that, if they find a flat they’re comfortable with, they may not mind paying Cash Over Valuation (COV). All that matters is the remaining lease can last out their years; and if they’re in their 70’s, for example, it doesn’t matter if the flat is 40 years old.

Also, for many older Singaporeans, the flat may not factor much into legacy planning. This is because Singapore has a very high homeownership rate of over 90 per cent.

By the time a couple is in their 70s, their children probably have homes of their own, and can’t inherit their flat anyway. This further reduces the need for long remaining leases or resale gains.

These older buyers may also want to pick a mature or central estate for comfort (see point 1), further propping up demand, and slowing depreciation of these flats.

Second, older buyers tend to have more savings accumulated, such as in their CPF. They may also be right-sizing, having just sold off a condo or even a landed property. This makes them better able to afford flats, even those sold well above valuation.

This isn’t to say lease decay is not a real concern

Once again, we’re not claiming it’s a good idea to buy a really old flat, or that you can count on every ageing flat to hold its value. Rather, our point is just that depreciation is not as severe as we may expect it to be.

Those who currently own ageing flats may want to research the valuation, as you may be sitting on more value than you thought. Also, it’s a reminder that sometimes, waiting a few more years to upgrade is not necessarily a terrible idea (especially if you need to build up savings).

For more on HDB resale flats and private properties alike, follow us on Stacked. We’ll also provide you with the most in-depth reviews of new and resale properties alike.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Trends

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

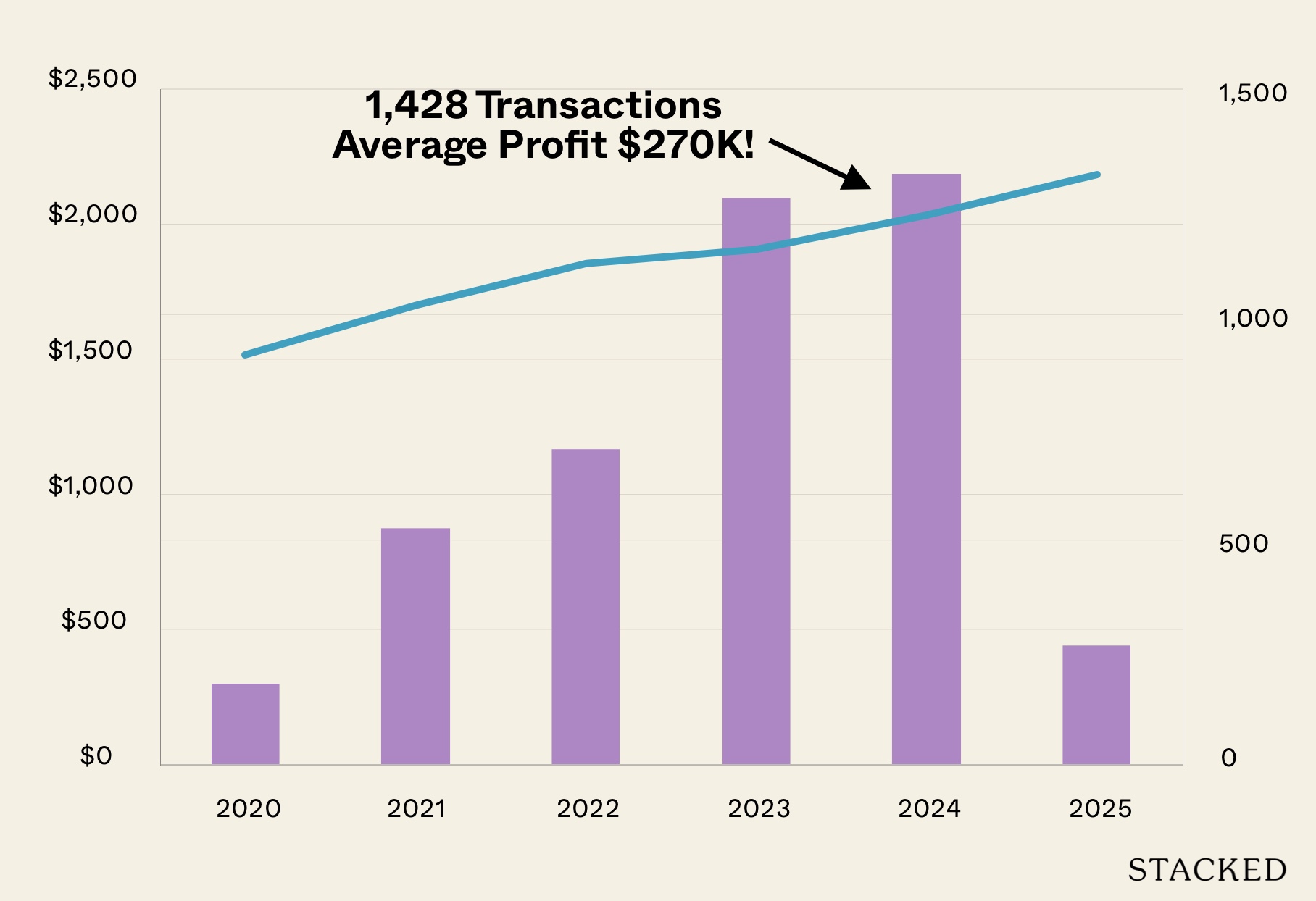

Editor's Pick Condo Profits Averaged $270K In 2024 Sub Sales: Could This Grow In 2025?

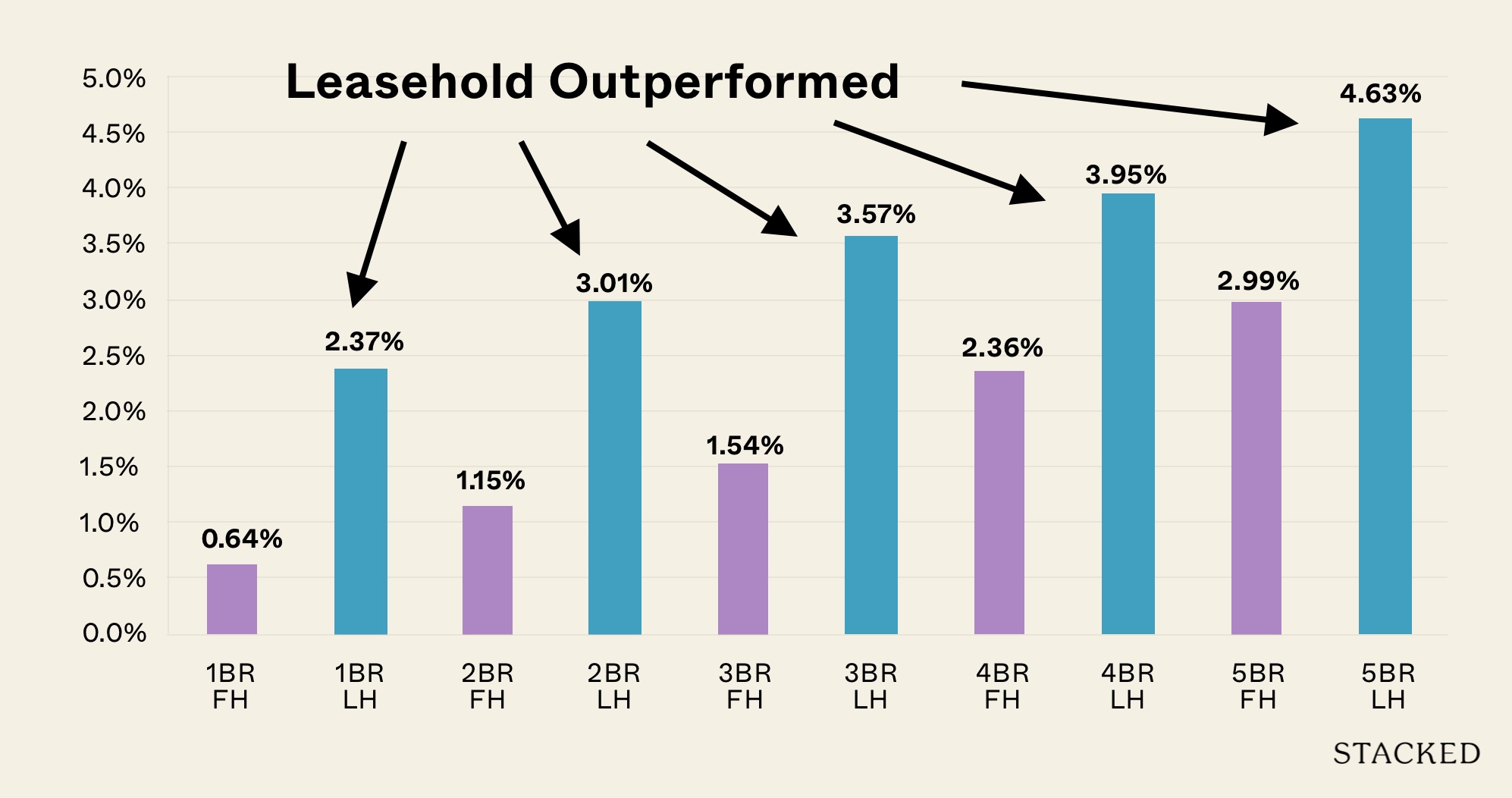

Property Trends Should You Buy A Freehold Or Leasehold Condo In 2025? Here’s The Surprising Better Performer

Latest Posts

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Landed Home Tours Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Overseas Property Investing Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Editor's Pick LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden

Property Market Commentary 2-Bedder vs 2+Study Units: Which Condo Layout Has Better Returns Over The Last Decade?

Homeowner Stories Does The “Sell One, Buy Two” Strategy Still Work In 2025? 3 Real Stories From Singapore Homeowners

Editor's Pick Where $4 Million Semi-Ds Sit Next To $40 Million GCBs: Touring First Avenue In Bukit Timah

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

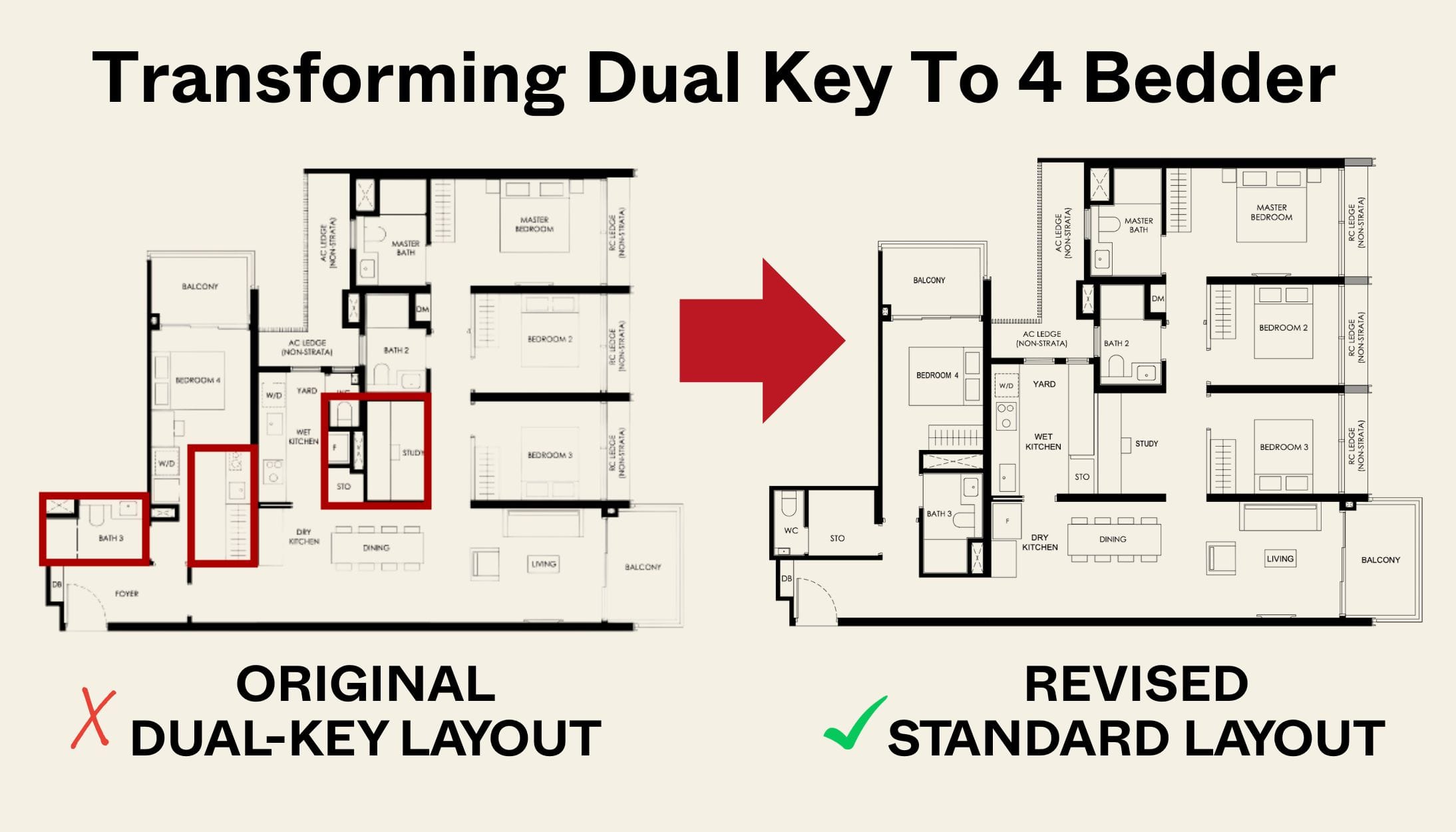

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

The analysis in article is not complete. There is no free lunch. Slower depreciation in early years, will mean much faster depreciation in later years (after 50 yrs), in general.

1. not much point if specific locations are not analysed e.g. TPY / AMK / BDK. I doubt we can take 5-10 years SK / PG and compare to these areas

2. Should analyse other periods besides 2021 as well. Don’t think the record COV will continue to stick for old flats. How long did the previous COV mania in 2011 last?

3. there is also some survivorship bias for old flats. Only the better old flats get sold, and the rest are unable be sold. No point selling your old flat now if u can’t get a good deal, because you will be worst off finding a new one.

I feel that Covid period is not a true picture of these old flats’ worth due to exceptional demand for resale flats for various reasons. When worker shortages start to ease and BTOs are available again with normal lead times, it would be interesting to research again the depreciation of old resale flats.

Don’t forget HDBs get new leases of life from HIP I and II and NRP.