New Condos With Big Price Discounts, How Have They Fared?: A Case Study On Urban Vista And Enclave Holland

April 1, 2024

A big drop in price for any condo always catches the attention of many, and the recent 20 per cent price drop at Cuscaden Reserve was no different. People love a good “bargain”, and the anchor price phenomenon is never so apparent as when a sale happens.

But the biggest question people typically ask is: “Is it a good deal now?”

As such, to answer that question, we decided to look back at some past condos which had large drops in prices before managing to sell out the development. Here’s a case study of how Urban Vista and The Enclave.Holland has performed since:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A quick rundown on Urban Vista

Urban Vista is a 99-year leasehold condo, completed in 2016. This is a mid-sized, 582-unit project located at Tanah Merah Kechil Link, just across from the Tanah Merah MRT station (EWL). Note that this MRT stop is significant, as it’s the point at which you change trains to get to Changi Airport.

As to the underperformance, you can check out further details here, but the numbers below will also reveal this.

Here’s what prices look like today:

Prices by unit type

| New Sale | Resale | ||||||||||

| Bedrooms | 2013 | 2014 | 2015 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| 1BR | $1,558 | $1,432 | $1,459 | $1,426 | $1,404 | $1,454 | $1,523 | $1,644 | $1,692 | ||

| 1BR PES | $1,310 | $1,384 | $1,254 | ||||||||

| 1BR PH | $1,289 | $1,024 | $1,450 | $1,155 | $1,667 | ||||||

| 2BR | $1,522 | $1,509 | $1,341 | $1,380 | $1,393 | $1,479 | $1,599 | ||||

| 2BR DK | $1,505 | $1,452 | $1,415 | $1,548 | $1,631 | ||||||

| 2BR DK PES | $1,344 | ||||||||||

| 2BR DK PH | $1,134 | $1,045 | $1,041 | $1,187 | |||||||

| 2BR PES | $1,364 | $1,327 | $1,165 | $1,301 | |||||||

| 2BR PH | $1,199 | $1,014 | $1,230 | ||||||||

| 3BR | $1,452 | $1,274 | $1,361 | $1,441 | $1,247 | $1,327 | $1,396 | $1,483 | |||

| 3BR DK | $1,475 | $1,327 | $1,377 | $1,298 | $1,404 | $1,360 | $1,386 | ||||

| 3BR DK PH | $1,228 | ||||||||||

| 3BR PES | $1,304 | $1,166 | $1,366 | ||||||||

| 3BR PH | $1,287 | $1,104 | $1,210 | ||||||||

| 4BR | $1,485 | $1,268 | $1,245 | $1,270 | $1,327 | $1,322 | $1,374 | ||||

| 4BR + Study PH | $1,297 | $1,139 | |||||||||

| 4BR DK | $1,434 | $1,261 | $1,275 | $1,343 | $1,530 | ||||||

| 4BR DK PES | $1,304 | ||||||||||

| 4BR PES | $1,297 | $1,221 | |||||||||

| 5BR DK PH | $1,225 | ||||||||||

Losses were the most severe in the year right after launch. This is because 2013 was the previous peak in the property market, so buyers in that year saw the biggest losses. As one sign of this, consider that those who bought in 2014, versus 2013, generally saw better gains:

| Bedrooms | 2013 | 2014 | 2015 |

| 1BR | -2.2% | ||

| 1BR PES | 4.5% | ||

| 1BR PH | -15.2% | 36.7% | |

| 2BR | -0.6% | ||

| 2BR DK | -1.0% | 13.0% | |

| 2BR DK PH | 4.6% | -0.6% | |

| 2BR PES | -3.3% | ||

| 2BR PH | 14.4% | ||

| 3BR | -3.0% | 6.8% | |

| 3BR DK | -6.4% | ||

| 3BR PES | -4.3% | ||

| 3BR PH | -3.9% | ||

| 4BR | -12.1% | 4.1% | |

| 4BR DK | -1.8% | 2.0% | |

| Grand Total | -2.2% | 8.6% | 13.0% |

(Although admittedly, there is a much lower volume of people who bought in 2014 and resold, compared to the year prior)

The initial prices in 2013 also weren’t unfairly high

We wouldn’t want to give the wrong impression that the buyers in 2013 bought at ridiculous prices. Even though it was a peak year, a comparison to the nearby Casa Merah (built in 2009) shows that Urban Vista wasn’t overpriced for the time:

| Project Name | Transacted Price ($) | Area (SQFT) | Bedroom | Unit Price ($ PSF) | Sale Date |

| CASA MERAH | $1,190,000 | 947 | 2 | 1256 | 22 Jan 2013 |

| CASA MERAH | $1,230,000 | 947 | 2 | 1299 | 2 Aug 2013 |

| CASA MERAH | $1,227,000 | 1227 | 3 | 1000 | 16 Jan 2013 |

| CASA MERAH | $1,370,000 | 1227 | 3 | 1116 | 21 Jan 2013 |

| CASA MERAH | $1,455,000 | 1227 | 3 | 1186 | 23 Jan 2013 |

| CASA MERAH | $1,480,000 | 1227 | 3 | 1206 | 31 Oct 2013 |

| CASA MERAH | $1,500,000 | 1238 | 3 | 1212 | 18 Jan 2013 |

| CASA MERAH | $1,560,000 | 1238 | 3 | 1260 | 19 Jun 2013 |

| CASA MERAH | $1,500,000 | 1249 | 3 | 1201 | 14 Jan 2013 |

| CASA MERAH | $1,500,000 | 1259 | 3 | 1191 | 18 Oct 2013 |

| CASA MERAH | $1,458,000 | 1270 | 3 | 1148 | 12 Mar 2013 |

| CASA MERAH | $1,530,000 | 1281 | 3 | 1194 | 7 Jan 2013 |

| CASA MERAH | $1,650,000 | 1302 | 3 | 1267 | 8 Oct 2013 |

| CASA MERAH | $1,610,000 | 1346 | 3 | 1197 | 9 Oct 2013 |

| CASA MERAH | $1,680,000 | 1378 | 3 | 1219 | 8 Mar 2013 |

| CASA MERAH | $1,653,600 | 1378 | 3 | 1200 | 18 Mar 2013 |

Back in 2013, the resale three-bedders at neighbouring Casa Merah were selling for about $1,186 psf, while Urban Vista’s three-bedders went for about $1,452 psf. This was a premium of 22.4 per cent for Urban Vista at the time, which is not an unusual price gap for a condo that’s seven years newer.

What’s happened in recent years?

The prices at Urban Vista did improve over the last few years; but it was only toward 2022/23 that some of the earlier buyers would have recovered their costs or profited. But this is probably due to the overall market conditions (e.g., the housing supply crunch right after Covid) which affected all condos, not something specific to Urban Vista.

Here are the prices right now:

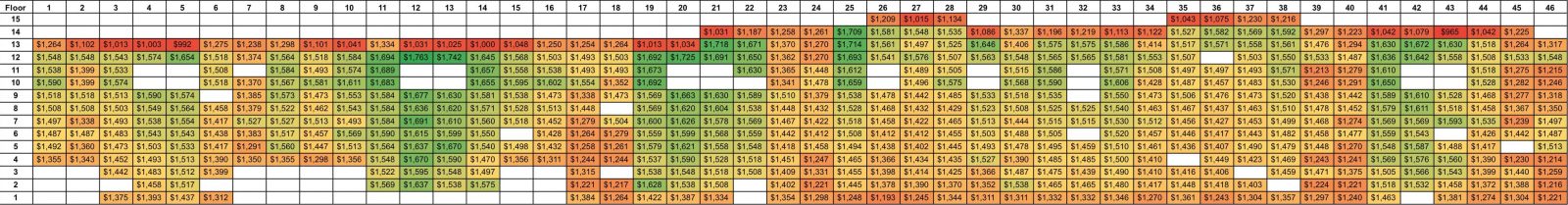

Price movements by stack

Click to view the full image here.

More from Stacked

We Compared Old vs New Condos in One of Singapore’s Priciest Neighbourhoods — Here’s What We Found for Smaller Units

District 11 (D11) has some of the most famous high-end residential enclaves: think Newton, Novena, Watten Estate and Thomson. Here,…

Price drops are noticeable in stack 23. Notice that units on levels 10 to 13 saw a fall in price psf for three-bedders, down to $1,341 psf and $1,370 psf respectively. This is cheaper than units on lower floors, which is strange as higher floor units are typically more desirable (the price discrepancy could be down to other factors, such as the condition or renovation status, which is not factored in here).

Stack 24, right next to it, also saw price drops – and again we can see a strange phenomenon where 13th and 12th-floor units (at $1,270 psf) are cheaper than most lower-floor units.

Note that stacks 23 and 24 are inner-facing stacks with a pool view. Perhaps the higher floor units would be more desirable if they were outward-facing; but frankly, there’s not a lot to see in this part of Tanah Merah (unless you like to see the train station or other condos).

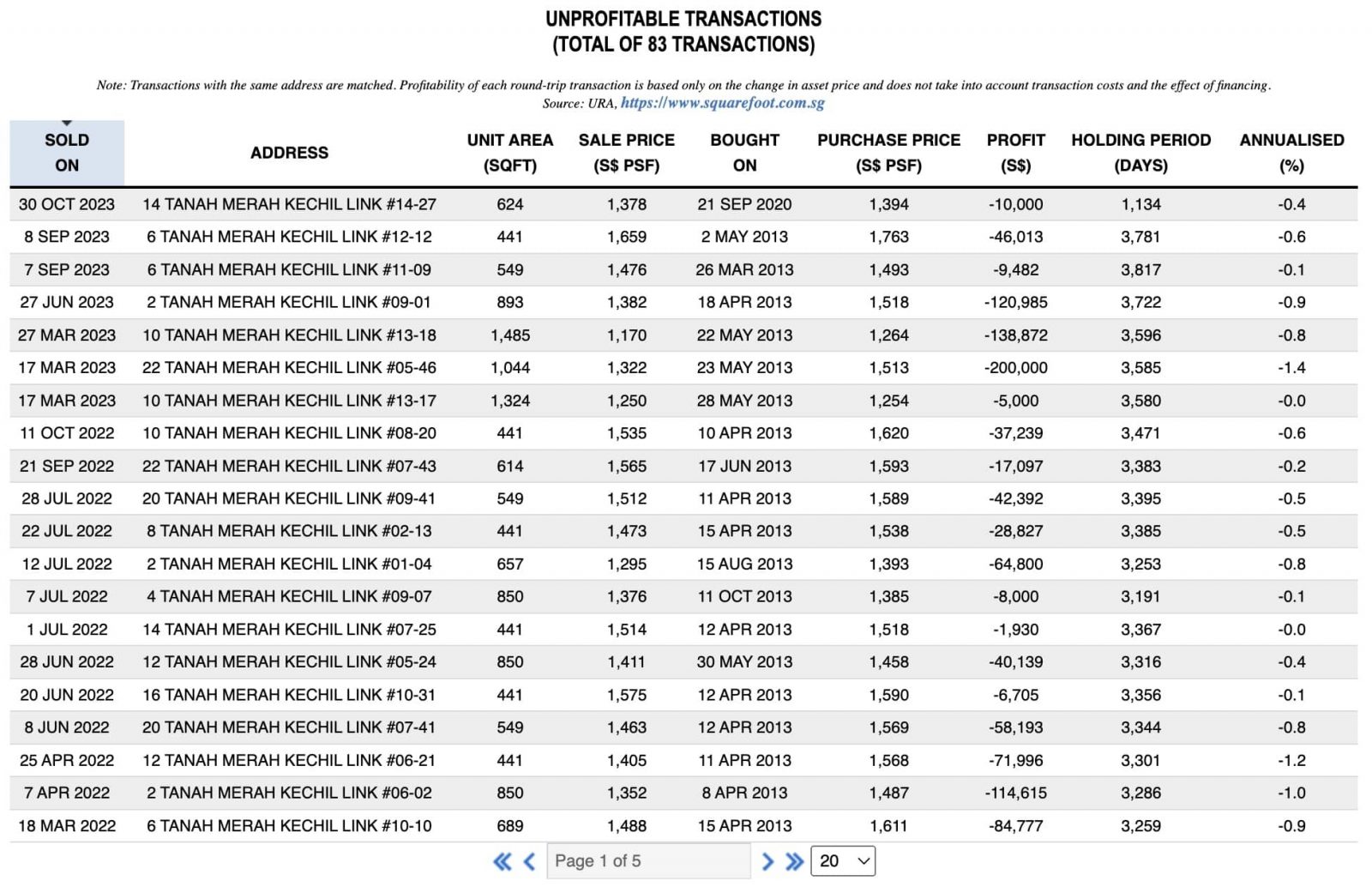

Profitable versus unprofitable transactions

Unprofitable transactions still outnumber the profitable ones. There are 83 losing transactions to 70 winning ones:

What do the average profits look like today?

| Bedrooms | 2013 | 2014 | 2015 |

| 1BR | -$17,158 | ||

| 1BR PES | $29,362 | ||

| 1BR PH | -$114,389 | $318,000 | |

| 2BR | -$5,395 | ||

| 2BR DK | -$11,288 | $130,000 | |

| 2BR DK PH | $61,216 | -$8,000 | |

| 2BR PES | -$30,652 | ||

| 2BR PH | $180,000 | ||

| 3BR | -$38,248 | $72,831 | |

| 3BR DK | -$87,210 | ||

| 3BR PES | -$60,087 | ||

| 3BR PH | -$71,936 | ||

| 4BR | -$186,392 | $49,750 | |

| 4BR DK | -$26,248 | $28,500 |

Overall, Urban Vista does seem to be recovering from its poor timing issues; and there’s certainly no defect or failings that would make it an inferior project.

As an aside, the upcoming Sceneca Residence will add some much-needed commercial amenities to the area. Given that Sceneca Residence is much pricier, but condos like Urban Vista, Optima, Casa Merah, etc. have the same advantage of location (and can access the same commercial component), buyers might show more interest in these older resale alternatives.

A quick rundown on The Enclave.Holland

(Ps. The period mark isn’t a typo, it’s in the name)

The Enclave is a boutique, freehold development along Holland Road, with just 26 units; which if you follow our articles, you’ll know is already a potential sign of trouble. The Enclave really does have a location that might make up for it though, as it’s just minutes away from Holland Village MRT (CCL).

The MRT station is also roughly the hub of Holland V, where you find most of the eateries, shops, and other entertainment; so this project is very convenient. This project is also quite new, having been built in 2019.

What went wrong?

The Enclave began sales in March of 2013, and again, this was a year of peak prices. To say that sales were slow is an understatement, as only 10 of the 26 units were sold by 2018. The remaining 16 units were sold between 2019 and 2020, which was after the project’s completion.

Here’s how the price moved on a year-on-year basis:

| New Sale | Resale | ||

| 2018 | 2019 | 2020 | 2023 |

| $2,622 | $2,475 | $1,848 | $2,501 |

| $2,450 | $2,467 | $2,081 | $2,366 |

| $1,844 | |||

| $1,922 | |||

There was an almost 30 per cent price drop for one-bedders here, from $2,622 psf in 2018, to $1,848 psf. This price drop may have been the reason the developers could finally move the last few units. However, this would be a major blow to the earlier buyers (the first 10 units sold), given that the later sales set the new baseline price.

This may be due to the oversaturation of condos in the Holland V area at the time, which we covered in this article. Another reason would be the many freehold developments nearby (in fact being freehold is not a big advantage here, as it’s the norm in Holland V).

If you compare price alone, The Enclave is not much more expensive than its competitors:

| Project Name | Transacted Price ($) | Area (SQFT) | Unit Price ($ PSF) | Sale Date |

| HOLLAND RESIDENCES | $1,220,000 | 603 | $2,024 | 23/2/18 |

| HOLLAND RESIDENCES | $1,760,000 | 969 | $1,817 | 20/4/18 |

| HOLLAND RESIDENCES | $1,680,000 | 980 | $1,715 | 19/11/18 |

| HOLLAND RESIDENCES | $2,900,000 | 1884 | $1,540 | 12/4/18 |

| HOLLAND RESIDENCES | $2,965,000 | 1916 | $1,548 | 1/2/18 |

| HOLLAND RESIDENCES | $3,750,000 | 2185 | $1,716 | 4/7/18 |

| LOFT@HOLLAND | $800,000 | 323 | $2,477 | 2/2/18 |

| LOFT@HOLLAND | $823,000 | 323 | $2,549 | 3/9/18 |

| LOFT@HOLLAND | $890,000 | 431 | $2,067 | 30/7/18 |

| LOFT@HOLLAND | $900,000 | 431 | $2,090 | 6/9/18 |

| LOFT@HOLLAND | $1,600,000 | 980 | $1,633 | 10/7/18 |

| THE CORNWALL | $1,150,000 | 614 | $1,874 | 22/6/18 |

| THE CORNWALL | $1,200,000 | 635 | $1,890 | 9/3/18 |

| THE CORNWALL | $1,241,730 | 657 | $1,891 | 29/6/18 |

| THE CORNWALL | $1,230,000 | 657 | $1,873 | 12/7/18 |

| THE CORNWALL | $1,260,000 | 667 | $1,888 | 26/6/18 |

| THE CORNWALL | $1,340,000 | 764 | $1,753 | 10/10/18 |

| THE CORNWALL | $2,400,800 | 1464 | $1,640 | 19/11/18 |

| Project Name | Built | 1BR | 2BR | 3BR | 4BR |

| HOLLAND RESIDENCES | 2012 | $2,024 | $1,766 | $1,544 | $1,716 |

| LOFT@HOLLAND | 2014 | $2,296 | $1,633 | ||

| THE CORNWALL | 2005 | $1,862 | $1,640 |

At $2,622 psf, The Enclave was about 15 per cent higher than existing competitors, which is not a very big price gap for a newer condo. The difference here is that some of the competitors are bigger and have more room for facilities. In addition, the Holland V area tends to attract more affluent families who can afford bigger units, not just one or two-bedders; so The Enclave would be more niche, and appeal more to landlords.

(And new investors, by the way, are unlikely to start with a pricier, higher-risk expense of a boutique Holland V condo)

But have prices recovered today?

Here’s a look at how prices have moved by floor:

| Floor | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 1 | $1,850 | $2,554 | $2,361 | $1,849 | |||

| 2 | $2,670 | $1,850 | $1,850 | $2,591 | $2,284 | $2,166 | $2,671 |

| 3 | $2,682 | $1,844 | $1,891 | $2,502 | $2,467 | $2,578 | $2,683 |

| 4 | $2,475 | $2,563 | $2,439 | $1,848 | |||

| 5 | $1,851 | $2,094 | $2,208 | $1,850 |

In 2023, condo prices went up across the board, so it’s unsurprising we saw some improvement in The Enclave as well. However, note that the earliest buyers wouldn’t have recovered their costs even then; and as far as profit goes, it’s the buyers who purchased in 2020 who are likely to see gains.

Of the 26 units, it’s mostly the one-bedders that sold well and were the first to go. As they were mostly in stacks 1, 4, and 7, it’s unsurprising that these stacks are mostly in the green.

The larger units (three and four-bedders) are mostly found in stacks two and three, hence the weaker performance of these two stacks; while stack 6 has the two-bedders.

As far as resale goes, there have been only two transactions since 2019; this sort of low transaction volume is quite common in boutique condos:

While we wouldn’t usually go on two transactions alone, we notice these two coincide with what we’ve mentioned above: the seller who initially purchased the unit in 2020 saw a profit, while the one who bought it in 2018 saw a loss.

As with most boutique condos, the low number of units – and accompanying low transaction volume – makes resale prices volatile. It’s hard to guess when, or if, the prices will recover sufficiently for the earliest buyers; so hopefully they purchased this for pure own-stay use rather than gains.

For more on the Singapore property market, as well as insights into new and resale projects alike, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are condos with big price drops good investments now?

How did Urban Vista perform after its price drops?

Did The Enclave Holland see a price recovery after its decline?

Why did some units in Urban Vista sell for less despite being higher floors?

Are resale prices of these condos volatile?

Should I buy a condo with a recent big price drop?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Property Investment Insights This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

Property Investment Insights We Compared Lease Decay Across HDB Towns — The Differences Are Significant

Property Investment Insights This Singapore Condo Skipped 1-Bedders And Focused On Space — Here’s What Happened 8 Years Later

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments