Are you able to afford an average HDB resale flat?

October 20, 2017

So, how much do you need to earn to afford that resale flat? Singapore’s HDB affordability has been put into question time and time again.

This article is meant to give you an overview of the minimum gross household income needed to purchase a resale flat. In producing the figures, we had to make several assumptions which cover most HDB resale flat buyers.

- Assumption 1: Only the down payment of 10% of the purchase price is made and a HDB loan is taken for the remaining 90%

- Assumption 2: The HDB loan charges an annual interest of 2.6%

- Assumption 3: The loan tenure is 25 years

- Assumption 4: No CPF Housing Grants are considered here

- Assumption 5: The HDB median resale flat prices in September 2017 is taken as the cost of purchasing a resale flat for that month

The steps taken to derive the gross household income are:

Step 1: Determine the median resale prices in September 2017.

Step 2: Calculate the monthly payments based on a 90% HDB loan at an 2.6% interest rate per annum and a 25-year loan tenure.

Note to step 2 – As taking a HDB loan requires that the monthly payments should not exceed the Mortgage Servicing Ratio of 30%, the result from step 2 is assumed to represent 30% of the gross household income.

Step 3: Multiply the result from step 2 by 3.33 (100% / 30%) to obtain the minimum household income needed to fulfill this MSR. This is the minimum household income you need to have to quality for the loan needed to purchase the flat.

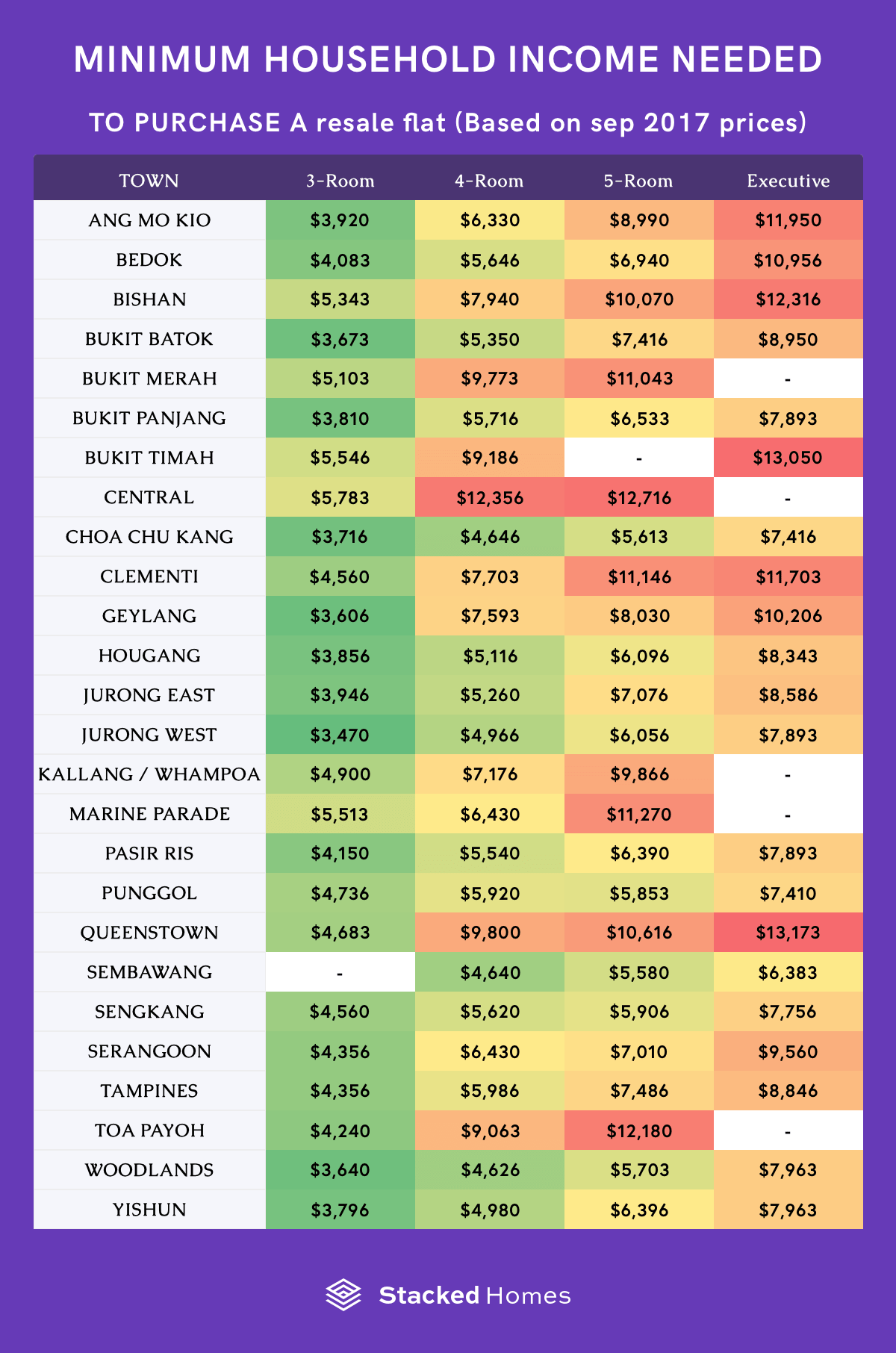

So diving straight into it, here are the gross household incomes needed for each estate and each flat type based on the median resale flat prices in September 2017:

These gross household income figures will only tell you how much HDB loan you qualify for, and does not account for the CPF Housing Grants you may receive, or the cash you have sitting in the bank. In other words, even if you had a million dollars in cash, applying for the HDB Loan does not take into account your hidden fortune. It only considers your household income.

Since these income figures were derived solely looking at the MSR, be mindful of other fees (see our first FAQ on estimated fees) you’ll need to pay such as the valuation fee, resale application fee, mortgage and fire insurance, so be sure to have cash lying around for these expenses too!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

0 Comments