Making $1 Million Dollars In Profit From An HDB: Why Pinnacle @ Duxton May Be The Most Unique Property In Singapore

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Pinnacle@Duxton remains the poster child of the “lottery effect” – the proof that certain desirable BTOs go on to make a killing for their lucky owners. In fact, it is probably Singapore’s most profitable HDB project (for its residents).

When this iconic HDB was launched, prices of 4-room flats ranged from $289,200 to $380,900 for 4-room flats and $345,100 to $439,400 for 5-room flats (source).

Recently, a 4-room flat at Pinnacle@Duxton broke a new record, selling for $1.41 million.

At a $1.3/4 million average price for the 4-rooms today, owners who snagged this HDB in 2004 would have made a cool million dollars from their HDB.

Exciting? Certainly, if you’re new to Singapore’s property market scene. Maybe even shocking.

But among longtime market watchers, this was greeted with nothing more than a nod of acknowledgement. It’s partly because of Pinnacle’s long record of million-dollar flats, and partly because expectations for this HDB project have never wavered.

So if you’re wondering what makes the Pinnacle @ Duxton so special, here are some of its more interesting points:

Why is Pinnacle @ Duxton so different and important?

Pinnacle has more than architectural significance – it was also a sort of bellwether, showing the effect of new flats in highly mature locations. It can be thought of as a possible forerunner, which indirectly influenced schemes like today’s Prime Housing Location (PLH) model. It doesn’t help that, with the new classification system, Pinnacle is set to become even more valuable.

Some of the key things to note are:

1. Pinnacle isn’t retroactively penalised by Prime and Plus classification

HDB has done away with mature versus non-mature classifications. Instead, flats are now classed as Prime, Plus, or Standard. This new approach works in favour of high-demand projects like Pinnacle, which existed before the new system.

Subsequent buyers of Prime or Plus flats are faced with a 10-year MOP, while the first batch of buyers also face Subsidy Recovery (SR) costs. The offset to this is supposed to be a superior location.

However, existing projects like Pinnacle are already in high-demand hot spots; and units here can be bought without requirements like a longer MOP or SR. Units here can also be fully rented out after five years, something that’s not possible for Prime or Plus flats. As such, we may see Pinnacle prices go even higher (or at least maintain their sky high values) over the coming years.

2. Pinnacle is a hotbed of rumours and a political talking point

There are few HDB projects that generate as many rumours as Pinnacle.

One of these, which has persisted for a long time, is that Pinnacle was an indirect “reward” for Grass Roots Leaders (GRL). Here’s a conversation on Reddit to show you what we mean:

Comment

byu/FitCranberry from discussion

insingapore

As well as:

Comment

byu/FitCranberry from discussion

insingapore

So it seems that to some Singaporeans, Pinnacle is representative of unfairness and cronyism. But these rumours are unverified, and just as many might accuse these people of simply being envious.

If nothing else, it demonstrates the social rifts that can emerge from the HDB windfall effect. And notice that, while the same rumours could circulate about almost any desirable HDB project, they almost always centre on Pinnacle.

This is likely because Pinnacle is so prominent, and keeps breaking transaction records.

More from Stacked

We Make $300k Per Year: Should We Buy An HDB Maisonette, Walk-Up Apartment Or A Condo?

Hi Stacked (Ryan),

Another ongoing rumour about Pinnacle is that it was a “testbed” for the short-lived DBSS initiative.

Pinnacle launched in May 2004, before the existence of DBSS. It was much pricier than other BTO flats, and had higher quality finishing, but didn’t have the typical full suite of condo facilities. On top of that, Pinnacle was specifically targeted at young urban professionals, who were likely to have higher incomes.

Sounds a lot like a DBSS right? Well, consider that DBSS then appeared on the scene in March 2005, very soon after the response to Pinnacle could be measured. You can probably see why there’s a persistent rumour that Pinnacle was an “unofficial pilot” for the scheme, and that DBSS may not have existed without the strong reception to Pinnacle.

But this rumour is also impossible to prove, unless someone privy to the internal discussions comes out with it.

3. Pinnacle is quite revolutionary in terms of layout

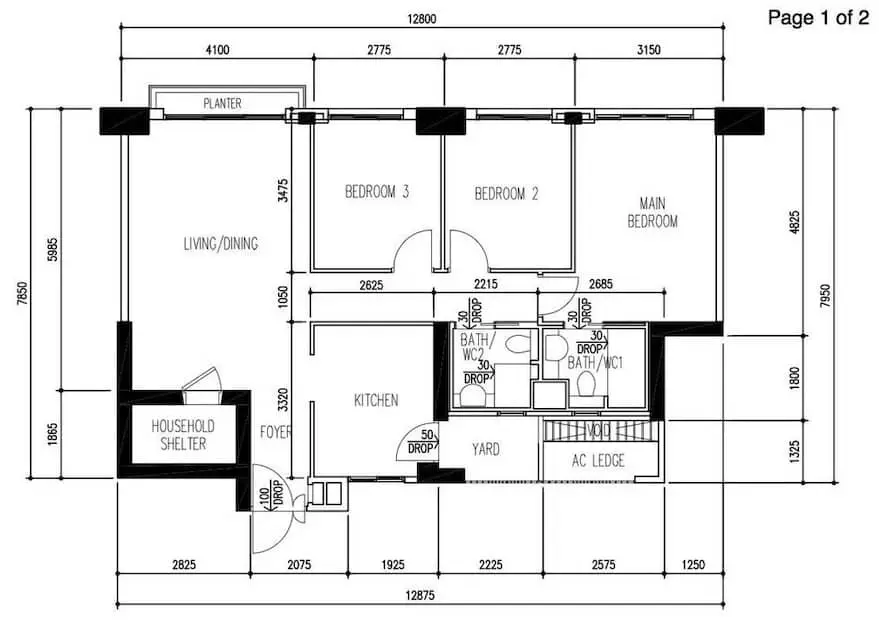

Most discussions of Pinnacle highlight its location, sky bridges, 50-storey height, etc. But what a lot of people may not realise is that the layout is much more versatile than previous flats.

The living spaces in each unit can be widened or shrunk more easily, because many of the walls are just light-weight placements; not load-bearing walls. This was also the first HDB project where the buyers could choose between features like planter boxes, bay windows, or balconies (granted, many of those aren’t popular today, but they were marketed as plus points in the early 2000s).

This flexibility means that most units at Pinnacle are easy to customise, and adapt to different design themes. We do wonder if this was an experimental effort, and if the good reception will prompt HDB to apply it to future flats.

4. The high-end food court at Pinnacle is quite unique among HDB projects

If you haven’t been before, check out the food court at Pinnacle, which is quite unique. The food and furnishing are definitely more high-end than your regular mall food court; and it’s way more impressive than the occasional cafe in a condo.

Barring some mixed-use or integrated developments, this sort of high-end food court hasn’t been tried in other condos before; and it’s definitely different from the usual kopitiams you’ll find at HDB blocks.

This is an interesting study in amenities: if this can work, why not a few higher-end cafes as part of standard HDB blocks too? We have started to see pricier food options in heartland areas; and they can co-exist with regular, affordable food stalls.

Pinnacle @ Duxton may technically be an HDB project; but it’s so unique it doesn’t really fit well into any property segment. It has DBSS-like features but is not itself a DBSS flat. It’s also not an EC, but has facilities and quality that rivals ECs, or even private developments. And as far as property values go, it’s established as being the project to beat.

Beyond the realm of real estate, Pinnacle is also going to be at the centre of housing policy discussions; and it’s going to be a part of Singapore history in more ways than just architecture.

For more on the Singapore property market, and in-depth reviews of its unusual projects (new or resale), follow us on Stacked. If you’d like to get in touch for a more in-depth consultation, you can do so here

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Editor's Pick

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

Overseas Property Investing Why The Johor-Singapore Economic Zone Isn’t Just “Iskandar 2.0”

Singapore Property News URA’s 2025 Draft Master Plan: 80,000 New Homes Across 10 Estates — Here’s What To Look Out For

Latest Posts

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

On The Market 5 Spacious Old But Freehold Condos Above 2,650 Sqft

Property Investment Insights We Compared New Launch And Resale Condo Prices Across Districts—Here’s Where The Price Gaps Are The Biggest

Pro Similar Layout, Same District—But Over $500K Cheaper? We Compare New Launch Vs Resale Condos In District 5

New Launch Condo Analysis The First New Condo In Science Park After 40 Years: Is LyndenWoods Worth A Look? (Priced From $2,173 Psf)

Pro Analysing Forest Woods Condo at Serangoon: Did This 2016 Project Hold Up Over Time?

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Singapore Property News She Lost $590,000 On A Shop Space That Didn’t Exist: The Problem With Floor Plans In Singapore

On The Market 5 Cheapest Newly MOP 5 Room HDB Flats From $700k