Just $100k For An HDB In 2024? 4 Odd Property Transactions In Singapore

May 4, 2024

Property is one of the most unique asset classes, because of how each unit is so stubbornly independent. With other assets, one barrel of oil is the same as the next, and one dollar is the same as the next. But with real estate, the flat next door might end up going for $500,000 more, and sometimes for no fathomable reason (at least, on the surface). To show you how strange it can get, here are some true oddballs we’ve found:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

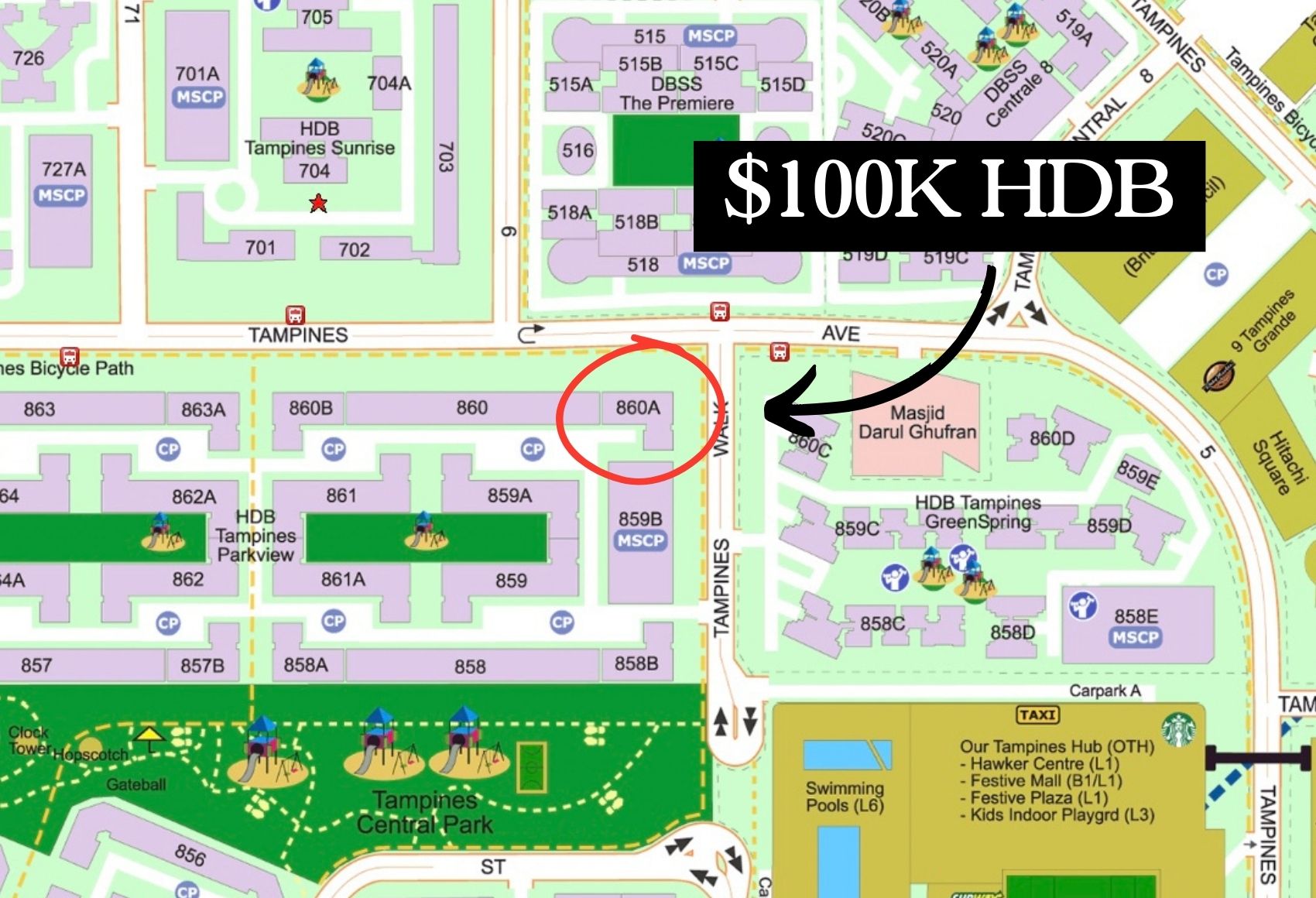

1. A 4-room flat for $100,000

This was a transaction that caught the attention of many recently. An older 4-room flat (built in 1987) at Block 860A Tampines Avenue 5 was sold in January 2024, for the amazing price of $100,000. As of the latest COE prices in April, this was slightly cheaper than obtaining a Cat B COE. And this wasn’t because something was wrong with the block – other transactions in the same block, over a 12-month period, lodged transactions of around $560,000 to $645,000.

These transactions tend to be familial; such as parents selling to children, or siblings selling to each other. For legal reasons, it might make sense to use a formal transaction with a token amount; or it may just be so the recipient feels better about it (e.g., parents don’t want low-income children to feel they’re getting something out of charity, because they’re incapable of affording it).

This does, however, provide an example of how price anchoring can be dangerous. The HDB block is safe from this as there’s a high volume of transactions, and one outlier won’t impact things too much. But imagine if the same thing happens in a boutique condo, where transactions are infrequent: it could severely impact the next sale.

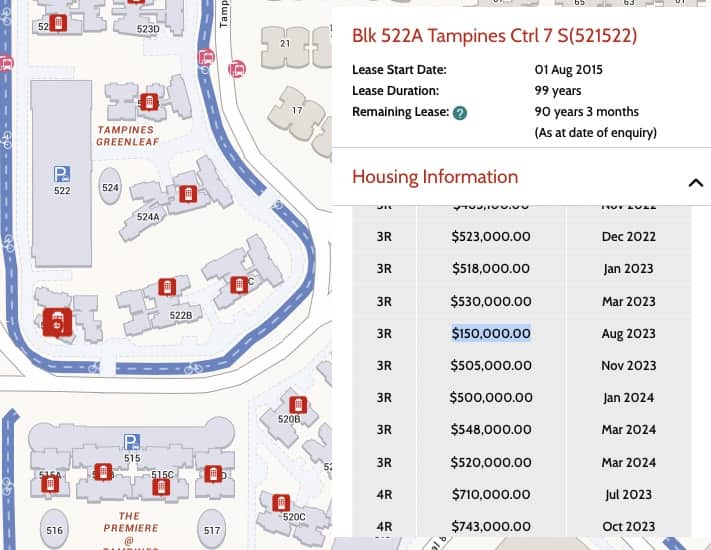

2. 3-room flats selling for $150,000

Not quite as cheap as the above example, but here’s another two:

| Month | Town | Flat Type | Address | storey_range | Area (Sqm) | Lease Started | Remaining Lease | Price |

| 2023-08 | TAMPINES | 3 ROOM | 522A TAMPINES CTRL 7 | 07 TO 09 | 67 | 2015 | 91 years 03 months | 150000 |

| 2023-12 | WOODLANDS | 2 ROOM | 182A WOODLANDS ST 13 | 28 TO 30 | 47 | 2019 | 94 years 11 months | 150000 |

Again, this could be a case of family members selling to each other; but what makes these unusual is their relatively young age: they have 91 and 94 years on the lease respectively. In most cases of intergenerational transfer, the flats involved will be much older.

In fact, you’ll see how drastically different it went for compared to units around:

We don’t really have any explanation for this one, short of guessing it’s a unique situation between family members.

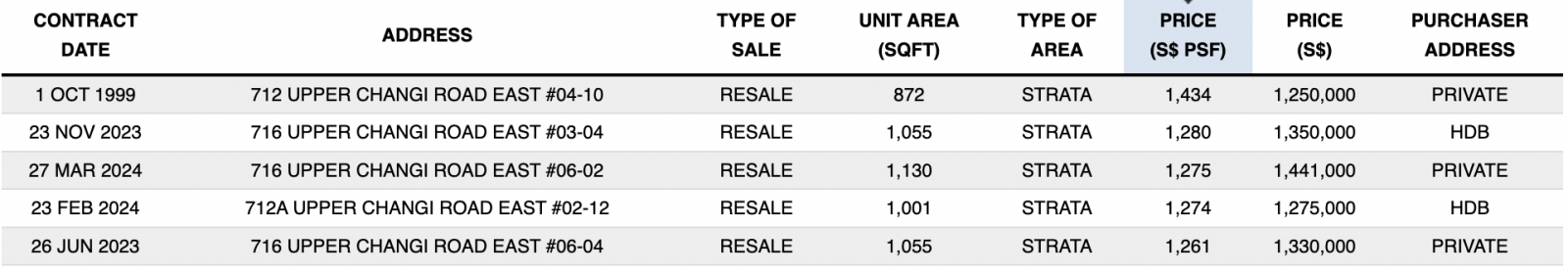

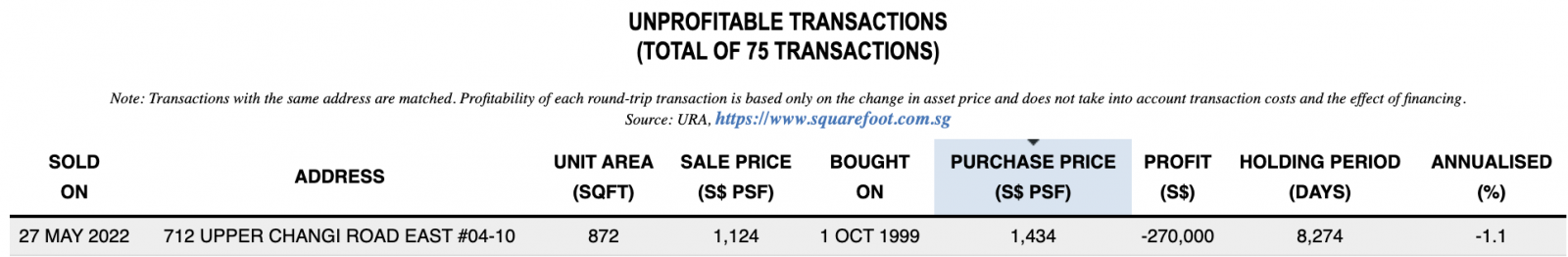

3. This loss-making transaction at Changi Green after 22 years

This is an illustration of how tough it can be to recover if you bought at an excessively high price. This losing transaction at Changi Green was bought way back in 1999, for $1,434 psf. If you are familiar with the market, that is certainly a strangely high price for Changi. Looking at the other transactions, we can see that none of the units have been sold at higher than this price… even though that price was nearly 25 years ago.

More from Stacked

5 Spacious Old But Freehold Condos Above 2,650 Sqft

This week, we’re shining a light on something a little harder to come by these days: proper space. We’re talking…

In fact, there were only 12 transactions recorded in 1999, and they ranged from just $465 psf to $732 psf. So this particular odd transaction was, in some cases, double/triple the average at that time. It is also even more strange when you consider that just a few months before a unit of the exact same size transacted at half the price!

What makes this even more phenomenal is that it didn’t rise past its original price despite:

- Being sold at a property peak that’s even higher than the last 2013 peak

- Changi Green saw a boost from an MRT station appearing within walking distance

- The emergence of SUDT nearby, which provides a strong catchment area for student tenants

This runs contrary to the belief that, with a long enough holding period, any freehold condo is sure to see solid gains. As of 2024, recent prices have now reached $1,280 psf – but this particular transaction still remains a weird high.

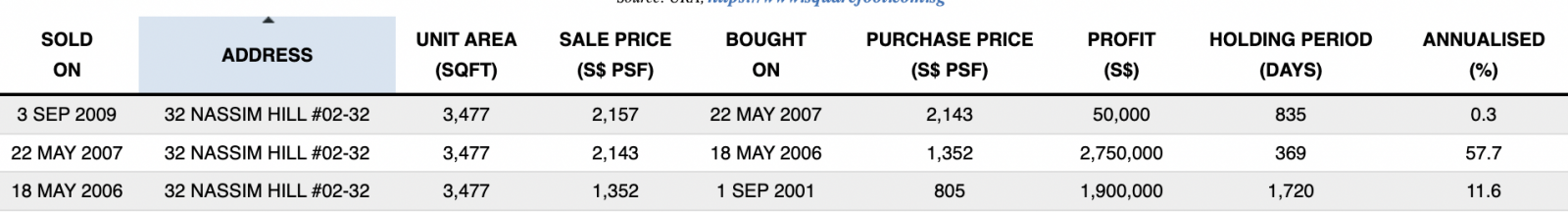

4. This unit at Nassim Mansion that transacted three times

Nassim Mansion is a District 10 boutique condo, and it has only 72 units. While it’s also old and dates back to 1977, this isn’t just any typical boutique condo. Units here are very large and start from a huge 2,852 sq. ft. So when we come across this combination of factors, we expect some degree of volatility and, well, weirdness. But nothing accounts for the above unit that was transacted three times in four years: May 2006, May 2007, and September 2009. (Remember, this was a time when there was no SSD, so you could buy a house today and sell it tomorrow with no tax).

In any case, the Sellers Stamp Duty (SSD) was introduced just one year after this and imposes a tax on properties sold within three years of their initial purchase.

| CONTRACT DATE | ADDRESS | UNIT AREA (SQFT) | PRICE (S$ PSF) | PRICE (S$) |

| 8 Apr 2019 | 40 NASSIM HILL #10-40 | 7,115 | 2,091 | 14,880,000 |

| 7 Jun 2007 | 40 NASSIM HILL #10-40 | 7,115 | 2,249 | 16,000,000 |

| 6 Feb 2004 | 40 NASSIM HILL #10-40 | 7,115 | 731 | 5,200,000 |

| 8 Mar 2000 | 40 NASSIM HILL #10-40 | 7,115 | 805 | 5,730,000 |

This was also the development where a massive penthouse unit (7,115 sq. ft.) was transacted 4 times, where one particular seller made a killing. It was bought in 2004 at a low of just $731 psf, and resold at a high in 2007 for $2,249 psf. This translates to a profit of nearly $11 million!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did a 4-room HDB flat in Tampines sell for only $100,000 in 2024?

What makes some property transactions in Singapore unusual, like flats selling for $150,000?

How can a property bought at a high price in 1999 at Changi Green result in a loss after 22 years?

Why did a large unit at Nassim Mansion sell three times within four years?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Picks

Property Picks Where to Find Singapore’s Oldest HDB Flats (And What They Cost In 2025)

Property Picks Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments