Is The Upcoming 900-Unit Chuan Park Residences Worth Looking At? 4 Crucial Things You Need To Know

April 9, 2024

It was a bumpy road for the $890 million en-bloc sale of Chuan Park – but now we’re at the point of seeing a new redevelopment in this much-desired spot. Here’s a look at what to expect from the upcoming new project, which is likely to draw attention back to Serangoon:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Main highlights of the new development at Chuan Park

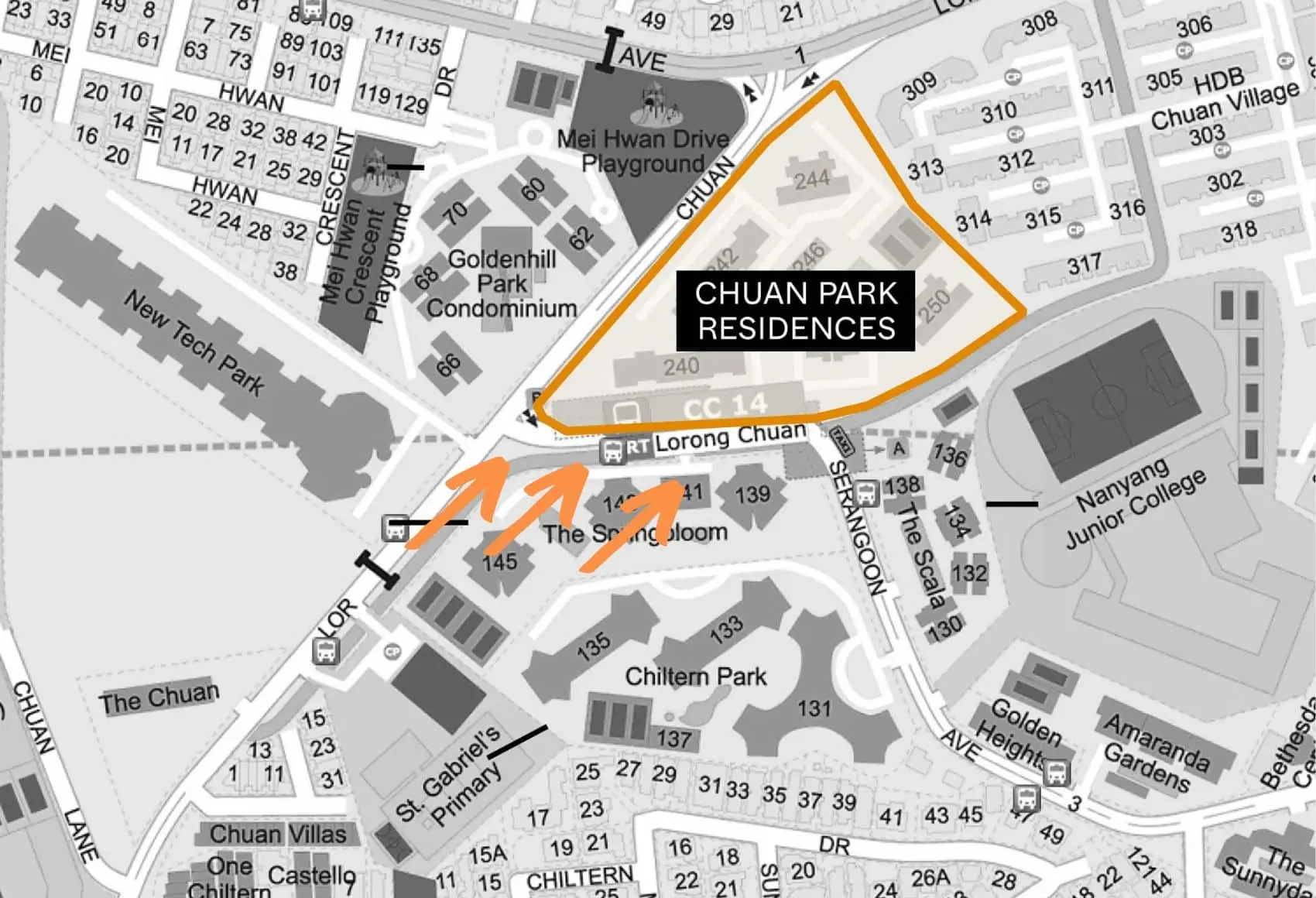

As the name implies (Chuan Park Residences), this project is located at Lorong Chuan and is a redevelopment of the former Chuan Park. This is one of the better-located land parcels in the Serangoon area, being just next to Lorong Chuan MRT (CCL).

This is almost as good as being next to NEX Megamall, one of the largest heartland malls in the country. Serangoon MRT (CCL, NEL) is only one stop away from Lorong Chuan. You can also take it one more stop to Woodleigh MRT (NEL), where the relatively new Woodleigh Mall is – so there’s a lot of easy access to retail, dining, and entertainment.

There are also multiple bus services nearby, such as bus 73 or 315, that go from here to the popular Serangoon Gardens in just a few minutes. This is where you’ll find Chomp Chomp and myVillage.

The second highlight is the proximity to schools. St. Gabriel’s Primary, CHIJ (Our Lady of Good Counsel) Yangzheng, Zonghua, and Kuo Chuan Secondary are all within one-kilometre. Also nearby is the Australian International School (just a few stops with bus 105), and Nanyang Junior College (NJC), which is just minutes away.

Besides the location, this represents the biggest collective sale since Tulip Garden ($906.9 million) back in January 2019. With an estimated 900 units that will be available, this is certainly a mega launch that will attract the attention of many. As you may have seen with the recent Lentor Mansion launch, there is clearly still demand and appetite for the right project – and Singaporeans seem to love their mega developments.

However, the biggest issue is always the price point, so let’s take a look at how that compares.

The launch price could be upward of $2,500 psf, despite being an OCR condo

While we don’t have confirmed prices right now, most people are speculating that prices would be at $2,500 psf and up. At such a price, this raises an important question: would buyers accept a quantum of around $2.4 million, for a 936 sq. ft. three-bedder, of the sort offered by Chuan Park Residences? This is keeping in mind it’s a 99-year leasehold property.

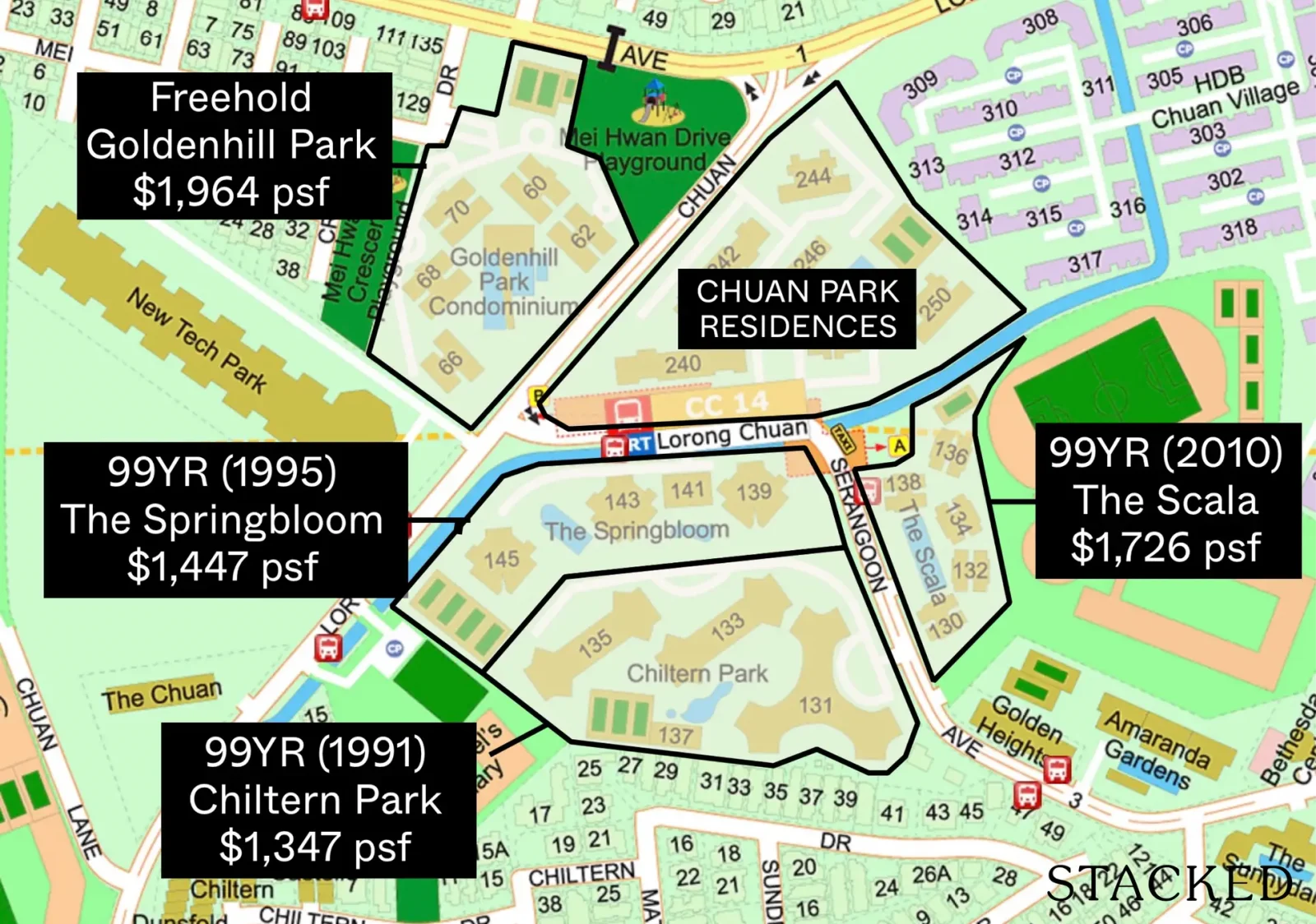

We took a look at prices of nearby resale properties, as buyers would definitely make a similar comparison:

| Development | Tenure | Completion Year | Average $PSF | Average Price |

| CHILTERN PARK | 99 yrs from 01/03/1991 | 1995 | $1,347 | $1,781,206 |

| 2BR | $1,342 | $1,675,608 | ||

| 3BR | $1,360 | $2,098,000 | ||

| GOLDENHILL PARK CONDOMINIUM | Freehold | 2004 | $1,964 | $2,606,267 |

| 3BR | $1,964 | $2,606,267 | ||

| THE SCALA | 99 yrs from 06/01/2010 | 2013 | $1,726 | $1,185,494 |

| 1BR | $1,748 | $852,333 | ||

| 2BR | $1,723 | $1,462,555 | ||

| 3BR | $1,643 | $1,715,000 | ||

| THE SPRINGBLOOM | 99 yrs from 01/03/1995 | 1999 | $1,447 | $1,957,204 |

| 2BR | $1,338 | $1,444,800 | ||

| 3BR | $1,487 | $2,080,520 | ||

| 4BR | $1,442 | $2,375,000 |

We notice that in Woodleigh Residences, just a train stop away, the sub sale three-bedders are already at a quantum of around $2.3 million. We also looked at prices of Affinity at Serangoon, Bartley Ridge, Bartley Residences, Kovan Residence, and Forest Woods – all of these showed three-bedders at above $2.3 million.

Goldenhill Park, which is about 850 metres away, has already reached the $3 million mark; but we should consider that Goldenhill is a freehold property, which comes with an expected premium.

Given that the resale prices are not too far from the estimated launch prices, the pricing may be tolerable; we can’t say it’s particularly cheap or affordable, but that goes for most new launches at this time.

More from Stacked

Why This New Condo in a Freehold-Dominated Enclave Is Lagging Behind

The Jovell launched with an impressive set of features: a sprawling 29,063 sq ft pool, a spacious resort-style layout, and…

Other notable factors that could affect sales:

1. Relatively few alternatives nearby

If you want a Serangoon location that’s mainly private housing, and close to the aforementioned schools, There are only three main projects that we would identify as serious competition: Springboom, Goldenhill Park, and Scala.

Springbloom and Goldenhill Park are both considerably older, going back to ‘99 and ‘04 respectively. These have notably older layouts and facades, so it’s most likely down to a comparison with Scala.

There’s also the issue that three-bedders are relatively hard to come by in this area – so Chuan Park Residences may have an edge here for those looking to upgrade to the area. Upgraders typically don’t want smaller units than this, while larger units have an unmanageable quantum.

Nevertheless, this is a strong city fringe location that most HDB upgraders would be happy with. Anything more prime/central, and the prices start to get out of reach.

2. A possible lack of nearby upgraders to drive sales

It’s uncertain, based on the HDB enclaves nearby, if there are sufficient upgraders that will provide a good price support – whether it is for current sales or in the future. Usually, a sizeable proportion of buyers will come from HDB upgraders who are already living in the general area.

But at $2,500 psf, the older nearby HDB flats may not have a high enough resale price that will bridge the gap and there aren’t enough new ones nearby. The more desirable resale flats (typically the ones near NEX) have the drawback of being much older, while the others may not have seen the requisite appreciation yet.

This isn’t something that will make or break sales though, as upgraders from much further away may consider Chuan Park, for no reason beyond its excellent school access. Speaking from what we know on the ground, this would be an area that those upgrading from Punggol/Sengkang would find appealing.

3. Quite a busy area with a lot of traffic

Some might say this applies to Serangoon in general – but traffic around the Chuan Park area is not light. This is an area caught between Lorong Chuan and Serangoon Ave. 3, and green spaces are fairly limited. So for the type of family that likes big parks and long park connectors, this may not be the most attractive environment.

This area will draw families who prize urban conveniences, like the proximity to NEX, over a quiet enclave.

4. An estimated 900 units

900 units is pretty much a mega-development (in fact, if you ask some buyers, they will consider it a mega-development already). From an investment perspective, some may be worried about higher competition when it comes to selling, or for tenants. There’s also a certain loss of privacy, which may be compounded by the busy Lorong Chuan/Serangoon Ave. 3 nexus (see above).

But given the sub-sales thus far from the bigger new launches like Treasure at Tampines or Jadescape, it appears that those fears could be unfounded. There seems to be a higher demand for such developments.

As such on the flip side, we would expect more lavish facilities, and lower management costs, given the larger number of households. Follow us and we’ll provide you with more details on this, once the launch is up.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Singapore Property News The First Mixed-Use Development Connected to Tampines West MRT Will Preview This Weekend — With Prices Starting from $1.486M

Property Advice Should I Pay $500K More For A New Launch — Or Buy A Resale Condo Instead?

Singapore Property News A Rare Freehold CBD Office Unit Is Up For Sale At $20.5M — And Foreigners Can Buy It

1 Comments

Great insights on Chuan Park Residences! The upcoming 900 units sound promising, especially with their strategic location and design features. I appreciate the focus on amenities and community living. It’s crucial for potential buyers to consider these factors, and this article does an excellent job of highlighting them!