Is It Still Worth Investing In A Condo Given The High PSF?

August 6, 2023

I was looking at some regrets on getting a condo on a Reddit thread lately, about whether a condo is still a good investment.

You can see it here. And reading through it, I noticed a few good points, but also several common half-truths and almost-right statements.

Here’s the top-voted comment, and rightly so:

“I think the location matters more than anything.”

But the next few became very debatable, the first of these is over the literal nature of leasehold vs. freehold land:

“Yeah, which is why, to me, it’s either HDB or FH private. LH private is the one that really doesn’t make sense. Price very close to FH private (80%?) which makes the lease decay much more painful.”

In a moment, I’ll show you why leasehold still makes sense for some people. But I would point out, as an aside, that some landlords avoid buying freehold.

Buying freehold properties usually translates to a worse rental yield, because (annual rental income/total cost of property) x100 = gross rental yield. So:

Assume a rental income of $48,000 per year for two condos in the same location: one leasehold ($1.5 million) and one freehold ($1.725 million).

Notice the annual rental income is the same, because tenants do not pay more for freehold properties; it’s irrelevant to them.

The gross rental yield for the leasehold property is 3.2 per cent, while the yield for the freehold counterpart is 2.78 per cent.

And ultimately, it’s not about whether it’s freehold or leasehold, it’s about whether it is the right property from an investment standpoint.

As a very simple example, if you were to buy a freehold condo in an already mature area, as compared to a leasehold condo in an area where there’s future upside – which do you think would do better?

It’s not so much about the tenure, but about the actual value.

Here’s another:

“If you don’t get FH, you lose 1% each year. It takes 10-15 years to make the premium worth it. That’s not a very long time in terms of properties and generations.”

One per cent each year is dubious. Here’s a snapshot of the appreciation of leasehold condos versus freehold condos (excluding Executive Condominiums) over 15 years:

On average, the freehold condos underperform leasehold ones, even over a 15-year period.

Of course, this can be very subjective on the age of the property that you are comparing. But let’s say if you were to buy a new freehold vs leasehold condo, it’s definitely not accurate to say that you will lose 1% each year.

(We’ve done a study of freehold vs leasehold new launches since 2014 which you can read more here).

Let’s look at a few other things:

“Depends on the condo. Not all condos are the same.

New launch condos are very not worth it. 2k psf for shoeboxes? Come on. 1800 psf for pasir ris 8? That kind of psf price can buy a condo in river valley. And almost all 99 years.

Look a Ki residence. Unit sizes from 700-1300 sqft. 999 years, 2-2.4kpsf

Clementi park across the road – units start from 1.1k sf all the way to 2000 plus sf. Prices from 1.4k-2k psf. Freehold.

Fresia woods abit further away similar story.

If u got 2mill now, you can buy a 1065 sqft Fresia woods condo, or a 1.4k sqft clementi park condo. You can only buy a 965 sqft Ki residence condo. If you can deal with one bedroom, then 1.5m will get you a 1039 sqft clementi park condo apartment. 1.6 mill will get you a 750 sqft apartment at Ki residence.

Obviously we can see Ki residence is not a great deal.

Look abit further to pandan valley, you have 2000+sqft condos going for 1.5k psf or lower!

So honestly, IMO, the older condos, yes, worth. Newer ones… No.”

Of which, there was a comment directly below that said it right: “Can’t just look at the prices/psf alone and make a blanket statement.”

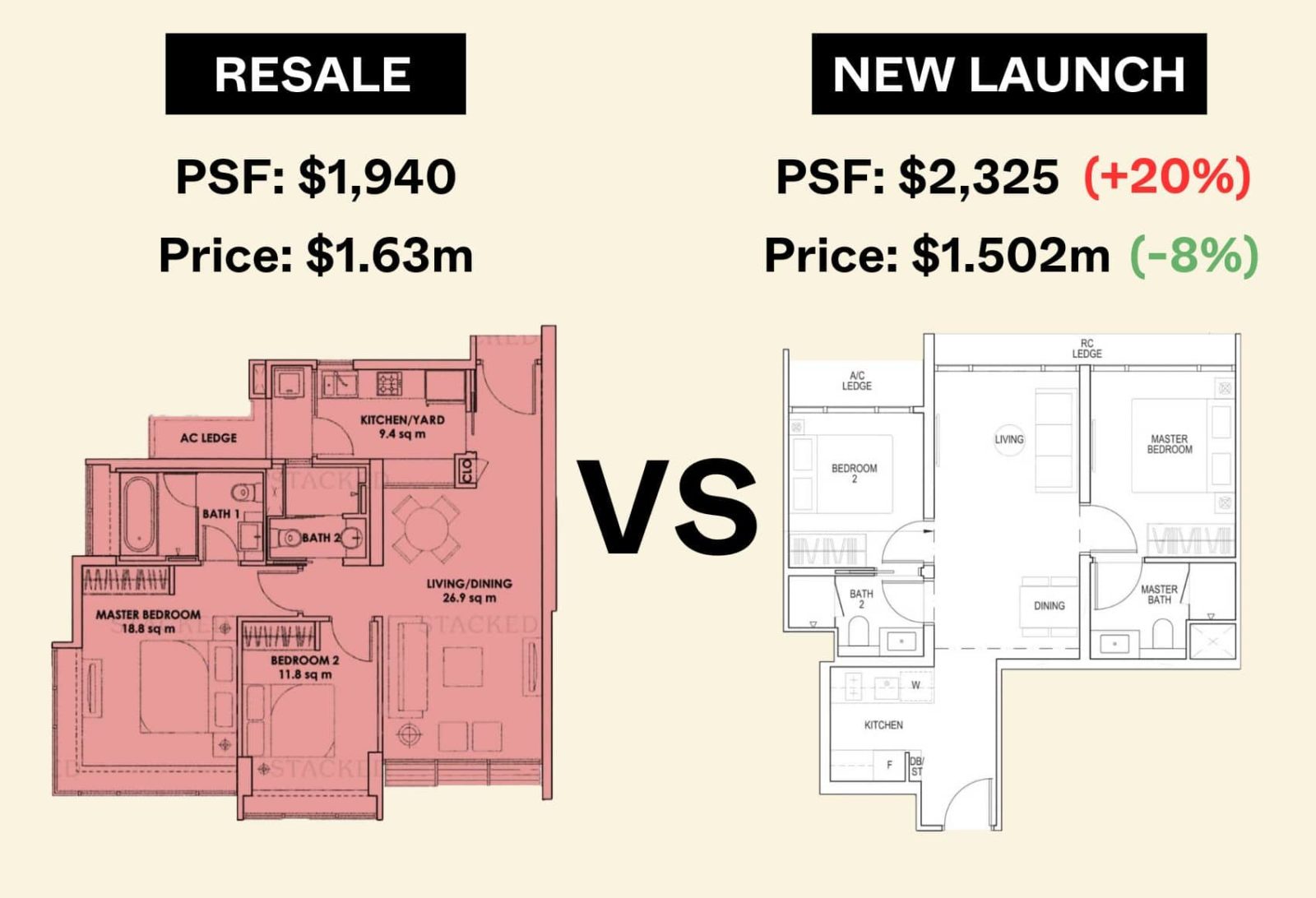

I’ve said it before, but price per square foot isn’t always the best or most practical indicator of value. For starters, price psf tends to increase as a unit gets smaller and more affordable, but decrease as the unit gets larger and less affordable.

If you were to buy a bungalow, for example, you could be looking at about $1,600 to $1,700 psf; but for a 7,000 sq. ft. detached home, that’s $11.9 million.

On the other hand, a $3,000 psf one-bedder, at 500 sq. ft., is only $1.5 million.

There’s also the matter of changing regulations over the years.

Comparing price per square foot makes sense if all the variables were the same, but when older condos have inefficiencies such as planters and bay windows, comparing it solely by psf would not be fair.

More from Stacked

Sign of the Times: Comparing An Old Resale HDB To A New BTO

Having stayed in an (old) resale flat for almost my entire life, I have grown accustomed to having sufficient space…

(Here are a few case studies that we’ve done before).

Rather than look at price per square foot, it’s really best to focus on the quantum, which also impacts:

- Your stamp duty rates

- Your loan amount, and hence interest paid over the decades

- How stretched your finances become after the purchase

Price per square foot is useful in a few specific circumstances, such as when you have two very similar layouts and sizes to compare; then it can give you a sense of better value.

It becomes less useful when comparing across very different property types, like HDB and private condos, or versus landed.

“HDB is definitely more worth it, even if the resale price is over 1mil! I regret everything about the condo except for the 1 fact that it is right across the rd from an mrt station. Still, not many choices for new places with combined income around 20k, not allowed to buy BTO/EC and can’t afford landed property…”

Anyway, if you make $20k a month and really want a resale flat, no one will stop you buying one. There’s no income ceiling for resale flats.

But at some point the thread went off tangent, and it was more about buying for home ownership than investment. If you asked me whether it’s worth investing in a condo though, I would just ask: which condo?

Property isn’t interchangeable. When a (sane) investor buys, they don’t invest in “condos” or “landed” or any such wide category. They invest quite specifically in a project, like The M or Midtown Bay or Pandan Valley or what have you.

There are some condos I’d certainly invest in even now; but there are others I’d avoid even with huge developer discounts.

In other serious property news this week…

- Do you think it’s time the $16k income ceiling for Executive Condos should go up? Weigh in on the topic.

- Price anchoring: It’s when developers narrow their eyes and give dirty looks to the second mover. Here’s how it matters for new launches.

- How are new launch condo prices moving? We looked at 74 new launches to see how they’re faring.

- Living near a good school helps your property value right? Well uhh…look here’s the full explanation on that.

Weekly Sales Roundup (24 – 30 July)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| MIDTOWN MODERN | $4,353,000 | 1464 | $2,974 | 99 yrs (2019) |

| THE RESERVE RESIDENCES | $3,831,653 | 1625 | $2,357 | 99 yrs (2021) |

| GRAND DUNMAN | $3,504,630 | 1432 | $2,448 | 99 years |

| ONE BERNAM | $3,427,800 | 1421 | $2,413 | 99 yrs (2019) |

| THE CONTINUUM | $3,192,000 | 1087 | $2,936 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| LENTOR HILLS RESIDENCES | $1,181,000 | 484 | $2,438 | 99 yrs (2022) |

| THE BOTANY AT DAIRY FARM | $1,198,000 | 506 | $2,368 | 99 yrs (2022) |

| GRAND DUNMAN | $1,251,000 | 452 | $2,767 | 99 years |

| THE MYST | $1,388,000 | 678 | $2,047 | 99 yrs (2023) |

| THE ATELIER | $1,458,000 | 549 | $2,656 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| RIVER VALLEY ROAD | $11,750,000 | 2110 | $5,569 | FH |

| PEBBLE BAY | $9,000,000 | 6114 | $1,472 | 99 yrs (1994) |

| ORANGE GROVE RESIDENCES | $5,400,000 | 2390 | $2,260 | FH |

| CAIRNHILL PLAZA | $4,500,000 | 2293 | $1,963 | FH |

| FLORIDIAN | $4,080,000 | 1830 | $2,230 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PARC ROSEWOOD | $640,000 | 431 | $1,486 | 99 yrs (2011) |

| MOUNTBATTEN LODGE | $650,000 | 334 | $1,948 | FH |

| CASA AERATA | $658,000 | 431 | $1,528 | FH |

| ISUITES @ MARSHALL | $659,000 | 355 | $1,855 | FH |

| SUITES @ GUILLEMARD | $685,000 | 388 | $1,768 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PARC ROSEWOOD | $640,000 | 431 | $1,486 | 99 yrs (2011) |

| MOUNTBATTEN LODGE | $650,000 | 334 | $1,948 | FH |

| CASA AERATA | $658,000 | 431 | $1,528 | FH |

| ISUITES @ MARSHALL | $659,000 | 355 | $1,855 | FH |

| SUITES @ GUILLEMARD | $685,000 | 388 | $1,768 | FH |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| ECO | $888,000 | 635 | $1,398 | -$45,546 | 11 Years |

| EDELWEISS PARK CONDOMINIUM | $780,000 | 710 | $1,098 | -$40,000 | 11 Years |

| REFLECTIONS AT KEPPEL BAY | $2,430,000 | 1550 | $1,568 | $6,300 | 16 Years |

| KINGSFORD WATERBAY | $945,000 | 689 | $1,372 | $15,463 | 6 Years |

| SIXTEEN35 RESIDENCES | $830,000 | 538 | $1,542 | $17,000 | 5 Years |

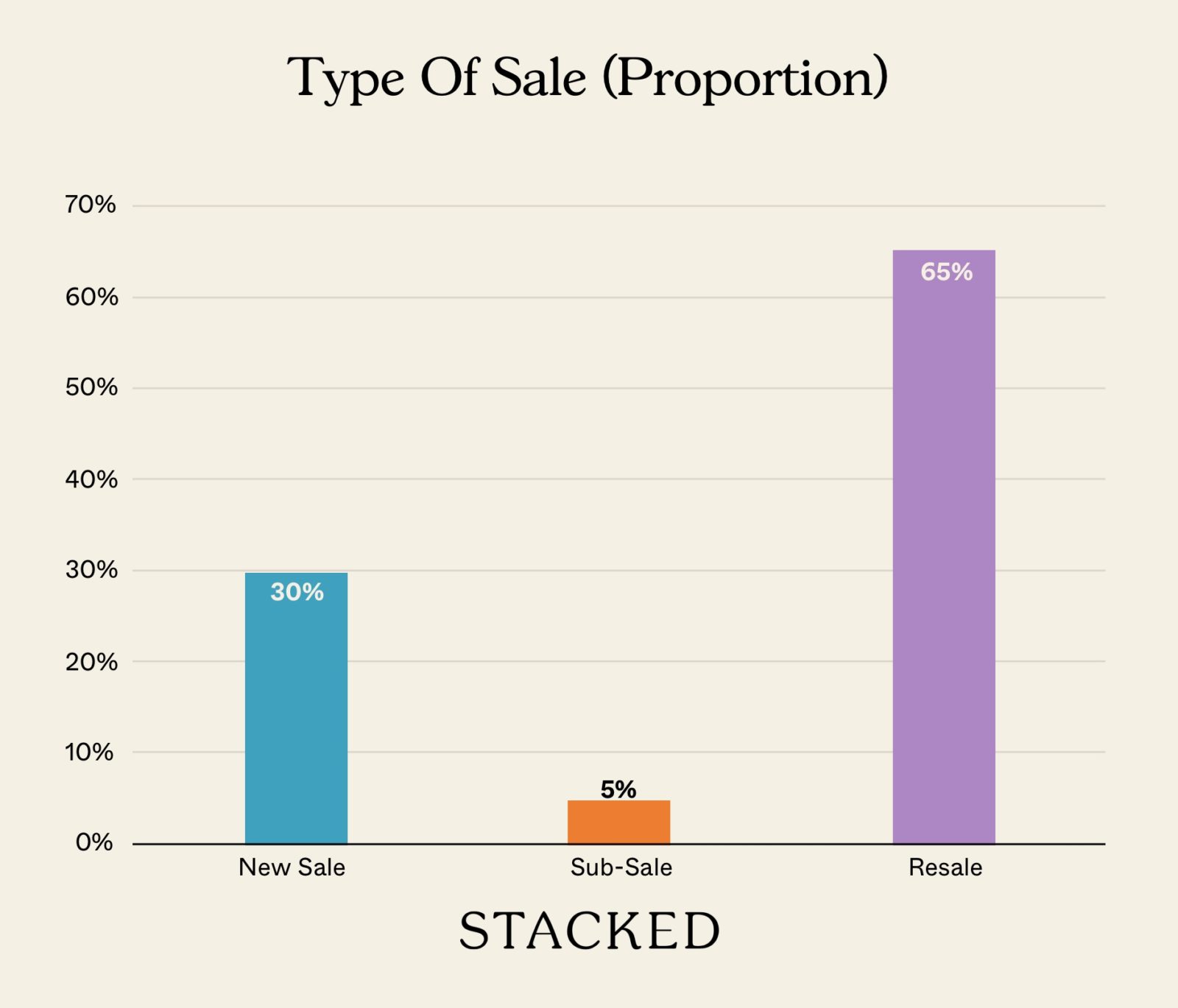

Transaction Breakdown

Some Other Interesting Links Of The Week:

- Renting a studio (bathroom) in London

Now I have no idea if this is real, but if this doesn’t incite a chuckle out of you, I don’t know what well.

Is this the fate that will reach us sooner rather than later in Singapore?

- Buy one floor, get one free in China

If there was such a tagline for a property in Singapore, this would definitely be one of the most well-received advertisements.

We don’t have this issue here, but it’s still a good reminder to see what would happen if our real estate market was left to its own devices.

With half-built or abandoned housing projects, developers in Tongling, a city in China have had to resort to such desperate sales tactics in order to move units.

According to the article, a local resident shared that monthly salaries averaged around 3 to 4,000 yuan. So even at that price point of $1.45 million yuan (S$270k), this was still unaffordable for most people.

Not accounting for mortgage interest, and taking their entire salary to pay for the home, this would take residents 30 years just to pay it back.

Follow us on Stacked for more insights on the Singapore real estate market, public or private.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is it still a good idea to invest in condos with high price per square foot?

How does leasehold compare to freehold properties in terms of investment?

Should I focus on price per square foot when choosing a property to invest in?

Are older condos a better investment than newer ones?

Does the location of a condo matter more than its price or size?

Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Latest Posts

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

0 Comments