I’m 51 And Own A 5-Room HDB And 2 1-Bedder Condos. Should I Buy A Landed For Legacy Planning Or Remain Status Quo?

June 10, 2023

Dear Stacked Homes

I have been following your articles and am really enjoying your valuables insights and thorough analysis on the questions posted by readers. I have been wondering whether I still have runway to adjust my portfolio to prepare for my retirement.

I am currently 51 years old. Monthly salary about $11,000. My wife is a housewife and have not been working since married due to her poor health. I will be retiring at 60 years old.

I have 2 1-bedder condos and a 5-room HDB flat. Below are the details:

| Property 1 | Info |

| Bedroom/Size | 1BR/495 sq ft |

| Outstanding Loan | $424,000 |

| Husband CPF | $88,860 |

| Property 2 | Info |

| Bedroom/Size | 1BR/495 sq ft |

| Outstanding Loan | $225,000 |

| Husband CPF | $132,548 |

| Property 3 | Info |

| Type | HDB (5-Room Flat) |

| Location | Woodlands |

| Outstanding Loan | $0 |

| CPF (Total) | $302,315 (Combined H + W) |

In addition, currently both our combined OA has only $30K and no cash saving for pty.

I am wondering whether there is still a chance to restructure my portfolio to achieve:

Landed house or

Two condos (one for stay and one for investment)

To own a landed property is my dream but guess it is a farfetched one but hope to hear your advice and insights. It will be used for stay and also as a legacy for my grown-up kid.

The 2nd option of owning one for stay and one for investment. For own stay, we have no preference of location, prefer at least 2-bedder, some appreciation value in future. For investment, no preference as long as it has appreciation value for the future.

If you could advise me what is the most sensible and viable strategy. Whether I should remain status quo or to further restructure my portfolio to achieve my dreams. Thank you so much for your time.

Editor’s Note: Due to privacy reasons, some details about the home have been omitted.

Hello,

We’re happy to hear that you’ve been enjoying our content, and we appreciate the thorough write-up you provided.

Since you have not reached the age of 55 yet, you still have some flexibility to make adjustments to your portfolio. If you choose to sell your properties now, your CPF funds will not be locked up in the Retirement Account (RA). As such, having 3 properties puts you in a relatively advantageous position. However, we understand that managing two mortgages on a single income can be challenging, especially considering your plan to retire in 9 years.

The article will cover the following topics, which will hopefully assist you in your decision-making process:

– The performance of all 3 properties you’re currently holding

– How much sales proceeds you can expect to receive if you sell them

– Your affordability

– Options you can consider

Let’s start by taking a look at how your properties are performing.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Performance of properties

Property 1

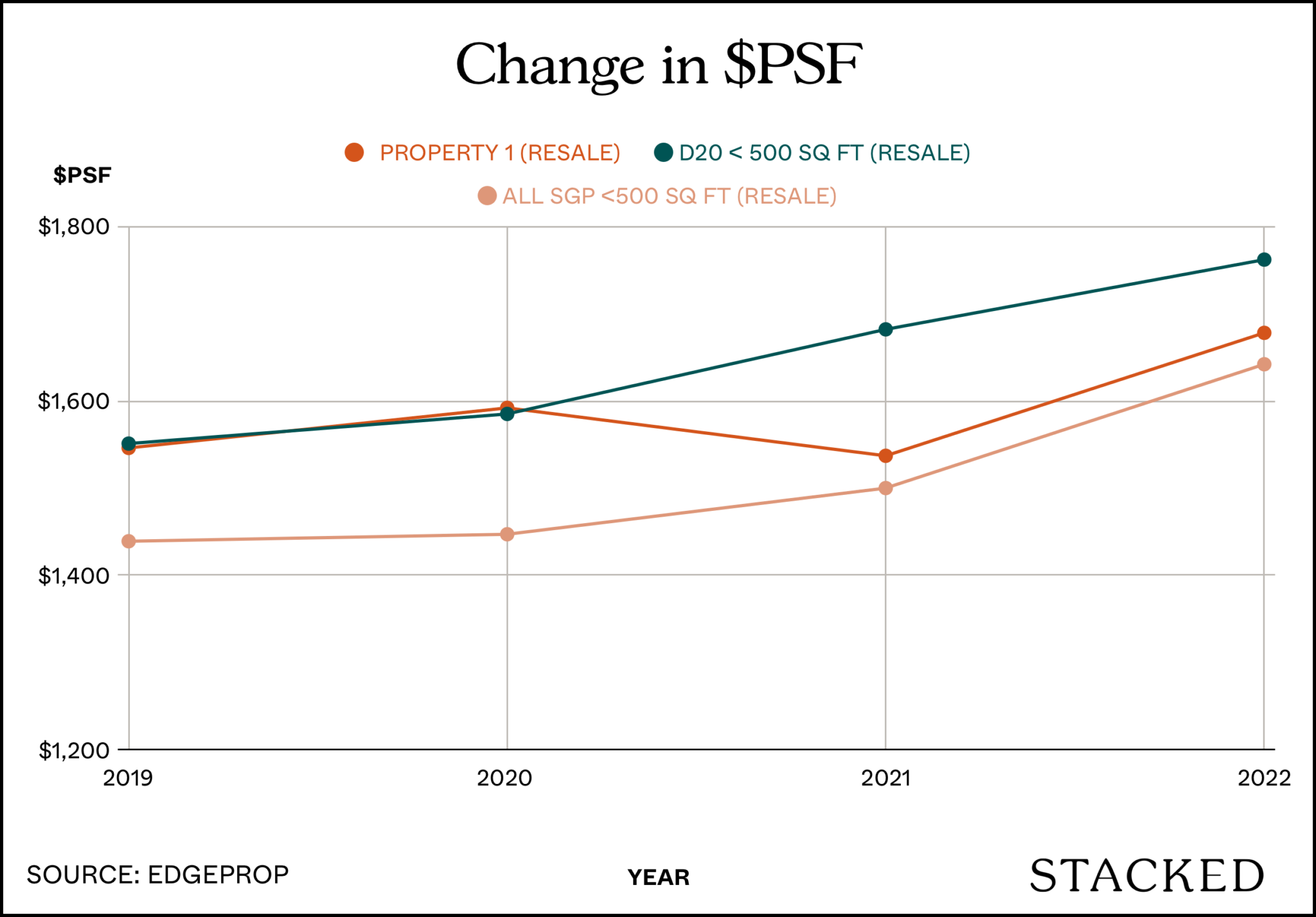

We will compare it against the performance of other 99-year leasehold 1-bedders (< 500 sq ft) in District 20 and all over Singapore.

| Year | Property 1 (Resale) | YoY | D20 <500sqft (resale) | YoY | All SGP <500sqft (resale) | YoY |

| 2019 | $1,546 | – | $1,551 | – | $1,439 | – |

| 2020 | $1,592 | 2.98% | $1,585 | 2.19% | $1,447 | 0.56% |

| 2021 | $1,537 | -3.45% | $1,682 | 6.12% | $1,500 | 3.66% |

| 2022 | $1,678 | 9.17% | $1,762 | 4.76% | $1,642 | 9.47% |

| Annualised | – | 2.77% | – | 4.34% | – | 4.50% |

Since this is a relatively young project, its resale transactions commenced in 2019, providing us with a limited dataset of only 3 years. Consequently, the available information may not be entirely conclusive.

Examining the table, we observe that its annualised growth rate is slower than that of other 99-year leasehold 1-bedders in District 20 and the rest of Singapore.

Here are some recent 1 bedder transactions in the development:

| Date | Size (sqft) | PSF | Price | Level |

| May 2023 | 495 | $1,808 | $895,000 | #16 |

| Feb 2023 | 538 | $1,529 | $823,000 | #01 |

| Jan 2023 | 495 | $1,767 | $875,000 | #21 |

Property 2

We will compare it against the performance of other freehold and 999-year leasehold 1-bedders (< 500 sqft) in District 16 as well as all over Singapore.

| Year | Property 2 (resale) | YoY | D16 <500sqft (resale) | YoY | All SGP <500sqft (resale) | YoY |

| 2012 | $1,406 | – | $1,454 | – | $1,609 | – |

| 2013 | $1,493 | 6.19% | $1,493 | 2.68% | $1,678 | 4.29% |

| 2014 | – | – | – | – | $1,676 | -0.12% |

| 2015 | $1,422 | – | $1,418 | – | $1,583 | -5.55% |

| 2016 | $1,234 | -13.22% | $1,295 | -8.67% | $1,563 | -1.26% |

| 2017 | $1,210 | -1.94% | $1,280 | -1.16% | $1,679 | 7.42% |

| 2018 | $1,292 | 6.78% | $1,306 | 2.03% | $1,605 | -4.41% |

| 2019 | $1,303 | 0.85% | $1,405 | 7.58% | $1,653 | 2.99% |

| 2020 | $1,302 | -0.08% | $1,493 | 6.26% | $1,501 | -9.20% |

| 2021 | $1,390 | 6.76% | $1,455 | -2.55% | $1,597 | 6.40% |

| 2022 | $1,582 | 13.81% | $1,576 | 8.32% | $1,683 | 5.39% |

| Annualised | – | 1.19% | – | 0.81% | – | 0.45% |

It is evident from the table that the performance of both freehold and 999-year leasehold 1-bedders in District 16, as well as throughout Singapore, is rather lacklustre. However, it stands out as a slightly better performer.

One possible explanation for this lacklustre performance is that a significant number of freehold and 999-year leasehold 1-bedders are situated in boutique developments. These developments often attract a high percentage of investors but have relatively low transaction volumes. Consequently, prices can be more susceptible to fluctuations as investors might opt to sell at a loss if they identify more profitable investment opportunities elsewhere.

Despite also being a boutique development, the development enjoys certain advantages. Its location is adjacent to the upcoming Sungei Bedok MRT station, slated for completion in 2025, and its unobstructed view of the Laguna National Golf and Country Club may contribute to its favourable performance.

Here are some recent 1 bedder transactions in Property 2:

| Date | Size (sqft) | PSF | Price | Level |

| Apr 2023 | 398 | $1,657 | $660,000 | #02 |

| Mar 2023 | 409 | $1,724 | $705,000 | #03 |

HDB Property

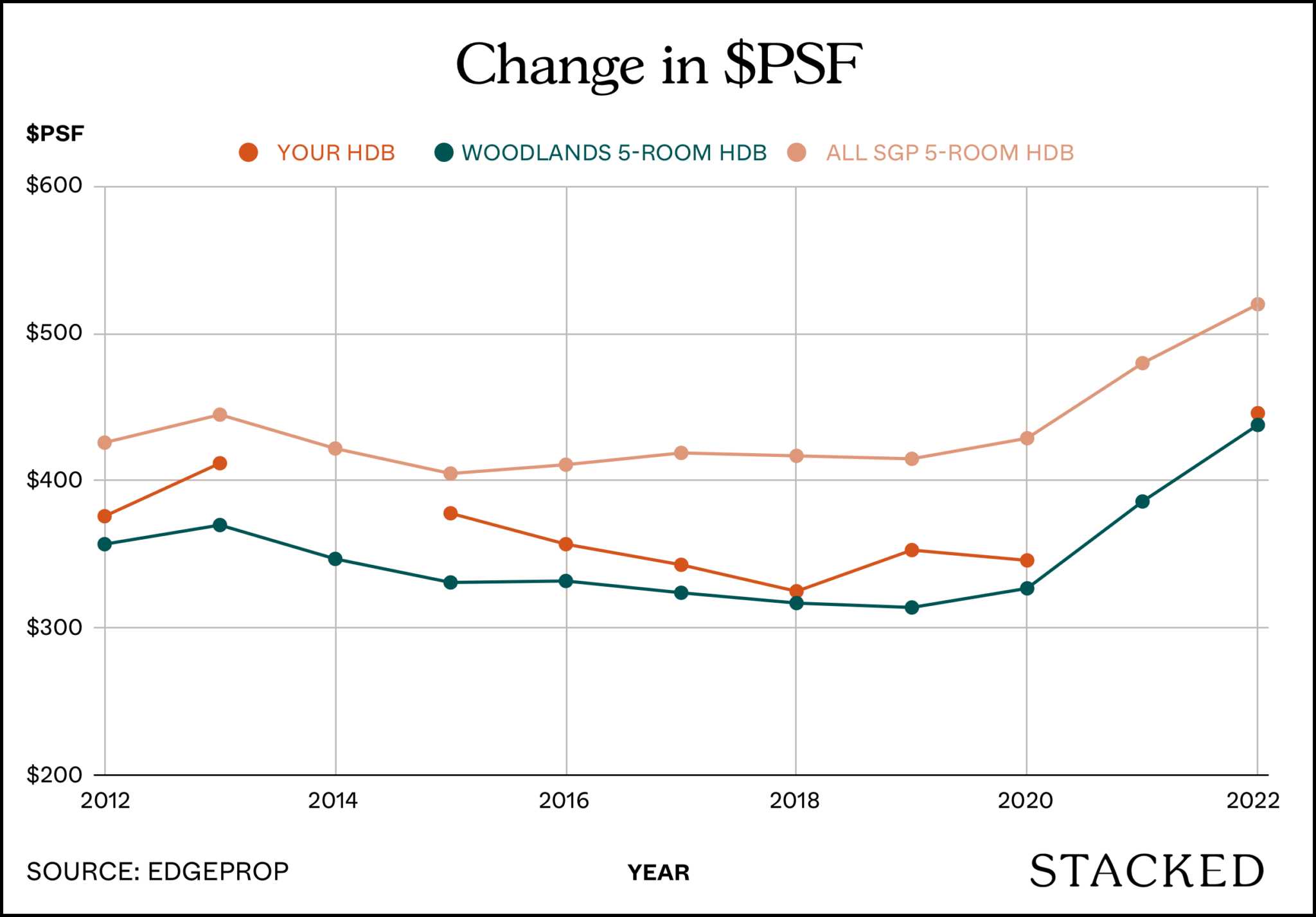

Here’s a look at its $PSF performance compared to other 5-room flats in Woodlands (where it’s situated) and across Singapore:

| Year | HDB | YoY | Woodlands 5-room HDB | YoY | All SGP 5-room HDB | YoY |

| 2012 | $376 | – | $357 | – | $426 | – |

| 2013 | $412 | 9.57% | $370 | 3.64% | $445 | 4.46% |

| 2014 | – | – | $347 | -6.22% | $422 | -5.17% |

| 2015 | $378 | – | $331 | -4.61% | $405 | -4.03% |

| 2016 | $357 | -5.56% | $332 | 0.30% | $411 | 1.48% |

| 2017 | $343 | -3.92% | $324 | -2.41% | $419 | 1.95% |

| 2018 | $325 | -5.10% | $317 | -2.16% | $417 | -0.48% |

| 2019 | $353 | 8.62% | $314 | -0.95% | $415 | -0.48% |

| 2020 | $346 | -2.02% | $327 | 4.14% | $429 | 3.37% |

| 2021 | – | – | $386 | 18.04% | $480 | 11.89% |

| 2022 | $446 | – | $438 | 13.47% | $520 | 8.33% |

| Annualised | – | 1.72% | – | 2.07% | – | 2.01% |

The table reveals that the growth rate of 5-room units around your HDB is marginally lower compared to other 5-room units in Woodlands and across Singapore as a whole.

Additionally, the graph illustrates a stagnation period between 2015 and 2019, during which prices at Admiralty Place experienced a decline starting in 2015, followed by a recovery in 2018.

The presence of newly constructed HDBs in the vicinity could potentially influence the demand and subsequently affect the prices of flats in there. However, one positive aspect is the proximity of the block to the MRT station.

Here are some recent 5-room transactions in Admiralty Place:

| Date | Price | Level |

| Jan 2023 | $678,000 | 04 to 06 |

Now that we have a better understanding of your properties’ performances, let’s examine the potential proceeds you can anticipate from their sale and evaluate your affordability accordingly.

We presume you and your family are staying in the HDB flat, so will also look at the rental yields for the private properties to see if it makes sense to keep either one of them.

Sales proceeds and affordability

Property 1

We will use the average price of $885,000 for a 495 sq ft unit as the sale price for the calculation.

| Description | Amount |

| Sale price | $885,000 |

| Outstanding loan | $424,000 |

| CPF plus accrued interest to be refunded into OA | $88,860 |

| Cash proceeds | $372,140 |

Based on transactions over the last 3 months, the average rent for a 1-bedder for this property is at $3,213. With a price of $885,000, this puts the rental yield at 4.35%.

Property 2

Since there are no recent transactions for 495 sq ft units, we took the average 1-bedder PSF of $1,691 to calculate the estimated sale price of $836,798.

| Description | Amount |

| Sale price | $836,798 |

| Outstanding loan | $225,000 |

| CPF plus accrued interest to be refunded into OA | $132,548 |

| Cash proceeds | $479,250 |

Based on transactions over the last 3 months, the average rent for a 1-bedder in this property is at $2,600. With a price of $836,798, this puts the rental yield at 3.73%.

HDB Property

Given there is only one transaction done recently, we will use the same selling price of $678,000.

| Description | Amount |

| Sale price | $678,000 |

| Outstanding loan | $0 |

| CPF plus accrued interest to be refunded into OA | $302,315 |

| Cash proceeds | $375,685 |

Total cash proceeds if you were to sell all 3 properties: $1,227,075

Total combined CPF funds if you were to sell all 3 properties: $523,723 (Husband only: $488,169), we will leave the $30K that is currently in both your OAs to be used for the monthly mortgage repayments

Affordability

Buying under both husband and wife’s names

| Description | Amount |

| Maximum loan based on age of 51 and $11K fixed monthly income | $777,290 (14 year tenure) |

| CPF funds | $523,723 |

| Cash (here we’ve set aside $200K just in case you need it for renovations if you’re buying a landed) | $1,000,000 |

| Total loan + CPF + Cash | $2,301,013 |

| BSD based on $2,301,013 | $84,650 |

| Estimated affordability | $2,216,363 |

Let’s say you’d like to purchase 2 properties without having to pay Additional Buyer’s Stamp Duty (ABSD), you’d have to buy one under each name. As your wife is not working and unable to take up a loan under her name alone, we will allocate more cash for her purchase.

Buying under wife’s name

| Description | Amount |

| CPF funds | $35,553 |

| Cash | $900,000 |

| Total CPF + Cash | $935,553 |

| BSD based on $935,553 | $22,666 |

| Estimated affordability | $912,887 |

Buying under husband’s name

| Description | Amount |

| Maximum loan based on age of 51 and $11K fixed monthly income | $777,290 (14 year tenure) |

| CPF funds | $488,169 |

| Cash | $327,075 |

| Total loan + CPF + Cash | $1,592,534 |

| BSD based on $1,592,534 | $49,226 |

| Estimated affordability | $1,543,308 |

With your plans to retire at 60 which is in 9 years time, you may wish to either shorten the loan tenure which will increase your monthly repayments, or reduce your loan amount. Alternatively, since the investment property under your wife’s name will be fully paid, you can also utilise the rent to offset the monthly repayments.

Your options

Considering your mention of legacy planning as one of the motivations for buying a landed property, we assume that you intend to hold on to it for a significant period of time. In light of this, opting for a freehold property would undoubtedly be an ideal choice, as it offers greater value retention and long-term growth potential.

Given your budget of $2.2-$2.4M ($2.2M if we set aside $200,000 for renovations), it seems adequate to purchase a landed property. However, it’s important to note that within this budget range, you may most likely be looking at 99-year leasehold properties which may not be the optimal choice for long-term ownership due to the issue of lease decay.

Looking at the landed properties that are currently on the market, these are some of the newer ones under $2.4M. The youngest of which is now 15 years old.

| Project | District | Completion year | Size (sqft) | Price |

| Springhill | 27 | 2008 | 3,261 | $2,200,000 |

| The Shaughnessy | 27 | 2006 | 3,283 | $2,380,000 |

| Villa Verde | 23 | 2002 | 1,615 | $2,300,000 |

| Century Woods | 25 | 2002 | 1,615 | $2,338,000 |

| Year | 99-year leasehold landed aged 11-20 (resale) | YoY | Freehold/ 999-year leasehold landed aged 11-20 (resale) | YoY |

| 2012 | $1,554 | – | $1,514 | – |

| 2013 | $1,461 | -5.98% | $1,485 | -1.92% |

| 2014 | $1,258 | -13.89% | $1,947 | 31.11% |

| 2015 | $1,253 | -0.40% | $1,358 | -30.25% |

| 2016 | $1,057 | -15.64% | $1,398 | 2.95% |

| 2017 | $1,103 | 4.35% | $1,500 | 7.30% |

| 2018 | $1,079 | -2.18% | $1,602 | 6.80% |

| 2019 | $1,061 | -1.67% | $1,463 | -8.68% |

| 2020 | $1,068 | 0.66% | $1,510 | 3.21% |

| 2021 | $1,113 | 4.21% | $1,722 | 14.04% |

| 2022 | $1,324 | 18.96% | $2,067 | 20.03% |

| Annualised | – | -1.59% | – | 3.16% |

From the table above, we can observe a significant contrast in the growth rates between 99-year leasehold landed properties aged between 11 to 20 and freehold/ 999-year leasehold landed properties within the same age group. Notably, the 99-year leasehold properties demonstrate a negative annualised growth rate.

It is for this reason that we wouldn’t recommend purchasing a landed home given the available budget – especially since legacy planning is the purpose for doing so.

Nevertheless, given your available funds, it is still viable to consider purchasing two properties.

This approach provides you with the potential for additional passive income or you could also cash out from the property, to support you in your retirement years.

If your intention is to pass down a property to your son, it might be worth exploring the option of acquiring a freehold 2-bedroom property for your own stay.

With a budget of $1.5M, here are some freehold/999-year leasehold 2-bedroom units that are currently available on the market:

| Project | District | Completion year | Unit type | Size (sq ft) | Price |

| The Tembusu | 19 | 2017 | 2b2b | 753 | $1.45M |

| Regent Residences | 12 | 2016 | 2b2b | 861 | $1.395M |

| Bullion Park | 26 | 1993 | 2b2b | 807 | $1.428M |

| Marymount View | 20 | 1992 | 2b2b | 872 | $1.48M |

As for the investment property, here are some younger developments under $900K that are currently available on the market:

| Project | District | Completion year | Unit type | Size (sq ft) | Price |

| Whistler Grand | 22 | 2022 | 1+S | 506 | $900,000 |

| Sol Acres | 23 | 2019 | 1+S | 570 | $838,000 |

| eCO | 16 | 2017 | 1+S | 592 | $900,000 |

| Woodhaven | 25 | 2015 | 2+S | 700 | $880,000 |

Considering the limited buyer pool for 1-bedroom properties due to their smaller size and the relatively low annualised growth rate of 0.58% for 99-year leasehold 1-bedders over the past 10 years, we would strongly advise exploring the option of a 2-bedroom property if it is feasible for you.

Do note that the selection of these developments is solely based on their alignment with your affordability and basic specific requirements.

Projection

We will now do some simple projections to compare the two scenarios of remaining status quo and selling all 3 properties to buy another 2. These projections are merely based on assumptions and shouldn’t be seen as fact – rather, they’re just used as a thought exercise to better frame the comparison with each other.

Option #1 – Remaining status quo

In this scenario, we look at what happens if you don’t do anything. We’ll take a look at how each of your existing properties performs:

Property 1

Here we are using the current price of $885,000 and an outstanding loan of $424,000 with a 4% interest rate and a remaining loan tenure of 14 years (presuming you took the maximum loan tenure of 23 years when you purchased it 9 years ago). We are also using the annualised growth rate of 2.77% and the average rent of $3,213.

Costs include interest expenses, property tax, a monthly maintenance fee of $200 and agency fees payable once every 2 years.

| Period | Total Cost | Total Gains | Profit |

| Starting point | $3,470 | $0 | -$3,470 |

| Year 1 | $27,721 | $63,071 | $35,349 |

| Year 2 | $54,503 | $126,820 | $72,317 |

| Year 3 | $76,837 | $191,267 | $114,430 |

| Year 4 | $101,624 | $256,432 | $154,808 |

| Year 5 | $121,881 | $322,334 | $200,453 |

| Year 6 | $144,506 | $388,993 | $244,487 |

| Year 7 | $162,513 | $456,430 | $293,917 |

| Year 8 | $182,797 | $524,668 | $341,871 |

| Year 9 | $198,368 | $593,728 | $395,360 |

| Year 10 | $216,116 | $663,633 | $447,517 |

| Year 11 | $229,048 | $734,406 | $505,358 |

| Year 12 | $244,049 | $806,071 | $562,022 |

| Year 13 | $254,122 | $878,654 | $624,532 |

| Year 14 | $266,148 | $952,179 | $686,031 |

| Year 15 | $273,860 | $1,026,673 | $752,813 |

In 15 years, the potential profits are $752,813.

Property 2

Here we are using the current price of $836,798 and an outstanding loan of $225,000 with a 4% interest rate and a remaining loan tenure of 14 years (presuming you took the maximum loan tenure of 19 years when you purchased it 5 years ago). We are also using the annualised growth rate of 1.19% and the average rent of $2,600.

Costs include interest expenses, property tax, a monthly maintenance fee of $200 and agency fees payable once every 2 years.

| Period | Total Cost | Total Gains | Profit |

| Starting point | $2,808 | $0 | -$2,808 |

| Year 1 | $17,825 | $41,158 | $23,333 |

| Year 2 | $35,152 | $82,434 | $47,282 |

| Year 3 | $49,152 | $123,831 | $74,679 |

| Year 4 | $65,419 | $165,348 | $99,929 |

| Year 5 | $78,317 | $206,989 | $128,672 |

| Year 6 | $93,438 | $248,753 | $155,316 |

| Year 7 | $105,142 | $290,644 | $185,502 |

| Year 8 | $119,020 | $332,661 | $213,641 |

| Year 9 | $129,431 | $374,808 | $245,377 |

| Year 10 | $141,963 | $417,084 | $275,121 |

| Year 11 | $150,974 | $459,493 | $308,519 |

| Year 12 | $162,049 | $502,034 | $339,986 |

| Year 13 | $169,542 | $544,711 | $375,169 |

| Year 14 | $179,039 | $587,524 | $408,486 |

| Year 15 | $185,279 | $630,476 | $445,197 |

In 15 years, the potential profits are $445,197.

HDB Property

Here we are using the current price of $678,000 and the annualised growth rate of 1.72%.

Costs include property tax and a monthly town council service and conservancy fee of $83.

| Period | Total Cost | Total Gains | Profit |

| Starting point | $0 | $0 | $0 |

| Year 1 | $1,490 | $11,662 | $10,172 |

| Year 2 | $2,979 | $23,524 | $20,545 |

| Year 3 | $4,469 | $35,590 | $31,121 |

| Year 4 | $5,958 | $47,864 | $41,905 |

| Year 5 | $7,448 | $60,349 | $52,901 |

| Year 6 | $8,938 | $73,048 | $64,111 |

| Year 7 | $10,427 | $85,966 | $75,539 |

| Year 8 | $11,917 | $99,106 | $87,190 |

| Year 9 | $13,406 | $112,473 | $99,066 |

| Year 10 | $14,896 | $126,069 | $111,173 |

| Year 11 | $16,386 | $139,899 | $123,513 |

| Year 12 | $17,875 | $153,967 | $136,091 |

| Year 13 | $19,365 | $168,276 | $148,912 |

| Year 14 | $20,854 | $182,832 | $161,978 |

| Year 15 | $22,344 | $197,639 | $175,295 |

In 15 years, the potential profits are $175,295.

Total potential profits after 15 years if you remain status quo: $1,373,306

Do note that in this projection, we have not considered depreciation, and the rental rate and growth rate may fluctuate in accordance with market conditions over the years. Hence, the actual figures are expected to differ. This projection is intended solely for illustrative purposes and serves only as a basic representation.

Option #2 – Sell 3, buy 2 (one each)

Purchasing a freehold 2-bedder for own stay purposes and a young 99-year leasehold 2-bedder for investment

| Year | 99-year leasehold non-landed (resale) | YoY | 99 year leasehold non-landed (resale) | YoY |

| 2012 | $1,289 | – | $986 | – |

| 2013 | $1,427 | 10.71% | $1,057 | 7.20% |

| 2014 | $1,366 | -4.27% | $1,029 | -2.65% |

| 2015 | $1,365 | -0.07% | $1,033 | 0.39% |

| 2016 | $1,396 | 2.27% | $1,129 | 9.29% |

| 2017 | $1,466 | 5.01% | $1,115 | -1.24% |

| 2018 | $1,543 | 5.25% | $1,153 | 3.41% |

| 2019 | $1,575 | 2.07% | $1,178 | 2.17% |

| 2020 | $1,504 | -4.51% | $1,174 | -0.34% |

| 2021 | $1,592 | 5.85% | $1,207 | 2.81% |

| 2022 | $1,714 | 7.66% | $1,337 | 10.77% |

| Annualised | – | 2.89% | – | 3.09% |

Let’s assume you were to purchase your own stay unit at Bullion Park for $1.428M utilising all your CPF funds of $488,169 and cash of $327,075, taking up a loan of $612,756 with a 4% interest and a 14-year tenure. Here we are using a growth rate of 2.89%.

Costs include BSD, interest expenses, property tax and a monthly maintenance fee of $250.

| Period | Total Cost | Total Gains | Profit |

| Starting point | $41,720 | $0 | -$41,720 |

| Year 1 | $70,388 | $41,269 | -$29,118 |

| Year 2 | $97,697 | $83,731 | -$13,966 |

| Year 3 | $123,594 | $127,420 | $3,826 |

| Year 4 | $148,020 | $172,372 | $24,352 |

| Year 5 | $170,915 | $218,622 | $47,708 |

| Year 6 | $192,217 | $266,210 | $73,993 |

| Year 7 | $211,861 | $315,173 | $103,311 |

| Year 8 | $229,780 | $365,550 | $135,770 |

| Year 9 | $245,903 | $417,384 | $171,481 |

| Year 10 | $260,157 | $470,715 | $210,559 |

| Year 11 | $272,465 | $525,588 | $253,123 |

| Year 12 | $282,750 | $582,047 | $299,297 |

| Year 13 | $290,927 | $640,137 | $349,210 |

| Year 14 | $296,912 | $699,907 | $402,994 |

| Year 15 | $301,676 | $761,403 | $459,727 |

In 15 years, the potential profits are $459,727.

As for the investment property, let’s assume your wife purchases a unit at Sol Acres for $838K utilising all her CPF funds and cash. As the project is an EC which has just recently hit its Minimum Occupation Period (MOP), there are not many rental transactions yet. There was only 1 transaction for a 1+S unit in June last year at $2,500. We will use this rental and a growth rate of 3.09% for the calculation.

Costs include BSD, property tax, a monthly maintenance fee of $200 and agency fees payable once every two years.

| Period | Total Cost | Total Gains | Profit |

| Starting point | $22,440 | $0 | -$22,440 |

| Year 1 | $28,440 | $55,894 | $27,454 |

| Year 2 | $37,140 | $112,589 | $75,449 |

| Year 3 | $43,140 | $170,108 | $126,968 |

| Year 4 | $51,840 | $228,477 | $176,637 |

| Year 5 | $57,840 | $287,723 | $229,883 |

| Year 6 | $66,540 | $347,873 | $281,333 |

| Year 7 | $72,540 | $408,955 | $336,415 |

| Year 8 | $81,240 | $470,997 | $389,757 |

| Year 9 | $87,240 | $534,029 | $446,789 |

| Year 10 | $95,940 | $598,081 | $502,141 |

| Year 11 | $101,940 | $663,186 | $561,246 |

| Year 12 | $110,640 | $729,376 | $618,736 |

| Year 13 | $116,640 | $796,684 | $680,044 |

| Year 14 | $125,340 | $865,145 | $739,805 |

| Year 15 | $131,340 | $934,794 | $803,454 |

In 15 years, the potential profits are $803,454.

Total potential profits after 15 years if you sell all 3 properties to purchase another 2: $1,263,180

Just as with the previous projection, we have not considered depreciation, and the rental rate and growth rate may fluctuate in accordance with market conditions over the years. Hence, the actual figures are expected to differ. This projection is intended solely for illustrative purposes and serves only as a basic representation.

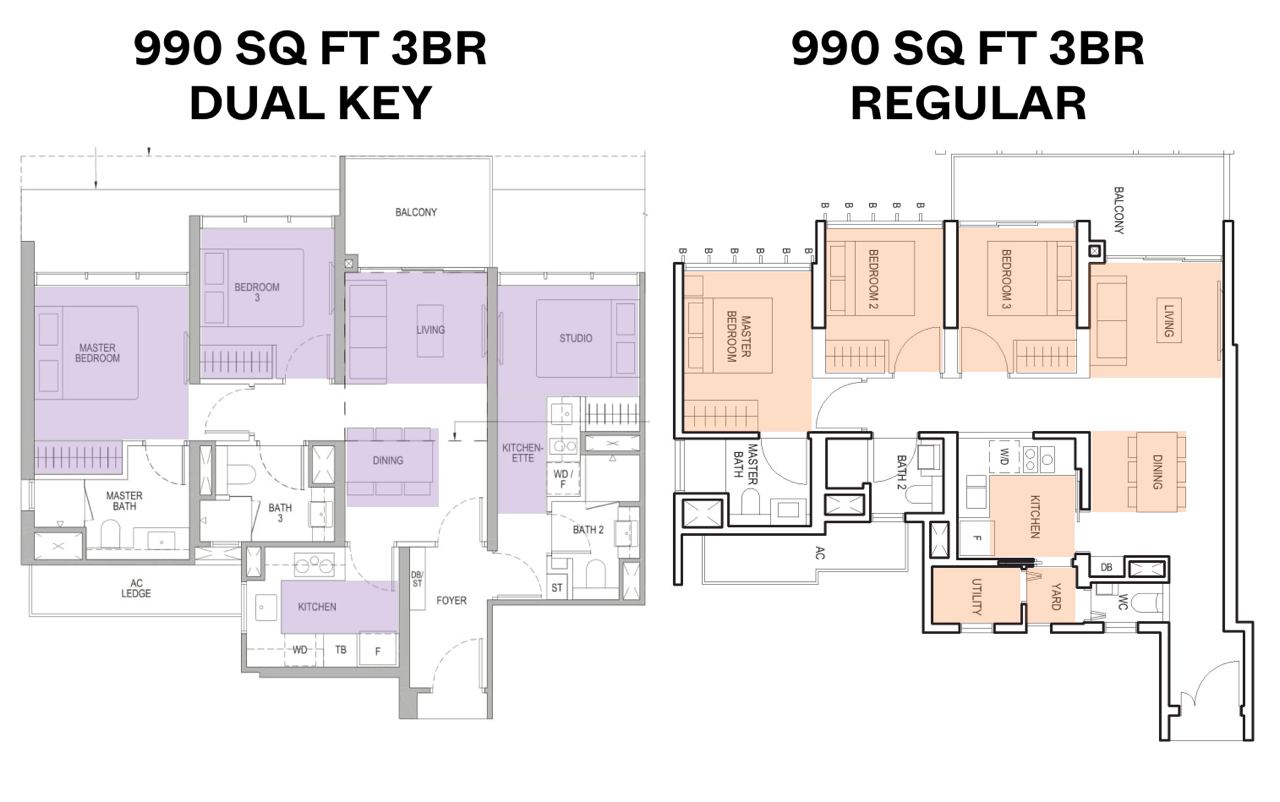

Dual-key unit: An alternative purchase?

Rather than purchasing 2 properties separately, one option is to simply purchase 1 dual-key unit under your name since your wife doesn’t have an income (as an even more prudent approach).

A dual-key unit has 2 separate units connected by a shared foyer, allowing you to own just one property (to avoid ABSD) while allowing you to stay in one and rent out the other.

We recognise that while this move is viable, we still prefer to purchase 2 properties instead for the following reasons:

- Having 2 properties gives you the flexibility to sell one later on for cash if the need arises. This could be for your retirement or to help your child meet their life goals later on. Doing so is better than downgrading from a larger property since you wouldn’t need to move which is a hassle – even more for when you’re older and retired.

- A separate investment property puts you far away from your tenant. Tenants prefer not to stay with their landlord due to privacy reasons, and even though a dual-key unit affords some privacy, chances are you’ll still meet them once in a while which may not be ideal. After all, you still share the same front door as them.

- A dual-key unit’s layout may not be ideal for you. The reason is that some space has to go to the foyer. There will also be space dedicated to the smaller configuration’s living quarters for a kitchen/pantry/dining area. This is space that could’ve gone to your home instead.

What should you do?

Although selling all 3 properties to buy 2 separate units may result in slightly lower profits after 15 years, these projections do not consider the rate of depreciation.

Given that your HDB flat is currently 25 years old, it is unlikely that prices will significantly appreciate in the future. With the upcoming supply of BTO flats over the next few years (and even a possible oversupply because of the ageing population), it’s still anyone’s guess what will happen with the prices of older HDB flats. This is, of course, unless there is a drastic market change like the one experienced during and after the pandemic when supply was limited and older flats saw a rapid increase in prices despite their age.

While the annualised growth rate for Property 2, at 1.19%, is higher than the overall growth rate of freehold/999-year leasehold 1-bedders, it is still relatively low compared to the general growth rate of all freehold/999-year leasehold properties, which stands at 2.89%. Considering the current thriving rental market, its rental yield is decent. However, given the performance of freehold/999-year leasehold 1-bedders in general (0.45%), particularly when they are part of a boutique development with a majority of 1-bedders, we should not expect significant capital gains even in the long run.

Taking into account the rental yield and growth potential of Property 1, we have deliberated on the possibility of holding onto it for the near future. However, to avoid the Additional Buyer’s Stamp Duty (ABSD), the second property would need to be bought under your wife’s name. This arrangement would restrict the budget allocated for the second property as she is unable to acquire a loan and you will not be able to utilise the CPF funds that you’ve unlocked from selling the other 2 properties.

We have also considered the possibility of selling the other two properties, paying off the outstanding loan for Property 1 and transferring it to your wife. However, this option does not substantially increase your budget, and it would involve additional expenses such as legal fees and BSD. As a result, that may not be the best approach.

Also, if you have legacy planning in mind, it is likely that you would prefer to leave behind an asset that serves as a good store of value. Taking all of this into account, selling all 3 properties to purchase 2 separate properties might be a better option.

Purchasing a freehold/999-year leasehold 2-bedder not only offers you a place to stay but also holds the potential for future appreciation (subject to the specific project you choose), which can be passed down to your son. Investing in a newer 99-year leasehold project ensures that the lease decay won’t be a major concern if you hold the property for the short to medium term. During this period, the rental income can help offset your mortgage for your own stay property or provide additional funds for your retirement. Eventually, you might consider either selling it for another newer property or cashing out the funds to support your retirement plans.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

2 Comments

Hi! I read this article with much interest but I couldn’t follow along with the argument of scenario 2 (selling all 3 properties to buy 2 more) being a better outcome than scenario 1 (status quo). Scenario 2 demands that a 51 year old sole breadwinner fully exhaust his cash and cpf balance to only marginally reduce his outstanding loan balance, with lower projected profit than if he were to just stay the course.

Did I completely miss some point that was trying to be made here?