I Wouldn’t Count Too much on ABSD-related discounts this year…

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

I wouldn’t count too much on ABSD-related discounts this year.

If you’ve never heard of it, an ABSD discount is when a developer comes close to its five-year deadline for completing and selling 90 per cent of the units. If they can’t manage it within this time frame, they pay a hefty sum based on the outstanding units (right now developers pay ABSD of 40 per cent on the land price, of which 35 per cent is remittable if they meet the deadline).

So when a developer has just a handful of units left, and the ABSD is around the corner, that’s when buyers start to circle around and watch for fire sales. But for anyone looking for an opportunity this year, I’d say don’t hold your breath.

44 projects which had a deadline between ‘21 and ‘23 were given an extension, on a case-by-case basis. But this has led to a number of questions on the ground: why were some of these projects given extensions, whereas others weren’t?

A good reason for keeping things opaque

The general response to inquiries over the extensions has been “due to extenuating circumstances” or “site-specific delays.” Which doesn’t really answer anything. Also, you’ll notice that it’s quite hard to find the names of the 44 projects, or any of the announcements that they were seeking extensions in the first place.

Some people have argued that it’s unfair to keep all this information opaque: from reasons such as “buyers have a right to know,” to making sure the system is fair. But I have an inkling that the information on this – just like information on why some people are allowed to sell their flats before MOP, is kept obscure for a reason.

Case-by-case is a sensitive thing: once you grant an extension or a reprieve for a “case,” a few dozen – or perhaps a few hundred – people will rush up claiming their situation is similar.

Grant one developer an extension because a subcontractor went bankrupt, and suddenly five or six others may come banging on the door saying one of their sub-cons went bust as well, so now they need a six-month extension too. And pretty soon, the relevant government agencies are swamped with trying to provide justifications as to why some cases are more valid than others.

So it’s just a necessity that, when it comes to real estate, not everything is too out in the open; and we can’t expect too many specifics on why a developer was granted an extension.

That being said, there’s something inherently unfair about ABSD-related discounts anyway

If you want another example of why the rich get richer, ABSD-related discounts are the perfect example. You see, it’s quite rare for the average Singaporean to benefit from these, whereas the affluent can get huge discounts from them.

More from Stacked

Do We Still Need Property Agents In 2023?

With property portals and the HDB resale portal now so established, buyers and sellers alike have started to wonder: why…

For starters, the last units left tend to be the very high quantum units; the penthouses or premium stack units, which aren’t moving because of their $5 million+ price tags. This is not something the average person can afford even with the discount – so it means that, while the richest buyers can wait around for these to have a 10, 15, or even 20 per cent discount, the average buyer doesn’t have the means to seize these opportunities.

The other reason is that developers aren’t inclined to give discounts to buyers of individual units. If there are seven units left, what’s the use of discounting them when the developer may end up selling just four or five, and still get hit by the ABSD anyway?

More often, the developer would rather sell all the remaining units to one affluent buyer (or group of affluent buyers), at a steep discount. Once again, not an opportunity for the average Singaporean – but a huge win for the more affluent buyers.

Meanwhile in other property news…

- Want a gigantic 2,650+ sq. ft. freehold apartment that can serve as an intergenerational asset? Here are some options.

- Last call for these new launch condos, which are on the verge of selling out. If they’re on your shortlist, move fast.

- Can you imagine having a home that you just…leave empty for seven whole years? Some Singaporeans apparently will do it while abroad.

- Should you rent out your HDB, to get money to rent a condo? Here’s a look at the details involved.

Weekly Sales Roundup (17 June – 23 June)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WATTEN HOUSE | $6,026,000 | 1851 | $3,255 | FH |

| KLIMT CAIRNHILL | $5,508,000 | 1432 | $3,847 | FH |

| TEMBUSU GRAND | $3,468,000 | 1432 | $2,422 | 99 yrs |

| J’DEN | $3,062,000 | 1259 | $2,431 | 99 yrs (2023) |

| 19 NASSIM | $3,062,000 | 926 | $3,308 | 99 yrs (2019) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| TEMBUSU GRAND | $1,352,000 | 527 | $2,563 | 99 yrs |

| LENTOR HILLS RESIDENCES | $1,385,000 | 581 | $2,383 | 99 yrs |

| LENTORIA | $1,491,000 | 732 | $2,037 | 99 yrs (2022) |

| HILLHAVEN | $1,500,786 | 678 | $2,213 | 99 yrs (2023) |

| THE LANDMARK | $1,515,000 | 495 | $3,060 | 99 yrs (2020) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE SOVEREIGN | $8,600,000 | 3305 | $2,602 | FH |

| N.A. | $6,300,000 | 2874 | $2,192 | FH |

| HILLTOPS | $4,600,000 | 1550 | $2,968 | FH |

| THE SEAFRONT ON MEYER | $3,930,000 | 1604 | $2,450 | FH |

| THE RESIDENCES AT W SINGAPORE SENTOSA COVE | $3,312,000 | 1948 | $1,700 | 99 yrs (2006) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| KINGSFORD . HILLVIEW PEAK | $750,000 | 517 | $1,452 | 99 yrs (2012) |

| THE GALE | $855,000 | 689 | $1,241 | FH |

| NEEM TREE | $878,000 | 506 | $1,735 | FH |

| SUITES AT BUKIT TIMAH | $890,000 | 517 | $1,723 | FH |

| THE INFLORA | $910,000 | 743 | $1,225 | 99 yrs (2012) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE SOVEREIGN | $8,600,000 | 3305 | $2,602 | $4,000,000 | 14 Years |

| CHILTERN PARK | $1,850,000 | 1270 | $1,457 | $1,350,000 | 21 Years |

| GARDENVISTA | $2,138,800 | 1130 | $1,892 | $1,348,800 | 18 Years |

| HIGHGATE | $1,850,000 | 1227 | $1,508 | $1,255,000 | 17 Years |

| 8 @ MOUNT SOPHIA | $2,460,000 | 1421 | $1,731 | $1,244,288 | 19 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| HILLTOPS | $4,600,000 | 1550 | $2,968 | -$1,935,442 | 17 Years |

| THE LAURELS | $1,380,000 | 549 | $2,514 | -$146,769 | 14 Years |

| DUO RESIDENCES | $1,228,000 | 538 | $2,282 | -$122,000 | 11 Years |

| THE ROCHESTER RESIDENCES | $1,400,000 | 1023 | $1,369 | -$93,973 | 17 Years |

| URBAN VISTA | $1,760,000 | 1485 | $1,185 | -$79,352 | 11 Years |

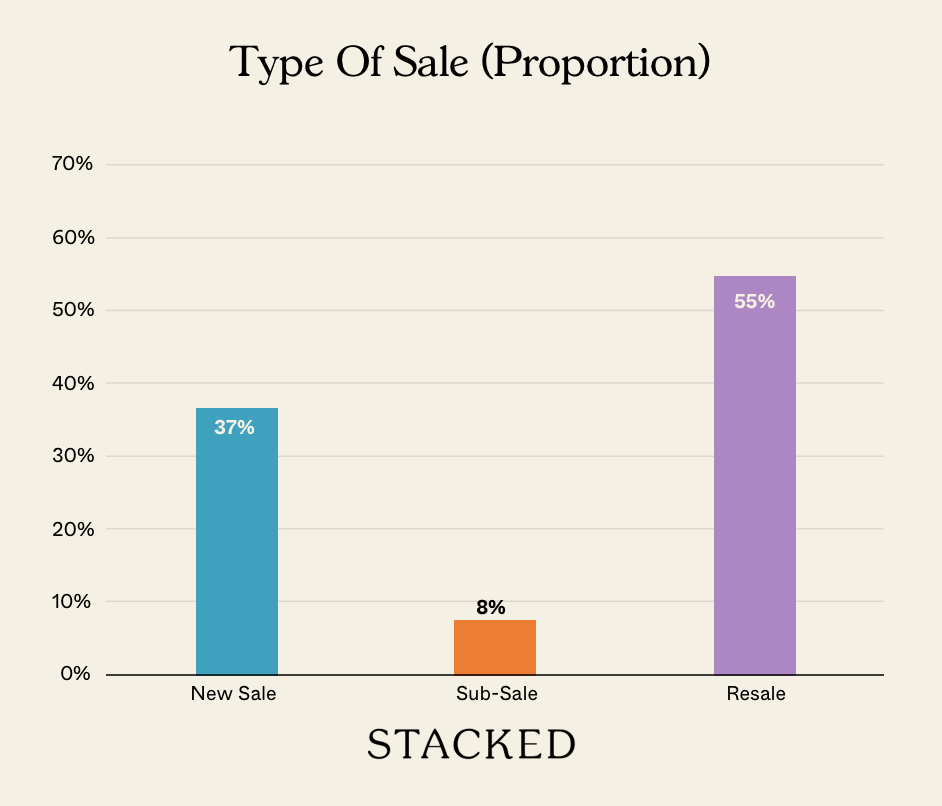

Transaction Breakdown

For more on the Singapore property market, follow us on Stacked .

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Singapore Property News

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

Singapore Property News URA’s 2025 Draft Master Plan: 80,000 New Homes Across 10 Estates — Here’s What To Look Out For

Latest Posts

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000

New Launch Condo Reviews The Robertson Opus Review: A Rare 999-Year New Launch Condo Priced From $1.37m

Pro Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

On The Market 5 Spacious Old But Freehold Condos Above 2,650 Sqft

Property Investment Insights We Compared New Launch And Resale Condo Prices Across Districts—Here’s Where The Price Gaps Are The Biggest

Pro Similar Layout, Same District—But Over $500K Cheaper? We Compare New Launch Vs Resale Condos In District 5

New Launch Condo Analysis The First New Condo In Science Park After 40 Years: Is LyndenWoods Worth A Look? (Priced From $2,173 Psf)