I Sold My Condo And Made $1 Million In Cash/CPF: Should I Buy A New Launch Or Invest In Fixed Income?

May 6, 2023

Hi guys.

First of all, let me say that it has always been a pleasure reading your articles and watching your videos. Love it!!!

I would love to see your advice on my current situation and on how to move forward.

I have recently sold my Property A and got back $1M after sales commission and mortgage repayment, out of which $240K will have to go back into my CPF OA. I have another Property B (HDB 4-room in Sengkang 990 sqft with 79 years lease) currently tenanted out at $2.5K and the lease is set to expire in mid of 2023. I had used $230K of CPF to fund this.

My wife had recently bought Property C (1 bedder in Avenue South Residence) in May 2022 and we will be moving in to stay when it TOP in May/Jun 23 (fingers crossed) for the time being, until 3 years have passed before we decide to rent it out or sell it.

We are in our mid forties and we still have some CPF OA funds which we do not intend to touch any time soon. Property A and B are under my name while Property C is under my wife’s.

With the rising interest rates and property prices being so hot right now, I wonder if it is the right time to buy a new launch for investment and sell it at TOP. Will I buy at a high price and sell low in 3-4 years time? If we go with this approach, I will have to sell my HDB so that I do not need to pay ABSD for the next purchase.

Or, should I continue to hold on to my HDB for the strong rental yield while I invest the proceeds from Property A in fixed income instruments for a safe and steady return?

Your advice and recommendations will be much appreciated. Thanks in advance!!

Hi there,

Thanks for writing in and it’s really great to hear that you enjoy our content.

What you are asking is probably what is on everyone’s mind right now. Should you be buying a property for investment when the market still seems to be at a high? What should you do given that it is a high interest rate environment as well?

As such, it’s understandable to feel cautious about making a purchase. Since you do not have a pressing need to purchase a property right away, one option is to wait and see if prices and interest rates drop, which could make buying more affordable.

Let’s talk about the optimistic view here. If property prices and interest rates do drop, you may be able to save money by buying at a lower price or with a lower interest rate. But bear in mind, if prices do drop this would likely be due to the wider economic issues, which would be an environment that most would consider “risky” to buy. Think about the early days of the pandemic, why is it that more people didn’t buy then? It was a period of uncertainty, and as counter-intuitive as it sounds – actually the best time to buy when you look at the past 3 years.

Also, given the number of cooling measures that the Government has to play with, they wouldn’t want a situation where property prices drastically drop. So barring another catastrophic event, how much could property prices really drop?

Additionally, it’s worth considering that future new launches may not necessarily be much cheaper than current offerings. Land and construction costs are constantly increasing, which means that developers may need to charge higher prices to cover their costs. So even if property prices do drop, the savings may not be significant, and you may end up waiting for an uncertain amount of time for a small reduction in price.

Generally though, if you have a short investment horizon and holding period, it may seem more prudent to wait it out a little.

Nevertheless in this piece, we will discuss and provide insights on the following pointers and hopefully assist you in making a more informed decision:

– Movement of land prices over the last 30 years

– Holding period

– Potential pathways (comparing both short and long-term hold)

Do note that we don’t have all the financials to give you an accurate picture of your exact situation, but we’ll try to cover as much as possible which should help create a good idea of what’s best for you.

Let’s start by looking at how land prices have been moving over the last 30 years.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

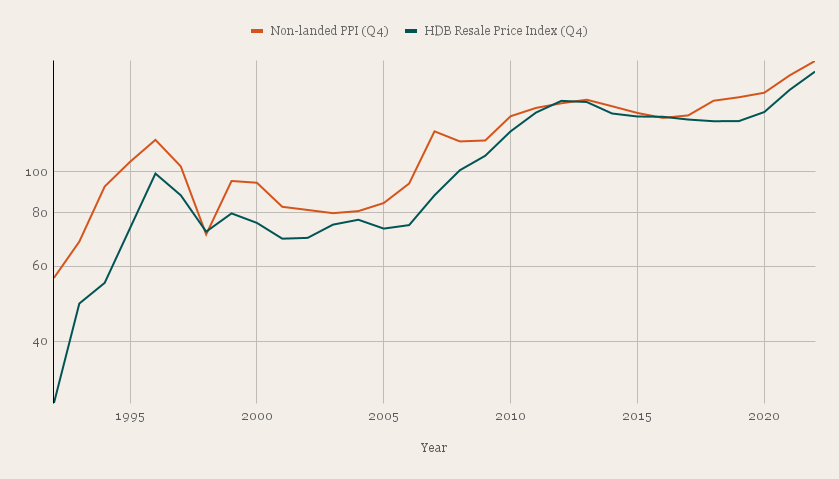

Movement of land prices

Property market peaks in Singapore since 1992:

- 1996: Property prices peaked in the first quarter of 1996, after a strong recovery from the property slump in the early 1990s.

- 2007: Property prices reached their peak in the second quarter of 2007, before the global financial crisis that began in the United States.

- 2013: Property prices reached a peak in the third quarter of 2013, driven by low-interest rates, strong demand from foreign buyers, and a limited supply of land.

- 2018: Property prices peaked in the third quarter of 2018 before the government introduced a series of cooling measures to curb rising prices and prevent a property bubble.

- 2022 – Now

| Year | Plots of land sold | Avg $PSM per GFA (Non-landed residential only) | YoY | Non-landed PPI (Q4) | YoY | HDB Resale Price Index (Q4) | YoY |

| 1992 | 2 | $1,468 | 56.3 | 28.6 | |||

| 1993 | 0 | $0 | -100.00% | 68.5 | 21.67% | 49 | 71.33% |

| 1994 | 9 | $3,240 | – | 92.3 | 34.74% | 54.8 | 11.84% |

| 1995 | 12 | $3,281 | 1.25% | 105.5 | 14.30% | 73.7 | 34.49% |

| 1996 | 11 | $3,670 | 11.87% | 118.8 | 12.61% | 99 | 34.33% |

| 1997 | 18 | $3,553 | -3.20% | 102.9 | -13.38% | 88 | -11.11% |

| 1998 | 0 | $0 | -100.00% | 71.2 | -30.81% | 72.3 | -17.84% |

| 1999 | 0 | $0 | – | 95.1 | 33.57% | 79.8 | 10.37% |

| 2000 | 9 | $2,360 | – | 94.2 | -0.95% | 75.8 | -5.01% |

| 2001 | 2 | $2,546 | 7.87% | 82.7 | -12.21% | 69.6 | -8.18% |

| 2002 | 3 | $2,330 | -8.47% | 81.3 | -1.69% | 69.9 | 0.43% |

| 2003 | 2 | $2,759 | 18.38% | 79.9 | -1.72% | 75.1 | 7.44% |

| 2004 | 0 | $0 | -100.00% | 80.8 | 1.13% | 77.1 | 2.66% |

| 2005 | 1 | $3,771 | – | 84.4 | 4.46% | 73.5 | -4.67% |

| 2006 | 2 | $4,441 | 17.78% | 93.8 | 11.14% | 74.9 | 1.90% |

| 2007 | 6 | $4,885 | 9.99% | 124.4 | 32.62% | 88 | 17.49% |

| 2008 | 4 | $2,853 | -41.59% | 117.8 | -5.31% | 100.8 | 14.55% |

| 2009 | 3 | $5,634 | 97.48% | 118.4 | 0.51% | 109 | 8.13% |

| 2010 | 11 | $4,792 | -14.95% | 135 | 14.02% | 124.4 | 14.13% |

| 2011 | 17 | $5,317 | 10.97% | 141.2 | 4.59% | 137.7 | 10.69% |

| 2012 | 16 | $7,675 | 44.34% | 144.8 | 2.55% | 146.7 | 6.54% |

| 2013 | 9 | $7,760 | 1.10% | 147.6 | 1.93% | 145.8 | -0.61% |

| 2014 | 5 | $6,606 | -14.87% | 142.5 | -3.46% | 137 | -6.04% |

| 2015 | 6 | $7,183 | 8.73% | 137.4 | -3.58% | 134.8 | -1.61% |

| 2016 | 6 | $8,229 | 14.57% | 133.8 | -2.62% | 134.6 | -0.15% |

| 2017 | 10 | $11,239 | 36.58% | 135.6 | 1.35% | 132.6 | -1.49% |

| 2018 | 5 | $13,804 | 22.83% | 146.8 | 8.26% | 131.4 | -0.90% |

| 2019 | 5 | $9,651 | -30.09% | 149.6 | 1.91% | 131.5 | 0.08% |

| 2020 | 1 | $12,031 | 24.66% | 153.3 | 2.47% | 138.1 | 5.02% |

| 2021 | 3 | $11,992 | -0.33% | 168.4 | 9.85% | 155.7 | 12.74% |

| 2022 | 6 | $13,049 | 8.81% | 182.1 | 8.14% | 171.9 | 10.40% |

| Annualised | – | – | 7.56% | – | 3.99% | – | 6.16% |

From here you can see that land prices and the property market trend are closely related.

When the property market is strong and demand is high, developers will be willing to pay more for land to develop new projects, which will drive land prices up.

Looking at the table above, we can see that land prices have generally been on an upward trajectory, driven by factors such as population growth, urbanisation, and limited land supply. However, land prices also tend to be cyclical, rising and falling in tandem with the property market trend.

During periods of property market peaks, such as in 1996, 2007, 2013, and 2018, land prices tend to reach new highs as developers compete for limited land supply to cater to strong demand.

The average price per square meter ($PSM) can also be influenced by the location and quantity of land plots being sold. For instance, in some years, there might be a diverse mix of land plots in the Core Central Region (CCR), Rest of Central Region (RCR), and Outside Central Region (OCR), while in other years, one region might have more land plots, which can lead to fluctuations in the average price.

Let’s now take a look at the price movement of new launches against land prices.

| Year | Avg $PSM per GFA (Non-landed residential only) | YoY | Avg PSF for new sales | YoY |

| 1995 | $3,281 | $701 | ||

| 1996 | $3,670 | 11.87% | $802 | 14.41% |

| 1997 | $3,553 | -3.20% | $706 | -11.97% |

| 1998 | $0 | -100.00% | $509 | -27.90% |

| 1999 | $0 | – | $611 | 20.04% |

| 2000 | $2,360 | – | $691 | 13.09% |

| 2001 | $2,546 | 7.87% | $551 | -20.26% |

| 2002 | $2,330 | -8.47% | $583 | 5.81% |

| 2003 | $2,759 | 18.38% | $600 | 2.92% |

| 2004 | $0 | -100.00% | $646 | 7.67% |

| 2005 | $3,771 | – | $730 | 13.00% |

| 2006 | $4,441 | 17.78% | $853 | 16.85% |

| 2007 | $4,885 | 9.99% | $1,313 | 53.93% |

| 2008 | $2,853 | -41.59% | $1,095 | -16.60% |

| 2009 | $5,634 | 97.48% | $1,047 | -4.38% |

| 2010 | $4,792 | -14.95% | $1,320 | 26.07% |

| 2011 | $5,317 | 10.97% | $1,183 | -10.38% |

| 2012 | $7,675 | 44.34% | $1,145 | -3.21% |

| 2013 | $7,760 | 1.10% | $1,257 | 9.78% |

| 2014 | $6,606 | -14.87% | $1,344 | 6.92% |

| 2015 | $7,183 | 8.73% | $1,185 | -11.83% |

| 2016 | $8,229 | 14.57% | $1,217 | 2.70% |

| 2017 | $11,239 | 36.58% | $1,318 | 8.30% |

| 2018 | $13,804 | 22.83% | $1,590 | 20.64% |

| 2019 | $9,651 | -30.09% | $1,766 | 11.07% |

| 2020 | $12,031 | 24.66% | $1,753 | -0.74% |

| 2021 | $11,992 | -0.33% | $1,931 | 10.15% |

| 2022 | $13,049 | 8.81% | $2,143 | 10.98% |

| Annualised | – | 5.25% | – | 4.23% |

That said, the relationship between land prices and new launch prices is not always straightforward. While there is often a correlation between land and property prices, it may always be the case that they move in tandem.

When land prices drop, developers may be able to acquire land at a lower cost, which could potentially translate into lower prices for new launches. This is because developers are able to pass on the cost savings from lower land prices to buyers.

However, there are also other factors that can influence new launch prices, such as construction costs, financing costs, and market demand. For example, in 2014 and 2019, even though land prices dropped after the peak, new launch prices were higher than before. But in general, we can see from the table above that just like with land prices, new launch prices are also on an upward trajectory.

While it is difficult to predict with certainty whether investing in a new launch property now will yield a profit or loss when selling in 3-4 years, one key consideration is the current state of the property market. Seeing as the market may be at or near its peak, it may be more challenging to realise a quick return on investment by selling the property in the near term.

As such, it may be necessary to hold onto the property for a longer period of time in order to benefit from the next upswing in the market. This could involve renting out the property in the interim, or simply waiting for the market to recover before selling.

And that’s exactly what this question is about – should you take a plunge now to buy a new launch to “flip” it or hold onto it for longer? Or perhaps, hold off buying a new launch and invest it in another instrument?

Let’s compare the two pathways you’re looking at.

Potential pathways

To provide a general sense of how the two strategies may perform over time, we will provide some simple projections. However, it is important to note that these figures are hypothetical as we do not have access to your specific numbers.

We looked at the HDB Resale Price Index (RPI) and the Property Price Index (PPI) between Q1 2013 to Q4 2022 to calculate the annualised returns and used them in assuming capital appreciation. This is 1.84% for HDBs and 2.34% for private property on a yearly basis.

First off, let’s consider the returns when “flipping” in 3-4 years’ time.

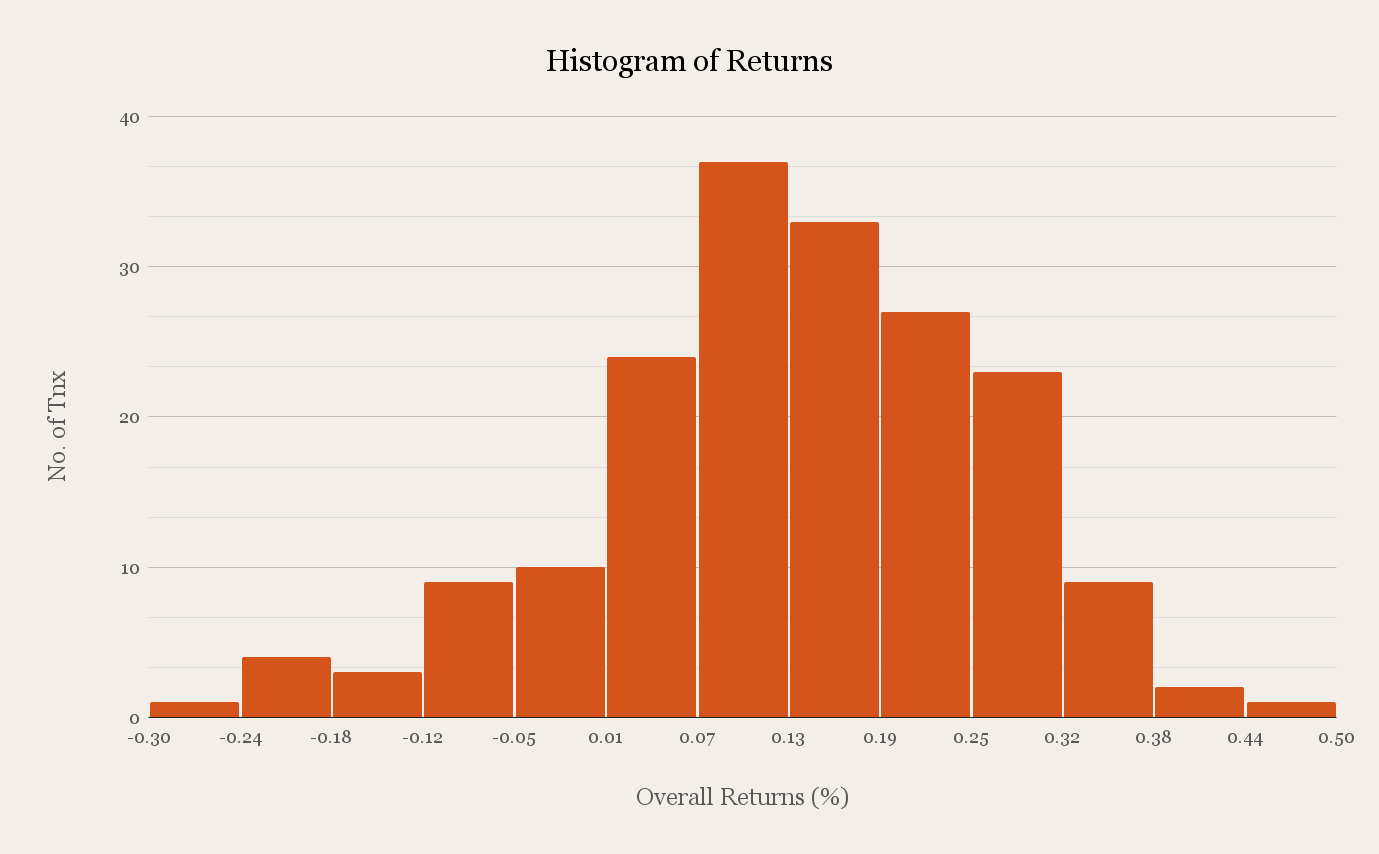

To come up with concrete data, let’s take a look at those who bought new launches in the run-up to the previous property market high in 2012-2013. We’ll also only look at those who sold within 3-4 years which would be the earliest you can sell today if you do not wish to pay the SSD.

In total, there were 183 buy-sell transactions of new launches in 2012-2013 with a holding period of 3-4 years. The average gain is 13.3% with an annualised average of 3.69%.

Do note that the rate of return varied widely across different projects. Hence, the profitability ultimately relies on the individual new launch and its market performance. We also did not take Sellers Stamp Duty (SSD) into consideration when calculating this rate of return – so those who sold in years 3-4 would have had to pay the 4% SSD which would’ve resulted in losses for some.

We can see that the majority of buyers who sold their property within 3-4 years of purchasing it made 7-19% gains.

Another thing to note is that survivor bias could be at play here. Transactions are only available when executed, and the assumption is that if a unit in condo A can transact at this price, then perhaps others can too. But this may not be 100% true. There could be many buyers holding onto paper losses and aren’t able to sell because of this.

Short term strategy

In the short-term strategy, we’re comparing between:

- Keeping the HDB and rent out for the next 4 years + investing proceeds from Property A in a safe asset that provides steady returns

- Selling your HDB and buying a new launch to sell in 3-4 years using all the proceeds from selling property A. The cash raised from selling the HDB is invested in a safe asset that provides steady returns.

Here are some assumptions we’ll need to make:

- The HDB has been fully paid and is valued at $500K with a monthly rental of $2.5K (6% yield)

- Costs include BSD, property tax, town council fees ($68/month) and agency fees payable every 2 years

- The new launch condo will cost $1.5M with a $500,000 loan at 4% interest and a 20-year tenure – with the presumption that you will sell it upon TOP. $1.5M is a budget we think is necessary to buy a decent 2-bedroom new launch as an investment property.

- Costs include interest expense and BSD (No property tax and maintenance fees will be payable as the building is still under construction)

Option 1 – Keeping the HDB and rent out for the next 4 years + investing proceeds from Property A in a safe asset that provides steady returns

Here’s what renting out the HDB for 4 years would look like:

| Period | Total Cost | Total Gains | Profit |

| Starting point | $2,700 | $0 | -$2,700 |

| Year 1 | $ 7,116 | $ 39,200.00 | $ 32,084 |

| Year 2 | $ 14,232 | $ 78,569.28 | $ 64,337 |

| Year 3 | $ 18,648 | $ 118,110.95 | $ 99,463 |

| Year 4 | $ 25,764 | $ 157,828.20 | $ 132,064 |

Investing profits ($1M – $240K CPF) from Property A with a 4% ROI annually

| Period | Amount invested | Gains |

| Starting point | $760,000 | $0 |

| Year 1 | $790,400 | $30,400 |

| Year 2 | $822,016 | $62,016 |

| Year 3 | $854,897 | $94,897 |

| Year 4 | $889,093 | $129,093 |

Total profits if you were to continue renting out the HDB for the next 4 years while investing your profits from Property A: $132,064 + $129,093 = $261,157

Option 2 – Selling your HDB and buying a new launch to sell in 3-4 years

Selling the HDB (Assuming that it is fully paid)

| Description | Amount |

| Selling price | $500,000 |

| CPF used plus accrued interest | $230,000 |

| Cash proceeds | $270,000 |

Buying a new launch and selling in 4 years or upon TOP

| Description | Estimated time taken | Interest per month | Total interest |

| Completion of Foundation | About 6 to 9 months (from launch) | – | – |

| Completion of Reinforced Concrete | 6 to 9 months after foundation work | – | – |

| Completion of Brick Wall | 3 to 6 months later | – | – |

| Completion of Ceiling/ Roofing | 3 to 6 months later | – | – |

| Completion of Electrical Wiring/ Plumbing | 3 to 6 months later | – | – |

| Completion of Roads/ Cars Parks/ Drainage | 3 to 6 months later | – | – |

| Issuance of Temporary Occupation Permit (TOP) | Usually a year before CSC | $916.50 | – |

| Certificate of Statutory Completion | – | $1,666.50 | – |

| Total interest paid upon TOP | $0 |

For simplicity’s sake, we’ll not assume any returns on the cash that’s reserved for the property since varying amounts would be paid out during this time.

If we consider purely the gains made by those who “flipped” in the last market high of 2012-2013, here’s what your gains could look like:

| Period | Total Gains |

| Starting point | $0 |

| Year 1 | $55,350 |

| Year 2 | $112,742 |

| Year 3 | $172,253 |

| Year 4 | $233,959 |

Total profits if you were to buy a new launch and sell it upon TOP is therefore: $233,959 – $44,600 (BSD) = $189,359

But let’s not forget that if you sell the HDB and Property A, you’ll have some cash left to invest in fixed income. Let’s assume the returns to be 4% annually.

| HDB | Property A | |

| Cash unlocked | $270,000 | $760,000 |

| CPF unlocked | $230,000 | $240,000 |

After selling the HDB, you’ll have $470K in your CPF account ($240K from Property A and $230K from the HDB). Assuming you utilise all your CPF funds plus cash of up to $1M to pay for the new launch, you’d still have $500K remaining. We will presume you re-invest this amount.

| New Launch Property | |

| CPF used | $470,000 |

| Cash needed | $530,000 |

| Total cash from before | $1,030,000 |

| Total cash left to invest for 4% returns | $500,000 |

Here’s what 4% returns would look like:

| Period | Amount invested | Gains |

| Starting point | $500,000 | $0 |

| Year 1 | $520,000 | $20,000 |

| Year 2 | $540,800 | $40,800 |

| Year 3 | $562,432 | $62,432 |

| Year 4 | $584,929 | $84,929 |

Total profits if you were to sell your HDB and buy a new launch to sell in 3-4 years: $189,359 + $84,929 = $274,288

From the above, it appears that purchasing a new launch and flipping it upon TOP while investing your remaining funds generated slightly higher profits compared to retaining the HDB and investing the remainder of the funds. It is important to note that this projection assumes that the HDB is fully paid off, as interest expenses on outstanding loans can reduce profits. However, interest costs may be less significant if a HDB loan is used instead of a bank loan.

It is also worth mentioning that the depreciation of the HDB was not factored into the projection. Nevertheless, over a short period of 3-4 years, the price of the HDB is unlikely to fluctuate considerably.

The difference in returns between both is $274,288 – $261,157 = $13,131. This represents around a 5% increase if you did scenario B instead of A.

However, you should know that the risk in scenario B is greater because you’d be depending on selling the new launch property for a profit within this period of time. On the other hand, scenario A would likely continue to generate decent rent in the next 3-4 years, and we doubt HDB prices would fluctuate greatly in this period.

Hence, with the increase of just 5% (again, this is just a very simple projection to give you some idea), it may not necessarily be attractive given the extra risk you’re taking.

Now, let’s take a look at the long-term strategy.

Long term strategy

In the long-term strategy, we’ll be comparing between:

- Keeping the HDB and renting it out for the next 10 years while investing proceeds from Property A into a safe asset that produces steady returns

- Selling the HDB to buy a new launch property to rent out for the next 10 years. Invest the remaining amount in a safe asset.

We will assume that:

- The HDB has been fully paid and is valued at $500K with a monthly rental of $2.5K (6% yield)

- Costs include BSD, property tax, town council fees and agency fees payable every 2 years

- The new launch condo will cost $1.5M with a $500,000 loan at 4% interest and a 20-year tenure – with the presumption that you will sell it upon TOP. $1.5M is a budget we think is necessary to buy a decent 2-bedroom new launch as an investment property.

- Costs include interest expense, BSD, property tax, maintenance fees (we have set this at $300/month) and agency fees payable every 2 years

Option 1 – Keeping the HDB and renting it out for the next 10 years while investing proceeds from Property A into a safe asset that produces steady returns

Renting out the HDB for 10 years

| Period | Total Cost | Total Gains | Profit |

| Starting point | $2,700 | $0 | -$2,700 |

| Year 1 | $7,116 | $39,200 | $32,084 |

| Year 2 | $14,232 | $78,569 | $64,337 |

| Year 3 | $18,648 | $118,111 | $99,463 |

| Year 4 | $25,764 | $157,828 | $132,064 |

| Year 5 | $30,180 | $197,724 | $167,544 |

| Year 6 | $37,296 | $237,802 | $200,506 |

| Year 7 | $41,712 | $278,066 | $236,354 |

| Year 8 | $48,828 | $318,518 | $269,690 |

| Year 9 | $53,244 | $359,163 | $305,919 |

| Year 10 | $60,360 | $400,004 | $339,644 |

Investing profits ($1M – $240K CPF) from Property A with a 4% ROI annually

| Period | Amount invested | Gains |

| Starting point | $760,000 | $0 |

| Year 1 | $790,400 | $30,400 |

| Year 2 | $822,016 | $62,016 |

| Year 3 | $854,897 | $94,897 |

| Year 4 | $889,093 | $129,093 |

| Year 5 | $924,656 | $164,656 |

| Year 6 | $961,642 | $201,642 |

| Year 7 | $1,000,108 | $240,108 |

| Year 8 | $1,040,112 | $280,112 |

| Year 9 | $1,081,717 | $321,717 |

| Year 10 | $1,124,986 | $364,986 |

Total profits if you were to continue renting out the HDB for the next 4 years while investing your profits from Property A: $339,644 + $364,986 = $704,630

Option 2 – Selling the HDB to buy a new launch property to rent out for the next 10 years

Buying a new launch and renting it out for 6.5 years, assuming it takes 3.5 years to obtain TOP

| Description | Estimated time taken | Interest per month | Total interest based on the longest amount of time taken |

| Total interest paid by TOP | – | – | $0 |

| Issuance of Temporary Occupation Permit (TOP) | Usually a year before CSC | $916.50 | $10,998 |

| Certificate of Statutory Completion (CSC) | Payable for 5.5 years while the unit is rented out | $1,666.50 | $109,989 |

| Total interest paid at the end of 10 years | – | – | $120,987 |

| Description | Per year | Total after 6.5 years |

| Maintenance fees | $3,600 | $23,400 |

| Agency fees | $4,050 (paid every 2 years) | $12,150 |

| Property tax | $6,600 | $42,900 |

| BSD | – | $44,600 |

| Total costs | – | $123,050 |

Total costs incurred in 10 years: $120,987 + $123,050 = $244,037

| Period | Amount invested | Gains |

| Starting point | $1,500,000 | $0 |

| Year 1 | $1,535,100 | $35,100 |

| Year 2 | $1,571,021 | $71,021 |

| Year 3 | $1,607,783 | $107,783 |

| Year 4 | $1,645,405 | $145,405 |

| Year 5 | $1,683,908 | $183,908 |

| Year 6 | $1,723,311 | $223,311 |

| Year 7 | $1,763,637 | $263,637 |

| Year 8 | $1,804,906 | $304,906 |

| Year 9 | $1,847,141 | $347,141 |

| Year 10 | $1,890,364 | $390,364 |

| Description | Per year | Total after 6.5 years |

| Rental income | $45,000 | $292,500 |

Total gains after 10 years: $390,364 +$292,500 = $682,864

Investing profits from the sale of the HDB and Property A with a 4% ROI annually

| Period | Amount invested | Gains |

| Starting point | $500,000 | $0 |

| Year 1 | $520,000 | $20,000 |

| Year 2 | $540,800 | $40,800 |

| Year 3 | $562,432 | $62,432 |

| Year 4 | $584,929 | $84,929 |

| Year 5 | $608,326 | $108,326 |

| Year 6 | $632,660 | $132,660 |

| Year 7 | $657,966 | $157,966 |

| Year 8 | $684,285 | $184,285 |

| Year 9 | $711,656 | $211,656 |

| Year 10 | $740,122 | $240,122 |

Total profits if you were to sell the HDB, buy a new launch and rent it out upon TOP for 6.5 years: $682,864 – $244,037 + $240,122 = $678,949

Based on the projection above, it appears that holding on to an HDB and investing the remaining funds is a more profitable strategy over a 10-year period compared to buying a new launch and renting it out after TOP. However, as before, it’s important to consider that this projection assumes the HDB is fully paid and does not take into account any depreciation that may occur over time.

The difference in returns between both is $704,630 – $678,949 = $25,681. This represents around a 3.78% increase if you did scenario A instead of B, which is marginal.

However, since 10 years is a relatively long period, the demand and price of the HDB may be affected in the future, depending on its age and location. On the other hand, a 10-year-old condo may have a healthier demand than an old HDB, but this isn’t always the case. Recent years have shown that even older properties can be in high demand. Ultimately, this will depend on the specific characteristics of the developments involved.

So what should you do?

As we have mentioned earlier, it is important to determine your intended holding period as this will influence your investment strategy.

In both short and long-term projections, the disparity in profits isn’t particularly significant. In the short run, buying a new launch while reinvesting the remaining funds yielded slightly higher profits while in the long run, retaining the HDB to rent out and investing the remaining funds yielded higher profits. But do bear in mind that this is provided the HDB has been fully paid up.

It also really depends on the new launch that you buy and the price you buy it at. While we can look at an average, it’s not uncommon to see people making upwards of over 20% (you can see this in the histogram above). Of course, the inverse could be true too.

In the short term, it is unlikely that the price of the HDB will experience a significant drop, making it a wise move to take advantage of the hot rental market and earn rental income while investing the remaining funds.

This is also a safer option as it’s easier to find a tenant compared to buying a sensibly priced unit in the current market.

Purchasing a new launch during a market high may lead to challenges in selling it for a significant profit in 3-4 years, despite the progressive payment scheme making the monthly repayments more manageable in the initial years.

In the long term, holding on to a newer condo may be more beneficial than an older HDB, but this is also dependent on the characteristics of both properties. Holding on to the HDB is less financially demanding, even with an outstanding loan on the HDB.

In addition to considering the holding period, it is important to take into account how purchasing a new launch could impact your lifestyle, as it would require a substantial amount for the down payment and monthly repayments.

To sum it up, we’d likely go with the long-term strategy of selling the HDB and buying a new launch if you intend to hold it for legacy reasons, or as an asset that you’d like to see appreciate over the years – perhaps till your retirement when you wish to liquidate it for cash. Renting it out would ensure you generate cash over the years while also acting as a hedge against real estate inflation.

Another reason we prefer this strategy over investing in fixed income investment, in the long run, is that you may generate little returns. Today, interest rates are high, so fixed income looks attractive. However, we don’t know what interest rates would look like years down the road, but what we know is that it’s subjected to external forces way beyond our geography. Bear in mind that if you do buy a new launch property, you’ll still be investing in fixed-income assets since you’d have to sell your HDB to avoid paying the ABSD.

At least with Singapore property, we know that there’s only so much land in Singapore to go around, and it’s likely that land prices continue to trudge upwards.

If you do not intend to hold onto the condo for the long term, then we think keeping the HDB to rent out is a safe bet rather than flipping it, especially since our assumption of growth for flippers in 2012-2013 may not necessarily hold. You wouldn’t have to incur the BSD and you can generate decent yields.

However, you do run the risk of lease decay at some point, and perhaps at that age, buying a private property could be difficult since the loan you can take would be less and the dilemma is having to balance between the amount of cash on hand versus what type of investment property you can purchase.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

0 Comments