I Make Less Than $70k Per Year And Own 50% Of A Hillview Condo: Should I Buy Over The Other Half Or Just Sell?

July 28, 2023

Dear Stacked Homes

I currently own a 50% share of a 1+1 condo unit in the Hillview area, which was fully paid for by my dad in 2019. The other 50% is owned by my uncle who is over 55 years old and plans to downgrade to a HDB flat. He wants me to buy out his share.

I’m in my early thirties, single, and earn an annual income of less than $70,000. The unit is currently in its 7th year, meaning that if I were to buy out my uncle’s share, I will need to wait another 3 years before selling it to avoid Seller’s Stamp Duty. The alternative option is to sell the unit immediately.

The condo is on a 99-year leasehold, and I’m unsure if it would be wise to hold onto the property for another 3 years. If i do buy my uncle’s share, I plan to rent it out.

Will it make more financial sense if I buy out my uncle’s share or simply sell the unit?

Many thanks in advance for your help.

Hi there,

This is a rather unique situation you are in and deciding whether to buy out your uncle’s share or sell the unit depends on several factors, including the current market conditions, potential rental income, your financial situation, and your long-term plans. But in essence, the procedure is similar to that of decoupling, where one owner purchases the shares of the other.

To make this easy to follow, we will run through several pointers and hopefully, can help you make a more informed decision:

– The cost, process, pros and cons of buying over your uncle’s shares

– Performance of 1 bedder units in District 23

– Cost of holding the property over a 3-year period

– The alternative of selling the property

Let’s begin by looking at the funds required to buy over your uncle’s shares.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How much will it cost you to buy over your uncle’s share?

The average transacted price per square foot (PSF) for units in District 23 (ranging in size from 500 to 600 sq ft) was $1,366 last year. Assuming your unit is 600 sq ft, that would approximately amount to $819,600. To simplify our calculation, let’s round it up to $820,000.

| Description | Seller (Your uncle) | Buyer (You) |

| Shares | 50% | 50% |

| Valuation | $410,000 | $410,000 |

| BSD | – | $6,900 (Payable with CPF, but will have to pay in cash first) |

| Legal fees | $3,000 | $3,000 (Payable with CPF) |

| Option and exercise fee (5%) | $20,500 (Received) | $20,500 (Payable in cash) |

| Completion fees (20%) | – | $82,000 (Payable with CPF) |

| New loan (By buyer) | – | $307,500 |

| Minimum cash required (By buyer) | – | $27,400 |

| CPF required (By buyer) | – | $85,000 |

| Cash proceeds (For seller) | $407,000 | – |

Assuming you are 32 years old and have a fixed annual income of $70,000, at an interest rate of 4.6%, the maximum loan you are eligible for is $625,804, with a 30-year tenure. This means you will be able to obtain the necessary loan of $307,500 to purchase the property.

To determine the minimum amount of cash required, we consider the 5% option and exercise fee, as well as the Buyer’s Stamp Duty (BSD). Although the BSD is payable with CPF, do note that it must be paid within 14 days from the exercise date. Typically, this timeframe is insufficient to withdraw the necessary funds from your CPF account. Therefore, the BSD must be initially paid in cash, and later on, you can write in to request a refund from CPF.

The CPF amount required is calculated based on the 20% completion fees and the legal fees. However, if your CPF funds are not enough to cover the $85,000, any shortfall must be supplemented with cash.

As we lack specific details about your financial situation, we cannot provide further advice regarding your affordability. So to go ahead, we will assume that you have the financial capacity to purchase the shares in question.

Let’s now look at the procedures involved should you decide to buy over your uncle’s shares.

Buying Over of Shares

As mentioned earlier, the process is the same as decoupling. While decoupling may seem complex, an easy way to look at it is by viewing it as a regular transaction with a buyer and seller.

The sale price or valuation of the property is determined by the shares held by the seller. In your case, the property is valued at $820,000, and as your uncle holds a 50% share, the valuation for his shares amounts to $410,000.

The cash proceeds receivable by the seller are calculated by deducting the outstanding loan and CPF used plus accrued interest from the valuation. And from there, the outstanding loan amount is divided according to the share value. As this property was fully paid in cash, your uncle will receive all the proceeds in cash after deducting the legal fees.

It’s important to note that one distinction between decoupling and a regular transaction is that in decoupling, there is never a negative sale. If the outstanding loan amount and CPF refund exceed the valuation of the seller’s share, the difference must be topped up in cash into the seller’s OA.

As for the buyer (you), you will need to secure a loan, similar to a regular transaction, unless you choose to pay for the property in full. The BSD payable is based on the valuation of the shares being purchased.

Like a typical sale and purchase, an Option to Purchase (OTP) will be issued, and the buyer is required to pay 1% as the option fee and 4% as the exercise fee. Upon completing the transaction, the buyer must pay the remaining 20% downpayment, with the entire process generally taking around three months. Having said that, the seller will be able to purchase the next property without having to pay ABSD once the buyer has exercised the OTP.

Let’s consider some pros and cons of buying your uncle’s shares.

Pros and Cons

| Pros | Cons |

| Compared to purchasing another property entirely, acquiring this property will allow you to own it without having to pay a substantial downpayment. | If you choose to purchase an HDB later on, you will need to comply with the 15-month wait-out period if you sell |

| As you’re in your early thirties, buying an HDB is not a feasible option at the moment, and purchasing a private property might be challenging given your loan quantum unless you have a considerable amount of cash/CPF funds. | To avoid incurring any Seller’s Stamp Duty (SSD), you must hold onto the property for the next three years, potentially causing you to miss out on other favourable investment opportunities should any come up. |

| With the property, you can generate rental income that can partially offset the mortgage payments. |

To determine whether or not you should buy over the property, let’s look at how the 1 bedders in District 23 have been performing.

1-Bedder Performance in District 23

| Year | D23 99y leasehold, 500-600sqft (resale) | YoY | All 99y leasehold, 500-600sqft (resale) | YoY |

| 2017 | $1,159 | – | $1,696 | – |

| 2018 | $1,332 | 14.93% | $1,495 | -11.85% |

| 2019 | $1,308 | -1.80% | $1,454 | -2.74% |

| 2020 | $1,240 | -5.20% | $1,303 | -10.39% |

| 2021 | $1,292 | 4.19% | $1,398 | 7.29% |

| 2022 | $1,366 | 5.73% | $1,512 | 8.15% |

| Annualised | – | 0.51% | – | 0.23% |

As there were no resale transactions for units sized between 500 – 600 sq ft in D23 before 2017, we only have 4 years of data to look back on which may not provide the most accurate depiction.

| Year | All 99-year leasehold, 500-600 sq ft (resale) | YoY |

| 2012 | $1,816 | – |

| 2013 | $1,895 | 4.35% |

| 2014 | $1,524 | -19.58% |

| 2015 | $1,511 | -0.85% |

| 2016 | $2,044 | 35.27% |

| 2017 | $1,696 | -17.03% |

| 2018 | $1,495 | -11.85% |

| 2019 | $1,454 | -2.74% |

| 2020 | $1,303 | -10.39% |

| 2021 | $1,398 | 7.29% |

| 2022 | $1,512 | 8.15% |

| Annualised | – | -1.82% |

If we were to look at the performance of all 99-year leasehold units sized between 500 – 600 sq ft over the last 10 years, the annualised growth rate is at -1.82%. Although there are years of growth, the majority of the years have a negative growth rate.

In general, 1-bedroom units typically attract a narrower buyer pool, including investors, singles, or couples, due to factors such as size and affordability. Furthermore, if a development consists predominantly of smaller units like 1 and 2 bedders, there may be a higher proportion of units owned by investors, which raises some concerns.

Investors, being profit-driven, are more inclined to sell a property at a loss if they find a better opportunity elsewhere. On the other hand, homeowners would generally hold for as long as possible to avoid selling at a loss unless they have no alternative.

However, this is not to say that all 1-bedroom units are destined to incur losses. The outcome still relies on the specific characteristics of each individual development.

Let’s now look at the costs involved to hold the property for the next 3 years.

Costs involved in holding the property

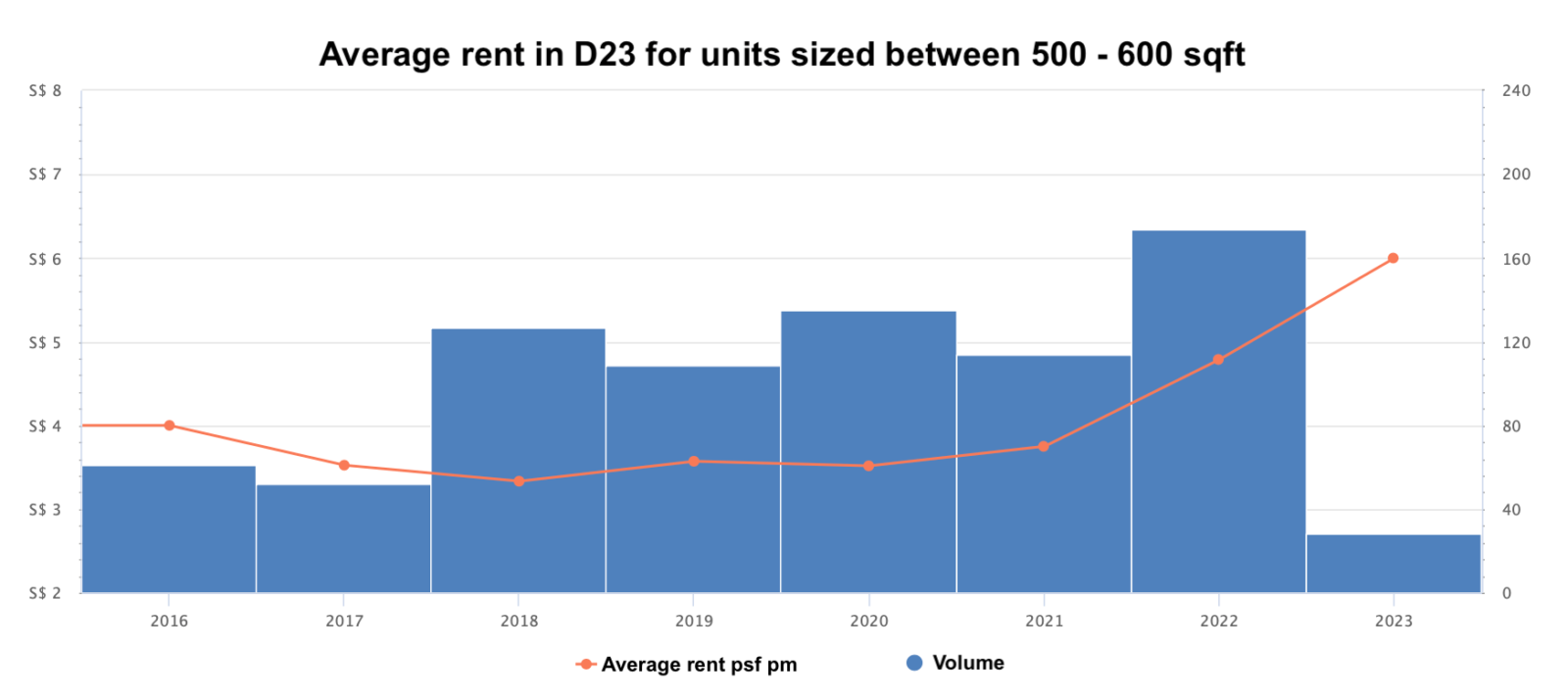

From January 2023 to date, the average rent psf for units sized between 500 – 600 sq ft in D23 is at $6. Assuming the unit is 600 sq ft, this would amount to an average rent of $3,600 per month. To keep things simple, we will presume this to be the rental rate in the calculation. Based on the property price of $820,000, this will give you a rental yield of 5.3%, which is above average.

| Description | Amount |

| BSD | $6,900 |

| Interest expense (Assuming a loan of $307,500 with a 4.6% interest rate and a 30-year tenure) | $41,432 |

| Property tax | $18,720 |

| Maintenance fees (Assuming $200/month) | $7,200 |

| Rental income (Assuming $3,600 a month and no vacancy period) | $129,600 |

| Agency fees (Payable once every 2 years) | $7,776 |

| Total profits | $47,572 |

By renting out the unit at $3,600 per month, you will make an estimated profit of $47,572 over a 3-year period.

Upon observing the above graph, it becomes evident that the rental rates for 1-bedroom units in D23 have only recently reached these levels. Between 2016 and 2020, the average rental psf ranged from $3.33 to $4. Now, let’s examine the potential expenses and profits if the rental rates were to decrease in the upcoming 3 years.

| Average psf | Average monthly rent | Rental yield based on price of $820K | Total rental income over 3 years | Costs over 3 years | Profits over 3 years |

| $3.50 | $2,100 | 3.10% | $75,600 | $69,140 | $6,460 |

| $4 | $2,400 | 3.50% | $86,400 | $71,084 | $15,316 |

| $4.50 | $2,700 | 4% | $97,200 | $73,604 | $23,596 |

| $5 | $3,000 | 4.40% | $108,000 | $76,412 | $31,588 |

| $5.50 | $3,300 | 4.80% | $118,800 | $79,220 | $39,580 |

Even in the scenario of rental rates decreasing, you will still generate a profit, although the extent of it may vary. However, please be aware that this analysis does not account for capital appreciation (we will address that shortly).

Now let’s explore the alternative option which is to sell the property.

Selling the Property

As previously mentioned, since the property has been fully paid for in cash, all proceeds will be in cash as well. Assuming a sale price of $820,000, the cash proceeds after deducting legal fees amount to $817,000. With an equal split between you and your uncle, each of you will receive $408,500.

As we lack information on your exact CPF funds, we will assume the same as in our earlier calculation, where you have at least $83,000 (CPF required to decouple).

Your affordability after selling the house:

| Description | Amount |

| Maximum loan based on the age of 32 and a fixed annual income of $70K, with a 4.6% interest | $625,804 |

| CPF funds | $83,000 |

| Cash | $408,500 |

| Total loan + CPF + cash | $1,117,304 |

| BSD based on $1,117,304 | $29,292 |

| Estimated affordability | $1,088,012 |

With a budget of $1M, these are some younger 2 bedders with decent rental yields that fall within your affordability:

| Project | Tenure | Completion year | District | Unit type | Size (sqft) | Asking price | Average 2 bedder rent (Q2 2023) | Rental yield |

| Sol Acres | 99 years | 2019 | 23 | 2b2b | 732 | $999,999 | $3,820 | 4.6% |

| Symphony Suites | 99 years | 2019 | 27 | 2b2b | 689 | $900,000 | $3,331 | 4.4% |

| Kingsford Waterbay | 99 years | 2018 | 19 | 2b2b | 689 | $948,555 | $3,704 | 4.7% |

Do note that these particular developments are selected solely because they meet the criteria of a 2-bedroom unit within your budget. You should definitely do more research to find out if these properties are suitable for an investment.

Let’s look at the cost involved should you buy a unit at Sol Acres.

From May till date, there have been 38 2-bedroom transactions in Sol Acres with an average price of $974,267. We will assume this as the purchase price.

| Description | Amount |

| BSD | $23,828 |

| Interest expense (Assuming a loan of $482,767 with a 4.6% interest rate and a 30-year tenure) | $65,047 |

| Property tax | $20,505 |

| Maintenance fees (Assuming $250/month) | $9,000 |

| Rental income (Assuming $3,820 a month and no vacancy period) | $137,520 |

| Agency fees (Payable once every 2 years) | $8,252 |

| Total profits | $10,888 |

Due to the higher loan amount, the interest expenses have also increased. Additionally, purchasing the entire property instead of just 50% results in a higher BSD, so these factors influence the potential profits you may make. Opting to sell your existing property to buy a new one (rather than acquiring your uncle’s share) would yield lower profits over the 3-year period.

It’s important to note that we haven’t considered capital appreciation yet. Let’s explore that aspect now.

Comparing The 2 Options

We’ve previously highlighted the performance of 1-bedders in D23 to be rather subpar. However, it’s difficult to compare between two options if we use two different appreciation rates. The reason is that we’re trying to isolate the financial outcomes based on different strategies here. As such, it’s best to assume the same appreciation rate for both scenarios. By doing so, it limits our comparison to just strategy.

To calculate the appreciation rate, we’ll use the Property Price Index over the past 10 years:

| Year | Property Price Index (PPI) of Residential Properties | YoY |

| 2012 | 151.5 | – |

| 2013 | 153.2 | 1.1 |

| 2014 | 147.0 | -4 |

| 2015 | 141.6 | -3.7 |

| 2016 | 137.2 | -3.1 |

| 2017 | 138.7 | 1.1 |

| 2018 | 149.6 | 7.9 |

| 2019 | 153.6 | 2.7 |

| 2020 | 157.0 | 2.2 |

| 2021 | 173.6 | 10.6 |

| 2022 | 188.6 | 8.6 |

| Annualised | – | 2.21% |

We will do a simple 3-year projection for the 2 options, buying over your uncle’s share of the existing property and selling the existing property to buy another property, and assuming a similar growth rate of 2.21%.

Buying over the existing property:

| Time period | Property price | Capital appreciation |

| Starting point | $820,000 | $0 |

| Year 1 | $838,122 | $18,122 |

| Year 2 | $856,644 | $36,644 |

| Year 3 | $875,576 | $55,576 |

Total profits if you were to buy over your uncle’s share of the property and rent it out for 3 years: $47,572 + $55,576 = $103,148

Selling the existing property and purchasing another unit:

| Time period | Property price | Capital appreciation |

| Starting point | $974,267 | $0 |

| Year 1 | $995,798 | $21,531 |

| Year 2 | $1,017,805 | $43,538 |

| Year 3 | $1,040,299 | $66,032 |

Total profits if you were to sell the current property and buy another property: $10,888 + $66,032 = $76,920

Notice that selling and then buying a higher-priced property yields a lower return.

Why is that so?

As mentioned, the higher interest rate expense due to the larger loan is the main reason for your reduced profit. As such, it would seem that simply buying over your uncle’s share here is better than selling and investing in another condo using a larger loan.

Of course, this was never the de facto strategy and it wasn’t something you’ve brought out in your question. The easiest way to invest your money once you’ve sold the unit is to put them in stocks and shares (preferably highly-diversified, of course), which brings us to our next comparison.

Alternative Option – Investments outside of property

Given your plan to buy over the property with the intention of renting it out, we assume it serves more as an investment vehicle rather than for personal use. Hence, an alternative worth considering is selling the property and utilising the proceeds in different investment channels like bonds or shares, instead of purchasing another property.

This approach offers certain advantages, including cost reduction and the avoidance of tenant management hassles.

Let’s make an assumption and project a 7% ROI on this investment. This figure is derived from the long-term gains in the S&P500.

| Time period | Investment amount | Gains |

| Starting point | $408,500 | $0 |

| Year 1 | $437,095 | $28,595 |

| Year 2 | $467,692 | $59,192 |

| Year 3 | $500,430 | $91,930 |

Of course, depending on your risk appetite and the market conditions, the potential gains will vary.

What Should You Do?

Here’s a summary of the profit based on the 3 different scenarios

Scenario #1 – Buy out your uncle’s share nets you a profit of $103,148. You’ll continue to rent the home.

Scenario #2 – Sell the unit and buy your own property to rent out. Here, your profit is estimated to be $76,920.

Scenario #3 – Sell the unit and invest the cash in other investments such as stocks and shares to yield a 7% return annually. This results in a profit of $91,930 over the same period of 3 years.

Based on the calculations, it is evident that buying over your uncle’s share would yield a slightly higher profit than selling and purchasing another property, assuming both properties appreciate at a similar rate. Furthermore, considering the potential profits before taking appreciation into account, the former option also generates higher returns due to lower BSD and interest expenses.

While historical data suggests that 1-bedroom units may not be the best-performing unit type, their performance ultimately depends on individual projects. As we do not have information about the specific project you are holding, we cannot provide further advice on its performance. However, you mentioned that the unit is now 7 years old which is still relatively young, it’s unlikely that prices will drop drastically within a short span of 3 years.

Considering these factors, buying over your uncle’s shares may be a more favourable option. You can immediately benefit from rental yield and continue to rent out the unit during the decoupling process, saving time compared to selling and searching for another property to purchase. Additionally, the costs involved are lower. Although the potential capital appreciation might not match that of a 2-bedroom unit, the lower costs and rental income could potentially compensate for it.

That said, it’s also here that we must highlight that these calculations were done based on a relatively short timeframe. Depending on your plans to hold the property, the outcome could also change. For example, moving from the Hillview area to one with possible higher growth in the future, where a longer-term hold could mean more in terms of capital appreciation.

You may also consider exploring alternative investment paths apart from real estate, which would involve lower costs and eliminate the hassle of managing tenants, which can be bothersome, especially if you encounter difficult tenants. With a 7% ROI, the returns over a 3-year period are only slightly lower compared to buying over the shares from your uncle and renting out the property.

Given that the disparity in potential profits between these two options is not substantial, the choice of investment ultimately depends on your personal preference and the type of investment you would prefer to hold.

Holding on to the property could mean you have the ability to move into the home if you ever need a place to stay without having to hunt for a home. This is a huge benefit since buying a home can be quite a hassle unless you find that the condo doesn’t meet your expectations.

Selling the unit and buying shares may also seem like a good idea at first, however, for a 7% return, it’s likely that you’d be holding onto riskier assets.

This means the investment should be more for the long-term – if you plan to liquidate in 3 years, the market may have crashed and you’ll be stuck with the dilemma of holding on to your shares. On the other hand, we can expect property prices to be more stable given the multiple cooling measures in place.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

0 Comments