I Had To Evict A Troublesome Tenant: Here’s Why It’s So Important To Screen Your Tenants

March 11, 2023

If you’re an experienced landlord, you’d know that sometimes it isn’t always about the highest rent that you can get, but getting a suitable tenant that’s fuss-free.

After all, what’s the point of having more money, but more headaches and stress?

So even though rental rates in the Singapore property market may be at an all-time high, and it’s easy to aspire to get as much monthly rent as possible, you really need to still screen your tenants carefully. Don’t assume desperate tenants are also responsible tenants. We can’t explain it, but there are people who will still break the rules and trash a rental unit; even if their next best alternative is going to be an overpriced hotel room. This week we spoke to a realtor, who had a tenant with no apparent fear of consequences… and what it was like to evict her:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A seemingly ordinary tenant, in a pricey rental market

Our Realtor, J, was out hunting for a tenant on behalf of his client. This was for a three-bedroom rental unit, priced at $4,800 per month.

J soon got an inquiry from a lady, whom we’ll just refer to as “the tenant” from this point. At first, J spotted no red flags: the questions were as expected, the tenant seemed legitimate, and J proceeded to discuss details such as her intended move-in date, and to organise a viewing.

J says:

“During the viewing, she mentioned she didn’t need anything to be done…she explained that she got divorced and was looking for a place to stay possibly for the next few years.

Her kids were in Nanyang Poly, which was near the unit. She only wanted to sign a one-year lease with the option to extend.”

So far it seemed this would be quick and easy leasing; and the tenant even claimed she would “offer $100 more than the highest offer,” to clinch the deal.

J then proceeded to draft the usual Letter Of Intent (LOI). As the unit was in good order and had been professionally cleaned, there were no unusual issues involved.

Problems began from the initial deposit

It’s never a good sign when problems begin this early, and the tenant started acting up as soon as it came time to pay the first deposit.

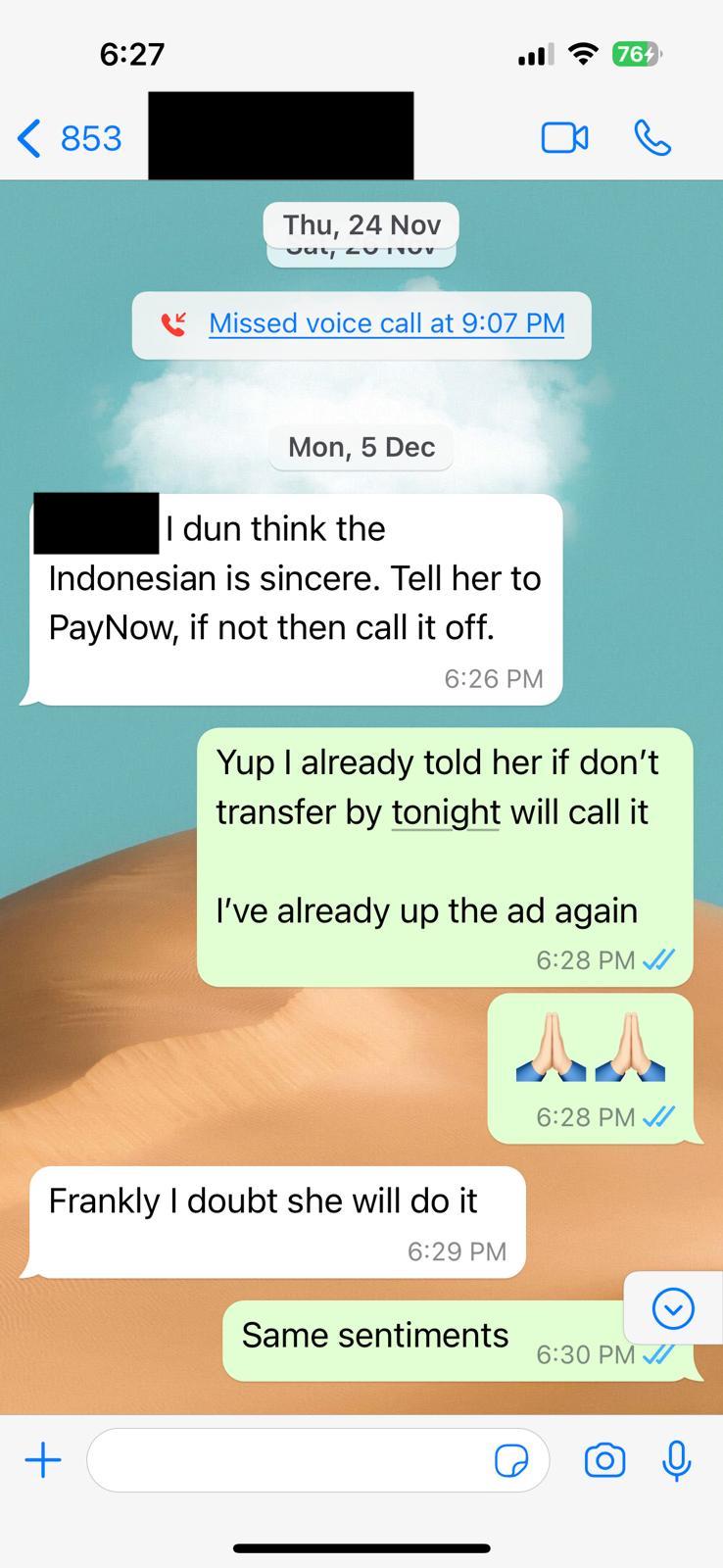

Usually, when the LOI is signed, the tenant will also provide a good-faith deposit. This was one month of the rent. J says:

“When we wanted her to transfer the good faith deposit, she delayed it for one week, stating an excuse that she was old and a bit slow. The funds finally came but not from her – she claimed the source to her daughter’s PayNow account.

The second issue came when paying for the first month’s deposit and the stamp duty. She delayed it till the last day, which was not right as the first month’s rent is payable before moving in, or when the Tenancy Agreement is signed; whichever is earlier.”

J says he had to pursue the tenant for these costs for two to three weeks, and the tenant even had the audacity to compare J to a “loan shark.”

A warning for the landlord

Based on her antics, J spoke to the landlord about the tenant’s behaviour. While he didn’t want to worry them too much, he felt they should be warned, as this tenant hadn’t shown any red flags during the initial process.

More from Stacked

SERS: What Is It, Where Has It Happened, And What Are Your Odds?

The Selective En-Bloc Redevelopment Scheme (SERS) is often considered the next big “HDB lottery winner”, next to a central region…

True enough, when rent was due on the first month, the landlord received nothing.

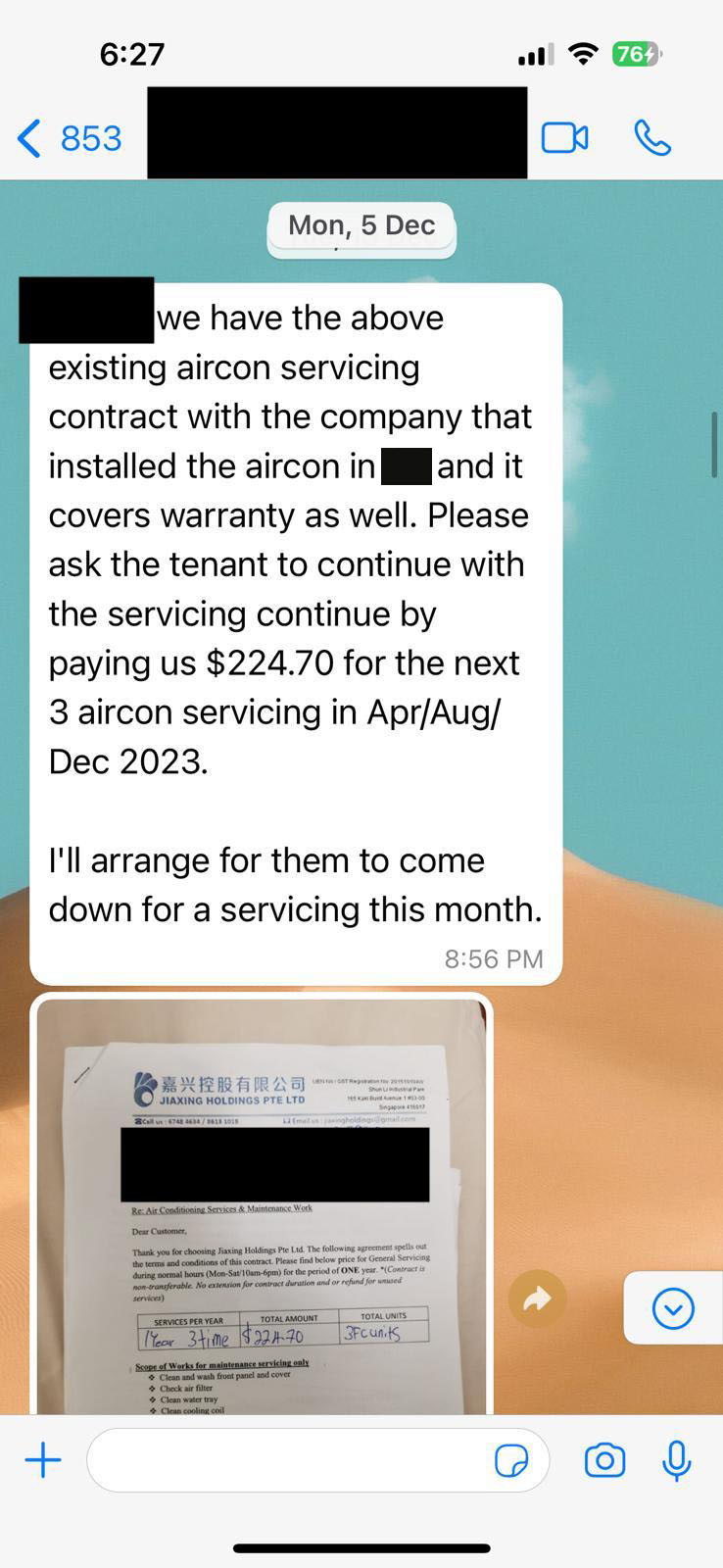

Furthermore, the tenant had not taken over the air-conditioner servicing as was agreed*. J says the service package was even subsidised and came with a warranty as the air-con was new; but still, she hadn’t paid back the landlord for it.

The tenant had to be chased for the rent and air-con servicing for a few days, before finally sending a screenshot of a telegraph transfer. But his sum of money also never arrived, and payment was eventually made through her daughter’s PayNow account again.

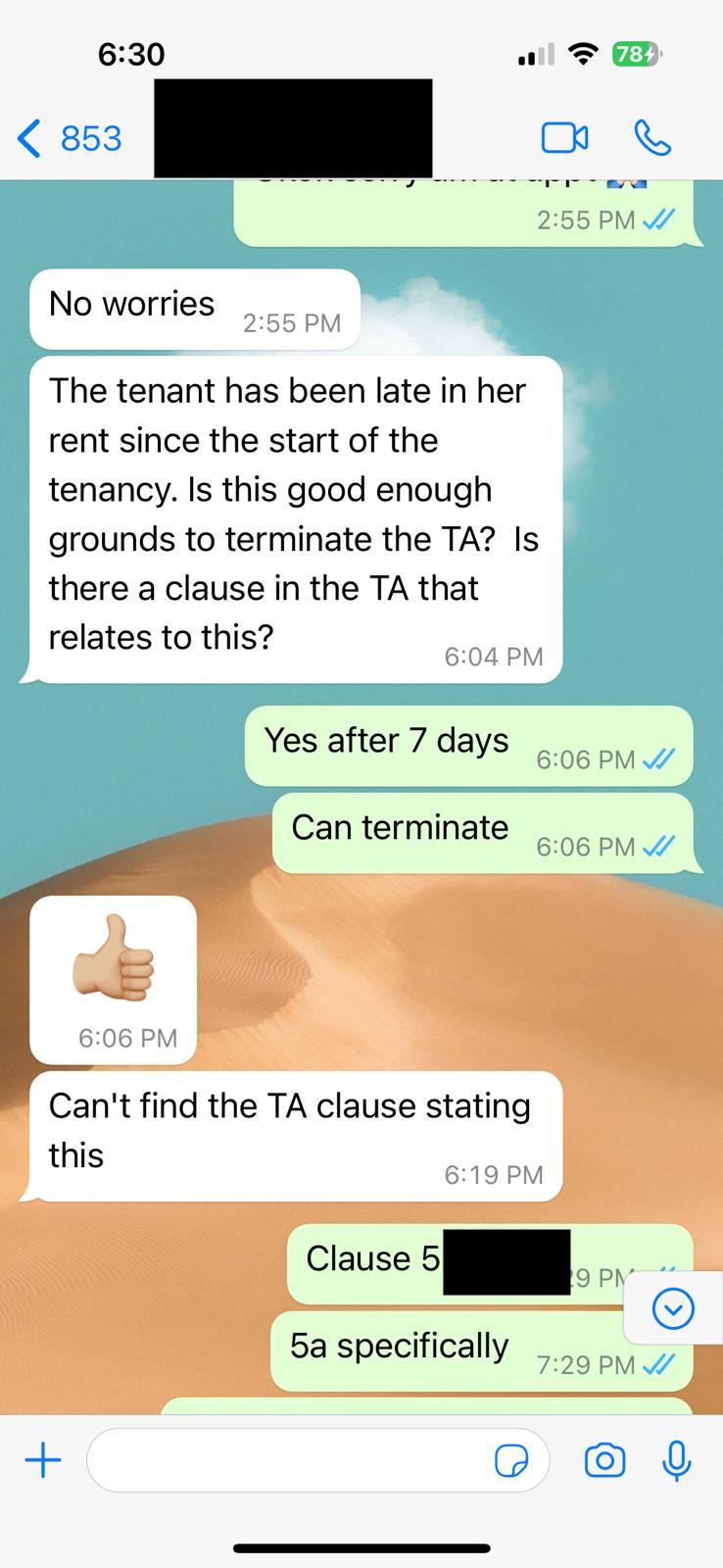

As it was less than seven days late, the landlord decided to be nice and didn’t charge interest.

A second missed payment

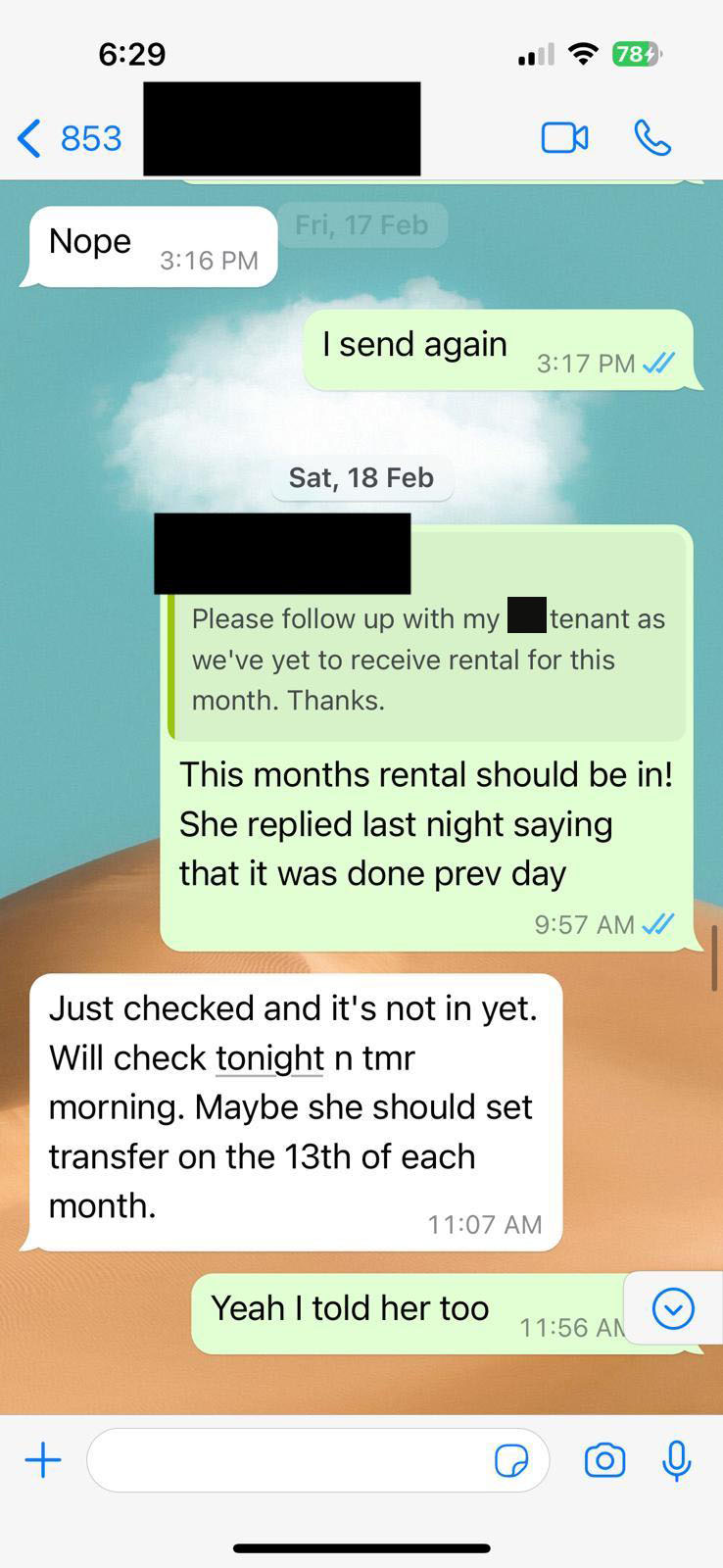

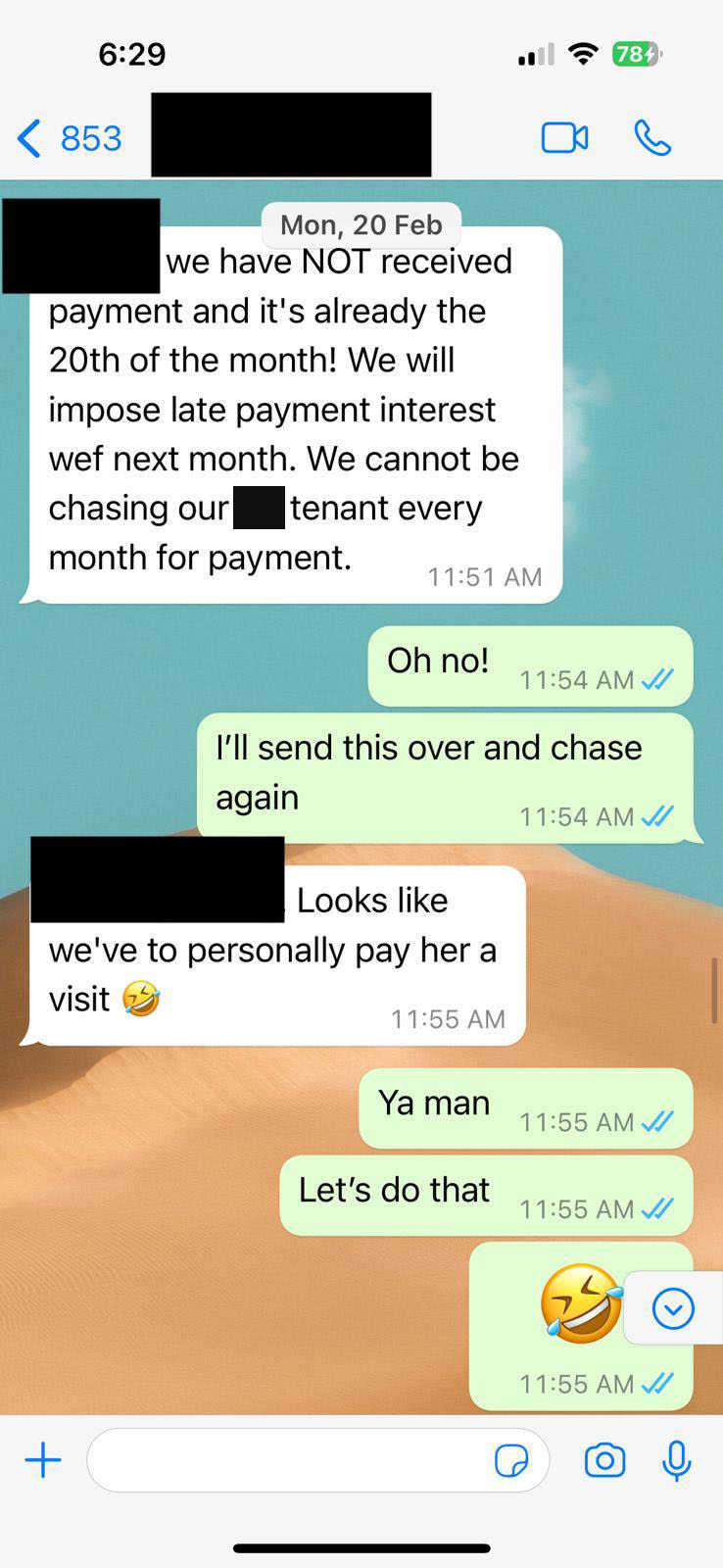

In what J says was the last straw, the tenant failed to pay the rent again in the second month.

“The landlord sent a notice that payment was late,” J says, “But she replied that she was in the hospital. Then the landlord went down to pay her a visit, but she did not open the door.”

That day, the tenant showed “proof of payment” having been made via telegraphic transfer; but the supposed transfer was made more than seven days ago.

The landlord then called the relevant bank and found out such transfers normally take at most a single working day. The bank informed the landlord that, if the funds were still not received, it either meant the account number was wrong, or that there were no funds in the account.

J was then asked to help issue a formal notice of eviction.

The tenant took it surprisingly well, saying the message was noted; and even offered to transfer $1,000 to the landlord as a deposit, in lieu of the month’s missed payment.

The day of eviction

J advised the landlord to send an official lease termination notice. This would be on the grounds of an unfulfilled contract; missed or late rental payments fall under this definition.

As part of the eviction process, J also advised the landlord to make a police report, as well as inform the management that they were about to repossess the unit.

While there was no difficulty getting in, they found by that point the tenant had packed up and left; and there was no further communication from them. It’s unlikely that anything else can be done at this point, barring the confiscation of the tenant’s deposit.

J says from this experience that sometimes, we need to be careful of “too good to be true” rental offers. It’s not always the best tenants that seem to offer the most; and sometimes, the red flags may only show after the initial encounter.

For more stories of the Singapore property market, as well as in-depth looks at new and resale properties alike, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Homeowner Stories

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

Homeowner Stories What I Only Learned After My First Year Of Homeownership In Singapore

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K

Latest Posts

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

0 Comments