How To Properly Plan Your Timeline When Upgrading To A Resale Condo (Move Once And Avoid ABSD)

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

One of the main hassles of upgrading that many people don’t think about is the timeline. From getting the sale proceeds of your flat, to being able to move in on the right date, there’s always the risk that you could end up renting – and it really doesn’t help that a minimum lease is three months. So, in cases of upgrading to a resale condo smoothly, it is very very important to plan your timeline thoroughly. The ultimate goal is to upgrade without going through the hassle and moving only once. So in this article, we explain the exact key dates you need to know and how to go about doing it:

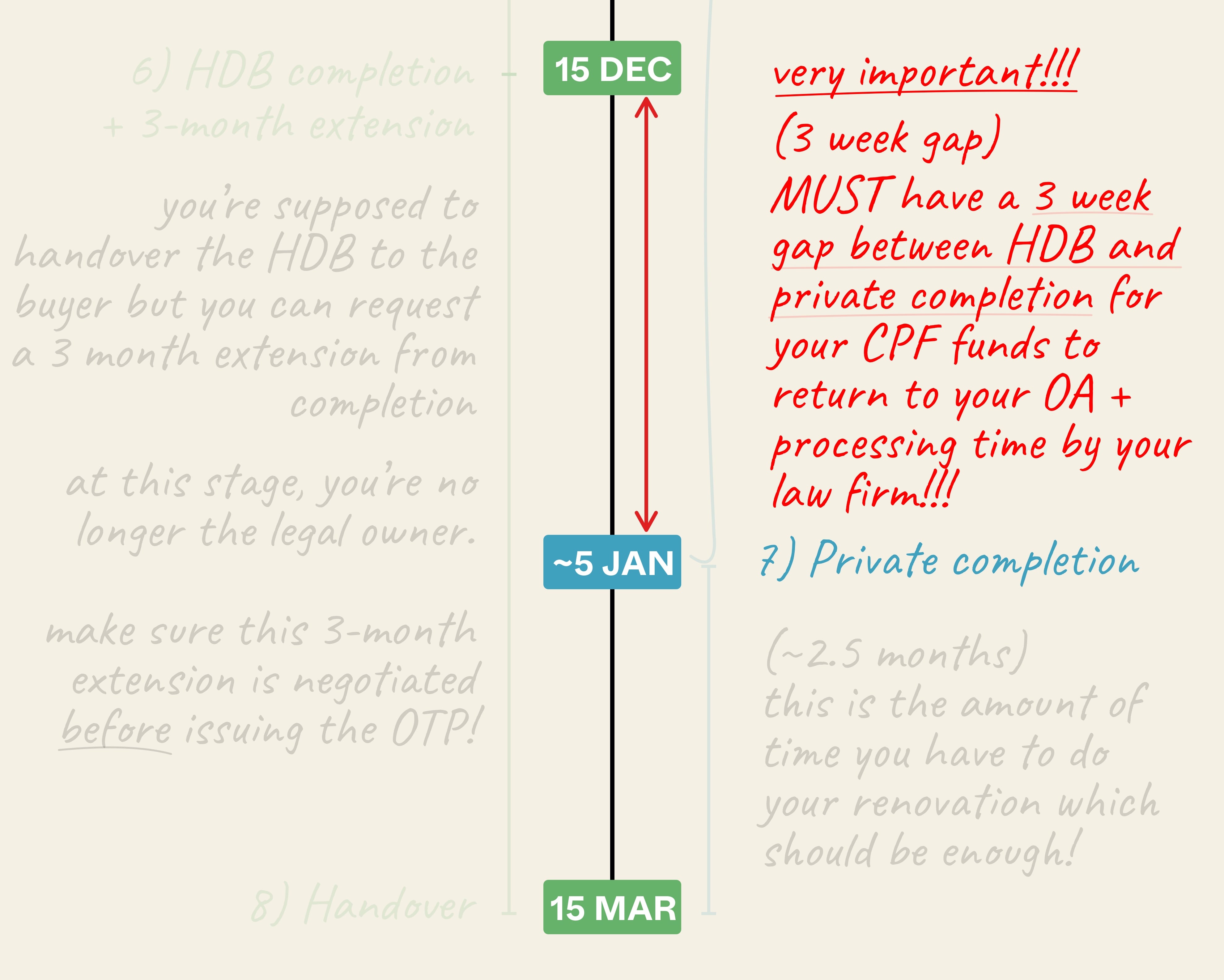

Timeline for moving from HDB to a condo

Key points in the timeline:

- Prior to timeline: Begin marketing your property, while also looking for a new home.

- Negotiate an extension of three months for the Date of Vacant Possession: This is to ensure you hand over your flat only on 15th December

- Give the OTP for your flat on 1st September, and secure the OTP for your condo on 16th September

- The OTP for your flat is exercised on 22nd September, but the OTP for your condo is exercised only on 30th September: Because the OTP for the condo is exercised after the flat, you won’t have to pay the Additional Buyers Stamp Duty (ABSD)

- The cash proceeds from your HDB flat arrive on 15th December. However, your CPF funds, plus the time taken for your law firm to draw down the cash, will take longer; plan for this to be completed around 5th January

- The typical OTP will stretch to 23rd December, but you should negotiate to stretch this to 5th January: See below for details

- From 5th January to 15th March, you can reside in your flat while your condo is being renovated

What allows this to work?

- Marketing the flat and finding a new home should happen concurrently

- The OTP for the condo must be exercised after the OTP for the flat

- The buyer agrees to an extension of stay

- There must be a three-week gap between the sale and purchase

- Most or all renovations must be doable within two months

1. Marketing the flat and finding a new home should happen concurrently

You can’t predict how long it takes to find a buyer for your flat; this can be anywhere from a few days, to several months. As such, it’s important to start marketing your flat early. A good agent will be able to advise you on the probable length of time based on on-the-ground sentiment, so use that to your advantage.

You also want to shortlist your desired condos at the same time. This means, for example, that your realtor is conducting viewings for your flat, at the same time that you’re viewing condos.

If you wait to sign the OTP on your flat before looking, your buying process can be quite rushed (it’s best to avoid this, and you can be rushed into decisions you’ll regret).

2. The OTP for the condo must be exercised after the OTP for the flat

The Option To Purchase (OTP) is secured with a non-refundable deposit. Once signed, buyers have a certain length of time to exercise the Option and buy, before it expires.

The OTP for HDB flats is 21 days, whereas the OTP for private properties is usually 14 days.

For upgraders, you’ll want to exercise the OTP for your condo after your buyer exercises the OTP for your flat. This is because, once your flat is sold, you won’t count as owning two properties when you buy the condo. This removes the need to pay ABSD.

Property Market CommentaryABSD remission in Singapore – Everything you need to know

by Druce TeoIn the example above, we assume your flat buyer secures the OTP on 1st September, and exercises the OTP on the last day (22nd September).

Assuming you secure the OTP for your condo on 16th September, you have a comfortable amount of time (up till 30th September) to exercise the OTP on your condo.

*The OTP for private properties can be negotiated, and extended for up to 12 weeks with URA approval. Your realtor can help you negotiate this if needed, and your conveyancing firm will need to review the OTP paperwork.

3. The buyer agrees to an extension of stay

Once your flat buyer exercises the OTP, you need to wait for HDB to confirm the registration (an SMS will be sent to you and your buyer). At present, this takes up to four weeks.

After confirmation, there’s a usual waiting time of about eight weeks, before the transaction is completed. This is when your flat buyer should be able to move in.

In the example above, where the registration is confirmed on 20th October, this would mean your flat buyer can move in by 15th December. However, this is too soon for you to complete your condo transaction, finish renovations, etc.

As such, your realtor needs to help you negotiate an extension of stay, as part of the deal to buy your flat. In our example above, an extension is negotiated, allowing you to stay till 15th March.

Different buyers will respond in various ways; the best-case scenario is that your flat buyer doesn’t mind at all, and just lets you stay. It’s more likely, however, that your flat buyer will want some benefits for this (e.g., a lower price, or you agree to do some extra maintenance).

4. There must be a three-week gap between the sale and purchase

In many (not all) cases of private property transactions, the time period is 14 days to exercise the OTP, and around another 12 weeks before you complete the transaction.

(The timeline is quite flexible, and can be negotiated).

In our above example, the would mean the condo transaction is completed on 23rd December.

However, this is too soon, and we’d have to negotiate for completion on 5th January instead. This is to create an important three-week gap, between the sale of the flat and the purchase of the condo.

This is because you’d receive only the cash portion from your flat sale on the 15th of December (when the sale of your flat is complete). The money refunded to your CPF*, upon selling the flat, takes about one week to enter your CPF Ordinary Account.

After this, the conveyancing firm takes another week to draw down the cash for the transaction. All in, most conveyancing firms will insist on an allowance of three weeks between the two transactions, or they won’t take the case.

As such, the upgrader would move in on the 5th of January.

*If you don’t understand why some of the proceeds are in cash and some go back to CPF, read this article on the required CPF refund first.

5. Most or all renovations must be doable within two months

Between the 5th of January to 15th March, your contractor can start renovating your condo.

To be frank, most renovation works end up taking a bit longer than two months; especially given the Covid-19 situation. However, you can tell the contractor to do the most important renovations first. So even if all the works are not yet complete, you can at least move in by the time your flat buyer arrives.

All of this takes close co-ordination between different parties

If this works it can be a huge money saver, as you don’t need to rent, or pay for temporary storage. You also have to move just once, thus saving on the movers’ costs (not to mention, a ton of hassle).

However, you must be prepared for a lot of back-and-forth conversations, as well as occasional objections. For example, one common issue is the flat buyer not wanting to move in later, as they have renovations of their own planned.

Likewise, the people selling you their condo may also want an extension from you, as they’re in the same scenario. So for this approach, we suggest using an experienced real estate agent, rather than taking the DIY route.

For more on transaction tips and methods in the Singapore private property market, follow us on Stacked. If you need help with your home selling, you can do so here. We’ll also provide you with in-depth reviews of new and resale condos alike, to help you shortlist a new home.

you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Advice

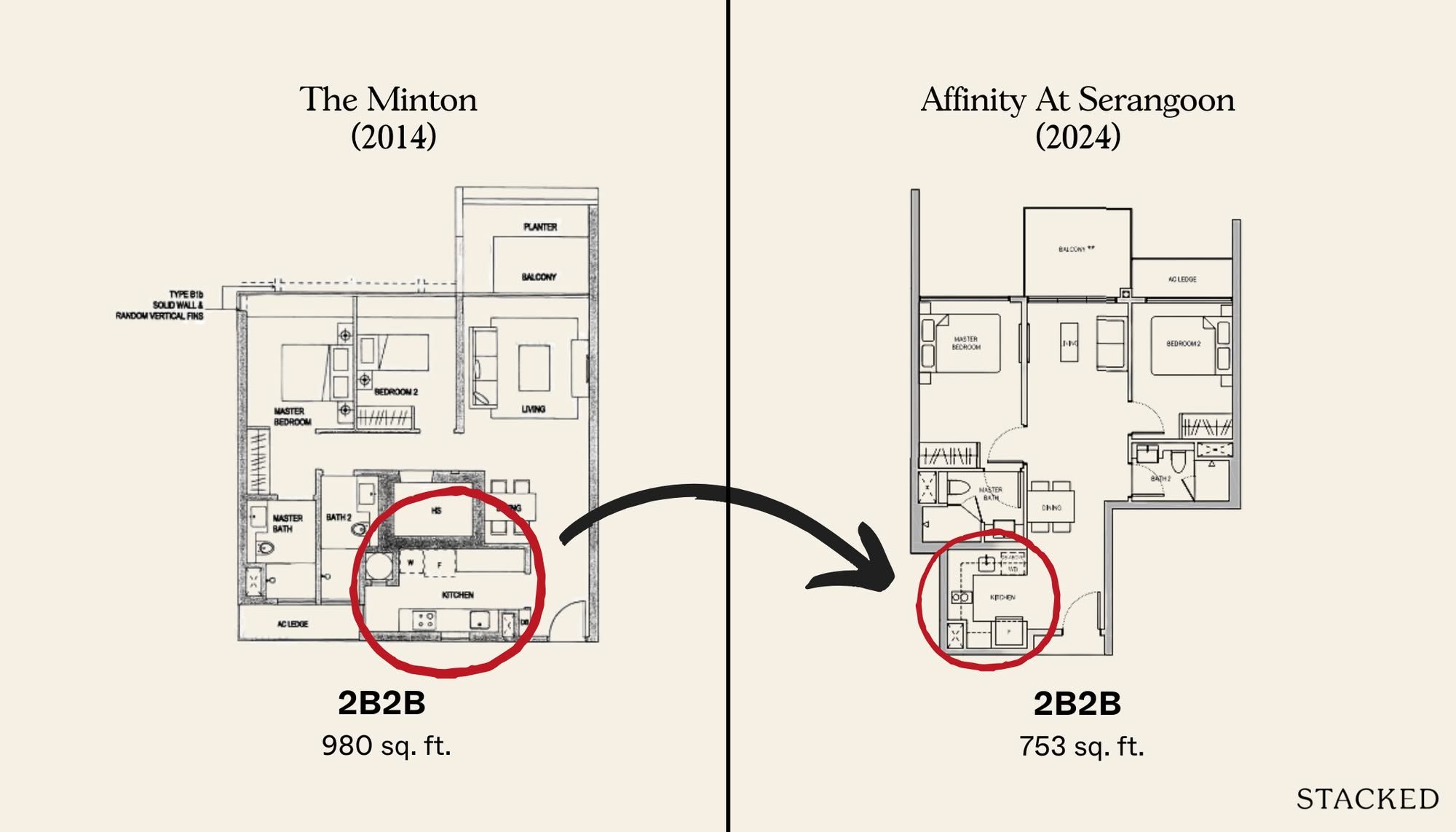

Property Advice The Ideal Size for Each Room of Your Condo to Actually Feel Liveable Revealed

Property Advice 5 Mistakes You Make When Comparing Condo Prices – Your ‘Good Deal’ Might Be Hiding a Secret

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Advice Why Punggol Northshore Could Be The Next Hotspot In The HDB Resale Market

Latest Posts

Pro District 7 vs District 9: Which Prime Location Has Delivered Better Condo Value?

Overseas Property Investing 4 Hidden Risks To Avoid When Buying Property In Malaysia (A Guide For Singaporeans)

Homeowner Stories I Bought a Freehold Property in Singapore and Regret It — Here’s the Big Mistake I Made

Editor's Pick We Toured A Rare Part Of Singapore Where Terrace Houses Are Bigger Than The Semi-Detached Units

Singapore Property News What Buyers Overlook When Purchasing Older Condos (Until It’s Too Late)

Editor's Pick 5 Ways Housing Shapes Singapore’s National Identity

On The Market 5 Attractive Freehold Condos With Private Pools (Under $2M)

Editor's Pick Springleaf Residence Pricing Review: How It Compares To Nearby Resale And New Launches

Editor's Pick Springleaf Residence Review: A 941 Mega-Development Near The MRT From $1,995 Psf

Property Market Commentary 4 Condo Layouts And Features Buyers Are Moving Away From in 2025

Editor's Pick Summer Suites Condo Review: A Freehold Johor Bahru Condo Near The RTS Link

Pro New Launch vs Resale Condos in District 9: Which Bedroom Types Offer Better Value Today?

Editor's Pick Over 900 Units Sold in One Weekend: The Surprising Lessons From River Green, Promenade Peak & Canberra Crescent

Singapore Property News Is Property Decoupling To Avoid ABSD Now Illegal?

Editor's Pick I Visited Freehold Terraces, Semi-Ds, and Detached Homes in the East Ranging from $2.5 Million to $11 Million