10 Things Non-Rich Singaporeans Who Buy Property In Their 20s Must Know

May 20, 2022

Honest response now: how many of you immediately asked “If not rich how to buy property in my 20’s” the moment you saw this headline? That’s one of the things we’re going to talk about below. The fact is, plenty of Joe-Average, middle-income Singaporeans do buy their first flat in their 20’s; and some even start with a condo (usually with parents’ help though). For these young, non-wealthy home buyers, there could be potential painful lessons in store; which is why it’s better to read this and learn from other people’s experiences:

Table Of Contents

- 1. Remember you’re “locked-in” for a few years, and we’re not referring to the mortgage

- 2. Your workplace may change sooner than you think

- 3. Think twice about accepting your parents’ help

- 4. It often means you can’t own a car

- 5. Your biggest risk is often wiping out your savings for the down payment

- 6. You may succeed in paying off your home sooner; but consider the full price

- 7. If you buy before you’re ready and the property becomes a liability, it may not be your liability

- 8. Buy a home that you know you can afford

- 9. It’s not just about the purchase price

- 10. Renovation costs are not a must

- This isn’t to discourage younger Singaporeans from buying a home

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Remember you’re “locked-in” for a few years, and we’re not referring to the mortgage

The most common oversight, among younger homebuyers, is the effect of the Minimum Occupancy Period (MOP) for HDB property, and the Sellers Stamp Duty (SSD) for private property.

If you’re in your 20’s, odds are you’re buying your very first home. This may result in thinking only about the near-term, and not considering what might happen in the future.

For example, some decide to buy a shoebox unit as their first home – and then find out it’s too small when they want to get married, but they can’t apply for a bigger flat as they already own a private property (and if you sell within the first three years, you have to pay the SSD).

Others may buy an HDB flat, but then decide they’re going overseas for work or study. Note that only the years spent living in your flat count toward your MOP.

2. Your workplace may change sooner than you think

One of the best pieces of advice to give younger potential homeowners is, don’t buy for the life you have today.

Like the crash of Luna, what you thought would be the future can crumble in an instant.

Gone are the days when Singaporeans would get their first job, and then stay on with that employer for the next 25 to 30 years. These days, it’s common for Singaporeans to change jobs more often – and when you’re young, those job changes may be more frequent, as you feel out your career.

This can mean “proximity to the office” is more temporary than you think. The home you pick may be close to your current job, but an hour away by bus from the next one.

Or you may think proximity to an MRT station doesn’t matter, since you are currently working from home or are self-employed. This can be a problem if you end up with a nine-to-five gig later, and your Executive Condo is far from any public transport.

What we’re saying here is, unless you know for certain that things aren’t going to change in the future, it’s worth it to consider getting a home with good access to public transport – even if you feel you don’t need it right now. It also helps when you are looking to exit as it will obviously cover a bigger audience.

Remember, buying a home isn’t like buying a car. You can’t just simply change your home when it doesn’t suit your needs anymore, there are opportunity costs, selling costs, and time to take note of.

3. Think twice about accepting your parents’ help

If you decline your parents’ help, you may end up buying a home five or even 10 years later. We agree that’s painful. However, before taking money from mum and dad, consider the potential complications.

If your parents are co-owners, who makes decisions such as when to sell the property? Also, what happens if there’s an emergency, and your parents can no longer contribute to the mortgage? Would you be in a position to pick up their share of the burden?

The most dangerous arrangement is when your parents offer to sell their home, and give you the proceeds to buy a big condo – with the plan that you can all move in together.

At least half of the “how I became homeless” stories we encounter start this way. If you accept your parents’ money, and later you find you can’t live under the same roof as them – no matter how big the property is – how will they move back out?

There’s also the emotional aspect of always feeling like you owe your parents for the house; and that can suck out the joy of homeownership.

Like Susan Newman, a social psychologist and author of “Nobody’s Baby Now: Reinventing Your Adult Relationship With Your Mother and Father” said in a New York Times article: “These gifts have strings attached; it’s the way some parents control their adult children”.

4. It often means you can’t own a car

Your maximum loan repayment (for a bank loan) is capped at 55 per cent of your monthly income. This is inclusive of other loans such as car loans, and education loans. This is called the Total Debt Servicing Ratio (TDSR).

For most young, middle-income Singaporeans, buying a car will cause you to bust the TDSR. This either means coughing up a much bigger down payment or buying a smaller unit that you’re truly happy with.

To be clear, we feel it’s always better to prioritise homeownership over car ownership. But if you must have both, then at the very least try to buy your car after you’ve secured your home loan (and talk to your financial advisor, because that sounds like it could be a dangerous stretch).

Thankfully though, Singapore’s public transport is great, and the country is small enough that you can definitely get by without a car.

5. Your biggest risk is often wiping out your savings for the down payment

For most young buyers, the challenge is in the down payment. Even if you have sufficient income to meet debt ratios, such as the TDSR or HDB’s Mortgage Servicing Ratio (MSR), you cannot borrow 100 per cent of your property price.

HDB will only lend up to 85 per cent of the flat’s price or value, whichever is lower. This means you need to have the remaining 15 per cent saved up, in CPF or elsewhere.

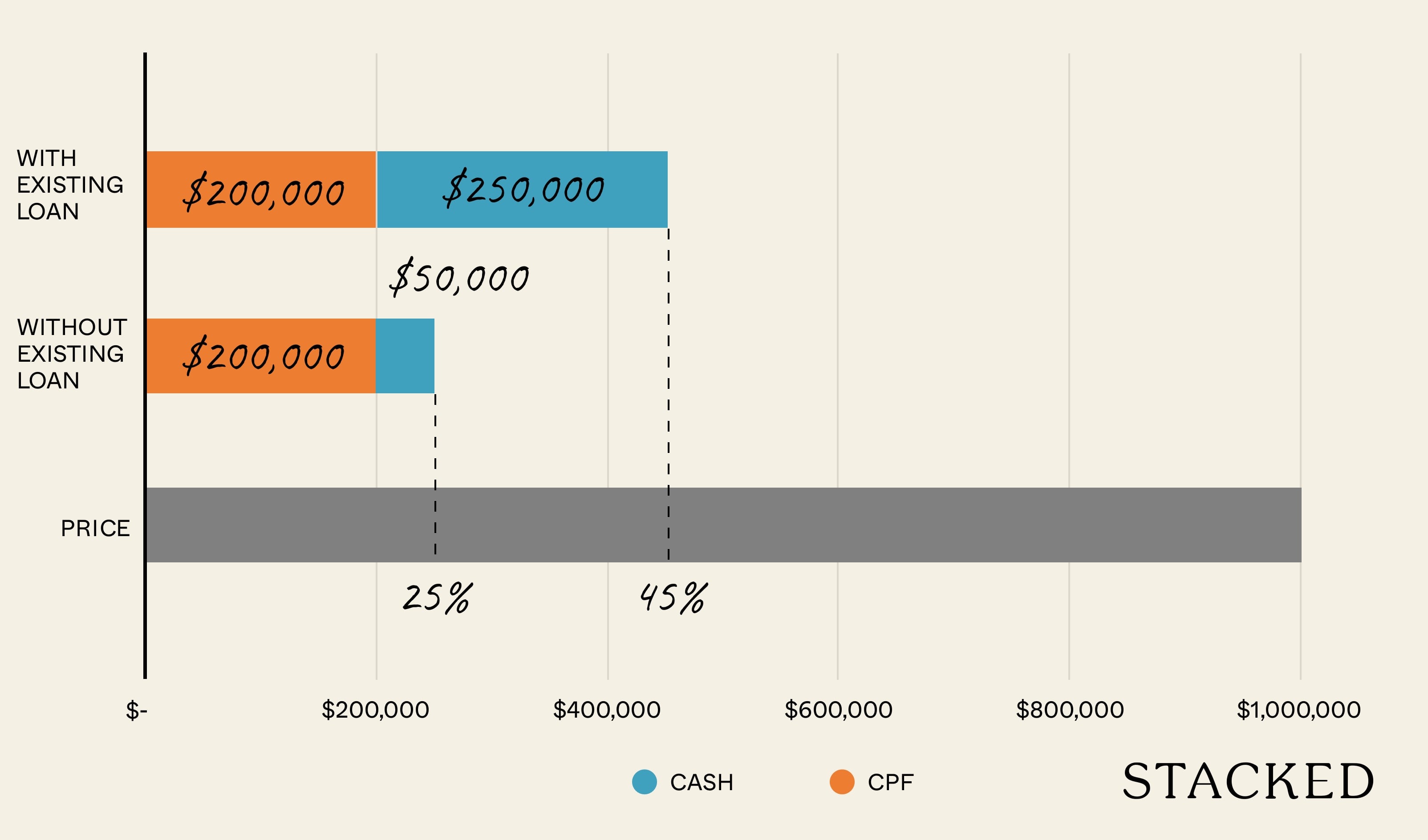

Private properties, as well as ECs, are even tougher. You need to use bank loans, and these require a minimum down payment of 25 per cent. The first five per cent has to be in cash (and no, you can’t take a loan to cover that).

The greatest danger for young buyers is that, sometimes, the down payment wipes out their entire bank account; but they insist on going ahead because they’re impatient.

We can’t overstress how dangerous this is, and it often leads to other problems like debt. When you have zero savings, your condo won’t pay for medical emergencies or even your meals – and that often leads to borrowing. It could also lead to further problems, like forcing you to make foolish decisions or undue stress.

Property AdviceShould You Rush Your Home Loan Repayment Before Interest Rates Rise?

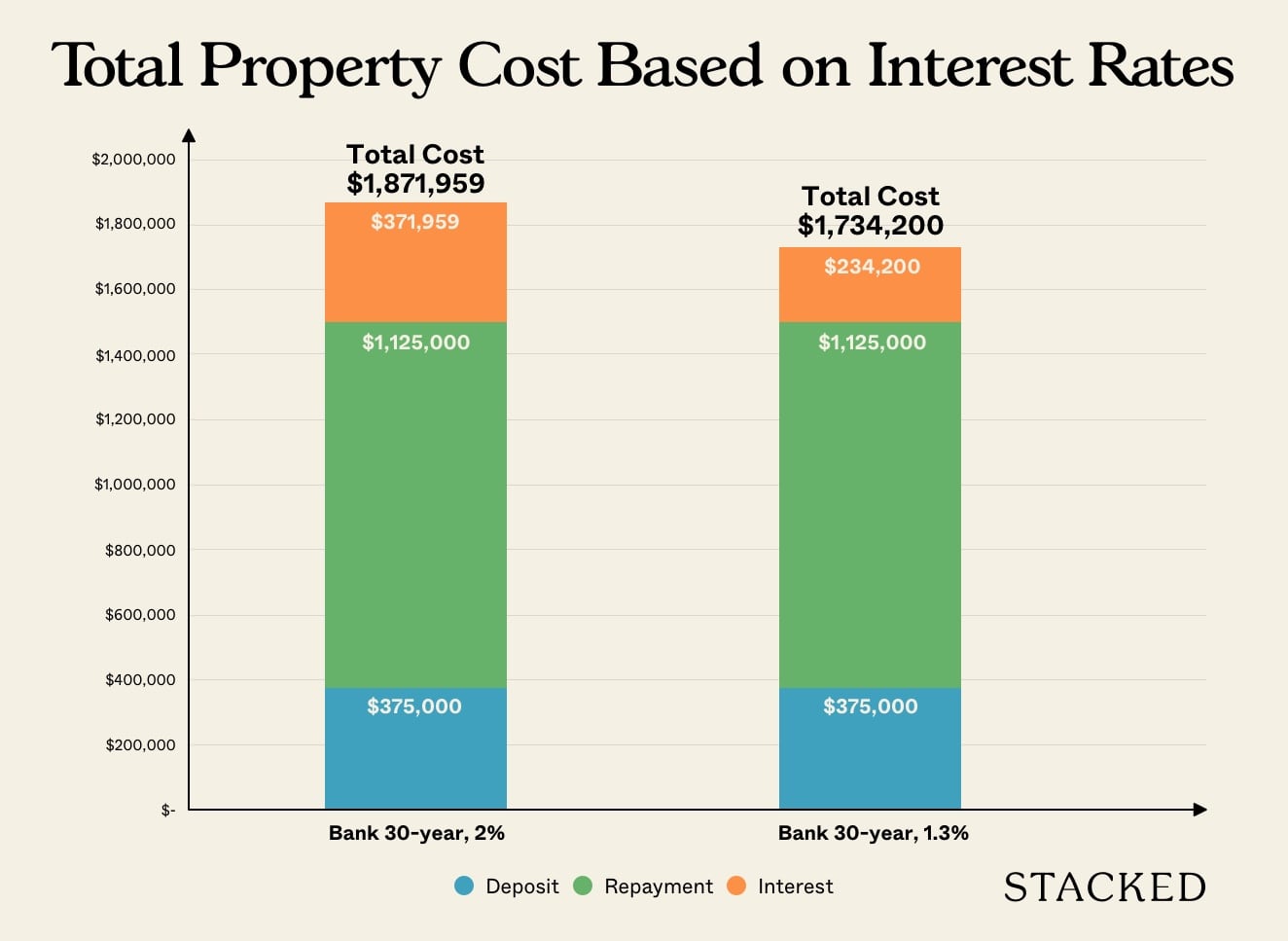

by Ryan J. Ong6. You may succeed in paying off your home sooner; but consider the full price

It’s true that, if you start paying for your home in your 20’s instead of your 30’s, you’ll be done with the mortgage sooner. However, you need to prepare to pay more than just cash.

You may not have opportunities such as gap years, backpacking, a big wedding, or a social life as active as your peers. Unless your income grows quickly, chances are your years from 20 to 35 are going to be spent on a tight budget, as you take on loan repayments and (if you bought a condo) maintenance fees.

We may have developed an unhealthy culture, where young Singaporeans are taught to worship after such sacrifices as “wisdom” or “responsibility”.

Try to look outside of this, and realise you won’t get your lost years back; even if you do manage to own a home earlier.

7. If you buy before you’re ready and the property becomes a liability, it may not be your liability

We don’t mean this in a positive way. If you buy before you’re financially ready, and something goes wrong (see point 5), you could end up unable to service the loan. In our experience, this almost always means your family has to step in. This might mean mum and dad taking cash out of their retirement fund to help you; or in some cases, even grandparents have to pitch in.

The sense of guilt can be severe when your mortgage becomes a liability to people you care about.

8. Buy a home that you know you can afford

This probably applies to everyone else, but you should know that what you can comfortably afford (in terms of stress levels, etc) is different from what the bank says you can afford.

While Singapore is already quite strict with how much you can borrow, sometimes it pays to be even more prudent with your home purchase. It’s easy to be taken in, especially when you see newer more luxurious spaces, but you shouldn’t make the assumption that you can and will always be advancing in your career and earning more.

With the economic outlook around the world not looking too great right now (plus rising interest rates), it’s best to err on the side of caution and consider not maximising your housing loan – even if you can.

9. It’s not just about the purchase price

It’s a common oversight, many younger homebuyers only think about the purchase price and forget everything else that comes after.

Do remember, that you have lawyer’s fees, stamp duty, home insurance, and the monthly mortgage to factor in. And of course, another huge chunk of change is your renovation costs.

And don’t forget for HDB you have monthly conservancy charges (this can range from $19.50 – $101 for subsidised rates), and for condos, you have monthly maintenance fees that can differ based on your unit share value.

This can run up to be quite a significant out-of-pocket cost, especially if you don’t even use the facilities at a condo.

Finally, there’s also your yearly property tax to consider.

10. Renovation costs are not a must

There’s no doubt that there is a trend right now for younger Singaporeans to do up their home, with many starting their own Instagram accounts to document the process.

It’s only easy to see that this is the “norm”, and part and parcel of buying and molding a home to your liking.

But sometimes, again it might be wise to consider just how long you would actually be staying in the home.

We’ve seen cases of younger homeowners tearing up perfectly good old flooring that just requires some touch-up, just because they prefer that industrial cement screed look. Or others that insist on redoing the kitchen, even if it is in reasonably good condition to have that classic English kitchen they’ve always dreamed of.

It might not always make sense to plow too much into renovation costs when you might outgrow the place in 5 years.

This isn’t to discourage younger Singaporeans from buying a home

Rather, the point is that you shouldn’t feel compelled to buy until you’re well and ready. If it means waiting till you’re 35, or even 40, then so be it – better that than to saddle yourself with massive liability.

The same goes for renting. Forget cliches about how renting is “helping your landlord to pay the mortgage”. By all means, aim to own your home eventually – but it’s not a “waste of money” to rent until you’re ready.

For help on homeownership and expert guidance, reach out to us on Stacked with your questions. If you’re certain you’re ready to buy, you can also check out our in-depth reviews of new and resale projects, to make an informed choice.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments