HDB Landed Terrace Houses: 5 Factors You Must Consider Before Buying One

June 28, 2021

If an HDB property is 49-years old, you’d expect nothing but depreciation. But what if it’s a landed home? This week, one of the rare HDB terrace houses in Whampoa sold for a whopping $1.268 million, making it the most expensive HDB transaction to date. That’s ignited some debate about whether or not it’s worth buying these old properties, balancing the limited lease against affordable living space. Here’s what you should know:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Wait, since when has HDB had landed property?

HDB never actually built terrace houses. Rather, these units were constructed by HDB’s predecessor, the Singapore Improvement Trust (SIT).

There are an estimated 200 units at Jalan Bahagia (Whampoa), and 84 units along Stirling Road (Queenstown). HDB “inherited” these properties, once it replaced SIT in the 1960s. Since then, HDB has not built any landed properties.

As such, these 284 units (thereabouts) are rare, with most dating back to 1972 (some go back to 1968).

How big are HDB terrace houses?

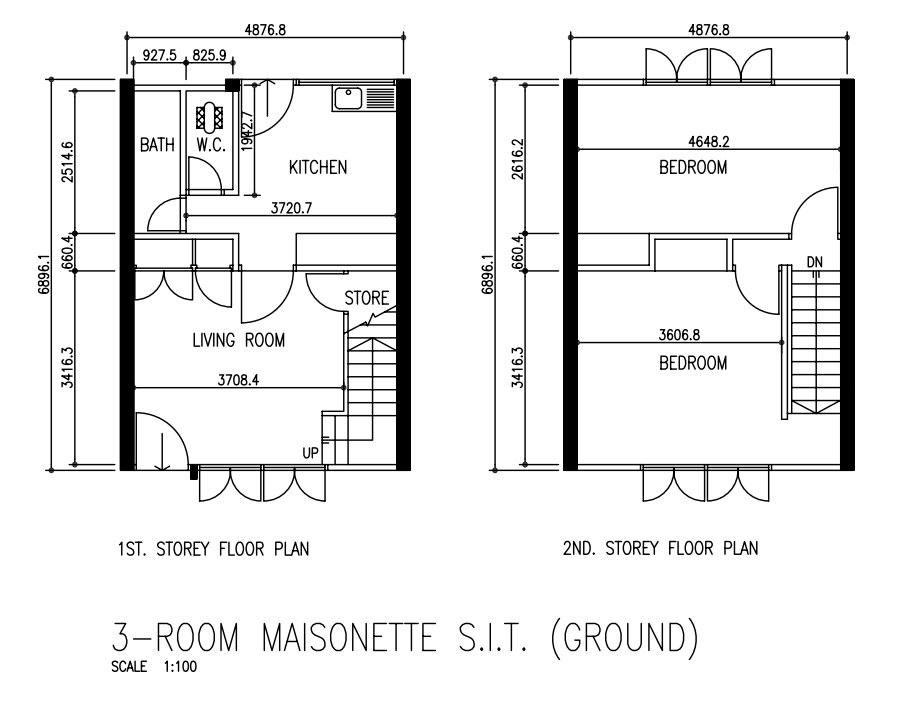

The majority of units appear to be around 78 sq.m. to 99 sq.m, and are often labelled “3-room” (but most are far larger than 3-room flats, which average 60 sq.m).

Over the years, some of these units have had additional rooms added, with one unit even exceeding 300 sq.m (this unit is believed to be the largest, and is located at Block 52 Jalan Bahagia).

The unit that transacted for $1.268 million was about 210 sq.m., and was a remodelled two-storey unit with four bedrooms.

Here’s a list of recently transacted HDB terrace units, with estimated sizes and costs:

| Date | Town | Size | Lease Start | Price |

| 2021-06 | KALLANG/WHAMPOA | 210 | 1972 | $1,268,000 |

| 2021-06 | KALLANG/WHAMPOA | 78 | 1972 | $731,200 |

| 2021-06 | KALLANG/WHAMPOA | 126 | 1972 | $920,000 |

| 2021-05 | KALLANG/WHAMPOA | 103 | 1972 | $845,000 |

| 2021-05 | QUEENSTOWN | 78 | 1968 | $720,000 |

| 2021-04 | KALLANG/WHAMPOA | 178 | 1972 | $1,140,000 |

| 2021-04 | KALLANG/WHAMPOA | 222 | 1972 | $1,100,000 |

| 2021-03 | KALLANG/WHAMPOA | 94 | 1972 | $830,000 |

| 2021-02 | QUEENSTOWN | 134 | 1968 | $975,000 |

| 2021-01 | KALLANG/WHAMPOA | 126 | 1972 | $895,000 |

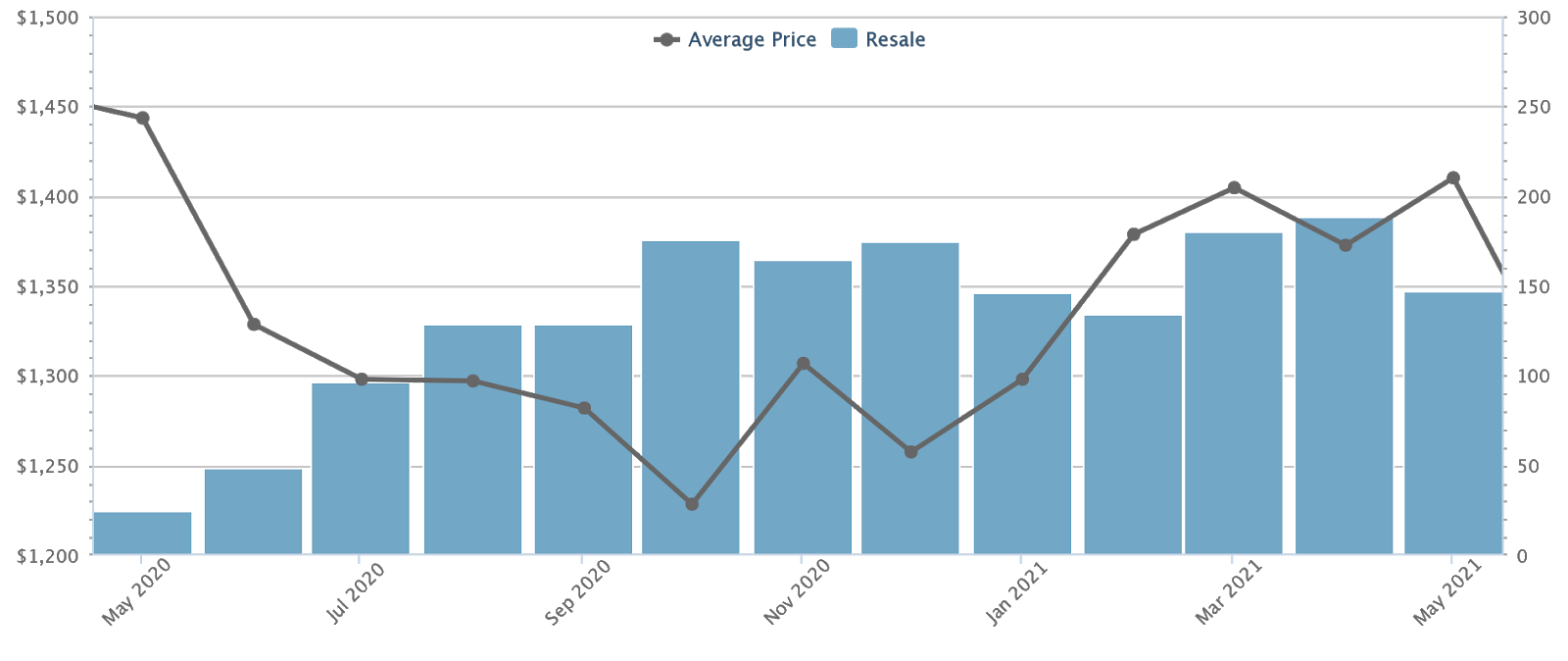

Note that, due to the low number of units and transactions, the prices of HDB terrace houses can be unpredictable. Realtors told us the average this year for a terrace unit was $941,150; but this average could be pulled up by the recent spike in HDB resale prices.

Is it worth buying HBD terrace houses?

Here are some of the factors worth considering:

- One of the cheapest ways to experience landed living

- There’s no private parking

- There might be good SERS potential

- You own the house, not the land

- May be more about the location than the type of property

1. One of the cheapest ways to experience landed living

As of end-May 2021, the average price of a resale terrace house, island-wide, was at $1,401 psf.

Overall, the median quantum of a private terrace house (leasehold) was around $1.77 million, as of end-2020. But check out the list of HDB terrace houses above, and you’ll see some have even been transacted for under $800,000.

So for those who want a landed living experience, the remaining 284+ HDB terrace houses are the most affordable option.

Another factor to consider is maintenance. If you opt for cluster housing, for example, you’d still face maintenance fees of $2,000+ per quarter. However, the conservancy charges for the HDB terrace houses are only $55 per month or $165 per quarter.

2. There’s no private parking

One drawback of HDB terrace houses is the lack of a driveway. Most of them are pressed up close to the road; so while you do have some “porch space”, it’s not going to be enough to park.

Instead, the terrace house clusters at Whampoa and Stirling Road share a common, HDB-run parking space; but some units may be a slightly further walk than others.

(Incidentally, if you don’t drive, the HDB terrace houses at Stirling Road are within walking distance to the Queenstown MRT station; they’re about 700 metres, or a 10-minute walk. The ones at Jalan Bahagia don’t have a train station within comfortable walking distance).

3. There might be good SERS potential

There is speculation that HDB terrace houses are prime candidates for the Selective En-Bloc Redevelopment Scheme (SERS). That’s definitely a possibility, as both Whampoa and Queenstown are desirable areas; and the terrace houses are located in well built-up areas.

It’s also hard to deny that, from today’s perspective, HDB would consider the land to be seriously under-utilised.

However, only four to five per cent of HDB estates will see SERS. It’s also questionable what will happen if SERS does take place, as we see no viable replacement sites close to Stirling Road and Jalan Bahagia. Odds are, the existing inhabitants will be moved far away; a major concern if part of the appeal is the location (see below).

So just as we advise against betting on en-bloc sales, we’ll say SERS potential is not a good reason to buy an HDB terrace house.

Homeowner StoriesHitting The SERS Jackpot: How One Singaporean Timed His HDB Purchase Just Right

by Ryan J. Ong4. You own the house, not the land

A subtle difference between an HDB terrace house, and a private 99-year leasehold terrace house is land ownership. With the HDB terrace house, you own the actual structure and not the land it’s on. With a private terrace house, you own the actual land (albeit for 99-years).

With private terrace houses, you could theoretically demolish the house and still hold on to the land for other allowed purposes (though you need to speak to a conveyancing lawyer for the exact details). With HDB terrace houses, all you get is the house.

For most owners, there’s no functional difference here, but it might irk those who feel land ownership does matter.

5. May be more about the location than the type of property

From the realtors we spoke to, the impression is that a large reason for buying the HDB terrace houses isn’t just that they’re landed. It may be worth it mainly because, well, they’re in Whampoa and Queenstown.

Realtors pointed out that Stirling Road is 700 metres from Queenstown MRT station, and 950 metres (12 minutes’ walk) to Queensway mall. Jalan Bahagia is only 2.5 kilometres, or about a five-minute drive, to Novena Square. Both locations are heavily built-up, with plenty in the way of nearby grocers, shops, and eateries.

This is in contrast to most landed private homes, which are in isolated enclaves that – while peaceful and exclusive – are also inconvenient.

For some home buyers, the handful of HDB terrace houses offer a unique balance between convenience, and landed living.

Ultimately, however, the HDB terrace houses are for pure homeowners, and not investors

The resale value of HDB terrace houses is unpredictable, especially given that they’re all entering the last half of their lease. And one thing we do know for sure is that depreciation will accelerate as the units near their last 20 to 30 years and financing for future buyers may be difficult.

Financing can drop to as low as 55 per cent, for properties with 40 or fewer years on the lease; and bank loans are not usually possible for leases of 30 years or less. Note that many buyers will require bank loans for HDB terrace houses, due to the income level needed to afford them.

As such, these homes are best for buyers who intend to live out the remainder of their years there, and aren’t looking at resale value or legacy value.

Follow us on Stacked, so we can update you as the situation changes. You can also check out in-depth reviews of new and resale properties alike, and the ongoing trends in the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

2 Comments

Hey Bro, your comparison between HDB pricing and landed property pricing is flawed, because HDB flats use floor area but landed houses use LAND AREA, that means that a landed house with 210 sqm of land may have floor area of more than 400 sqm!