How Do I Choose Between A Freehold Or Leasehold Condo?

June 7, 2020

This is Part 8 of our 18-part first-time home buyer series. You may refer to the full table below:

Many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

First Time Home Buyer Guide

Financing

- Approval-in-Principle: Why It’s Your First Step for a Home Loan/Mortgage

- How Much Can You Borrow For A Home Loan / Mortgage?

- How Much Income Do You Need To Get A Home Loan / Mortgage?

- How To Read Your Credit Report For Your Home Loan / Mortgage

- Understanding SIBOR, Board Rate, And Fixed Deposit Home Loans

- How You Can Compare Home Loans And Get The Best Deal

Choosing The Right Condo

- Executive Condo Versus Private Condo

- Freehold Versus Leasehold Condos

- New Versus Resale Condos

- Large Versus Small Condo Developments

Choosing The Best Condo Unit In A Development

- How To Pick The Best Stack In A Development

- Key Questions To Ask About Condo Facilities

- Key Factors To Note About A Condo’s Location

- How To Read And Compare Floor Plans

- What To Look For In Condo Shoebox Units

- When Should You Consider A Dual-Key Unit?

- Key Questions To Ask At A Showflat

- Condo Purchase Timeline

If you’ve decided between an EC and a private condo, and decided that a private condo is the way to go – here’s another major decision you have to make – a freehold or leasehold condo?

One advantage of private property is that, if you’re willing to pay more, you can buy a freehold property. There’s no 99-year lease, so there’s no risk of lease decay affecting your property value; and it’s ideal for a property that you want to leave as a legacy.

Well, that’s the theory anyway.

In reality, a freehold condos doesn’t always beat out a leasehold condo as an asset; in fact, some investors roll their eyes at freehold status, and see it as an unnecessary cost. In this part of the guide, we’ll take a deeper look at the differences when choosing your condo:

What is a leasehold condo?

This typically refers to properties that have a 99-year or 103-year lease (either from the time of the land purchase, or the development’s Temporary Occupation Permit). At the end of the lease, the land returns to the Singapore Land Authority (SLA), without any obligation for them to compensate you.

HDB flats, Executive Condominiums (ECs), and most private condos have 99-year leases. New land plots released by the government are all leasehold.

A 99-year lease can also be “carved out” of a freehold plot of land. This means the title holder of the land allows its use for 99-years, after which it reverts back to the title holder.

As a holdover from the colonial administration, there are also some properties on land plots with 999-year leases; these are effectively considered freehold properties, given the duration.

What is a freehold condo?

This refers to properties that can be owned indefinitely. There’s no lease decay, as the government won’t take it back at the end of 99-years. As mentioned above, new government land sales are all leasehold, so whatever freehold plots are left are from earlier days, and will dwindle as time passes.

How do the prices differ between freehold and leasehold?

We’ll give you the short answer and long answer.

Short answer: As a rule of thumb, freehold properties tend to cost about 20 per cent more than their leasehold counterparts, all other factors being equal.

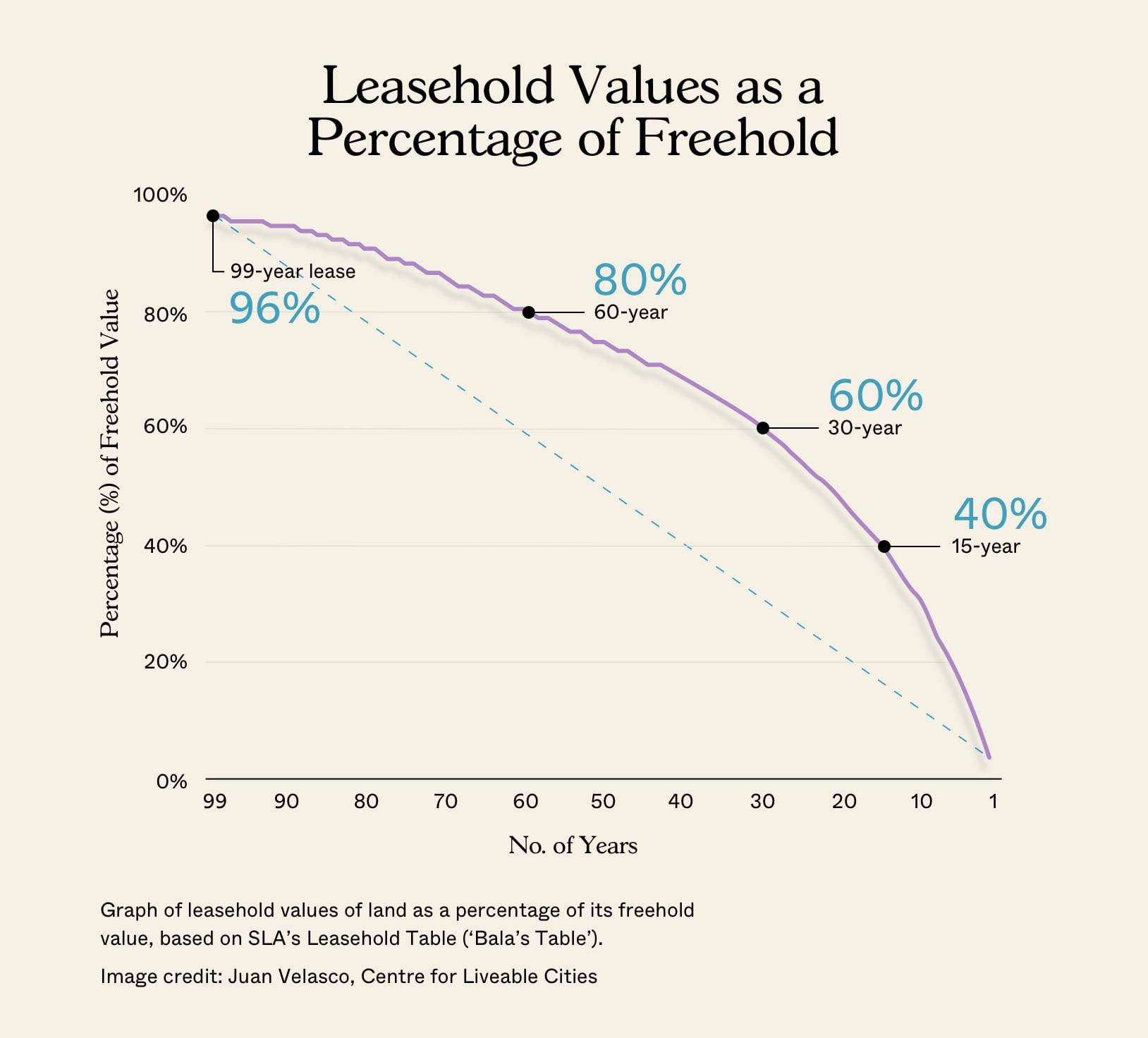

Long answer: The complete long answer is in this earlier article. Leasehold values are determined by Bala’s Table*, or the SLA leasehold table (which is based on Bala’s Table).

This is Bala’s Table:

The table expresses leasehold value as a percentage of freehold value. So at the 30-year mark, for instance, a leasehold condo should be worth 60 per cent of the value of an equivalent freehold counterpart.

The important thing to note here is the non-linear nature of the table. The curve shows that the first few years of a property’s lease are more valuable than the later years (i.e. the last 30 years are not as valuable as the first 30 years).

As such, the impact of lease decay accelerates exponentially toward the end.

For a year-by-year account, you can check out SLA’s leasehold table:

| Term of Years | Percentage (%) of Freehold Value | Terms of Years | Percentage (%) of Freehold Value | Term of Years | Percentage (%) of Freehold Value |

| 1 | 3.8 | 37 | 66.2 | 73 | 87.5 |

| 2 | 7.5 | 38 | 67.0 | 74 | 88.0 |

| 3 | 10.9 | 39 | 67.7 | 75 | 88.5 |

| 4 | 14.1 | 40 | 68.5 | 76 | 89.0 |

| 5 | 17.1 | 41 | 69.2 | 77 | 89.5 |

| 6 | 19.9 | 42 | 69.8 | 78 | 90.0 |

| 7 | 22.7 | 43 | 70.5 | 79 | 90.5 |

| 8 | 25.2 | 44 | 71.2 | 80 | 91.0 |

| 9 | 27.7 | 45 | 71.8 | 81 | 91.4 |

| 10 | 30.0 | 46 | 72.4 | 82 | 91.8 |

| 11 | 32.2 | 47 | 73.0 | 83 | 92.2 |

| 12 | 34.3 | 48 | 73.6 | 84 | 92.6 |

| 13 | 36.3 | 49 | 74.1 | 85 | 92.9 |

| 14 | 38.2 | 50 | 74.7 | 86 | 93.3 |

| 15 | 40.0 | 51 | 75.2 | 87 | 93.6 |

| 16 | 41.8 | 52 | 75.7 | 88 | 94.0 |

| 17 | 43.4 | 53 | 76.2 | 89 | 94.3 |

| 18 | 45.0 | 54 | 76.7 | 90 | 94.6 |

| 19 | 46.6 | 55 | 77.3 | 91 | 94.8 |

| 20 | 48.0 | 56 | 77.9 | 92 | 95.0 |

| 21 | 49.5 | 57 | 78.5 | 93 | 95.2 |

| 22 | 50.8 | 58 | 79.0 | 94 | 95.4 |

| 23 | 52.1 | 59 | 79.5 | 95 | 95.6 |

| 24 | 53.4 | 60 | 80.0 | 96 | 95.7 |

| 25 | 54.6 | 61 | 80.6 | 97 | 95.8 |

| 26 | 55.8 | 62 | 81.2 | 98 | 95.9 |

| 27 | 56.9 | 63 | 81.8 | 99 | 96.0 |

| 28 | 58.0 | 64 | 82.4 | ||

| 29 | 59.0 | 65 | 83.0 | ||

| 30 | 60.0 | 66 | 83.6 | ||

| 31 | 61.0 | 67 | 84.2 | ||

| 32 | 61.9 | 68 | 84.5 | ||

| 33 | 62.8 | 69 | 85.4 | ||

| 34 | 63.7 | 70 | 86.0 | ||

| 35 | 64.6 | 71 | 86.5 | ||

| 36 | 65.4 | 72 | 87.0 |

This leasehold table is quite important to developers, as it determines how much they need to pay to “top up” the property back to 99-years if they buy it in a collective sale.

*Who Bala was is lost to time and history; but it’s generally accepted that he was someone working in the British colonial administration, who first devised this method of determining leasehold value.

Property Investment InsightsFreehold vs Leasehold: 3 Tests To Determine Which Is Better (Part 2)

by Sean GohHow have freehold condos performed versus leasehold condos?

As mentioned earlier, this is something that we have covered pretty comprehensively before (see here), so this will be a summarised version.

In short, there is really no right answer to this – it all depends on the time period that you use to make a comparison.

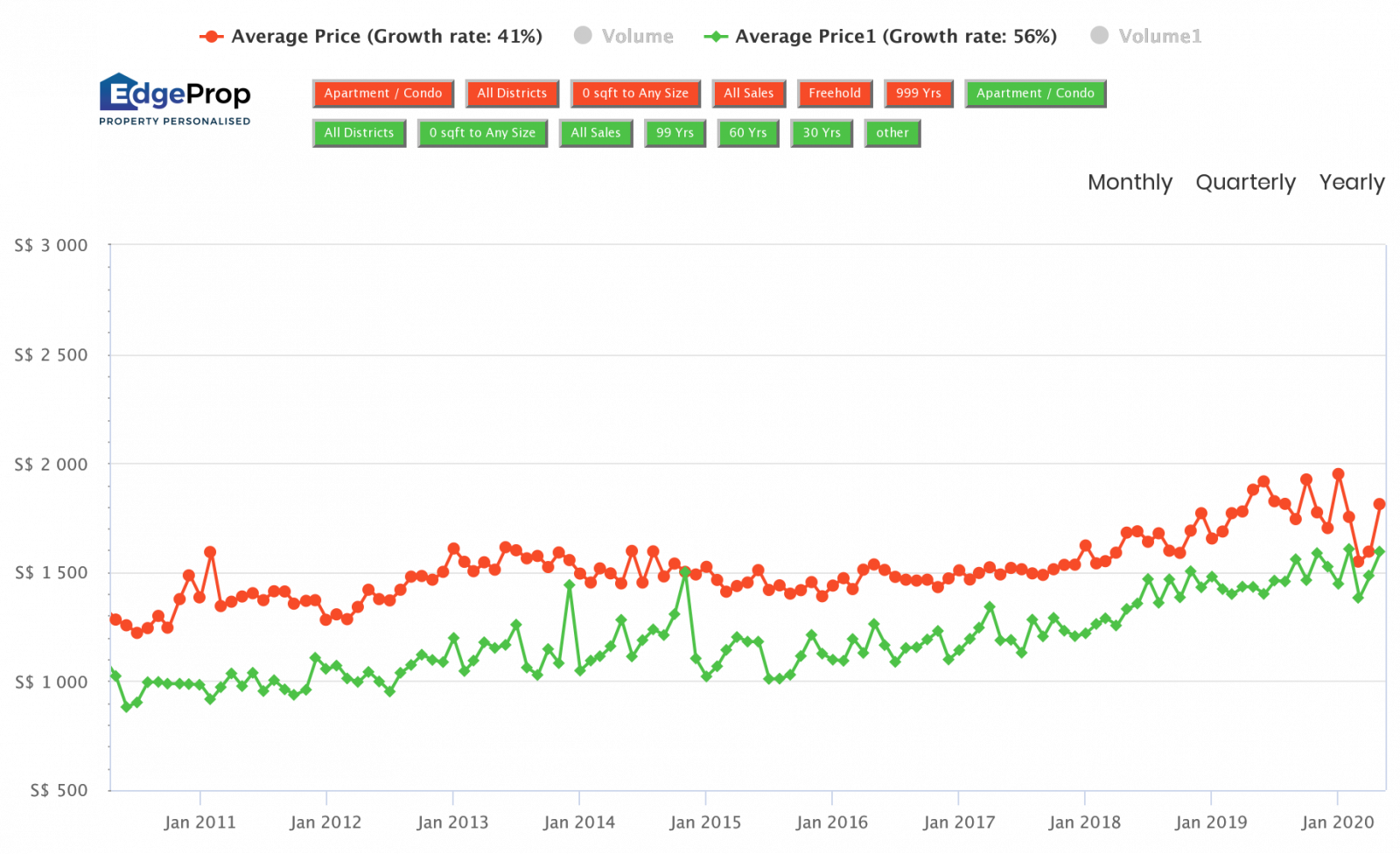

For example, if you decided to look at a time period of the past ten years (March 2010 to March 2020), you will see that leasehold condos have appreciated from an average of $1,023 psf in 2010, to $1,594 psf as of today, or about a 56 per cent increase.

On the other hand, freehold condos have gone from an average of $1,282 psf to $1,812 psf today, which represents a 41 per cent increase.

So if you aren’t too familiar with the real estate market, this information can be easily misrepresented to fit a salespersons narrative.

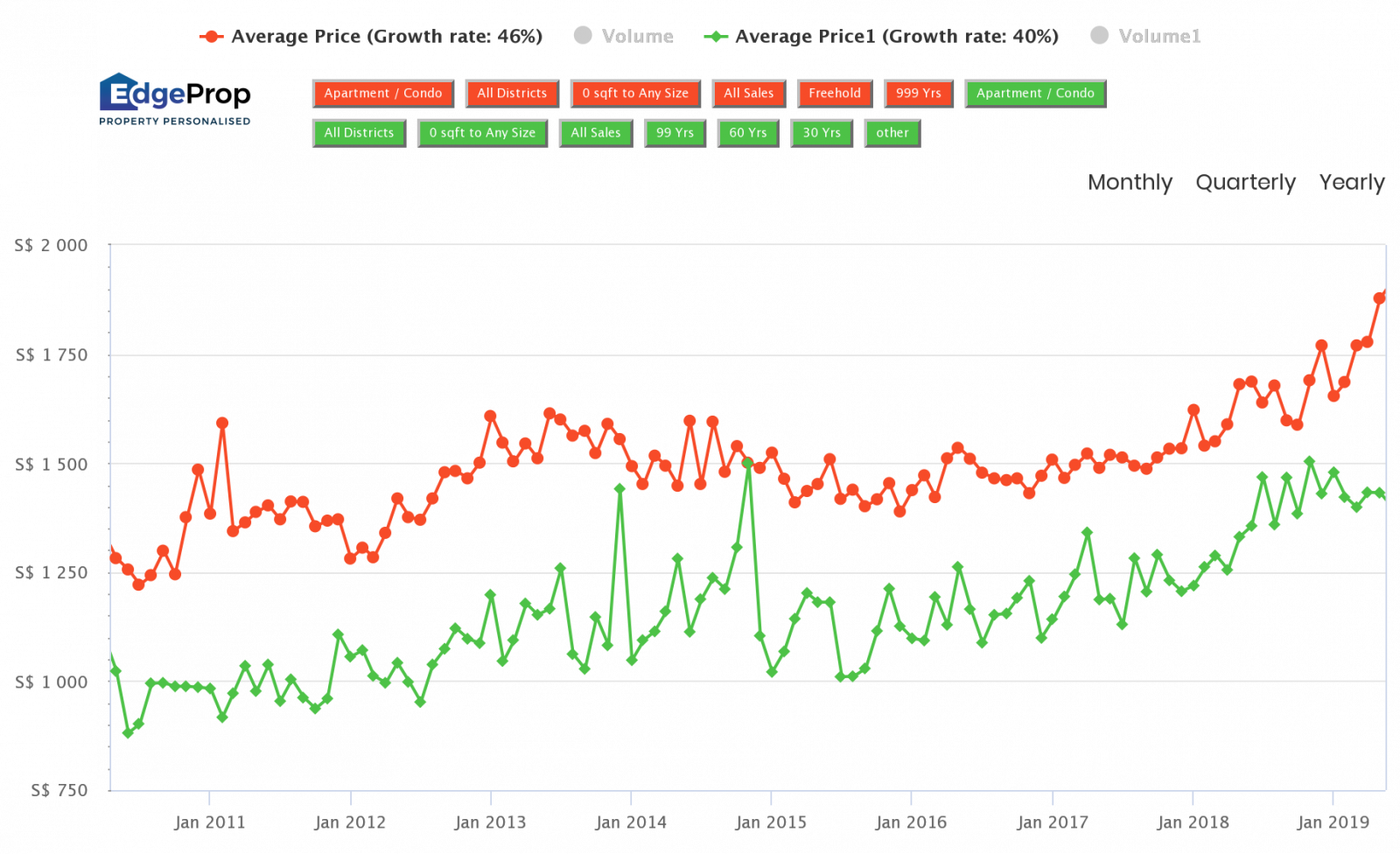

Let’s see what happens when we adjust that time period to end one year earlier in May 2019 instead.

In this case, freehold condos have grown to an average of $1,770 psf, a 46 per cent increase.

As compared to leasehold condos, with an average appreciation to $1,399 psf, a 40 per cent increase.

If you’re wondering why such variances can exist it is because this really depends on the transactions of that month. For example, it could be that May 2019 just had fewer transactions for leasehold condos, or many of the more affordable leasehold condos were sold that month instead, bringing the average psf down.

But numbers aside, a leasehold condo can be overcome by other factors such as location (a leasehold property in the middle of Orchard can still appreciate better than a freehold property in a less accessible fringe region), greater room for appreciation (as freehold units are already purchased at a premium), affordability, and others.

The lease on a condo is just one of many factors that buyers will look at, so it’s entirely possible for a leasehold condo to outperform a freehold counterpart.

In light of that…

Is a freehold or leasehold condo better for you?

This depends on your view toward factors such as:

- Affordability

- En-bloc potential

- Long versus short-term plans

- Legacy plans

- Rental yield

1. Affordability

For pure home owners, affordability should be the primary concern. To put it in perspective:

Say you purchase a leasehold condo for $1 million, on a 30-year loan tenure, at 1.4 per cent interest.

Your maximum loan quantum would be $750,000. This would mean a down payment of $250,000 ($50,000 in cash), and monthly repayments of around $2,550.

Now, say you purchase a freehold property, at a 20 per cent premium ($1.2 million). Your loan quantum – assuming you use the same loan as above – increases to $900,000. You would make a down payment of $300,000 ($60,000 in cash), and monthly repayments of around $3,060.

An additional $510 a month may not seem like much, but remember this is for the next two or more decades of your life.

In general, your property should not cost more than five times your annual income (to be prudent), and absolutely no more than seven times. The monthly loan repayment, along with your other debts, should not consume more than 40 per cent of your monthly income.

If picking a freehold property would take you past those safety markers, it may be best to consider leasehold instead.

2. En-bloc potential

Freehold properties have more en-bloc potential, in both the sense of a successful en-bloc attempt, and receiving bigger sales proceeds.

Developers know that sellers are likely to be more desperate once a condo development is pushing 40. By that point, bank loans for the property may be restricted (as low as 55 per cent financing); and there’s no loans available once a property has only 30 years or less remaining.

Also, the developer will be less generous during the collective sale, given that they need to pay to top up the lease later.

If you opt for leasehold, you must be psychologically prepared that somewhere down the line – for either you or the people you leave the property to – there’s a chance an en-bloc will fail, and the property value will fade to zero.

As an aside, note that leasehold properties carved out of freehold land carry additional risks of not going en-bloc. The title holder may not be interested in letting it out for another 99-years (they may have plans to develop or use the land for other purposes).

3. Long versus short term plans

Freehold properties can outshine their leasehold counterparts in the long game. Over a short period, such as 10 years, leasehold properties largely have the advantage – the facilities and condition of the unit are not likely to deteriorate much in that time, and 89 years is a long time that won’t be a resale issue.

Over a long period, such 40 years, freehold properties can hold their value even as their leasehold counterparts start to suffer from lease decay. Toward these twilight days, when you’re eager to sell and move on, freehold status means you can still get a good offer.

4. Legacy plans

If you’re buying with the intent to pass the property down to your children, grandchildren, etc., then freehold is the better option. However, keep in mind that relatively few condos make it past the 40-year mark without an en-bloc, even if they happen to be freehold!

You should also consider what happens if your children do well and have a home of their own anyway. If they won’t need it, then maybe you should save money by getting a leasehold, and investing the savings elsewhere for them (especially if investing is your forte).

5. Rental yield

Some landlords believe in high rental yields as the key consideration. Those using this strategy will almost never opt for freehold.

Their tenant is not going to pay more because their property is freehold. A leasehold and freehold property, in an area where rental income is $3,500 a month, will both probably generate $3,500 a month. The freehold unit just costs more, and requires a bigger cash outlay.

This is not a factor for genuine home buyers, as you’re not planning to rent out the unit anyway.

Remember that in the end, location should win out

If you’re absolutely unable to decide, go back to the location. Better accessibility and amenities should always win out, over concerns regarding leasehold or freehold. You can also drop us a message on Facebook, if you need further help.

When you’re comparing your freehold and leasehold options, don’t forget to check out our in-depth reviews on Stacked.

For more details on buying your first home, check out the rest of our Ultimate guide on Stacked Homes.

This is Part 8 of our Ultimate Guide to buying your first home. If you haven’t read Part 7, you can do so at the link!

Next up: Part 9 – New versus resale condos: which are better?

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Property Advice We’re In Our 50s And Own An Ageing Leasehold Condo And HDB Flat: Is Keeping Both A Mistake?

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

1 Comments

Hi what about the project size? I noticed that freehold projects are normally smaller scale, at most 200+ units, is this a norm?