Are Dual Key Condos Profitable? Here Are The Results From All 193 Transactions So Far

April 25, 2020

It’s easy to see why Singaporeans like dual key condo units.

They are functional, offer flexibility, and are good options for having a little rental income without having to fork out additional cash for the ABSD.

So it is of little surprise to see that since the launch of Caspian by Fraser Centrepoint in 2009, dual key condo units have been quite popular – featuring in 93 condo developments so far.

For those of you who are new to this concept – dual key condo units are basically two separate living spaces that share a main foyer. Some dual key units might share a lounge or kitchen as well.

So if you are considering a dual key unit, this article will be helpful for you to decide if a dual key is right for you.

This is split into 3 parts for easy reading:

- Advantages and disadvantages of dual key condo units

- Dual key layouts

- The profitability of dual key condo units

Let’s start with the advantages.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Advantages of Dual Key condo units

- Multi-generational living

Before the introduction of dual key condo units, multi-generation living was mainly just about buying a big enough house to fit everyone.

But unless you had deep enough pockets for a 5 or 6 bedroom condo or a landed home, living with different families together in a smaller space was not always the best living arrangement.

So a dual key condo family home is really making the best of both worlds.

You have a way for two families to live together – being able to enjoy the close comforts of each other’s company.

Yet you are still able to retain a certain level of privacy, as there are separate living spaces.

It’s also worth knowing that you could see demand for such units to go up as Singapore has a rapidly ageing population – as it is said by 2030, one in five people will be aged 65 or older.

This means that there will be more people looking for homes that allow for multi-generation living.

- Higher rental yield

If you aren’t aware of it already, the average rental yield in Singapore is between 2 to 3%.

In other words, it’s not great.

Investors are always looking out for a development with good rental so that they can cover as much of the monthly mortgage as possible, or as passive income for themselves.

This makes dual key units a good option as you can get a higher rental yield as compared to a normal unit.

As an example, let’s look at a dual key unit at 8 Riversuites.

A regular 3 bedroom unit at 980 square feet can fetch anywhere between $2,500 to $3,500 per month.

While a dual key 3 bedroom unit at 1,033 square feet can achieve a rental of:

- $2,400 to $3,000 per month for the 2 bedroom main unit

- $1,500 to $2,000 for the studio unit

So yes, it is a higher rental figure per month that’s clear to see.

But let’s not forget that a dual key condo unit is always priced higher as well.

Let’s work it out to see if you do achieve a higher rental yield in this case.

| Unit Type | Price | Rental | Rental Yield |

| 3 Bedroom | $1,400,000 | $3,000 | 2.57% |

| 3 Bedroom Dual Key | $1,550,000 | $2,700 + $1,750 = $4,450 | 3.45% |

*Rental is derived as an average of the range of rental figures

**Rental yield here is gross rental yield

Although a 3.45% gross rental yield isn’t a mindblowing figure by any means, you can see from here that you can still achieve a higher rental yield if that is your main goal.

- Flexibility

One of the reasons people are attracted to dual key condo units is because of its flexibility.

For example, for maximum returns – rent both units out individually.

Want some passive income? Stay in the bigger unit and rent out the studio.

Times are hard? Stay in the smaller unit and rent out the bigger one for more income.

Work from home? (especially so in this Covid-19 climate) Have your own private working space to still be able to keep a good work/life balance.

- Save on ABSD

Last but not least (and probably one of the main reasons why the dual key concept took off), is so that you can save on ABSD.

Given how high the stamp duty fees are for buying a second property, it’s safe to say that many people have tried ways and means of avoiding it.

So if you were looking to buy a 2 bedroom for your own stay, and a studio unit for rental income, purchasing a dual key condo unit may seem like a no brainer decision.

Property Market CommentaryAdditional Buyer Stamp Duty: How does this affect you?

by Druce TeoDisadvantages of Dual Key units

- Dual key units are more expensive

As mentioned in our ultimate list of dual key units, it wasn’t long before developers realised that dual key units were becoming a popular option.

And in business what do you do when demand outstrips supply?

Yes, that’s right.

You raise the prices.

At the heights of its demand, dual key units could command price premiums of as much as 16 percent.

If not for the TDSR limits, who knows how much higher prices could have become?

- Size constraints

As with the trend of shrinking unit sizes in Singapore, dual key units are not spared from that same fate.

Let’s look at multi-generational living as an example.

Again, unless you have the means to purchase a big enough dual key unit, the family that has to live in the smaller studio unit might find it a little too small for comfort.

Also, while a kitchenette is no doubt useful, for some people it might be quite a limiting factor if they do cook a lot for themselves.

More from Stacked

This Up-And-Coming Area Has 5 New Condos In Just 2 Years: Is Lentor Mansion Still Worth A Look?

Lentor has been a hotspot since 2022, with the launch of projects like Lentor Modern and Lentoria. The next project…

For those who intend to use it as a home office, it is important to note that there are constraints when it comes to that too.

URA has stipulated that you can hire up to 2 non-resident employees if you have registered to set up a home office.

But, there are certain restrictions to doing so:

- Not hiring more than 2 non-resident employees

- Not displaying any external business advertisements

- Not generating noise, smoke, odour, waste matter or dust

And the usage cannot fall within the list of businesses that are not permitted in the home office scheme.

- Privacy

Although this was mooted as an advantage, this could be seen as a disadvantage too.

For those who intend to live in one section and rent out the other, you do have to be mindful that other than the foyer which separates the entrances – it is almost like renting out a room in your house to a tenant.

Put simply, there are some landlords that might not like living in such close quarters to their tenants.

This could be due to your own level of privacy or just accounting for the fact that soundproofing levels might not be the same as two totally separate units.

- Harder to sell in resale market

Naturally, not every family is going to be looking to live together at such close quarters.

Neither are the pool of investors that big of a group.

The bulk of the demand still comes from homeowners – so you could find it harder to sell come resale time.

Typical Unit Layouts

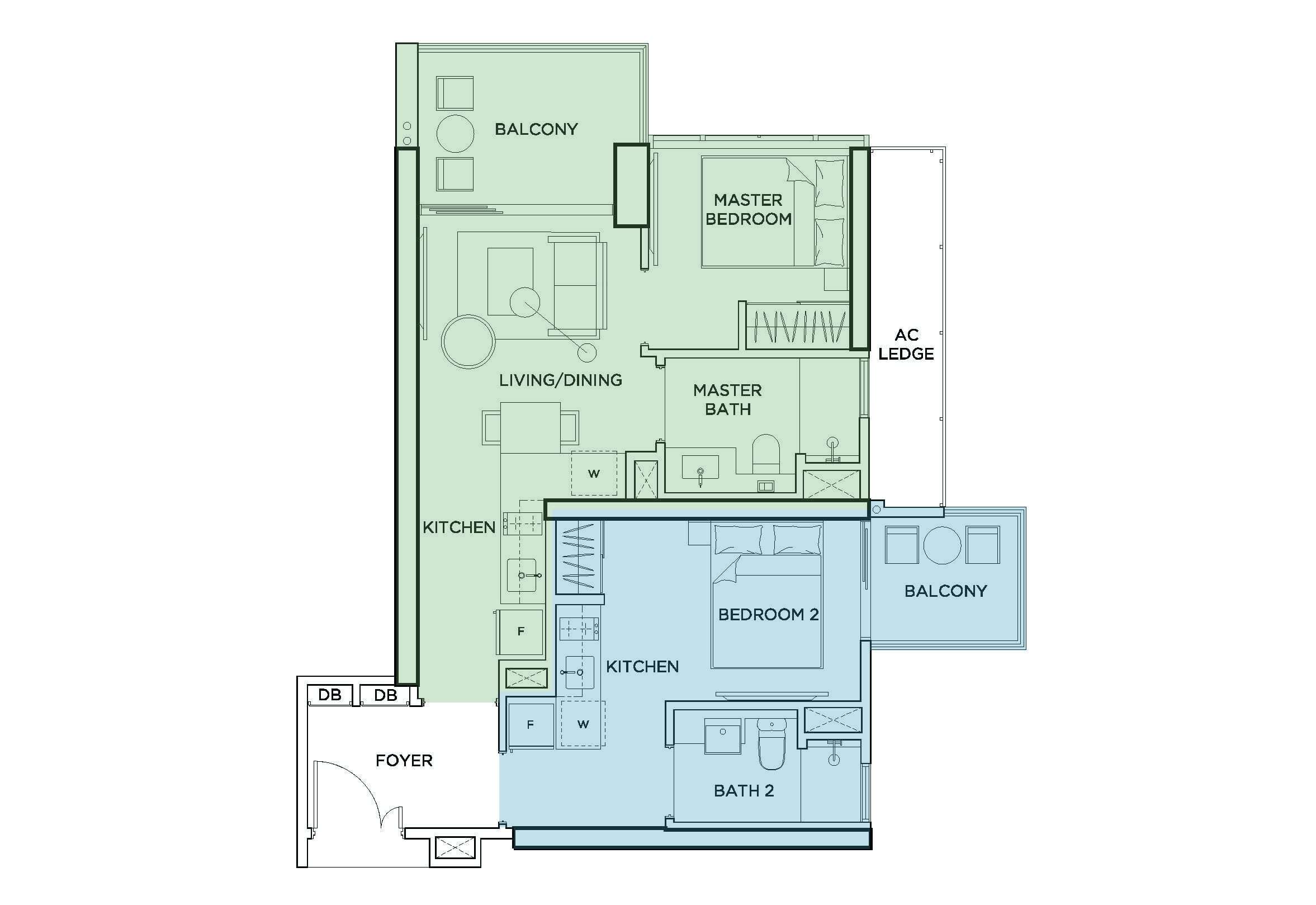

2 bedroom dual key condo unit floorplan

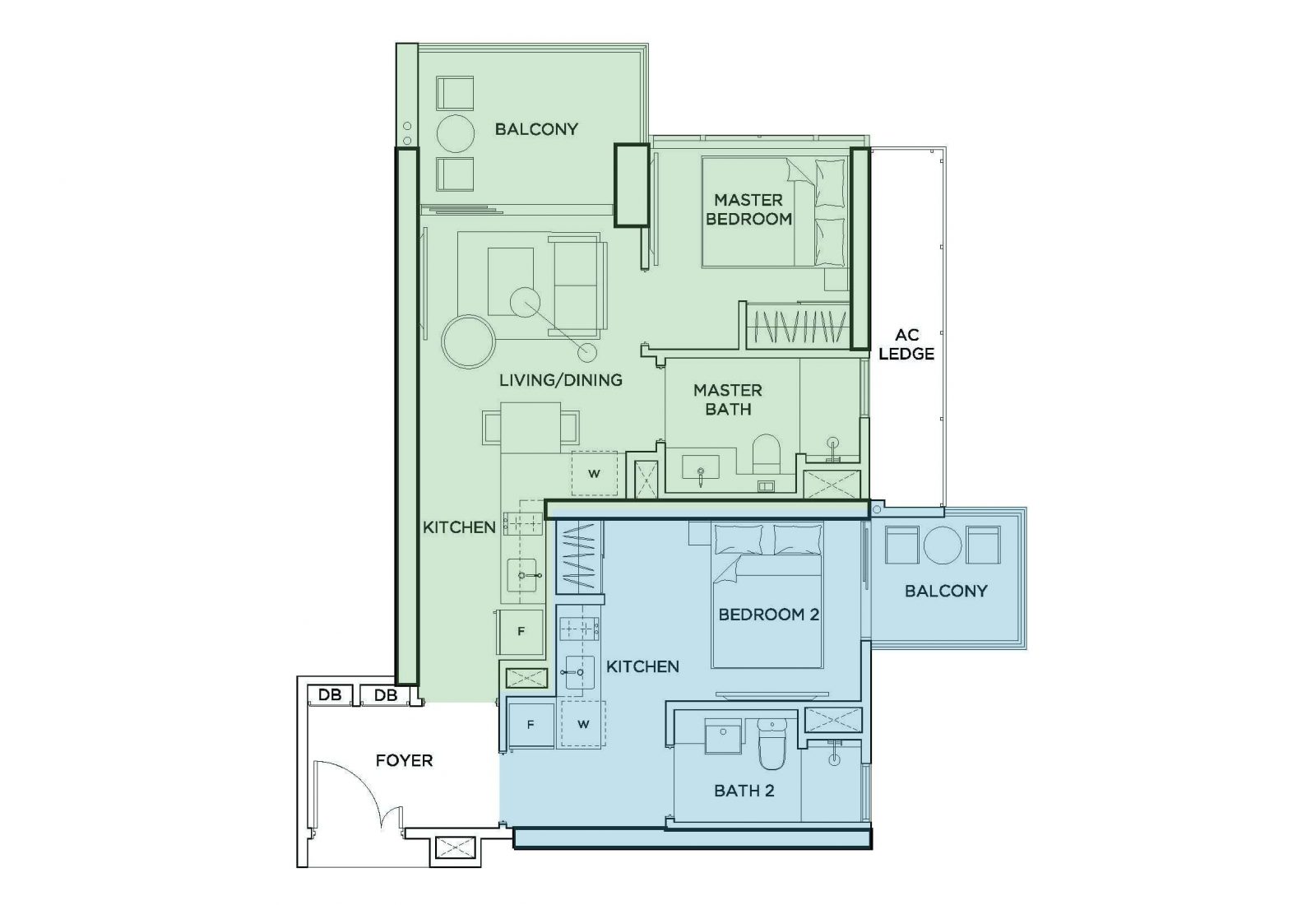

3 bedroom dual key condo unit floorplan

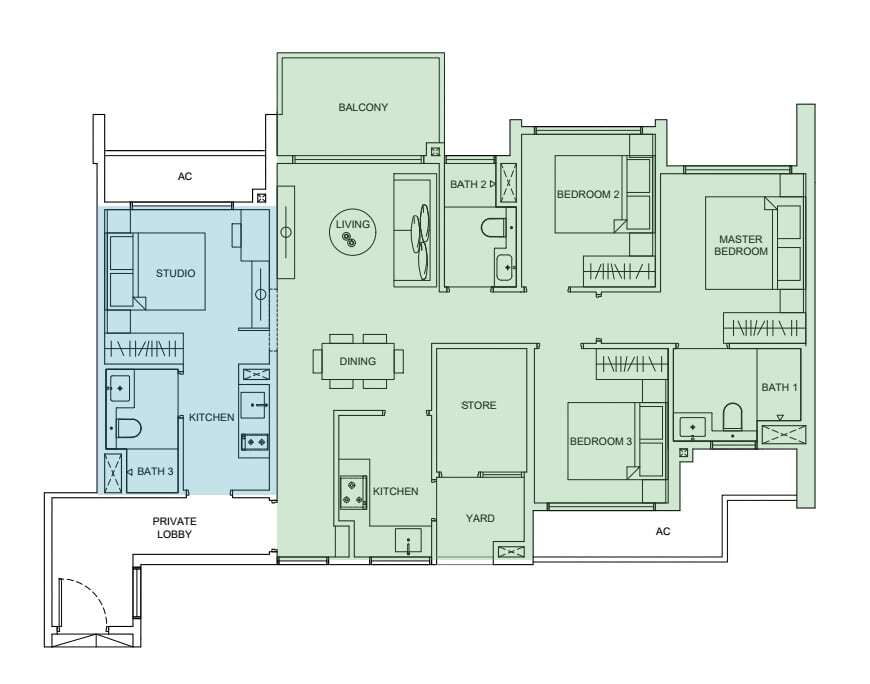

4 bedroom dual key condo unit floorplan

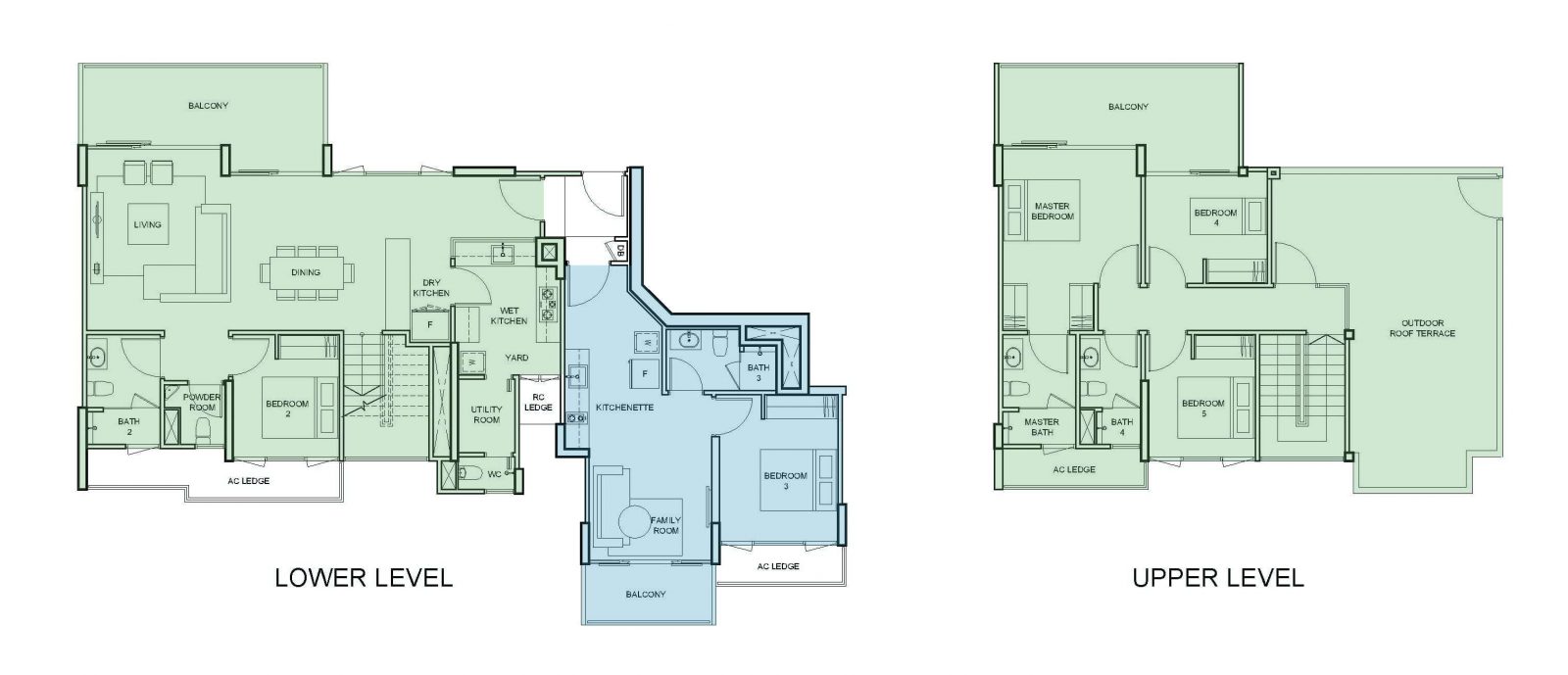

5 bedroom dual key condo unit floorplan

Dual Key Condo Profitability

| Condo | Average of Gains / Loss | No of Transactions |

| 8@WOODLEIGH | 32.98% | 13 |

| BARTLEY RESIDENCES | 0.88% | 2 |

| BARTLEY RIDGE | 11.44% | 2 |

| BOTANIQUE AT BARTLEY | 15.77% | 20 |

| CASPIAN | 37.71% | 7 |

| CITY GATE | 9.53% | 7 |

| COCO PALMS | 16.19% | 3 |

| EIGHT COURTYARDS | 12.56% | 4 |

| EIGHT RIVERSUITES | 3.78% | 3 |

| FLAMINGO VALLEY | 8.47% | 14 |

| HIGH PARK RESIDENCES | 19.66% | 3 |

| HILLS TWOONE | 1.48% | 2 |

| LIV ON SOPHIA | -6.52% | 3 |

| LIV ON WIKIE | -10.52% | 3 |

| LA FIESTA | 2.43% | 7 |

| MEADOWS @ PEIRCE | 25.57% | 1 |

| MY MANHATTAN | -9.46% | 2 |

| ONZE @ TANJONG PAGAR | 7.98% | 1 |

| PARC OLYMPIA | -3.56% | 4 |

| Q BAY RESIDENCES | 5.31% | 3 |

| RIVER ISLES | 10.25% | 13 |

| RIVERSOUND RESIDENCE | 14.85% | 6 |

| RIVERTREES RESIDENCES | 7.93% | 3 |

| SEA ESTA | 7.02% | 6 |

| SIMS URBAN OASIS | 13.07% | 1 |

| SKIES MILTONIA | -13.01% | 1 |

| SKY GREEN | 14.19% | 2 |

| SOPHIA HILLS | 6.93% | 1 |

| SUITES 28 | 6.95% | 2 |

| SUNNYVALE RESIDENCES | 0.07% | 1 |

| TERRASSE | 5.91% | 2 |

| THE CITRON RESIDENCES | -5.98% | 1 |

| THE CREST | 5.07% | 1 |

| THE HILLFORD | 5.20% | 3 |

| THE INFLORA | 11.50% | 2 |

| THE MINTON | 21.33% | 6 |

| THE NAUTICAL | 7.70% | 3 |

| THE PALETTE | 12.73% | 3 |

| THE SANTORINI | -3.45% | 1 |

| THE TEMBUSU | -0.04% | 2 |

| TRILIVE | 8.62% | 3 |

| URBAN VISTA | -10.05% | 7 |

| WATERBANK AT DAKOTA | 23.96% | 20 |

| Grand Total | 12.30% | 194 |

Now if you were wondering why there are only 43 condos remaining of the 93 dual key condos, that’s because there were only transactions for these few developments.

So because the first dual key condo was only completed in 2012, and with the bulk of them in 2015/2016, you really aren’t going to be seeing that many transactions.

While it isn’t great from an analytical standpoint, here are some of the interesting points that we can gather from the data:

- 9 out of 43 condos registered an overall loss with Skies Miltonia recording the biggest loss at -13.01%. That said, this was just the one transaction so you could see it as a one off.

- The next biggest loss was the Liv on Wilkie, registering a -10.52% loss.

- After Liv on Wilkie is Urban Vista with a loss of -10.05%. This was much more significant as there were 7 transactions recorded in total. All 7 were loss-making as well.

- The very first duo key development, the Caspian was the highest achiever, with total average gains of 37.71% over 7 transactions.

- 8 @ Woodleigh came in a close second at 32.98% with an even greater number of transactions – 13.

- Only 2 out of the top 10 appreciating developments were freehold.

- The top 5 appreciating condos, Caspian, 8 @ Woodleigh, Meadows @ Peirce, Waterbank at Dakota, and the Minton were all completed in 2012 and 2013.

Let’s now compare this to transactions of regular units within the same development to see which does better, dual key or regular units.

In this graph I’ve gathered the transaction data for all the regular units from these developments to pit their appreciation statistics against dual key units appreciation numbers.

Here are some of the more noteworthy points:

- Regular units outperform dual key condo units in general, with an average of 20% appreciation as compared to 12.3%.

- There were only 3 developments in the negative territory for regular units, as compared to 8 dual key ones.

- This means that 5 developments (My Manhattan, Parc Olympia, Skies Miltonia, The Santorini, and the Tembusu) had loss wielding dual key condo units, as opposed to the regular units performing positively.

- My Manhattan was a particular standout, with regular units appreciating 9%, as compared to -9.46% for dual key units.

Final Words

While on the surface it looks as if dual key condo units do not perform as well as regular units from an appreciation standpoint, there are a few possible reasons why this could have happened.

First off, there isn’t as many transactions for dual key units as regular units, so it isn’t exactly an apples to apples comparison.

Second, because dual key units were mainly mooted as an investment property, the vast majority would have made their money in rental income, thus there is less pressure for them to sell the unit off at a solid appreciation.

Lastly, as mentioned as one of the disadvantages, the pool of potential buyers in the resale market is smaller.

So it may still take a few more years to get enough data to accurately judge the merits of a dual key condo for capital appreciation.

But I think there’s no denying the usefulness of one from a multi-generational perspective and a rental income one. If you are searching for one and need help, do feel free to reach out to us at stories@stackedhomes.com

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are dual key condos in Singapore profitable for investors?

What are the main advantages of owning a dual key condo?

What are the disadvantages of dual key condos?

How do dual key condos compare to regular units in terms of appreciation?

Why might someone choose a dual key condo instead of a regular unit?

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

Property Investment Insights This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

5 Comments

heyy great read. shocking to see the dual key units lost more than regular. but like you mentioned at the end , maybe investors didn’t mind selling lower because of the rental income they’ve made. but why sell lower though? would this mean naturally dual key units have a lower PSF than others?

This article provides details about dual key condos profitable . This blog happens to be one of the best blog, which give proper details about it. I enjoyed reading this blog and would suggest others too, and you would get to read about it in this link.

Hi Stacked Homes team,

Thanks for the great read! I’d like to ask further – are the dual key units mostly less profitable because:

(A) the dual key PSF price ended up lower than regular units PSF price OR

(B) the dual keys units were less profitable during resale as they were bought at higher price from developers during launch?

As mentioned earlier in your article, developers typically launch dual key units at higher price, I’ll imagine that will have very significant effect of profitability, likely resulting scenario (B).

Are you able to compare the PSF price of dual key units vs. regular units in each project to verify? Thanks a lot!