Downpayment for condo in 2020: How much do you have to save exactly?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

Stanley loves crunching numbers in excel and analysing them. Naturally, he helps Stacked Homes generate articles based on his analysis as much as he can. When he's not using Excel, he enjoys watching movies and eating chocolates.

Buying your first home in Singapore is always going to be an overwhelming experience. Especially when Singapore is one of the most expensive places in the world for real estate. Plus the thought of committing yourself to a very long term mortgage is enough to scare anyone off. The truth is, buying a home will always be a heavily contemplated decision, even for seasoned investors. This isn’t really a surprise as the property rules in Singapore are ever changing, with cooling measures being announced or cut out making it easy to be inundated with it all.

So before you start your journey into buying a home in Singapore, it is wise to prepare yourself with the financials of it all. For the fortunate few among us who are looking to buy a condo as their first home, let us begin with the downpayment for a condo.

Downpayment for condo: How much cash do I need?

Now, if you were to refer strictly to the downpayment for a condo, it is simply 25%. This is based on the LTV (loan-to-valuation) that is currently capped at 75% for your first property. So for a million dollar condo, you would have to splash out $250k as a downpayment. 20% of which can come from your CPF and a minimum 5% cash ($50,000).

Downpayment for condo: 25% ($250,000): 5% cash ($50,000) + CPF ($200,000)

Remember, the 20% from your CPF OA can be a mixture of CPF and cash – depending on how you want to allocate your funds.

Alas, if only it were actually that simple, it would be the end of this article.

But it never is that easy in Singapore because you still have to account for your BSD (buyer stamp duty) and TDSR (total debt to servicing ratio).

Many people only think about the minimum 5% cash that they need to save, but they always forget about the stamp duty as well. For first time buyers, the buyer stamp duty rate is calculated in several tiers:

| Purchase price of property | BSD rate |

| First $180,000 | 1% |

| Next $180,000 | 2% |

| Next $640,000 | 3% |

| Remaining amount | 4% |

Example, for a $1 million property, the buyer stamp duty that you will have to pay would be:

1% of $180,000 = $1,800

2% of $180,000 = $3,600

3% of $640,000 = $19,200

Total BSD payable = $24,600

Homeowner StoriesFirst time home buyer in Singapore: Our first viewing at Regency Suites

by JaredA quick tip for properties below $1million: (3% x purchase price) – $5,400.

As an example for a $900,000 property, your buyer stamp duty calculation will look like this:

3% x $900,000 = $27,000

$27,000 – $5,400 = $21,600

You can use your CPF to pay for the BSD, but you will have to pay in cash first, then get reimbursed from your CPF.

Lastly, the most important part about securing the amount you have to save for your downpayment for your condo is dependant on your TDSR. Calculating your TDSR is pretty simple, you would just have to total up your monthly debt and divide it by your base salary.

For example, if you are earning $6,000 a month and you have a car loan of $1,000 a month, your debt to income ratio would be 16% ($1,000 / $6,000). This means you would not be able to borrow as much as you would have without your car loan as any borrowing of money would have an impact on your TDSR.

Because the TDSR restricts your loans to 60% of your monthly income, this also means that your downpayment needed for your condo could be higher depending on how much you earn.

Conclusion

Now that you know how much cash you will have to effectively pony up for your first home, you can plan better and not look around mindlessly. Remember that while property is an asset, you should still exercise prudence with your decisions and not overcommit!

Stanley

Stanley loves crunching numbers in excel and analysing them. Naturally, he helps Stacked Homes generate articles based on his analysis as much as he can. When he's not using Excel, he enjoys watching movies and eating chocolates.Read next from Property Advice

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Advice Why Punggol Northshore Could Be The Next Hotspot In The HDB Resale Market

Property Advice How Much Is Your Home Really Worth? How Property Valuations Work in Singapore

Property Advice Why I Had Second Thoughts After Buying My Dream Home In Singapore

Latest Posts

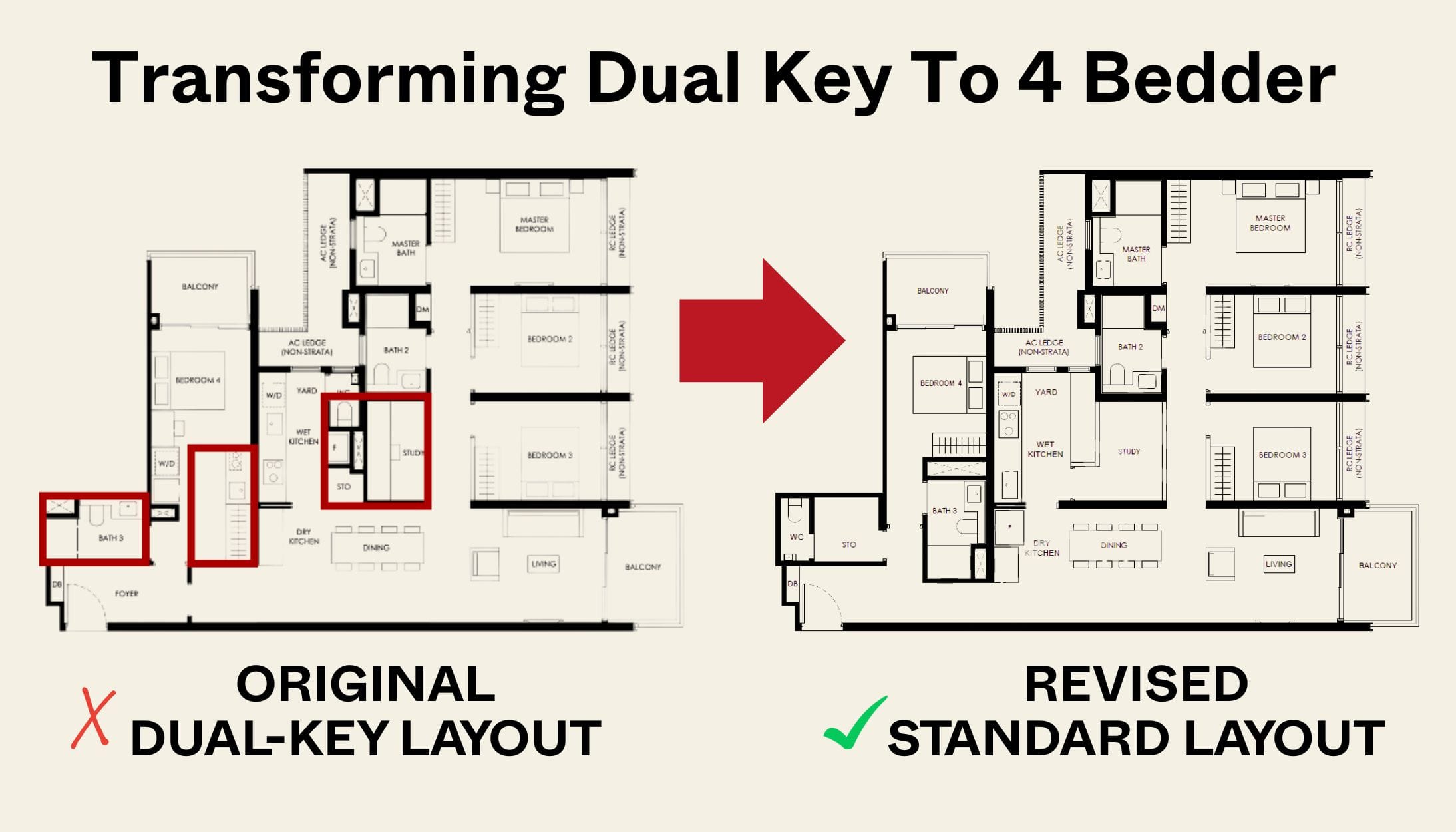

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000

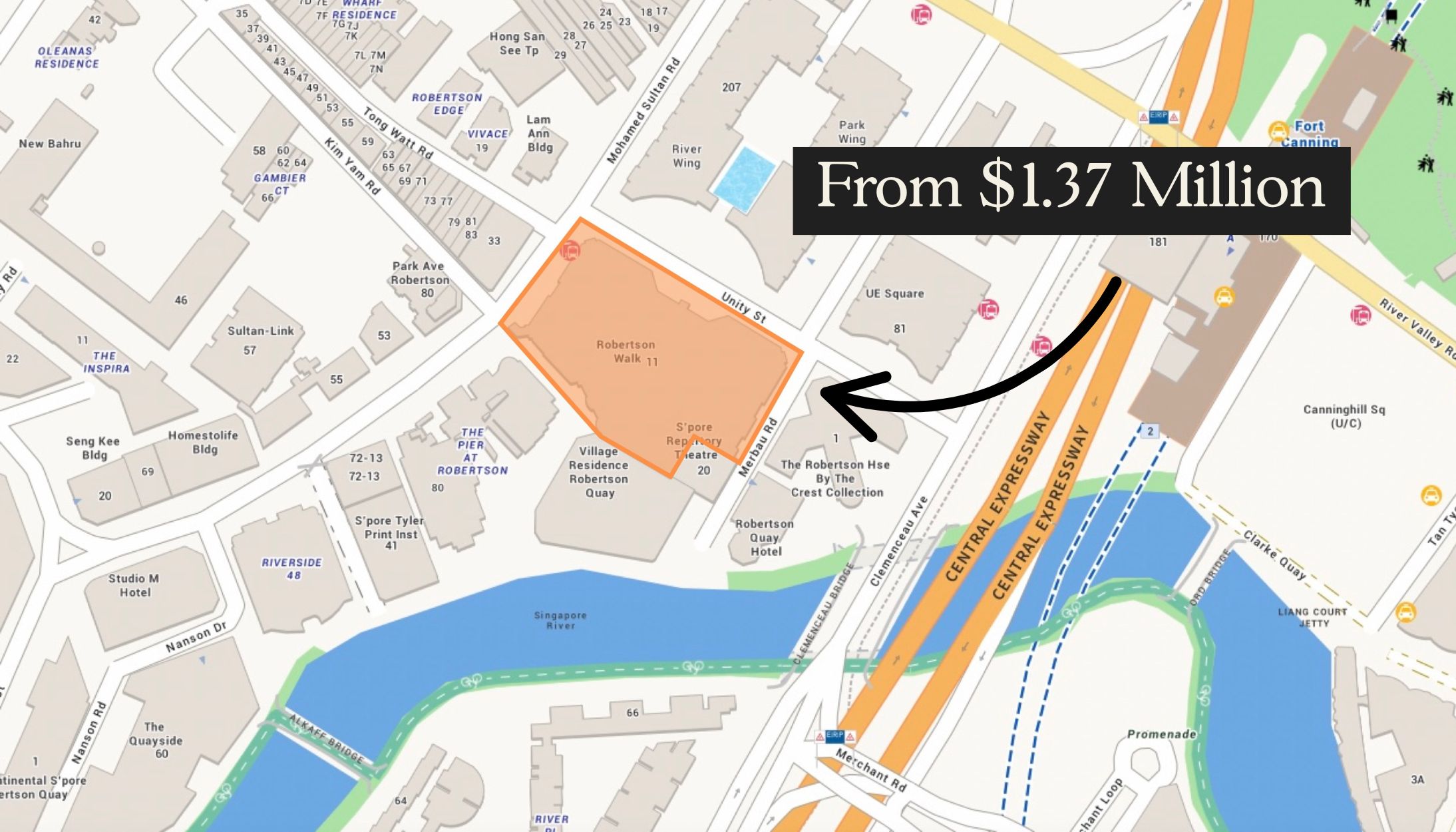

New Launch Condo Reviews The Robertson Opus Review: A Rare 999-Year New Launch Condo Priced From $1.37m

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

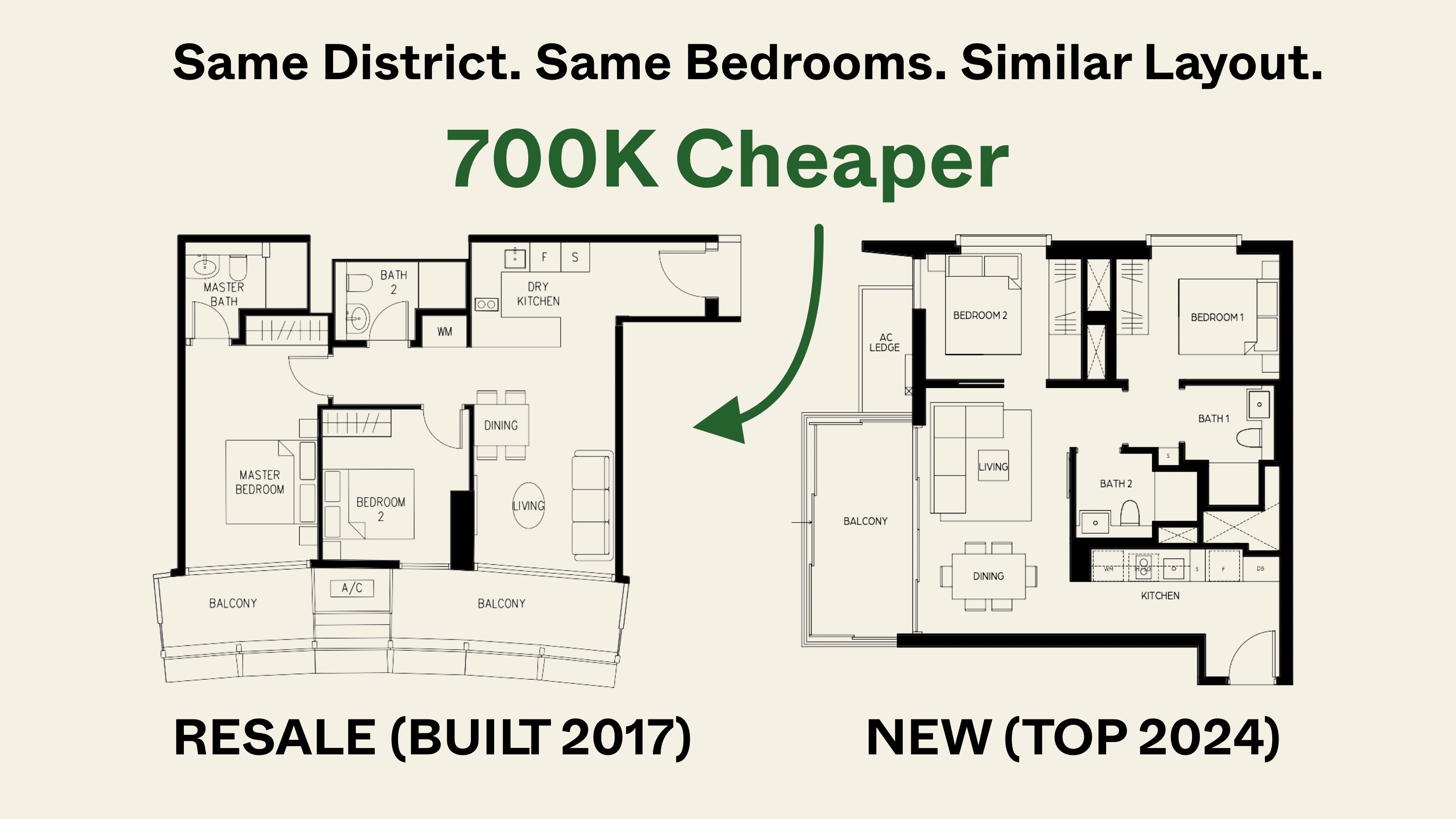

Pro Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

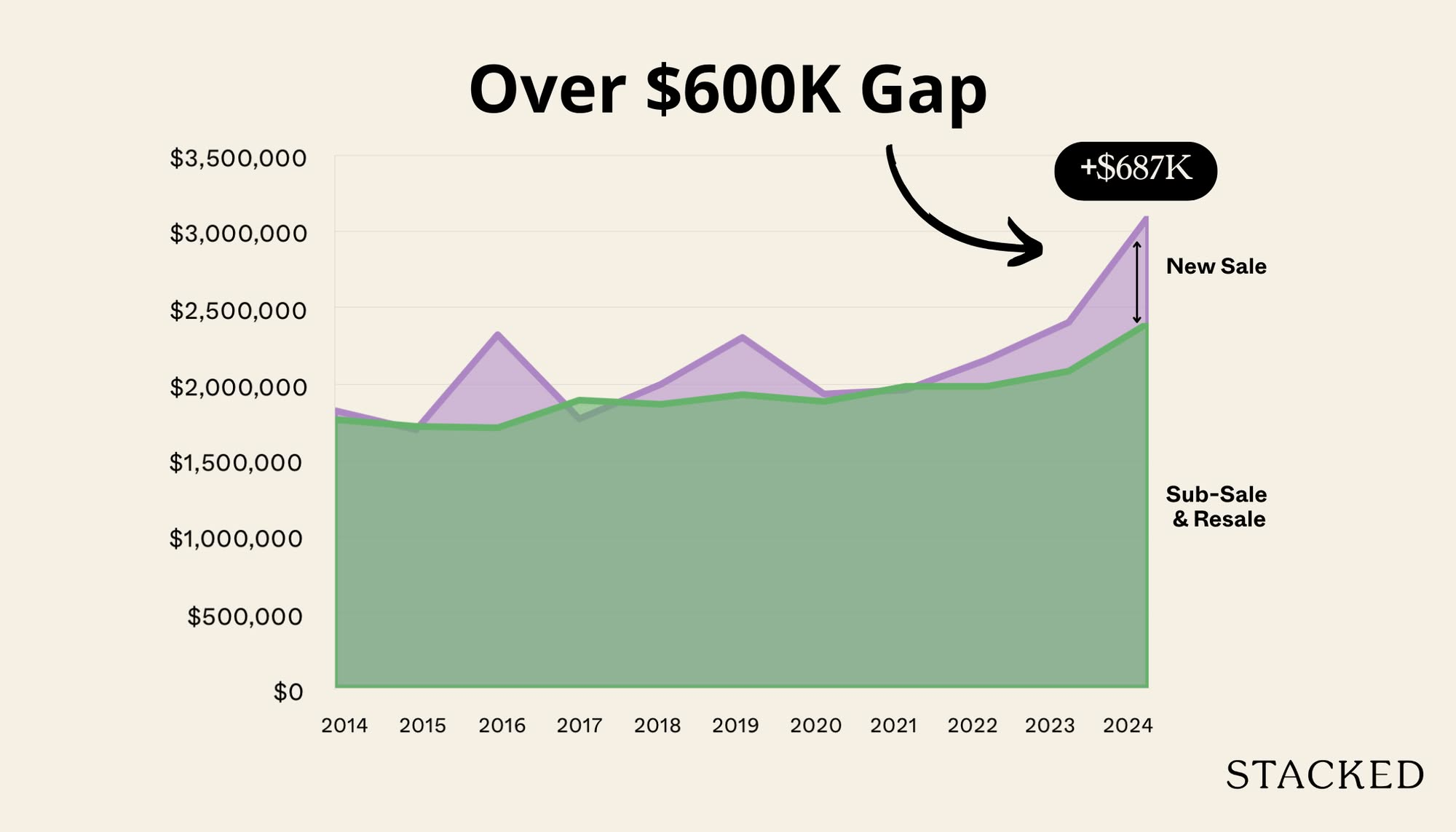

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

condos are way too expensive in singapore. 25% downpayment is just crazy don’t you think? in this climate, i hope this rule is relaxed back to 20% at least. unfortunaetly the low interest rates now means must be much more careful.