Here’s How To Read Your Credit Report For Your Home Loan / Mortgage

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

This is Part 4 of our 18-part first-time home buyer series. You may refer to the full table below:

First Time Home Buyer Guide

Financing

- Approval-in-Principle: Why It’s Your First Step for a Home Loan/Mortgage

- How Much Can You Borrow For A Home Loan / Mortgage?

- How Much Income Do You Need To Get A Home Loan / Mortgage?

- How To Read Your Credit Report For Your Home Loan / Mortgage

- Understanding SIBOR, Board Rate, And Fixed Deposit Home Loans

- How You Can Compare Home Loans And Get The Best Deal

Choosing The Right Condo

- Executive Condo Versus Private Condo

- Freehold Versus Leasehold Condos

- New Versus Resale Condos

- Large Versus Small Condo Developments

Choosing The Best Condo Unit In A Development

- How To Pick The Best Stack In A Development

- Key Questions To Ask About Condo Facilities

- Key Factors To Note About A Condo’s Location

- How To Read And Compare Floor Plans

- What To Look For In Condo Shoebox Units

- When Should You Consider A Dual-Key Unit?

- Key Questions To Ask At A Showflat

- Condo Purchase Timeline

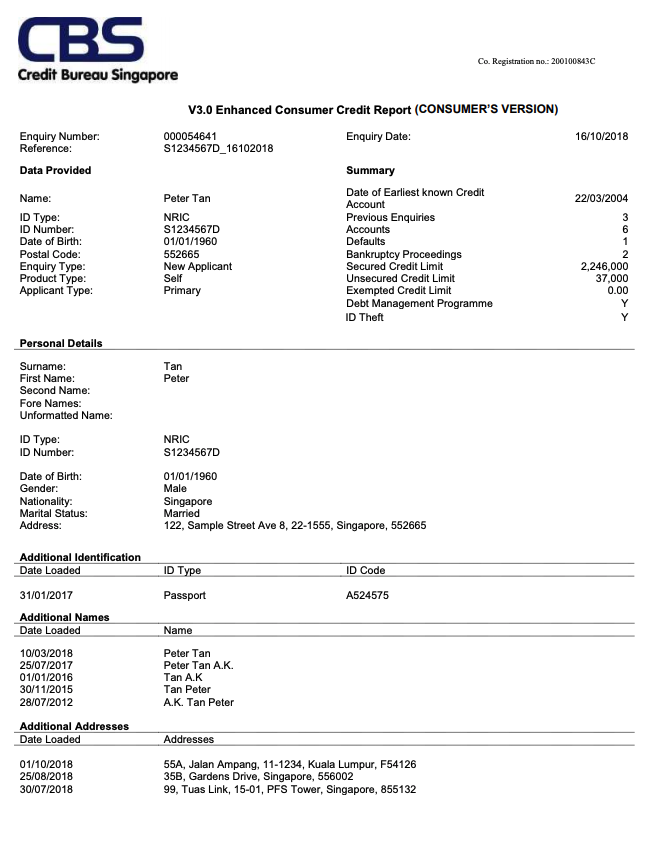

Your credit report is checked by the bank, before they decide to grant you a home loan / mortgage. If you find that your applications are constantly being turned down, or your loan quantum (the amount you can borrow) is too small, the issue may come down to what the bank’s loan officer is seeing in the report.

Here’s what you need to know about it:

What is a credit report?

You can obtain a credit report from the Credit Bureau of Singapore (CBS) for $6.42. However, there are sometimes special promotions where you can get your credit report for free when you apply for Approval In Principle (AIP), or even other unrelated loans (shop around to take advantage of this).

Your credit report provides a credit score, and a credit grade:

| Credit Grade | Credit Score |

| AA | 1911 – 2000 |

| BB | 1844 – 1910 |

| CC | 1825 – 1843 |

| DD | 1813 – 1824 |

| EE | 1782 – 1812 |

| FF | 1755 – 1781 |

| GG | 1724 – 1754 |

| HH | 1000 – 1723 |

Note that the exact breakdown to determine your score is not available. It’s calculated according to a proprietary algorithm, and no one knows the exact weightage of different factors.

Credit grades without scores

Sometimes you won’t have any credit score, just a grade. Here’s what they indicate:

Cx – This is one of the most commonly encountered issues. It just means there’s insufficient data to determine your creditworthiness (e.g. you have never used a loan before).

If you’re a foreigner, note that your credit score in your home country probably has no bearing on your credit score from CBS. You might find yourself starting with this credit grade.

Gx – This just means enquiries have been made about your creditworthiness, but there’s no credit information.

Hx – A writ of bankruptcy has been or is presently being filed against you, or you’re facing some form of litigation. This usually takes three years to be taken off your credit report, even after the situation has been cleared up. Banks usually won’t lend to you, but a non-banking Financial Institution might.

Hz – You have outstanding debts that are long past due, and which remain unpaid.

HH – A milder form of Hz. You may have had unpaid debts, for which you negotiated a settlement with the bank rather than outright defaulting. Loans may be possible, but the loan quantum is always significantly reduced.

What factors into your credit score?

The data is contributed by organisations that send data to CBS (virtually all banks and financial institutions that give consumer loans), The actual algorithm that determines your score is secret – so while we can know some of the factors, we won’t know the exact weightage of even one. However, the key ones that matter are:

- How promptly you repay your loans

- The overall size of your debts

- The number of open credit accounts or credit lines you maintain*

- The number of credit enquiries you’ve recently made

*This is regardless of whether you actually use those sources of credit. Having a credit card that you owe $0 on can still lower your score, so it’s advisable to cancel any unused credit cards before filling up a home loan application.

Property AdviceComplete Guide To Getting Your Home Loan Approved This Month

by Ryan JWhat’s the impact of the different credit scores and grades?

In many banks, even a credit grade of BB is enough to reduce your loan quantum. Almost across the board, a credit grade of CC or worse will result in a reduced loan quantum or outright rejection.

For credit scores of BB or CC, the bank may decide to lower your loan quantum – such as to just 55 per cent of your property price or value. This will result in having to make a much bigger down payment than usual.

For a credit grade of Cx or Hx, banks are often unwilling to disburse big loans – such as home loans – until you build up some credit first (in the same way you wouldn’t lend a huge amount of money to someone you just met).

This is quite easy to fix. All you need to do is get a small loan of around $1,000 or apply for a credit card. Pay back the credit card or loan on time, until the full amount is paid off. This will finally give you a credit score that the bank can use. You should start doing this 12 months prior to your loan application, to ensure it’s reflected when the bank checks.

For Hx, if you were formerly bankrupt, note that you still need to wait around five to seven years after your official discharge from bankruptcy. However, a non-bank lender might still be willing to give you a loan (albeit at higher interest) as long as you’re already discharged.

For other issues such as litigation, you may need to wait around three years after the situation is resolved. Again though, a non-bank lender might make an exception, and grant a loan as long as you can show the issue is resolved.

For Hz, it’s largely impossible to get a loan until the outstanding debts are somehow resolved.

For these complex situations, it’s best to start talking to a mortgage expert early. Contact us on Facebook if you see this on your credit report; we’ll find someone to help you out.

It takes time to fix or improve your credit score, so you need to begin the process long before you apply for a loan

Fixing a bad credit score is not something you can do in a matter of weeks, or even a month. It takes time for the changes to be reflected. As such, it’s always advisable to pay down loans and cancel unused credit 12 months before you try to get a home loan.

Also, check your credit score early. While uncommon, it’s not unheard of for errors to exist. You can raise a dispute to CBS if you see this, but you don’t want to be doing this while at the same time trying to plan for your new home; so do get started early.

For more on owning your first home, do check out the rest of this guide on Stacked. We also provide in-depth reviews on the top properties in Singapore, to make your first move the right one.

This is Part 4 of our Ultimate Guide to buying your first home. If you haven’t read Part 3, you can do so at the link!

Next up: Part 5 – Understanding SIBOR, Board Rate, and Fixed Deposit Home Loans

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Advice

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Advice Why Punggol Northshore Could Be The Next Hotspot In The HDB Resale Market

Property Advice How Much Is Your Home Really Worth? How Property Valuations Work in Singapore

Property Advice Why I Had Second Thoughts After Buying My Dream Home In Singapore

Latest Posts

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

On The Market 5 Spacious Old But Freehold Condos Above 2,650 Sqft

Property Investment Insights We Compared New Launch And Resale Condo Prices Across Districts—Here’s Where The Price Gaps Are The Biggest

Pro Similar Layout, Same District—But Over $500K Cheaper? We Compare New Launch Vs Resale Condos In District 5

New Launch Condo Analysis The First New Condo In Science Park After 40 Years: Is LyndenWoods Worth A Look? (Priced From $2,173 Psf)

Editor's Pick Why The Johor-Singapore Economic Zone Isn’t Just “Iskandar 2.0”

Editor's Pick URA’s 2025 Draft Master Plan: 80,000 New Homes Across 10 Estates — Here’s What To Look Out For

Pro Analysing Forest Woods Condo at Serangoon: Did This 2016 Project Hold Up Over Time?

Property Market Commentary This Upcoming 710-Unit Executive Condo In Pasir Ris Will Be One To Watch For Families