Can We Afford To Upgrade From An EC To A Landed Home?

August 30, 2024

Hi, thanks for the quick response.

I would like to share my story and seek Stacked Home advice.

My family is currently staying in an EC, we bought during the 2015 launches in the north, the EC was MOP in late 2022, and it’s a 4 bedder.

My spouse and I are both working, we are middle income family around $200k annually with bonus included with 2 kids.

We have some dumb luck and currently own $2m of equity. Combined CPF OA balance and both invested $500k.

Outstanding EC mortgage $550k, monthly payment per pax using CPF OA at around 3%, $1370.

Would like to seek advice, what are the options should we explore?

- Decouple and get another private?

- Sell EC and buy condo or penthouse?

- Buy landed? Would this be out of our budget?

We have plan to stop working in our mid 50s and our annual expenses is around $80k when we retire.

Thank you so much!

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hi there,

Thanks for writing in. With quite a significant size amount at your disposal, you have a wide range of options to consider. As usual, determining the right choice depends largely on your objectives and long-term goals.

Based on the information you’ve shared, we assume that the EC you’re currently living in is The Brownstone, as it was the only project launched in the north in 2015. Let’s begin by looking at its performance.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

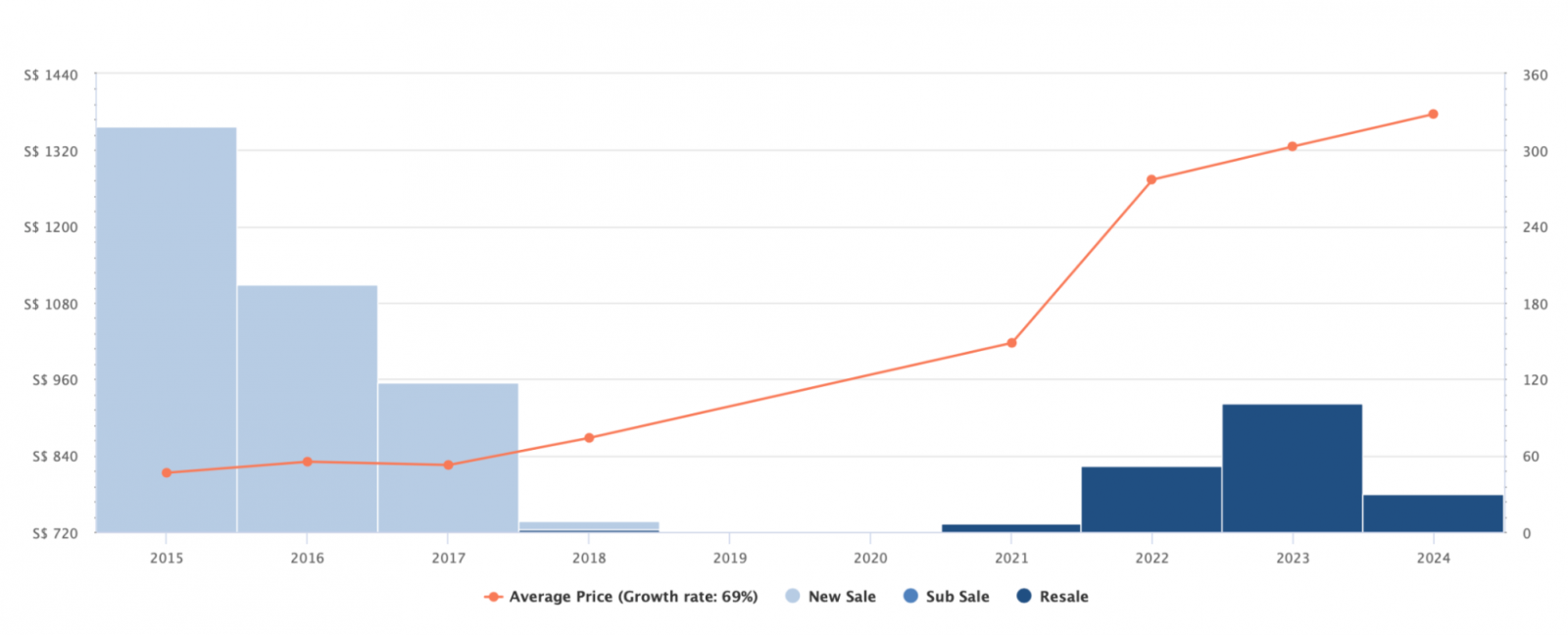

Performance of The Brownstone EC

Since its launch, the average price psf for the project has increased by 69% over 9 years, equating to an impressive annual growth rate of 7.7%.

Typically, new developments experience a significant price increase during the initial years, driven by the developer’s strategy to gradually raise prices as the project approaches its TOP. However, The Brownstone deviates from this trend. Instead of a price increase early on, the developer maintained relatively stable pricing throughout the project, with most of the growth occurring during resale transactions. This is because the property was launched at a time when the market was rather stagnant and was still adjusting to the new cooling measures implemented before.

During the Minimum Occupation Period (MOP) of 5 years was where the property market boomed and saw impressive growth.

Next, let’s look at The Brownstone compared with other projects in the area, starting with the resale developments.

| Project | Property type | Tenure | No. of units | Completion year | Avg PSF (2023) |

| Yishun Sapphire | Condominium | 99 years | 380 | 2001 | $1,005 |

| Yishun Emerald | Condominium | 99 years | 436 | 2002 | $952 |

| Canberra Residences | Condominium | 99 years | 320 | 2013 | $1,104 |

| Eight Courtyards | Condominium | 99 years | 654 | 2014 | $1,221 |

| 1 Canberra | Condominium | 99 years | 665 | 2015 | $1,166 |

| The Nautical | Condominium | 99 years | 435 | 2015 | $1,267 |

| The Brownstone | EC | 99 years | 638 | 2017 | $1,326 |

| The Visionaire | EC | 99 years | 632 | 2018 | $1,319 |

It’s interesting that contrary to the usual trend where ECs are slightly more affordable than private condominiums in the same area, the ECs here are commanding a higher price psf. This could be attributed to their status as the newest developments on the resale market, as well as their prime location near the MRT station and shopping mall. Additionally, with many ECs today offering a full range of facilities comparable to those of private condominiums, their EC status may be less of a concern for buyers.

Now, let’s explore the new launches in the area.

| Project | Property type | Tenure | No. of units | Completion year | Avg PSF (new sales) |

| Parc Canberra | EC | 99 years | 496 | 2023 (Completed but hasn’t hit MOP) | $1,356 |

| The Commodore | Condominium | 99 years | 219 | 2024 | $1,404 |

| Provence Residence | EC | 99 years | 413 | 2025 | $1,481 |

| Watergardens | Condominium | 99 years | 448 | 2026 | $1,686 |

Given the new launch prices in the area, which are all higher than The Brownstone’s, it’s reasonable to anticipate some potential appreciation for The Brownstone, as the resale prices of these launches will likely exceed their original purchase price.

Canberra is also a relatively new housing estate, with the oldest HDB blocks completed in 2018. Canberra Vista, the BTO project adjacent to The Brownstone, is set to be completed this year. The availability of new flats in the area provides a pool of potential upgraders who may be looking to cash out from their BTO units.

As such, if you wanted to continue holding onto a property as you retire – renting it out while you move into another home, we wouldn’t be too quick to dismiss The Brownstone. As affordability becomes an increasing concern for residents in Singapore, mass-market developments in the outskirts like this would remain an attractive option.

Moreover, Canberra is seen to be a remote area in Singapore. If one were to choose such an area to live in, being close to the MRT would be extremely advantageous due to its lower cost yet convenience to a transport node.

However, let’s still run the numbers regardless so that you can have a thorough view of the financial situation should you choose to decouple or sell your unit.

Affordability

To know what you can afford, we’ll have to assess what you’d have if you sold The Brownstone. These are some of the recent 4-bedroom transactions:

| Date | Size (sqft) | PSF | Price | Address |

| Jul 2024 | 1,184 | $1,360 | $1,610,000 | 150 Canberra Drive #04 |

| May 2024 | 1,141 | $1,437 | $1,640,000 | 156 Canberra Drive #06 |

| Apr 2024 | 1,130 | $1,407 | $1,590,000 | 150 Canberra Drive #07 |

| Feb 2024 | 1,141 | $1,315 | $1,500,000 | 160 Canberra Drive #04 |

| Feb 2024 | 1,141 | $1,323 | $1,510,000 | 164 Canberra Drive #04 |

| Jan 2024 | 1,130 | $1,380 | $1,560,000 | 158 Canberra Drive #03 |

This averages out to around $1.57M, which we will use as the selling price/valuation for our calculations.

Decoupling the existing property

A few assumptions that we are making here:

- Both of you have equal shares of the property

- You took an 80% loan of $691,200 for the purchase of the property

- The remaining 20% (5% cash, 15% CPF) down payment was paid evenly by both of you

- Assuming a 3.5% interest on the loan, with an outstanding loan amount of $550,000, you’d have paid $335,210. This is based on the medium-term interest rate back then.

- We will presume the $335,210 was paid with CPF and split evenly between the two of you

| Description | Seller | Buyer |

| Shares | 50% | 50% |

| Valuation | $785,000 | $785,000 |

| Outstanding loan | $275,000 | $275,000 |

| Legal fees | $3,000 | $3,000 |

| BSD | – | $18,150 |

| 5% option fee | $39,250 (received) | $39,250 (paid) |

| 20% completion fee | $157,000 (received) | $157,000 (paid) |

| Sales proceeds (Cash + CPF) | $507,000 | – |

| New loan | – | $863,750 |

Presuming that you each make $100K annually, based on a 4.8% interest, your maximum loan quantum will be:

| Husband (44) | $726,793 (21-year tenure) |

| Wife (42) | $765,073 (23-year tenure) |

Although there is a loan shortfall, given that you have a substantial amount of equity, decoupling will still be a viable option.

Sell The Brownstone and purchase another property together/2 properties individually

| Selling price | $1,570,000 |

| Outstanding loan | $550,000 |

| CPF to be refunded into OA | $464,810* |

| Cash proceeds | $555,190 |

*335,210 paid for the mortgage loan + $129,600 for the initial 15% down payment

Combined affordability

| Maximum loan based on ages of 44 and 42, with an annual income of $200K, at a 4.8% interest | $1,492,783 (22-year tenure) |

| CPF funds | $464,810 |

| Cash | $2,555,190* |

| Total loan + CPF + cash | $4,512,783 |

| BSD based on $4,512,783 | $210,366 |

| Estimated affordability | $4,302,417 |

*Here, we are using the cash proceeds from the sale and assuming you realise the $2M equity. We did not include the amounts you’ve invested from your CPF, SSB and fixed deposit. Your affordability will vary depending on how much you wish to cash out and put towards the purchase.

Individual affordability – assuming that all CPF funds and cash are equally split

Husband

| Maximum loan based on the age of 44 with an annual income of $100K, at a 4.8% interest | $726,793 (21-year tenure) |

| CPF funds | $232,405 |

| Cash | $1,277,595 |

| Total loan + CPF + cash | $2,236,793 |

| BSD based on $2,236,793 | $81,439 |

| Estimated affordability | $2,155,354 |

Wife

| Maximum loan based on the age of 42 with an annual income of $100K, at a 4.8% interest | $765,073 (23-year tenure) |

| CPF funds | $232,405 |

| Cash | $1,277,595 |

| Total loan + CPF + cash | $2,275,073 |

| BSD based on $2,275,073 | $83,353 |

| Estimated affordability | $2,191,720 |

Given that you have a substantial amount of cash on hand, you can adjust your individual affordability by moving the cash around.

Of course, this doesn’t mean you should liquidate all of your equities and funnel this to the property purchase. It depends on your objectives, and with your retirement in mind, it could make sense to have some alternate liquid investments elsewhere.

Let’s now examine the performance of both non-landed and landed properties, as these are the two categories you’re considering.

Performance of non-landed vs landed properties

| Year | Non-landed | Landed |

| 2013-Q4 | 147.6 | 177.1 |

| 2014-Q4 | 142.5 | 167.6 |

| 2015-Q4 | 137.4 | 160.8 |

| 2016-Q4 | 133.8 | 153.6 |

| 2017-Q4 | 135.6 | 152.9 |

| 2018-Q4 | 146.8 | 162.6 |

| 2019-Q4 | 149.6 | 171.8 |

| 2020-Q4 | 153.3 | 173.8 |

| 2021-Q4 | 168.4 | 197 |

| 2022-Q4 | 182.1 | 216 |

| 2023-Q4 | 194.2 | 233.2 |

| Average | 2.78% | 2.79% |

When it comes to overall performance, both categories have shown comparable growth rates over the past 10 years. Let’s also analyse this further by comparing leasehold and freehold tenures as within landed properties there’s a very big difference between leasehold and freehold.

Landed properties

| Year | 99y | Freehold/999y | Freehold Premium |

| 2013 | $1,009 | $1,320 | +30.8% |

| 2014 | $865 | $1,314 | +51.9% |

| 2015 | $846 | $1,265 | +49.5% |

| 2016 | $798 | $1,205 | +51.0% |

| 2017 | $853 | $1,223 | +43.4% |

| 2018 | $845 | $1,317 | +55.9% |

| 2019 | $863 | $1,359 | +57.5% |

| 2020 | $869 | $1,393 | +60.3% |

| 2021 | $958 | $1,502 | +56.8% |

| 2022 | $1,115 | $1,718 | +54.1% |

| 2023 | $1,185 | $1,875 | +58.2% |

| Average | 1.6% | 3.6% |

We can see from the table that when it comes to landed properties, those with a freehold tenure experienced a much better appreciation in the last 10 years. One of the primary reasons is the value of permanent ownership in a land-scarce country. This perpetual ownership contrasts with leasehold properties, which eventually revert to the state, diminishing their long-term appeal. As a result, freehold properties command higher prices and see stronger demand.

The scarcity of freehold land further drives up the value of these properties. With the government releasing new land on a leasehold basis, freehold properties have become increasingly rare.

Freehold landed properties also tend to appreciate more reliably over time, as we can see with the YoY performance above, avoiding the depreciation issues that often plague leasehold properties as their lease terms shorten. Because of this, freehold properties are seen as a safer and more lucrative long-term investment, offering better prospects for wealth preservation and capital growth.

So why do freehold landed properties tend to outperform their leasehold counterparts, while the same doesn’t necessarily apply to non-landed properties?

One of the main reasons is the fundamental difference in land ownership. When you own a freehold landed property, you hold the title to both the land and the structure on it, giving you complete control and long-term security. In contrast, owning a freehold condo means you only own the unit itself, with shared ownership of the common areas and land. This distinction in ownership drives stronger performance for freehold landed properties compared to freehold condos.

Another factor is the limited supply of landed properties in Singapore. This scarcity naturally leads to higher demand and supports stronger price growth for freehold landed properties. While freehold condos are also limited in supply, they do not face the same level of scarcity as landed properties.

Leasehold condos also have a chance of going en bloc. While it’s not a guarantee, this possibility makes it an exit strategy. This is unlike leasehold landed homes which don’t have that same attraction as some face restrictions in height due to regulations.

Cultural and aspirational preferences also play a significant role in the superior performance of freehold landed properties. In Singapore, owning a landed property is often seen as a symbol of wealth, status, and success. The allure of more space, privacy, and prestige makes freehold landed homes highly desirable.

Lastly, freehold landed properties tend to offer better capital appreciation and wealth preservation over time. The unique value proposition of owning land in a highly constrained market means that landed properties are often viewed as a secure investment, capable of retaining and growing value across generations. In contrast, freehold condos face competition from new developments and may not benefit as much from land scarcity. Additionally, factors such as maintenance fees, shared decision-making, and the potential depreciation of building infrastructure can further impact the long-term value of a condo.

Having said all that, which property type you should buy would depend on your intended holding period and objective.

Let’s now run through some numbers for the options you’re considering.

Potential pathways

Decouple and get a second private property

While decoupling is a feasible option, it’s important to note that your property has appreciated significantly, meaning the party buying the shares is doing so at a much higher price. Instead of selling the unit on the market and earning profits from an external buyer, you essentially end up “paying” for this profit yourselves. This situation may be less advantageous, especially if your ownership is split 50/50, compared to a 99/1 arrangement.

For our calculations, we’ll assume a 10-year holding period and in this case, that your husband buys out your shares.

Cost to decouple and hold your existing property

| Decoupling cost (BSD + legal fees) | $21,150 |

| Interest expense (Assuming a 21-year tenure at 4% interest) | $240,443 |

| Property tax | $21,900 |

| Maintenance fees (Assuming $320/month) | $38,400 |

| Total costs | $321,893 |

Depending on how much cash you want to put towards the purchase of the second property, your affordability will vary. If we do not touch any of your equity and investments, your affordability will be:

| Maximum loan based on the age of 42 with an annual income of $100K, at a 4.8% interest | $765,073 |

| CPF funds | $232,405 |

| Cash | $274,595 |

| Total loan + CPF + cash | $1,272,073 |

| BSD based on $1,272,073 | $35,482 |

| Estimated affordability | $1,236,591 |

We will use $1.2M as the purchase price and assume a rental yield of 3%.

| Purchase price | $1,200,000 |

| BSD | $32,600 |

| CPF + cash | $507,000 |

| Loan required | $725,600 |

| BSD | $32,600 |

| Interest expense (Assuming a 23-year tenure at 4% interest) | $246,460 |

| Property tax | $48,000 |

| Maintenance fees (Assuming $250/month) | $30,000 |

| Renovation | $20,000 |

| Rental income | $360,000 |

| Agency fees (Payable once every 2 years) | $16,350 |

| Total costs | $33,410 |

Total cost if you were to take this pathway: $321,893 + $33,410 = $355,303

Monthly mortgage repayment for both properties: $4,268 (The Brownstone) + $4,025 (second property) = $8,293

Sell EC to buy another condo or penthouse unit

We are assuming that when you mention buying another condo, you might be considering either a larger unit or a different location that better suits your preferences.

With your combined affordability, you certainly have the option to upgrade to a larger unit, move to a more central location if that suits your preferences, or even consider a penthouse. For calculation purposes, let’s use a $3.5M purchase price and the same 10-year holding period.

| Purchase price | $3,500,000 |

| BSD | $149,600 |

| CPF + cash | $3,020,000 |

| Loan required | $629,600 |

| BSD | $149,600 |

| Interest expense (Assuming a 22-year tenure at 4% interest) | $211,205 |

| Property tax | $135,800 |

| Maintenance fees (Assuming $450/month) | $54,000 |

| Renovation | $80,000 |

| Total costs | $630,605 |

Monthly mortgage repayment: $3,590

Sell EC to buy a landed property

When considering the purchase of a landed property, there are several factors to keep in mind.

Firstly, the extent of renovations required will depend on the condition and design of the property. Even if the house has been rebuilt, it may have been customised to the current owner’s preferences, which might not align with yours, which may mean further renovations. Unlike apartments where renovation limits are clearer, landed properties come with more extensive guidelines. Major changes will typically require an assessment by a quantity surveyor.

Although you won’t be paying a monthly maintenance fee like in a condominium, unexpected issues such as roof leaks or pest infestations could lead to significant one-time expenses. These additional costs should be factored into your decision when buying a landed home.

Assuming your goal is to hold the property for the long term, as the data suggests, a freehold landed property would be preferable.

With a budget of $4.3M, or potentially more if you liquidate your investments, you should be able to secure a landed house in the Outside Central Region (OCR) (most likely a terraced house). While there may be options in the Rest of Central Region (RCR), they are likely to be smaller properties. A quick search on property portals reveals that some landed houses within your budget are already renovated, allowing you to potentially save on renovation costs if their designs meet your preferences.

For calculation purposes, we will use $4.3M as the purchase price.

| Purchase price | $4,300,000 |

| BSD | $197,600 |

| CPF + cash | $3,020,000 |

| Loan required | $1,477,600 |

| BSD | $197,600 |

| Interest expense (Assuming a 22-year tenure at 4% interest) | $495,675 |

| Property tax | $212,600 |

| Renovation | $200,000 |

| Total costs | $1,105,875 |

Monthly mortgage repayment: $8,425

What should you do?

| Potential pathways | No. of properties owned | Value of property/properties | Monthly repayment | Costs incurred in 10 years | Equity/investment remaining |

| Decouple and get a second property | 2 | $2.77M | $8,293 | $355,303 | $2.5M |

| Sell EC to buy another condo or penthouse unit | 1 | $3.5M | $3,590 | $630,605 | $500K |

| Sell EC to buy a landed property | 1 | $4.3M | $8,425 | $1,105,875 | $500K |

Based on this information, here’s a look at the annual returns by the time you hit 55. Note that inflation was not taken into account here.

You mentioned that by some stroke of dumb luck, you have $2 million in equities investment. Going by the withdrawal rule of 4%, this equates to exactly $80,000 per year. Considering this, you’re already in a good position to retire comfortably. Regardless, here’s what your funds remaining would look like by the time you hit 55:

| Potential pathways | Equity/investment remaining | 11 years later with a 7% ROI | Funds remaining after deducting costs |

| Decouple and get a second property | $2.5M | $5,262,130 | $4,906,827 |

| Sell EC to buy another condo or penthouse unit | $500K | $1,052,426 | $421,821 |

| Sell EC to buy a landed property | $500K | $1,052,426 | -$53,449 |

Based on the figures, the first option of decoupling and purchasing a second property seems to be suitable. This approach allows you to keep your equity and investments intact, which can be allocated for your retirement. With an estimated annual expense of $80K when you retire, a 7% ROI on $2.5M will yield $175K per year, covering your expenses and more. Additionally, renting out one property will provide an extra stream of passive income. When your children are older, you can choose to sell the second property or sell both and downsize to a smaller unit. This pathway seems to offer the most comfort for retirement, in terms of finances. In terms of legacy planning, you can also leave behind 1 property for each child.

In contrast, the other two options may require you to cash out some of your equity or investments to fund the purchase, potentially reducing your retirement funds. For the second option, depending on the development you choose, you might not need to use a significant portion of your funds. These options will necessitate a higher ROI to cover your expenses.

While living in a penthouse is appealing, it may not be practical for everyone, especially if you have plans to sell it later.

Buying a freehold landed property is an ideal long-term investment, particularly for legacy planning. However, it involves substantial costs, including a higher purchase price, as well as renovation and maintenance costs. You’ll be allocating most of your wealth into a single landed home and purely banking on the capital appreciation of the landed home outperforming everything else over the next 11 years. While this could happen, it seems like a bigger risk to take. In the future, if you want to own 2 properties again, you may find it to be challenging as you’ll have a much shorter loan tenure. This means that owning 2 properties in the future might require you to sacrifice a large part of your retirement funds. In other words, it’s a stretch that could put your comfortable retirement at risk – and not something we’d recommend especially if you intend to have 2 properties by the time you retire – one for renting out and one for staying.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

0 Comments