Can New ECs Actually Lose Money? 4 Lessons Learned From 1,094 Unprofitable Transactions

April 20, 2023

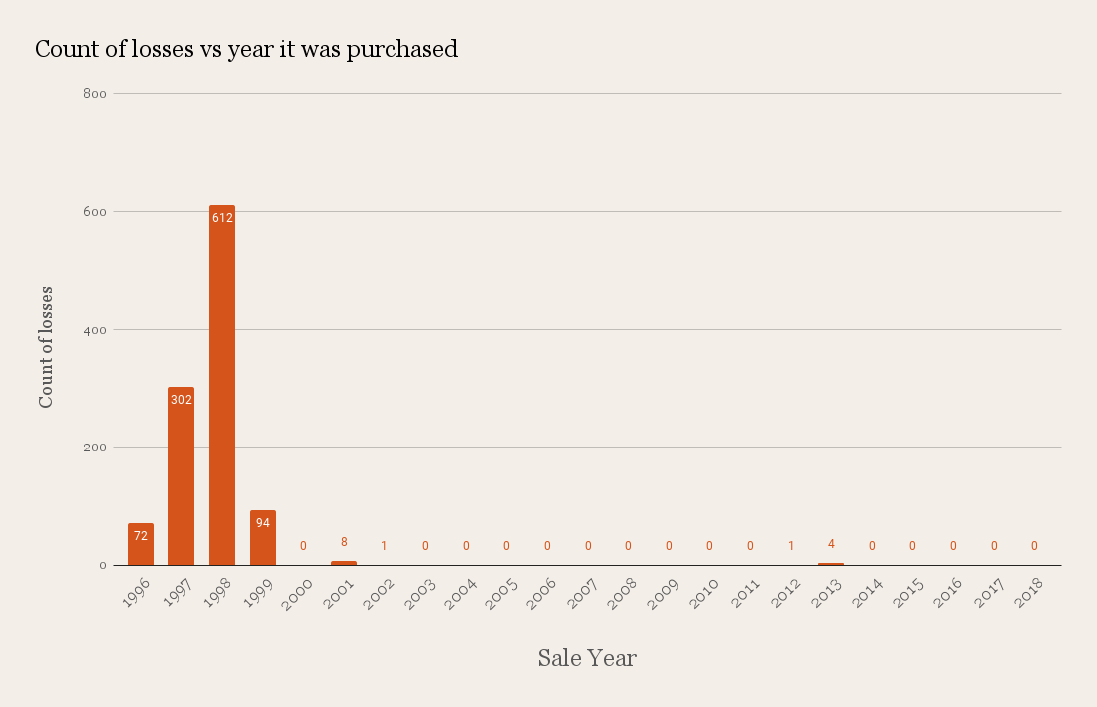

While most property stories in Singapore are success stories, it’s important to know the flip side as well. So you may be surprised to know that even “sure-fire” investments like new Executive Condominiums can sometimes transact at a loss. But timing is everything (which you will see in a bit). Here are some new ECs with losing transactions, and what you can learn over the 1,094 unprofitable transactions:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

ECs that have seen losing transactions:

| Condos | Region | District | Sale Year | Breakeven | Gain | Loss | Grand Total |

| YEW MEI GREEN | West Region | 23 | 1998 | 296 | 141 | 437 | |

| SIMEI GREEN CONDOMINIUM | East Region | 18 | 1997 | 218 | 129 | 347 | |

| NORTHOAKS | North Region | 25 | 1998 | 378 | 128 | 506 | |

| WOODSVALE | North Region | 25 | 1998 | 351 | 109 | 460 | |

| THE FLORAVALE | West Region | 22 | 1999 | 319 | 94 | 413 | |

| THE RIVERVALE | North East Region | 19 | 1998 | 257 | 94 | 351 | |

| THE FLORIDA | North East Region | 19 | 1998 | 1 | 218 | 83 | 302 |

| CHESTERVALE | West Region | 23 | 1997 | 140 | 63 | 203 | |

| WINDERMERE | West Region | 23 | 1997 | 1 | 137 | 59 | 197 |

| SUMMERDALE | West Region | 22 | 1998 | 194 | 57 | 251 | |

| PINEVALE | East Region | 18 | 1997 | 118 | 51 | 169 | |

| EASTVALE | East Region | 18 | 1996 | 95 | 36 | 131 | |

| WESTMERE | West Region | 22 | 1996 | 61 | 36 | 97 | |

| THE EDEN AT TAMPINES | East Region | 18 | 2001 | 244 | 4 | 248 | |

| LILYDALE | North Region | 27 | 2001 | 243 | 3 | 246 | |

| ECOPOLITAN | North East Region | 19 | 2013 | 147 | 2 | 149 | |

| FORESTVILLE | North Region | 25 | 2013 | 155 | 1 | 156 | |

| THE DEW | West Region | 23 | 2001 | 114 | 1 | 115 | |

| THE TOPIARY | North East Region | 28 | 2013 | 261 | 1 | 262 | |

| WATERCOLOURS | East Region | 18 | 2012 | 165 | 1 | 166 | |

| WHITEWATER | East Region | 18 | 2002 | 259 | 1 | 260 |

Some notable details:

Table Of Contents

- Losses seem related to timing rather than fundamental issues

- The holding period is a factor

- Smaller units didn’t seem to record losses

- Gains still outnumbered losses

1. Losses seem related to timing rather than fundamental issues

The bulk of losses stemmed from units purchased between 1996 to 1999. We should note that in May 1996, the government introduced measures to combat property flipping – this came in the form of stamp duty on sellers.

At the time, properties sold within one year of purchase had 100 per cent (!) of their gains taxed. Properties sold within two years or three years had two-thirds and one-third of the gains taxed respectively.

(This policy is defunct today, it ended in 2005).

Now this wouldn’t have directly impacted resale ECs, as ECs already had a five-year Minimum Occupancy Period (MOP). However, it did cause a knee-jerk reaction in the wider market, as cooling measures are accustomed to do; and it did curb enthusiasm for property purchases.

This was partly because, at the time, a trend was to buy a condo with the aim of quickly reselling it, rather than holding it for long periods; the whole purpose of the added stamp duty at the time was to disincentivise this practice.

More from Stacked

Watertown Condo’s 10-Year Case Study: When Holding Period And Exit Timing Mattered More Than Buying Early

In this Stacked Pro breakdown:

Here’s an old archived report, if you want a snapshot of the situation at the time. While this can seem like ancient history (being almost three decades ago) it’s still a reminder of how changes to government policy can impact even “safer” property choices like ECs.

2. Holding period is a factor

| Holding Period (Years) | Breakeven | Gain | Loss | Grand Total |

| 0 | 4 | 3 | 7 | |

| 1 | 32 | 5 | 37 | |

| 2 | 50 | 12 | 62 | |

| 3 | 1 | 77 | 16 | 94 |

| 4 | 97 | 15 | 112 | |

| 5 | 296 | 46 | 342 | |

| 6 | 728 | 81 | 809 | |

| 7 | 1246 | 257 | 1503 | |

| 8 | 2207 | 347 | 2554 | |

| 9 | 1468 | 203 | 1671 | |

| 10 | 1 | 936 | 73 | 1010 |

| 11 | 1 | 541 | 27 | 569 |

| 12 | 412 | 9 | 421 | |

| 13 | 349 | 349 | ||

| 14 | 293 | 293 | ||

| 15 | 181 | 181 | ||

| 16 | 170 | 170 | ||

| 17 | 100 | 100 | ||

| 18 | 133 | 133 | ||

| 19 | 152 | 152 | ||

| 20 | 116 | 116 | ||

| 21 | 98 | 98 | ||

| 22 | 87 | 87 | ||

| 23 | 83 | 83 | ||

| 24 | 60 | 60 | ||

| 25 | 38 | 38 | ||

| 26 | 10 | 10 |

It’s no surprise that longer holding periods correspond to lower chances of loss, but you could say that it is unexpected that just over 13 per cent of losses come from units sold after five years. Conventional wisdom is that ECs are good resale as they’re halfway to full privatisation (and subsequent buyers will be free of the MOP).

And yet, it is from 13 years onward that we no longer see any losing transactions – quite sometime after the EC is already privatised. This may suggest that EC buyers should consider selling after privatisation, rather than in the fifth to 10th years if they are looking for a better payout (as obvious as it may sound).

(Note that losses seen in holding periods of less than five years are “special case” scenarios, where the buyers are given special permission to sell early due to divorce, changes in financial circumstances, etc. The losses for this batch are likely due to their related circumstances).

3. Smaller units didn’t seem to record losses

| Size | Breakeven | Gain | Loss |

| < 893 sqft | 710 | ||

| >1496 sqft | 810 | 103 | |

| 1205 sqft to 1496 sqft | 3 | 4547 | 860 |

| 893 sqft to 1205 sqft | 3897 | 131 |

Of the 710 units that were 893 sq. ft. or smaller, none of them recorded any losses. It was units between 1,205 sq. ft. to 1,496 sq. ft. that recorded the most losing transactions, by a significant margin.

The reason is uncertain, but it may simply be due to their higher quantum at the time of purchase.

Property Picks5 Almost Perfect New Launch Condo Layouts (Smaller But More Efficient)

by Ryan J. Ong4. Gains still outnumbered losses

At 9,964 gains to 1,094 losses, it’s clear that losing money on an EC is still an outlier. Most buyers will see positive returns, even among those who sold in less-than-ideal markets.

The key is to ensure that – just as a contingency – you’re ready to hold even past full privatisation to sell later. There’s no guarantee that selling right after MOP will be profitable; and in the words of one realtor:

“If everyone wants to sell right after MOP, then it should actually be the worst time to sell, correct? That is when there will be the biggest number of competing listings in your EC!”

Realtors are expecting a likely pick-up in resale condo prices for 2023 to 2024

According to the realtors we spoke to, there’s rising interest in resale condos, including resale ECs. This is due to a rise in new launch prices, with even fringe region properties crossing the $2,100 psf mark.

On the flip side, resale flats are also at their highest price point in decades; and those who have just sold off a private property are now unable to purchase a resale flat for at least 15 months.

As such, word on the ground is that buyers are instead considering buying – or rightsizing into – older condos instead. With their significantly lower price point, resale ECs have been drawing more attention again.

It’s especially helpful that there’s no MOP on the subsequent batch of buyers for an EC. Investment-wise, this means the buyers can purchase a resale EC and start renting it out right away, to tap into the strong rental market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Can I lose money on a new Executive Condominium (EC) in Singapore?

What factors influence whether I might lose money when selling an EC?

Do smaller EC units tend to be more profitable or less risky?

Is it better to sell an EC after it becomes fully privatized?

How common are losses among EC transactions compared to gains?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

Property Investment Insights This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Latest Posts

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

0 Comments