Can I Afford To Buy A Private Property As A Single Before 35?

March 11, 2020

I had 2 (single) friends visit the M showflat recently.

It was their maiden showflat tour, and of course, I was eager to find out what they thought of it.

To my surprise, I was faced with glum expressions when I met up with them post-visit.

“Was it that bad a project?”

They shook their heads.

“We never knew how much cash we needed as downpayment!!”

That sounds about right.

Private property in Singapore is expensive. And unless you were born with a silver spoon, you probably wouldn’t even consider owning one at a young age.

Especially if you’re single.

Now this statement might seem harsh, but it is becoming an increasing reality for many.

And here’s why.

If you speak to those who hail from the younger demographics, you’ll realise that quite a lot of them actually have no intention of getting married nowadays!

And in a property sense, it means that most of them have to wait till at least 35 to get a HDB.

So if you want to own your own place by 30, you are really relegated only to private property.

Be prepared though, it’s gonna cost you an exorbitant sum.

But how much is ‘exorbitant’ exactly…and how long (or much) will it take you to save?

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

So what do I need to save?

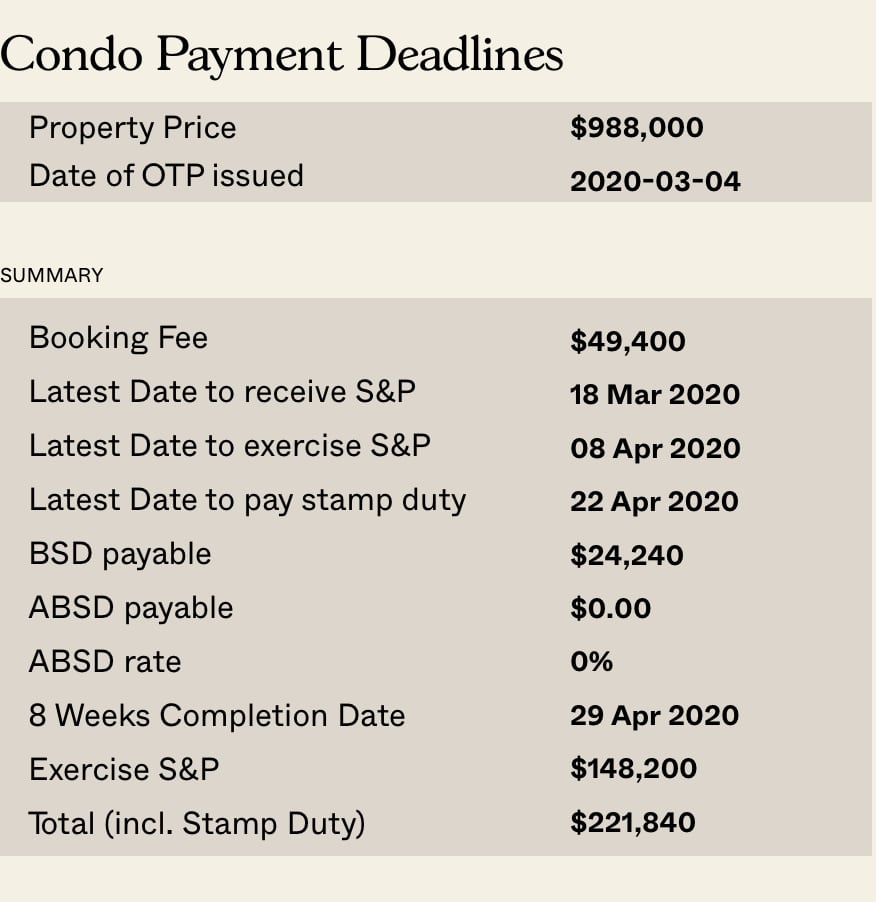

For the sake of congruity, let’s base the total payments off a Studio Apartment at The M.

Initial Payments

Assuming that the value of the unit is $988,000 (and that this is your first property), you’d have to fork out a hefty 25% downpayment of $247,000 (at the very least) based on the LTV ratios.

For those who are new to the current downpayment scheme, you can further split the 25% payments into:

- 15% CPF – $148,200,

- 5% Cash – $49,400 (Booking Fee),

- 5% at Loan Disbursement – $49,400 (Foundation stage of construction)

You’ll also have to pay for Buyer Stamp Duty (BSD), which comes up to $24,240.

And although the BSD payment can be paid from the Ordinary CPF Account, let’s just even the scale by adding it to the initial cash payments for now.

That’s $73,640 of payments in cash and $197,600 in CPF up to this point.

Savings Timeline

Now if you’re a fresh graduate at 22, chances are you probably have a small sum of savings from those holiday part-time jobs or CNY ‘ang paos’.

But let’s just imagine you’re starting from $0.

Assuming you immediately find a job that pays you a solid $3,500, and you settle in for the long haul, making dedicated housing savings of $1,000 per month.

In a year, you would save $12,000.

6 years later, at the ripe old age of 28, you’d have finally saved up enough to make that $73,640 down payment in cash (give or take a thousand or so).

What about your CPF then?

Well, 6 years later at 23% (Ordinary Account) CPF contribution per month based on a $3,500 monthly salary, you would have a total CPF value of $57,960.

Not nearly enough to meet that $197,600 CPF fee. You’d still be short of a staggering $139,640.

Now assuming that you continue with your current savings, it would take you about 7 more years for an additional $84,000 in cash + $67,620 in CPF to make up for this shortfall.

Basically, you would be 35 by the time you could afford the initial downpayment for a studio apartment at the M based on this particular salary and saving scheme.

Or in other words, ready to purchase a HDB flat on your own at this point.

Of course, one would naturally expect increments in wages + investment returns over the years, so you could possibly expect two to four years deducted from this projected end date (possibly more if you’re frugal and hardworking) after also considering the:

- Conveyancing fees cost of $2.5 – $4.5k,

- Valuation report costs ($300 – $600),

…which would, on most occasions, be paid during this period as well.

So not quite the magical number 30, but it is quite close.

Just give or take 9-11 years from your first day at work.

And then the real sh*t begins.

Interest Fees

Reaching that 25% mark was hard, but you now have an additional 75% to go.

To paint a clearer picture, if you were to spread out the $741,000 (75%) loan over the maximum 30-year period with a 2% interest rate per annum, these are the ‘end-loan’ figures you’d be looking at:

| Property Value | $988,000 |

| Down payment | $247,000 (25%) |

| Principal | $741,000 |

| Interest | 2% |

| Term | 30 years |

| Payment | $2,738.88 |

| Total | $2,738.88 |

| Total Interest | $244,996.91 |

| Total Payments | $985,996.91 |

To make things clear you’ll be paying a staggering $244,996 for interest fees, and dishing out $2,738.88 for combined interest and principal payments every month for the next 30 years of your life.

| Year | Interest | Principal | Balance |

| 2020 | 12,236.71 | 15,152.10 | 725,847.90 |

| 2021 | 14,347.82 | 18,518.75 | 707,329.16 |

| 2022 | 13,974.03 | 18,892.54 | 688,436.62 |

| 2023 | 13,592.69 | 19,273.87 | 669,162.75 |

| 2024 | 13,203.66 | 19,662.90 | 649,499.85 |

| 2025 | 12,806.78 | 20,059.78 | 629,440.06 |

| 2026 | 12,401.89 | 20,464.68 | 608,975.38 |

| 2027 | 11,988.82 | 20,877.74 | 588,097.64 |

| 2028 | 11,567.42 | 21,299.15 | 566,798.49 |

| 2029 | 11,137.51 | 21,729.06 | 545,069.43 |

| 2030 | 10,698.92 | 22,167.65 | 522,901.79 |

| 2031 | 10,251.48 | 22,615.08 | 500,286.70 |

| 2032 | 9,795.01 | 23,071.56 | 477,215.15 |

| 2033 | 9,329.32 | 23,537.24 | 453,677.91 |

| 2034 | 8,854.24 | 24,012.32 | 429,665.58 |

| 2035 | 8,369.57 | 24,497.00 | 405,168.58 |

| 2036 | 7,875.11 | 24,991.45 | 380,177.13 |

| 2037 | 7,370.67 | 25,495.89 | 354,681.24 |

| 2038 | 6,856.06 | 26,010.51 | 328,670.73 |

| 2039 | 6,331.05 | 26,535.51 | 302,135.22 |

| 2040 | 5,795.45 | 27,071.12 | 275,064.10 |

| 2041 | 5,249.03 | 27,617.53 | 247,446.57 |

| 2042 | 4,691.59 | 28,174.97 | 219,271.60 |

| 2043 | 4,122.90 | 28,743.66 | 190,527.94 |

| 2044 | 3,542.73 | 29,323.84 | 161,204.10 |

| 2045 | 2,950.84 | 29,915.72 | 131,288.38 |

| 2046 | 2,347.01 | 30,519.55 | 100,768.83 |

| 2047 | 1,731.00 | 31,135.57 | 69,633.27 |

| 2048 | 1,102.55 | 31,764.02 | 37,869.25 |

| 2049 | 461.41 | 32,405.15 | 5,464.10 |

| 2050 | 13.66 | 5,464.10 | 0.00 |

Table: Annual Payment Breakdown

So how much would I need to earn at this point?

Now this should be pretty simple.

Based on TDSR values, the max amount you can borrow is 60% of your monthly salary… so if you’re paying out $2,738.88 each month for your mortgage, then you would need to earn at least $4,565.80 per month to qualify… right?

Unfortunately not.

You see, the interest rates that determine your loan affordability and the interest rates you agree on with that 3rd party entity on your actual loan is completely different altogether.

MAS has set a 3.5% interest fee to every loan as a stress figure (to simulate any unforeseen ‘rainy days’).

And if you were to add a 3.5% interest fee to a $741,000 loan over 30 years, this is what you’d have to pay each month ($3,327.42).

| Property Value | $988,000 |

| Down payment | $247,000 (25%) |

| Principal | $741,000 |

| Interest | 3.5% |

| Term | 30 years |

| Payment | $3,327.42 |

| Total | $3,327.42 |

| Total Interest | $456,871.61 |

| Total Payments | $1,197,871.61 |

Or in other words, you need to be earning at least $5545.7 per month (if $3,327.42 = 60% based on TDSR values).

…Assuming you do not have any current pre-existing loans.

And that you have a steady job – e.g not a freelancer/self-employed personnel (acknowledged salary figures for those in this ‘variable income’ demographic are capped at 70% of the original monthly value).

That being said, you are able to use secondary income (eg. 70% of rental profits) as well as any investment assets (once again capped at 70% of their value) to ‘top up’ this minimum required salary/loan affordability value.

Property AdviceComplete Guide To Getting Your Home Loan Approved This Month

by Ryan J. OngProgressive Payments

That’s essentially the bulk of it.

Now here’s a little titbit for those who are gunning towards the idea of a private property purchase.

For new launch condos, payment is usually made on a progressive payment scheme.

What that means is that unlike ‘lump-sum’-type payments for completed developments, payments for new launch condos are often staggered out.

In crux, percentage-based payments are made based on milestones. To illustrate:

| Milestone | Percentage of Total Value | Time of Payment |

| Foundation Work (Completion) + 5% Initial Downpayment | 10% | 6-9 Months From Launch |

| Reinforced Concrete Framework (Completion) | 10% | 6-9 Months After |

| Brick Walls (Completion) | 5% | 3-6 Months After |

| Ceiling (Completion) | 5% | 3-6 Months After |

| Door & Window Frames + Plastering & Plumbing/Electrical Wiring (Completion) | 5% | 3-6 Months After |

| Car Park/Roads/Drains + Project Servicing (Completion) | 5% | 3-6 Months After |

| TOP Date | 25% | N.A |

| Legal Completion Date | 15% | N.A |

I know what you’re thinking at this point.

If payments are spread out, then we should be able to spread out our loans to reduce interest fees right?

Unfortunately, construction periods vary and can often occur before their projected completion dates – and so almost everyone has to take that massive initial loan lump sum.

Add in the extra payments from housing tax, utility bills, maintenance fees, daily expenses plus retirement/entertainment savings, and you’d need at least a $6k monthly salary by this point to be able to live relatively comfortably aside from your mortgage payments (provided you do get a good interest rate on your loan).

Final Word

At the end of the day, we can see how a private property purchase (even that of a studio apartment) is truly a ‘life-long journey’ in more ways than one.

For those who are adamant about remaining single, the reality is unfortunately, a harsh, yet unsurprisingly, mitigatable one.

You’ll have to earn well from the start – and perhaps more importantly, look to compound your savings (investments) as quickly as you can.

All that, if you want to have your own private property by that 35-year old milestone.

If you are 22 and this sounds like an insurmountable task – take heart from others that have gone down this path! (If you want some inspiration, take a look at Khai’s story).

Of course, you’ll always have an option of purchasing private property units in the OCR and RCR regions for lesser, as well as MOP-ed EC units – which usually go for 25-30% lesser than actual private condo residentials (past the initial 10 year HDB period that is).

But in the end, it really does come down to accumulating your funds from the start for a much smoother house hunt in the future.

It’s hard. But it’s definitely doable.

And with a solid goal in mind from the start, you will succeed.

I’ll leave you with a quote from Tweet Jukebox’s CEO, Tim Fargo to cap things off.

– ‘Who you are tomorrow begins with what you do today.’

Best of luck!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Reuben Dhanaraj

Reuben is a digital nomad gone rogue. An avid traveler, photographer and public speaker, he now resides in Singapore where he has since found a new passion in generating creative and enriching content for Stacked. Outside of work, you’ll find him either relaxing in nature or retreated to his cozy man-cave in quiet contemplation.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

5 Comments

I think one can always go for a lower cost housing option – leasehold in older projects. It’s certainly more affordable. Surely it won’t be as nice as a new launch like The M, but can still be very nice.

I must be luck.. bought my condo – 3rm at age 30…

new launch btw.