7 Ways To Avoid ABSD Legally In Singapore (Updated For 2022)

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Remember back in the 1990s? Those were the days when Singapore property investors strutted around, explaining how every home they bought made the next home purchase even easier.

The rent from one property paid for the next property, the rent from that property paid for a third, etc. You could say those were the glory days for a property investor in Singapore.

Well, those days are long over. Today, the massive tax on second or subsequent housing – called the Additional Buyers Stamp Duty (ABSD) – has put a damper on it. The good news is, it indirectly makes your first home more affordable. The bad news is, it can cost you a pretty penny when you’re ready to expand your property portfolio.

In fact, since we last wrote this piece, the ABSD rate has become even more expensive. Here’s what it looks like now after the December 2021 cooling measures:

| Cooling Measure | Old Measure | 16 December 2021 New Measure |

|---|---|---|

| Loan To Value Ratio | 90% for HDB loans 75% for bank loans | 85% for HDB loans 75% for bank loans |

| Total Debt Servicing Ratio | 60% of monthly income | 55% of monthly income |

| Additional Buyers Stamp Duty | Singapore Citizens None for first property 12% on second property 15% on subsequent property Permanent Residents 5% on first property 15% on subsequent property Foreigners 20% Entities 25% +5% non-remissible for property developers | Singapore Citizens None for first property 17% on second property 25% on subsequent property Permanent Residents 5% on first property 25% on second property 30% on subsequent property Foreigners 30% Entities 35% +5% non-remissible for property developers |

Given the new changes, here are the fair and legal ways you can be excused from paying the ABSD in 2022:

- Buy an Executive Condominium (for upgraders)

- Decouple (if the cost doesn’t exceed the ABSD)

- Purchase under a Trust (if you have a lot of cash in hand)

- Sell one, buy two

- Get a dual-key unit

- Buy a commercial property

Table Of Contents

1. Buy an Executive Condominium (for upgraders)

One annoying thing about ABSD is that, even if you’re just upgrading and have no intention to own two properties, you still need to pay the ABSD first (you can apply for remission if you sell your previous home within six months of getting the new one).

This means you still need to have the hefty 17 per cent tax (or 25 per cent for Permanent Residents) in cash or your CPF*.

But here’s the good news: that only applies to private condos. If you purchase a new Executive Condominium (EC), you don’t need to pay the ABSD first. You do still need to dispose of your flat within six months of course, but at least you won’t be faced with needing more cash or CPF savings upfront.

*You can pay stamp duties like the ABSD with your CPF.

Note: For ABSD payments, if it’s a new development, CPF can be used right away. However, resale properties requires payment in cash first through your lawyer. Once you are the legal owner, you can then apply to pay it using CPF.

2. Decouple (if the cost doesn’t exceed the ABSD)

This is the most heavily promoted way to avoid the ABSD, but note that it has costs of its own, and it doesn’t always work.

The idea is that one spouse transfers her share to the other, and then goes out and buys a second property under her own name. She won’t pay ABSD because, having transferred her share of the property to you, she no longer counts as owning a property when she buys the next unit.

Before you do this, though, remember that transferring one’s share of the property is not free. If your spouse transfers her share of the property to you, you still need to pay the Buyers Stamp Duty (BSD).

For example, if the property is worth $1 million, and your spouse transfers 50 per cent of the property to you, then you’d have to pay BSD on $500,000 (in this case, $9,600).

In addition, other stamp duties – such as the Sellers Stamp Duty (SSD) – still apply (SSD is payable if you sell the property within the first three years of buying it, and it applies on the transferred portion).

You also need to factor in the cost of the decoupling process, which is often in the range of $5,000 – $6,000.

Always make sure that the cost of decoupling is less than paying the actual ABSD; otherwise, there’s no point. If you think this might happen, drop us a message; we can help you work out the numbers.

Finally, if you are thinking about decoupling to buy a new property, do take note if the sole owner is able to support the new mortgage. Do also remember that if you’re using your CPF funds, then you need to return your CPF monies (including accrued interest) back to your CPF account.

Regarding the transfer of ownership for HDB flats, that “loophole” has been plugged since 2016. Right now you are only allowed to do so under 6 special scenarios: grounds of marriage, divorce, death of an owner, financial hardship, renunciation of citizenship and medical reasons.

3. Single Owner and Essential Occupier scheme

In a continuation of the previous point, because the transfer of ownership for HDB flats is no longer allowed outside of the 6 special scenarios, you will have to plan ahead if you are planning to buy 2 properties from the beginning.

The one way to do so is to adopt the Single Owner and Essential Occupier scheme. In this method, your spouse can be listed as an essential occupier instead of a co-owner. To qualify for this, you have to list one of the applicants as the single owner, and your spouse/fiance as the essential owner during the flat application.

This means that as the essential owner is not seen as a homeowner (and after the 5-year MOP is up) you will be considered to be a first-time homeowner when buying a private property. As such, you will be able to avoid the ABSD and also qualify for the higher loan quantum (75% of LTV), as compared to the maximum 55% limit for a second property loan if you hadn’t done so.

It’s not for everyone though, there are cons to think about.

First, as an essential occupier, you can’t use your CPF to fund the purchase (meaning you can’t help your partner to pay off the flat, down payment or monthly instalments). You can of course use cash directly to help finance the unit. But because the essential occupier isn’t seen as having legal ownership right, you will have no claims over the property if there’s a fallout at the end. Second, because only the single owner will be qualified to take on a mortgage, the assessable income will naturally be lower. In that way, not everyone will be able to “afford” such a scheme.

4. Purchase under a Trust (if you have a lot of cash in hand)

This involves buying the property under trust for your children. You’ll need the help of a conveyancing lawyer to do this. But as of 8 May 2022, it was announced that a 35% Additional Buyer’s Stamp Duty charge will apply on any transfer of residential property into a living trust occurring on or after 9 May 2022.

So while previously if you do so under your children’s name (and they don’t have any properties under their name), you could do so with no ABSD payable. Now, 35% ABSD will be payable (upfront, there’s no way around this) upon any transfer of a property to a living trust, regardless of whether there is an identifiable beneficiary.

However, you can apply for a refund of the ABSD within 6 months after the trust document is extended, as long as the following conditions below are met:

- all beneficial owners of the residential property are identifiable individuals

- beneficial ownership of the residential property has vested in all of these beneficial owners at the time of property transferred into the trust

- the beneficial ownership cannot be changed or revoked, or be subject to any condition subsequent, under the terms of the trust

As a result, it is now crucial to ensure that your conveyancing lawyer drafts the trust document in a manner that fulfils the ABSD refund conditions. If not, you could lose a huge chunk of cash here.

Do remember though, that if your children were to take possession of the property, they can’t then apply for an HDB flat while owning it. And of course, they’d be subject to ABSD if they try to get another property for themselves.

Besides this, there are no bank loans for properties held in trust. You need to pay for the property in cash.

5. Sell one, buy two

The idea here is to sell your existing property. Then with the sales proceeds, you buy one property, while your spouse buys a smaller one.

For example:

Say you sell your five-room flat for $575,000. You then use $375,000 as the down payment on a $1.5 million condo. You buy this under your own name.

Your spouse then looks for a smaller condo – say an $800,000 shoebox unit – and puts down $200,000 for it. She also buys this under her own name.

As both of you have no property at the time of purchase, neither of you will incur ABSD.

For this to work, both of you must qualify for the respective mortgages.

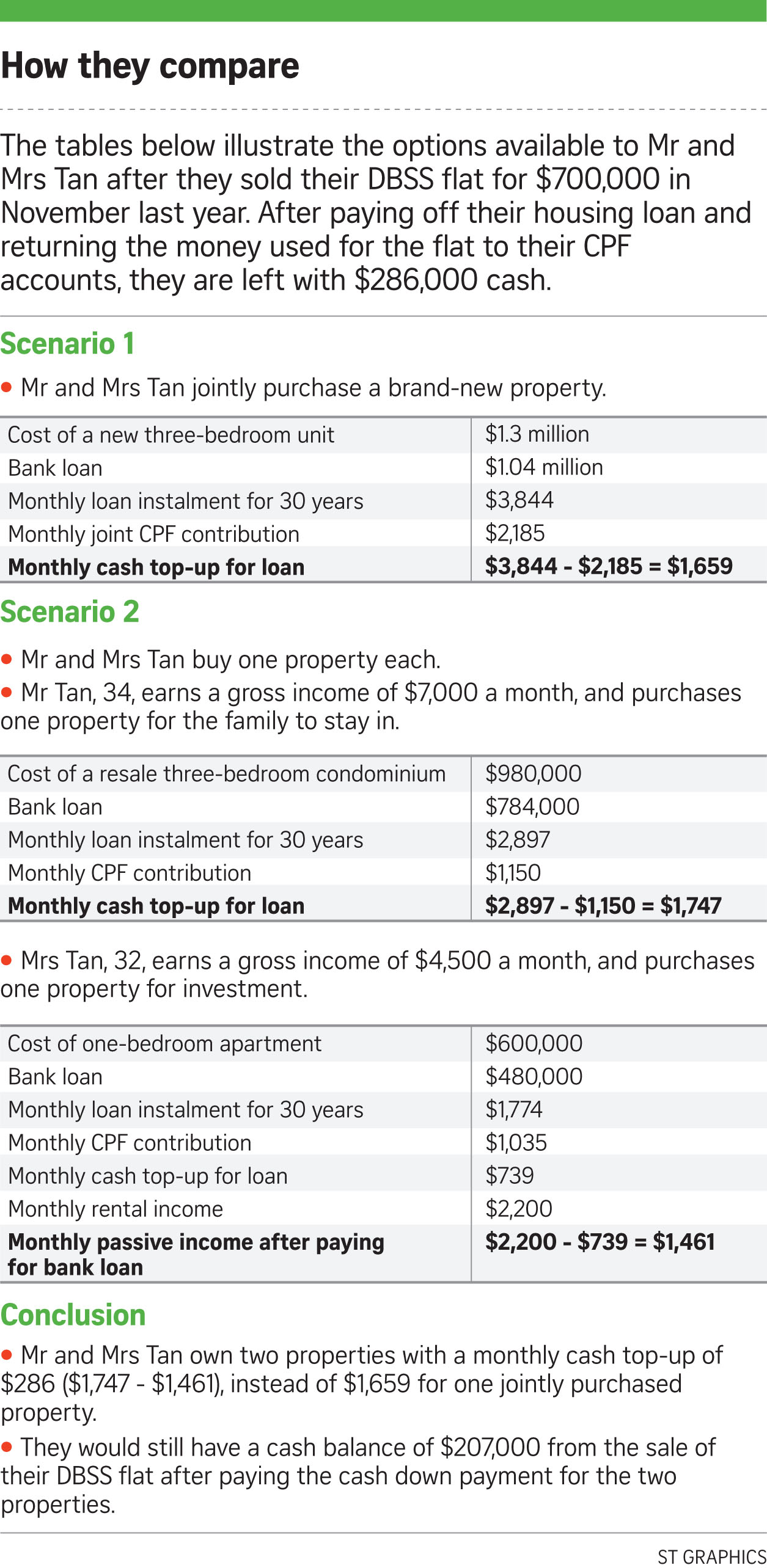

Here’s another comparison taken from the Straits Times.

6. Get a dual-key unit

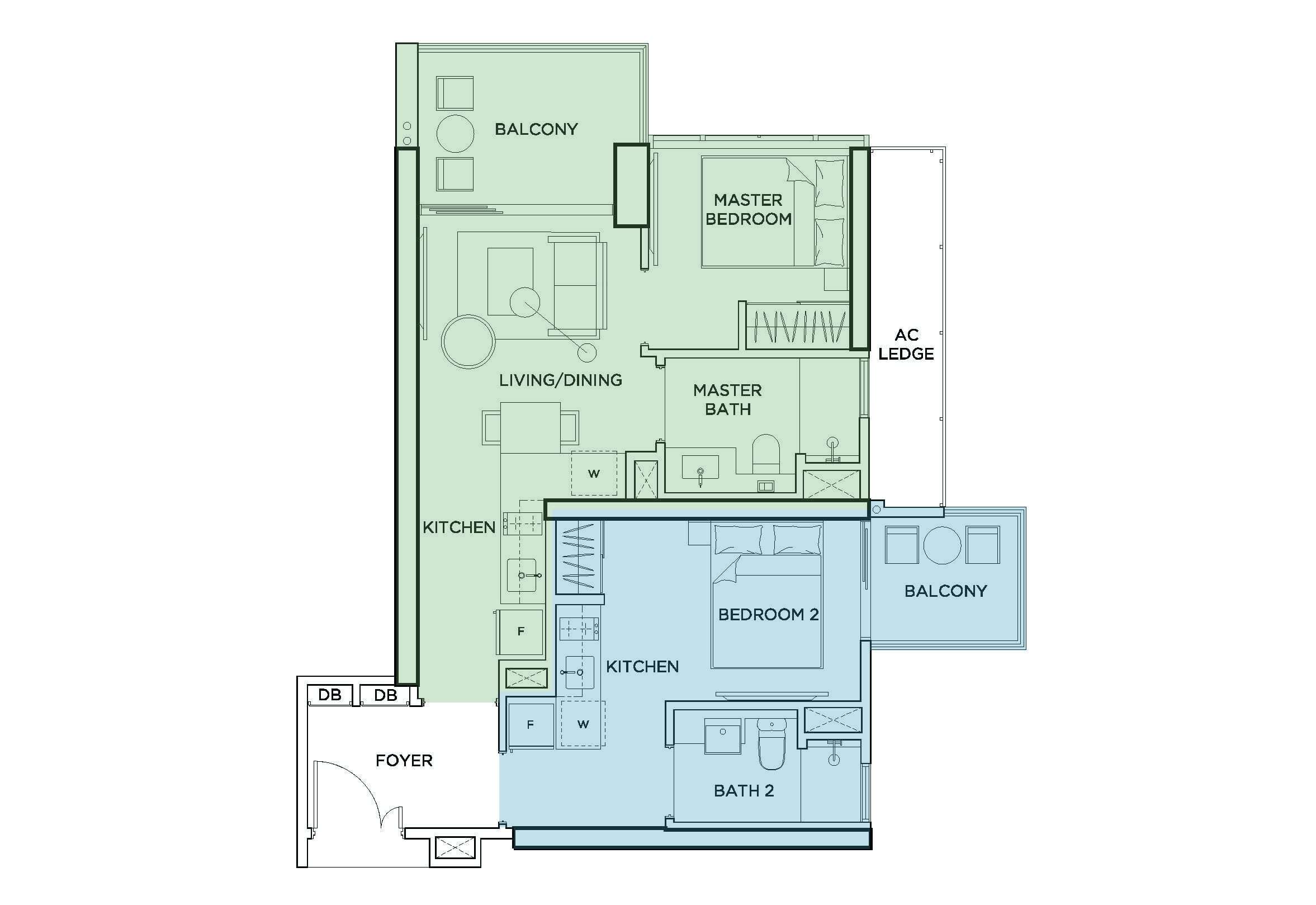

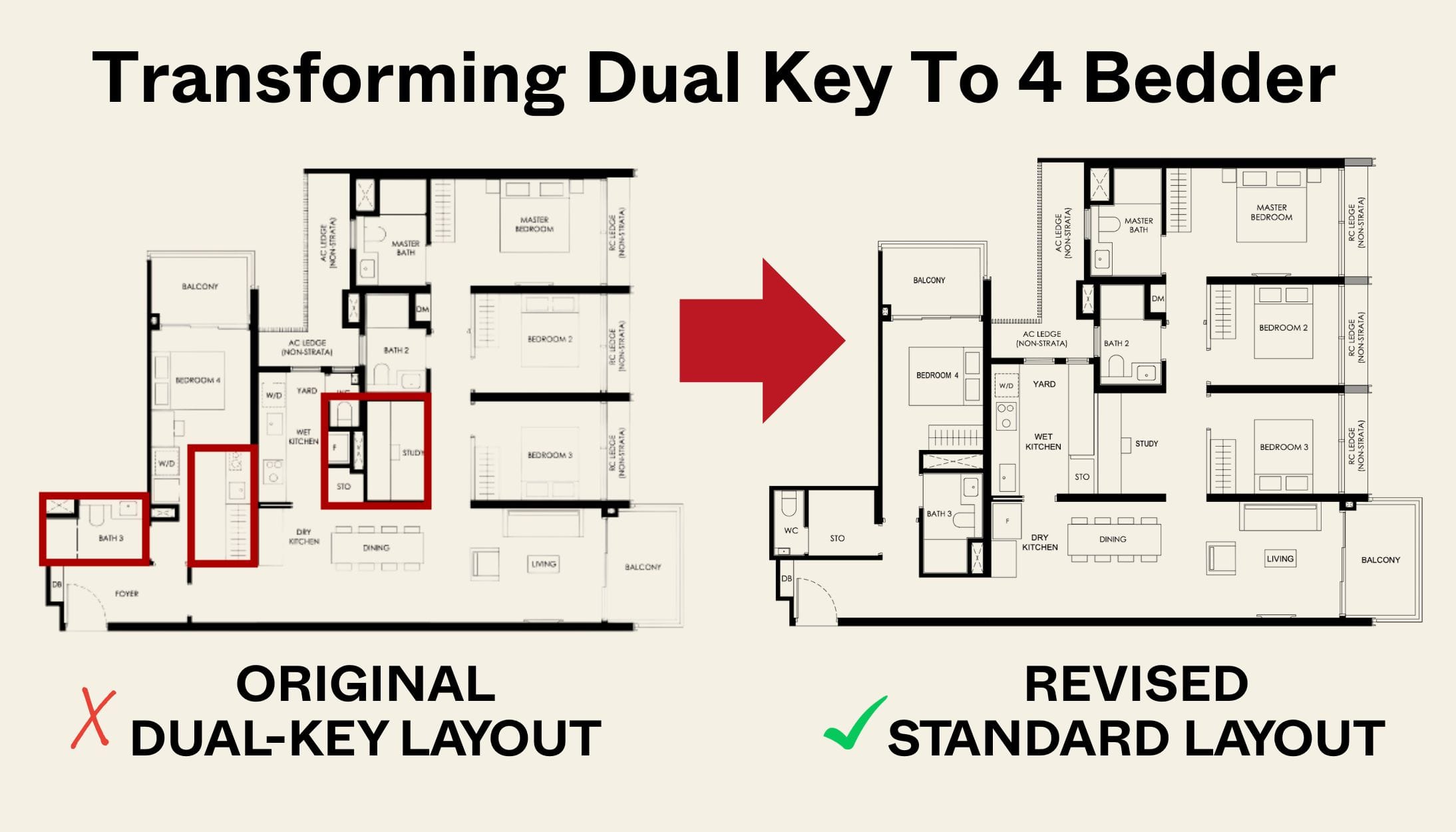

We’ve covered this in a previous article on dual-key floor plans. But to recap: a dual-key unit often has a common foyer, after which it splits into two separate sub-units. This allows two immediate families (e.g. your family and your in-laws), or a tenant and a landlord, to co-exist with privacy.

The dual-key unit still counts as a single property, so you don’t need to pay ABSD on a second unit.

We’ve compiled a list of 121 condos with these dual-key units for you.

Property Investment InsightsAre Dual Key Condos Profitable? Here Are The Results From All 193 Transactions So Far

by Sean7. Buy a commercial property

For all you pure investors out there, you’ll be glad to hear there’s no ABSD on commercial properties. You only have to pay the GST, which is seven per cent at the time of writing.

So instead of buying another condo to rent out, you could consider a coffee shop, industrial space, etc. Be sure to do your homework though, as commercial property is a whole different ball game from residential.

Finally, the simplest method for ambitious couples: just to put the first home under one spouse.

If you have the means to shoulder the mortgage alone, then consider not having a co-borrower.

Later on, with sufficient savings, your spouse can simply go on and buy another property as a first-time buyer. This will put two properties in your family, without incurring any ABSD. This is the slow and patient method, but it’s also the most hassle-free.

To find a great second property, start with our condo reviews. We provide insights and news into Singapore’s property market, as well as the most detailed condo reviews.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Trends

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

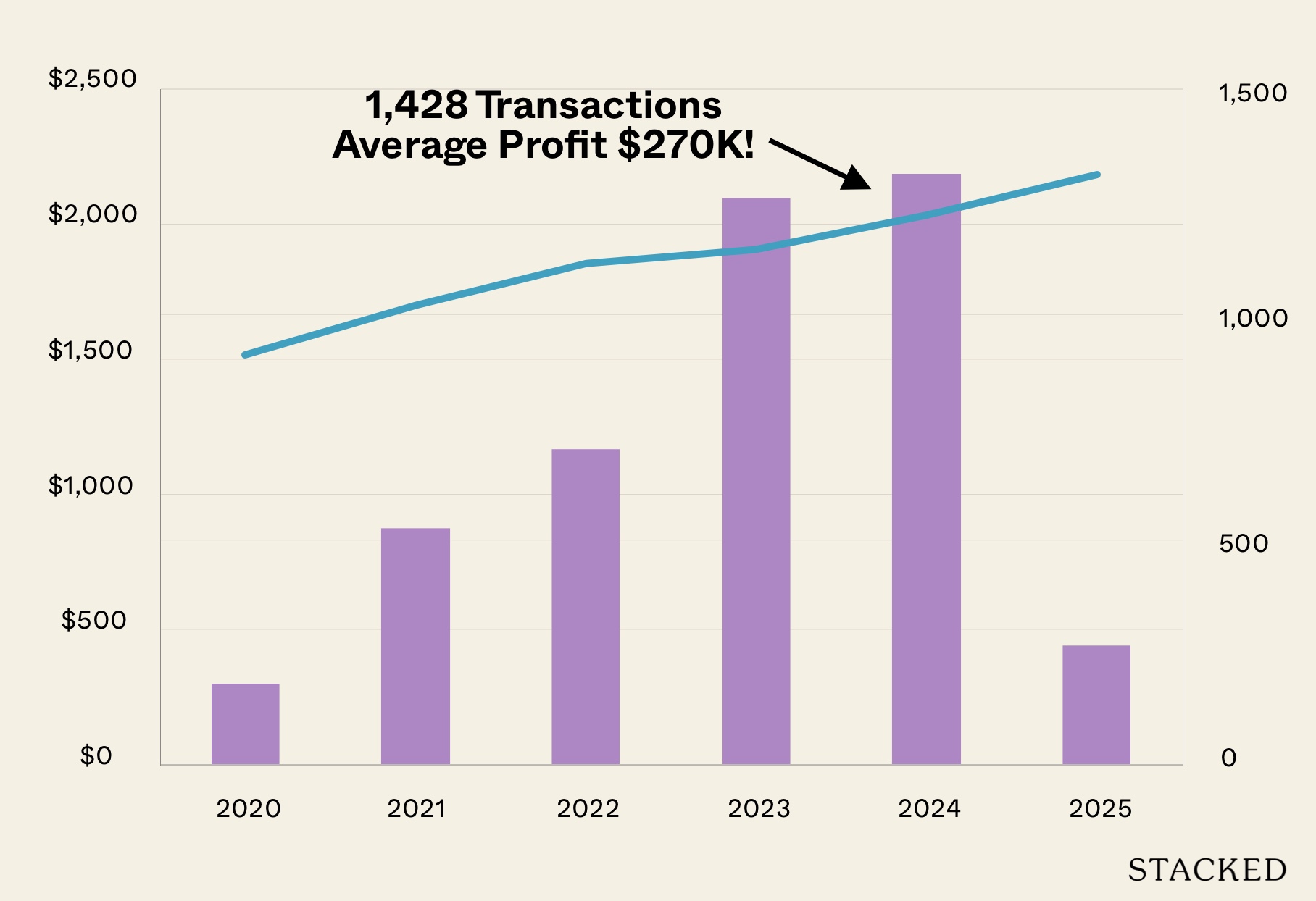

Editor's Pick Condo Profits Averaged $270K In 2024 Sub Sales: Could This Grow In 2025?

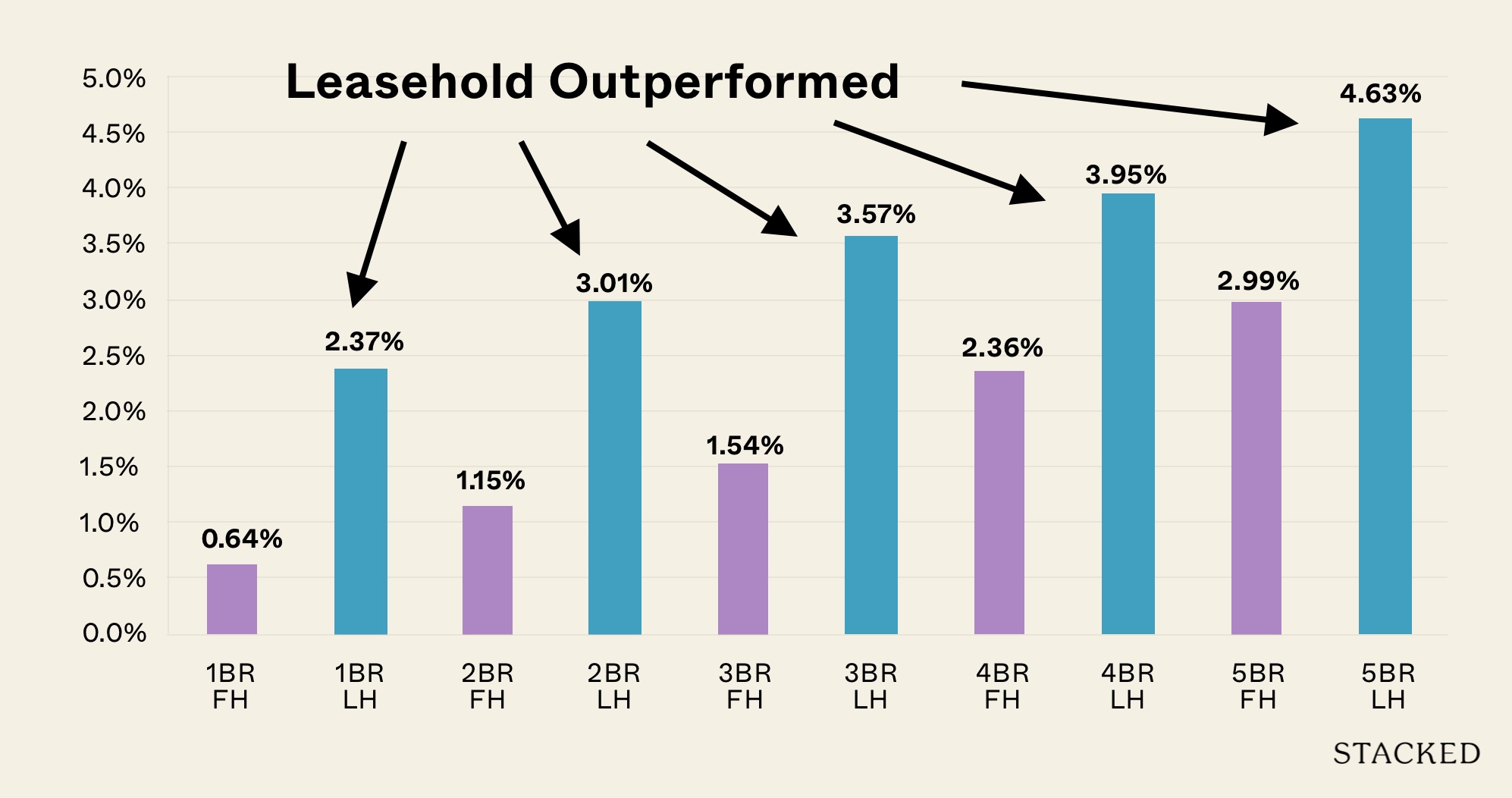

Property Trends Should You Buy A Freehold Or Leasehold Condo In 2025? Here’s The Surprising Better Performer

Latest Posts

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Editor's Pick LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden

Property Market Commentary 2-Bedder vs 2+Study Units: Which Condo Layout Has Better Returns Over The Last Decade?

Homeowner Stories Does The “Sell One, Buy Two” Strategy Still Work In 2025? 3 Real Stories From Singapore Homeowners

Editor's Pick Where $4 Million Semi-Ds Sit Next To $40 Million GCBs: Touring First Avenue In Bukit Timah

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000

Editor's Pick The Robertson Opus Review: A Rare 999-Year New Launch Condo Priced From $1.37m

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Editor's Pick Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

Hi, I am interested to learn more about your last method. What you are referring to is called the Owner-Essential Occupier Scheme. What do you think is the bare minimum income (or best combination for H&W) to get the best loan?

For an average 4k income on 1 person, HDB will only loan you about 50% LTV. So the alternative is the bank loan. Do you think an average 4k income on 1 person will be able to get a full LTV of 75% from the bank, despite the fact that both H&W are servicing the loan?

Hi, would like to know, how to avoid ABSD, if I would like to purchase another resale private property . Currently, We own HDB n private condo.

Thanks

Hi, regarding point number 1, what if I am selling my existing HDB and upgrading to a Resale EC, do I still need to pay ABSD?

Hi Ryan, firstly what a great site you have. Data-driven, and always insightful.

Pardon my ‘dumb’ question

When Decoupling, eg. spouse buying over the 50% shares.

the BSD paid on the 50% share, is on the initial purchase value?

Or the existing market value? if it is the market value, how is it determined and who determines it? Is there a regulation to engage pre-approved valuers?

Hi there! would you be able to help me with my silly question please? Thanks.

Hi, great value from your articles as always. Is it possible to buy a resale HDB as a married couple to form a family nucleus, but list one of them as an Occupier? After fulfilling the MOP period of 5 years, the Occupier can then proceed to buy a Private Property without having to pay for ABSD?

Hi Ryan! Was trying to find more about decoupling & found your article.

Currently we own a approx. S$2.5 mio house, fully paid up, no bank loan & monies returned to CPF. Thinking of getting another HDB / private property. What is the best way to avoid ABSD? Gift it to 21-year old child/ spouse? Transfer 50% to spouse? Appreciate your advice. Thanks Ryan!

Hi Stacked/ Ryan,

I have a question about the Single Owner-Essential Occupier scheme. I wasn’t a PR when we were married and purchased our resale HDB, so I was listed as Essential Occupier for the flat and my partner as the Owner. I’m a SG Citizen now but still listed as an Essential Occupier, and wondering if this means we could keep the HDB flat and I can buy a private property under my name without having to pay ABSD. I asked another agent before but was told that I can’t avoid ABSD even if I’m only an Essential Occupier, so was confused when seeing this option listed here.

My spouse and I own a resale HDB and interested to buy a 2nd private property for investment. HDB was not owned under Owner Essential Scheme. Can I now change to my husband as the owner and I as essential occupier so that we can buy the 2nd property under my name without paying ABSD?

Hi, just a question on ABSD. If 2 brothers shared 50% to buy a private property & then bought a 2nd property on 50% sharing. Would they be subjected to ABSD as ethnically, they individually own just 1 property each? Tks

Hi Ryan thank you for this insightful article. My husband and I currently own a fully paid up HDB. If we sell this off, and use the single owner essential occupier scheme for our 2nd HDB (a bto), does this mean the essential occupier is free to buy a private property anytime, without absd and without having to wait for the 5yr MOP of the new bto?

Hi. Can I report you to iras for giving tax avoidance