Are You In Danger Of Negative Cash Sales? Here’s How Much Your HDB Has To Appreciate To Avoid It

January 14, 2023

With resale flat prices at record highs, there’s a tendency to assume negative cash sales won’t happen right now. But it’s not always true that selling your flat right after MOP will yield sufficient cash for a condo down payment, and negative cash sales still happen in a seller’s market. Here’s how much your flat needs to appreciate, to avoid a negative cash sale:

Table Of Contents

- What’s a negative cash sale?

- Are you likely to incur a negative cash sale if you sell right after MOP?

- So how much must your HDB appreciate to avoid a negative cash sale?

- But what if you’re looking to have some cash proceeds to use when upgrading to a condo?

- As of 2023, this has become much trickier for those using bank loans

- For those buying resale flats, keep in mind that peak prices are not sustainable

- Rather than count on your flat’s appreciation, the best solution is to just use less from your CPF

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What’s a negative cash sale?

We have a longer explanation of this in an earlier article, but to summarise: it’s a situation where you have no cash in hand after refunding your CPF.

When you sell your property, you must pay back any CPF monies used, along with the accrued 2.5 per cent interest. For example, if you sell your flat for $500,000, but have to refund $515,000* to your CPF, you will be left with no cash.

Of course, you can still use your CPF for your next property; but the problem is that a bank loan requires you to pay a minimum of five per cent in cash for your next property. So unless you can raise this amount, it can curtail upgrading plans.

We do have to add, that such a situation might not be applicable to everyone. Most people use their CPF to service their mortgage to preserve cash that they may use to save or invest further. As such, even if they do encounter a negative cash sale situation, it doesn’t necessarily mean they are in an untenable situation.

*So long as you sell at market value, you don’t need to pay back the extra $15,000. It just means you refund the full $500,000 into CPF.

Are you likely to incur a negative cash sale if you sell right after MOP?

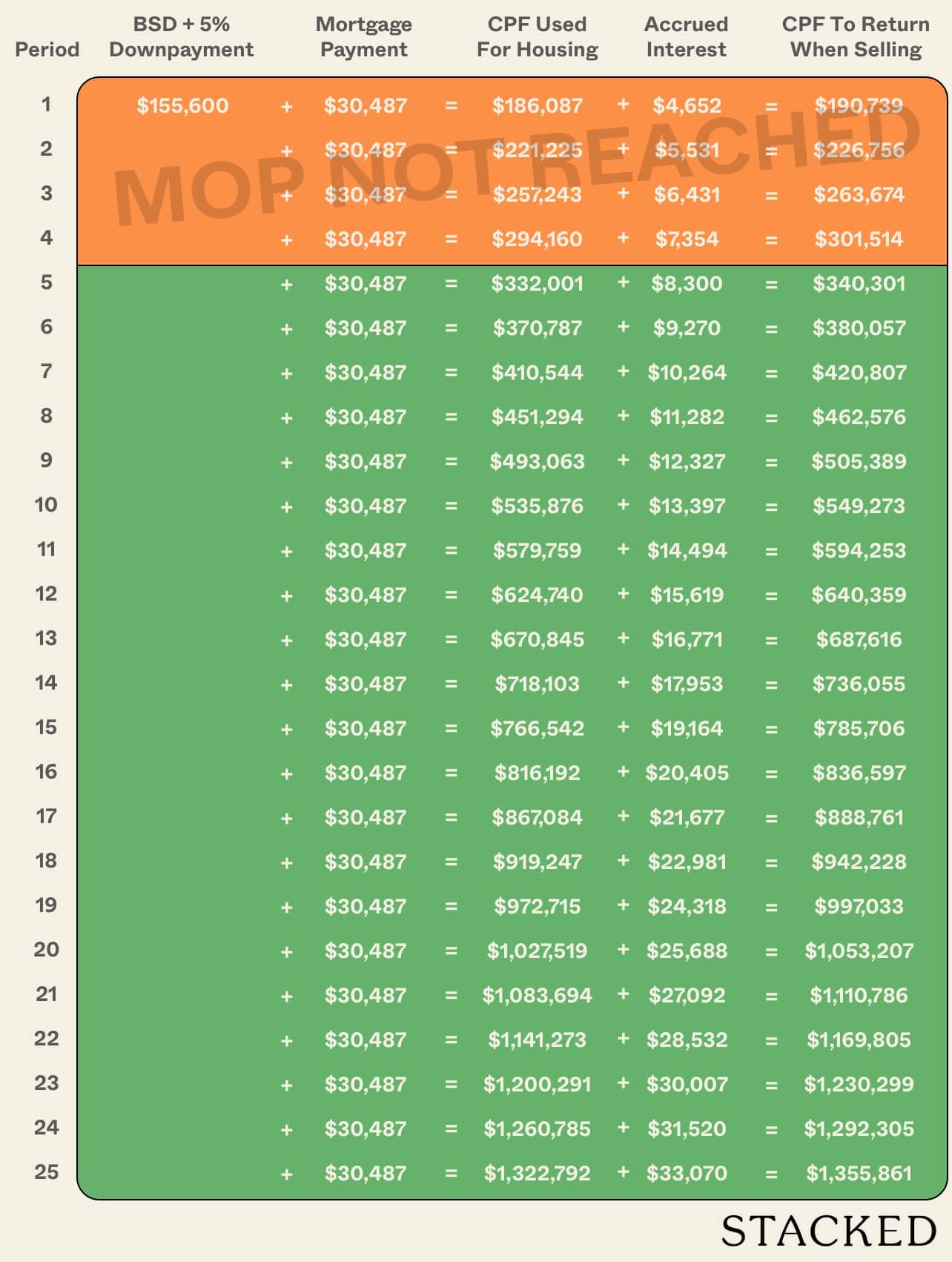

Before we look at how much your flat needs to appreciate so that you do not incur a negative cash sale, let’s look at what the refund to CPF looks like for a $700,000 HDB resale flat, bought with a 25-year HDB loan, at the usual rate of 2.6 per cent per annum. We’ll assume the maximum loan amount* of 80 per cent, or $560,000.

The initial $140,000 down payment will be from CPF, as will the Buyer’s Stamp Duty (BSD) of $15,600. All mortgage payments will be paid using CPF too.

This is roughly how much you have to refund assuming it’s sold from the 5th year onwards:

How it’s calculated: We assume the BSD and downpayment are made at the start of the year, and the mortgage is paid through that same year. The interest is then accrued at the end of the period on the total sum and added to the total CPF used. This balance is then brought forward to the next year where we add the mortgage payments again, after which we add the accrued interest on top of this new balance and so on.

Past the 25th year, the amount of CPF to be refunded upon sale grows based on the accrued interest only since the flat is fully paid for.

Do note that the above illustration takes into account legal fees of $2,500 and agent fees of 2% of the selling price (both paid with cash).

So how much must your HDB appreciate to avoid a negative cash sale?

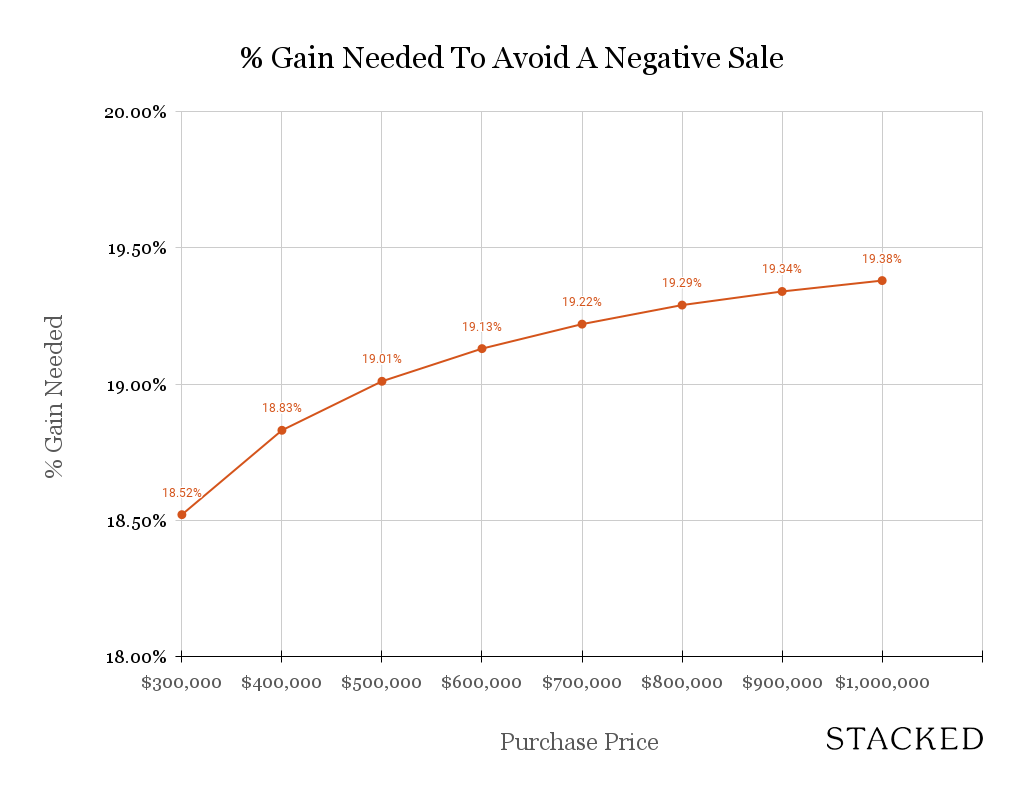

Using the table above, we ran a simulation for HDB prices ranging from $300,000 to $1,000,000. To keep things simple, we will use the same assumptions as the above.

Here’s how much your HDB has to appreciate to avoid a negative cash sale assuming you sell in the 5th year (right after MOP):

| HDB Price | Value After 5 Years To A Avoid Negative Sale | % Gain |

| $300,000 | $355,560 | 18.52% |

| $400,000 | $475,320 | 18.83% |

| $500,000 | $595,050 | 19.01% |

| $600,000 | $733,500 | 19.13% |

| $700,000 | $834,540 | 19.22% |

| $800,000 | $954,320 | 19.29% |

| $900,000 | $1,074,060 | 19.34% |

| $1,000,000 | $1,193,800 | 19.38% |

Visually, the more expensive the HDB is, the higher the flat has to appreciate – albeit marginally.

More from Stacked

An Introvert Buys Property: Getting Prepared To Pull The Trigger (Part 4)

Every journey has to end. And sometimes, as poet T.S. Eliot wrote, it’s not with a bang, but with a…

From the chart, you’ll see that to avoid a negative cash sale situation, your flat needs to appreciate by around 19% over 5 years.

But what if you’re looking to have some cash proceeds to use when upgrading to a condo?

The typical price range that most upgraders can manage is around $1.6 million dollars. This means you’ll need a minimum of $80,000 cash as the 5% downpayment.

To achieve this, here’s how much your flat needs to appreciate:

| Period | Start Year Price | End Year Price (A) | % Appreciation | Total CPF Used (B) | Outstanding Loan (C) | Cash Leftovers (A – B – C)** |

| Year 1 | $700,000 | $743,246 | 6.18% | $190,739 | $543,882 | -$8,740 |

| Year 2 | $743,246 | $786,492 | 5.82% | $226,756 | $527,340 | $14,166 |

| Year 3 | $786,492 | $829,738 | 5.50% | $263,674 | $510,363 | $36,606 |

| Year 4 | $829,738 | $872,984 | 5.21% | $301,514 | $492,939 | $58,571 |

| Year 5 | $872,984 | $916,230 | 4.95% | $340,301 | $475,057 | $80,047 |

At the end of 5 years, the flat needs to appreciate from $700,000 to $916,230. This translates to a 31% increase over 5 years, which is not unheard of, but at such appreciation rates, this also means private property prices will be at a higher price point too (e.g. what is happening now).

*In practice, most Singaporeans will not end up getting the maximum loan amount. You are allowed to retain up to $20,000 in your CPF only; anything beyond that must go into your property purchase.

**Cash leftovers include deducting the 2% selling fee on top of the price plus the legal fee of $2,500.

As of 2023, this has become much trickier for those using bank loans

Not everyone can get an HDB loan. If your income is higher, for example, HDB may tell you to use the bank. This can significantly raise your risk of a negative cash sale.

The first reason is that bank loan rates are variable; they change all the time – we have no guarantees that an interest rate spike won’t happen down the line.

The second reason is that interest rates are much higher today than in the past decade: the average interest rate is three per cent and set to climb. Even a fixed-rate loan may not help much, as the current fixed-rate packages are at four per cent.

This means that, for those who buy a flat with a bank loan, the flat needs to appreciate more than those who have HDB loans.

Let’s assume the flat appreciates to $904,513 as shown above, but this time, you took a bank loan at 4% fixed over the next 5 years as well as a 25% downpayment:

| Period | Start Year Price | End Year Price (A) | % Appreciation | Total CPF Used (B) | Outstanding Loan (C) | Cash Leftovers (A – B – C) |

| Year 1 | $700,000 | $743,246 | 6.18% | $229,450 | $512,519 | -$16,088 |

| Year 2 | $743,246 | $786,492 | 5.82% | $269,271 | $499,530 | -$539 |

| Year 3 | $786,492 | $829,738 | 5.50% | $310,088 | $486,011 | $14,544 |

| Year 4 | $829,738 | $872,984 | 5.21% | $351,925 | $471,942 | $29,157 |

| Year 5 | $872,984 | $916,230 | 4.95% | $394,809 | $457,299 | $43,297 |

Given the higher interest rate (4% vs 2.6%), you’ll see that the difference in cash after 5 years is close to $40K! Moreover, you had to forgo an extra 5% of the $700K ($35,000) when making the downpayment.

For those buying resale flats, keep in mind that peak prices are not sustainable

If you buy a resale flat in 2023, you are buying at what may be a market peak. It’s very improbable that these price increases can be sustained for the next five years; especially since HDB has ramped up production of BTO flats in 2022 and 2023.

As such, a significant number of flats could join the pool of resale flats in the future – and if you’re selling at around this time, you may not recognise the level of returns that you need; and you may end up with a negative cash sale.

Rather than count on your flat’s appreciation, the best solution is to just use less from your CPF

If you want to keep your upgrading plans on track, your best bet in 2023 is to use partial cash payments (i.e., pay part of your loan in cash, and part of your loan in CPF).

Or if you have the means and want to be 100 per cent sure, you might consider paying only the down payment and BSD with CPF, and servicing the monthly loan in cash. This will guarantee there’s no chance of a negative cash sale.

For more on the Singapore property market, or help with regard to your flat, reach out to us at Stacked and we’ll see what we can do. In the meantime, keep your eye on reviews of resale condos, which are more likely to come into vogue again this year.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is a negative cash sale in property transactions?

How much does my HDB flat need to appreciate to avoid a negative cash sale after 5 years?

Can I have cash proceeds from selling my HDB flat to upgrade to a condo?

How do bank loans affect the risk of negative cash sales when selling an HDB flat?

Why is buying resale flats in 2023 considered risky in terms of future appreciation?

What is the best way to avoid negative cash sales when upgrading your property?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments