Are Singapore Property Prices Finally Slowing? Here’s A Snapshot Of The Property Market In 2023 So Far

October 17, 2023

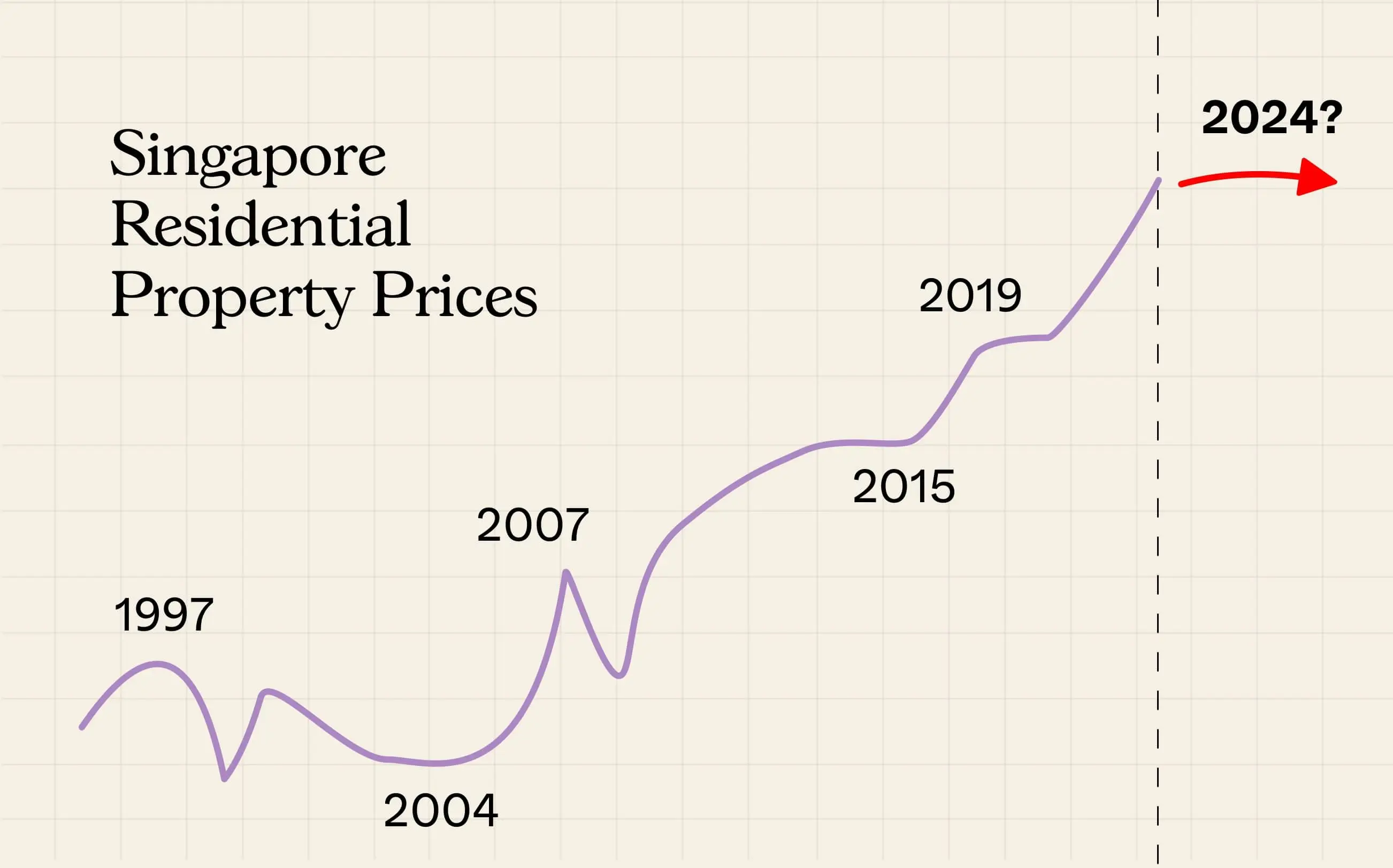

At this point, quite a few homeowners – and even investors – might feel that’s not a bad thing (even sellers and realtors fear another round of cooling measures.) Prices in the post-Covid phase have caused some to give up on private home ownership altogether, while resale flat prices have stoked public dissent. But there are some signs that, as we move into Q4 2023, the price hikes may finally be losing momentum:

Table Of Contents

- 1. The first price dip in three years

- 2. The OCR is of most interest to the average home buyer

- 3. New launches sales figures

- 4. The supply of completed housing is also rising

- 5. Rising home loan interest rates are starting to bite

- 6. The return of the Deferred Payment Scheme

- 7. Resale flats have also seen a loss of momentum

- 8. The dips that we see may signal an inflection point in the property market

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The first price dip in three years

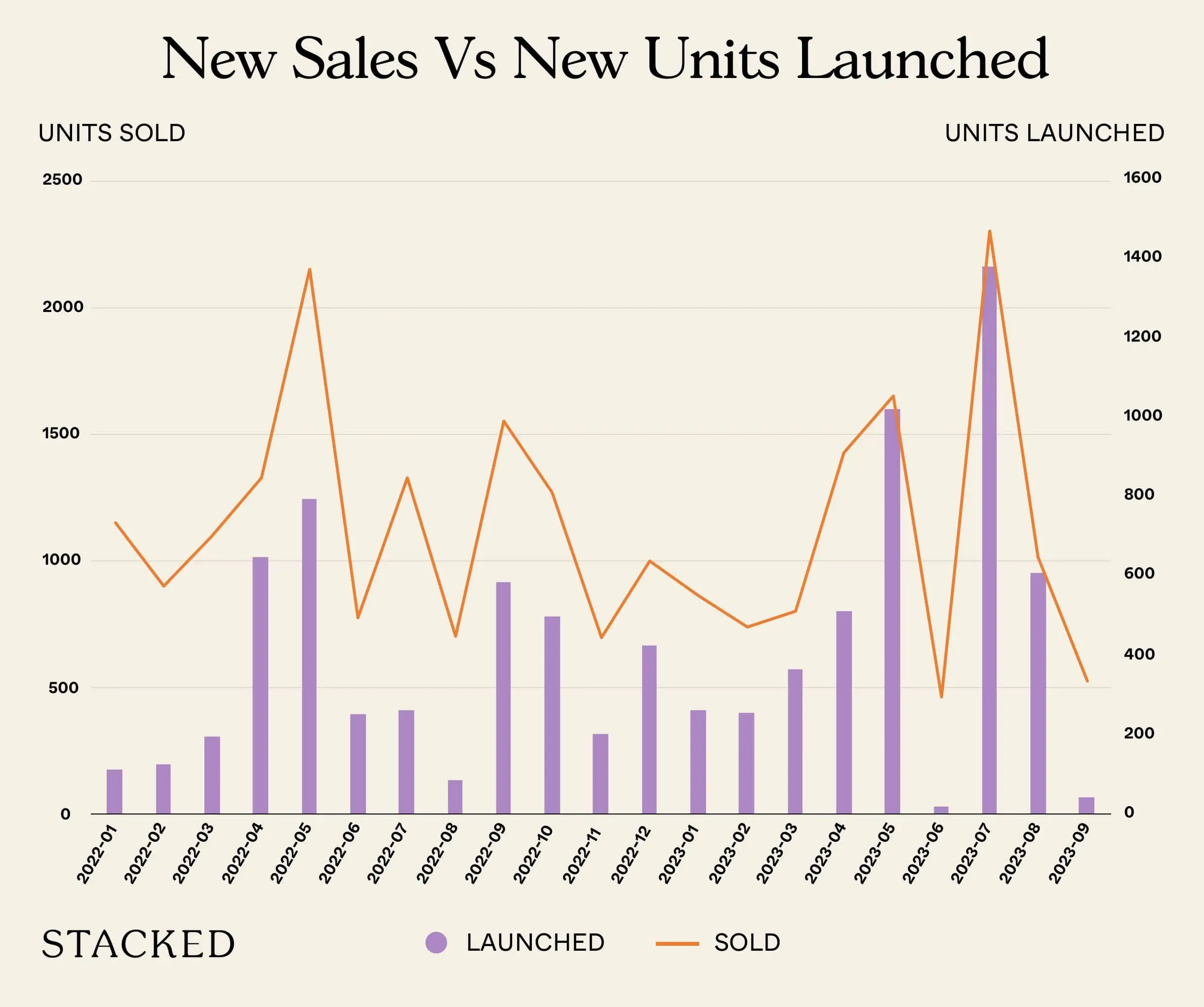

We saw a recent news report that, in Q2 this year, private home prices saw a small dip of 0.2 per cent. Not a huge amount, but significant as it’s allegedly the first time this happened since Q1 2020. This was followed by the news of new private home sales falling to a record low of 217 in September (which is the lowest since December 2022’s figure of just 170 new units).

As usual, this is typically down to no big new launches during the period and also coinciding with the lunar seventh month.

That said, if we look by per quarter instead, in Q3 2023, developers sold 2,024 new homes. This is compared to the same period in 2022, where there were fewer new units launched, but developers still enjoyed higher sales figures.

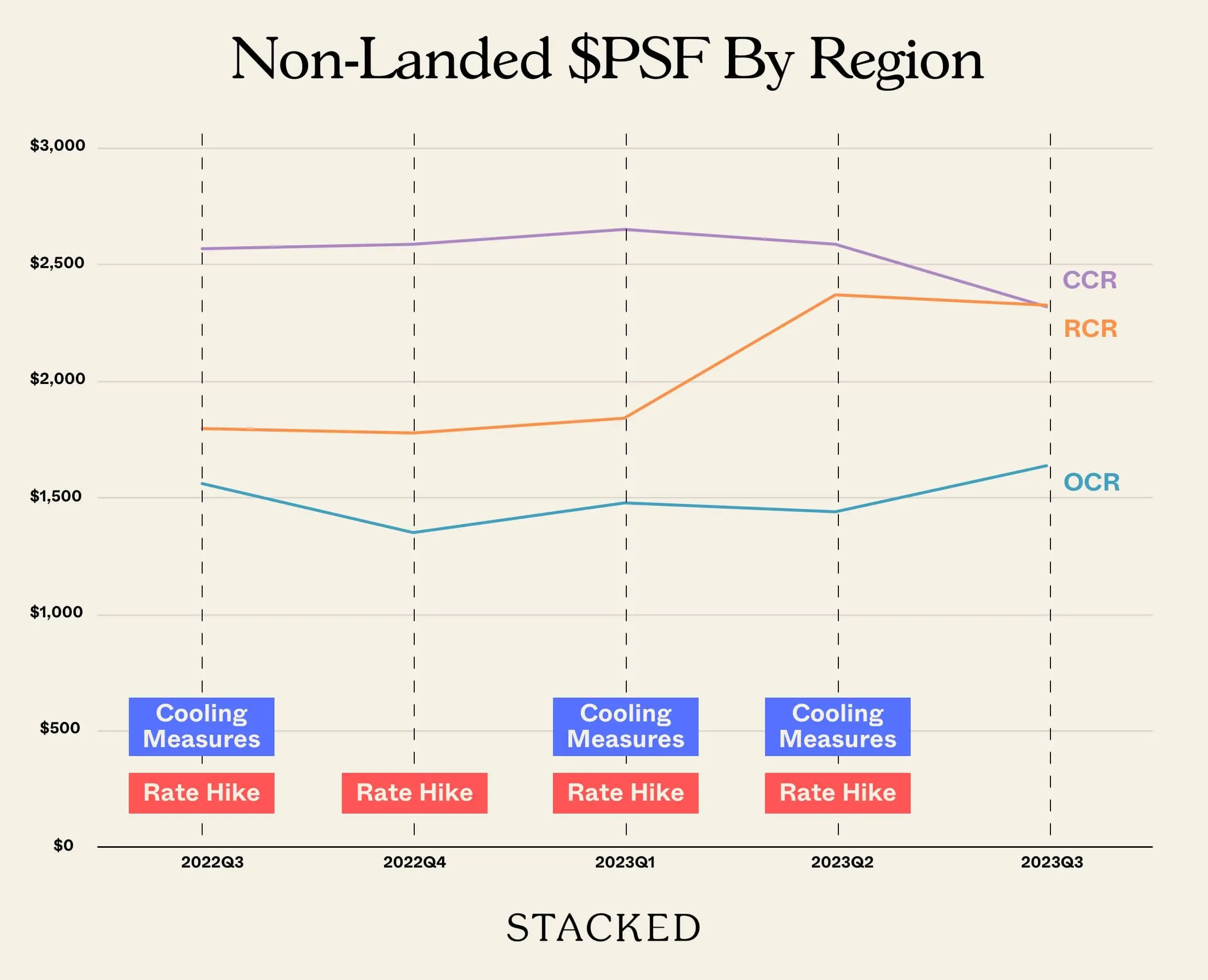

If so, this might signal a potential inflection point. Perhaps all the cooling measures, coupled with high home loan interest rates, have finally started to drag on property prices. So for a short-term picture, we looked at how condo prices have moved over the past year, based on region:

Note: ECs have been excluded from the above.

The dip in the CCR is widely expected; this was due to the April 2023 cooling measures, which raised ABSD rates (especially ABSD rates on foreigners, which were doubled to 60 per cent.) Investors and foreigners constitute a bigger portion of prime CCR properties, so this region is expected to see the toughest challenge going forward.

That said, we don’t think a drop in CCR prices means anything to most home buyers. Only the most affluent tend to buy condos in areas like Tanglin, Orchard, Bukit Timah, etc… So even if the price drops here, it’s of little help to the average Singaporean.

The sharp spike in RCR properties was due to the launch of the freehold Terra Hill condo, as well as multiple launches in District 15. Three major launches – Grand Dunman, Tembusu Grand, and The Continuum – were all happening close to each other (you can see this from the transaction volume as well.)

One realtor also opined that, as prices in the CCR rise, investors and upper-middle income homebuyers may flock to the RCR instead; so we may continue to see prices rise here.

Our interest should be in the OCR, which is where most homebuyers flock. Notice that prices here have only crept up by a negibile 0.12 per cent, over the past year. This was despite some (in our opinion) strong launches, such as Lentor Hills and Lentor Modern.

The OCR is of most interest to the average home buyer

HDB upgraders probably won’t find the $2.5 million+ quantum of RCR and CCR condos to be palatable. Most will stay within the OCR, where condos are attainable at $2 million or lower (thanks to the rising sale proceeds of resale flats.)

For home buyers, it’s probably a relief that this region is not seeing any sharp spikes, even with new launches. It would be better if the average prices were dropping of course, but compared to the wild price increases in the past two years, many would settle for “mostly flat” as a good thing.

New launches sales figures

There was a point in time over 2021/22 where most new launches would have sold well during launch weekend. The general rule of thumb was anything over 70 per cent would be seen as a successful launch, and we’ve even seen some that have crossed 80 per cent (like Lentor Modern), even in a new location such as Lentor.

| Major New Launches in 2023 | Launch Weekend Sales |

| Sceneca Residence | 60% |

| Terra Hill | 38% |

| The Botany at Dairy Farm | 48% |

| Tembusu Grand | 53% |

| Blossoms by the Park | 73% |

| The Continuum | 26.50% |

| The Reserve Residences | 71% |

| The Myst | 27% |

| Lentor Hill Residences | 50% |

| Pinetree Hill | 29% |

| Grand Dunman | 54.60% |

| The Lakegarden Residences | 23% |

| Altura EC | 61% |

That hasn’t been the same story in 2023, as we can see that buyers have been more selective. While there are still stand-out projects such as Blossoms by the Park and The Reserve Residences, most of the other launches have sold in the 40 to 50 per cent range. This is likely to be seen as the new standard of success, and we can’t expect the same numbers moving forward.

The supply of completed housing is also rising

The reason for rising home prices is multifactorial, but at least part of the reason was a lack of supply (albeit worse in the HDB market than the private market.) But the private segment can recover from supply issues quicker, partly because there’s no Minimum Occupancy Period.

The main factor here is whether developers have sufficient land to build, and are incentivised to do so. And for the whole year of 2023, Government Land Sales have provided sufficient room for 9,250 new homes (including ECs). This is the highest number we’ve seen in 10 years.

We doubt the increased supply will cause developers to slash prices, as they’re already operating on thin margins. Solving the supply crunch will, however, slow the fevered pace of rising prices.

Rising home loan interest rates are starting to bite

In August 2022, the SORA rate (the rate to which bank home loans are pegged) was 1.28 per cent. As of the end of August this year, the rate was at 3.69. On average, home loan rates are moving toward the four per cent mark.

(You can see how interest rate changes affect your repayments here).

Higher interest rates mean higher monthly loan repayments. This doesn’t just constrain buyers out of prudence; there are government-imposed loan curbs that have to be followed. The Total Debt Servicing Ratio (TDSR), for example, caps monthly loan repayments to 55 per cent of the borrowers’ monthly income (inclusive of other loans).

For buyers of ECs or resale flats*, there is also the Mortgage Servicing Ratio (MSR), which caps monthly repayments at 30 per cent of monthly income (not inclusive of other loans.)

The servicing ratios, coupled with higher interest rates, may force buyers into larger cash down payments, which they’re unable to make. So in effect, the combination of servicing ratios and rising interest also restrain home prices.

*Some flat buyers may have to use bank loans instead of HDB loans, such as those who previously switched when bank loan rates were lower. Buyers of ECs cannot use HDB loans, and must use bank loans.

The return of the Deferred Payment Scheme

The Deferred Payment Scheme (DPS) tends to appear only when developers have leftover units. DPS is only applicable to projects that have already received the Temporary Occupancy Permit (TOP) – under this scheme, a buyer typically puts down 20 per cent, and doesn’t have to pay anything over the next 24 months. This is useful for buyers who are caught in no man’s land (waiting for their PR status), which would save them a significant sum due to the new 60 per cent foreigner ABSD.

In most (not all) cases, the buyer may even be allowed to rent out the unit immediately, thus gaining rental income before even starting loan repayments. The downside to this scheme is that the price is almost always higher to account for the flexibility.

We’ve been seeing this scheme come up more in recent months. This may suggest that developers are seeing more leftover units after TOP, which in turn suggests that it’s getting harder to move units.

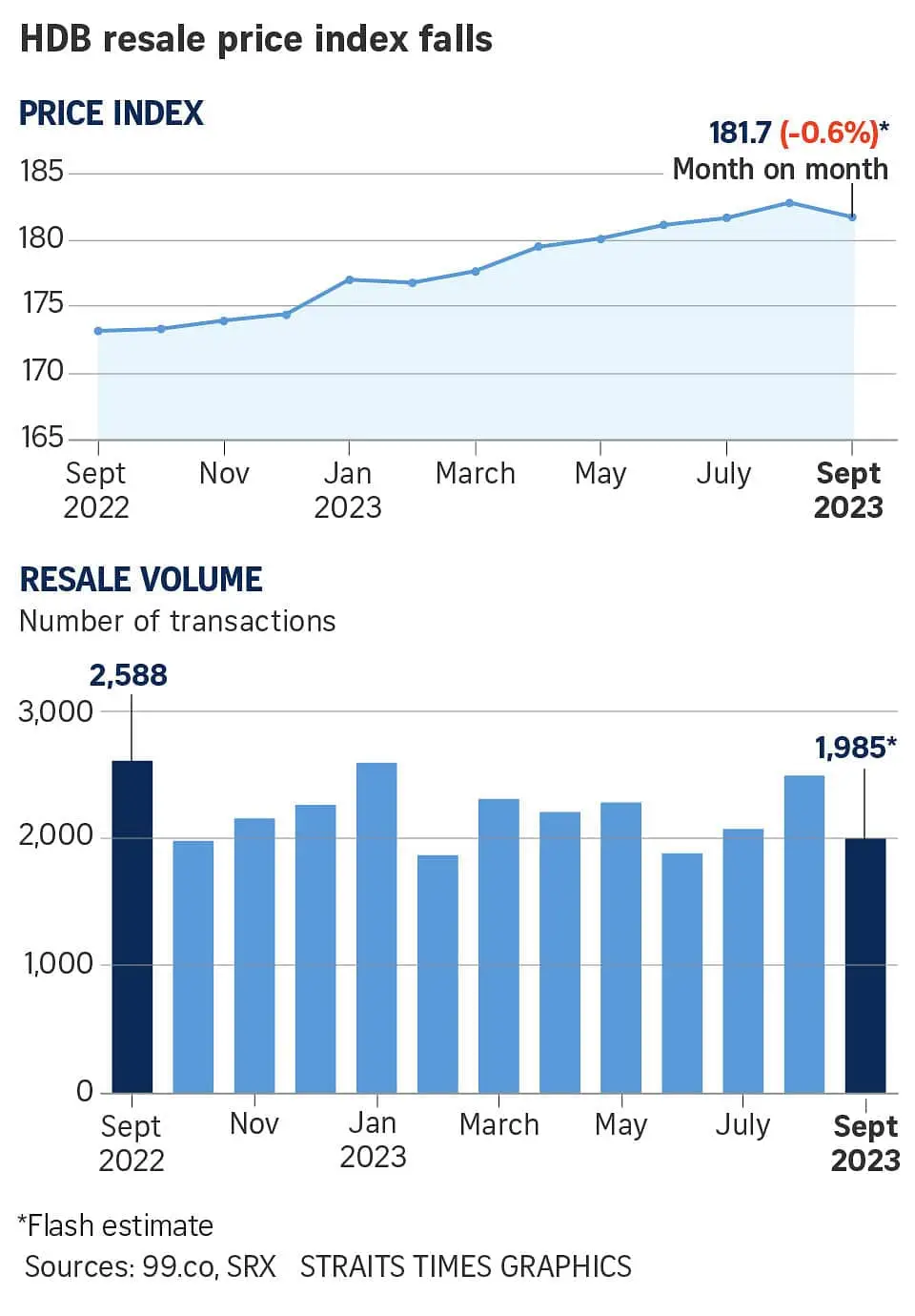

Resale flats have also seen a loss of momentum

September saw a drop in resale flat prices, the second since February of this year. To be clear, this was a small movement from month-to-month (0.6 per cent since the previous month), and resale flat prices are still up around 4.9 per cent year-on-year. Some analysts have mentioned that this was due to the impending October BTO launch but as of now, it remains to be seen if the BTO launches can siphon significant demand from the resale market.

However, the price increases from the past two to three years are likely unsustainable. This is due to the accelerated number of BTO launches since 2021, which are expected to divert some demand from the resale market.

If we look at volume, for instance, the number of resale flat transactions dipped 4.6 per cent between Q1 and Q2 of this year. The total number of transactions (around 6,409 flats) marks the lowest point since Q3 2020.

This said, we do need to consider a new wild card in the HDB market: this is the introduction of the new Prime, Plus, and Standard model, which will replace the former system of mature versus non-mature areas.

As this was just introduced during National Day, and the first Plus flats will only hit the market in 2024 (in the vicinity of Bayshore), it’s too early to tell how this might impact the overall HDB market.

As we’ve mentioned in the linked article above, there has been speculation that the new model could cause a brief spike in certain high-demand flats. This could occur because the new model isn’t retroactively applied; so there are flats in desirable areas like Bishan, Queenstown, Tiong Bahru, etc., which can match the location of Prime or Plus flats, but don’t have a Subsidy Recovery or 10-year MOP. This could potentially spike demand and prices for these flats, at least in the near term.

This is unlikely to be a factor for the wider market, however, as it’s only a consideration for a handful of high-demand flats.

The dips that we see may signal an inflection point in the property market

While there’s no reliable crystal ball for the property market, all the signs are pointing to a loss of momentum. The trifecta of rising home loan rates, rising supply, and aggressive cooling measures provide little room for prices to go higher.

We also expect that the floor rate for TDSR calculations will shortly be raised further (it makes no sense to have a floor rate so close to the actual rate), along with rising interest rates. This will further tighten the screws on both new and resale properties alike. And with HDB and the private sector both completing more homes, sellers are going to lose some of the negotiating power they had in the past two years.

It’s not unreasonable to expect the floor rate to rise, if interest rates keep moving up. The floor rate is meant to be a bit higher than the interest rate, as it ensures buyers can cope with rate hikes. The previous floor rate was set at 3.5% even back when interest rates of just 2% were still possible, so it’s probable that floor rates will rise if home loan rates continue on this trajectory.

We’ll keep monitoring the situation and update you accordingly, so follow us on Stacked. You can also follow us for in-depth reviews of new and resale projects in the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments